Sykodelicc

No content yet

Sykodelicc

This happens in every cycle.

And its always around mid cycle peak.

This adds an interesting weight on the overall market position.

You can see that each time Global Liquidity breaks out, Bitcoin moves slightly higher, then has a multi month correction...

Just like now.

Then, as global liquidity continues to increase, Bitcoin resumes higher again.

Last two cycles Global liquidity broke out for 671 days and 731 days.

Very similar.

So far, this cycle, we are only at 306 days.

What is also very striking to observe is that the contraction of global liquidity this cycle was much larger than 2016 and

And its always around mid cycle peak.

This adds an interesting weight on the overall market position.

You can see that each time Global Liquidity breaks out, Bitcoin moves slightly higher, then has a multi month correction...

Just like now.

Then, as global liquidity continues to increase, Bitcoin resumes higher again.

Last two cycles Global liquidity broke out for 671 days and 731 days.

Very similar.

So far, this cycle, we are only at 306 days.

What is also very striking to observe is that the contraction of global liquidity this cycle was much larger than 2016 and

BTC-3,75%

- Reward

- 3

- 1

- Repost

- Share

Mrworldwide :

:

true 💯 it's always around mid cycle peak when ever global liquidity breaks outIt happens every single time

Every single time Bitcoin has been at these record levels of oversold on the weekly timeframe, people declare it dead.

And it just so happens that every time, there is a new narrative for it.

- Bitcoin is useless

- Bitcoin has lost the digital gold race

- Quantum will kill it

- Saylor will be liquidated

- 20k coming

Right now, we are the most oversold on the weekly ever…

So is it a surprise that the FUD is worse than ever?

The funniest thing about this phenomenon is everyone is capable of looking back and seeing this…

But this is the power of emotion.

The fear of t

Every single time Bitcoin has been at these record levels of oversold on the weekly timeframe, people declare it dead.

And it just so happens that every time, there is a new narrative for it.

- Bitcoin is useless

- Bitcoin has lost the digital gold race

- Quantum will kill it

- Saylor will be liquidated

- 20k coming

Right now, we are the most oversold on the weekly ever…

So is it a surprise that the FUD is worse than ever?

The funniest thing about this phenomenon is everyone is capable of looking back and seeing this…

But this is the power of emotion.

The fear of t

BTC-3,75%

- Reward

- like

- Comment

- Repost

- Share

Is a 100% move coming for $ETH?

Nice hidden bullish divergence printed on the Weekly chart here.

Last time this happened, $ETH rallied 100%.

For those that don't know, a hidden bullish divergence is when the RSI makes a lower lower, but price makes a higher low.

It means that momentum was actually stronger, but price absorbed it better.

Its a Bullish continuation signal and on HTF it matters more.

Nice hidden bullish divergence printed on the Weekly chart here.

Last time this happened, $ETH rallied 100%.

For those that don't know, a hidden bullish divergence is when the RSI makes a lower lower, but price makes a higher low.

It means that momentum was actually stronger, but price absorbed it better.

Its a Bullish continuation signal and on HTF it matters more.

ETH-3,85%

- Reward

- 2

- 1

- Repost

- Share

Yunna :

:

Wishing you great wealth in the Year of the Horse 🐴What the hell is this timeline...

Its become so utterly bear jaded that Its genuinely baffling.

This is the state of comments over and over, on every post i see.

Crazy times.

Its become so utterly bear jaded that Its genuinely baffling.

This is the state of comments over and over, on every post i see.

Crazy times.

- Reward

- 2

- Comment

- Repost

- Share

Same thing happens every cycle.

And its always around mid cycle peak.

This further hits home where we are and my overall thesis.

You can see that each time Global Liquidity breaks out, Bitcoin moves slightly higher, then has a multi month correction...

Just like now.

Then, as global liquidity continues to increase, Bitcoin resumes higher again.

Last two cycles Global liquidity broke out for 671 days and 731 days.

Very similar.

So far, this cycle, we are only at 306 days.

What is also very striking to observe is that the contraction of global liquidity this cycle was much larger than 2016 and 2

And its always around mid cycle peak.

This further hits home where we are and my overall thesis.

You can see that each time Global Liquidity breaks out, Bitcoin moves slightly higher, then has a multi month correction...

Just like now.

Then, as global liquidity continues to increase, Bitcoin resumes higher again.

Last two cycles Global liquidity broke out for 671 days and 731 days.

Very similar.

So far, this cycle, we are only at 306 days.

What is also very striking to observe is that the contraction of global liquidity this cycle was much larger than 2016 and 2

BTC-3,75%

- Reward

- 2

- Comment

- Repost

- Share

Here is my thesis.

Broken down and put forward with key charts that I think show the greatest signal of it.

A lot of people don't understand why I think what I do... why I am targeting a continued cycle and new highs this year...

When surely a prolonged bear market seems obvious?

Overall, this chart highlights almost all the key differences we have seen within this cycle that have to be accounted for, and explained.

But most notably, in my view, it shows us exactly where we are in the cycle right now...

Even if it looks a little different to what most of us expected.

It looks a little complex

Broken down and put forward with key charts that I think show the greatest signal of it.

A lot of people don't understand why I think what I do... why I am targeting a continued cycle and new highs this year...

When surely a prolonged bear market seems obvious?

Overall, this chart highlights almost all the key differences we have seen within this cycle that have to be accounted for, and explained.

But most notably, in my view, it shows us exactly where we are in the cycle right now...

Even if it looks a little different to what most of us expected.

It looks a little complex

- Reward

- 2

- Comment

- Repost

- Share

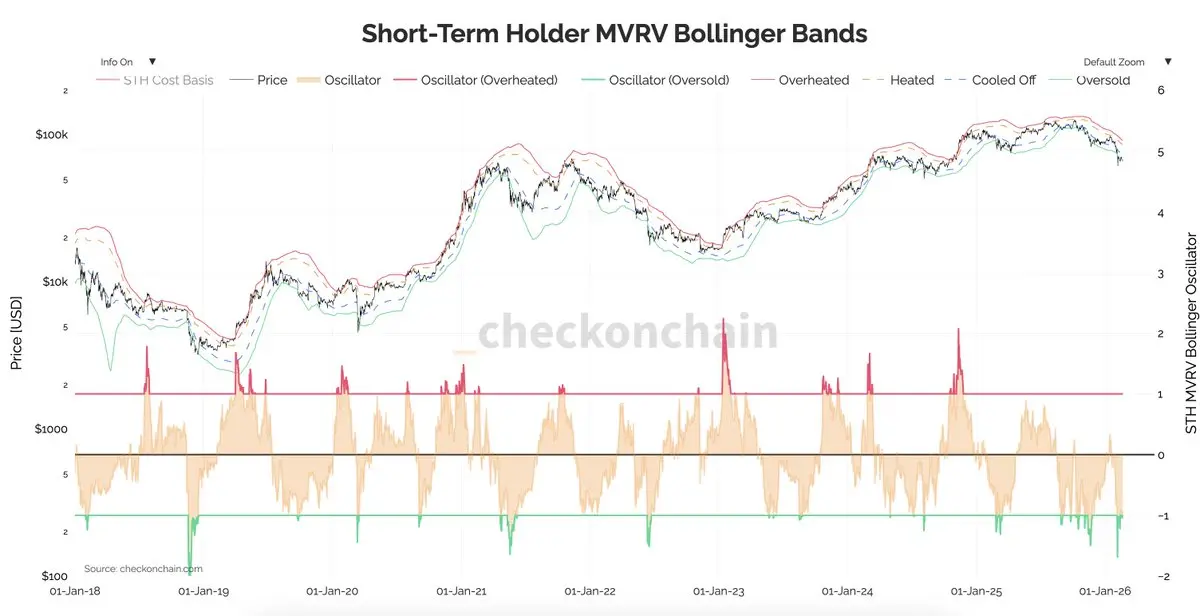

Max pain is now officially, up.

People say this all the time and usually it is not the case.

But the market bottoming here and pushing on to new highs in aggressive fashion, this year, is the most unexpected scenario right now.

It would quite literally leave the space utterly stunned.

Almost everyone is expecting 4 year cycle lows, $35k in October, then new highs 2029 etc.

Suggesting anything different is simply attacked right now.

But right here, Short term holders reached the most overextended Bollinger bands, and most STH losses since 2018.

What that means is short term holders have capitul

People say this all the time and usually it is not the case.

But the market bottoming here and pushing on to new highs in aggressive fashion, this year, is the most unexpected scenario right now.

It would quite literally leave the space utterly stunned.

Almost everyone is expecting 4 year cycle lows, $35k in October, then new highs 2029 etc.

Suggesting anything different is simply attacked right now.

But right here, Short term holders reached the most overextended Bollinger bands, and most STH losses since 2018.

What that means is short term holders have capitul

- Reward

- 3

- Comment

- Repost

- Share

I'm calling it now...

The ISM is going to come in even higher than 52.6 for Feb.

The US economy is now fully within expansion mode, and the process of it entering expansion like this has always sparked large bull runs... 100% of the time.

To signal this, the top chart is "Deere & Co" a large industrial machinery company, and there stock is god candling like it never has before.

That is not for no reason. This is expansion.

Next is IWM, which is small cap stocks, which mirror closely to Deere & Co as small caps only perform well in economic and liquidity expansion.

Then below, ETH, which moves

The ISM is going to come in even higher than 52.6 for Feb.

The US economy is now fully within expansion mode, and the process of it entering expansion like this has always sparked large bull runs... 100% of the time.

To signal this, the top chart is "Deere & Co" a large industrial machinery company, and there stock is god candling like it never has before.

That is not for no reason. This is expansion.

Next is IWM, which is small cap stocks, which mirror closely to Deere & Co as small caps only perform well in economic and liquidity expansion.

Then below, ETH, which moves

ETH-3,85%

- Reward

- 2

- Comment

- Repost

- Share

Its all happening at the same time.

The Clarity Act has been given a deadline of March 1st.

With now an 84% chance on Polymarket.

This is one of those things were they will be positive, then negative, then positive... then it will seem like it'll never happen... and then all of a sudden it does.

So lining up for the beginning of March is:

- Clarity Act

- Next ISM print

- New Lunar cycle

- All bears are gay

The Clarity Act has been given a deadline of March 1st.

With now an 84% chance on Polymarket.

This is one of those things were they will be positive, then negative, then positive... then it will seem like it'll never happen... and then all of a sudden it does.

So lining up for the beginning of March is:

- Clarity Act

- Next ISM print

- New Lunar cycle

- All bears are gay

- Reward

- 1

- Comment

- Repost

- Share

This is very clean.

When you take emotions out of it and just observe Bitcoin on the 1M with simple metrics...

You can see its just in one massive uptrend, with a breakout and retest of previous ATH...

Every cycle.

Whats interesting is that every cycle:

- BTC at least tags the 1M 50EMA

- At least tags its old ATH

- Never closes a candle below its old ATH

- RSI resets to a very similar level

The main difference this cycle is that the RSI never entered overexpnasion.

From a TA perspective, this is very clean.

If we were to close a monthly candle below $61,400 it would be the first time it has ev

When you take emotions out of it and just observe Bitcoin on the 1M with simple metrics...

You can see its just in one massive uptrend, with a breakout and retest of previous ATH...

Every cycle.

Whats interesting is that every cycle:

- BTC at least tags the 1M 50EMA

- At least tags its old ATH

- Never closes a candle below its old ATH

- RSI resets to a very similar level

The main difference this cycle is that the RSI never entered overexpnasion.

From a TA perspective, this is very clean.

If we were to close a monthly candle below $61,400 it would be the first time it has ev

BTC-3,75%

- Reward

- 1

- Comment

- Repost

- Share

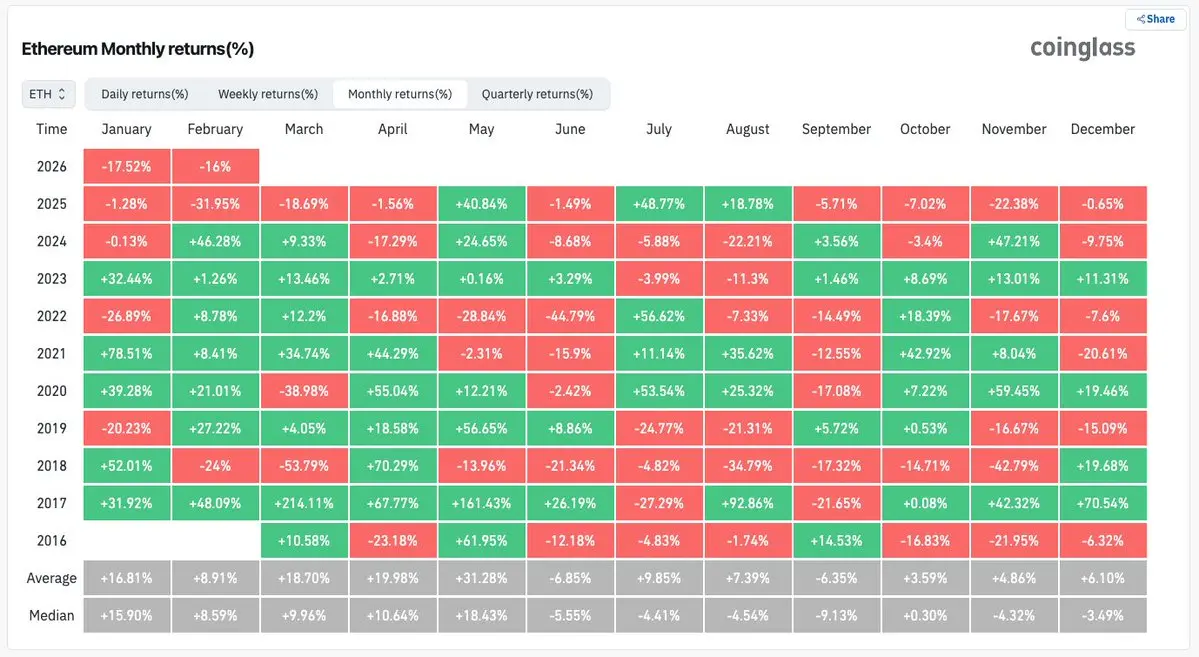

More records have been broken.

2025 was Ethereums worst year on record.

11 out of the last 14 months have been red.

And 2025 tied 2018 with 9 out of 12 red months.

Simply put, this last 14 months has been Ethereums worst ever performance over that period of time.

So if you have been here this whole time, you have endured the worst market conditions ever.

If you've made money, you're truly skilled.

The silver lining?

The last time ETH performed like this it had 5 green months in a row.

Soon.

2025 was Ethereums worst year on record.

11 out of the last 14 months have been red.

And 2025 tied 2018 with 9 out of 12 red months.

Simply put, this last 14 months has been Ethereums worst ever performance over that period of time.

So if you have been here this whole time, you have endured the worst market conditions ever.

If you've made money, you're truly skilled.

The silver lining?

The last time ETH performed like this it had 5 green months in a row.

Soon.

ETH-3,85%

- Reward

- 3

- Comment

- Repost

- Share

This cycle was different.

Fundamentally different.

1. New ATH before the halving

2. No true overbought expansion on 1M RSI

3. The whole cycle in ISM contraction

These are very big factors that cannot just be ignored.

So when looking at this current bear phase, we cannot look at it the same way as before.

The 1M RSI is already at the 2015 and 2018 bear market lows, and very close to 2022 lows.

In addition it has already tagged the 1M 50 EMA.

And it has made it there after only 4 months.

What this shows us is that just how we never had true expansion, we would be silly to expect the same contrac

Fundamentally different.

1. New ATH before the halving

2. No true overbought expansion on 1M RSI

3. The whole cycle in ISM contraction

These are very big factors that cannot just be ignored.

So when looking at this current bear phase, we cannot look at it the same way as before.

The 1M RSI is already at the 2015 and 2018 bear market lows, and very close to 2022 lows.

In addition it has already tagged the 1M 50 EMA.

And it has made it there after only 4 months.

What this shows us is that just how we never had true expansion, we would be silly to expect the same contrac

- Reward

- 1

- Comment

- Repost

- Share

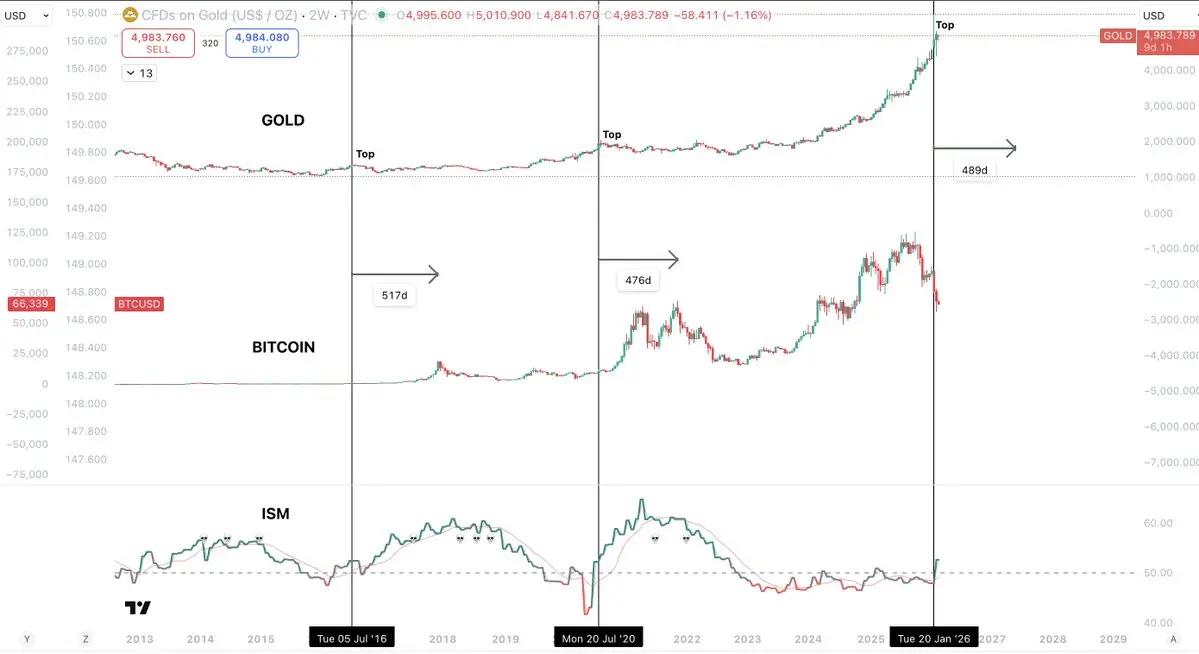

You do not need to overcomplicate it.

I don't understand why everyone finds its so hard to see these things.

Well, I do, because emotions rule 99% of people.

But anyone can line up these three fundamental macro charts and analyse where we are.

It literally takes two minutes.

In every single cycle we have had:

1. GOLD tops as ISM moves into expansion

2. Bitcoin tops between 476d and 517d after

It is very clear to see that.

And it is not a coincidence this happens, it happens for fundamental macro reasons.

GOLD is a strong risk off asset that performs well in economic and geopolitical uncertaint

I don't understand why everyone finds its so hard to see these things.

Well, I do, because emotions rule 99% of people.

But anyone can line up these three fundamental macro charts and analyse where we are.

It literally takes two minutes.

In every single cycle we have had:

1. GOLD tops as ISM moves into expansion

2. Bitcoin tops between 476d and 517d after

It is very clear to see that.

And it is not a coincidence this happens, it happens for fundamental macro reasons.

GOLD is a strong risk off asset that performs well in economic and geopolitical uncertaint

BTC-3,75%

- Reward

- 1

- Comment

- Repost

- Share

This is a massive difference.

Finally, we are seeing a much lesser amount of longs pile in.

We have $1bn in longs and $20bn in shorts.

20x more short liquidations than longs.

Whilst at the same time, I have seen over the last few days...

- So many Bitcoin going to zero posts

- Perma bears revising their targets after every drop

- Quantum FUD literally everywhere

- Time Capitulation taking effect

Few more LTF moves here and we start to work on taking out these shorts.

$64k/65k first.

Finally, we are seeing a much lesser amount of longs pile in.

We have $1bn in longs and $20bn in shorts.

20x more short liquidations than longs.

Whilst at the same time, I have seen over the last few days...

- So many Bitcoin going to zero posts

- Perma bears revising their targets after every drop

- Quantum FUD literally everywhere

- Time Capitulation taking effect

Few more LTF moves here and we start to work on taking out these shorts.

$64k/65k first.

BTC-3,75%

- Reward

- 2

- Comment

- Repost

- Share

Looking for something like this.

$65k - $73k.

Then we see how it holds.

Timeline getting pretty exhausted now.

$65k - $73k.

Then we see how it holds.

Timeline getting pretty exhausted now.

- Reward

- 2

- Comment

- Repost

- Share

This is a very important chart.

Above we have the PSCF, which represents the performance, price movements, and market trends of the Invesco S&P SmallCap Financials ETF.

This essentially represents small-capitalisation U.S companies in the financial services and real estate sectors.

Basically, the companies that are the most sensitive to liquidity, borrowing, interest rates, credit etc. Small cap financials and regional banks.

This performs well in times of economic expansion and easing liquidity and badly in times of contractions. It is a lot more sensitive than that of the main S&P500 for ex

Above we have the PSCF, which represents the performance, price movements, and market trends of the Invesco S&P SmallCap Financials ETF.

This essentially represents small-capitalisation U.S companies in the financial services and real estate sectors.

Basically, the companies that are the most sensitive to liquidity, borrowing, interest rates, credit etc. Small cap financials and regional banks.

This performs well in times of economic expansion and easing liquidity and badly in times of contractions. It is a lot more sensitive than that of the main S&P500 for ex

BTC-3,75%

- Reward

- 2

- Comment

- Repost

- Share

Alts are starting breakout against Bitcoin.

The last two times this happened Alts outperformed against Bitcoin for:

2016- 574 days

2019- 770 days

Now, in 2026, they have broken the weekly trend and already put in 5 green weekly candles against Bitcoin.

This is not what has ever happened within traditional bear markets.

You can very clearly see that in every bear market since OTHERS has existed, this chart enters a steep and aggressive downtrend against Bitcoin.

And right now, its been consolidating and now breaking higher as Bitcoin has been dropping.

I'm not saying we are going to get 770 day

The last two times this happened Alts outperformed against Bitcoin for:

2016- 574 days

2019- 770 days

Now, in 2026, they have broken the weekly trend and already put in 5 green weekly candles against Bitcoin.

This is not what has ever happened within traditional bear markets.

You can very clearly see that in every bear market since OTHERS has existed, this chart enters a steep and aggressive downtrend against Bitcoin.

And right now, its been consolidating and now breaking higher as Bitcoin has been dropping.

I'm not saying we are going to get 770 day

BTC-3,75%

- Reward

- like

- Comment

- Repost

- Share

There will never be another alt szn...

Is all you hear, everywhere.

Alts have never been declared more dead than they are today.

And yet, while that is happening, a 100% hit rate signal for alt szn has just flashed.

This has predicted 6 out 6 alt szns, and it's happening right now.

Just as everyone thinks they're done and has bought metals.

It will never change.

Every single time the 3W MACD has flipped bullish, it has sparked an alt szn...

And for at least 6 months.

Call me delusional, retard, whatever...

This is just what the chart says... and i tend to listen to those over braindead reply g

Is all you hear, everywhere.

Alts have never been declared more dead than they are today.

And yet, while that is happening, a 100% hit rate signal for alt szn has just flashed.

This has predicted 6 out 6 alt szns, and it's happening right now.

Just as everyone thinks they're done and has bought metals.

It will never change.

Every single time the 3W MACD has flipped bullish, it has sparked an alt szn...

And for at least 6 months.

Call me delusional, retard, whatever...

This is just what the chart says... and i tend to listen to those over braindead reply g

- Reward

- like

- Comment

- Repost

- Share

It’s pretty simple.

Rates are coming down

Clarity act will be passed

Money will be very cheap

The tokens will send.

In 2022 after we topped we had

- 9% inflation

- had expanded the money supply by $3tn

- been in business cycle expansion for 18 months

Contraction was imminent.

Today, inflation is 2.4%, we finished the longest period of QT ever and the business cycle has just started expanding again.

The situation we are in could not be more different to 2022 and to expect this year to play out the same way, is folly.

The underlying market foundation could not be more different to las

Rates are coming down

Clarity act will be passed

Money will be very cheap

The tokens will send.

In 2022 after we topped we had

- 9% inflation

- had expanded the money supply by $3tn

- been in business cycle expansion for 18 months

Contraction was imminent.

Today, inflation is 2.4%, we finished the longest period of QT ever and the business cycle has just started expanding again.

The situation we are in could not be more different to 2022 and to expect this year to play out the same way, is folly.

The underlying market foundation could not be more different to las

- Reward

- like

- Comment

- Repost

- Share