Jamesvanst

No content yet

Jamesvanst

This is officially the worst start to Bitcoin in the first 49 days of any year.

BTC-0,64%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

Can you see how easy it is for sentiment to shift slightly in Bitcoin? It blows like the wind.

Quantum-resistant BIP360 proposed.

Discussions around Satoshi coins and P2PK coins via Hourglass V2.

Sovereign wealth funds buying.

Miner capitulation ending.

A good old flush is sometimes very much needed to get back on the road.

Quantum-resistant BIP360 proposed.

Discussions around Satoshi coins and P2PK coins via Hourglass V2.

Sovereign wealth funds buying.

Miner capitulation ending.

A good old flush is sometimes very much needed to get back on the road.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

While there is full-on hysteria, panic, and speculation on this platform.

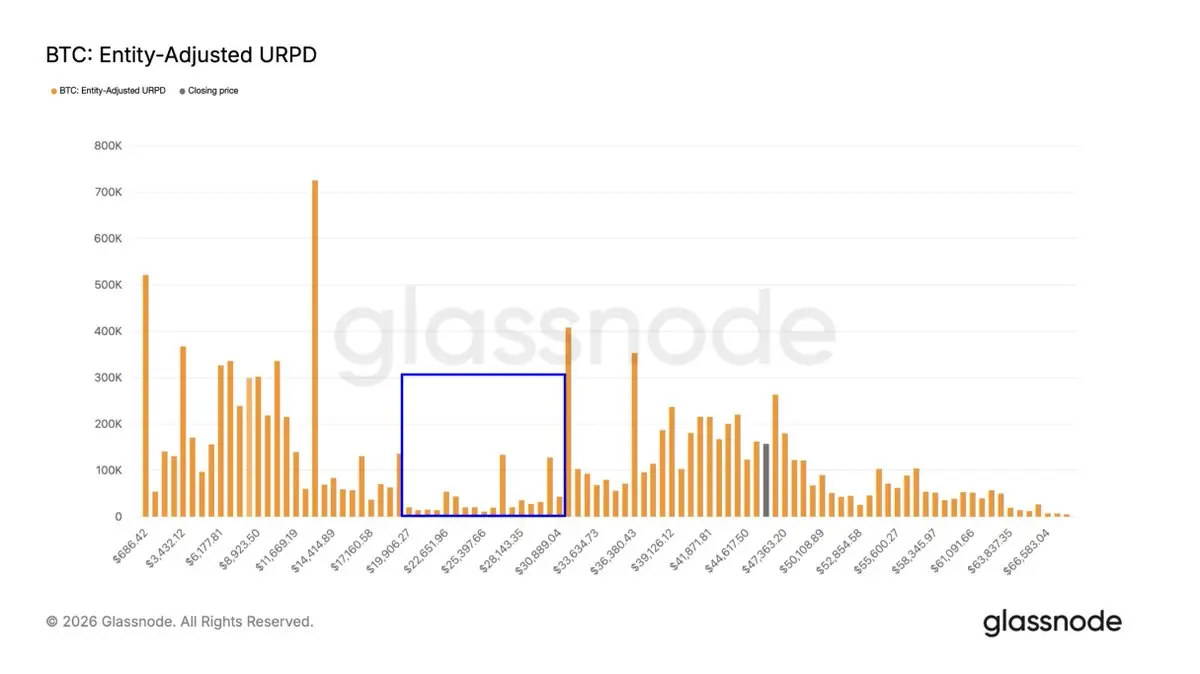

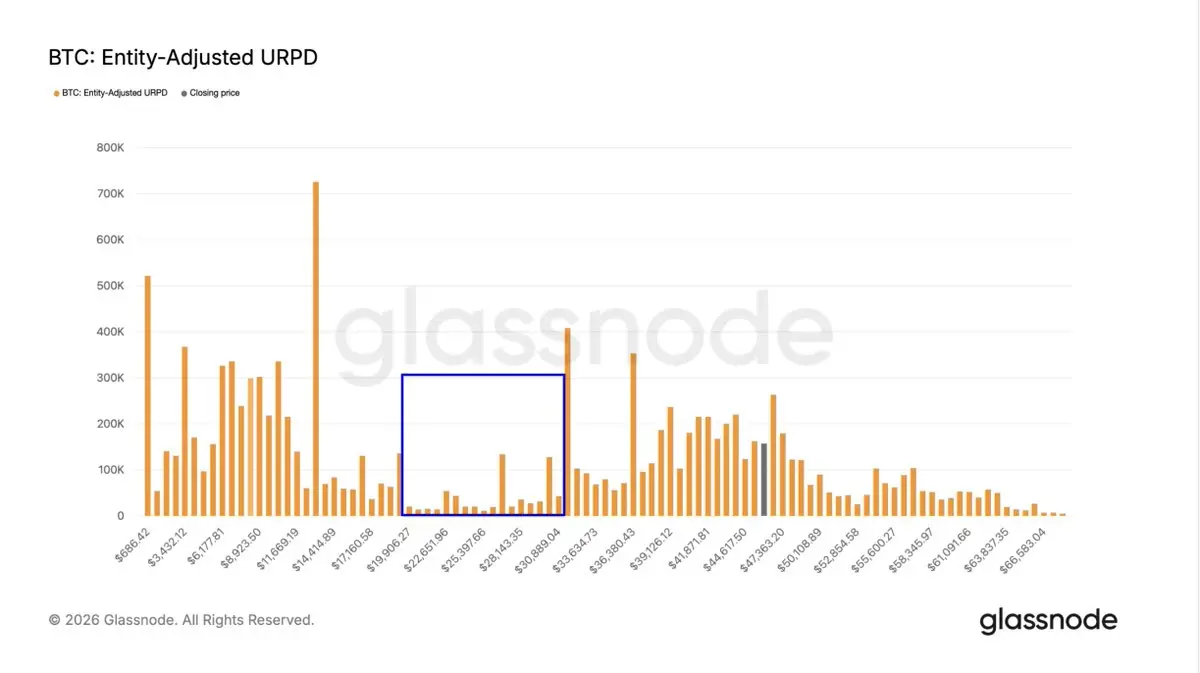

I get to stack BTC in the $60ks.

I get to stack BTC in the $60ks.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is currently on its seventh consecutive red month against gold, which would be a new record.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

Far out-of-the-money puts at $40,000 are the most concentrated strike price for end of February expiry in BTC.

This clearly shows where sentiment is, everyone is paying for downside protection.

Seems like a consensus trade.

This clearly shows where sentiment is, everyone is paying for downside protection.

Seems like a consensus trade.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

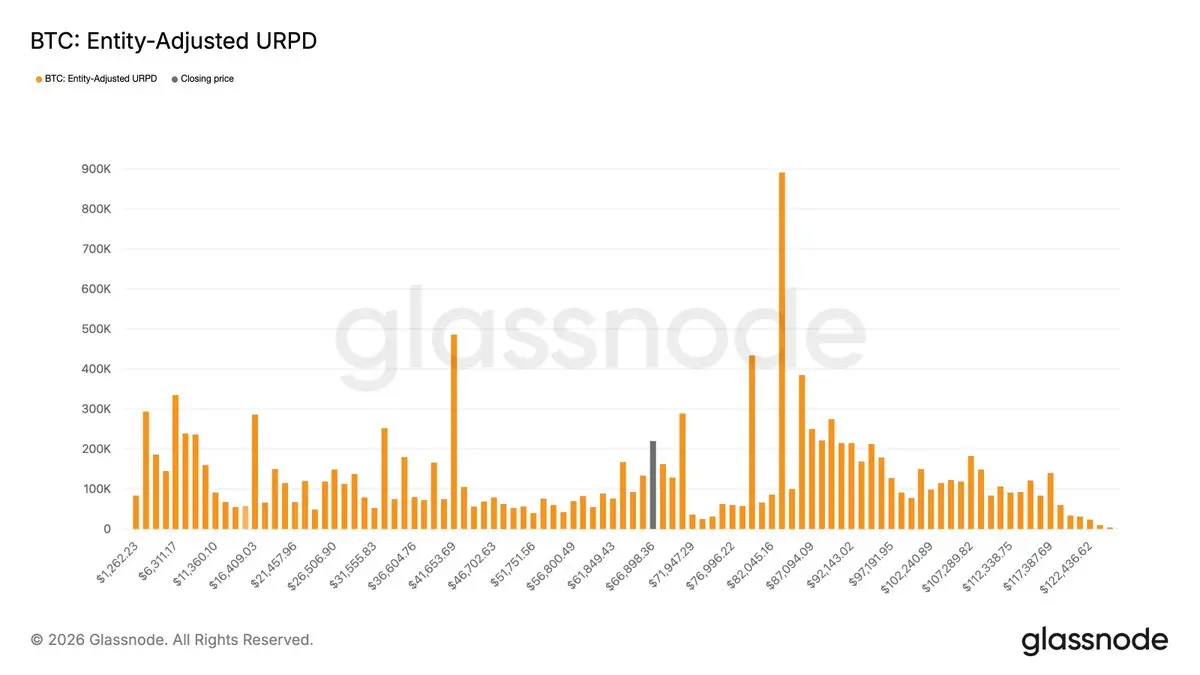

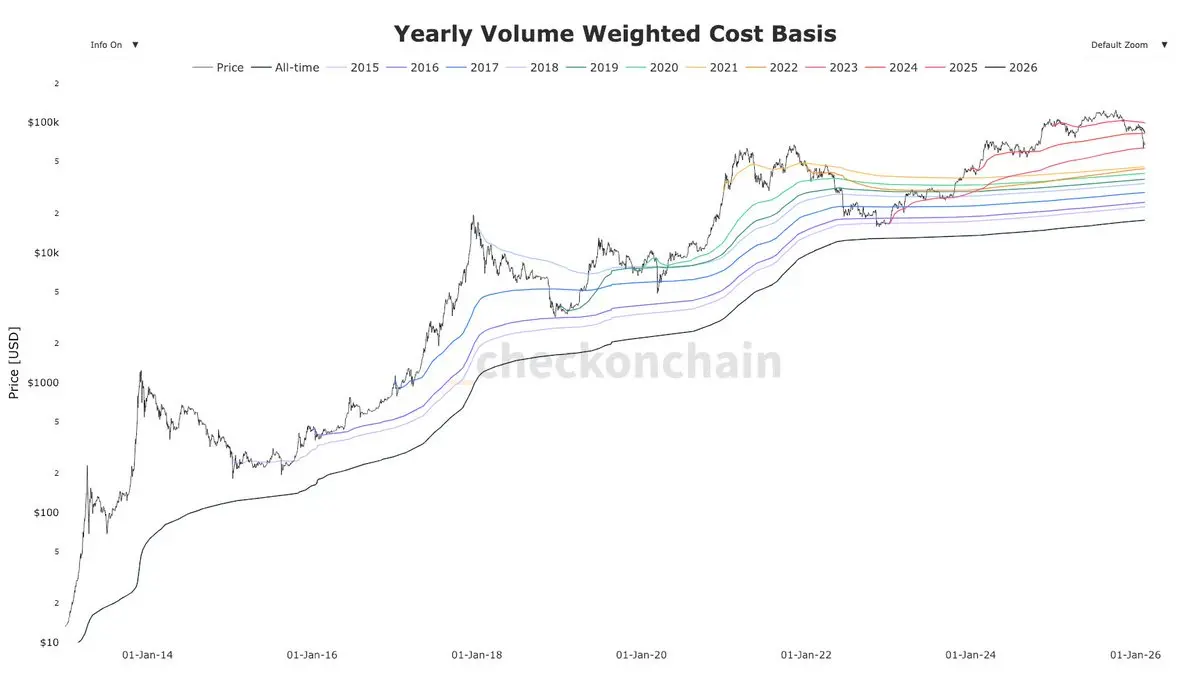

TA and on-chain together isn't a thing, but this is absolutely wild.

If we go by this chart, history would suggest the bottom is in for BTC.

If we go by this chart, history would suggest the bottom is in for BTC.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

In two weeks, the 20 millionth bitcoin will be mined.

Good luck, all.

Good luck, all.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

MSTR has already acquired 65k BTC since December.

The company managed just 10k BTC in the entirety of 2022.

The company managed just 10k BTC in the entirety of 2022.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

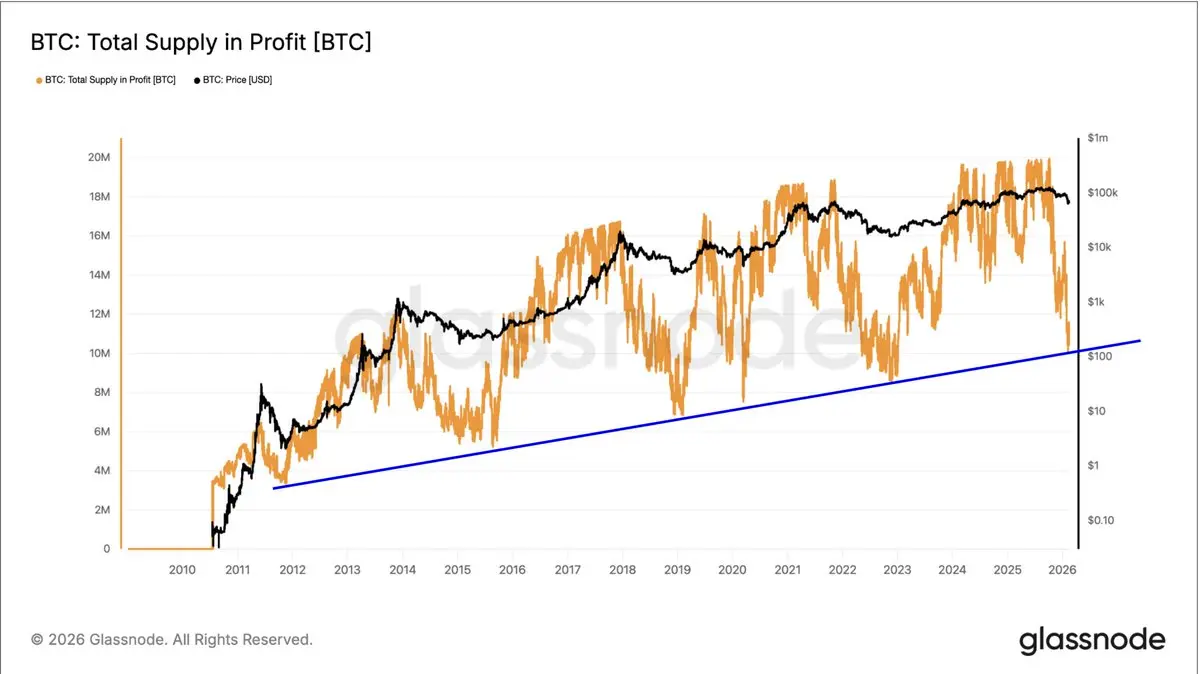

Last week's drop to $60k not only saw the largest one-day realized loss in Bitcoin history, but also bounced straight off the 2023 realized price.

Very similar to December 2018 using the 2016 realized price as support.

Very similar to December 2018 using the 2016 realized price as support.

BTC-0,64%

- Reward

- 1

- 1

- Repost

- Share

Unoshi :

:

Thanks for informationMSTR has now survived a full cycle, so it is prudent to include it in all analysis when looking at Bitcoin.

If we are in May 2022, why does the MSTR/BTC ratio look nothing like May 2022?

The MSTR/BTC ratio is up 10% YTD.

If we are in May 2022, why does the MSTR/BTC ratio look nothing like May 2022?

The MSTR/BTC ratio is up 10% YTD.

BTC-0,64%

- Reward

- like

- 1

- Repost

- Share

Shahid1995 :

:

so niceThe two largest Bitcoin treasury companies, MSTR and Metaplanet, both have a positive mNAV of 1.19 and 1.17.

This follows a +50% correction in Bitcoin's price.

mNAV is a forward-looking metric.

It captures market expectations of future BTC scaling.

The premium exists because of anticipated growth in BTC holdings beyond current levels, not just today's snapshot.

When mNAV compresses toward or below 1x, it signals fading confidence in that future accretion story.

This follows a +50% correction in Bitcoin's price.

mNAV is a forward-looking metric.

It captures market expectations of future BTC scaling.

The premium exists because of anticipated growth in BTC holdings beyond current levels, not just today's snapshot.

When mNAV compresses toward or below 1x, it signals fading confidence in that future accretion story.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

One of my mates had a loan with Ledn and got liquidated in the downturn. Substantial amount.

Back to my theory of time based capitulation.

Back to my theory of time based capitulation.

- Reward

- like

- Comment

- Repost

- Share

Bitcoin did not enter backwardation last week.

This may not occur this time around due to low industry vol and leverage, which is a major difference compared to 2022.

This may not occur this time around due to low industry vol and leverage, which is a major difference compared to 2022.

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

Bottoms take months to form and, by design, are the choppiest period.

- Reward

- like

- Comment

- Repost

- Share

I have never seen so much hate toward a stock that people don’t even own towards MSTR.

If you don’t own the stock, why do you care?

Or were in the depths of a bear market and this is normal behaviour

If you don’t own the stock, why do you care?

Or were in the depths of a bear market and this is normal behaviour

- Reward

- like

- Comment

- Repost

- Share

Bitcoin Back at $70k the Singularity

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

Wonder what the market makers have in store for us this weekend.

- Reward

- like

- Comment

- Repost

- Share

Anyone who is solvent, has cash flow, and is not trading on margin with a liquidation level hanging over them is not panicking. The ones who are panicking can\'t manage risk, and any margin should have been removed after Oct. 10.

- Reward

- like

- Comment

- Repost

- Share