2025 BIO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: BIO's Market Position and Investment Value

BIO (Bio Protocol) is a curation and liquidity protocol for Decentralized Science (DeSci), dedicated to accelerating biotechnology development by enabling global communities of patients, scientists, and biotech professionals to collectively fund, build, and own tokenized biotech projects and intellectual property. Since its launch on December 25, 2024, BIO has quickly established itself as a significant player in the emerging DeSci sector. As of December 17, 2025, BIO has achieved a market capitalization of approximately $85.24 million, with a circulating supply of approximately 1.88 billion tokens, currently trading at $0.04526. This innovative protocol, recognized for its mission to democratize biotech funding and ownership, is playing an increasingly critical role in bridging decentralized finance with scientific innovation.

This article will provide a comprehensive analysis of BIO's price dynamics and market trends through 2030, incorporating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to the DeSci sector.

BIO Protocol (BIO) Market Analysis Report

I. BIO Price History Review and Current Market Status

BIO Historical Price Evolution

BIO Protocol has experienced significant volatility since its launch in December 2024. The token reached its all-time high (ATH) of $1.09 on December 25, 2024, approximately one month after its initial listing. However, the token has subsequently experienced substantial downward pressure, declining to its all-time low (ATL) of $0.02906 on October 10, 2025, representing a staggering decline of approximately 95.09% from its peak value.

Key price milestones include:

- December 2024: Launch period with initial momentum, reaching ATH of $1.09

- October 2025: Severe market correction leading to ATL of $0.02906

- December 2025: Partial recovery from lows with current price stabilizing around $0.04526

BIO Current Market Status

As of December 17, 2025, BIO is trading at $0.04526, representing a modest recovery from its recent lows. The token demonstrates the following characteristics:

Price Performance:

- 24-hour change: +1.82% ($0.000809)

- 7-day change: -7.52% ($-0.003680)

- 30-day change: -30.52% ($-0.019881)

- 1-year change: -95.088% ($-0.876157)

- 1-hour change: +0.33% ($0.000149)

Market Capitalization Metrics:

- Market capitalization: $85,236,942.30

- Fully diluted valuation (FDV): $150,263,200.00

- Market cap to FDV ratio: 56.73%

- 24-hour trading volume: $1,795,079.86

- Market dominance: 0.0047%

Supply and Distribution:

- Circulating supply: 1,883,273,139.62 BIO (56.73% of total supply)

- Total supply: 3,320,000,000 BIO

- Maximum supply: 3,320,000,000 BIO

- Token holders: 10,309

- Listed on 40 cryptocurrency exchanges

Technical Details:

- Smart contract standard: ERC20

- Blockchain network: Ethereum (ETH)

- Contract address: 0xcb1592591996765ec0efc1f92599a19767ee5ffa

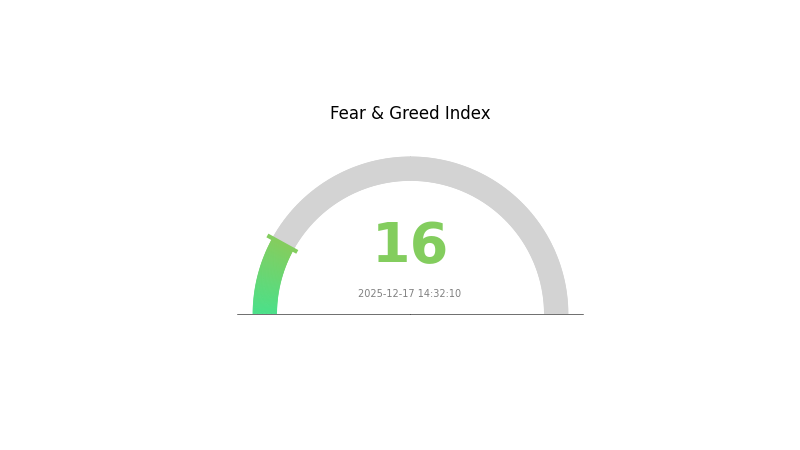

The current market sentiment reflects "Extreme Fear" with a VIX reading of 16, indicating heightened volatility and risk aversion in the broader cryptocurrency market. BIO's trading range over the past 24 hours spans from $0.04416 to $0.04834, demonstrating continued price pressure within a constrained range.

Click to view current BIO market price

BIO 市场情绪指标

2025-12-17 恐惧与贪婪指数:16(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This indicates heightened market anxiety and risk aversion among investors. During periods of extreme fear, market volatility typically increases as investors adopt defensive positions. However, contrarian investors often view such conditions as potential buying opportunities, as assets may be undervalued. It's advisable to exercise caution when trading and conduct thorough research before making investment decisions. Monitor market developments closely and adjust your portfolio strategy according to your risk tolerance.

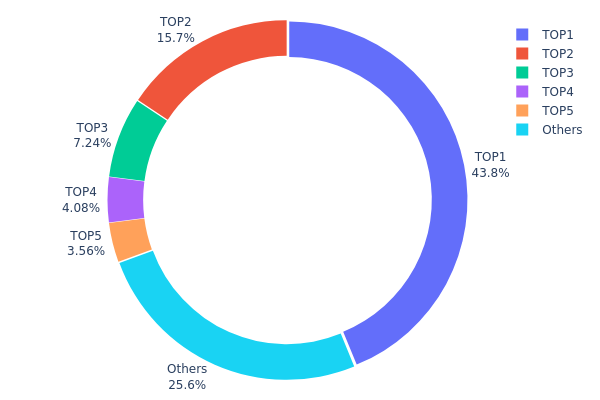

BIO Holdings Distribution

The address holding distribution map presents a comprehensive view of how BIO tokens are allocated across different blockchain addresses, offering critical insights into token concentration, market structure, and potential centralization risks. By analyzing the top holders and their respective percentages, market participants can assess the level of decentralization and evaluate the vulnerability of the token to potential price manipulation or sudden liquidity shifts.

BIO exhibits a notably concentrated holding structure, with significant centralization evident in the upper tier of addresses. The top holder commands 43.82% of total supply, while the combined top five addresses account for approximately 74.38% of all BIO tokens in circulation. This extreme concentration level presents considerable risks to market stability and price integrity. The second-largest holder maintains 15.69% of supply, and the third-largest holds 7.24%, creating a steep concentration curve that deviates markedly from a well-distributed token ecosystem. The remaining distributed holdings constitute only 25.62% of total supply, suggesting that the broader market lacks sufficient token distribution to counterbalance the influence of major holders.

The current distribution pattern implies elevated systemic risks, particularly regarding price volatility and potential market manipulation. Large holders possess substantial leverage to influence BIO's market dynamics through coordinated movements, and any liquidation activity from top addresses could trigger significant downward pressure. Furthermore, the concentration of over 74% of supply among five addresses raises concerns about governance decentralization and long-term sustainability. From a structural perspective, BIO demonstrates limited on-chain decentralization, indicating that the token's market maturity remains dependent on the stability and intentions of a small number of major stakeholders. This configuration suggests investors should exercise heightened caution regarding liquidity conditions and price stability.

Check current BIO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d2a...7d2ef4 | 1338277.22K | 43.82% |

| 2 | 0xd9c6...e8a1ab | 479383.99K | 15.69% |

| 3 | 0xf977...41acec | 221230.15K | 7.24% |

| 4 | 0xf91a...56f40c | 124569.18K | 4.07% |

| 5 | 0xf3dc...458a43 | 108800.00K | 3.56% |

| - | Others | 781501.82K | 25.62% |

II. Core Factors Impacting BIO's Future Price

Supply Mechanism

- Market Demand: Market demand directly influences BIO price movements. Supply and demand dynamics are fundamental drivers of price fluctuations in the cryptocurrency market.

- Current Impact: Changes in supply-demand structure will determine the direction of short-term price volatility.

Adoption Rate and Ecosystem Development

- DAO Tokenization: Increased adoption by more DAOs tokenizing intellectual property on the platform will expand BIO's use cases and demand.

- Staking Activity: Staked BIO tokens have climbed to 1.25 million, indicating growing ecosystem engagement and token utility.

Market Volatility Considerations

The cryptocurrency market itself exhibits high volatility, with prices potentially affected by market sentiment and external factors. BIO's prospects depend significantly on the development of the DeSci (Decentralized Science) industry. If this sector fails to develop rapidly, it could impact BIO's long-term growth trajectory.

III. BIO Price Forecast for 2025-2030

2025 Outlook

- Conservative Estimate: $0.04245 - $0.04516

- Base Case Estimate: $0.04516

- Optimistic Estimate: $0.05916 (pending positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and adoption phase with steady price appreciation driven by ecosystem expansion and increasing institutional interest.

- Price Range Forecast:

- 2026: $0.04016 - $0.06989 (15% upside potential)

- 2027: $0.05126 - $0.08544 (34% cumulative gains)

- 2028: $0.05712 - $0.10545 (61% cumulative gains)

- Key Catalysts: Enhanced protocol functionality, strategic partnerships, increased DeFi integration, and growing demand for biological asset tokenization solutions.

2029-2030 Long-term Outlook

- Base Scenario: $0.06701 - $0.09202 (sustained growth with moderate volatility)

- Optimistic Scenario: $0.08934 - $0.10519 (strong ecosystem adoption and market maturation)

- Transformational Scenario: $0.09068+ (mainstream institutional adoption, regulatory clarity, and breakthrough use cases in biological asset management)

- 2030-12-31: BIO approaching $0.10519 (potential decade high, reflecting sustained ecosystem development and market confidence)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05916 | 0.04516 | 0.04245 | 0 |

| 2026 | 0.06989 | 0.05216 | 0.04016 | 15 |

| 2027 | 0.08544 | 0.06103 | 0.05126 | 34 |

| 2028 | 0.10545 | 0.07323 | 0.05712 | 61 |

| 2029 | 0.09202 | 0.08934 | 0.06701 | 97 |

| 2030 | 0.10519 | 0.09068 | 0.07436 | 100 |

Bio Protocol (BIO) Investment Strategy and Risk Management Report

IV. BIO Professional Investment Strategy and Risk Management

BIO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Community members and believers in decentralized science movement, patient advocates, institutional research organizations

- Operation recommendations:

- Accumulate BIO tokens during market downturns, particularly when the token experiences significant corrections from all-time highs (ATH of $1.09 reached on December 25, 2024)

- Maintain positions through development cycles as the DeSci ecosystem matures and adoption increases

- Dollar-cost averaging (DCA) to reduce timing risk given the current -95.088% year-over-year decline

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages (MA): Use 50-day and 200-day moving averages to identify trend reversals and support/resistance levels

- Relative Strength Index (RSI): Monitor overbought/oversold conditions given BIO's high volatility

- Swing trading key points:

- Monitor 24-hour volume levels (currently around 1.8M in trading volume) for liquidity confirmation

- Watch for capitulation patterns given the -30.52% monthly decline and 7-day -7.52% performance

BIO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of portfolio maximum

- Active investors: 3-5% of portfolio maximum

- Professional/specialized investors: 5-10% of portfolio maximum

(2) Risk Hedging Options

- Stablecoin reserves: Maintain 40-60% of DeSci allocation in stablecoins to capture buying opportunities during market downturns

- Position sizing: Never commit more capital than you can afford to lose completely, given BIO's nascent market stage

(3) Secure Storage Solutions

- Hot wallet solution: Gate.com Web3 Wallet for frequent trading and active participation in DeSci ecosystem activities

- Cold storage approach: For long-term holdings exceeding 90 days, consider securing tokens on hardware devices or self-custody solutions with proper backup procedures

- Security considerations: Implement multi-signature verification for large holdings, enable two-factor authentication on all exchange accounts, never share private keys or recovery phrases

V. BIO Potential Risks and Challenges

BIO Market Risks

- Extreme volatility: The token has declined -95.088% over one year from its peak, with current price at $0.04526, indicating severe price instability

- Liquidity constraints: Available on only 40 exchanges with 24-hour volume of approximately $1.79M, potentially limiting exit opportunities during market stress

- Market adoption uncertainty: DeSci adoption remains early-stage; failure to attract mainstream institutional participation could result in further price depreciation

BIO Regulatory Risks

- Tokenized biotech IP classification: Regulatory uncertainty regarding how jurisdictions will classify and tax tokenized intellectual property and biotech projects

- Securities classification concerns: Depending on jurisdiction, DeSci project tokens may be classified as securities, triggering compliance requirements and potential trading restrictions

- Evolving compliance landscape: Decentralized science frameworks lack established regulatory precedents, creating uncertainty for project operation and token utility

BIO Technical Risks

- Smart contract vulnerabilities: As an ERC20 token on Ethereum, BIO depends on Ethereum network stability and smart contract security; any vulnerabilities could compromise token functionality

- Protocol adoption: Success depends on widespread adoption of the Bio Protocol framework by biotech projects; low adoption rates would undermine the ecosystem's value proposition

- Competition from alternative DeSci solutions: Other decentralized science protocols may offer superior features or attract critical mass before Bio Protocol achieves network effects

VI. Conclusion and Action Recommendations

BIO Investment Value Assessment

Bio Protocol operates in the nascent DeSci sector with significant long-term potential but currently faces substantial headwinds. The project's mission to democratize biotech research and enable collective ownership of IP addresses a genuine market need. However, the -95.088% annual decline, extreme volatility (ranging from $0.02906 to $1.09), and limited trading liquidity present formidable challenges for near-term investors. BIO represents a high-risk, potentially high-reward opportunity suitable only for investors with substantial risk tolerance and conviction in DeSci's long-term viability.

BIO Investment Recommendations

✅ For Beginners: Start with minimal positions (0.1-0.5% of your portfolio) and focus on understanding the DeSci ecosystem fundamentals before increasing exposure. Use dollar-cost averaging to reduce timing risk.

✅ For Experienced Investors: Consider BIO as a speculative/venture capital allocation within a diversified crypto portfolio. Implement strict position sizing rules and predetermined exit points both for losses and gains.

✅ For Institutional Investors: Conduct thorough due diligence on Bio Protocol's tokenomics, governance structure, and competitive positioning within the DeSci landscape before institutional allocation decisions.

BIO Trading Participation Methods

- Direct spot trading on Gate.com: Access BIO/USDT and other trading pairs with professional tools and charts for technical analysis

- Dollar-cost averaging programs: Set up automated purchases at regular intervals through Gate.com to systematically build positions while mitigating timing risk

- On-chain participation: Engage with Bio Protocol's governance and DeSci projects directly through the protocol, enabling deeper ecosystem participation beyond simple token holding

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and circumstances. Always consult with professional financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

Will bio protocol reach $1?

Bio Protocol could potentially reach $1 if adoption increases and utility expands significantly. Success depends on ecosystem growth, user adoption, and market conditions. While possible, no guarantees exist for this price target.

What is the price prediction for bio token in 2025?

Based on current market analysis, Bio Protocol's 2025 price prediction shows a bearish sentiment. Technical indicators suggest downward pressure, with analysts expecting potential decline due to market conditions and reduced bullish momentum throughout the year.

Is bio token a good investment?

BIO token shows strong investment potential driven by increasing adoption in scientific research and biotechnology projects. With growing real-world utility and expanding ecosystem, analysts predict significant value appreciation through 2030-2040.

What is the bio price prediction for 2030?

Bio Protocol's 2030 price prediction remains uncertain due to market volatility. Analysts suggest potential growth driven by ecosystem adoption and technological developments, though exact price targets vary widely based on different methodologies and market conditions.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

DRIFT vs ZIL: Which Layer-1 Blockchain Offers Better Performance and Scalability?

USELESS vs TRX: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Crypto Market

What is ORBR: A Comprehensive Guide to Optimizing Real-time Business Response Systems

What is WAVES: A Comprehensive Guide to Understanding Wave Technology and Its Applications in Modern Society

What is USELESS: A Comprehensive Guide to Understanding Things That Serve No Purpose in Modern Life