Post content & earn content mining yield

placeholder

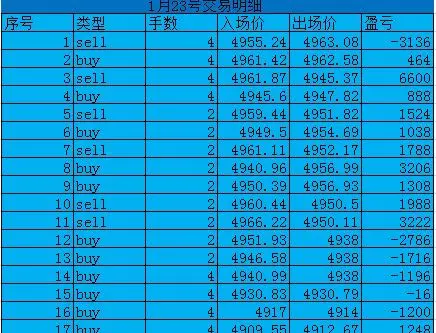

OldCatInTheCryptoCi

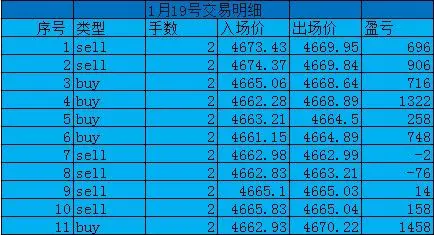

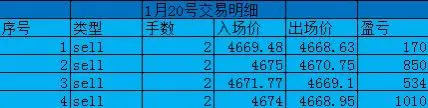

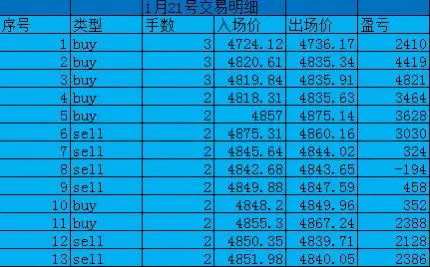

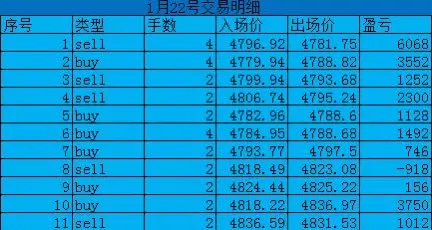

This week's trading conclusion ✅ followed a steady strategy throughout, adjusting promptly when encountering setbacks, closely following the trend, and making firm arrangements. The result was an impressive performance with an 81.5% high win rate and a 2:1 profit-to-loss ratio, with the account steadily increasing in value! Trading is never smooth sailing, but the key is to combine knowledge and action, adapt flexibly. Next week, continue to precisely grasp the market, help live trading students steadily capture profits, and work together to reach new highs 💪.

View Original

- Reward

- like

- Comment

- Repost

- Share

🎉#GateSquareCreatorNewYearIncentives represents more than just a campaign hashtag it marks Gate Square’s commitment to empowering creators, rewarding ideas, and turning community participation into real value. As we step into 2026, this initiative brings creators, beginners, and crypto thinkers together on one global platform, where sharing insights, engaging in discussions, and staying consistent can unlock visibility, credibility, and meaningful rewards. This hashtag is your entry point into Gate Square’s creator economy, where every post has the potential to build influence and turn knowle

- Reward

- like

- Comment

- Repost

- Share

Dollar Stays Near Lows as Trump’s Davos Speech Looms, Greenland Deal Uncertain - - #cryptocurrency #bitcoin #altcoins

BTC-0.08%

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$37.3K

Create My Token

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3881?ref=UgMXU15Z&ref_type=132&utm_cmp=TpIkMKPZ

- Reward

- 3

- 5

- Repost

- Share

楚老魔 :

:

2026 Go Go Go 👊View More

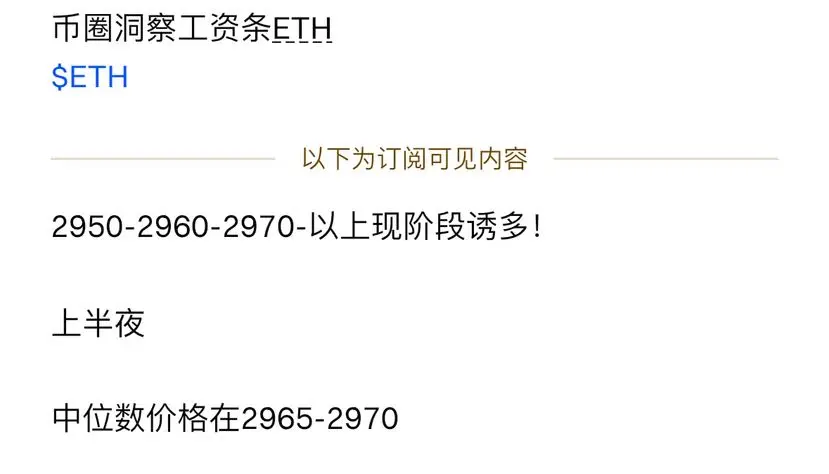

$ETH $BTC Ethereum and Bitcoin Weekly Review! Pure personal insights.

Offering some speculative possibilities about institutions and market makers! Hope this helps everyone capture swings, signals, and thus improve effective market control and risk management!

Crypto insights will provide a daily update during the first half of the night on intra-swing movements, where institutions do not make high-frequency moves in a short period, and market makers do not engage in tricks, maintaining stable prices! Please stay tuned and engage in discussions.

View OriginalOffering some speculative possibilities about institutions and market makers! Hope this helps everyone capture swings, signals, and thus improve effective market control and risk management!

Crypto insights will provide a daily update during the first half of the night on intra-swing movements, where institutions do not make high-frequency moves in a short period, and market makers do not engage in tricks, maintaining stable prices! Please stay tuned and engage in discussions.

- Reward

- 1

- Comment

- Repost

- Share

#GoldAndSilverHitRecordHighs continues to push prices to their all-time highs, creating a new legend about silver and gold that are breaking new records each time and are currently being witnessed $BTC

BTC-0.08%

- Reward

- 1

- 1

- Repost

- Share

CryptoMabuS :

:

Follow me and I follow back, thank you🚀 #FuturesTrading | Gate ELSA Futures Challenge

Test Your Skill. Trade Smart. Win Big.

Ready to prove your futures trading skills? The Gate ELSA Futures Trading Challenge is not a lucky draw — it’s a performance-based competition where strategy, discipline, and consistency define the winners.

💰 Total Prize Pool: 200,000 USDT

🔰 Beginner-Friendly Entry

New to futures trading? Start strong: ✅ Complete your first futures trade

🎁 Earn 20 USDT instantly

Perfect opportunity to: • Experience real market conditions

• Learn responsible leverage usage

• Build confidence with minimal risk

This is lear

Test Your Skill. Trade Smart. Win Big.

Ready to prove your futures trading skills? The Gate ELSA Futures Trading Challenge is not a lucky draw — it’s a performance-based competition where strategy, discipline, and consistency define the winners.

💰 Total Prize Pool: 200,000 USDT

🔰 Beginner-Friendly Entry

New to futures trading? Start strong: ✅ Complete your first futures trade

🎁 Earn 20 USDT instantly

Perfect opportunity to: • Experience real market conditions

• Learn responsible leverage usage

• Build confidence with minimal risk

This is lear

ELSA-14.31%

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊- Reward

- like

- Comment

- Repost

- Share

#Show my position gains#SKR $SKR This wave of rise is at the 0.618 level, which is at 0.026384. Go long around this area. Everyone can calculate how many units to buy in total, then buy a little at a time while monitoring, trying to stay below the liquidation price. Shanzhai tokens are quite volatile, so be cautious of the risks. The current price can first be used to buy a minimum unit to mark it, so as not to forget. Lay in wait, and when it reaches this area, I will provide a more precise position.

SKR-28.18%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

加密市场观察 | Political Signal Watch 👁️

🚨 Elon Musk Activates Political Strategy Ahead of 2026 U.S. Midterm Elections

According to BlockBeats (Jan 23), Elon Musk is re-entering U.S. politics with a strategic push ahead of the 2026 midterms. The world’s richest man has already donated $10M to a Republican Senate candidate, signaling a shift from his previously distant stance toward Trump.

💼 Political Mobilization in Action

Musk’s team, led by chief strategist Chris Young, is reportedly working with digital and SMS marketing firms to lay the groundwork for large-scale voter outreach, targeting Tru

🚨 Elon Musk Activates Political Strategy Ahead of 2026 U.S. Midterm Elections

According to BlockBeats (Jan 23), Elon Musk is re-entering U.S. politics with a strategic push ahead of the 2026 midterms. The world’s richest man has already donated $10M to a Republican Senate candidate, signaling a shift from his previously distant stance toward Trump.

💼 Political Mobilization in Action

Musk’s team, led by chief strategist Chris Young, is reportedly working with digital and SMS marketing firms to lay the groundwork for large-scale voter outreach, targeting Tru

- Reward

- 2

- Comment

- Repost

- Share

$Nifty is showing extreme oversold conditions on the daily timeframe. Immediate support cluster: 24,970–24,800. A successful defense of 24,800 could trigger short covering rally ahead of the Union Budget 2026, targeting at least 25,630 in the initial move. #nifty50

- Reward

- like

- Comment

- Repost

- Share

$ZEC (Zcash)

Support:

✔️ $350 — key reaction level

✔️ $330 — defensive support

Resistance:

🚧 $400–$420 — near-term supply zone

🚧 $460+ — mid-term breakout

$ZEC #DoubleRewardsWithGUSD #TrumpWithdrawsEUTariffThreats

Support:

✔️ $350 — key reaction level

✔️ $330 — defensive support

Resistance:

🚧 $400–$420 — near-term supply zone

🚧 $460+ — mid-term breakout

$ZEC #DoubleRewardsWithGUSD #TrumpWithdrawsEUTariffThreats

ZEC2.82%

- Reward

- like

- Comment

- Repost

- Share

MYJB

蚂蚁金币

Created By@MunanYiBufan

Listing Progress

100.00%

MC:

$8.6K

Create My Token

market attention on NFT projects heating up

- Reward

- like

- Comment

- Repost

- Share

Good morning everyone! As I mentioned earlier, among the projects built on the ZKsync ecosystem, a few are particularly impressive, with Creator Chain (@oncreator_) being one of the directions I am most optimistic about. Creator Chain is an on-chain digital ecosystem designed specifically for content creators and their supporters, with a clear core focus: serving various creators such as music, art, video, virtual avatars, and UGC, helping them achieve true ownership, direct monetization, and community co-creation in the AI era. The project is developed in close collaboration with Matter Labs

ZTX2.09%

- Reward

- 1

- Comment

- Repost

- Share

#特朗普取消对欧关税威胁 Real-time trend orders today (1/24/White Market)

Come back to go long, (Suggestion; total position not to exceed 10%, 10x leverage)

ETH

Open position with a stop loss of (18) points

Price direction; go long around 2925

First take profit level; around 2939

Second take profit level; around 2953

Third take profit level; around 2966

BTC

Open position with a stop loss of (390) points

Price direction; go long around 89580

First take profit level; around 89880

Second take profit level; around 90180

Third take profit level; around 90480

After the first take profit (reduce position by 30%)

View OriginalCome back to go long, (Suggestion; total position not to exceed 10%, 10x leverage)

ETH

Open position with a stop loss of (18) points

Price direction; go long around 2925

First take profit level; around 2939

Second take profit level; around 2953

Third take profit level; around 2966

BTC

Open position with a stop loss of (390) points

Price direction; go long around 89580

First take profit level; around 89880

Second take profit level; around 90180

Third take profit level; around 90480

After the first take profit (reduce position by 30%)

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

#GateWeb3UpgradestoGateDEX

Gate DEX Just Got Smarter, Faster, and Safer 🚀

Gate Web3 is taking decentralized trading to the next level. The newly upgraded Gate DEX introduces a suite of improvements designed to boost speed, security, usability, and rewards—all while deepening community engagement.

1️⃣ Upgraded Trading Engine

• Faster Execution: Transactions happen instantly, minimizing delays.

• Optimized Matching Algorithm: Advanced order matching reduces slippage and maximizes trader efficiency.

• High-Performance Infrastructure: Supports high-volume trading without sacrificing speed, ideal

Gate DEX Just Got Smarter, Faster, and Safer 🚀

Gate Web3 is taking decentralized trading to the next level. The newly upgraded Gate DEX introduces a suite of improvements designed to boost speed, security, usability, and rewards—all while deepening community engagement.

1️⃣ Upgraded Trading Engine

• Faster Execution: Transactions happen instantly, minimizing delays.

• Optimized Matching Algorithm: Advanced order matching reduces slippage and maximizes trader efficiency.

• High-Performance Infrastructure: Supports high-volume trading without sacrificing speed, ideal

DEFI1.25%

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊Scambase Futures rugged all the gold longs

- Reward

- like

- Comment

- Repost

- Share

#TrumpWithdrawsEUTariffThreats

The decision by former U.S. President Donald Trump to withdraw proposed tariff threats against the European Union marks a notable shift in transatlantic trade dynamics. At a time when global markets remain sensitive to geopolitical developments, the easing of tariff pressure has reduced immediate fears of a renewed trade conflict between two of the world’s largest economic blocs. This development carries implications not only for diplomacy but also for financial markets, investor sentiment, and global trade stability.

Market Reaction and Investor Response

Global

The decision by former U.S. President Donald Trump to withdraw proposed tariff threats against the European Union marks a notable shift in transatlantic trade dynamics. At a time when global markets remain sensitive to geopolitical developments, the easing of tariff pressure has reduced immediate fears of a renewed trade conflict between two of the world’s largest economic blocs. This development carries implications not only for diplomacy but also for financial markets, investor sentiment, and global trade stability.

Market Reaction and Investor Response

Global

- Reward

- 3

- 7

- Repost

- Share

楚老魔 :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More37.36K Popularity

20.9K Popularity

14.97K Popularity

4.78K Popularity

11.29K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.47KHolders:20.04%

- MC:$3.47KHolders:20.04%

- MC:$3.55KHolders:20.44%

- MC:$3.42KHolders:10.00%

News

View MoreYesterday, the US spot Ethereum ETF experienced a net outflow of $41.7 million, marking the fourth consecutive day of net outflows.

5 m

Ethereum spot ETF saw a net outflow of $41,735,800 yesterday, continuing a 4-day net outflow.

8 m

Yesterday, the US spot Bitcoin ETF experienced a net outflow of $103.5 million, marking the fourth consecutive trading day of net outflows.

9 m

Bitcoin spot ETF experienced a net outflow of $104 million yesterday, marking the fifth consecutive day of net outflows.

9 m

Data: The current Crypto Fear & Greed Index is 24, indicating extreme fear.

37 m

Pin

Gate ELSA Futures Trading Challenge is Now Live!

Share a 200,000 USDT Prize Pool

💰 Get 20 USDT for your first futures trade

🏆 Trade to share 160,000 USDT!

join now: https://www.gate.com/campaigns/3911

Announcement link: https://www.gate.com/announcements/article/49432

#ELSA #FuturesTrading #GateStrike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889