UnlimitedCryptoTrading

No content yet

UnlimitedCryptoTrading

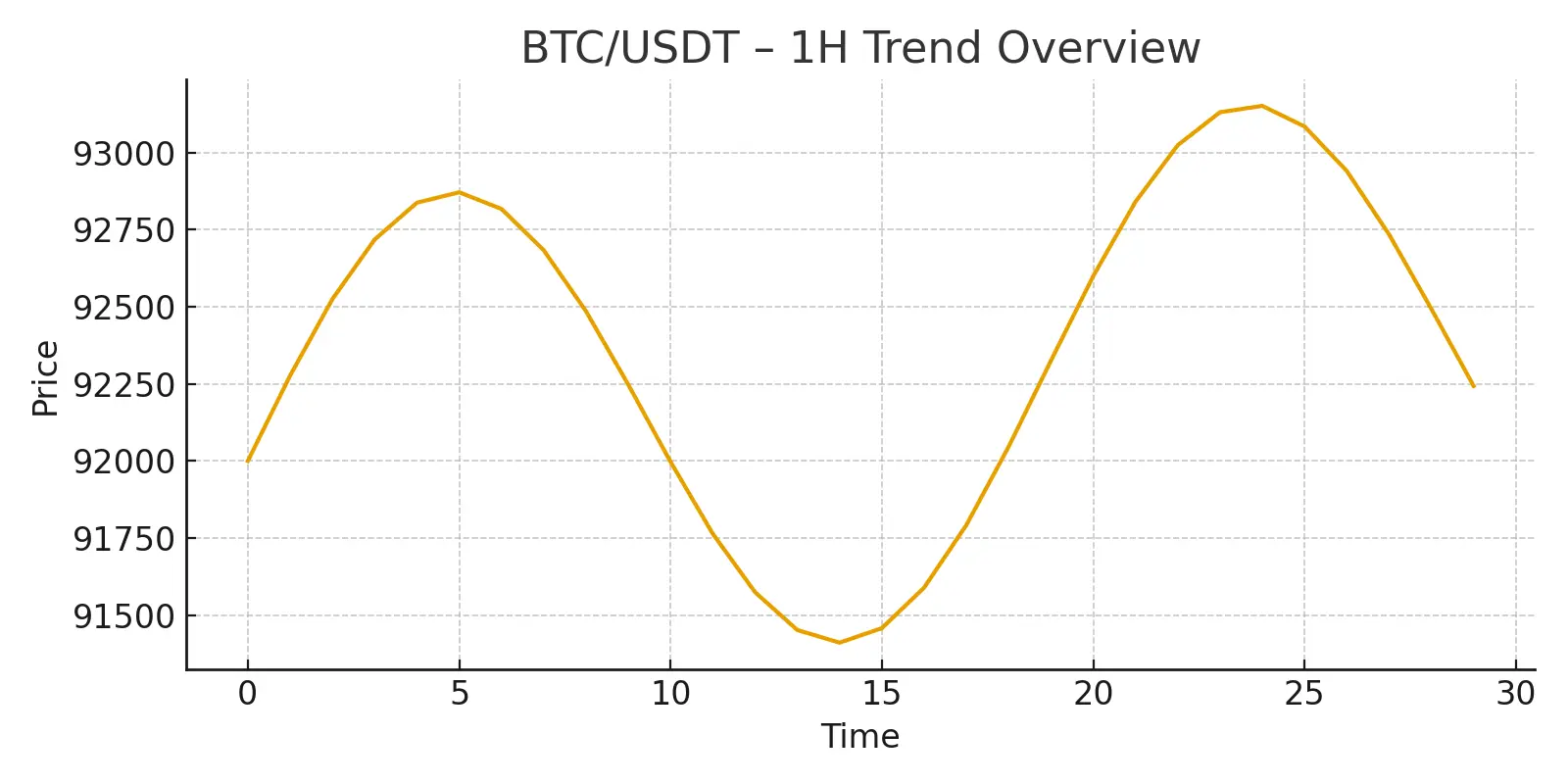

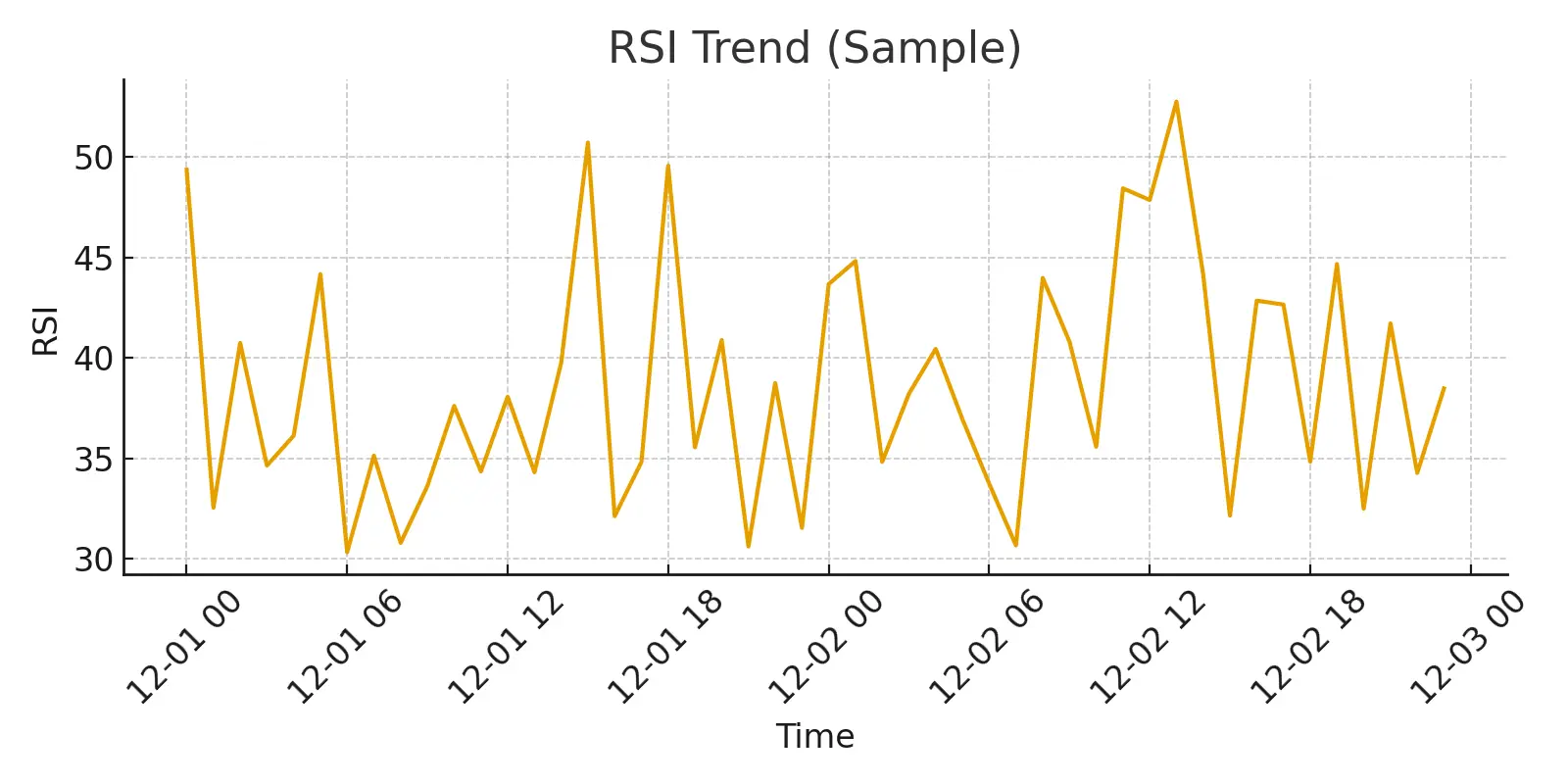

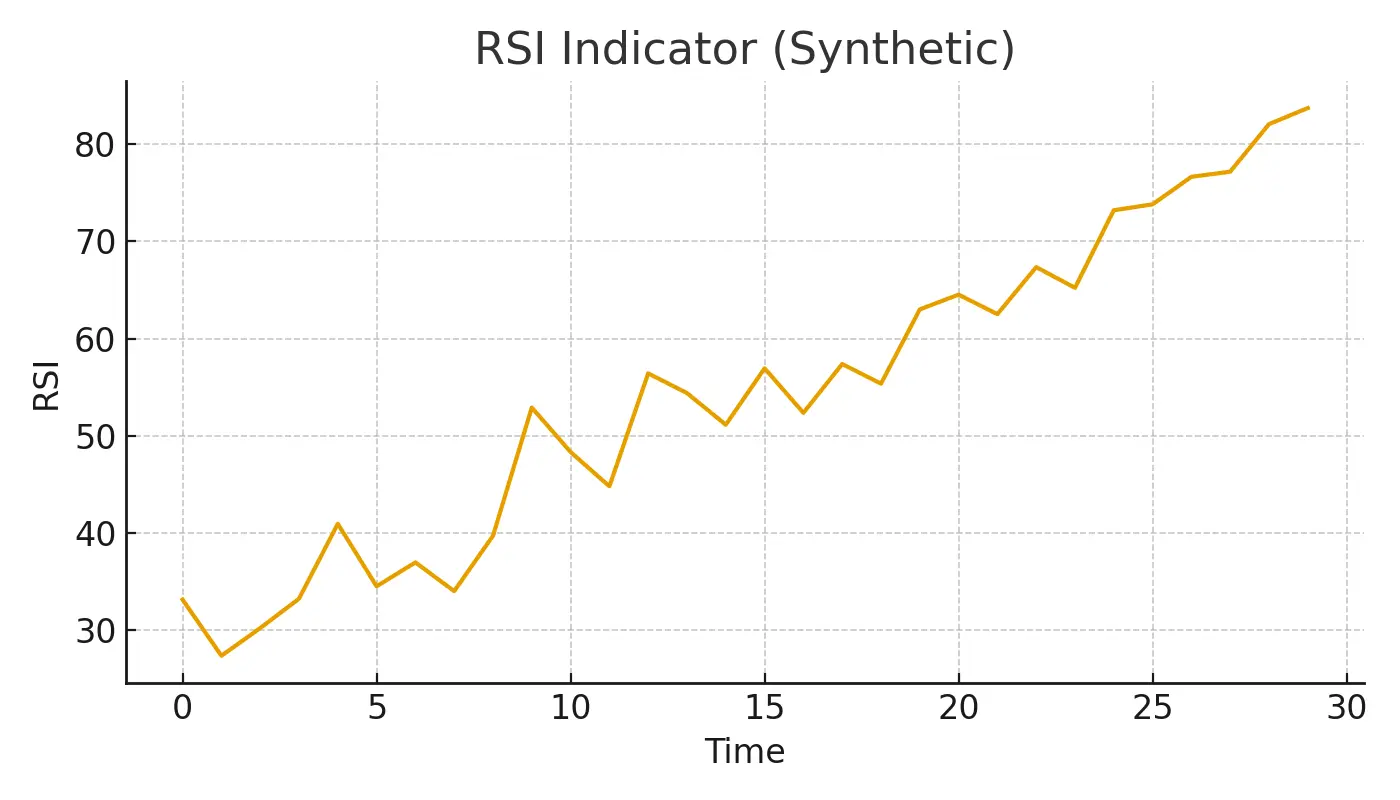

$BTC The market has been moving in a tight range after yesterday’s strong push, and price is now stabilizing around the mid-zone. Buyers are still showing interest, but momentum is slowing down compared to the earlier impulse move.

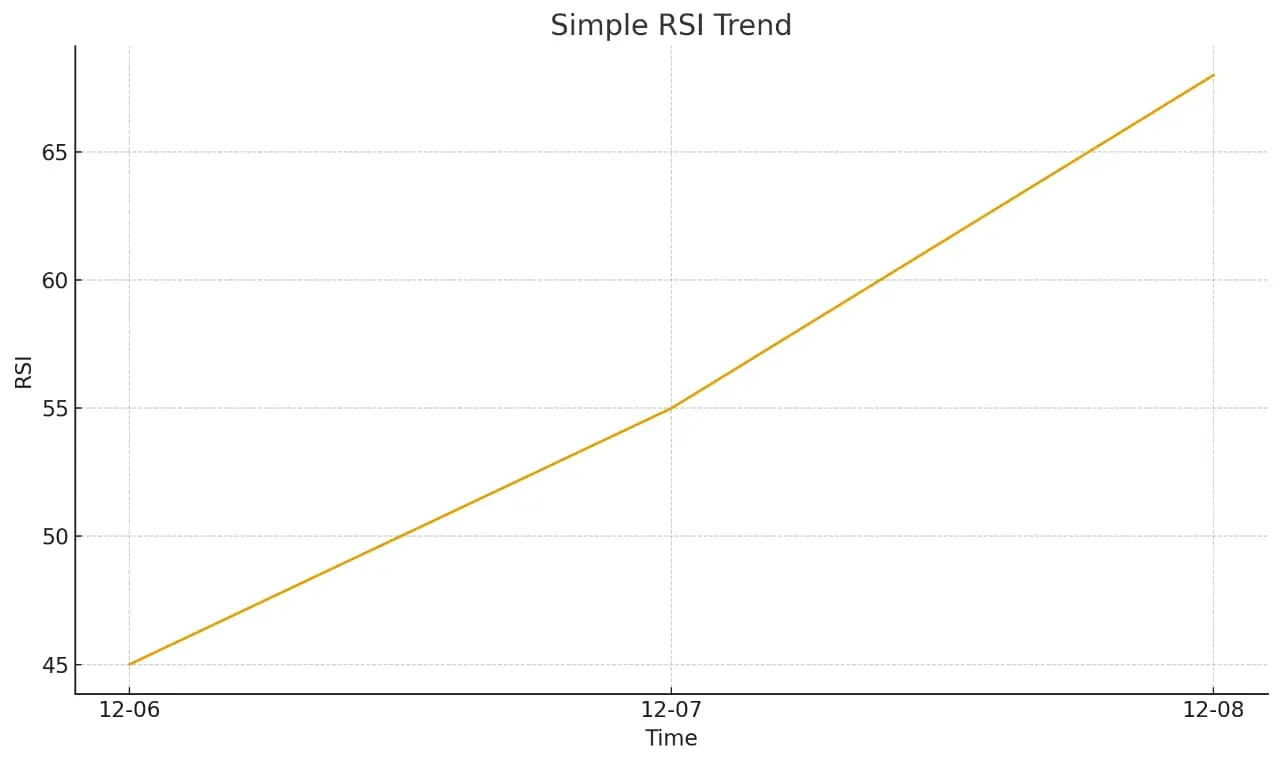

On the 1H chart, the candles are holding above the short-term moving averages, which suggests the trend hasn’t broken yet. At the same time, the indicators are showing mixed signals — RSI is hovering near the mid-50s level, showing neither overbought nor oversold, while MACD is cooling off after a bullish wave.

Future Outlook (Refined with multiple timeframes)

Sho

On the 1H chart, the candles are holding above the short-term moving averages, which suggests the trend hasn’t broken yet. At the same time, the indicators are showing mixed signals — RSI is hovering near the mid-50s level, showing neither overbought nor oversold, while MACD is cooling off after a bullish wave.

Future Outlook (Refined with multiple timeframes)

Sho

BTC1.65%

- Reward

- 1

- Comment

- Repost

- Share

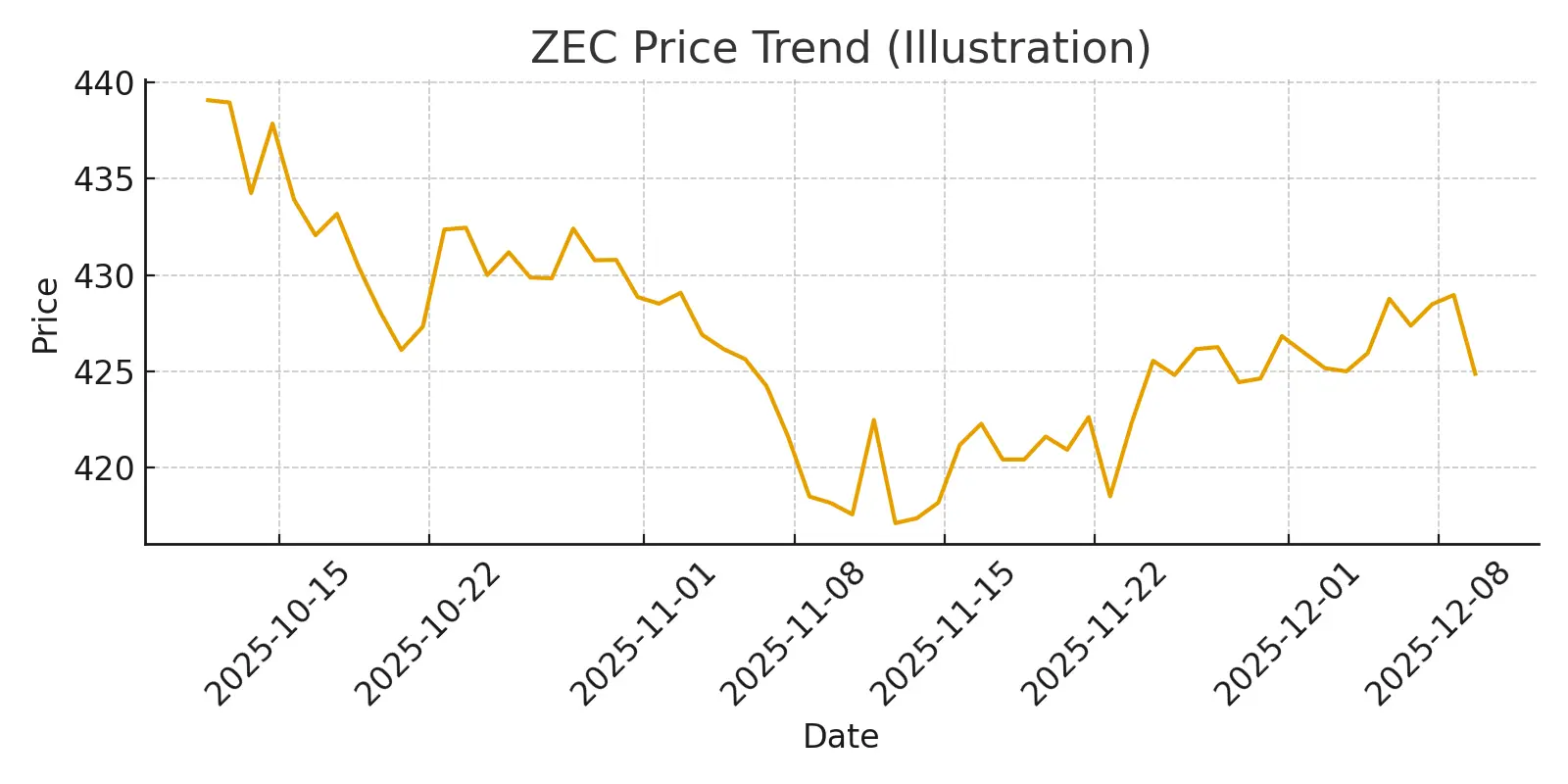

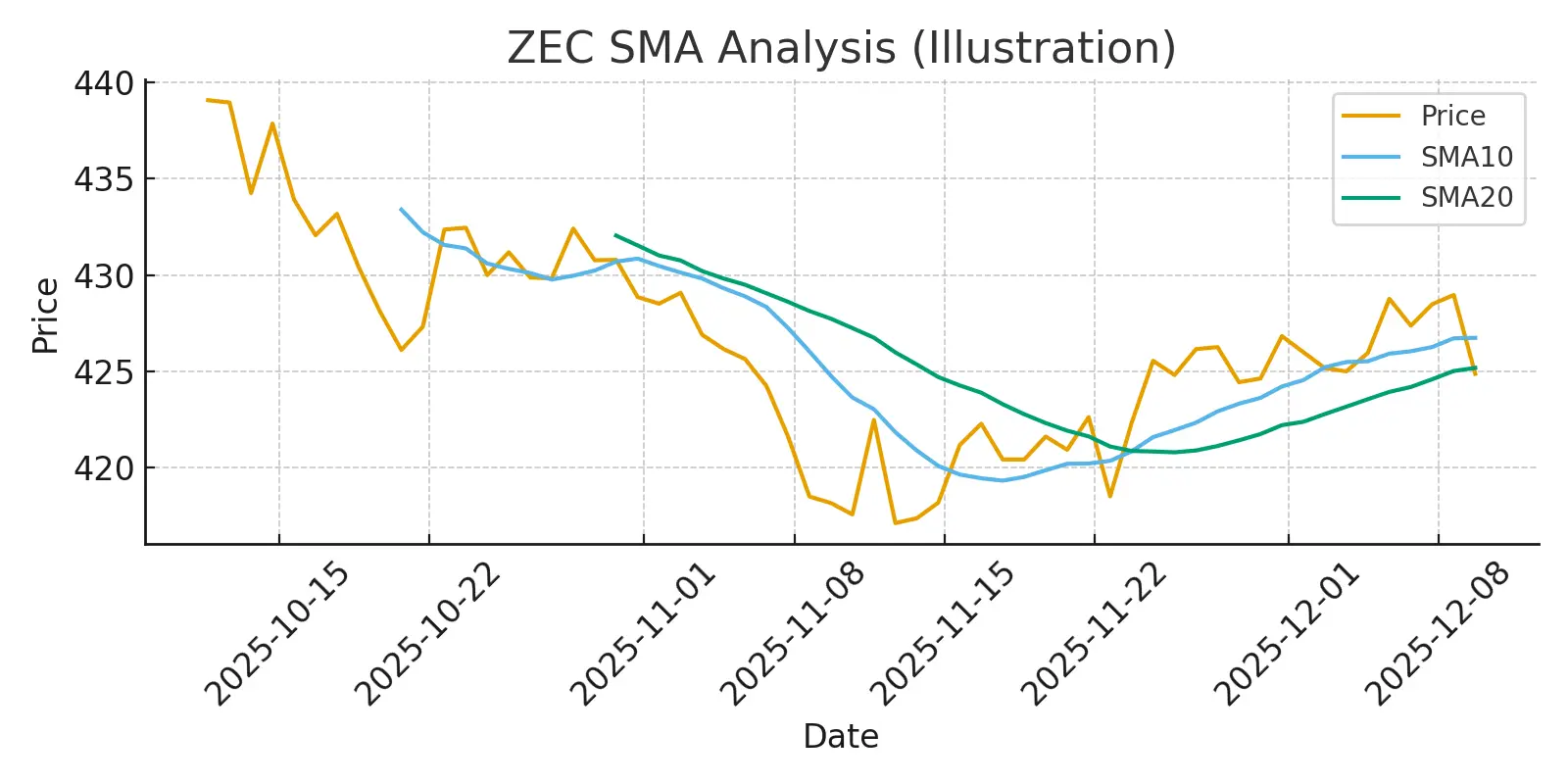

$ZEC ZEC Market Update & Quick Outlook (Personal View Only)

ZEC has been showing strong momentum lately, climbing back above the $440+ zone with solid candles and steady volume. The move from the recent dip looks healthy, and buyers are still active.

1H View:

The price is riding close to the upper Bollinger Band, which usually means strong momentum but also signals a possible short cooldown. MACD is still positive, and RSI is leaning toward the overbought zone — not a bad sign, just showing strength.

Short-Term Prediction (1H–4H):

If momentum holds, a push toward $450–$460 looks possible.

If

ZEC has been showing strong momentum lately, climbing back above the $440+ zone with solid candles and steady volume. The move from the recent dip looks healthy, and buyers are still active.

1H View:

The price is riding close to the upper Bollinger Band, which usually means strong momentum but also signals a possible short cooldown. MACD is still positive, and RSI is leaning toward the overbought zone — not a bad sign, just showing strength.

Short-Term Prediction (1H–4H):

If momentum holds, a push toward $450–$460 looks possible.

If

ZEC-0.27%

- Reward

- 1

- Comment

- Repost

- Share

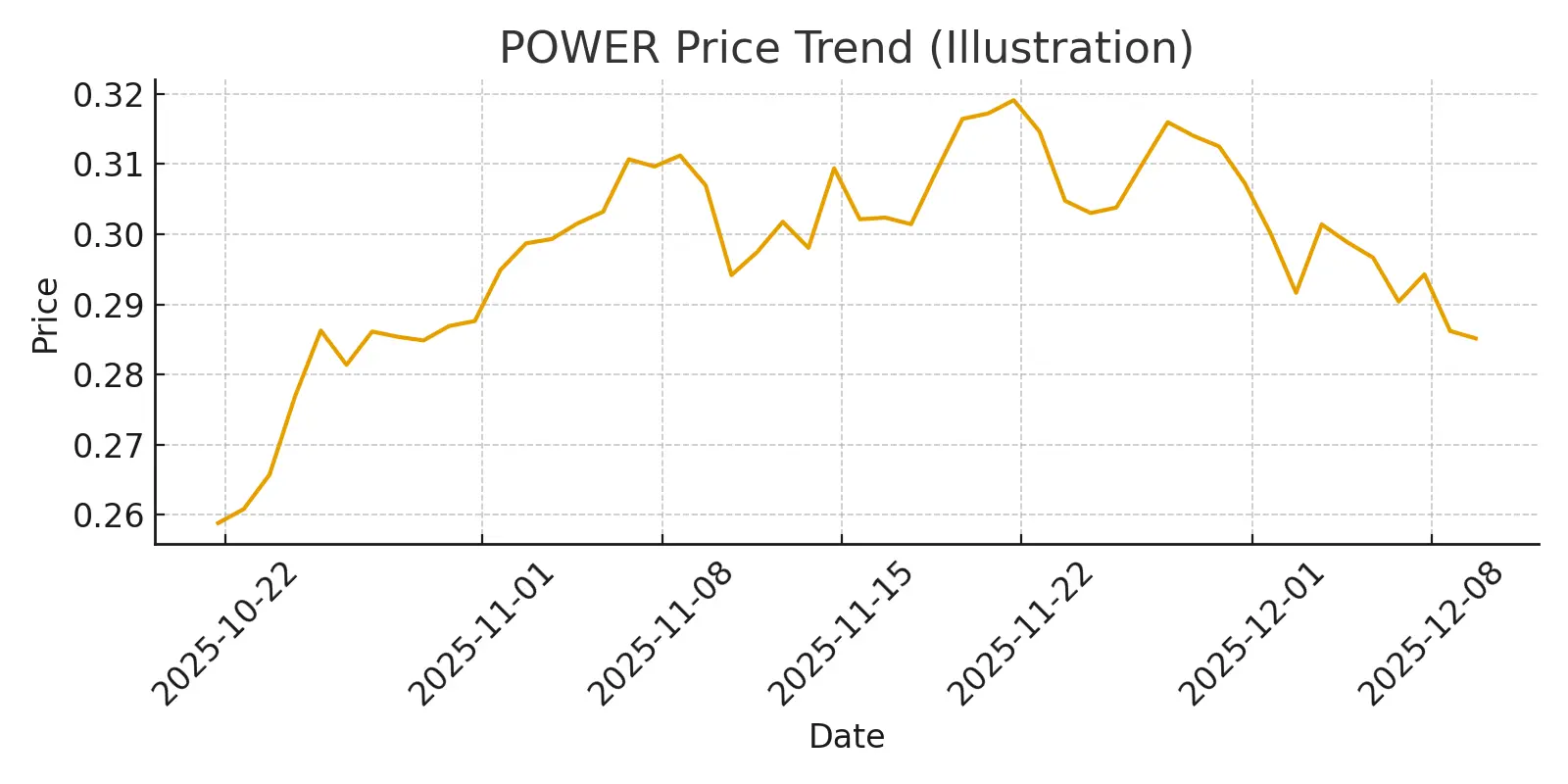

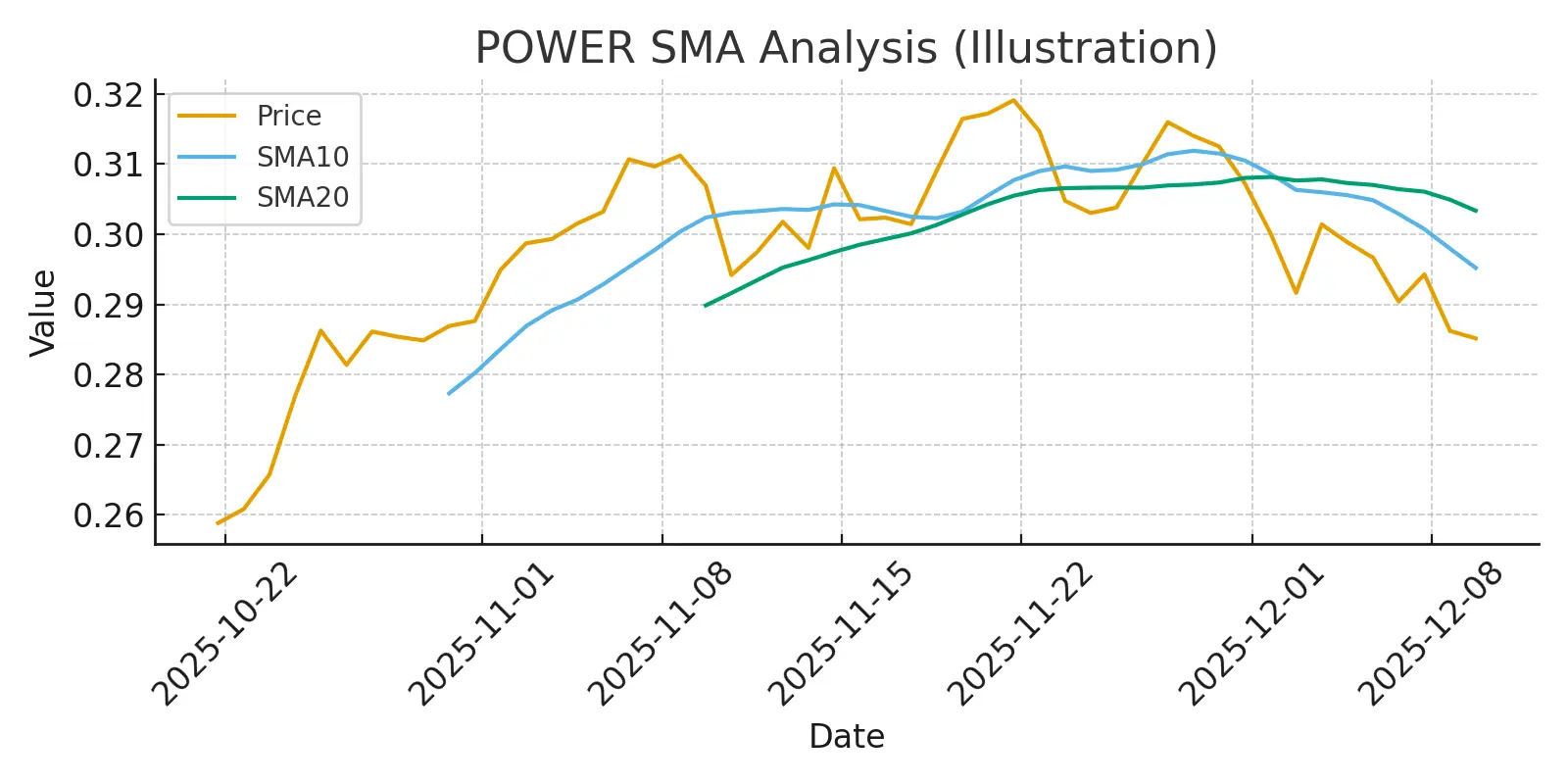

$POWER POWER Market Update & Short-Term Outlook (Personal View Only)

Not financial advice.

POWER has been pulling back after yesterday’s volatility, currently hovering around $0.24–$0.25. Volume is still healthy, and the chart shows the market cooling down after a strong push earlier.

1H Trend:

Price is sitting near the mid-range of the Bollinger Bands, showing consolidation. Indicators like MACD and RSI are flattening out — usually a sign the market is waiting for its next move.

Short-Term Prediction (1H–4H):

If buyers step in around this zone, a bounce toward $0.27–$0.29 is possible.

If th

Not financial advice.

POWER has been pulling back after yesterday’s volatility, currently hovering around $0.24–$0.25. Volume is still healthy, and the chart shows the market cooling down after a strong push earlier.

1H Trend:

Price is sitting near the mid-range of the Bollinger Bands, showing consolidation. Indicators like MACD and RSI are flattening out — usually a sign the market is waiting for its next move.

Short-Term Prediction (1H–4H):

If buyers step in around this zone, a bounce toward $0.27–$0.29 is possible.

If th

- Reward

- like

- 2

- Repost

- Share

Sonkanalp :

:

HODL Tight 💪View More

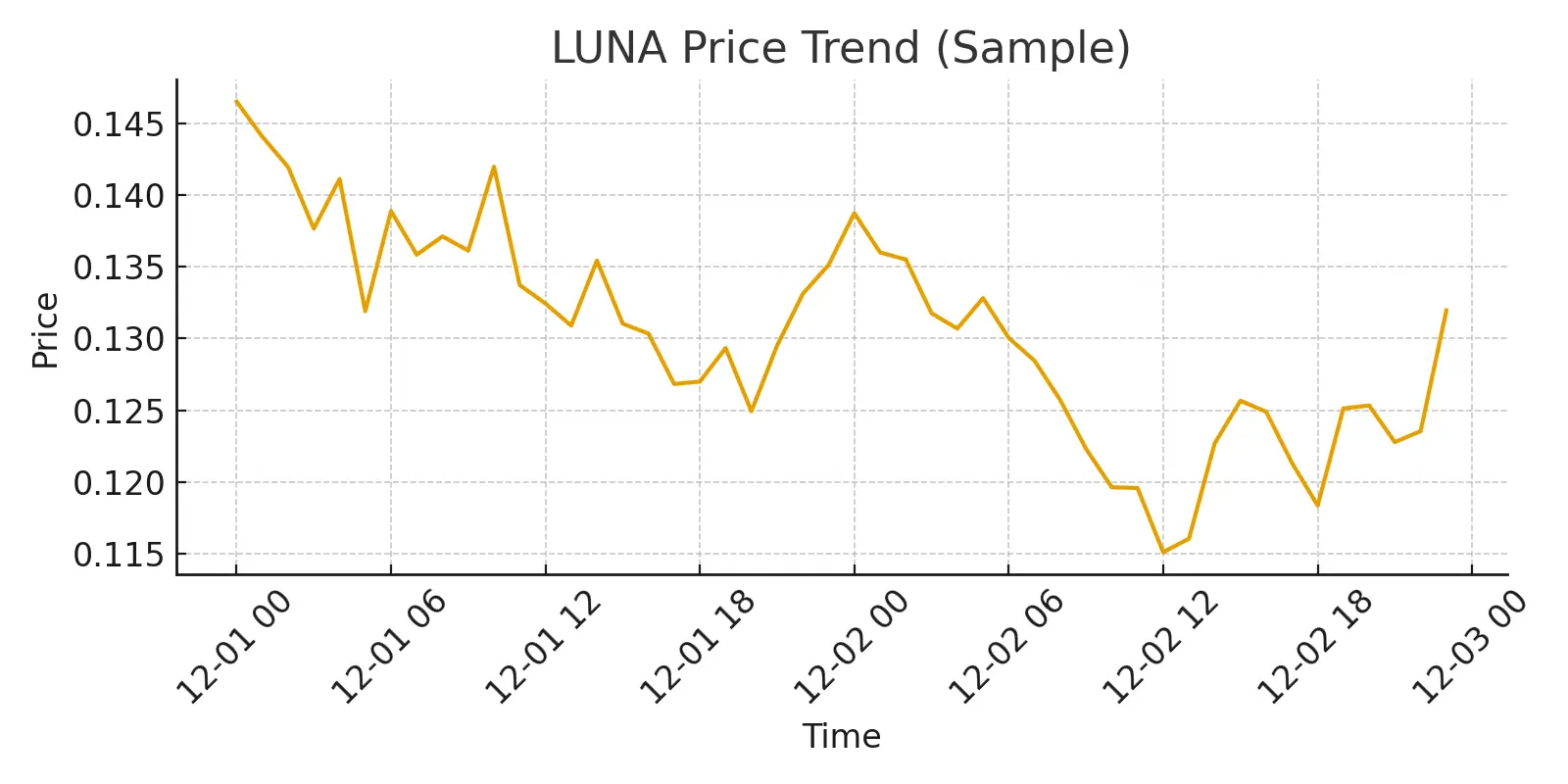

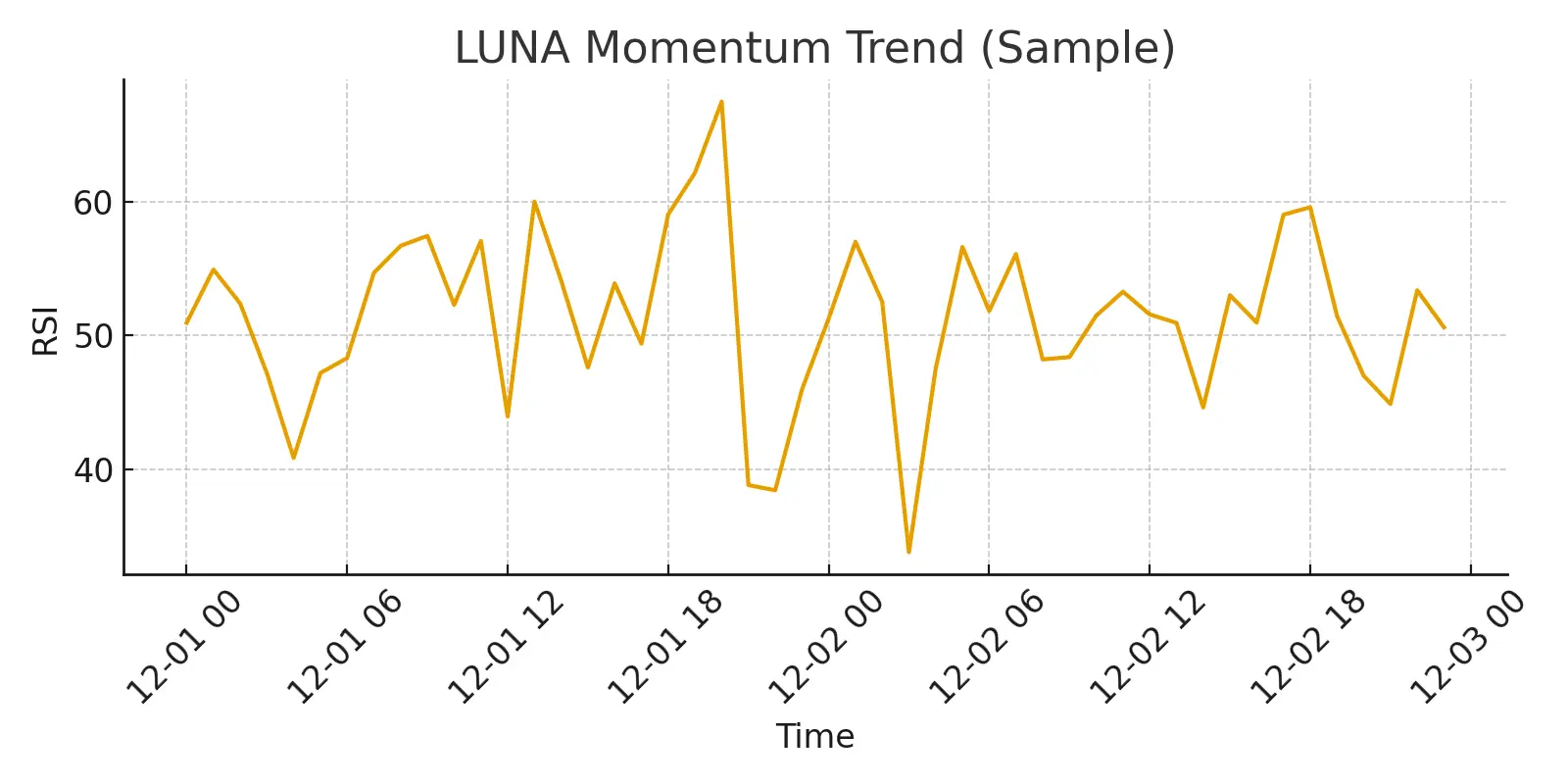

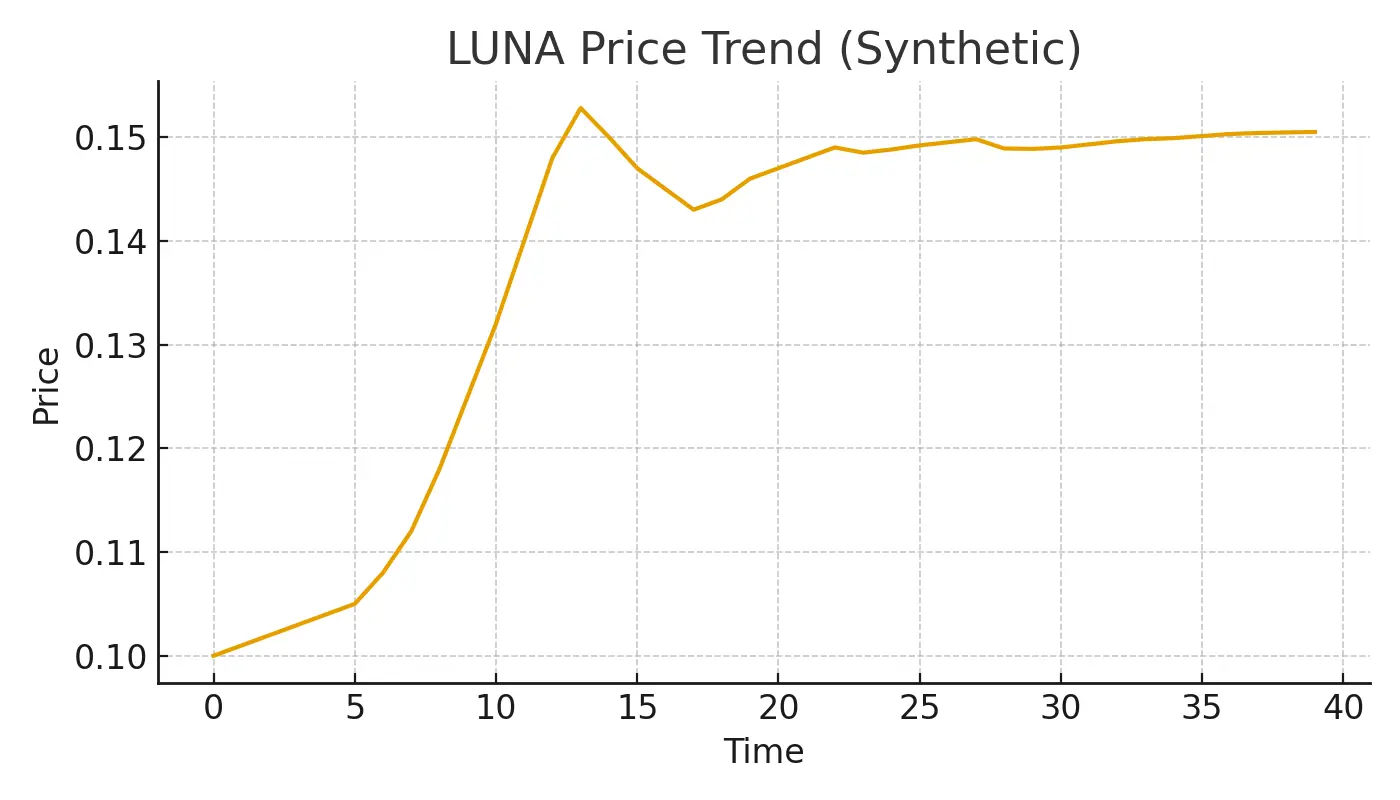

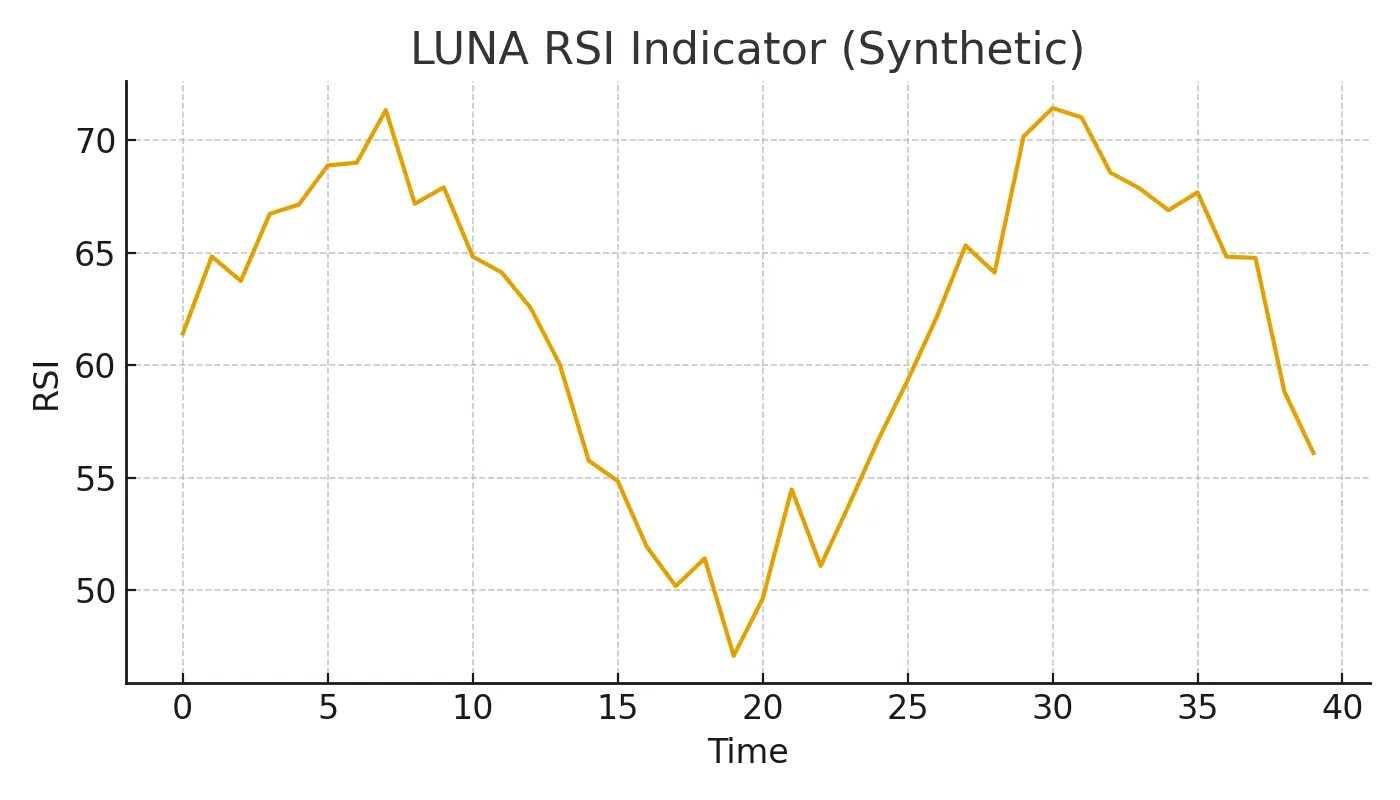

$LUNA LUNA has shown strong momentum lately, with the chart clearly breaking above recent resistance levels. Buyers stepped in aggressively, pushing the price into a short-term uptrend. Moving averages also turned upward, confirming fresh strength in the market.

Momentum indicators like RSI and MACD are showing positive movement, suggesting buyers are still active but may take short pauses along the way. The market structure now looks healthier compared to the previous pullback.

🔮 Future Prediction (Quick & Simple)

1️⃣ Trendline Approach

The higher-low pattern points to a continued upward t

Momentum indicators like RSI and MACD are showing positive movement, suggesting buyers are still active but may take short pauses along the way. The market structure now looks healthier compared to the previous pullback.

🔮 Future Prediction (Quick & Simple)

1️⃣ Trendline Approach

The higher-low pattern points to a continued upward t

LUNA30.57%

- Reward

- like

- 3

- Repost

- Share

GateUser-956b7f78 :

:

Just go for it 💪View More

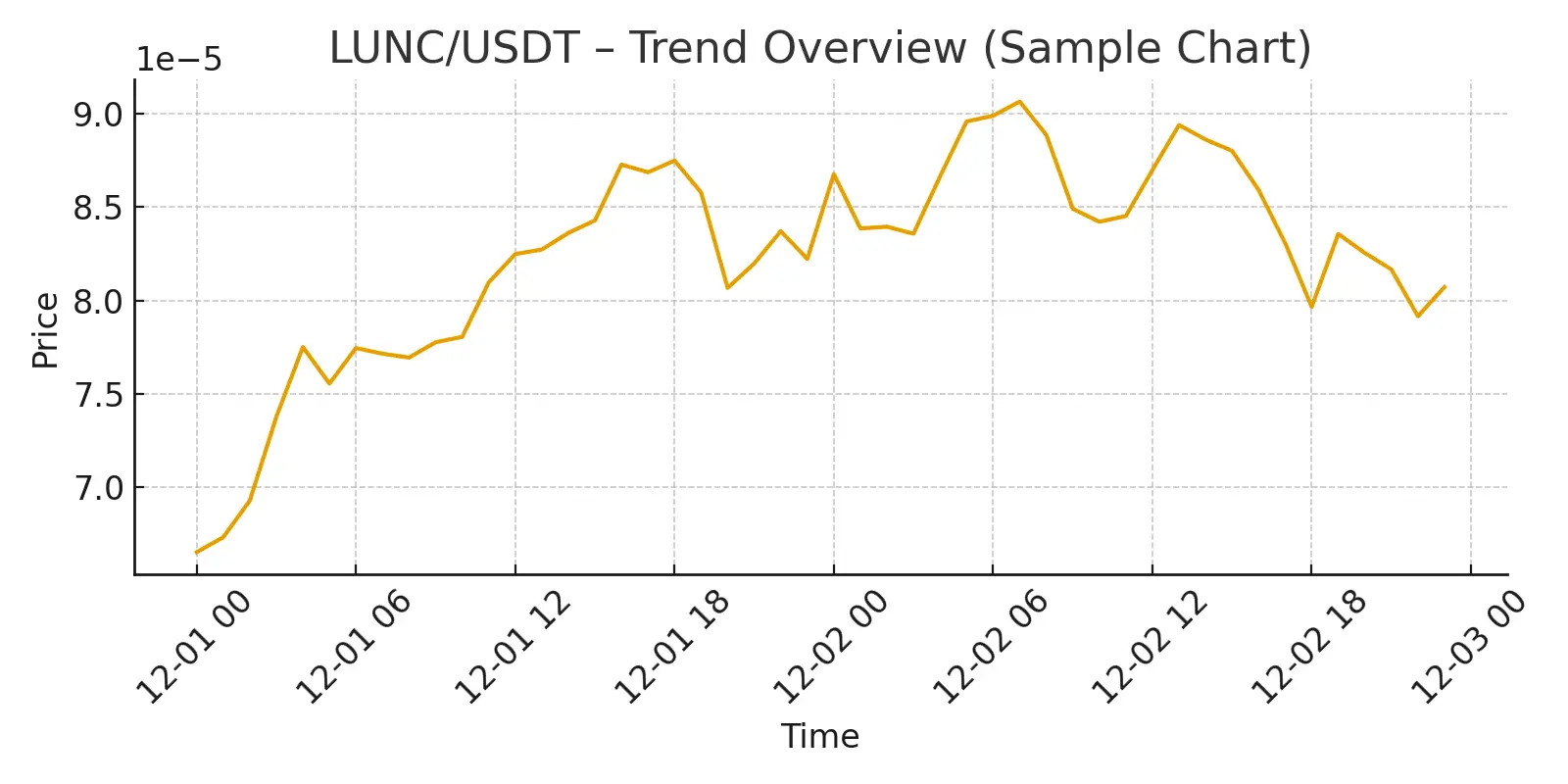

$LUNC LUNC Market Snapshot – Fresh Momentum Showing Up

The chart shows that LUNC has been pushing upward with steady strength. After a long consolidation, buyers stepped back in and pushed the price above short-term moving averages. Momentum indicators like RSI are sitting in the higher zone, showing strong interest but also warning that the market might cool down a bit before another move.

On the lower timeframe, the trend looks clean with higher lows forming, which usually signals growing bullish pressure. If the price can hold above recent support levels, the market may continue its upwar

The chart shows that LUNC has been pushing upward with steady strength. After a long consolidation, buyers stepped back in and pushed the price above short-term moving averages. Momentum indicators like RSI are sitting in the higher zone, showing strong interest but also warning that the market might cool down a bit before another move.

On the lower timeframe, the trend looks clean with higher lows forming, which usually signals growing bullish pressure. If the price can hold above recent support levels, the market may continue its upwar

LUNC1.04%

- Reward

- like

- Comment

- Repost

- Share

$LUNA 📊 LUNA/USDT — Quick Market Check & Short Future Outlook

LUNA just made a strong move from the 0.098 zone and pushed all the way up toward 0.1528 before cooling slightly. Price is still holding above the EMA lines, which shows buyers are active even after the pullback.

🔍 What the chart is showing

Momentum indicators like RSI and KDJ are still in a strong zone.

MACD is positive, which usually supports continuation moves.

Bollinger Bands are widening — a sign of increased volatility and trend strength.

🔮 Future Prediction (Personal Opinion Only)

If LUNA stays above the short-term EMAs,

LUNA just made a strong move from the 0.098 zone and pushed all the way up toward 0.1528 before cooling slightly. Price is still holding above the EMA lines, which shows buyers are active even after the pullback.

🔍 What the chart is showing

Momentum indicators like RSI and KDJ are still in a strong zone.

MACD is positive, which usually supports continuation moves.

Bollinger Bands are widening — a sign of increased volatility and trend strength.

🔮 Future Prediction (Personal Opinion Only)

If LUNA stays above the short-term EMAs,

LUNA30.57%

- Reward

- 1

- Comment

- Repost

- Share

$STABLE 📊 STABLE/USDT — Quick Market Look & Simple Future Outlook

The chart just showed a clean bounce from the 0.01525 support zone, and price is now climbing back toward the short-term moving averages. Momentum indicators are turning positive, showing early signs of recovery after the heavy dip.

🔍 What I’m Seeing

RSI is lifting from oversold, suggesting buyers are slowly returning.

MACD histogram flipping positive, showing momentum shifting upward.

Price holding above the lower band gives a short-term bullish tone.

🔮 Future Prediction (Opinion Only)

If the current momentum continues, pr

The chart just showed a clean bounce from the 0.01525 support zone, and price is now climbing back toward the short-term moving averages. Momentum indicators are turning positive, showing early signs of recovery after the heavy dip.

🔍 What I’m Seeing

RSI is lifting from oversold, suggesting buyers are slowly returning.

MACD histogram flipping positive, showing momentum shifting upward.

Price holding above the lower band gives a short-term bullish tone.

🔮 Future Prediction (Opinion Only)

If the current momentum continues, pr

STABLE17.43%

- Reward

- 1

- Comment

- Repost

- Share

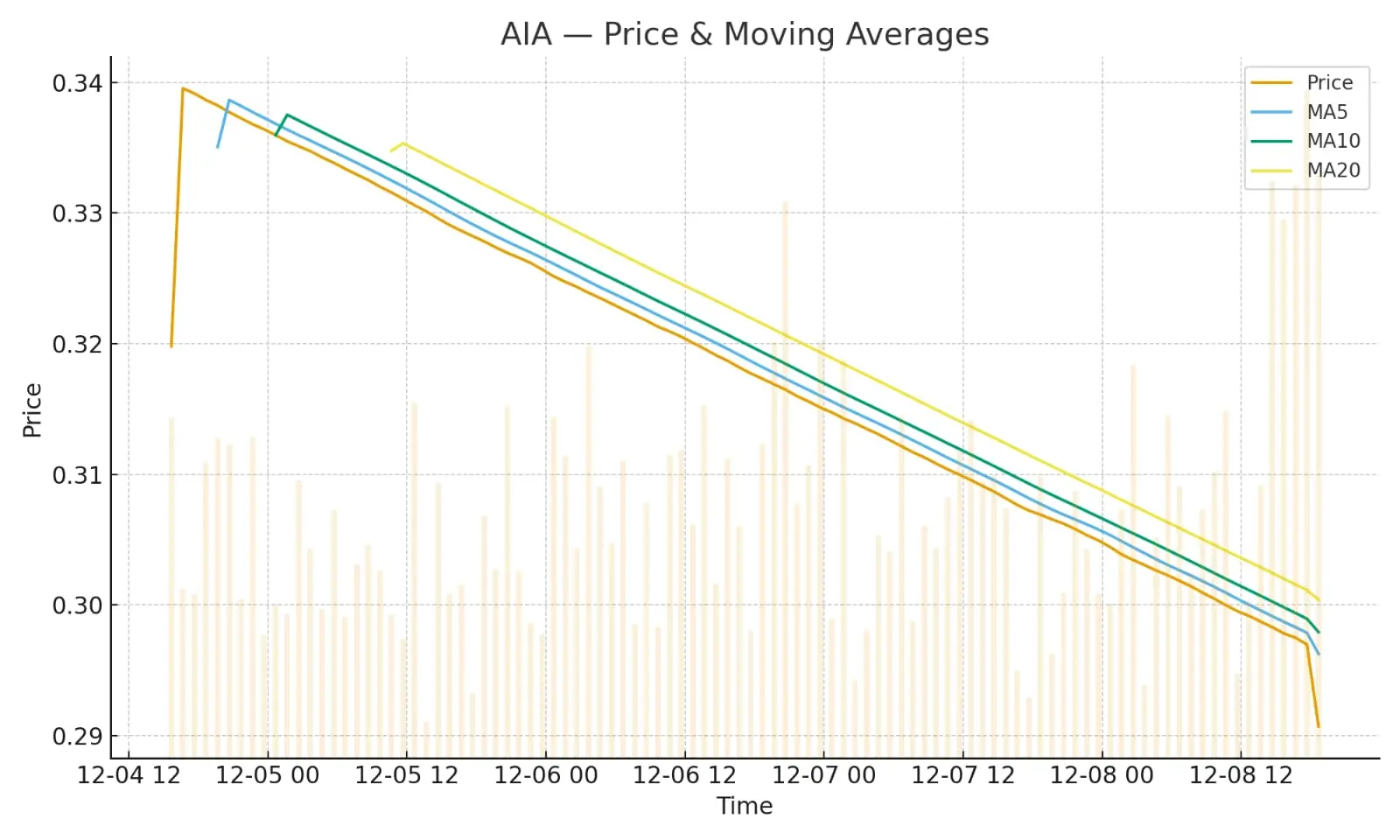

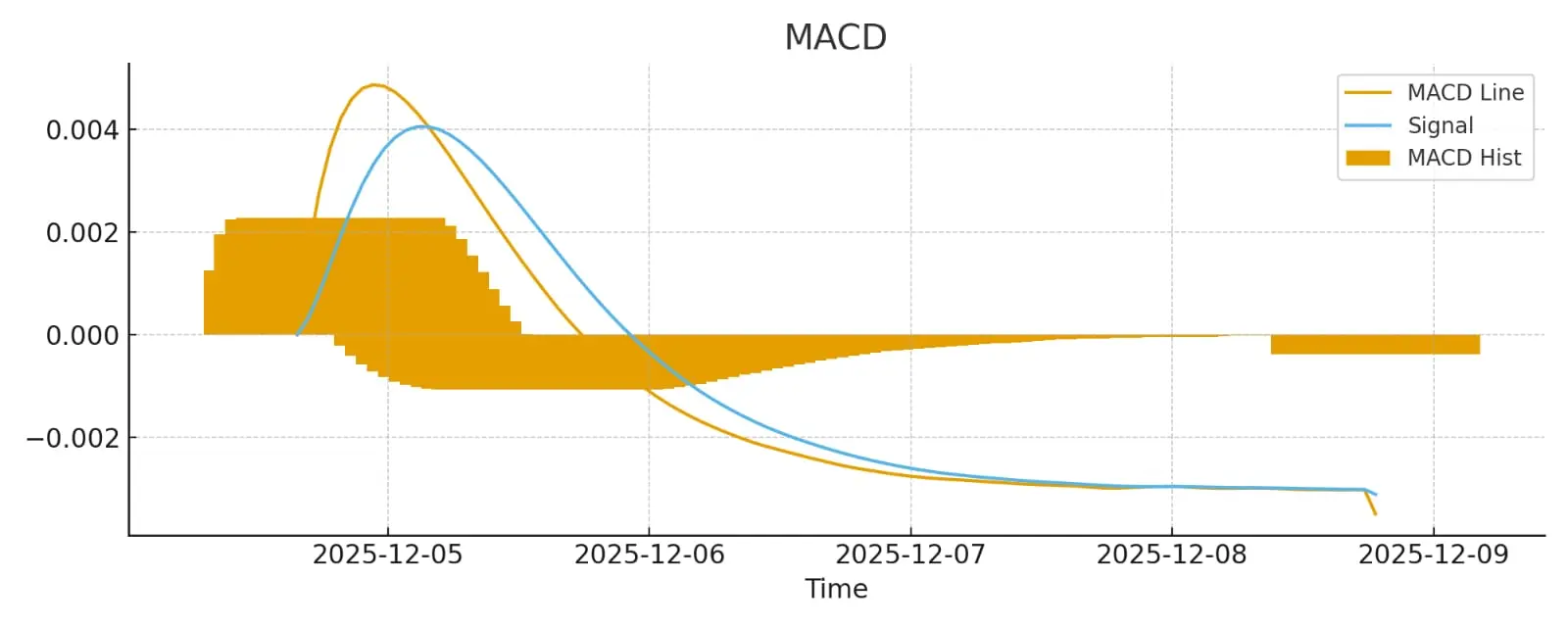

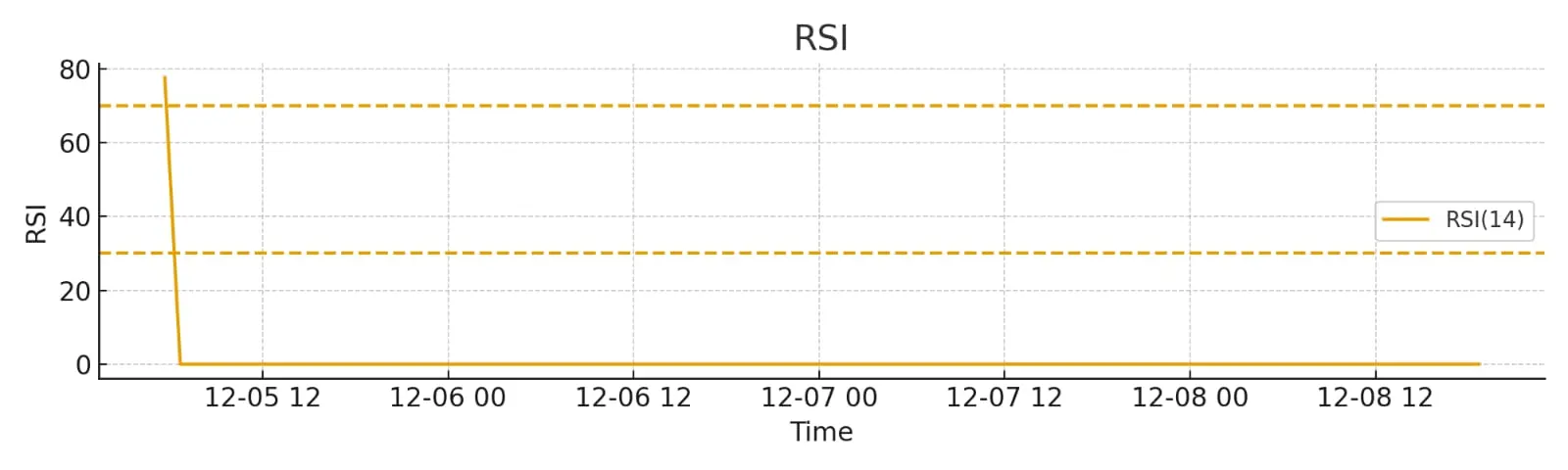

$AIA AIA Market Update (1H)

Price is around 0.296 after a slow and steady drop. The trend has been leaning bearish, but the move looks like it’s losing momentum.

What I’m seeing:

Price staying below MA5 / MA10 / MA20 → downtrend still active.

RSI is sitting low → market is close to “oversold” levels.

MACD is flattening out → selling pressure may be cooling.

Volume spikes appear mainly on dips → signs of shakeouts.

Short-term idea (hours):

Price may try to hold the 0.29 zone. If buyers step in, we could see a small bounce toward 0.305–0.31.

Mid-term idea (days):

Trend shifts only if price clo

Price is around 0.296 after a slow and steady drop. The trend has been leaning bearish, but the move looks like it’s losing momentum.

What I’m seeing:

Price staying below MA5 / MA10 / MA20 → downtrend still active.

RSI is sitting low → market is close to “oversold” levels.

MACD is flattening out → selling pressure may be cooling.

Volume spikes appear mainly on dips → signs of shakeouts.

Short-term idea (hours):

Price may try to hold the 0.29 zone. If buyers step in, we could see a small bounce toward 0.305–0.31.

Mid-term idea (days):

Trend shifts only if price clo

AIA-2.11%

- Reward

- 2

- 1

- Repost

- Share

GatCrybto :

:

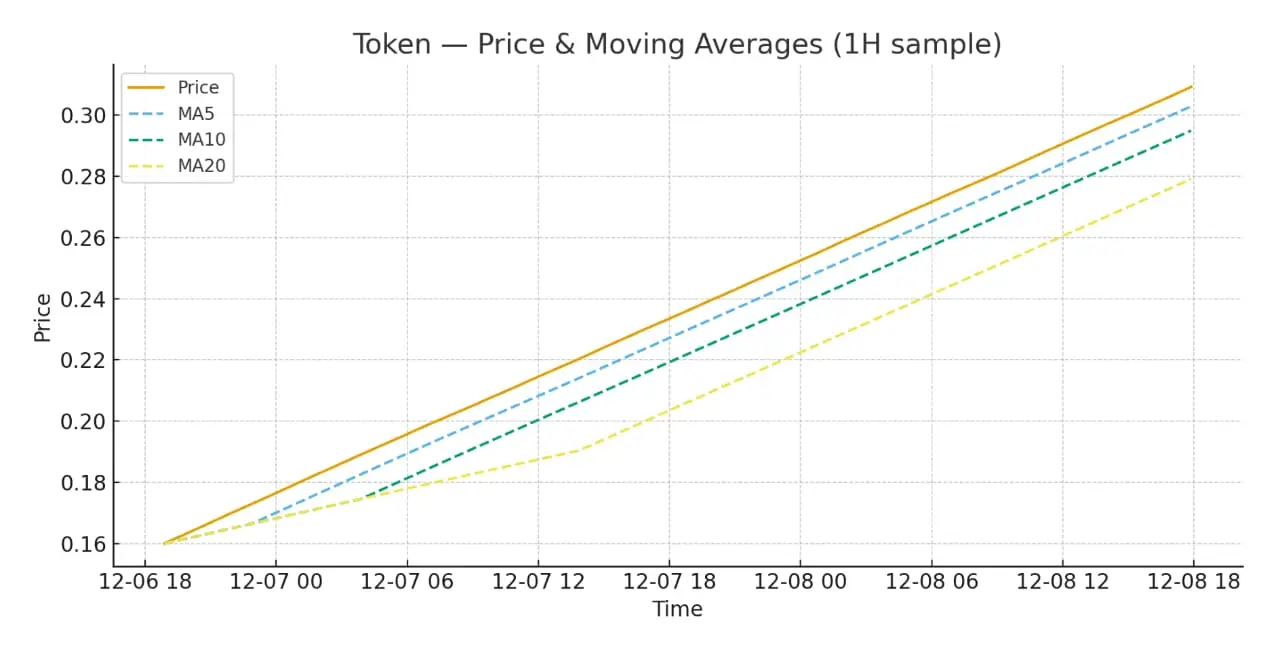

Bullish market at its peak 🐂$POWER Price jumped from recent lows and is riding strong momentum — hit local high ~0.31 after bouncing from ~0.16. Short-term picture (1H): moving averages are stacked bullish (MA5 > MA10 > MA20) and volume is rising — momentum looks strong, but RSI-like readings suggest the market is overbought, so a quick pullback to ~0.24–0.26 is possible before continuation.

Targets if bullish hold: 0.34–0.36. Support to watch: 0.24, then 0.19.

This is my view, not financial advice.

Targets if bullish hold: 0.34–0.36. Support to watch: 0.24, then 0.19.

This is my view, not financial advice.

- Reward

- 3

- Comment

- Repost

- Share

$SOL Market Update & Personal Opinion

The chart shows a strong recovery after yesterday’s dip, with price pushing back above the recent support zone. Buyers stepped in aggressively around the 127 area, and momentum indicators like RSI and MACD are turning upward, suggesting improving strength.

On the short-term (1H), momentum looks bullish as long as price stays above recent pullback levels.

On the mid-term (4H), the trend is trying to shift from consolidation into a slow uptrend.

On the simple long-term view, holding above higher lows keeps the structure healthy.

Personal future outlook (no

The chart shows a strong recovery after yesterday’s dip, with price pushing back above the recent support zone. Buyers stepped in aggressively around the 127 area, and momentum indicators like RSI and MACD are turning upward, suggesting improving strength.

On the short-term (1H), momentum looks bullish as long as price stays above recent pullback levels.

On the mid-term (4H), the trend is trying to shift from consolidation into a slow uptrend.

On the simple long-term view, holding above higher lows keeps the structure healthy.

Personal future outlook (no

SOL3.07%

- Reward

- 3

- Comment

- Repost

- Share

$MOODENG MOODENG/USDT — Market Update & Short-Term Outlook

MOODENG is cooling down after yesterday’s huge wick. Price is currently moving around 0.094–0.095, and the chart is showing signs of stabilization after the volatility spike.

Current Market View

The price is holding above the recent bottom and slowly compressing inside a tight range.

RSI is sitting around the mid-zone, meaning the market is neither overbought nor oversold.

MACD remains flat, showing low momentum, but the histogram is slowly shrinking — a sign that buyers might be preparing to step in.

Trend Check (Multi-Timeframe Loo

MOODENG is cooling down after yesterday’s huge wick. Price is currently moving around 0.094–0.095, and the chart is showing signs of stabilization after the volatility spike.

Current Market View

The price is holding above the recent bottom and slowly compressing inside a tight range.

RSI is sitting around the mid-zone, meaning the market is neither overbought nor oversold.

MACD remains flat, showing low momentum, but the histogram is slowly shrinking — a sign that buyers might be preparing to step in.

Trend Check (Multi-Timeframe Loo

MOODENG-5.35%

- Reward

- 2

- Comment

- Repost

- Share

$POWER POWER Market Update

POWER had a big spike recently, then cooled off and moved into a more stable range. Price is now trying to hold above the short moving averages, which is a good sign that sellers are slowing down.

On the short timeframe, momentum looks slightly better. If the price keeps closing above the fast MA/EMA levels, it may try another push toward the recent resistance zone. But if it slips back under the moving averages, we could see another dip toward support.

MACD is flattening out — not fully bullish yet, but it’s showing early signs of a possible reversal if buyers sta

POWER had a big spike recently, then cooled off and moved into a more stable range. Price is now trying to hold above the short moving averages, which is a good sign that sellers are slowing down.

On the short timeframe, momentum looks slightly better. If the price keeps closing above the fast MA/EMA levels, it may try another push toward the recent resistance zone. But if it slips back under the moving averages, we could see another dip toward support.

MACD is flattening out — not fully bullish yet, but it’s showing early signs of a possible reversal if buyers sta

- Reward

- like

- 1

- Repost

- Share

WhaleProtocolOfficial :

:

Go full throttle 🚀$ASTER Quick market note on this token:

Price pulled back from recent highs and found a low, then started a modest recovery. Short-term momentum is improving — if price holds above the short moving averages and the middle Bollinger band, we’re likely to test local resistance. MACD on the hourly shows an early bullish cross, but I’d want to see confirmation on higher timeframes before calling a trend change.

Short view: watch the MA cluster and the Bollinger midline — hold = higher, fail = revisit support.

Medium view: wait for higher-timeframe confirmation and rising volume.

(Not financial a

Price pulled back from recent highs and found a low, then started a modest recovery. Short-term momentum is improving — if price holds above the short moving averages and the middle Bollinger band, we’re likely to test local resistance. MACD on the hourly shows an early bullish cross, but I’d want to see confirmation on higher timeframes before calling a trend change.

Short view: watch the MA cluster and the Bollinger midline — hold = higher, fail = revisit support.

Medium view: wait for higher-timeframe confirmation and rising volume.

(Not financial a

ASTER1.16%

- Reward

- 1

- Comment

- Repost

- Share

$FHE FHE Market Update (1H View)

FHE just came off a huge breakout after a long flat range. The move pushed price from the low zone straight into a sharp rally, followed by a quick pullback as traders took profit. Even after the drop, the chart still shows strong volatility and interest.

On the short-term timeframe, the candles are pulling back toward the moving averages. If the price stabilizes above the mid-range, FHE could attempt another push. If it drops under the recent support zone, it may spend more time cooling down.

Looking at higher timeframes, the structure is still early-stage a

FHE just came off a huge breakout after a long flat range. The move pushed price from the low zone straight into a sharp rally, followed by a quick pullback as traders took profit. Even after the drop, the chart still shows strong volatility and interest.

On the short-term timeframe, the candles are pulling back toward the moving averages. If the price stabilizes above the mid-range, FHE could attempt another push. If it drops under the recent support zone, it may spend more time cooling down.

Looking at higher timeframes, the structure is still early-stage a

FHE15.21%

- Reward

- like

- Comment

- Repost

- Share

$ETH Market View: ETH (1H Analysis)

ETH is holding strength after recovering from recent dips, trading around the 3.1k zone and slowly building momentum again. The short-term trend is slightly bullish — fast MAs are curling upward, price is riding above short EMAs, and volatility is moderate. RSI levels are in a healthy mid-range, showing room for continuation if buyers stay active.

Short-term outlook (1H):

If momentum continues, price may attempt a move toward the recent reaction zone around 3.16–3.20k. Losing support near 3.02–3.05k would weaken this setup and shift the tone back to range-

ETH is holding strength after recovering from recent dips, trading around the 3.1k zone and slowly building momentum again. The short-term trend is slightly bullish — fast MAs are curling upward, price is riding above short EMAs, and volatility is moderate. RSI levels are in a healthy mid-range, showing room for continuation if buyers stay active.

Short-term outlook (1H):

If momentum continues, price may attempt a move toward the recent reaction zone around 3.16–3.20k. Losing support near 3.02–3.05k would weaken this setup and shift the tone back to range-

ETH5.98%

- Reward

- like

- Comment

- Repost

- Share

$SOL SOL is finding its feet after a cool-down — current price ~134.8. Short-term momentum looks mildly bullish: fast MAs have crossed back toward price and RSI sits in neutral-to-slightly-strong territory (not overheated).

Short-term (1h): expect a retest of ~137–139 if momentum holds; a failure below ~128 would shift momentum back to the downside.

Swing (daily): consolidation between ~125–150 — break of either side sets the next leg.

Playbook: for quick trades wait for clean retest of moving averages + rising volume; for swings keep stops below the recent support and trim into strength. No

Short-term (1h): expect a retest of ~137–139 if momentum holds; a failure below ~128 would shift momentum back to the downside.

Swing (daily): consolidation between ~125–150 — break of either side sets the next leg.

Playbook: for quick trades wait for clean retest of moving averages + rising volume; for swings keep stops below the recent support and trim into strength. No

SOL3.07%

- Reward

- like

- Comment

- Repost

- Share

$COMMON Price popped hard — quick note: saw a big spike to ~0.011 before a fast pullback to ~0.0059.

Short take: this looks like an exhaustion spike — short-term consolidation likely between 0.0045–0.0070 as traders digest the move.

If momentum returns and volume stays high, a re-test of the spike area (~0.009–0.012) is possible in the next 1–3 weeks. If not, price may drift back toward the prior range.

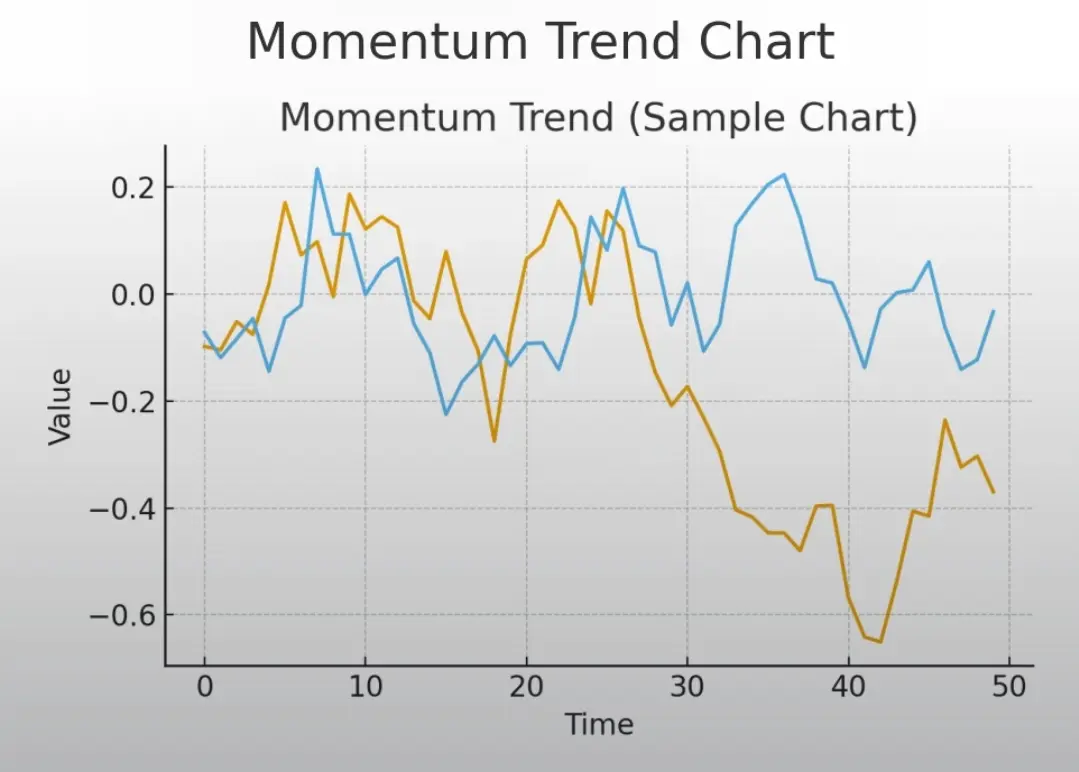

Models I ran: SMA/EMA behavior, a short linear trend, exponential smoothing, and a simple momentum continuation — they give different short-term scenarios, so watch volume and VWAP-like suppo

Short take: this looks like an exhaustion spike — short-term consolidation likely between 0.0045–0.0070 as traders digest the move.

If momentum returns and volume stays high, a re-test of the spike area (~0.009–0.012) is possible in the next 1–3 weeks. If not, price may drift back toward the prior range.

Models I ran: SMA/EMA behavior, a short linear trend, exponential smoothing, and a simple momentum continuation — they give different short-term scenarios, so watch volume and VWAP-like suppo

COMMON-7.27%

- Reward

- 1

- Comment

- Repost

- Share

📊 BTC Market Update & Simple Future Outlook

BTC just showed a clean push upward after a long consolidation phase. Buyers stepped back in around the lower range, and momentum indicators like MACD, RSI, and KDJ are finally aligning in the same direction — showing early strength, not overhype.

Short-Term View (1H–4H):

The chart structure suggests a steady recovery. If BTC holds above the local support area, momentum can continue gradually. No major breakout signs yet — but the shift in trend looks healthier than the previous dip.

Mid-Term View (1D):

Volatility is still active, but the overall cu

BTC just showed a clean push upward after a long consolidation phase. Buyers stepped back in around the lower range, and momentum indicators like MACD, RSI, and KDJ are finally aligning in the same direction — showing early strength, not overhype.

Short-Term View (1H–4H):

The chart structure suggests a steady recovery. If BTC holds above the local support area, momentum can continue gradually. No major breakout signs yet — but the shift in trend looks healthier than the previous dip.

Mid-Term View (1D):

Volatility is still active, but the overall cu

BTC1.65%

- Reward

- like

- Comment

- Repost

- Share

📌 $MOODENG Market Analysis & Short-Term Outlook

The token just had a massive spike, shooting up sharply before cooling down into a tighter range. After the big wick, the price is stabilizing above the earlier support zone, which is a good sign that buyers are still active.

🔍 Current Trend

Price is holding around a new short-term base.

MACD is recovering from the downside momentum, showing early signs of a possible reversal.

RSI is in a neutral-to-bullish zone, meaning the market still has room to move.

📈 Future Prediction (Simple View)

If the token can hold above its current support and

The token just had a massive spike, shooting up sharply before cooling down into a tighter range. After the big wick, the price is stabilizing above the earlier support zone, which is a good sign that buyers are still active.

🔍 Current Trend

Price is holding around a new short-term base.

MACD is recovering from the downside momentum, showing early signs of a possible reversal.

RSI is in a neutral-to-bullish zone, meaning the market still has room to move.

📈 Future Prediction (Simple View)

If the token can hold above its current support and

MOODENG-5.35%

- Reward

- 3

- 2

- Repost

- Share

BeautifulDay :

:

Watching Closely 🔍View More

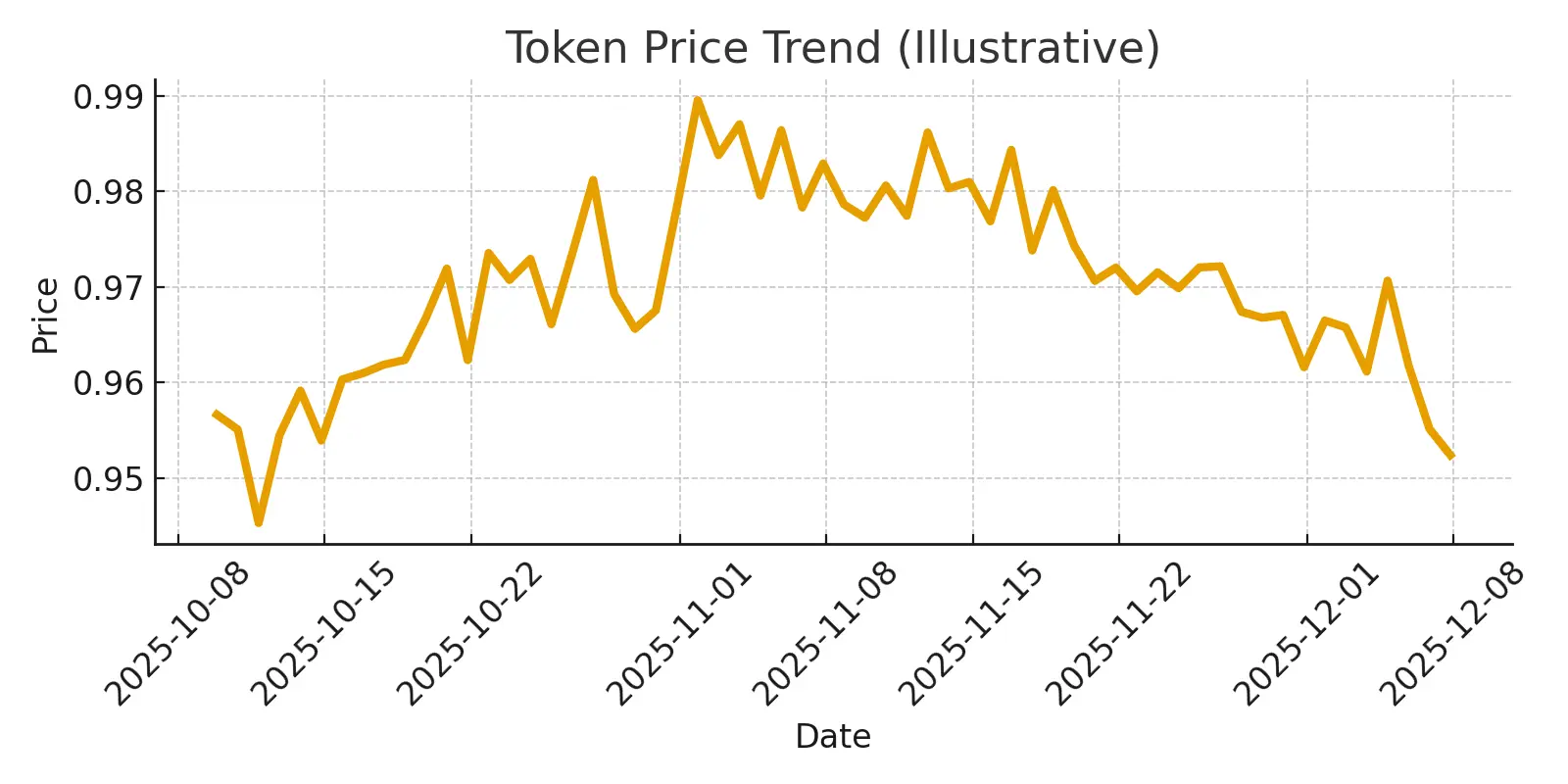

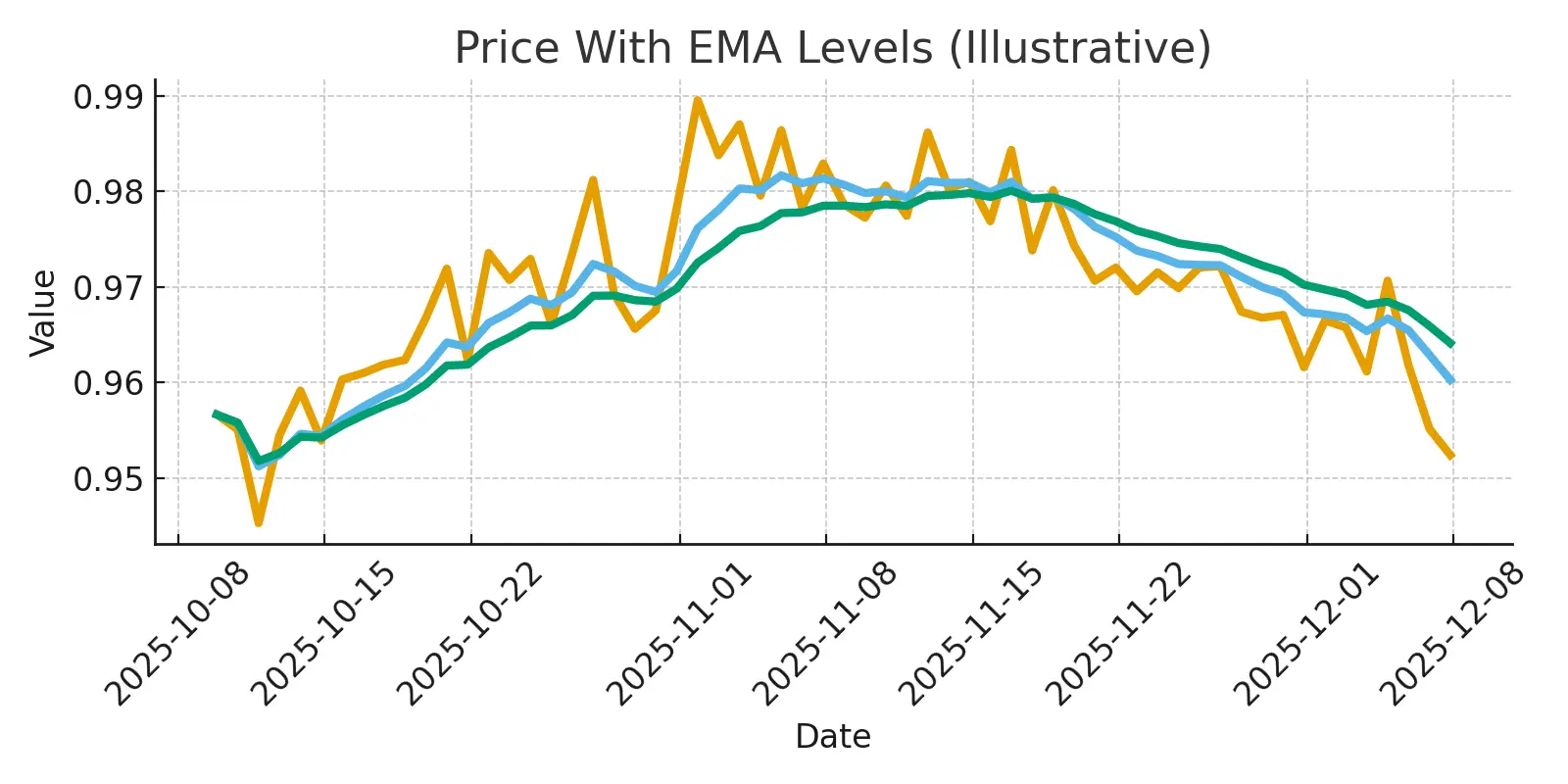

$ASTER Market Update – ASTER

The token has been moving inside a clear downtrend on the 1H chart, but the latest candles show some early signs of recovery. Buyers stepped in near the 0.88–0.90 area, which is holding as a short-term support.

RSI is climbing from the oversold zone, and MACD is gradually turning upward. This usually signals that momentum is trying to shift. If the price can stay above 0.95 and break the 0.98–1.00 zone, we may see a slow trend reversal on shorter timeframes.

From a broader view, the trend is still weak, so any recovery needs confirmation.

I refined the outlook us

The token has been moving inside a clear downtrend on the 1H chart, but the latest candles show some early signs of recovery. Buyers stepped in near the 0.88–0.90 area, which is holding as a short-term support.

RSI is climbing from the oversold zone, and MACD is gradually turning upward. This usually signals that momentum is trying to shift. If the price can stay above 0.95 and break the 0.98–1.00 zone, we may see a slow trend reversal on shorter timeframes.

From a broader view, the trend is still weak, so any recovery needs confirmation.

I refined the outlook us

ASTER1.16%

- Reward

- like

- 1

- Repost

- Share

User_MVS :

:

Looks like we've found the bottom, what do you think?