Mr_Desoza

No content yet

Mr_Desoza

$FOGO is in a clear corrective phase after rejection from the 0.031 supply zone. The market has been printing lower highs, confirming distribution rather than accumulation. Price is currently sitting near 0.0285, which is acting as weak support. The key level to watch is 0.0277–0.0268; a loss of this zone would likely accelerate downside toward 0.0245. Resistance stands at 0.0298–0.0303, with major supply still stacked at 0.031. Only a reclaim and hold above 0.0303 would signal stabilization and open the next upside target at 0.0335. Until then, structure remains bearish-to-neutral, favoring d

FOGO11%

- Reward

- like

- Comment

- Repost

- Share

$FUN is trending lower after failing to hold the 0.074 supply zone, transitioning into a controlled downtrend. Price is now hovering near 0.0665, which is a critical support level. Holding this zone may allow for a short-term relief bounce; failure would likely expose FUN to 0.062 and potentially 0.058. Resistance is layered at 0.0695–0.0705, followed by a stronger ceiling near 0.074. A reclaim above 0.0705 would be required to neutralize downside pressure and open the door for a move back toward 0.078. Until that happens, structure favors sellers on rallies, with upside moves considered corre

FUN-9,55%

- Reward

- like

- Comment

- Repost

- Share

$FUN is trending lower after failing to hold the 0.074 supply zone, transitioning into a controlled downtrend. Price is now hovering near 0.0665, which is a critical support level. Holding this zone may allow for a short-term relief bounce; failure would likely expose FUN to 0.062 and potentially 0.058. Resistance is layered at 0.0695–0.0705, followed by a stronger ceiling near 0.074. A reclaim above 0.0705 would be required to neutralize downside pressure and open the door for a move back toward 0.078. Until that happens, structure favors sellers on rallies, with upside moves considered corre

FUN-9,55%

- Reward

- like

- 3

- Repost

- Share

DoganCcc :

:

Happy New Year! 🤑View More

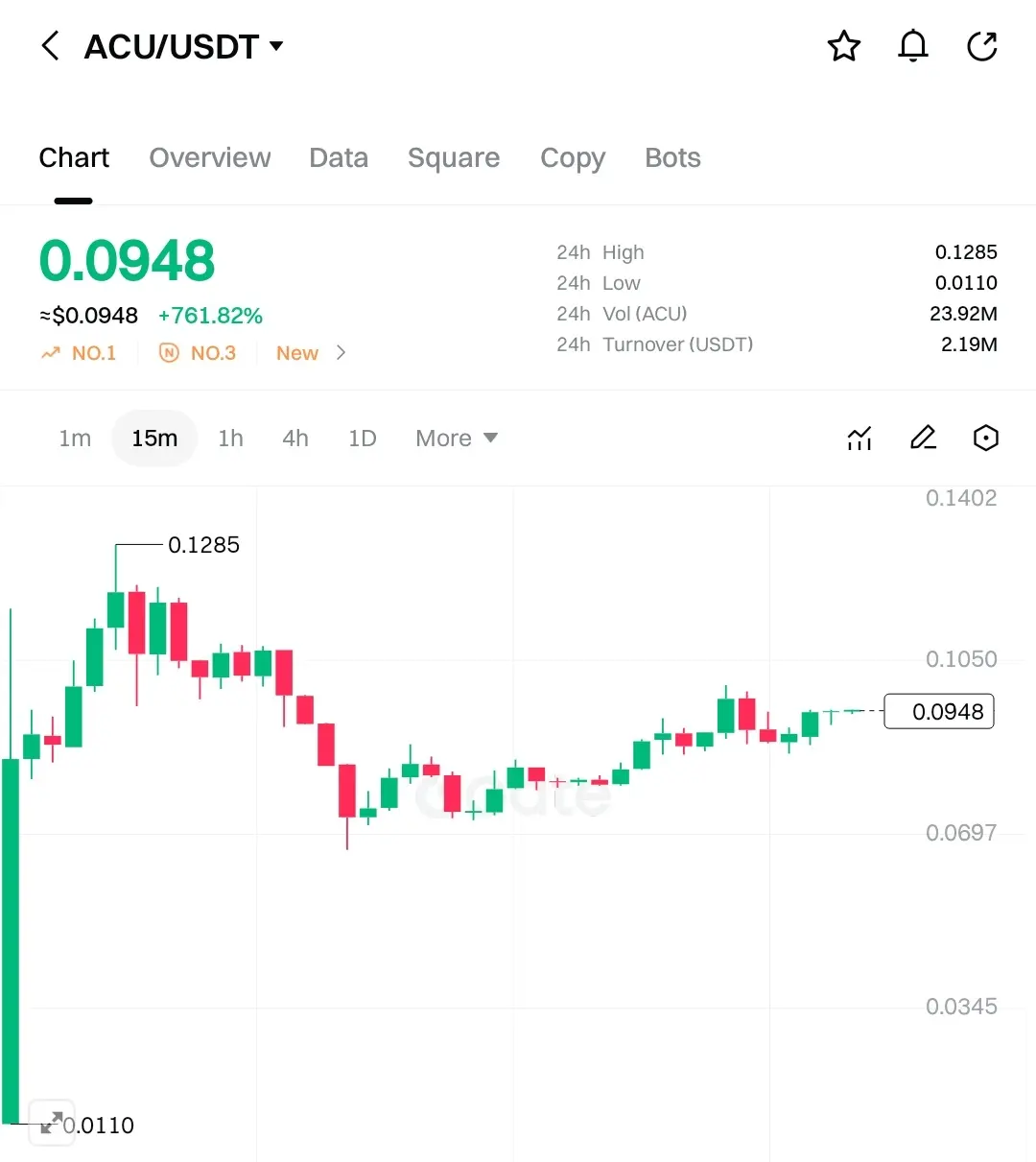

$ACU remains in a post-parabolic consolidation after an extreme expansion from sub-0.02 levels. Price is currently stabilizing near 0.095, which represents a mid-range equilibrium following distribution from 0.128. The most important support is located at 0.082–0.078; holding this zone keeps the higher-structure intact. A loss of 0.078 would signal a deeper corrective phase toward 0.065. On the upside, resistance is clearly defined at 0.105, followed by a major supply zone near 0.128. A decisive breakout and acceptance above 0.105 would signal trend continuation and open the next upside target

ACU54,53%

- Reward

- 6

- Comment

- Repost

- Share

$DN is consolidating after a violent expansion and subsequent full retrace from the 0.43 spike, indicating a completed blow-off phase. Price is now holding around 0.18, which acts as a compression zone rather than confirmed accumulation. Immediate support lies at 0.168–0.160, a level that must hold to prevent continuation toward 0.145. As long as this zone is defended, DN may continue to build a base. Resistance is now layered at 0.195–0.205, followed by a major supply zone near 0.230. A reclaim above 0.205 would indicate renewed momentum and open the next upside target at 0.26. Failure to rec

DN4,34%

- Reward

- like

- Comment

- Repost

- Share

$我踏马来了

Price is trading deep in a corrective structure after a sharp distribution move from the 0.0176–0.0180 supply zone. The aggressive sell-off flushed momentum buyers and reset leverage, with price now stabilizing near 0.0150. This area is short-term balance, not yet confirmed demand. Key support sits at 0.0142–0.0137, the origin of the last strong reaction; loss of this zone would likely trigger continuation toward 0.0125. On the upside, resistance is clearly defined at 0.0158–0.0162, followed by a stronger supply wall at 0.0176. A clean reclaim and hold above 0.0162 would be the first si

Price is trading deep in a corrective structure after a sharp distribution move from the 0.0176–0.0180 supply zone. The aggressive sell-off flushed momentum buyers and reset leverage, with price now stabilizing near 0.0150. This area is short-term balance, not yet confirmed demand. Key support sits at 0.0142–0.0137, the origin of the last strong reaction; loss of this zone would likely trigger continuation toward 0.0125. On the upside, resistance is clearly defined at 0.0158–0.0162, followed by a stronger supply wall at 0.0176. A clean reclaim and hold above 0.0162 would be the first si

我踏马来了66,76%

- Reward

- 1

- 1

- Repost

- Share

GateUser-3c8c9679 :

:

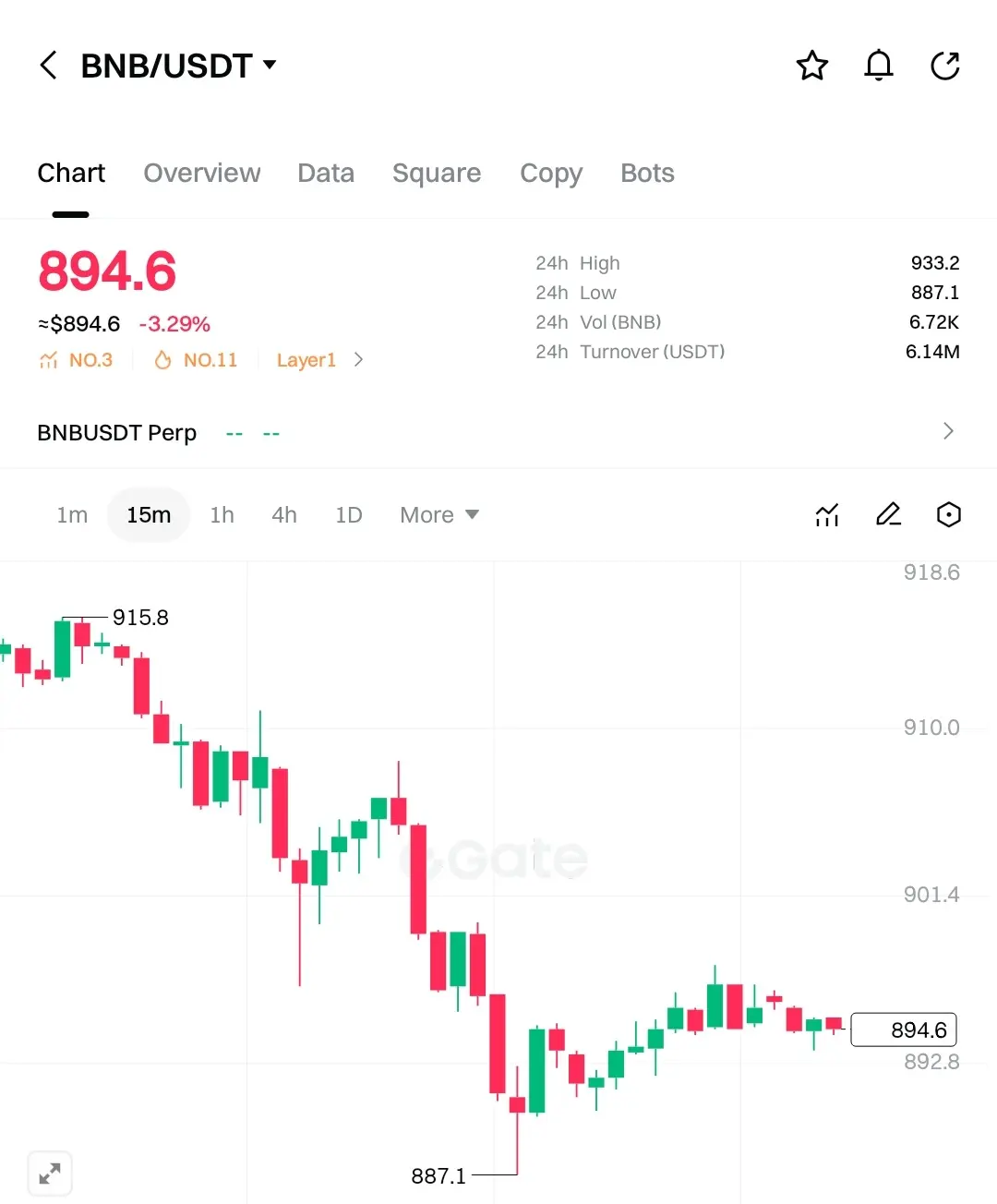

New Year Wealth Explosion 🤑$BNB remains under pressure after rejecting the 915–930 resistance zone and rotating sharply lower. Price has found temporary footing near 890, which is acting as a short-term balance level. The most important support lies at 880–870, a zone that must hold to avoid continuation toward 840. As long as buyers defend this area, a relief bounce remains possible. Immediate resistance is positioned at 905–910, followed by a stronger barrier near 930. A reclaim above 910 would be the first signal of stabilization and could open the next upside target at 960. Until resistance is reclaimed, upside move

BNB-4,82%

- Reward

- like

- Comment

- Repost

- Share

$BTC is in a short-term corrective phase after losing the 91,000–92,000 support region and flushing liquidity into the 89,200 demand zone. Price is currently stabilizing around 89,500, suggesting selling pressure is slowing but not yet reversed. The key support to watch remains 89,000–88,500; holding this zone is critical to prevent continuation toward 86,500. On the upside, resistance is clearly defined at 90,800, followed by a major supply area near 93,000. A reclaim and sustained hold above 90,800 would indicate absorption of selling pressure and open the next upside target at 94,500. Until

BTC-2,87%

- Reward

- like

- Comment

- Repost

- Share

$DUSK continues to show relative strength despite recent volatility, recovering cleanly from the 0.205 demand zone and pushing back toward 0.226. This recovery suggests buyers remain active and the broader bullish structure is still intact. Immediate support is now located at 0.218–0.215, which should act as demand on pullbacks. As long as price holds above this zone, continuation remains favored. Resistance is positioned at 0.235–0.240, followed by a major supply zone near 0.250. A clean breakout and hold above 0.240 would open the next upside target at 0.275. Loss of 0.215 would signal a dee

DUSK7,63%

- Reward

- 1

- Comment

- Repost

- Share

$RESOLV is trading in a controlled corrective structure after rejecting the 0.112–0.118 supply zone and rotating lower into consolidation. Price is currently holding near 0.103, which sits inside a key intraday balance area. The most important support remains at 0.098–0.095, a demand zone that previously triggered strong reactions and should attract buyers again if revisited. As long as RESOLV holds above this zone, downside risk remains limited. Immediate resistance is now defined at 0.108–0.110, followed by a stronger ceiling near 0.118. A clean reclaim and acceptance above 0.110 would signa

RESOLV1,59%

- Reward

- like

- Comment

- Repost

- Share

$SUI is trading in a controlled downtrend after failing to hold above 1.53 and rotating lower toward the 1.49 demand zone. Price is currently compressing near support, suggesting sellers are losing momentum but buyers have not yet fully taken control. The key support remains at 1.48–1.46; a loss of this zone would open downside toward 1.40. On the upside, resistance is clearly defined at 1.52, followed by a stronger supply area near 1.58. A reclaim and acceptance above 1.52 would signal trend stabilization and open the next upside target at 1.65. Until that happens, price action is likely to r

SUI-3,02%

- Reward

- like

- Comment

- Repost

- Share

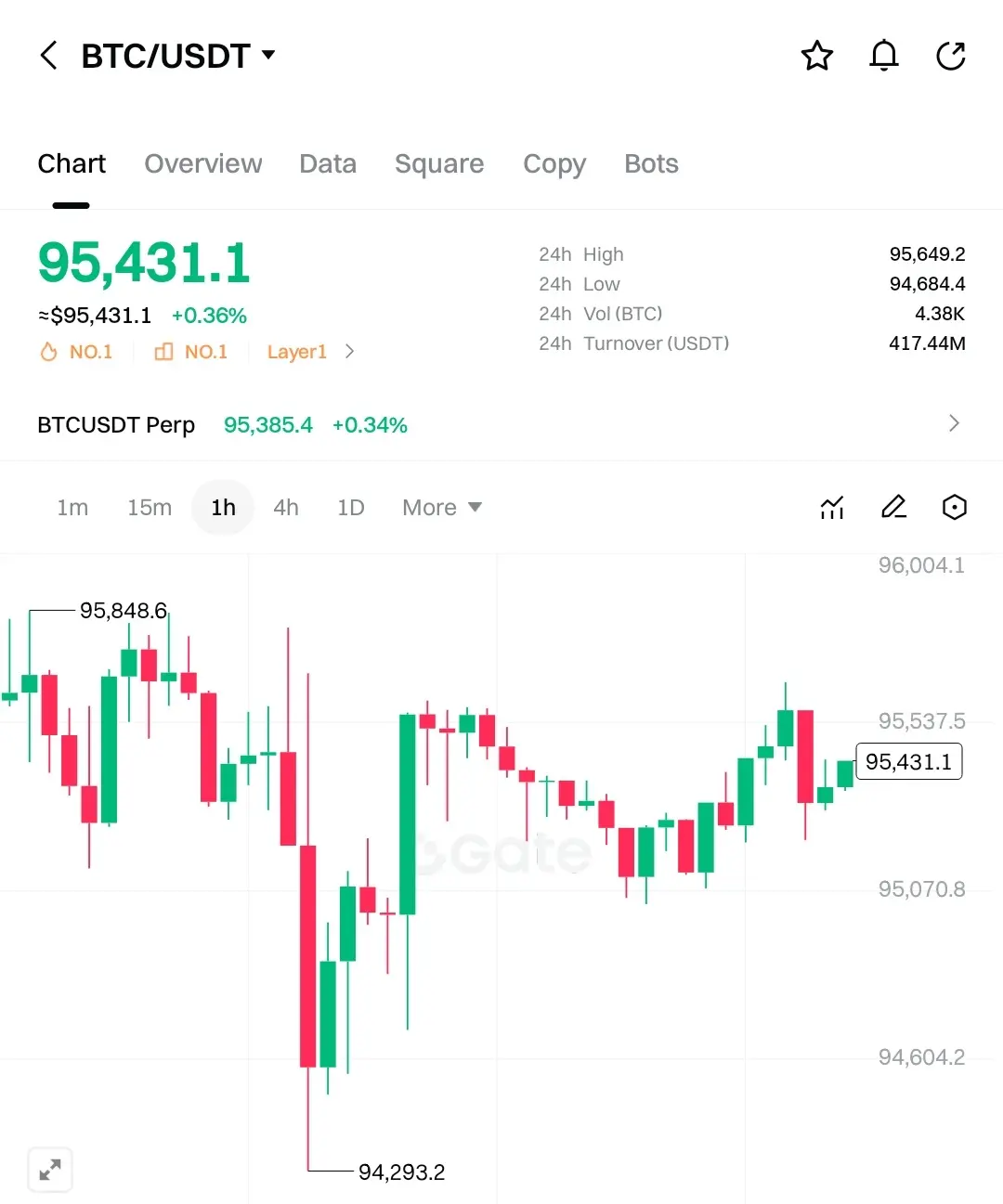

$BTC

Bitcoin continues to trade in a high-value consolidation range, maintaining strength above the critical support at 94,300–94,600, which acted as a strong rebound zone after the recent sell-off. The ability to reclaim and hold above 95,000 signals that buyers remain in control despite short-term volatility. Immediate resistance is positioned near 95,800–96,000, a psychological and technical barrier. A clean breakout above this zone would confirm bullish continuation and open the next target at 97,500, followed by 99,000 if momentum accelerates. On the downside, any pullback toward 94,600 i

Bitcoin continues to trade in a high-value consolidation range, maintaining strength above the critical support at 94,300–94,600, which acted as a strong rebound zone after the recent sell-off. The ability to reclaim and hold above 95,000 signals that buyers remain in control despite short-term volatility. Immediate resistance is positioned near 95,800–96,000, a psychological and technical barrier. A clean breakout above this zone would confirm bullish continuation and open the next target at 97,500, followed by 99,000 if momentum accelerates. On the downside, any pullback toward 94,600 i

BTC-2,87%

- Reward

- 1

- 1

- Repost

- Share

Stuart_Crown :

:

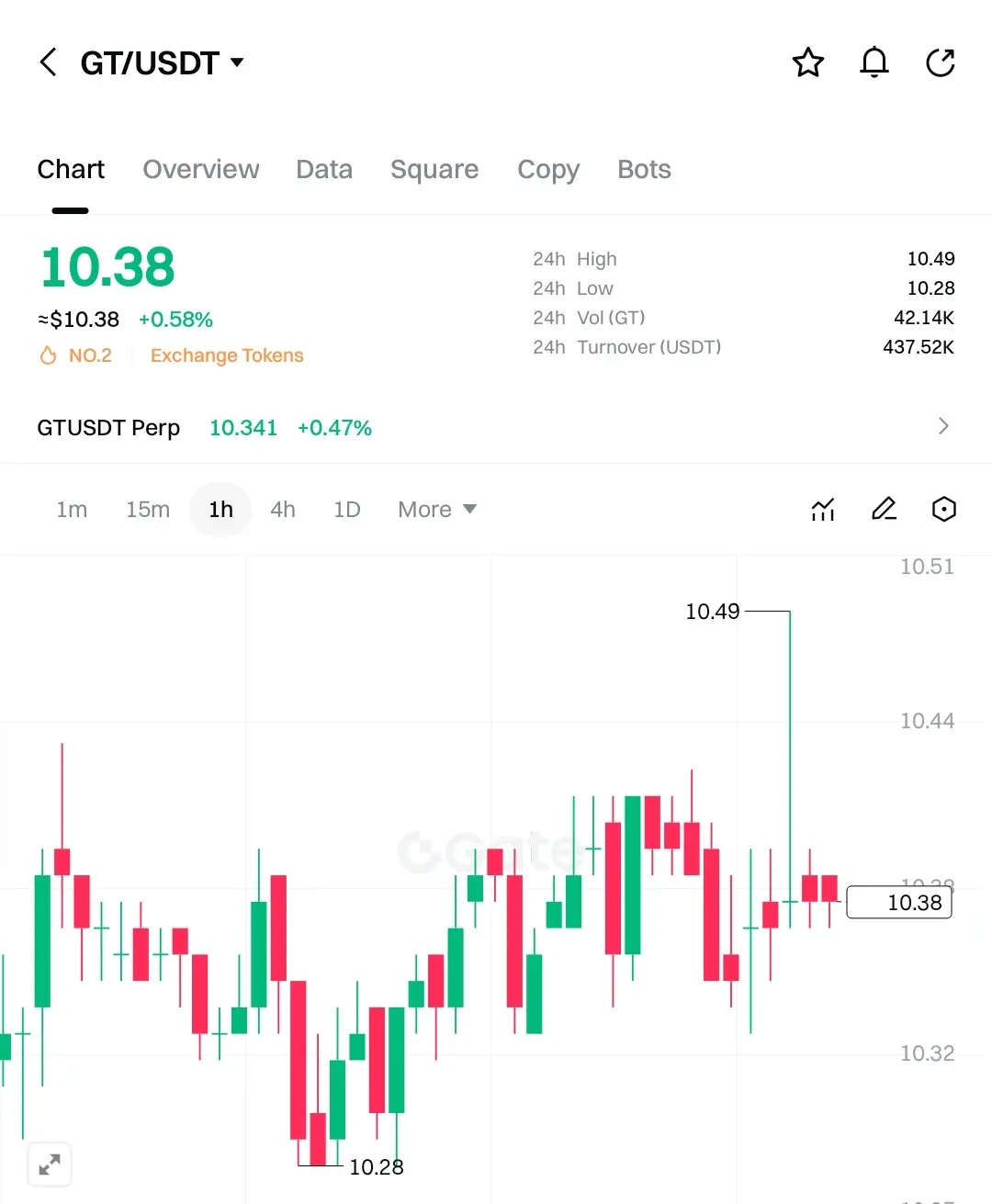

Send it higher 🚀$GT is trading in a tight consolidation range, signaling balance between buyers and sellers after recent volatility. The price is holding above a strong support zone at 10.28–10.30, which has repeatedly attracted buyers, confirming it as a reliable demand area. As long as this level holds, downside risk remains limited. Immediate resistance is located at 10.50, a level where price previously faced rejection and supply pressure. A decisive breakout above 10.50 can shift momentum bullish and push GT toward the next target at 10.80, followed by 11.20 in an extended move. The current sideways acti

GT-1,8%

- Reward

- like

- Comment

- Repost

- Share

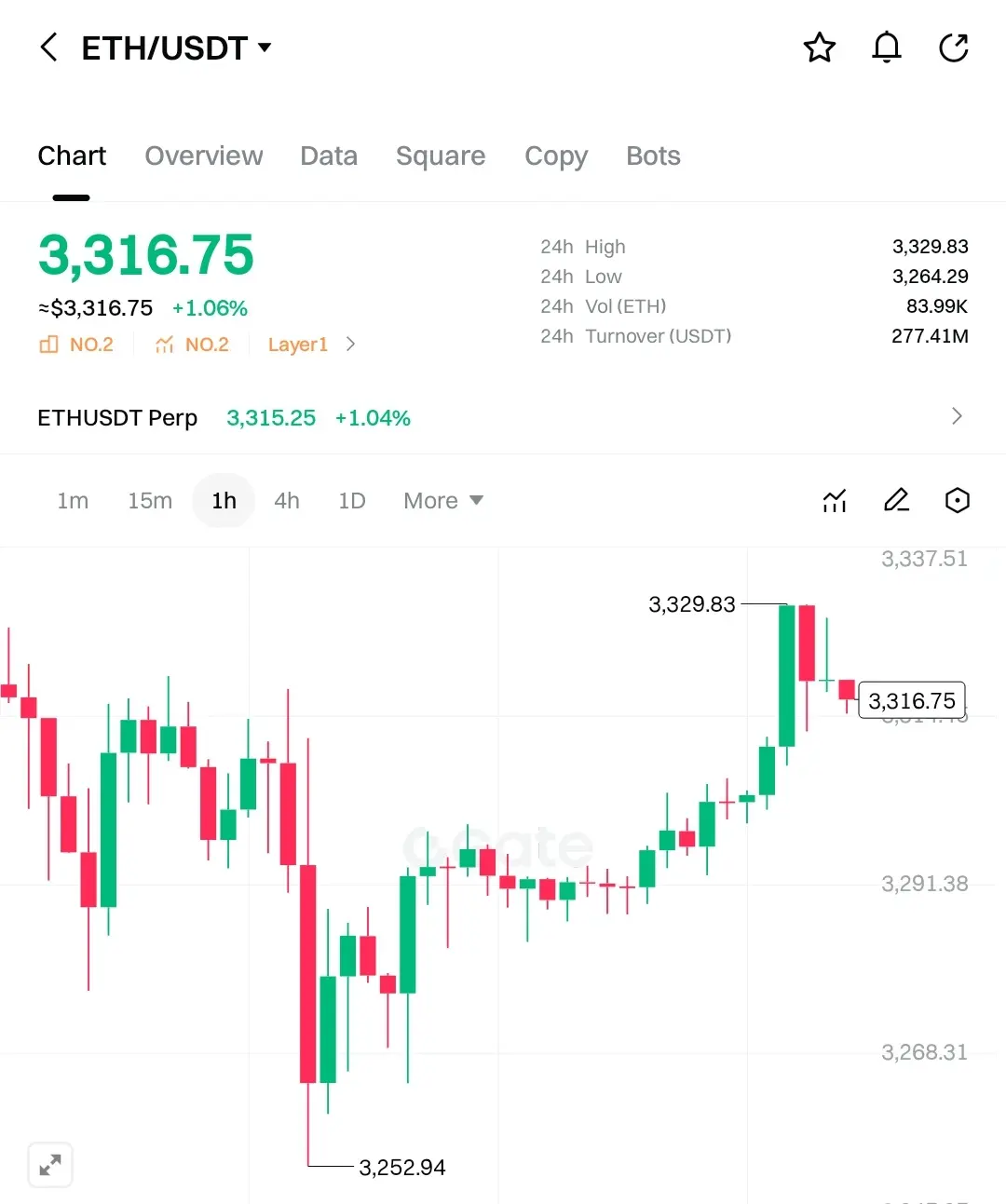

$ETH

Ethereum is displaying a clear bullish reversal on the intraday structure after defending the strong support zone at 3,250–3,270, where buyers absorbed selling pressure effectively. The price has since formed higher lows, signaling strengthening demand and renewed confidence. Currently, ETH is consolidating below a major resistance at 3,330–3,340, which is a critical breakout level. A confirmed push above this zone with volume can accelerate price toward the next target at 3,400, followed by 3,480 if momentum sustains. As long as ETH holds above 3,290, the bullish structure remains intact

Ethereum is displaying a clear bullish reversal on the intraday structure after defending the strong support zone at 3,250–3,270, where buyers absorbed selling pressure effectively. The price has since formed higher lows, signaling strengthening demand and renewed confidence. Currently, ETH is consolidating below a major resistance at 3,330–3,340, which is a critical breakout level. A confirmed push above this zone with volume can accelerate price toward the next target at 3,400, followed by 3,480 if momentum sustains. As long as ETH holds above 3,290, the bullish structure remains intact

ETH-6,06%

- Reward

- 2

- Comment

- Repost

- Share

$SOL

Solana is holding a constructive bullish structure after bouncing strongly from the support zone around 140.20–141.00, where aggressive buying reversed the prior decline. Price is now stabilizing above 144.00, signaling strength and acceptance at higher levels. Immediate resistance is seen at 145.50, which previously capped the upside. A successful breakout above this level can fuel momentum toward the next target at 148.00, followed by 152.00 if bullish pressure sustains. As long as SOL remains above 142.80, the structure stays bullish and pullbacks are likely to attract buyers. A loss o

Solana is holding a constructive bullish structure after bouncing strongly from the support zone around 140.20–141.00, where aggressive buying reversed the prior decline. Price is now stabilizing above 144.00, signaling strength and acceptance at higher levels. Immediate resistance is seen at 145.50, which previously capped the upside. A successful breakout above this level can fuel momentum toward the next target at 148.00, followed by 152.00 if bullish pressure sustains. As long as SOL remains above 142.80, the structure stays bullish and pullbacks are likely to attract buyers. A loss o

SOL-1,7%

- Reward

- like

- Comment

- Repost

- Share

$XRP is currently showing a strong short-term recovery structure on the 1H timeframe, holding firmly above the key demand zone after a sharp bounce from the recent low near 2.02. This area is acting as a solid support, where buyers stepped in aggressively, indicating accumulation rather than panic selling. As long as price sustains above 2.05–2.06, bullish continuation remains favored. Immediate resistance is seen around 2.09–2.10, which aligns with the recent rejection zone and short-term supply. A clean breakout and hold above this level can open the door for the next upside target at 2.15,

XRP-2,22%

- Reward

- like

- Comment

- Repost

- Share

$ZEC is maintaining strength above its structural base, with price respecting higher lows despite broader market noise. The setup favors continuation if resistance is cleared.

Support: 378 – 365

Resistance: 405 – 425

Entry Point (EP): 382 – 392

Targets:

TP1: 405

TP2: 425

TP3: 460

Stop Loss (SL): 358

Outlook:

$ZEC remains bullish while holding above 378. A decisive move through 405 would likely invite follow-through toward higher liquidity zones.$ZEC

Support: 378 – 365

Resistance: 405 – 425

Entry Point (EP): 382 – 392

Targets:

TP1: 405

TP2: 425

TP3: 460

Stop Loss (SL): 358

Outlook:

$ZEC remains bullish while holding above 378. A decisive move through 405 would likely invite follow-through toward higher liquidity zones.$ZEC

ZEC-1,28%

- Reward

- like

- Comment

- Repost

- Share

$MNT is under corrective pressure after failing to hold prior range support. Selling momentum is elevated, but price is approaching a historically responsive demand zone where reactions are likely. This is a high-risk, mean-reversion setup rather than a trend trade.

Support: 1.16 – 1.12

Resistance: 1.26 – 1.34

Entry Point (EP): 1.17 – 1.20

Only valid if price stabilizes and prints higher lows.

Targets:

TP1: 1.26 – range reclaim

TP2: 1.34 – breakdown retest

TP3: 1.48 – extension on strength

Stop Loss (SL): 1.09

Outlook:

$MNT requires confirmation. A reclaim of 1.26 would signal buyer control re

Support: 1.16 – 1.12

Resistance: 1.26 – 1.34

Entry Point (EP): 1.17 – 1.20

Only valid if price stabilizes and prints higher lows.

Targets:

TP1: 1.26 – range reclaim

TP2: 1.34 – breakdown retest

TP3: 1.48 – extension on strength

Stop Loss (SL): 1.09

Outlook:

$MNT requires confirmation. A reclaim of 1.26 would signal buyer control re

MNT-5,03%

- Reward

- 2

- Comment

- Repost

- Share

$MON remains in a sharp drawdown phase with heavy selling pressure. However, price is now deeply extended and nearing a potential exhaustion zone. Volatility expansion to the downside often precedes short-term relief rallies.

Support: 0.0172 – 0.0164

Resistance: 0.0205 – 0.0230

Entry Point (EP): 0.0175 – 0.0182

Targets:

TP1: 0.0205

TP2: 0.0230

TP3: 0.0275

Stop Loss (SL): 0.0159

Outlook:

$MON is speculative. While downside momentum is strong, any stabilization above 0.0172 could trigger a sharp reactive bounce.

$MON

Support: 0.0172 – 0.0164

Resistance: 0.0205 – 0.0230

Entry Point (EP): 0.0175 – 0.0182

Targets:

TP1: 0.0205

TP2: 0.0230

TP3: 0.0275

Stop Loss (SL): 0.0159

Outlook:

$MON is speculative. While downside momentum is strong, any stabilization above 0.0172 could trigger a sharp reactive bounce.

$MON

MON-5,55%

- Reward

- like

- Comment

- Repost

- Share

$JELLYJELLY is attempting to base after a steep pullback. Selling pressure has slowed, and price is compressing near support, indicating balance returning between buyers and sellers.

Support: 0.0860 – 0.0835

Resistance: 0.0955 – 0.1020

Entry Point (EP): 0.0870 – 0.0890

Targets:

TP1: 0.0955

TP2: 0.1020

TP3: 0.1150

Stop Loss (SL): 0.0819

Outlook:

Holding above 0.086 keeps $JELLYJELLY positioned for recovery. A break above 0.0955 would confirm momentum shift.$JELLYJELLY

Support: 0.0860 – 0.0835

Resistance: 0.0955 – 0.1020

Entry Point (EP): 0.0870 – 0.0890

Targets:

TP1: 0.0955

TP2: 0.1020

TP3: 0.1150

Stop Loss (SL): 0.0819

Outlook:

Holding above 0.086 keeps $JELLYJELLY positioned for recovery. A break above 0.0955 would confirm momentum shift.$JELLYJELLY

JELLYJELLY-0,84%

- Reward

- 1

- Comment

- Repost

- Share