NekoZz

No content yet

NekoZz

- Reward

- like

- Comment

- Repost

- Share

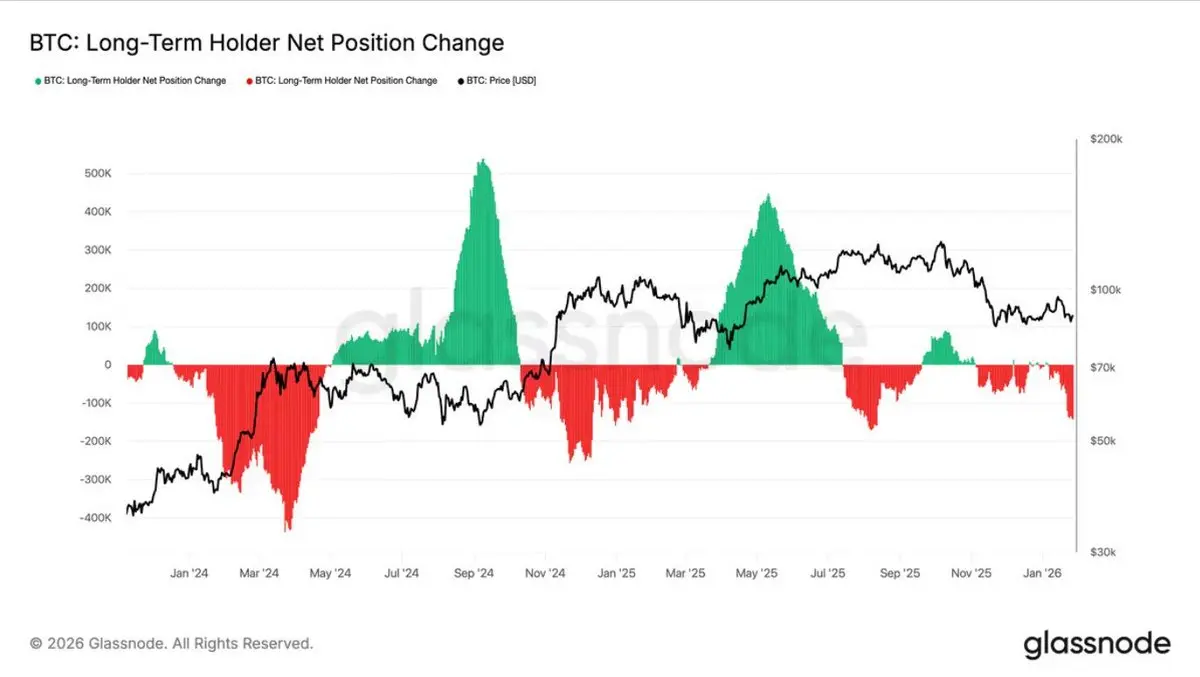

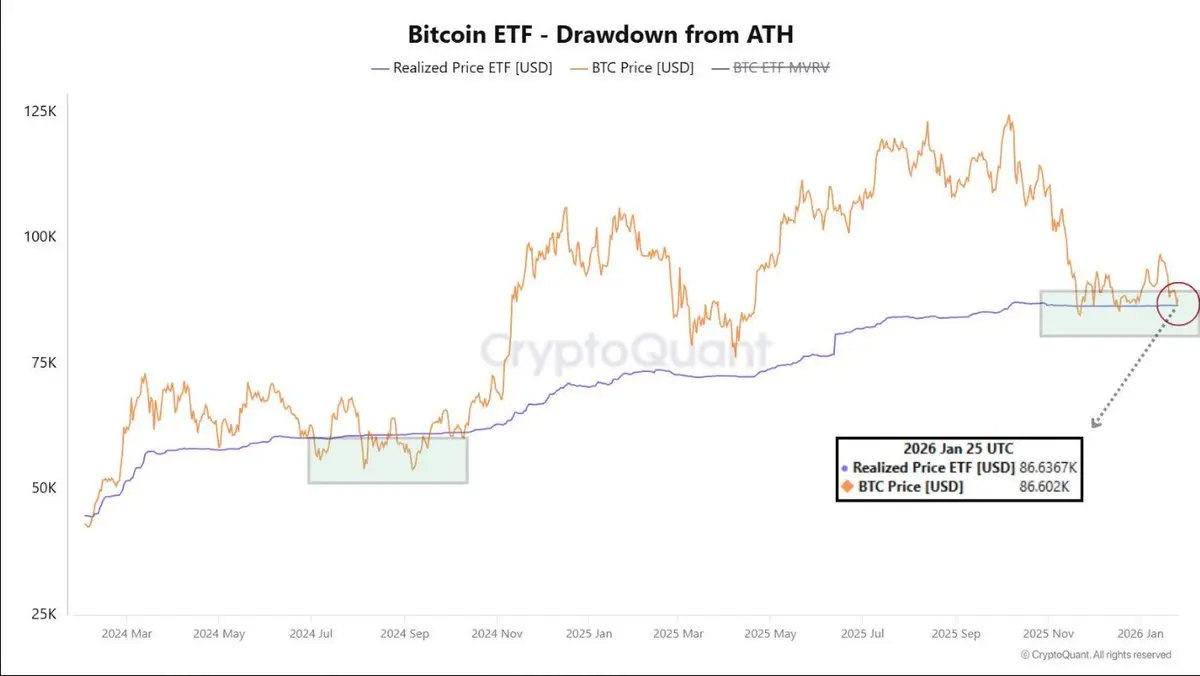

Crypto is at a massive crossroads. We are sitting on a multi-year support line that hasn\'t failed us yet. History says we bounce and send it to new ATHs.Don\'t overcomplicate it: Trend is your friend until the end.Loading or sitting on hands ?

- Reward

- like

- Comment

- Repost

- Share

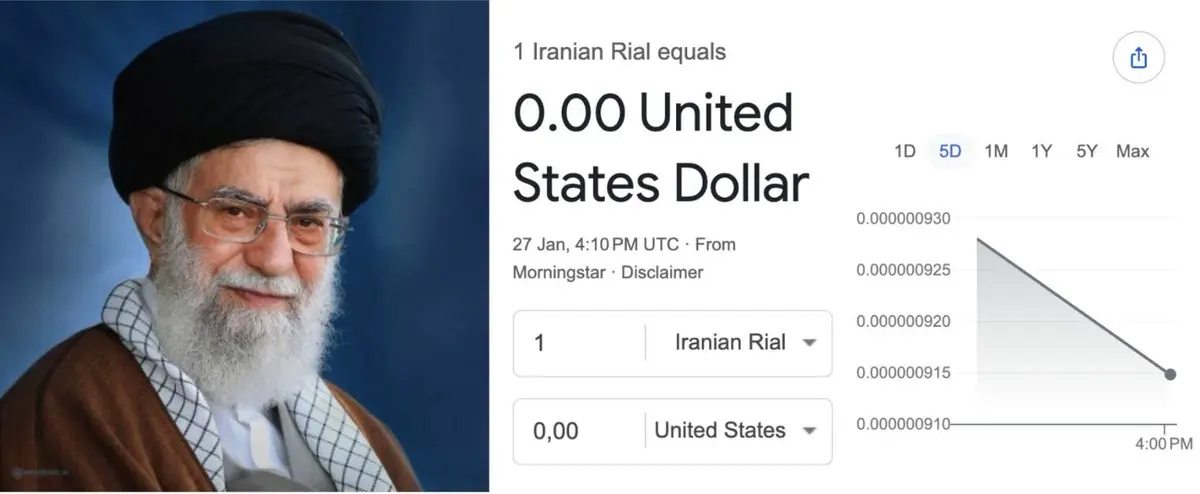

Iran’s currency has officially entered the death spiral. Yesterday: 1.5MToday: 1.67M per $1 USDConfidence has left the building. When the math breaks this hard, the system follows. 🇮🇷

- Reward

- like

- Comment

- Repost

- Share

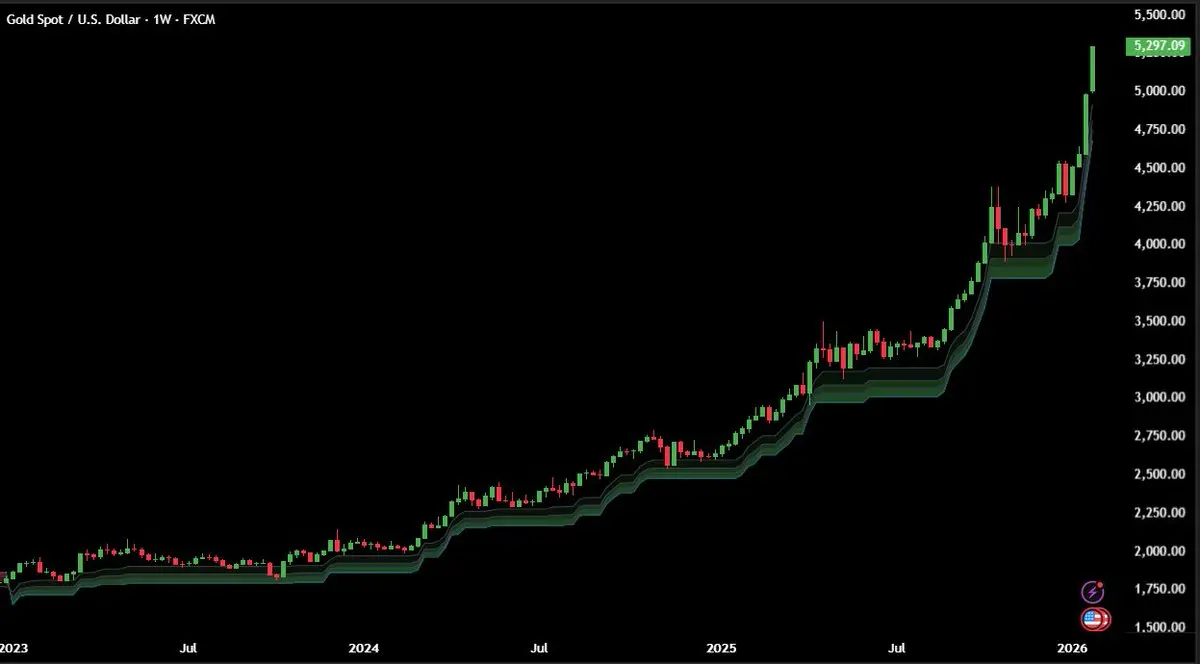

Metaplanet just announced a $137M capital raise for one reason: Buying more Bitcoin. 🇯🇵They already hold over 35,000 BTC and they\'re still hungry. The "MicroStrategy Playbook" is officially the new gold standard for corporate treasuries.Tick tock. Next block.

BTC-5,3%

- Reward

- like

- Comment

- Repost

- Share

10:30 AM ET. Senate. Market Structure Bill. Manipulation has been the "hidden tax" on every retail investor for too long. Time to clean up the Wild West and build a real ecosystem.Make it happen

- Reward

- like

- Comment

- Repost

- Share

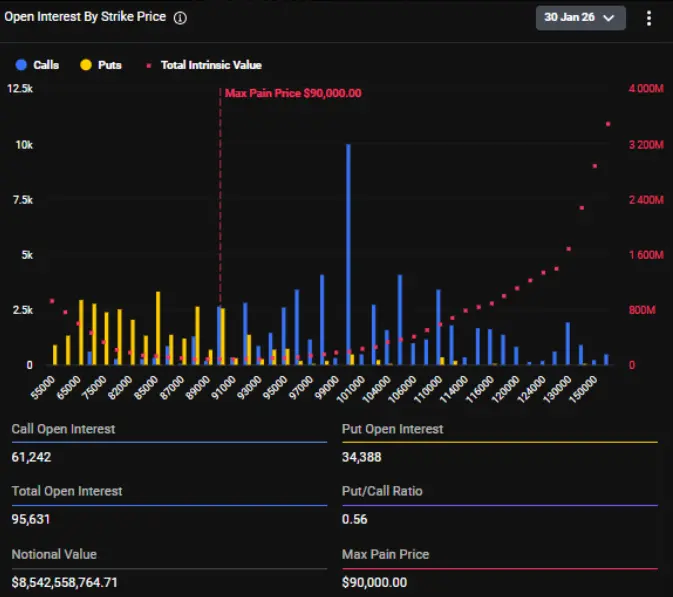

The biggest expiry of 2026 is here. $8.53B at stake.• Max Pain: $90K • Call Walls: $100K • Put Support: $85KPrice is currently the ultimate arbiter of pain. We’ve seen this movie before—expect heavy manipulation into the 8am UTC print.Don\'t get liquidated in the noise. Stay focused.

- Reward

- 1

- Comment

- Repost

- Share

UK bans Coinbase ads for being "misleading." Basically: Don\'t tell people crypto will pay their electricity bills if you aren\'t ready for the hammer to drop. Compliance is the new meta. Who’s next?

- Reward

- like

- Comment

- Repost

- Share

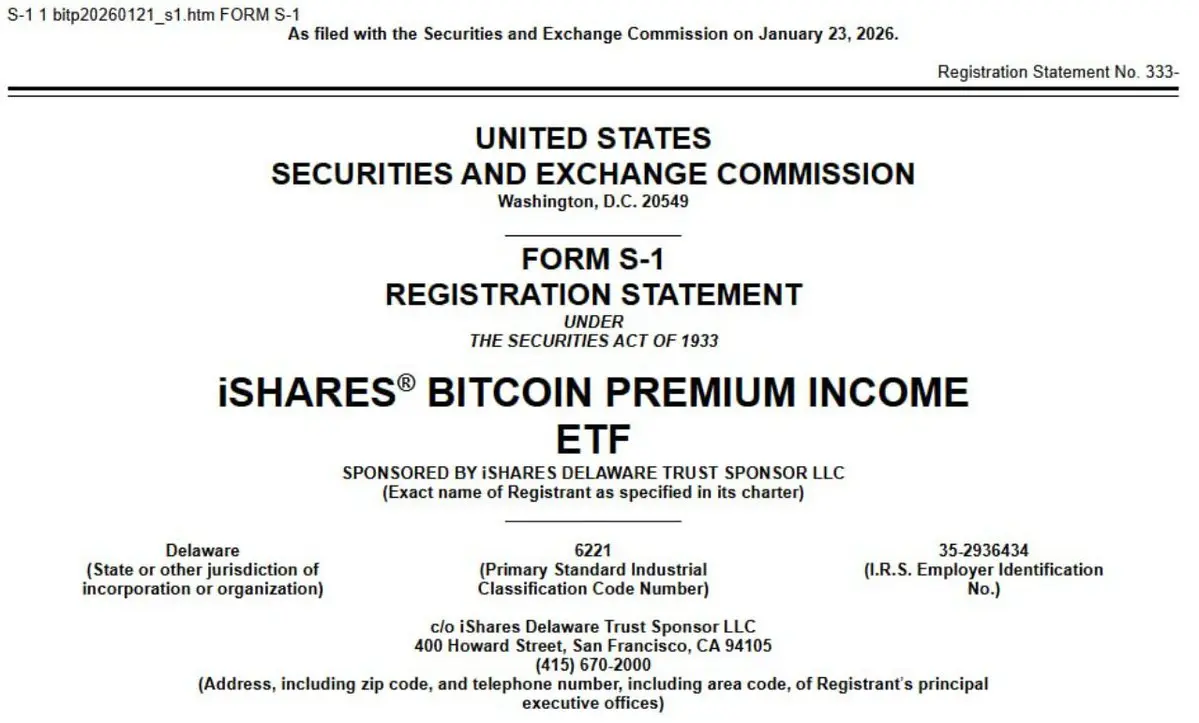

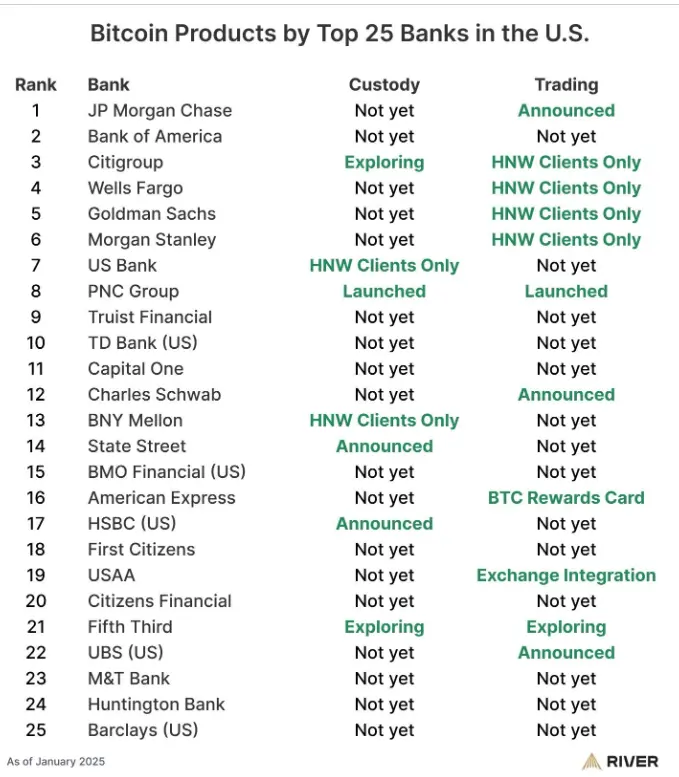

HUGE: 6/10 top U.S. banks are officially in the Bitcoin game. 🇺🇸JPMorgan, Wells Fargo, and Citi are already building services while the laggards watch from the sidelines.You don\'t bet against the biggest liquidity providers in the world. The flip is happening in real-time.

BTC-5,3%

- Reward

- like

- Comment

- Repost

- Share

Stop looking at "total volume" and start looking at B2B.$230B in actual business payments settled via stablecoins this year. Asia is the undisputed king of this trend, moving $245B across the region.Faster settlement, lower fees, zero bank holidays. The efficiency gains are too big for the enterprise world to ignore. The future of money is a stablecoin.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More16.54K Popularity

14.54K Popularity

12.64K Popularity

5.25K Popularity

46.74K Popularity

Pin