2025 SKL Price Prediction: Expert Analysis and Future Market Outlook for Skale Network Token

Introduction: SKL's Market Position and Investment Value

SKALE (SKL) is an open-source Web3 platform designed to bring speed and configurability to blockchains. Since its inception in 2020, SKALE Network has established itself as a key infrastructure project within the Web3 ecosystem. As of December 18, 2025, SKL maintains a market capitalization of approximately $62.52 million with a circulating supply of around 6.06 billion tokens, trading at $0.01029 per token. This infrastructure asset, recognized for enabling scalable and configurable blockchain solutions, plays an increasingly critical role in supporting decentralized applications and Web3 development.

This article will provide a comprehensive analysis of SKL's price movements from 2025 through 2030, integrating historical price patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for market participants.

SKALE Network (SKL) Market Analysis Report

I. SKL Price History Review and Current Market Status

SKL Historical Price Evolution

-

2021: SKALE Network token listing and early adoption phase. SKL reached its all-time high (ATH) of $1.22 on March 12, 2021, marking the peak of initial market enthusiasm following the platform's launch.

-

2021-2025: Extended bear market period. SKL experienced significant depreciation over the subsequent four years, with the token declining substantially from its peak valuations as the broader cryptocurrency market cycled through various phases.

-

2025: Continued downward pressure. SKL reached new lows, with the all-time low (ATL) of $0.01018707 recorded on December 18, 2025, representing an 82.8% decline over the one-year period.

SKL Current Market Position

As of December 18, 2025, SKL is trading at $0.01029 with the following market characteristics:

Price Performance Metrics:

- 1-hour change: -0.19%

- 24-hour change: -3.83%

- 7-day change: -16.31%

- 30-day change: -31.86%

- 1-year change: -82.80%

Market Capitalization & Supply Data:

- Market capitalization: $62,377,321.48

- Fully diluted valuation (FDV): $62,522,040

- Circulating supply: 6,061,936,004 SKL (86.59% of total supply)

- Total supply: 6,076,000,000 SKL

- Maximum supply: 7,000,000,000 SKL

- Market dominance: 0.0020%

Trading Activity:

- 24-hour trading volume: $75,517.12

- Market ranking: #440

- Active holders: 30,281

- Listed on 34 exchanges

Price Range (24-hour):

- High: $0.01083

- Low: $0.01015

Click to view current SKL market price

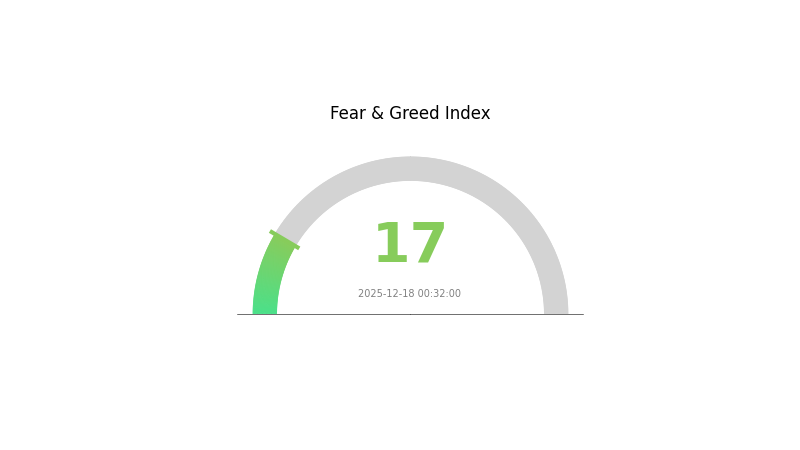

SKL Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear as the Fear and Greed Index plummets to 17. This severe sentiment indicates widespread panic and bearish pressure among investors. During such periods, market volatility typically increases while confidence diminishes significantly. Traders should exercise caution and implement proper risk management strategies. However, historically, extreme fear can present contrarian opportunities for long-term investors with strong conviction. Monitor key support levels closely and consider your risk tolerance before making any trading decisions in this highly uncertain environment.

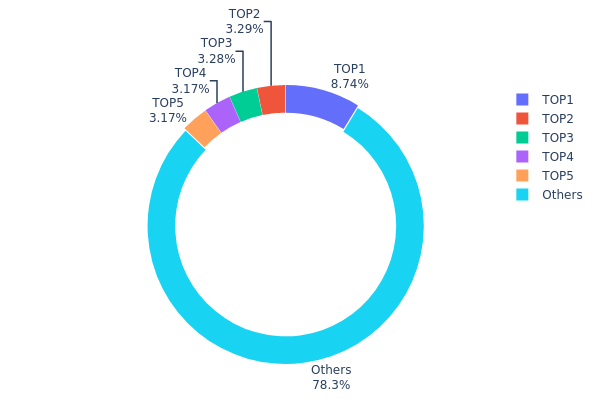

SKL Holdings Distribution

The address holdings distribution chart illustrates the concentration pattern of SKL tokens across blockchain addresses, revealing the degree of token centralization and potential market concentration risks. By analyzing the top token holders and their proportional stakes, this metric provides critical insights into the decentralization level and market structure of the SKL ecosystem.

Based on the current data, SKL demonstrates a relatively moderate concentration profile. The top five addresses collectively control approximately 21.62% of the total token supply, with the largest holder (0xf977...41acec) commanding 8.74% of all circulating tokens. While this concentration level is notable, it remains below critical thresholds that would indicate severe centralization concerns. The fact that 78.38% of tokens are distributed among remaining addresses suggests a reasonably dispersed holder base, which is generally favorable for long-term ecosystem health and price stability.

However, the distribution pattern warrants careful monitoring regarding potential market dynamics. The top holder's substantial 8.74% stake represents significant liquidation risk should the address execute large sell-orders, potentially triggering downward price pressure. Additionally, coordinated movements among the top five holders could theoretically influence short-term price volatility. That said, the absence of extreme concentration (where a single entity controls over 20-30%) and the substantial "Others" category indicate that SKL maintains a relatively healthy decentralization structure. This distribution suggests that while institutional or major stakeholders hold meaningful positions, the token ecosystem retains sufficient dispersal to mitigate unilateral market manipulation risks.

View the current SKL holdings distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 522314.92K | 8.74% |

| 2 | 0x76ec...78fbd3 | 196397.65K | 3.28% |

| 3 | 0x905d...3ae38f | 196065.23K | 3.28% |

| 4 | 0xf78f...6dac61 | 189269.85K | 3.16% |

| 5 | 0x2a42...4bab90 | 189164.57K | 3.16% |

| - | Others | 4679930.46K | 78.38% |

II. Core Factors Influencing SKL's Future Price

Regulatory Environment

-

Government Policy Impact: Government cryptocurrency policies and regulatory frameworks directly impact market acceptance and investor confidence in SKL. Regulatory clarity or restrictions can significantly influence price movements and market adoption rates.

-

Market Acceptance: The regulatory environment determines the degree of institutional and retail adoption, which in turn affects demand dynamics for the token.

Market Sentiment and Broader Trends

-

Investor Sentiment: Investor emotions and confidence have a direct impact on SKL/USD price movements. Market sentiment reflects the collective psychology of market participants and drives short-term price volatility.

-

Cryptocurrency Market Correlation: SKL's price trend is influenced by broader cryptocurrency market movements. As with other digital assets, SKL exhibits correlation with the overall crypto market dynamics, meaning Bitcoin and Ethereum price movements often influence alt-coin performance.

-

Volatility Considerations: Given the inherent volatility of cryptocurrency markets, SKL price predictions tend to be speculative in nature. Price forecasting requires careful consideration of market conditions and sentiment shifts.

Three, 2025-2030 SKL Price Forecast

2025 Outlook

- Conservative forecast: $0.00982 - $0.01034

- Neutral forecast: $0.01034

- Bullish forecast: $0.0123 (requires sustained platform adoption and ecosystem expansion)

2026-2028 Medium-term Outlook

- Market phase expectation: Gradual accumulation and development phase with increasing institutional interest in Layer 2 solutions

- Price range forecast:

- 2026: $0.00928 - $0.01596

- 2027: $0.01228 - $0.02006

- 2028: $0.01449 - $0.02308

- Key catalysts: Expansion of decentralized application ecosystem, improvement in network throughput and transaction efficiency, strategic partnerships and integrations, growing adoption of blockchain technology in enterprise solutions

2029-2030 Long-term Outlook

- Base case: $0.01478 - $0.02236 (assuming steady growth in DeFi sector and moderate market conditions)

- Bullish case: $0.02236 - $0.02963 (assuming accelerated adoption of scaling solutions and favorable regulatory environment)

- Transformative case: $0.02963+ (extreme positive conditions including mainstream institutional adoption, breakthrough in Web3 infrastructure, and significant TVL growth)

- 2030-12-18: SKL shows cumulative appreciation of approximately 105% from current levels (approaching $0.02963 range), reflecting sustained ecosystem development and market maturation

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0123 | 0.01034 | 0.00982 | 0 |

| 2026 | 0.01596 | 0.01132 | 0.00928 | 10 |

| 2027 | 0.02006 | 0.01364 | 0.01228 | 32 |

| 2028 | 0.02308 | 0.01685 | 0.01449 | 63 |

| 2029 | 0.02236 | 0.01997 | 0.01478 | 94 |

| 2030 | 0.02963 | 0.02116 | 0.01249 | 105 |

SKALE (SKL) Professional Investment Strategy and Risk Management Report

I. Executive Overview

SKALE Network is an open-source Web3 platform designed to bring speed and configurability to blockchains. As a project of the NODE Foundation (Liechtenstein Foundation), SKALE aims to promote Web3 technology development and make the decentralized web more accessible to users, developers, validators, and end-users. SKALE Labs, headquartered in San Francisco, California, serves as the core team responsible for creating technical specifications, developing code, and enhancing network adoption.

Current Market Position (December 18, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.01029 |

| Market Cap | $62,377,321.48 |

| Fully Diluted Valuation | $62,522,040 |

| Circulating Supply | 6,061,936,004 SKL |

| Total Supply | 6,076,000,000 SKL |

| Max Supply | 7,000,000,000 SKL |

| Market Rank | #440 |

| 24H Volume | $75,517.12 |

| Token Holders | 30,281 |

Price Performance Analysis

| Period | Change | Price Movement |

|---|---|---|

| 1 Hour | -0.19% | -$0.000019588 |

| 24 Hours | -3.83% | -$0.000409802 |

| 7 Days | -16.31% | -$0.002005376 |

| 30 Days | -31.86% | -$0.004811262 |

| 1 Year | -82.80% | -$0.049535581 |

All-Time High: $1.22 (March 12, 2021)

All-Time Low: $0.01018707 (December 18, 2025)

Market Dominance: 0.002%

II. SKALE Network Fundamentals

Project Mission and Vision

SKALE Network operates as a modular blockchain platform enabling developers to create custom, scalable blockchain networks. The platform emphasizes:

- Speed and Scalability: Designed to overcome blockchain speed limitations

- Configurability: Allows customization of blockchain parameters for specific use cases

- Accessibility: Making Web3 technology more user-friendly and approachable

- Developer-Centric: Providing tools and infrastructure for decentralized application development

Organizational Structure

NODE Foundation serves as the governance entity overseeing SKALE Network's strategic direction and development priorities.

SKALE Labs functions as the primary development team, responsible for:

- Technical specification design

- Core code development

- Network optimization and security

- Community engagement and adoption initiatives

Token Economics

Circulation Status:

- Circulating Supply: 6,061,936,004 SKL (86.6% of total supply)

- Token Distribution: Currently at 86.6% circulation ratio

- Unlock Schedule: Gradual release toward 7 billion maximum supply cap

Tokenomics Implications:

- Additional token supply dilution possible as circulation approaches max supply

- Current market cap reflects reduced valuation compared to historical peaks

- Token holders: 30,281 (indicating moderate network distribution)

III. Market Analysis and Performance Metrics

Price Trend Analysis

SKL has experienced significant bearish pressure over extended timeframes:

Short-term Weakness:

- 24-hour decline of -3.83% reflects ongoing selling pressure

- 7-day performance of -16.31% indicates strengthening downtrend

- Recent trading range: $0.01015 (24h low) to $0.01083 (24h high)

Long-term Deterioration:

- One-year performance of -82.80% demonstrates substantial value erosion

- Current price near all-time lows established on the current date

- Distance from peak: Down 99.16% from $1.22 ATH

Market Depth and Liquidity

Trading Activity:

- 24-hour volume: $75,517.12

- Exchange listings: 34 platforms

- Market capitalization: $62,377,321.48 (relatively modest)

Liquidity Assessment:

- Moderate trading volume relative to market cap

- Listed on multiple exchanges including Gate.com for accessibility

- Market depth suggests institutional adoption remains limited

Valuation Metrics

Fundamental Ratios:

- Fully Diluted Valuation: $62,522,040

- Current Market Cap vs. FDV: 99.77% (minimal variance)

- Market Dominance: 0.002% of global crypto market cap

IV. SKL Professional Investment Strategy and Risk Management

SKL Investment Methodology

(1) Long-Term Holding Strategy

Target Investors:

- Web3 infrastructure believers with extended time horizons (5+ years)

- Portfolio diversifiers seeking exposure to scaling solutions

- Development community members engaged with SKALE ecosystem

Operational Recommendations:

-

Accumulation Approach: Consider dollar-cost averaging (DCA) during extended bearish periods to reduce average entry cost. Current all-time low pricing may present long-term accumulation opportunities for conviction investors.

-

Research-Driven Allocation: Conduct thorough technical and fundamental due diligence before deploying capital. Monitor SKALE Labs development milestones, network validator growth, and ecosystem application deployment.

-

Storage and Security: Maintain SKL tokens in secure custody appropriate to your asset size and technical proficiency level.

(2) Active Trading Strategy

Technical Analysis Considerations:

-

Support and Resistance Levels: Monitor key price levels including the current all-time low ($0.01018707) as potential support. Resistance emerges near 24-hour highs ($0.01083).

-

Trend Confirmation Tools: Utilize volume analysis to confirm directional moves. Current moderate volume requires careful position sizing and stop-loss discipline.

Swing Trading Considerations:

-

Volatility Assessment: 24-hour price range of approximately 6.7% suggests limited intraday swing opportunities. Extended timeframe swings (weekly/monthly) may offer improved risk-reward ratios.

-

Risk-Reward Positioning: Current bearish momentum requires strict adherence to predetermined stop-loss levels, typically 2-3% below entry points for short-term positions.

SKL Risk Management Framework

(1) Asset Allocation Principles

Given SKL's high-risk profile (market rank #440, significant drawdown from ATH):

Conservative Investors: 0.5% - 2% portfolio allocation

- Suitable only for investors with extreme risk tolerance

- Consider only if convinced of long-term Web3 infrastructure thesis

- Implement strict stop-loss discipline

Aggressive Investors: 2% - 5% portfolio allocation

- Reserved for experienced traders with extended investment horizons

- Accept potential for substantial further drawdowns

- Utilize staged entry strategies to manage downside risk

Professional Investors: 1% - 3% portfolio allocation

- Treat as speculative infrastructure play within diversified portfolio

- Employ systematic rebalancing to maintain target allocations

- Integrate into broader Web3 infrastructure thesis

(2) Risk Mitigation Strategies

Position Sizing Discipline:

- Limit individual trade size to 1-2% of total trading capital to contain downside exposure

- Implement maximum portfolio concentration limits for high-volatility assets

Stop-Loss Implementation:

- Establish predetermined exit points at 15-25% below entry levels for long positions

- Utilize trailing stops to lock in gains during uptrend recovery phases

(3) Secure Storage Solutions

Custody Options:

-

Gate Web3 wallet Integration: Gate.com offers integrated Web3 wallet functionality for convenient SKL management. Users can maintain direct custody while accessing Gate.com's trading and liquidity infrastructure. This approach balances security with operational convenience.

-

Self-Custody Approach: For larger holdings, consider self-managed wallets where you control private keys, reducing counterparty risk associated with exchange custody.

Security Precautions:

- Never share private keys or seed phrases

- Verify contract addresses before transfers (SKL contract on ETH: 0x00c83aecc790e8a4453e5dd3b0b4b3680501a7a7)

- Utilize multiple signature requirements for substantial holdings

- Maintain offline backup copies of access credentials

- Enable all available security features on exchange accounts

V. Potential Risks and Challenges

SKL Market Risks

Severe Valuation Decline:

- SKL has declined 82.80% over the past year, indicating sustained market skepticism

- Current pricing near all-time lows suggests potential for further downside or stabilization

- Liquidity relative to market cap may amplify price volatility during significant sell-offs

Limited Trading Volume:

- 24-hour trading volume of $75,517 is modest relative to $62M market cap

- Thin order books may result in slippage during larger position entries or exits

- Reduced institutional participation limits price discovery mechanisms

Competitive Pressure:

- Multiple alternative scaling solutions compete for developer mindshare and ecosystem adoption

- Network effects favor established platforms with larger developer communities

- SKALE must differentiate features to attract and retain application developers

SKL Regulatory Risks

Classification Uncertainty:

- Regulatory treatment of Layer 2 solutions and infrastructure tokens remains evolving

- Potential future classification changes could impact token utility and trading access

- Geopolitical regulatory developments may restrict access in key markets

Compliance Requirements:

- Increasing regulatory scrutiny of crypto infrastructure platforms

- SKALE may face operational restrictions or compliance obligations

- Token holder voting or governance structures may face regulatory challenges

Market Access Restrictions:

- Certain jurisdictions may limit retail or institutional access to SKL trading

- Exchange delisting risks if regulatory frameworks tighten unexpectedly

SKL Technical Risks

Smart Contract Vulnerabilities:

- Any exploits or security breaches could compromise network integrity and token value

- Network upgrades carry inherent technical implementation risks

- Dependencies on Ethereum network security and performance

Adoption Rate Limitations:

- Slow application developer migration to SKALE would constrain network utility

- Network validation set size may limit decentralization and security properties

- Technical barriers to entry may slow enterprise adoption

Ecosystem Development Challenges:

- Developer community must grow significantly to justify current valuation

- Competitive disadvantages compared to established scaling solutions

- Liquidity fragmentation across multiple SKALE network instances

VI. Conclusion and Action Recommendations

SKL Investment Value Assessment

SKALE Network represents a speculative infrastructure play targeting the Web3 scaling trilemma. While the project's underlying technology addresses legitimate blockchain scalability challenges, the current market environment reflects pronounced skepticism regarding execution and competitive positioning.

Positive Considerations:

- Legitimate technical approach to blockchain scaling

- Active development team with clear infrastructure focus

- Listed on 34 exchanges providing reasonable accessibility

Significant Concerns:

- 82.80% one-year drawdown indicates sustained market concern

- Current pricing near all-time lows provides limited margin of safety

- Modest trading volume and modest market capitalization suggest limited institutional adoption

- Intense competition from alternative scaling solutions

- Regulatory environment for infrastructure tokens remains uncertain

The project appears better positioned as a long-term speculative allocation for conviction investors rather than a near-term trading opportunity. Current all-time low pricing may represent extreme capitulation, but does not guarantee reversal without substantial positive catalysts.

SKL Investment Recommendations

✅ Beginners:

- Avoid concentrated positions until fundamental knowledge of blockchain scaling solutions improves

- Consider limiting any SKL allocation to 0.5% of experimental portfolio capital

- Focus on understanding SKALE's competitive advantages versus alternative solutions before investing

- If participating, use Gate.com for secure trading access and integrated Web3 wallet functionality

✅ Experienced Investors:

- Current all-time lows may represent opportune accumulation levels for 3-5 year investment thesis

- Implement staged entry strategy across multiple price levels to reduce dollar-cost average

- Monitor SKALE Labs development milestones, validator set growth, and application deployment metrics

- Maintain strict 15-20% stop-loss discipline to contain downside exposure

- Allocate no more than 2-3% of portfolio to this speculative infrastructure position

✅ Institutional Investors:

- Evaluate SKL within broader Web3 infrastructure allocation thesis

- Conduct comprehensive technical due diligence on network architecture and security

- Assess regulatory positioning and potential policy impacts on token utility

- Consider participation through fund vehicles if available, limiting direct custody complexity

- Establish systematic rebalancing protocols to maintain target risk parameters

SKL Trading Participation Methods

Exchange Trading (Primary Method):

- Access SKL through Gate.com, which provides reliable liquidity, competitive spreads, and integrated trading tools

- Utilize Gate.com's Web3 wallet for seamless token management and withdrawal to self-custody if desired

- Implement limit orders rather than market orders to minimize slippage during entry and exit

Long-Term Custody:

- Withdraw SKL from exchanges to Gate Web3 Wallet for enhanced security during extended holding periods

- Maintain complete control of private keys while retaining convenient access to trading and liquidity

Risk Management Tools:

- Utilize stop-loss and take-profit orders available through Gate.com to automate position management

- Monitor portfolio allocation regularly to ensure SKL position sizing remains within predetermined risk parameters

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors should conduct independent research and consult qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely. Past performance does not guarantee future results. Market conditions, regulatory developments, and technical factors can change rapidly, significantly impacting cryptocurrency valuations.

FAQ

Can Skale reach $1?

Yes, SKALE has the potential to reach $1. Based on current market trends and technological development, SKL could potentially climb past $1 by 2030. However, specific timelines may vary depending on market conditions.

Does Skale crypto have a future?

Yes. SKALE has strong long-term potential driven by its Layer 2 scaling solution and growing ecosystem adoption. Projections show SKL reaching $0.059204 by 2027 with steady growth, supported by increasing demand for Ethereum scaling infrastructure and enterprise partnerships.

Is Skale a good buy?

SKALE shows strong potential as a layer-2 scaling solution. With growing adoption and ecosystem development, SKL presents attractive opportunities for investors seeking exposure to blockchain infrastructure. Consider your risk tolerance and investment horizon before deciding.

Can Sky Coin reach $1?

Yes, with sustained adoption and platform evolution, Sky Coin could realistically reach $1 by 2029. Token scarcity and growing ecosystem development support this potential milestone.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Optimal Times for Low Ethereum Gas Fees in the UK

Discover the Historical Highs of $MATIC: Insights into Its Price Journey

TrumpCoin Price and Real-Time News Today

Most Sought-After NFT Artworks in the Market

Dogecoin Mining: The Ultimate Beginner's Guide