Bitcoindata21

No content yet

bitcoindata21

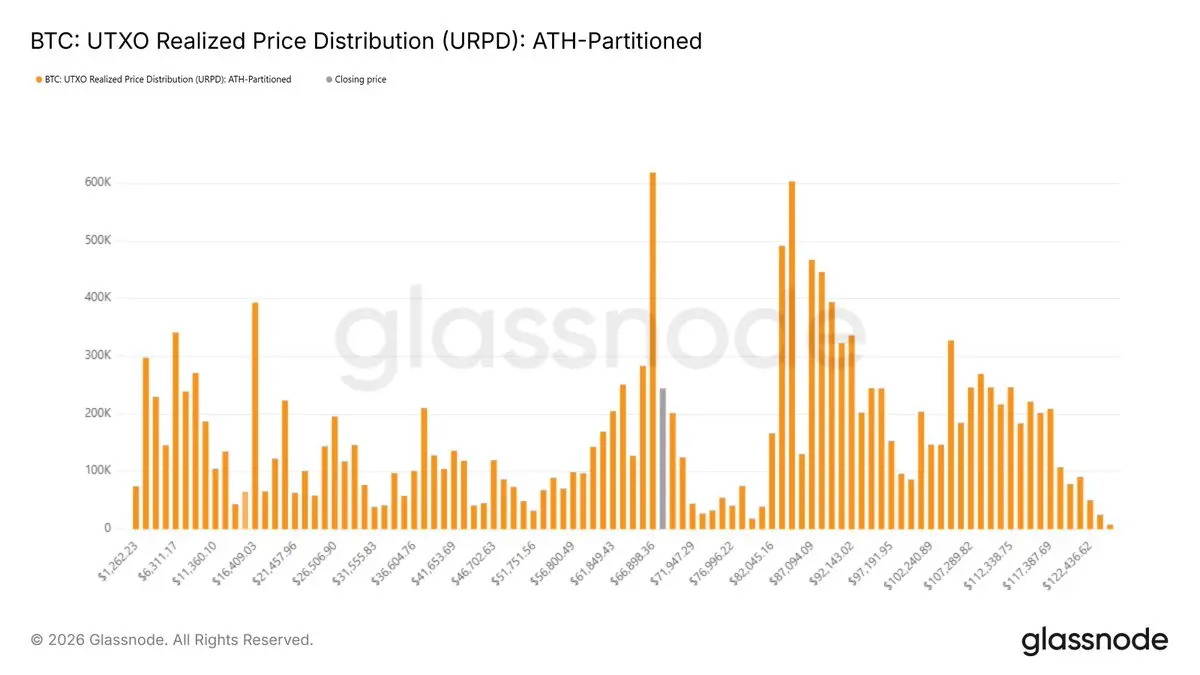

Whales have been buying the dip.

$67k is now the most transacted price, with over 618,405 bitcoin (or 3.09% of the supply).

This area had only 241,788 bitcoin transacted, just 3 weeks ago.

$67k is now the most transacted price, with over 618,405 bitcoin (or 3.09% of the supply).

This area had only 241,788 bitcoin transacted, just 3 weeks ago.

BTC-0,21%

- Reward

- 3

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

For UK followers who use Stocks ISA accounts - vibe coded a comparison table of brokers fees.

If you search on the internet, you will be given promoted choices, while the cheapest/best-value are completely left out. Please verify fees below yourself, but the data looks about right to me.

5 of the best VS 5 of the worst

If you search on the internet, you will be given promoted choices, while the cheapest/best-value are completely left out. Please verify fees below yourself, but the data looks about right to me.

5 of the best VS 5 of the worst

- Reward

- like

- Comment

- Repost

- Share

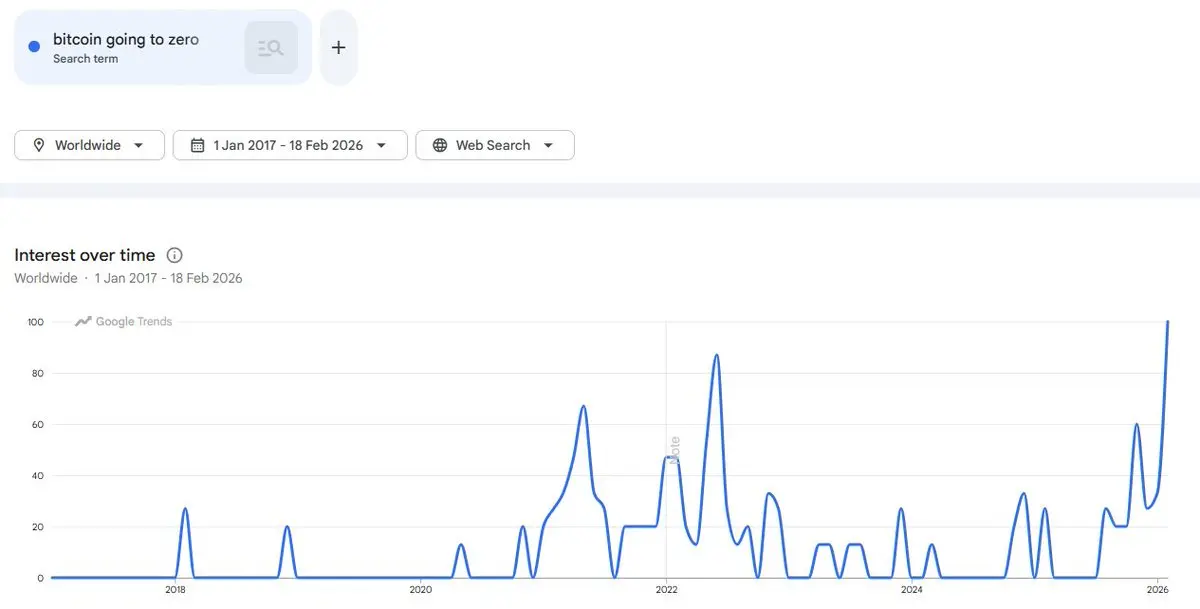

Me: breathes

Reader: WTF you say you POS SOB. Unfollowed n blocked MFR

Send me to zero!😳😂

Reader: WTF you say you POS SOB. Unfollowed n blocked MFR

Send me to zero!😳😂

- Reward

- 2

- Comment

- Repost

- Share

More stock market bears than bulls for first time since November 2025.

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 3

- 1

- 1

- Share

GateUser-e7b7fcf8 :

:

2026 GOGOGO 👊Is someone just TWAP buying or selling bitcoin around the rolling 7 day VWAP, since February 8th?

BTC-0,21%

- Reward

- 2

- Comment

- Repost

- Share

Been trying Claude Opus 4.6

Should make things easier for quant type analysis, once I can understand how best to apply it.

Should make things easier for quant type analysis, once I can understand how best to apply it.

- Reward

- like

- Comment

- Repost

- Share

@Doctor_Magic_ "how is it possible?"

"Is it too late to buy?"

"Should I wait for a pullback?"

"Is it too late to buy?"

"Should I wait for a pullback?"

- Reward

- like

- Comment

- Repost

- Share

[ALTCOINS] Others dominance is breaking out on the monthly.

- Reward

- like

- Comment

- Repost

- Share

$IREN vs $MARA

- Reward

- like

- Comment

- Repost

- Share

Are the lows in for bitcoin at 60k (looking out 12 months or so)?

BTC-0,21%

- Reward

- like

- Comment

- Repost

- Share

Textbook technicals on $IGV Software ETF.

And another massive week of volume.

The World is capitulating on tech stocks.

And another massive week of volume.

The World is capitulating on tech stocks.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Which is a better Altcoin buy for holding 1-2 years out?

- Reward

- like

- Comment

- Repost

- Share

Capitulation everywhere

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More286.97K Popularity

90.21K Popularity

412.18K Popularity

108.89K Popularity

15.89K Popularity

Pin