IncomeSharks

No content yet

IncomeSharks

Everyone can be a buyer on green days. The best days for buying and doing research are on red days because it means you actually have conviction if you still want to buy.

- Reward

- like

- Comment

- Repost

- Share

$TSLA - Very bullish on the stock long term so much that I want lower prices again. Diagonal broken, ideal scenario is the lower gap, and OBV flirting with danger.

- Reward

- 1

- Comment

- Repost

- Share

$MSTR - Testing a theory: When Michael Saylor is all over the timeline being praised as hero you sell. When Peter Schiff is all over the timeline doing victory laps you probably should be buying.

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

thanks for sharing thisn informationI think Warren Buffet proved his point well about not investing in fear and being an optimist. He never once purchased Gold and was a big advocate against shorting the markets.

- Reward

- like

- Comment

- Repost

- Share

I know this is a controversial take but the US dollar will be back to $100 this year on the $DXY and the US dollar isn\'t going to zero.

- Reward

- like

- Comment

- Repost

- Share

The Department of Energy has been ramping up Nuclear investments faster than ever before. Worth having exposure for the next 5 years as the battle for energy will only get bigger.

- Reward

- like

- Comment

- Repost

- Share

It\'s sad how many old people get their financial advice from infomercials and commercials between watching their favorite cable news channel push them constant fear.

- Reward

- like

- Comment

- Repost

- Share

$FLNC - Another double digit day today. Easy energy narrative play with a 5 billion dollar backlog in orders and more demand with the recent Arizona deal.

- Reward

- like

- Comment

- Repost

- Share

Fear is the easiest product to sell. People would rather invest money into worst case scenarios than invest in opportunities that could better their lives. This is the same reason so many don\'t take risks, they focus too much on the fear of failing.

- Reward

- like

- Comment

- Repost

- Share

Crypto has been loving Tuesdays for the past few months.

- Reward

- like

- Comment

- Repost

- Share

Energy will be the currency of the future

- Reward

- like

- Comment

- Repost

- Share

Won\'t be long until we see everyone tweeting, "Why are we pumping" about Bitcoin. OBV looks great.

BTC-5,51%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

$DXY - If you actually wanted to time the debasing trades you should have been buying when it\'s high and selling when it\'s low. Now that it\'s dropped people react late and panic buy into assets that do well on fear. Being contrarian here and saying the dollar doesn\'t go to zero.

- Reward

- like

- Comment

- Repost

- Share

$RUT - Still early on the small marketcap stocks. The last asset class waiting for the parabolic move.

- Reward

- like

- Comment

- Repost

- Share

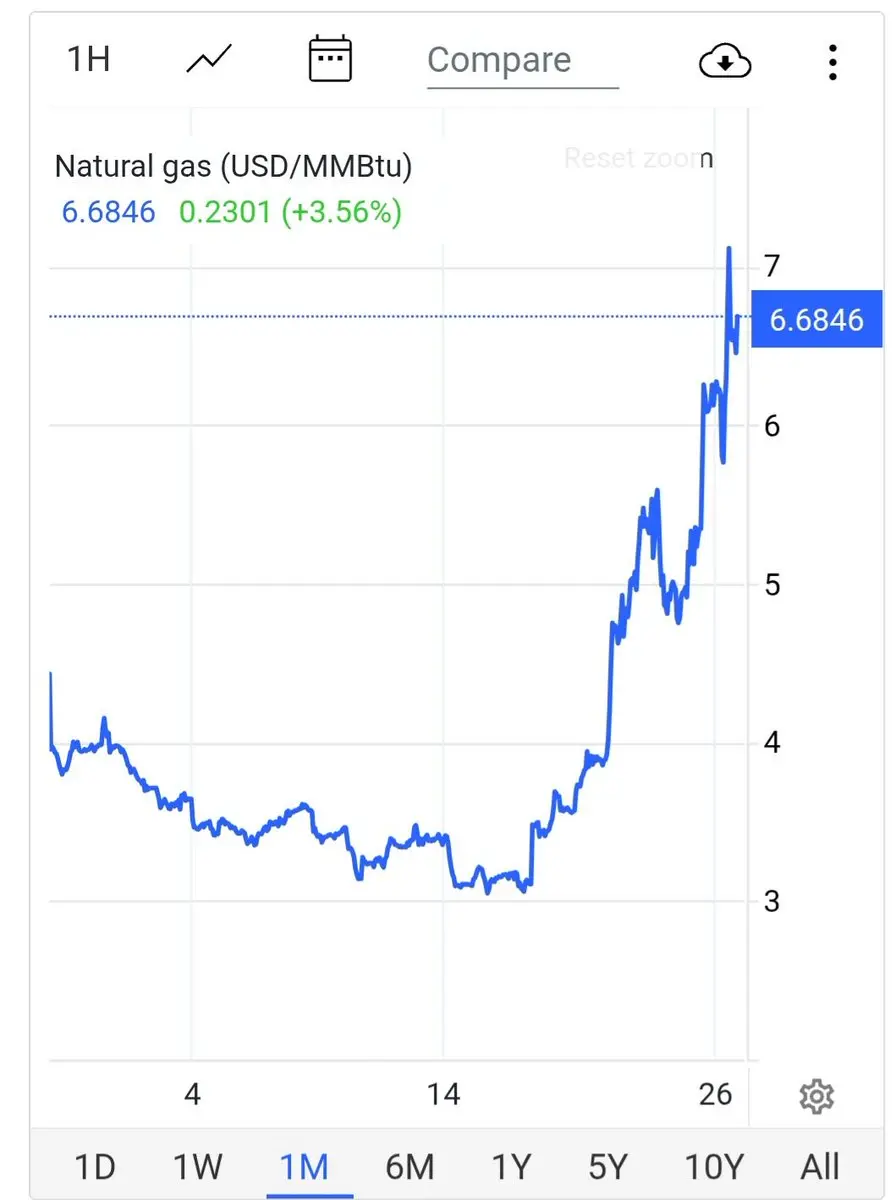

Wish I could set a reminder to automatically buy Natural Gas before a giant snow storm or winter freeze. It\'s one of those boring but incredibly consistent trades.

- Reward

- like

- Comment

- Repost

- Share

You can celebrate a trade when the profits been realized. There\'s no space that knows this lesson better than Crypto.

- Reward

- like

- Comment

- Repost

- Share

$XAU - Have two lower gaps, with a 30 minute trendline breaking.

- Reward

- like

- Comment

- Repost

- Share

Warren Buffet says it best. He describes gold as an "unproductive" asset that doesn\'t generate income, doesn\'t produce anything useful on its own, and is essentially a bet on fear rather than productive value creation.

- Reward

- like

- Comment

- Repost

- Share