2025 POL Price Prediction: Expert Analysis and Market Outlook for Polygon's Native Token

Introduction: POL's Market Position and Investment Value

Polygon Ecosystem Token (POL), as a key player in the Ethereum scaling and infrastructure development space, has made significant strides since its inception. As of 2025, POL's market capitalization has reached $1,170,495,400, with a circulating supply of approximately 10,556,415,953 tokens, and a price hovering around $0.11088. This asset, often referred to as the "Ethereum scaling solution," is playing an increasingly crucial role in enhancing blockchain scalability and interoperability.

This article will comprehensively analyze POL's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. POL Price History Review and Current Market Status

POL Historical Price Evolution

- 2023: Project launch, price fluctuated around $0.31

- 2024: Reached all-time high of $1.5711 on April 22

- 2025: Market correction, price dropped to $0.11088

POL Current Market Situation

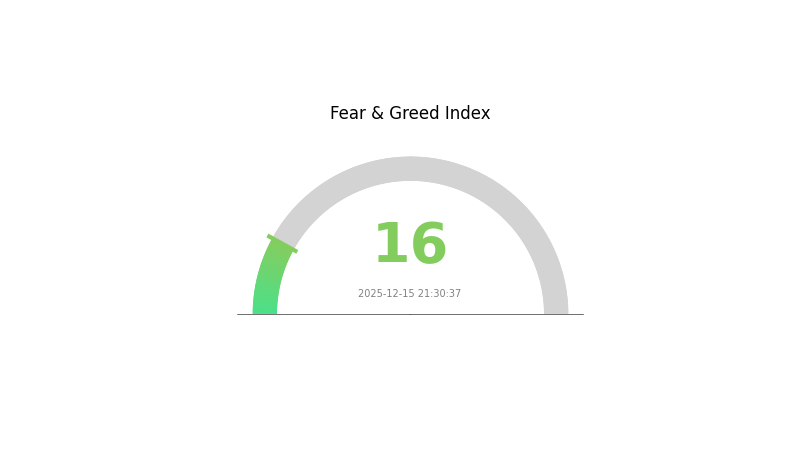

As of December 16, 2025, POL is trading at $0.11088, with a 24-hour trading volume of $1,687,394.81. The token has experienced a 4.96% decrease in the last 24 hours. POL's market cap stands at $1,170,495,400.94, ranking it 71st in the cryptocurrency market. The circulating supply is 10,556,415,953.65972 POL, which is also the total supply. POL has seen significant volatility, with a 1-hour gain of 1%, but a 7-day decline of 10.15% and a 30-day drop of 28.53%. The token is currently 92.94% below its all-time high of $1.5711, recorded on April 22, 2024. The market sentiment for POL appears bearish in the short term, reflecting the broader cryptocurrency market's extreme fear state as indicated by the VIX index of 16.

Click to view the current POL market price

POL Market Sentiment Indicator

2025-12-15 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, caution is advised as market conditions remain volatile. Traders on Gate.com are closely monitoring this sentiment shift, as it could indicate an imminent market reversal. Remember, while fear can present opportunities, thorough research and risk management are crucial in navigating these uncertain waters.

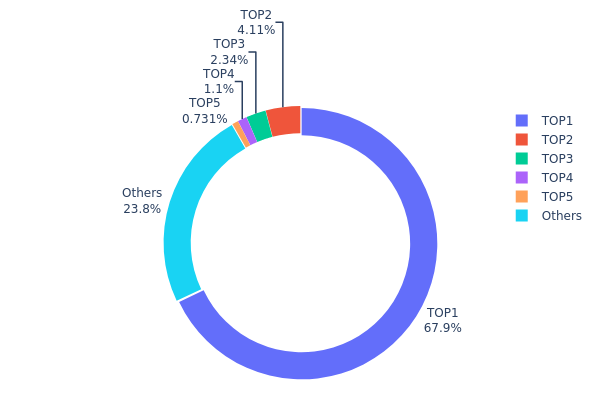

POL Holdings Distribution

The address holdings distribution data for POL reveals a highly concentrated ownership structure. The top address holds a staggering 67.94% of the total supply, indicating a significant centralization of control. This concentration is further emphasized by the fact that the top 5 addresses collectively hold 76.22% of all POL tokens.

Such a concentrated distribution raises concerns about market stability and potential price manipulation. The dominant holder could exert considerable influence over the token's price movements, potentially leading to increased volatility. Moreover, this centralization contradicts the principle of decentralization often associated with cryptocurrency projects.

While the presence of numerous smaller holders (23.78% held by "Others") suggests some level of distribution, the overwhelming dominance of the top address significantly impacts the overall market structure. This concentration may deter potential investors and could pose risks to the long-term sustainability and adoption of the POL ecosystem.

Click to view the current POL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...001010 | 7172231.39K | 67.94% |

| 2 | 0x4c56...989ff4 | 433972.73K | 4.11% |

| 3 | 0x0d50...df1270 | 247318.09K | 2.34% |

| 4 | 0x79b4...c2cf38 | 115736.63K | 1.10% |

| 5 | 0x7d34...c4777e | 77152.77K | 0.73% |

| - | Others | 2510004.36K | 23.78% |

II. Key Factors Influencing POL's Future Price

Supply Mechanism

- Token Migration: The transition from MATIC to POL tokens is designed to be smooth and seamless to reduce user resistance.

- Current Impact: The initial supply is primarily used for MATIC to POL conversion/migration, with no new tokens being issued.

Institutional and Whale Dynamics

- Enterprise Adoption: An increasing number of projects are utilizing Polygon's solutions, strengthening investor confidence in holding POL tokens.

Macroeconomic Environment

- Inflation Hedge Properties: POL's performance in an inflationary environment is a key factor influencing its price.

- Geopolitical Factors: International situations can impact POL's price movements.

Technical Development and Ecosystem Building

- AggLayer Technology: The deployment progress of the AggLayer aggregation layer technology is a crucial factor affecting POL's price. This technology is expected to launch its testnet by the end of 2025, significantly enhancing POL's capabilities.

- Polygon 2.0 Architecture: The implementation of Polygon's new architecture, including multiple layers and components, with POL serving as the "coordinator" and "security pool" for the network.

- Ecosystem Applications: Polygon is building a multi-chain network with applications in DeFi, gaming, NFTs, and infrastructure. The growth of this ecosystem directly impacts POL's value.

III. POL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.1049 - $0.1116

- Neutral prediction: $0.1116 - $0.13

- Optimistic prediction: $0.13 - $0.14396 (requires positive market sentiment and increased adoption)

2026-2028 Outlook

- Market phase expectation: Gradual growth with potential volatility

- Price range forecast:

- 2026: $0.12012 - $0.14567

- 2027: $0.12032 - $0.20236

- 2028: $0.1119 - $0.20175

- Key catalysts: Technological advancements, increased institutional interest, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.18565 - $0.21349 (assuming steady market growth and continued project development)

- Optimistic scenario: $0.21349 - $0.29889 (assuming strong market conditions and significant project milestones)

- Transformative scenario: $0.29889 - $0.35 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: POL $0.29889 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14396 | 0.1116 | 0.1049 | 0 |

| 2026 | 0.14567 | 0.12778 | 0.12012 | 15 |

| 2027 | 0.20236 | 0.13673 | 0.12032 | 23 |

| 2028 | 0.20175 | 0.16954 | 0.1119 | 52 |

| 2029 | 0.24134 | 0.18565 | 0.10025 | 67 |

| 2030 | 0.29889 | 0.21349 | 0.17507 | 92 |

IV. Professional Investment Strategies and Risk Management for POL

POL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Polygon's ecosystem

- Operational suggestions:

- Accumulate POL during market dips

- Stake POL tokens to earn passive income

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor Polygon ecosystem developments closely

- Set stop-loss orders to manage downside risk

POL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different blockchain projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for POL

POL Market Risks

- Volatility: Crypto market's inherent price fluctuations

- Competition: Emerging Layer 2 solutions may challenge Polygon's market position

- Market sentiment: Influenced by overall crypto market trends

POL Regulatory Risks

- Regulatory uncertainty: Changing global cryptocurrency regulations

- Compliance challenges: Potential issues with securities laws

- Tax implications: Evolving tax treatments for crypto assets

POL Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol

- Scalability challenges: Unforeseen issues in network upgrades

- Interoperability risks: Complications in cross-chain operations

VI. Conclusion and Action Recommendations

POL Investment Value Assessment

POL presents long-term value as a key player in Ethereum scaling solutions, but faces short-term volatility and competitive pressures in the rapidly evolving blockchain landscape.

POL Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the market ✅ Experienced investors: Consider a balanced approach with both holding and trading strategies ✅ Institutional investors: Explore deeper involvement in Polygon's ecosystem and governance

POL Trading Participation Methods

- Spot trading: Buy and sell POL on reputable exchanges like Gate.com

- Staking: Participate in Polygon's network security and earn rewards

- DeFi involvement: Explore yield farming and liquidity provision opportunities within the Polygon ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is pol coin a good investment?

Yes, POL coin is a promising investment. Its role in Ethereum scalability and growing DeFi adoption make it attractive. As of 2025, POL remains a strong contender with significant growth potential in the crypto market.

What will a Polygon be worth in 2025?

Based on current trends, Polygon is projected to reach $0.16 by the end of 2025, a forecast widely accepted in the crypto community.

Will Polygon coins reach $1?

Polygon's POL token could reach $3 if network adoption and crypto market conditions improve. Current projections do not predict it reaching $1. Long-term potential depends on broader market trends.

Can a Polygon reach $3?

Yes, Polygon could potentially reach $3. While ambitious, it's not impossible given its strong ecosystem, growing adoption, and ongoing technological advancements in the blockchain space.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

# What Is the Current Crypto Market Overview: Market Cap Rankings, Trading Volume, and Liquidity in 2025?

What is Velo Protocol: Whitepaper Logic, Use Cases, and Roadmap Analysis

How Active Is the Crypto Community and Ecosystem in 2025 With Social Media Engagement and Developer Contributions?

How to Read Technical Indicators for BNB: RSI, MACD, and Bollinger Bands Analysis

How to Use MACD, RSI, and Moving Averages to Analyze THQ Token Price Signals?