2025 USDC Price Prediction: Analyzing Stablecoin Stability in the Evolving Crypto Regulatory Landscape

Introduction: USDC's Market Position and Investment Value

USD Coin (USDC) has established itself as a leading fully-collateralized stablecoin pegged to the US dollar since its inception in 2018. As of 2025, USDC's market capitalization has reached $72.63 billion, with a circulating supply of approximately 72.61 billion tokens, maintaining a price close to $1. This asset, often referred to as the "digital dollar," is playing an increasingly crucial role in facilitating transactions, cross-border payments, and decentralized finance (DeFi) applications.

This article will provide a comprehensive analysis of USDC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. USDC Price History Review and Current Market Status

USDC Historical Price Evolution Trajectory

- 2018: USDC launched, price remained stable around $1

- 2020: Increased adoption during DeFi boom, price maintained $1 peg

- 2023: Banking crisis concerns, price briefly dropped to $0.877647 on March 11

USDC Current Market Situation

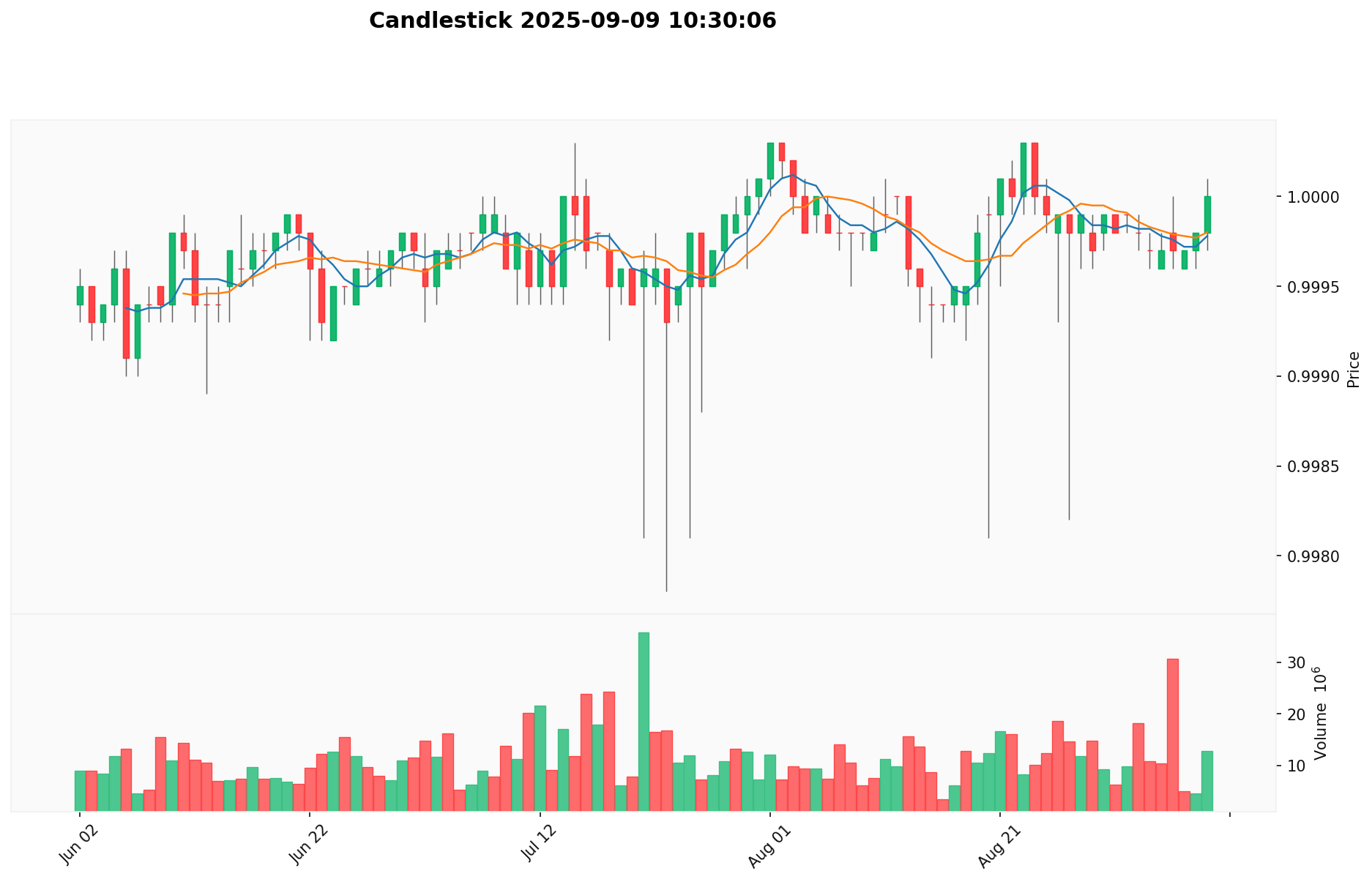

As of September 9, 2025, USDC is trading at $1.00, maintaining its peg to the US dollar. The 24-hour trading volume stands at $18,035,901.60. USDC's market capitalization is $72,607,478,728.91, ranking it 7th in the overall cryptocurrency market with a 1.74% market share. The circulating supply matches the total supply at 72,607,478,728.91 USDC. Over the past 24 hours, USDC has shown minimal price movement with a slight decrease of 0.01%. The coin has demonstrated stability over various timeframes, with minimal fluctuations ranging from -0.0086% to -0.02% over periods from 1 hour to 1 year.

Click to view the current USDC market price

USDC Market Sentiment Indicator

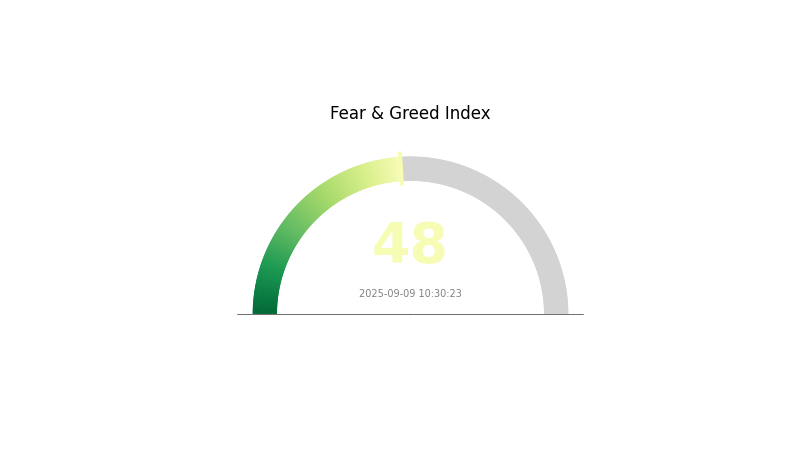

2025-09-09 Fear and Greed Index: 48 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced as the Fear and Greed Index hovers at 48, indicating a neutral stance. This equilibrium suggests investors are neither overly pessimistic nor excessively optimistic. While caution persists, there's also a hint of optimism in the air. Traders should stay vigilant, as this neutral zone often precedes significant market movements. It's an ideal time for thorough research and strategic planning before making any investment decisions.

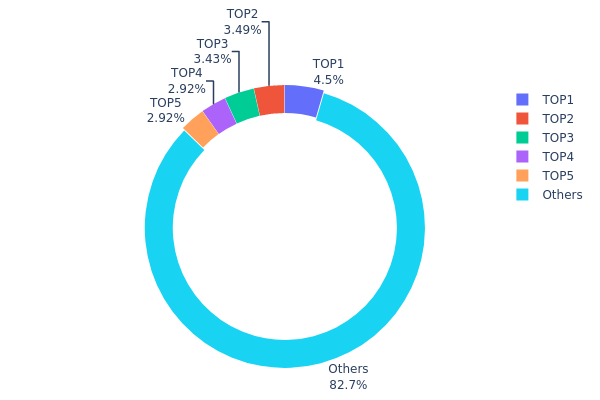

USDC Holdings Distribution

The address holdings distribution data provides insight into the concentration of USDC ownership across different wallet addresses. Analysis of the provided data reveals that the top 5 addresses collectively hold 17.24% of the total USDC supply, with the largest single address controlling 4.49%. This distribution suggests a moderate level of concentration, as no single entity possesses an overwhelming share of the total supply.

While the top addresses hold significant amounts, the fact that 82.76% of USDC is distributed among other addresses indicates a relatively healthy dispersion. This distribution pattern helps mitigate risks associated with extreme centralization, such as market manipulation or sudden large-scale sell-offs. However, it's worth noting that the top holders still have the potential to influence market dynamics if they were to move large quantities of USDC simultaneously.

Overall, the current USDC address distribution reflects a balanced market structure with a moderate degree of decentralization. This distribution contributes to the stablecoin's on-chain stability and reduces the likelihood of severe price volatility caused by the actions of a few large holders.

Click to view the current USDC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3730...fd7341 | 2155032.55K | 4.49% |

| 2 | 0x38aa...f9b200 | 1672188.17K | 3.48% |

| 3 | 0xee7a...3b4055 | 1644413.10K | 3.43% |

| 4 | 0xad35...329ef5 | 1400000.00K | 2.92% |

| 5 | 0xe194...6929b6 | 1400000.00K | 2.92% |

| - | Others | 39661564.53K | 82.76% |

II. Key Factors Affecting USDC's Future Price

Supply Mechanism

- Reserve-backed: USDC is backed by 100% reserves, including cash (23%) and short-term US Treasury bonds (77%).

- Historical pattern: Transparent reserves have positively influenced USDC's stability and adoption.

- Current impact: The robust reserve structure is expected to maintain USDC's price stability around $1.

Institutional and Whale Dynamics

- Institutional holdings: As of 2024, institutional holdings of USDC reached 38%.

- Corporate adoption: Major institutions like BlackRock and Goldman Sachs have chosen USDC for cross-border settlements.

- Government policies: The EU's MiCA regulations have favored USDC over some competitors in the European market.

Macroeconomic Environment

- Monetary policy impact: Federal Reserve policies, particularly interest rates, affect USDC's investment returns and adoption.

- Inflation hedging properties: USDC's stable value makes it attractive during high inflation periods.

- Geopolitical factors: Global economic uncertainties may increase demand for stable digital assets like USDC.

Technological Developments and Ecosystem Building

- Digital Dollar Payment Gateway: USDC's partnership with SWIFT to develop a "digital dollar payment gateway" connected 150 international banks in 2024.

- Multi-chain deployment: USDC is available on multiple blockchains, enhancing its accessibility and utility in various ecosystems.

III. USDC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.98-$1.00

- Neutral prediction: $0.99-$1.01

- Optimistic prediction: $1.00-$1.02 (requires increased adoption and market stability)

2027-2028 Outlook

- Market phase expectation: Stable growth and wider acceptance

- Price range forecast:

- 2027: $0.99-$1.01

- 2028: $0.99-$1.01

- Key catalysts: Regulatory clarity and increased institutional adoption

2029-2030 Long-term Outlook

- Base scenario: $0.99-$1.01 (assuming continued market stability)

- Optimistic scenario: $1.00-$1.02 (assuming widespread global adoption)

- Transformative scenario: $1.00-$1.03 (assuming USDC becomes the dominant stablecoin)

- 2030-12-31: USDC $1.01 (slight premium due to high demand)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. USDC Professional Investment Strategies and Risk Management

USDC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable value preservation

- Operational suggestions:

- Allocate a portion of fiat savings to USDC for diversification

- Set up regular USDC purchases to average out price fluctuations

- Store USDC in secure hardware wallets or reputable custodial services

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought or oversold conditions

- Key points for swing trading:

- Monitor USDC/USD exchange rates across major platforms

- Track overall stablecoin market sentiment and adoption trends

USDC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of total portfolio

- Moderate investors: 10-20% of total portfolio

- Aggressive investors: 20-30% of total portfolio

(2) Risk Hedging Solutions

- Diversification: Spread holdings across multiple stablecoins and platforms

- Insurance: Consider crypto-asset insurance products for large holdings

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for convenient access

- Cold storage solution: Hardware wallets for long-term, high-value storage

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. Potential Risks and Challenges for USDC

USDC Market Risks

- Liquidity risk: Potential challenges in large-scale redemptions during market stress

- Competition risk: Emerging stablecoins may erode USDC's market share

- Adoption risk: Slow mainstream acceptance may limit growth potential

USDC Regulatory Risks

- Compliance uncertainty: Evolving regulations may impact USDC's operations

- Banking relationships: Potential loss of banking partners could disrupt services

- Cross-border restrictions: International regulations may limit USDC's global use

USDC Technical Risks

- Smart contract vulnerabilities: Potential for exploits in underlying code

- Blockchain congestion: Network issues could delay transactions or increase fees

- Centralization concerns: Reliance on Circle and Coinbase for issuance and management

VI. Conclusion and Recommendations

USDC Investment Value Assessment

USDC offers a relatively stable digital asset pegged to the US dollar, providing a balance between traditional finance stability and crypto ecosystem utility. While it presents lower volatility compared to other cryptocurrencies, investors should remain aware of potential regulatory and technical risks.

USDC Investment Recommendations

✅ Beginners: Start with small allocations to understand the stablecoin ecosystem ✅ Experienced investors: Use USDC for portfolio stabilization and as a trading pair ✅ Institutional investors: Consider USDC for treasury management and cross-border transactions

USDC Participation Methods

- Direct purchase: Buy USDC on Gate.com or other regulated exchanges

- Yield farming: Explore DeFi protocols offering USDC lending or liquidity provision

- Payment usage: Utilize USDC for faster, cheaper international transfers where applicable

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is USDC a good investment?

USDC is a stable and reliable investment option. As a dollar-pegged stablecoin with a large market cap, it offers low volatility and wide acceptance in the crypto ecosystem.

Will USDC always be $1?

USDC aims to maintain a $1 value, backed by reserves. However, its stability depends on Circle's ongoing commitment and market conditions.

Can USDC go down in value?

Yes, USDC can experience minor value fluctuations due to market demand, but it typically maintains its peg to the US dollar. These temporary deviations are normal and usually short-lived.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts reaching $127,864. Chainlink follows with a peak prediction of $56.65.

Is Worldwide USD (WUSD) a good investment?: Analyzing the Potential and Risks of This Emerging Stablecoin

Circle’s USDC Surge: Stablecoins Rippling Through Stocks and Crypto

What Might Cause a Change in the Value of Fiat Money? A Comprehensive Analysis

Will XRP Be Backed by Gold?

2025 USD1Price Prediction: Comprehensive Analysis and Forecast of Key Market Factors Influencing Digital Currency Values

Falcon Finance (FF): What It Is and How It Works

Xenea Daily Quiz Answer December 12, 2025

Dropee Daily Combo December 11, 2025

Tomarket Daily Combo December 11, 2025

Understanding Impermanent Loss in Decentralized Finance

Understanding Double Spending in Cryptocurrency: Strategies for Prevention