@zheyiguanjsn @On_Veera Have a great weekend!

View OriginalGateUser-005439fc

No content yet

GateUser-005439fc

When it comes to stablecoin governance, should everything be decided by voting?

My answer is: absolutely not.

Many people, when talking about decentralization, reflexively demand "full democracy."

But in the world of stablecoins, excessive democracy often isn't liberation, but self-destruction.

I looked at @stbl_official's governance design, and what worries me most, and what I agree with most, isn't how much power it gives to the DAO, but that it clearly defines the boundaries of that power.

It is very clear—🌟

You can discuss fees, incentives, parameter settings;

but there are two things tha

My answer is: absolutely not.

Many people, when talking about decentralization, reflexively demand "full democracy."

But in the world of stablecoins, excessive democracy often isn't liberation, but self-destruction.

I looked at @stbl_official's governance design, and what worries me most, and what I agree with most, isn't how much power it gives to the DAO, but that it clearly defines the boundaries of that power.

It is very clear—🌟

You can discuss fees, incentives, parameter settings;

but there are two things tha

STBL3,91%

- Reward

- like

- 1

- Repost

- Share

ThreeFlowersGatherAtTheTop :

:

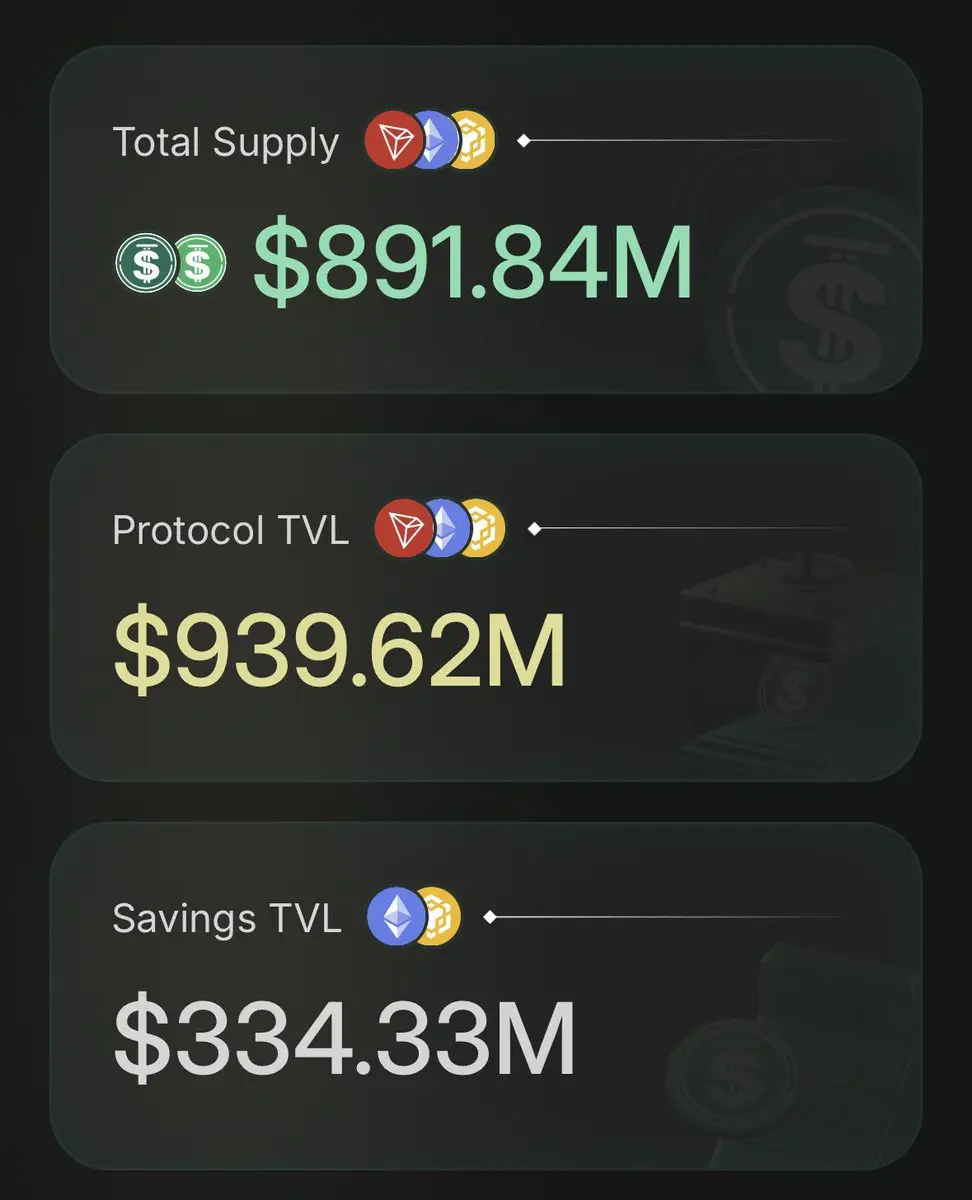

Hold on tight, we're about to take off 🛫✦USDD is about to enter the "900 million era"!🏁

From a supply scale of about 400–600 million in early 2025 to now rapidly approaching 900 million, in just one year, USDD's size has nearly doubled.

Why are more and more users choosing $USDD 🤔?

I break down the logic into three points👇

※1|A truly decentralized over-collateralized structure.

USDD adopts a community-driven over-collateralization model, maintaining a collateral ratio above 200% for the long term. The reserves are composed of multiple assets such as "$BTC, $TRX, $USDT," and are transparent and verifiable on the blockchain.

Compar

View OriginalFrom a supply scale of about 400–600 million in early 2025 to now rapidly approaching 900 million, in just one year, USDD's size has nearly doubled.

Why are more and more users choosing $USDD 🤔?

I break down the logic into three points👇

※1|A truly decentralized over-collateralized structure.

USDD adopts a community-driven over-collateralization model, maintaining a collateral ratio above 200% for the long term. The reserves are composed of multiple assets such as "$BTC, $TRX, $USDT," and are transparent and verifiable on the blockchain.

Compar

- Reward

- like

- Comment

- Repost

- Share

Just came across the heavyweight news officially announced by @trondao: The TRON chain utility token $TRX is officially logging in to @base 🎉.

The weight of this matter may be greater than many people imagine.

This is not just about connecting two chains; it is a true integration of the largest capital pool in Web3 (TRON) and the most active application market (Base).

On a technical level, this time the OFT standard of @LayerZero_Core is adopted and cross-chain is implemented through @StarGateFinance.

Those in the know understand that the key to OFT is that the assets are natively existing,

View OriginalThe weight of this matter may be greater than many people imagine.

This is not just about connecting two chains; it is a true integration of the largest capital pool in Web3 (TRON) and the most active application market (Base).

On a technical level, this time the OFT standard of @LayerZero_Core is adopted and cross-chain is implemented through @StarGateFinance.

Those in the know understand that the key to OFT is that the assets are natively existing,

- Reward

- like

- Comment

- Repost

- Share

Just saw the big news announced by @trondao: TRON Global Settlement Network officially logs in to @base 🎉.

The significance of this matter may be greater than many people imagine.

This is not just a simple connection between two chains, but rather the true integration of the largest capital pool in Web3 (TRON) and the most active application market (Base).

On the technical level, this time the OFT standard from @LayerZero_Core is adopted and cross-chain is implemented through @StarGateFinance.

Those who are knowledgeable understand that the key to OFT is that the assets exist natively, rather

View OriginalThe significance of this matter may be greater than many people imagine.

This is not just a simple connection between two chains, but rather the true integration of the largest capital pool in Web3 (TRON) and the most active application market (Base).

On the technical level, this time the OFT standard from @LayerZero_Core is adopted and cross-chain is implemented through @StarGateFinance.

Those who are knowledgeable understand that the key to OFT is that the assets exist natively, rather

- Reward

- like

- Comment

- Repost

- Share

Aptos is lowering the barrier to entry for Web3 users

Have you noticed? @Aptos's Keyless allows users to log in to their wallets directly with Google Account or Apple ID, and even complete transaction signatures using Face ID.

No mnemonic phrases, no need for complicated private key management— the overall experience is almost indistinguishable from using a Web2 app.

This is not just about convenience, but a paradigm shift:

➣ Other public chains: Still competing over TPS, mainly serving the few million existing Degen users.

➣ Aptos Chain: Lowering the entry barrier, aiming to reach the billion

Have you noticed? @Aptos's Keyless allows users to log in to their wallets directly with Google Account or Apple ID, and even complete transaction signatures using Face ID.

No mnemonic phrases, no need for complicated private key management— the overall experience is almost indistinguishable from using a Web2 app.

This is not just about convenience, but a paradigm shift:

➣ Other public chains: Still competing over TPS, mainly serving the few million existing Degen users.

➣ Aptos Chain: Lowering the entry barrier, aiming to reach the billion

APT-0,38%

- Reward

- like

- 1

- Repost

- Share

TreasureBasin2522 :

:

It seems that APT is really going to develop a global trading engineJust now, the news that @AlloraNetwork officially launched @trondaoCN has surfaced, and it's worth talking about.

People's impression of TRON is often: fast transfers, low Gas fees, essentially a high-efficiency settlement chain.

But with the integration of Allora's predictive intelligence, TRON is like adding artificial intelligence, beginning to evolve into a predictive chain.

Past DeFi was reactive: liquidations only triggered when prices fell, and the fastest responders always profited.

Now, DeFi can become predictive: AI forecasts increased volatility, allowing protocols to adjust risk co

View OriginalPeople's impression of TRON is often: fast transfers, low Gas fees, essentially a high-efficiency settlement chain.

But with the integration of Allora's predictive intelligence, TRON is like adding artificial intelligence, beginning to evolve into a predictive chain.

Past DeFi was reactive: liquidations only triggered when prices fell, and the fastest responders always profited.

Now, DeFi can become predictive: AI forecasts increased volatility, allowing protocols to adjust risk co

- Reward

- like

- Comment

- Repost

- Share

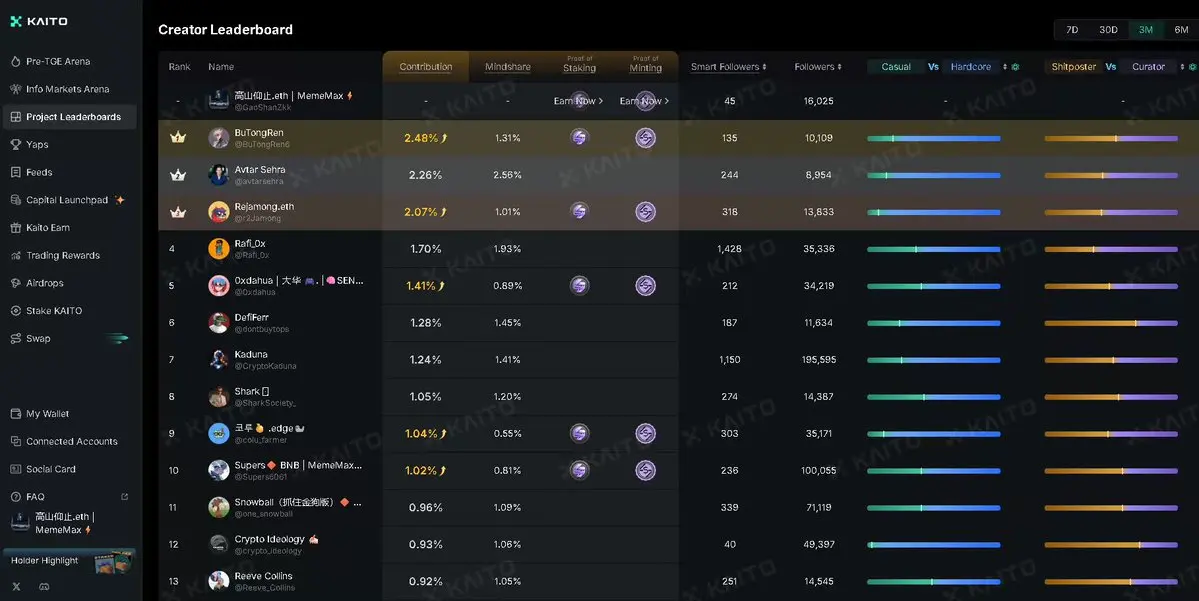

It hasn't even been that long since I last wrote, and my STBL has already dropped out of the rankings. Never mind, let's focus on stabilizing the ranking first.

I've compiled some recent answers from the STBL @stbl_official team to community questions.

The content mainly focuses on two key points: delivery timeline and audit risk areas.

🟨 1|Delivery Timeline

Brand and Website

A brand-new brand image and website design are expected to launch in mid-December. This is a key milestone that will impact market sentiment.

Institutional Partnership Announcements

The team is working hard to announce

I've compiled some recent answers from the STBL @stbl_official team to community questions.

The content mainly focuses on two key points: delivery timeline and audit risk areas.

🟨 1|Delivery Timeline

Brand and Website

A brand-new brand image and website design are expected to launch in mid-December. This is a key milestone that will impact market sentiment.

Institutional Partnership Announcements

The team is working hard to announce

STBL3,91%

- Reward

- like

- Comment

- Repost

- Share

Just watched the live stream in Dubai with @Aptos co-founder @AveryChing, and it left a deep impression on me.

Many people only see that Aptos is fast, but it's easy to overlook where its real foundation comes from.

Back then, Libra's goal was to enable billions of people worldwide to complete transfers as easily as sending a message, but it was struck down by regulators, and that unfulfilled ambition has always been considered a regret in Web3 history.

But now, it seems that fire never really went out.

Aptos is more like the successor carrying Libra’s legacy, continuing several of Libra’s mos

Many people only see that Aptos is fast, but it's easy to overlook where its real foundation comes from.

Back then, Libra's goal was to enable billions of people worldwide to complete transfers as easily as sending a message, but it was struck down by regulators, and that unfulfilled ambition has always been considered a regret in Web3 history.

But now, it seems that fire never really went out.

Aptos is more like the successor carrying Libra’s legacy, continuing several of Libra’s mos

APT-0,38%

- Reward

- like

- 2

- Repost

- Share

$36,000 :

:

The fighter jet among trash, just waiting to hit zero.View More

✦ @Lombard_Finance I have been working on this project for more than half a month, and I don't know why it just won't make it to the list.

I'm puzzled. Logically speaking, I've written so many articles and should have made the list, right? I'm really out of ideas. Can someone give me a boost of motivation? I'm feeling a bit stuck 😭

Let's talk about how Lombard can maximize profits using LBTC.

The current BTC-Fi is no longer just simple Staking. Lombard is turning LBTC into the most user-friendly and highly composable DeFi Lego piece.

If you want your BTC to no long

I'm puzzled. Logically speaking, I've written so many articles and should have made the list, right? I'm really out of ideas. Can someone give me a boost of motivation? I'm feeling a bit stuck 😭

Let's talk about how Lombard can maximize profits using LBTC.

The current BTC-Fi is no longer just simple Staking. Lombard is turning LBTC into the most user-friendly and highly composable DeFi Lego piece.

If you want your BTC to no long

BTC-0,92%

- Reward

- like

- Comment

- Repost

- Share

✧➣ @TheoriqAI is doing something in the encryption industry that no one has truly accomplished yet —

Establish a credit rating system for Agent🏁

In the past, the market assessed projects, token sentiment, and KOL influence, but in the era of Agentic DeFi, the true control of funds lies with the Agents themselves.

So the question naturally becomes:

Is this Agent trustworthy? Can I safely entrust my money to it?🤔

✦ Theoriq's approach is very professional; it quantifies the execution quality of Agents, risk control robustness, strategy transparency, violation records, and profit stability o

View OriginalEstablish a credit rating system for Agent🏁

In the past, the market assessed projects, token sentiment, and KOL influence, but in the era of Agentic DeFi, the true control of funds lies with the Agents themselves.

So the question naturally becomes:

Is this Agent trustworthy? Can I safely entrust my money to it?🤔

✦ Theoriq's approach is very professional; it quantifies the execution quality of Agents, risk control robustness, strategy transparency, violation records, and profit stability o

- Reward

- like

- Comment

- Repost

- Share

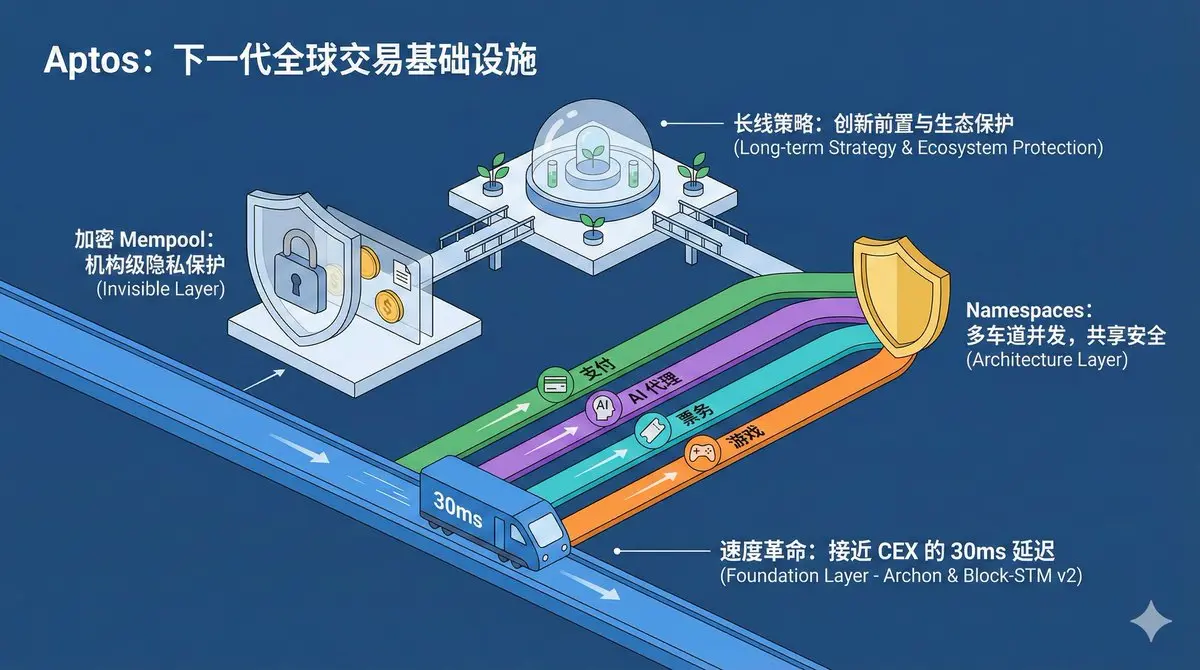

After reading the latest disclosed technical upgrade framework from @Aptos, I am increasingly certain of one thing:

It no longer considers itself just a simple "fast chain", but is trying to build a global trading infrastructure that can approach the user experience of a CEX.

The core of this upgrade is not about piling on features, but rather a complete re-engineering of the underlying architecture.

Speed, privacy, throughput, automation—these main lines push forward together, aiming at the high standards of the real-world financial system, rather than just boosting scores on a leaderboard.

T

It no longer considers itself just a simple "fast chain", but is trying to build a global trading infrastructure that can approach the user experience of a CEX.

The core of this upgrade is not about piling on features, but rather a complete re-engineering of the underlying architecture.

Speed, privacy, throughput, automation—these main lines push forward together, aiming at the high standards of the real-world financial system, rather than just boosting scores on a leaderboard.

T

APT-0,38%

- Reward

- 5

- 4

- Repost

- Share

ABID :

:

Aptos is clearly chasing institutional flow.View More

The performance of @Aptos in this wave is impressive👀!

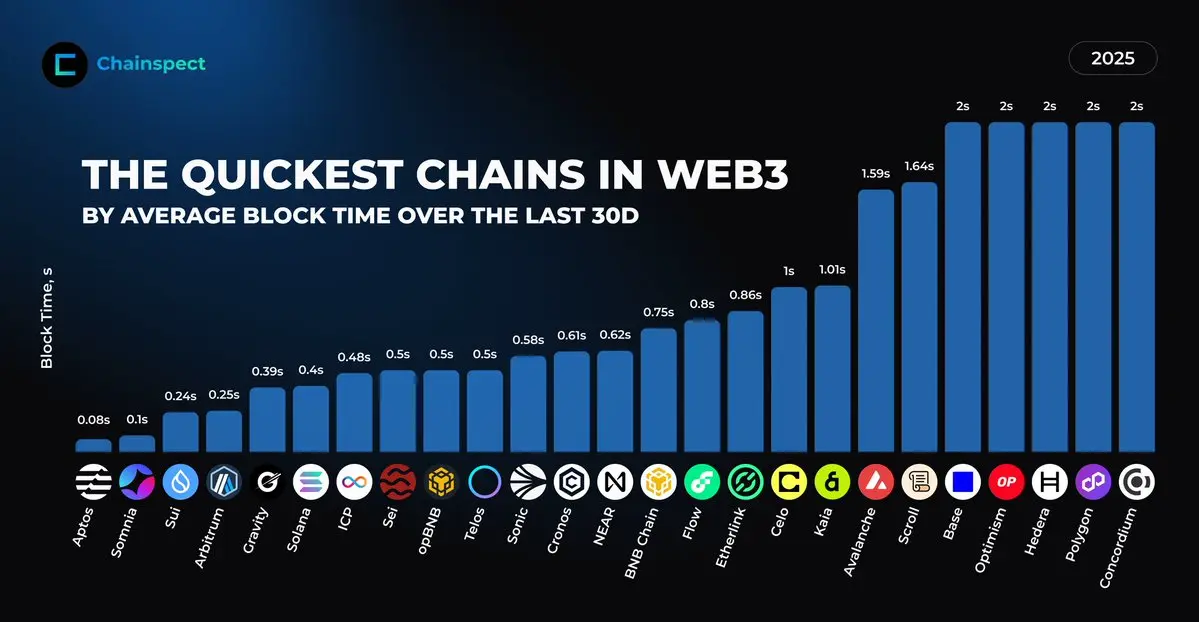

It won MVP in the latest block test leaderboard, with a block confirmation time as fast as 0.08 seconds—fast as lightning⚡, simply unmatched.

Aptos's outstanding performance makes me ponder:

Has the high-performance public chain arrived 🤔?

In the past year, everyone has been talking about L2, modularization, and data availability, as if the performance of L1 no longer matters. But the reality is—users only care about the experience, and developers only care about whether it runs steadily, whether it's fast enough, and whether the

It won MVP in the latest block test leaderboard, with a block confirmation time as fast as 0.08 seconds—fast as lightning⚡, simply unmatched.

Aptos's outstanding performance makes me ponder:

Has the high-performance public chain arrived 🤔?

In the past year, everyone has been talking about L2, modularization, and data availability, as if the performance of L1 no longer matters. But the reality is—users only care about the experience, and developers only care about whether it runs steadily, whether it's fast enough, and whether the

APT-0,38%

- Reward

- like

- 1

- Repost

- Share

TreasureBasin2522 :

:

Then it's useless, the coin price has fallen to shit.- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More26.19K Popularity

50.49K Popularity

16.75K Popularity

11.76K Popularity

39.39K Popularity

Pin