Will S&P hit >$7,000 by the end of 2025??

GateUser-62cada74

No content yet

GateUser-62cada74

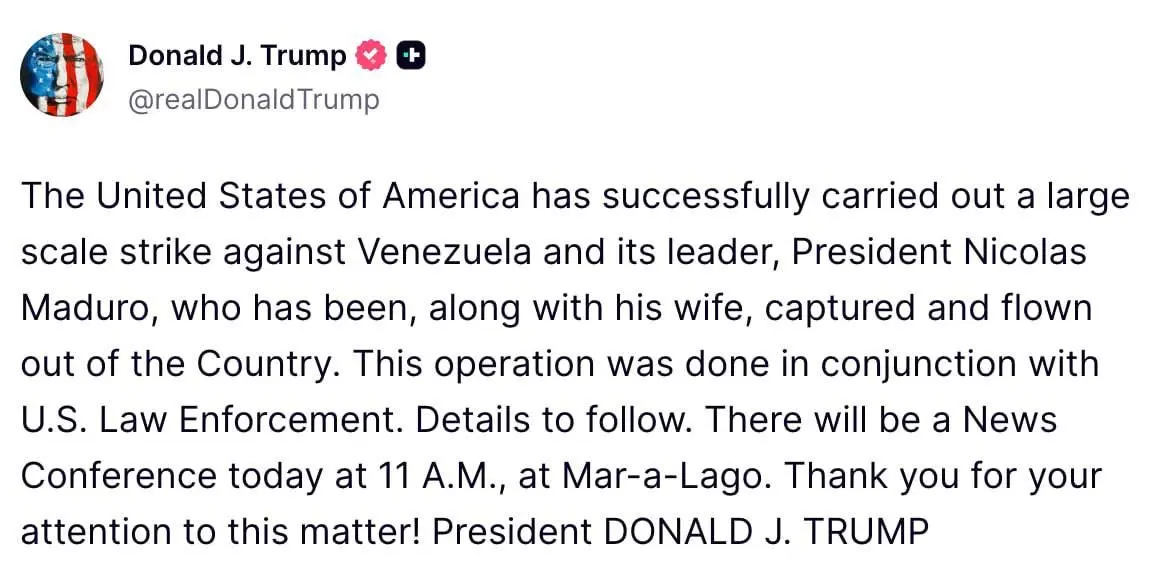

🚨BREAKING

The United States carried out a large-scale strike against Venezuela and President Nicolás Maduro was captured and flown out of the country

The United States carried out a large-scale strike against Venezuela and President Nicolás Maduro was captured and flown out of the country

- Reward

- like

- Comment

- Repost

- Share

Happy New Year 𝕏-fam 🫶

- Reward

- like

- Comment

- Repost

- Share

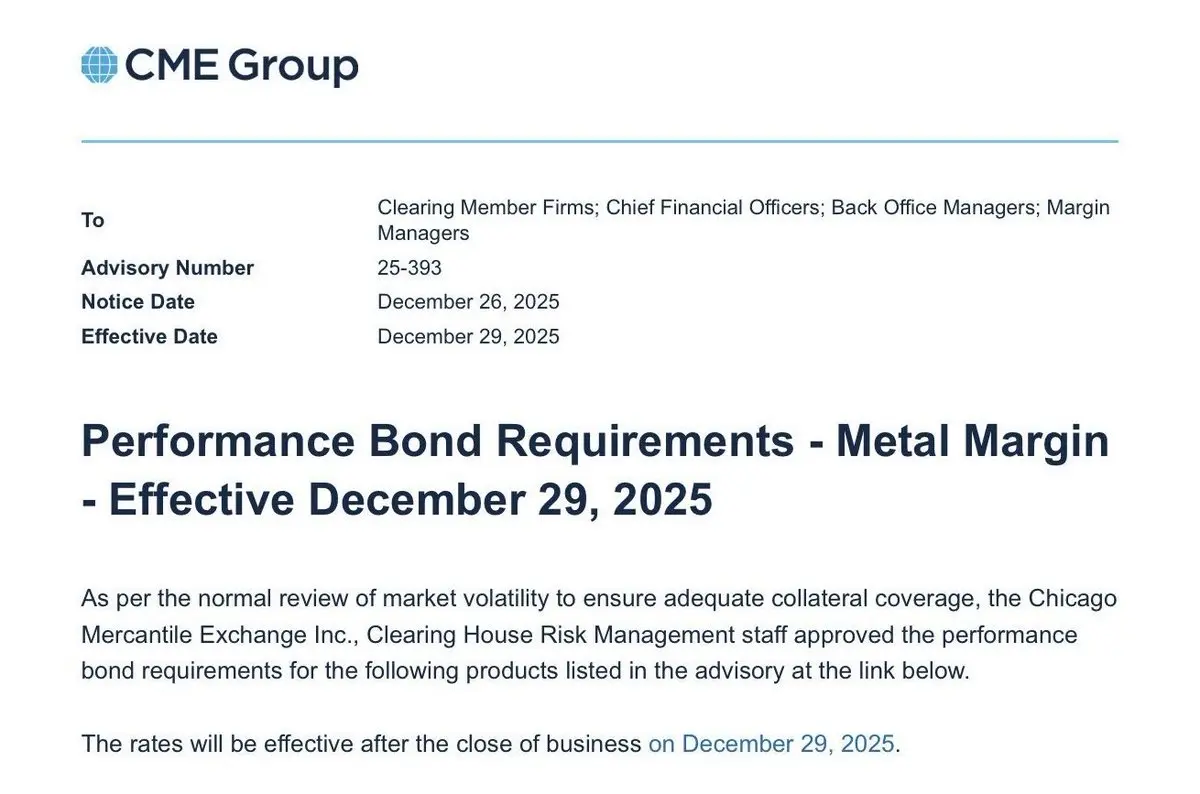

If you wonder why silver dumped today..

- Reward

- like

- Comment

- Repost

- Share

If you wonder why metals dumped today

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Good night fam 😴

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Merry Christmas & Happy Holidays yall 🫶

- Reward

- like

- Comment

- Repost

- Share

🚨BREAKING

🇨🇦 Canada officially confirms Santa Claus is Canadian citizen!!

• Official recognition dating back to 2008

• A registered North Pole address with postal code H0H 0H0

• Canada Post’s continued handling of Santa’s global correspondence

🇨🇦 Canada officially confirms Santa Claus is Canadian citizen!!

• Official recognition dating back to 2008

• A registered North Pole address with postal code H0H 0H0

• Canada Post’s continued handling of Santa’s global correspondence

- Reward

- like

- Comment

- Repost

- Share

#Ethereum prices on Christmas Eve🎄

2015 — $0.94

2016 — $8

2017 — $756

2018 — $133

2019 — $130

2020 — $737

2021 — $3,679

2022 — $1,221

2023 — $2,281

2024 — $3,492

2025 — $2,965

2015 — $0.94

2016 — $8

2017 — $756

2018 — $133

2019 — $130

2020 — $737

2021 — $3,679

2022 — $1,221

2023 — $2,281

2024 — $3,492

2025 — $2,965

ETH-0,36%

- Reward

- 2

- 1

- Repost

- Share

GateUser-df1bed87 :

:

I am expecting a long position🚨BREAKING

CFTC CoT (Dec 9-16 data, released Dec 23):

• Ags: Corn MM short; SRW wheat MM short

• Energy: P/M short hedging; MM long

• NatGas: Massive OI; Swap Dealers heavy short; MM long

• Electricity: Commercials dominate

• Metals & other: Gold MM long; Copper OR short

Compared with the previous release, agricultural positioning has softened further rather than rebounding. Managed Money is now net short in both corn and SRW wheat, marking a shift from mixed exposure toward a more defensive stance across grains. Commercial hedging remains heavy and unchanged, suggesting the adjustment is co

CFTC CoT (Dec 9-16 data, released Dec 23):

• Ags: Corn MM short; SRW wheat MM short

• Energy: P/M short hedging; MM long

• NatGas: Massive OI; Swap Dealers heavy short; MM long

• Electricity: Commercials dominate

• Metals & other: Gold MM long; Copper OR short

Compared with the previous release, agricultural positioning has softened further rather than rebounding. Managed Money is now net short in both corn and SRW wheat, marking a shift from mixed exposure toward a more defensive stance across grains. Commercial hedging remains heavy and unchanged, suggesting the adjustment is co

- Reward

- like

- Comment

- Repost

- Share

🚨REMINDER

🇺🇸 US GDP Q3 (Est.) — TODAY, 8:30 AM ET

🇺🇸 US GDP Q3 (Est.) — TODAY, 8:30 AM ET

- Reward

- like

- Comment

- Repost

- Share

🚨REMINDER

🎄 Holiday Schedule:

• Dec 24, Christmas Eve — half day open

• Dec 25, Christmas — markets closed

🎄 Holiday Schedule:

• Dec 24, Christmas Eve — half day open

• Dec 25, Christmas — markets closed

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨BREAKING

CFTC CoT (Dec 2-9 data, released Dec 19):

• Ags: Corn MM long; SRW wheat MM short

• Energy: P/M short hedging; MM long

• NatGas: Huge OI; Swap Dealers heavy short; MM long

• Electricity: MM activity again NOT minimal

• Metals: Gold MM long; Copper OR short

Compared with the prior update, grain positioning shows stability rather than escalation. Managed Money exposure in corn remains net long but without a broad expansion across the complex, while SRW wheat stays net short, reinforcing that speculative interest is still selective and contract-specific, not trend-wide. Commercial

CFTC CoT (Dec 2-9 data, released Dec 19):

• Ags: Corn MM long; SRW wheat MM short

• Energy: P/M short hedging; MM long

• NatGas: Huge OI; Swap Dealers heavy short; MM long

• Electricity: MM activity again NOT minimal

• Metals: Gold MM long; Copper OR short

Compared with the prior update, grain positioning shows stability rather than escalation. Managed Money exposure in corn remains net long but without a broad expansion across the complex, while SRW wheat stays net short, reinforcing that speculative interest is still selective and contract-specific, not trend-wide. Commercial

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨BREAKING

🇺🇸 EPSTEIN FILES BEING RELEASED

— MORE FILES WILL APPEAR TODAY

🇺🇸 EPSTEIN FILES BEING RELEASED

— MORE FILES WILL APPEAR TODAY

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More19.99K Popularity

59K Popularity

65.21K Popularity

101.87K Popularity

4.07K Popularity

Pin