JackBTC

No content yet

Pin

JackBtc

- Reward

- 3

- Comment

- Repost

- Share

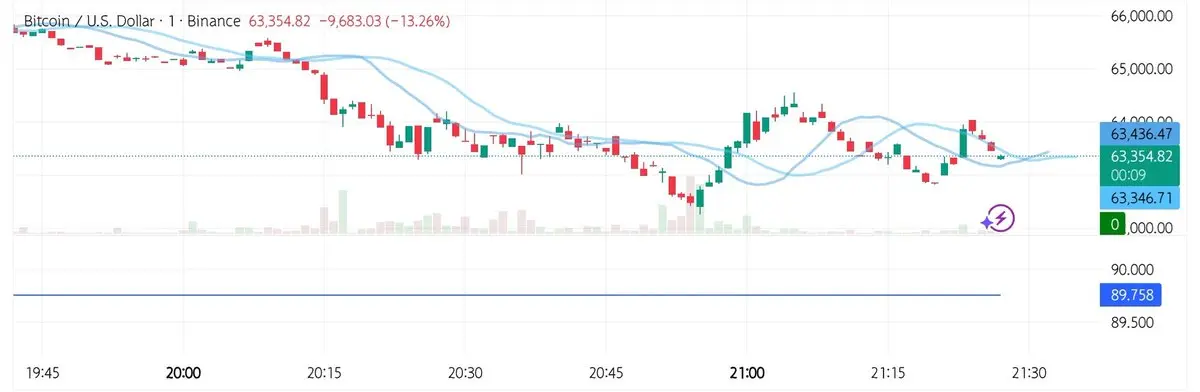

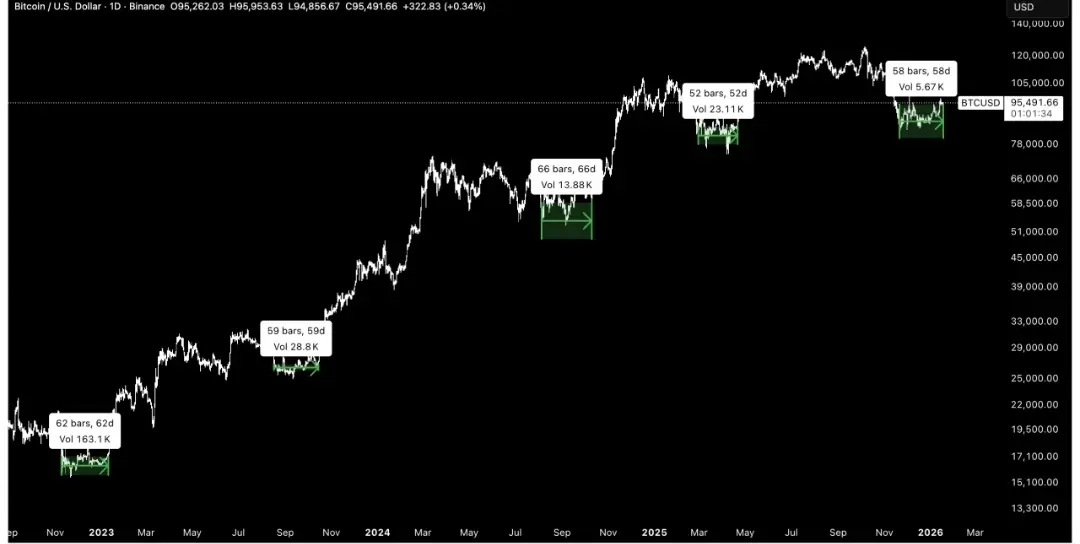

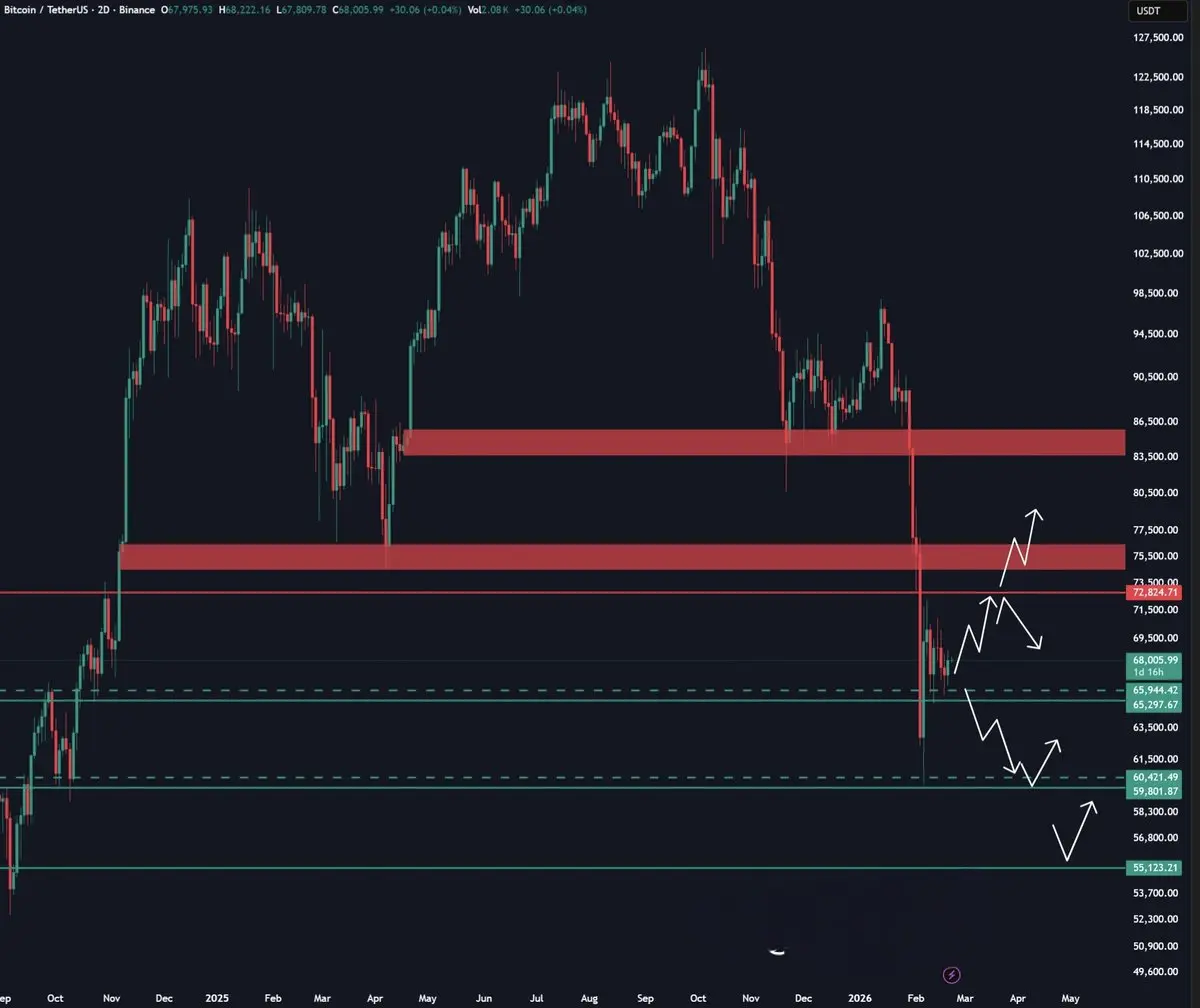

$BTC continues to trade near the $68K mark, showing notable resilience.

Even with ongoing selling pressure from Garrett Bullish and rising tensions between the U.S. and Iran, the market hasn’t broken down.

If BTC maintains support in the $65K–$66K zone, momentum could build for a move toward the $72K region.

Even with ongoing selling pressure from Garrett Bullish and rising tensions between the U.S. and Iran, the market hasn’t broken down.

If BTC maintains support in the $65K–$66K zone, momentum could build for a move toward the $72K region.

BTC-0,14%

- Reward

- 2

- Comment

- Repost

- Share

Stablecoins are gaining serious market share right now.

In my view, this trend still has room to expand, and that usually signals caution for the broader crypto market.

In my view, this trend still has room to expand, and that usually signals caution for the broader crypto market.

- Reward

- 1

- Comment

- Repost

- Share

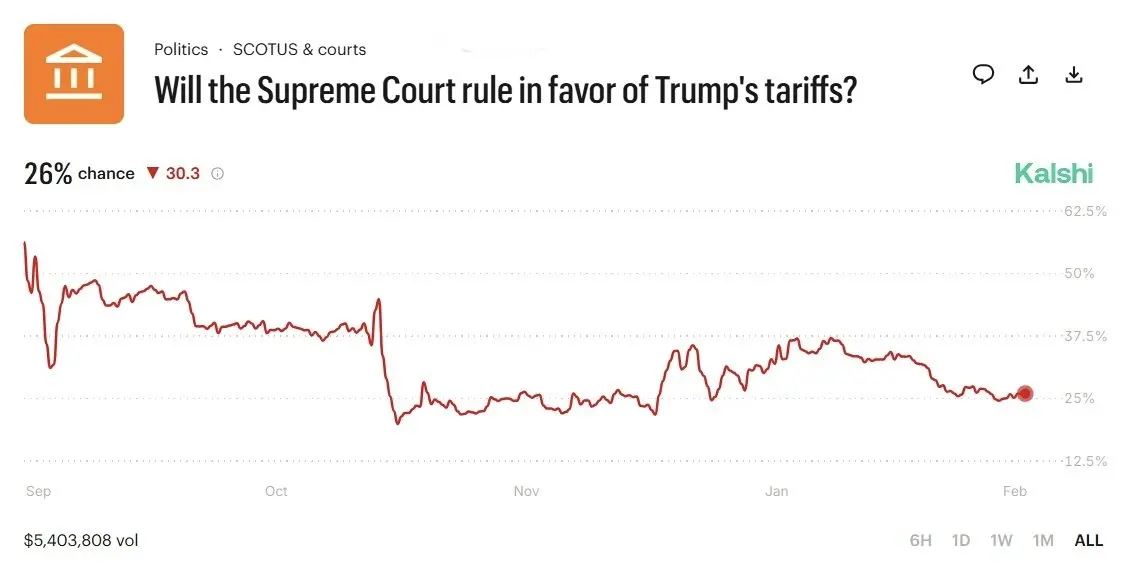

The Supreme Court of the United States is set to issue its decision on Donald Trump’s tariff policy at 10: 00 a.m. ET today.

Current estimates suggest there is just a 26 percent probability that the Court will uphold the tariffs.

Current estimates suggest there is just a 26 percent probability that the Court will uphold the tariffs.

- Reward

- 3

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

$750 million worth of USDC has just been issued.New capital is flowing into the market.

- Reward

- 2

- Comment

- Repost

- Share

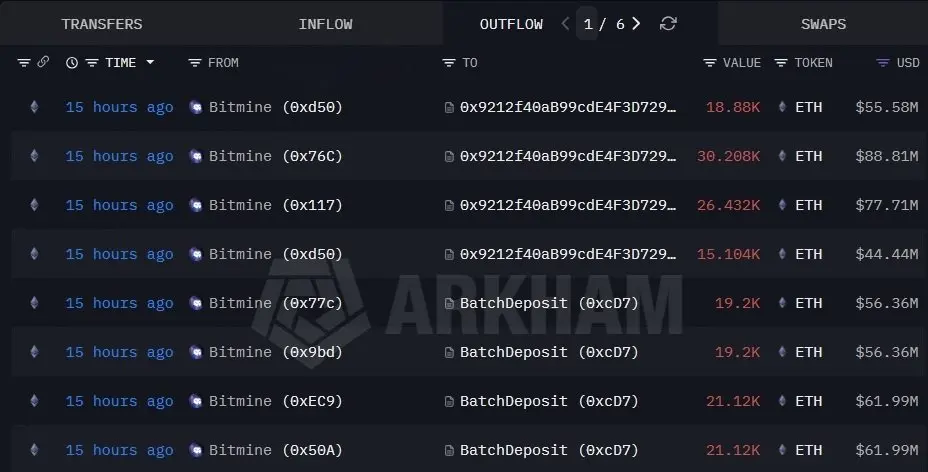

Over $230 billion has vanished from the market.Hopefully, you didn’t go in with everything on the line.

- Reward

- 3

- Comment

- Repost

- Share

Silver just suffered a brutal sell-off, dropping nearly a quarter in 24 hours and erasing around $1.6 trillion in value.Naturally, questions are starting to surface, is the team still fully committed to the project?

- Reward

- 3

- Comment

- Repost

- Share

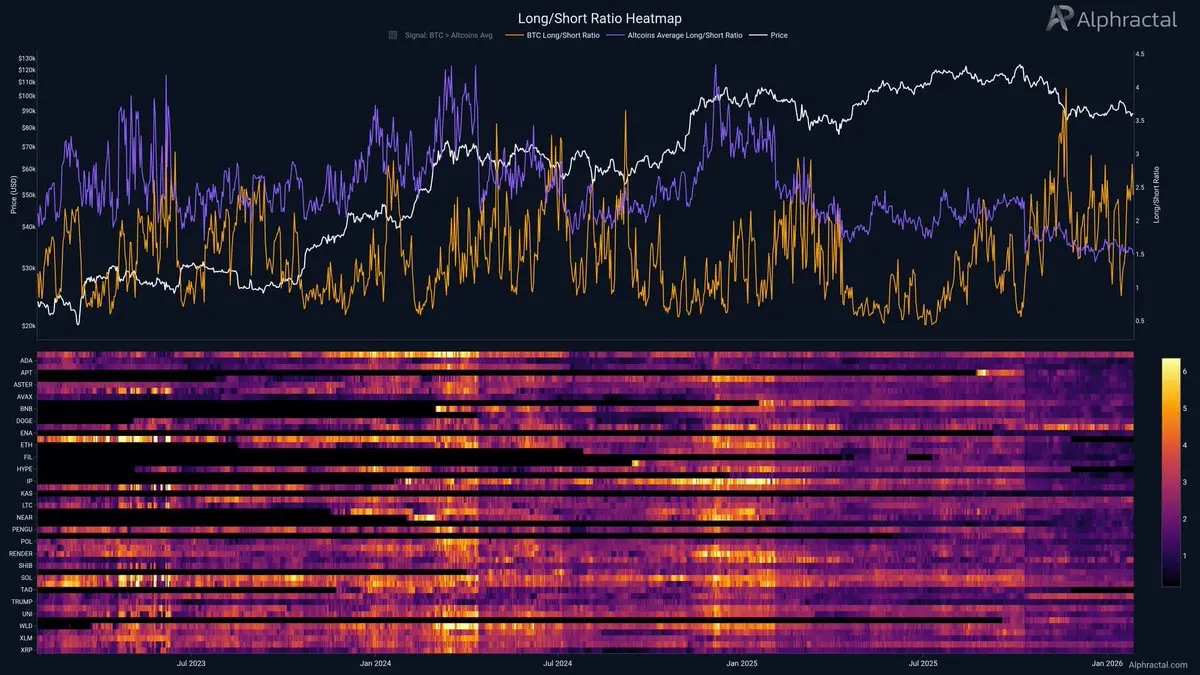

Altcoins are under heavy pressure right now.▫️ A multi-year support level has broken▫️ Price failed to hold above the bull-market support zoneFor a real turnaround, total altcoin market cap must regain the weekly bull-market support range.

- Reward

- 3

- Comment

- Repost

- Share