Uniswap (UNI) News Today

Latest crypto news and price forecasts for UNI: Gate News brings together the latest updates, market analysis, and in-depth insights.

Aztec angariou mais de 61 milhões de dólares numa oferta pública, desbloqueio por votação de governação em fevereiro de 2026

A Aztec Network, uma solução L2 da Ethereum focada na privacidade, concluiu a venda pública de tokens a 6 de dezembro, utilizando o novo protocolo de “Leilão de Liquidação Contínua (Continuous Clearing Auction, CCA)”, desenvolvido em conjunto com a Uniswap Labs. Foram angariados mais de 19.400 ETH (cerca de 61 milhões de dólares) de mais de 16.000 participantes. A Aztec destaca que este financiamento simboliza uma mudança significativa na emissão de tokens, passando de “dominada por insiders” para “prioridade à comunidade”, sendo um passo crucial para concretizar a sua visão de criar um computador mundial com privacidade.

Aztec angaria 19.400 ETH, distribuição de tokens liderada pela comunidade

A Aztec Network realizou a venda pública de 2 a 6 de dezembro

ETH-0.32%

ChainNewsAbmedia·12-08 02:44

Gráficos da Uniswap (UNI) Sinalizam Estrutura de Quebra Enquanto Analistas Identificam Força em Prazos Mais Alargados

O token UNI da Uniswap mostra sinais de um possível breakout ao negociar-se em torno dos $5,48, apresentando uma série de mínimos ascendentes e um aumento do momento comprador. Analistas sugerem que os níveis de suporte estão a fortalecer-se, indicando uma mudança na confiança do mercado.

UNI-3.45%

CaptainAltcoin·12-06 18:04

Lindsay Fraser da Uniswap será a nova Diretora de Políticas da Associação de Blockchain dos Estados Unidos

A Associação de Blockchain contratou Lindsay Fraser da Uniswap Labs para liderar os assuntos de políticas. Ela irá utilizar a sua experiência em DeFi para se concentrar no enquadramento regulatório do mercado de cripto dos EUA, na implementação da legislação das stablecoins e no progresso das políticas fiscais relativas às criptomoedas.

MarsBitNews·12-05 14:16

Fundador da Uniswap Rebate Pedido da Citadel por Supervisão Mais Rigorosa ao DeFi

Hayden Adams, da Uniswap, criticou a Citadel por querer regular as finanças descentralizadas como as finanças tradicionais, argumentando que isso limita a inovação. O debate destaca uma divisão entre empresas tradicionais e DeFi, com implicações para a conformidade e o crescimento do mercado.

CryptometerIo·12-04 13:32

FCA abre o sandbox regulatório para moeda estável Proposta da Uniswap aprovada na votação inicial

Manchete

▌A FCA do Reino Unido abre um sandbox regulatório para stablecoins, e o Escritório de Gestão da Dívida explora a expansão do mercado de títulos do tesouro.

A Autoridade de Conduta Financeira do Reino Unido (FCA) anunciou a criação de um grupo de projeto de stablecoins no seu sandbox regulatório, com o período de candidatura aberto até 18 de janeiro de 2026. Ao mesmo tempo, segundo a Bloomberg, o Escritório de Gestão da Dívida do Reino Unido está a estudar a expansão do mercado de bilhetes do Tesouro do Reino Unido, uma medida que pode estar relacionada com a estrutura de reservas de stablecoins.

▌A proposta "UNIfication" da Uniswap foi aprovada por uma ampla margem na votação inicial, iniciando um programa de recompensas por vulnerabilidades de 15,5 milhões de dólares.

A proposta de governança "UNIfication" da Uniswap obteve mais de 63 milhões de tokens UNI em apoio na votação inicial do Snapshot, com quase nenhuma oposição. A proposta visa unir a Uniswap Labs e a Uniswap

UNI-3.45%

金色财经_·11-28 00:00

A proposta "UNIfication" da Uniswap foi aprovada com uma vantagem esmagadora na votação preliminar, lançando um programa de recompensas pelos erros de 15,5 milhões de dólares.

A proposta de governança "UNIfication" da Uniswap recebeu mais de 63 milhões de tokens UNI em apoio na votação preliminar, com quase nenhuma objeção. A proposta visa unificar a Uniswap Labs com a Uniswap Foundation, ativar o mecanismo de taxas e iniciar um programa de recompensas pelos erros no valor de 15,5 milhões de dólares.

UNI-3.45%

MarsBitNews·11-27 15:55

Token de recompra, voltando com tudo

Escrito por: Ekko an e Ryan Yoon

O programa de recompra que foi paralisado em 2022 devido à pressão da Comissão de Valores Mobiliários dos EUA voltou a ser o centro das atenções. Este relatório, elaborado pela Tiger Research, analisa como esse mecanismo, que uma vez foi considerado inviável, está retornando ao mercado.

Resumo dos pontos principais

A recompra de 99% da Hyperliquid e a discussão sobre a reinicialização da recompra da Uniswap trazem a recompra de volta ao centro das atenções.

O que antes era considerado inviável, como a recompra, agora se torna possível devido ao projeto "cripto" da Comissão de Valores Mobiliários dos EUA e à introdução do "Clear Act".

No entanto, nem todas as estruturas de recompra são viáveis, o que confirma que os requisitos fundamentais da descentralização continuam a ser essenciais.

1. A recompra voltará em três anos.

O recompra que desapareceu do mercado de criptomoedas após 2022, em 2025.

DeepFlowTech·11-27 01:55

100x Cripto News: LivLive Aumenta Com Bónus BLACK300 Enquanto DOT Cai Para $2.05 e UNI Vê Ma...

A narrativa das criptomoedas 100x retornou mais forte do que nunca no Q4 de 2025, à medida que novos projetos de utilidade real começam a ofuscar as moedas de narrativas mais antigas. O mercado está se transformando rapidamente, e a atenção está se voltando para os tokens que conectam a atividade física com recompensas digitais.

Esta mudança foi direcionada

CaptainAltcoin·11-26 12:36

Token de recompra, retornando novamente

Autor: Ekko an e Ryan Yoon

O programa de recompra, que ficou estagnado em 2022 devido à pressão da Comissão de Valores Mobiliários dos EUA, voltou a ser o centro das atenções. Este relatório, elaborado pela Tiger Research, analisa como este mecanismo, que outrora era considerado inviável, voltou ao mercado.

Resumo dos pontos principais

A recompra de 99% da Hyperliquid e a discussão sobre o reinício da recompra da Uniswap trazem a recompra de volta ao centro das atenções.

O que antes era considerado inviável, o recompra, agora se tornou possível devido ao "projeto de criptomoedas" da Comissão de Valores Mobiliários dos Estados Unidos e à introdução da "Lei da Clareza".

No entanto, nem todas as estruturas de recompra são viáveis, o que confirma que os requisitos centrais da descentralização continuam a ser cruciais.

1. A recompra retorna três anos depois

O recompra que desapareceu do mercado de criptomoedas após 2022, reaparecerá em 2025.

PANews·11-26 10:22

Uniswap Lança Programa de recompensas de $15,5M na Cantina para Fortalecer a Segurança

Em Resumo

A Uniswap lançou um programa de recompensas por bugs com recompensas de até 15,5 milhões de dólares para incentivar pesquisadores a identificar vulnerabilidades de segurança em seu protocolo, contratos e infraestrutura relacionada.

A exchange descentralizada (DEX) Uniswap anunciou que introduziu um novo programa de recompensas por bugs.

UNI-3.45%

MpostMediaGroup·11-26 07:22

Até que ponto o preço do Uniswap pode subir antes que os vendedores façam um contra-ataque?

Uniswap (UNI) experimentou uma alta repentina para $10.3, mas desde então enfrentou potenciais correções, atualmente pairando acima de $5.92. Indicadores técnicos mostram sinais mistos, com tendências de baixa predominantes. Movimentos futuros dependem da superação de níveis de preço-chave.

UNI-3.45%

TapChiBitcoin·11-26 04:09

UNI estabiliza em $6,24 enquanto o wedge descendente se estreita acima do suporte chave de $5,88

UNI é negociado a 6,24 $, com um aumento de 3,6% nas 24 horas, enquanto permanece abaixo da 9 EMA e da 50 SMA no gráfico de quatro horas.

O token continua a mover-se dentro de um triângulo descendente, com suporte em $5.88 e resistência em $6.33 a moldar a faixa de curto prazo.

O volume de vendas em declínio acompanha o movimento do UNI ao longo de t

UNI-3.45%

CryptoNewsLand·11-25 19:35

Nova proposta reconfigura o valor do UNI. O Uniswap esquecido ainda vale a pena investir?

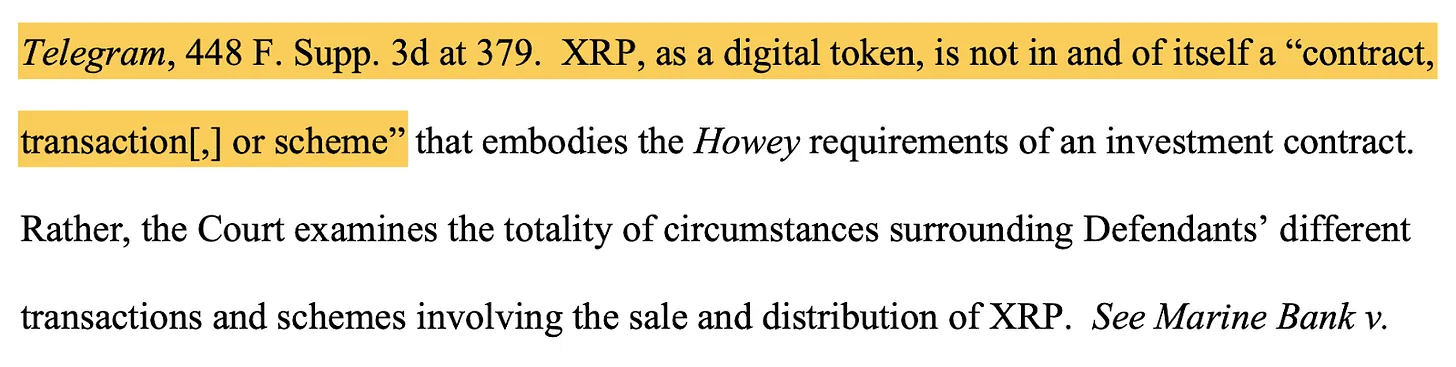

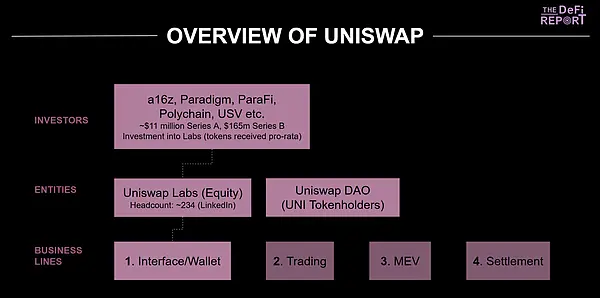

Escrito por: Michael Nadeau, O Relatório DeFi; traduzido por: Glendon, Techub News

Uniswap foi lançado em 2018 e é uma inovação revolucionária que possibilita a formação orgânica de um mercado bilateral para a negociação de ativos financeiros. Desde a sua criação, este protocolo gerou mais de 3,3 trilhões de dólares em volume de negociação e 4,7 bilhões de dólares em taxas de negociação.

No entanto, sempre consideramos a Uniswap como um projeto que não vale a pena investir.

Por que é isso?

Uniswap possui múltiplas tabelas de capital, uma voltada para investidores de ações e outra para detentores de tokens. Essa estrutura não é exclusiva da Uniswap, mas o que a torna única é que a Uniswap frequentemente distribui a receita para os acionistas em vez de para os detentores de tokens.

Isto é um sério conflito de interesses.

金色财经_·11-24 06:33

As negociações da Uniswap disparam enquanto a valorização da UNI declina

O volume de negociação da Uniswap teve uma alta repentina para $116B mensalmente, no entanto, a capitalização de mercado do UNI caiu para 6,8B$, destacando a desconexão entre o valor do token e o crescimento do protocolo. Novos lançamentos melhoram a acessibilidade, e a proposta UNIfication poderia aumentar o valor do token através de recompra, potencialmente influenciando as tendências DeFi.

UNI-3.45%

CryptoFrontNews·11-23 21:33

Ruptura da UNI em risco: Forte pressão de venda atinge a Uniswap

A UNI enfrenta uma forte resistência entre os $8-$8,6, limitando o ímpeto altista adicional.

Uma forte pressão de venda proveniente de tokens inativos e baleias dificulta a recuperação do preço.

Os indicadores on-chain mostram um otimismo cauteloso, mas a procura orgânica precisa aumentar para ganhos sustentados.

A UNI da Uniswap chamou recentemente a atenção com um/a

UNI-3.45%

CryptoNewsLand·11-23 16:24

A comunidade Uniswap, através da proposta "UNIfication", ativará as taxas do protocolo e unificará o mecanismo de incentivos ecológicos.

A comunidade Uniswap aprovou a proposta de governança "UNIfication" em 23 de novembro, recebendo 100% de apoio. A proposta inclui a ativação de taxas de protocolo, a queima de 100 milhões de Tokens UNI, a criação de leilões de desconto de taxas, a atualização para agregador na cadeia, e o ajuste da relação entre a Uniswap Labs e a fundação para o desenvolvimento conjunto do protocolo.

UNI-3.45%

DeepFlowTech·11-23 11:38

Notícias de Criptomoedas: UNI, ETH e XRP Estão Prestes a Libertar a Captação de Valor Real, Diz Executivo da Bitwise

O CIO da Bitwise afirma que UNI, ETH e XRP estão a melhorar a captação de valor através de queima de taxas, staking e atualização Fusaka, com efeitos claros até 2026.

Os principais tokens de criptomoedas estão a sofrer alterações que podem melhorar a captação de valor para os detentores. UNI, ETH e XRP estão a implementar atualizações que afetam as receitas e s

LiveBTCNews·11-23 11:23

Dados: 381,96 mil EIGEN foram transferidos de um endereço anônimo e, após um intermédio, fluíram para o Uniswap.

Notícias da Mars Finance, de acordo com os dados da Arkham, às 11:25, 3.8196 milhões de EIGEN (no valor de aproximadamente 2.1111 milhões de dólares) foram transferidos de um endereço anônimo (começando com 0x4817...) para a Uniswap. Em seguida, esse endereço transferiu parte do EIGEN para a Uniswap.

EIGEN-4.39%

MarsBitNews·11-23 04:44

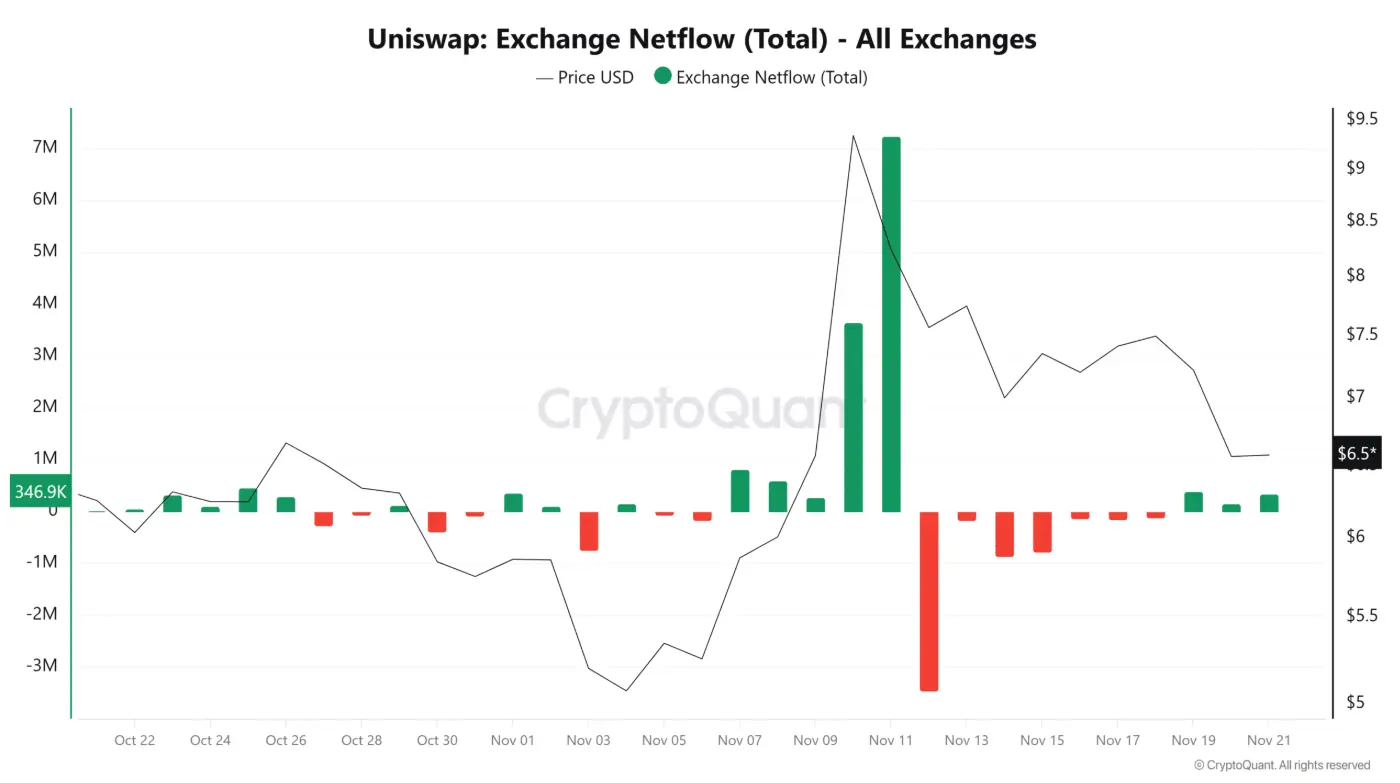

Porque é que as baleias da Uniswap “adormecidas” descarregaram subitamente 512.000 UNI, aceitando uma perda de até 76%?

Após a Uniswap ter anunciado a proposta “Unification” há 10 dias, o UNI disparou rapidamente, atingindo os $10,2 quando o fluxo de capitais dos investidores entrou em massa. No entanto, o entusiasmo não durou muito. Apenas alguns dias depois, tanto as “baleias” como os pequenos investidores decidiram realizar lucros em simultâneo, levando o UNI a entrar numa trajetória de correção.

UNI-3.45%

TapChiBitcoin·11-22 10:08

Gigante DeFi Uniswap Labs adquire Guidestar para impulsionar a pesquisa em AMM

A Uniswap Labs adquiriu a Guidestar, uma equipa especializada em tecnologia de criador de mercado automatizado, para melhorar a eficiência do comércio descentralizado e o desenho de mercado. Esta colaboração visa aprimorar a execução de negociações e o acesso à liquidez em vários tipos de ativos.

UNI-3.45%

Coinpedia·11-21 02:48

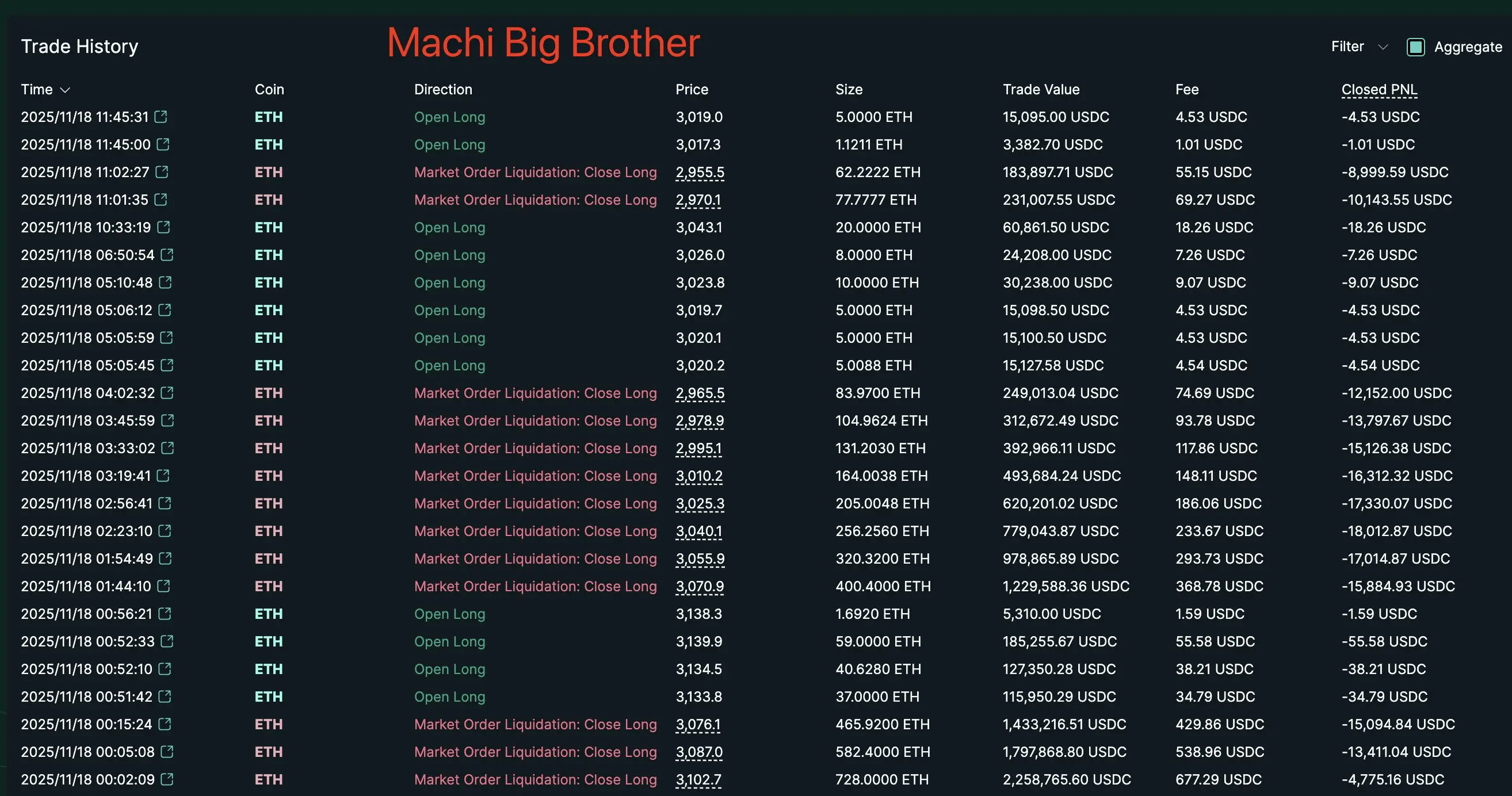

Huang Licheng foi liquidado 71 vezes e chegou ao primeiro lugar! Aster homenageia o irmão com um modo exclusivo.

A DEX Aster está se aprofundando na cultura Degen dos ativos de criptografia, lançando o "Modo Machi", uma nova funcionalidade que recompensa os traders com pontos por serem liquidado. A atualização está prevista para ser lançada na próxima semana, homenageando diretamente o "Machi Big Brother" (nome verdadeiro Huang Li Cheng). Desde 1º de novembro, Machi Big Brother já registrou 71 liquidações, muito mais do que James Wynn.

MarketWhisper·11-20 05:07

Fundador da Uniswap: Bem-vindo aos desafiantes, mas cético quanto a ser "substituído".

De acordo com notícias da Mars Finance, o fundador da Uniswap, Hayden Adams, publicou no X que frequentemente novos concorrentes proclamam querer "substituir a Uniswap". A equipe tem uma atitude receptiva em relação a essa competição, acreditando que um campo de competição sem concorrência se tornaria entediante. Ele afirmou que não descarta que certos projetos possam trazer mudanças diferentes, mas mantém uma atitude cética em relação a isso.

UNI-3.45%

MarsBitNews·11-19 02:38

Baleias de FIL & UNI continuam a despejar, enquanto a prova de conhecimento zero (ZKP) oferece a primeira entrada justa...

A atenção atual do mercado gira em torno da intensa subida de preço do Uniswap (UNI) e das mudanças abruptas que influenciam cada previsão de preço do Filecoin (FIL). Esses movimentos, embora emocionantes, também expõem como muitos dos principais ativos cripto ainda dependem de estruturas moldadas por alocações iniciais e

CryptoNewsLand·11-19 01:03

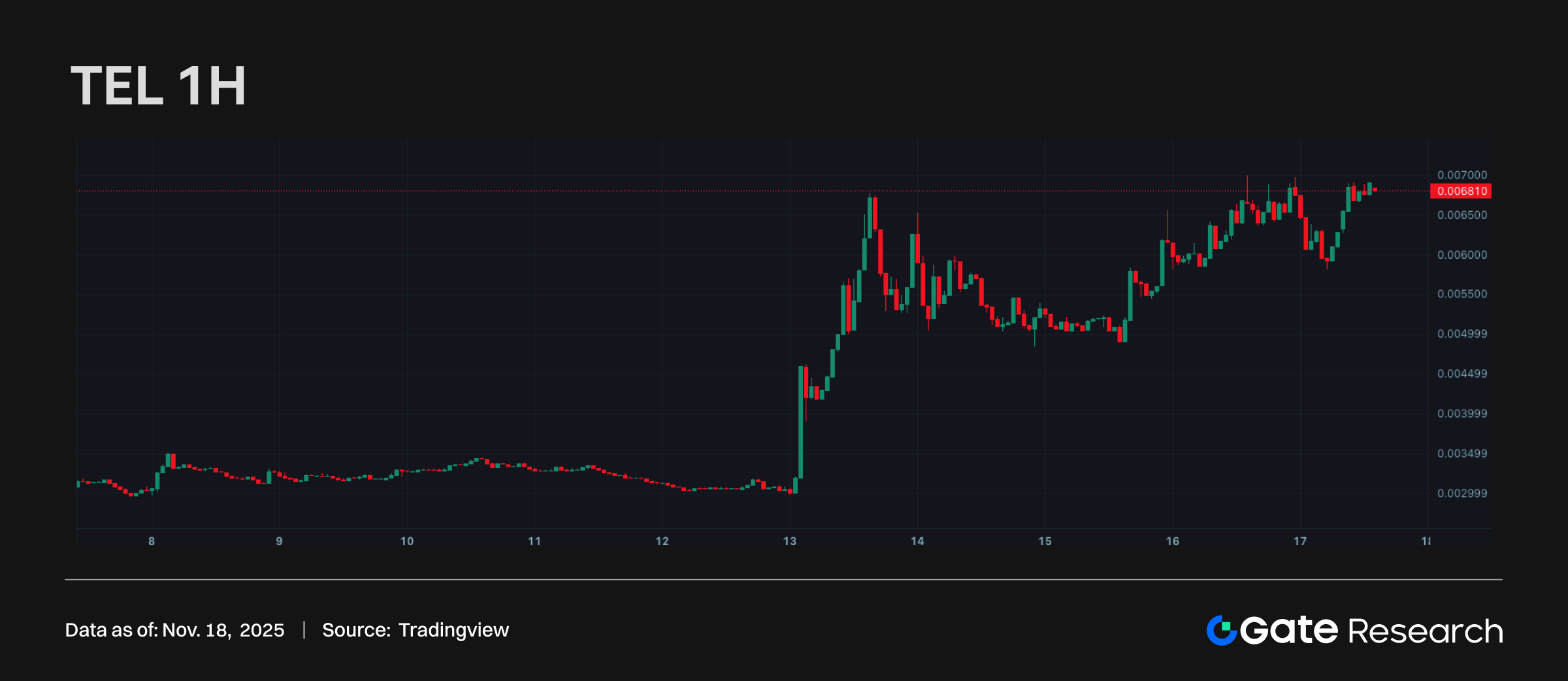

Gate Research Institute: TEL subiu mais de 100%, proposta de governança UNI estimula um grande subida de 50% no preço em um único dia|Gate VIP Weekly Report

Na semana passada, os dados do mercado mostraram que BTC e ETH apresentaram uma recuperação técnica, enquanto TEL teve um grande pump de mais de 100%. O ecossistema Sei e o fluxo de capital cresceram rapidamente, e a Uniswap apresentou uma proposta de reforma de governança que pode remodelar o seu modelo econômico. O relatório completo oferece uma análise aprofundada e suporte de dados.

GateResearch·11-18 10:03

A Uniswap lançou a proposta "UNIfication", que visa ativar a taxa de protocolo e recomprar e queimar UNI.

Notícias da Mars Finance, o fundador da Uniswap, Hayden Adams, publicou um tweet informando que já submeteu a proposta "UNIfication" à plataforma Snapshot para votação de temperatura. A proposta foi apresentada em conjunto pela Uniswap Labs e pela fundação, com o plano de iniciar a taxa do protocolo e usá-la para a recompra e destruição de UNI, ao mesmo tempo que destrói 100 milhões de UNI em reserva. O conteúdo também inclui a construção de um mecanismo de aumento de rendimento LP, integração de liquidez externa e otimização da Uniswap.

UNI-3.45%

MarsBitNews·11-18 03:16

Proposta de unificação do Uniswap e o valor do protocolo CCA

Introdução

Recentemente, a onda no setor foi desviada pelo surgimento da pista de pagamento X402, bem como pelo pânico da segunda a sexta-feira negra, além da rotação do setor de privacidade da lenda do fim do touro.

Este mundo é realmente maravilhoso, mas também muito barulhento.

Agora, seja o Bear Point ou não, afinal, um erro comum que pessoas inteligentes cometem é: esforçar-se para otimizar algo que não deveria existir~ (de Musk). Agora, desacelere e analise as maravilhas dos produtos de sucesso do passado, observe quais ações dos concorrentes são ineficazes, veja quais são os "porcos" na crista da onda; quando o vento parar, será possível ver o verdadeiro valor de longo prazo.

Se perguntarmos, qual é a tendência de pista representativa deste ano?

A minha primeira escolha é Dex, já se passaram 4 anos desde o verão do DeFi, e em 25 anos houve vários produtos típicos que, desde a sua concepção, ocuparam um grande espaço no mercado. O mais incrível nesta área é que, quando você pensa que já fez tudo o que podia, a situação também...

金色财经_·11-18 02:15

temporada de alts预期搁浅:Uniswap、Ethena与Immutable为何逆势走高?

Em novembro de 2025, o índice de medo e ganância do mercado de criptomoedas caiu para 17, uma zona de medo extremo, com o Bitcoin pairando em torno de 94.000 dólares, enquanto as expectativas para a temporada de alts estavam totalmente paradas. No entanto, Uniswap (UNI), Ethena (ENA) e Immutable (IMX) apresentaram um aumento inverso, com um aumento de 24 horas de 5%, 3% e 2,5%, respectivamente.

Os analistas apontam que, em um ambiente de aperto de liquidez, os fundos estão fluindo para projetos com casos de uso claros, fluxo de caixa estável e desenvolvimento ativo, refletindo uma escolha seletiva que mostra a transição do mercado de especulação em conceitos para validação de fundamentos.

MarketWhisper·11-18 01:42

Análise do valor da proposta de unificação do Uniswap e do protocolo de leilão CCA

Autor | Shísì Jūn

Introdução

Recentemente, a onda na indústria foi desviada pela ascensão do X402 no setor de pagamentos, bem como pelo pânico das segundas, terças, quartas e quintas-feiras negras, além da rotação do setor de privacidade da lenda do fim do mercado.

Este mundo é realmente maravilhoso, mas também muito barulhento.

Agora, mesmo que o mercado esteja em baixa, afinal, um erro comum que as pessoas inteligentes cometem é: esforçar-se para otimizar algo que nunca deveria ter existido (de Elon Musk). Agora, acalmando-se, vamos revisar as maravilhas dos produtos de sucesso do passado, observar quais jogadores no mercado estão fazendo movimentos ineficazes, e identificar quais são os "porcos" na crista da onda. Quando o vento parar, poderemos realmente ver o valor a longo prazo do futuro.

Se perguntarmos, qual é a tendência de pista representativa deste ano?

A minha primeira escolha é a Dex. Já passaram 4 anos desde o verão da DeFi, e em 25 anos houve vários produtos típicos, desde a ideia até uma grande presença no mercado. E o mais incrível deste setor é que,

WuSaidBlockchainW·11-17 23:32

Hoje, os 100 principais Tokens de ativos de criptografia em capitalização de mercado subiram e desceram: UNI subiu 6,21%, DASH caiu 10,98%.

深潮 TechFlow 消息,11 月 18 日,据 Coinmarketcap 数据,今日 Ativos de criptografia capitalização de mercado前 100 Token表现如下,

As cinco maiores altas:

Uniswap (UNI) subiu 6,21%, agora a 7,83 dólares;

Monero (XMR) subiu 5,39%, preço atual 418,20 dólares;

Bitcoin Cash (BCH) subiu 3,80%, preço atual 503,47 dólares;

MemeCore (M) subiu 3,51%, preço atual 2,16 dólares;

Cosmos (ATOM) subiu 2,70%, preço atual 2,85 dólares.

Queda das cinco principais:

Dash (DASH) caiu 10,98%, preço atual 83,44

DeepFlowTech·11-17 16:06

O preço da Uniswap dispara 18% em uma semana, os touros conseguem virar $8 e reivindicar $9,46?

O preço do UNI subiu além das médias chave, com foco no nível psicológico de $8 . A atividade de negociação diária aumentou em 48% à medida que os traders buscam oportunidades de breakout, enfrentando a resistência de Fibonacci de $9,46 como o próximo desafio para o momentum em alta.

UNI-3.45%

BitcoincomNews·11-17 09:00

Eugene:Ver UNI em alta ou liderar na recuperação do mercado

Segundo a Mars Finance, o trader Eugene afirmou que desde 10 de outubro, a maioria dos altcoins passou por uma grande retração. Ele acredita que a pressão de venda temporária foi basicamente liberada, e a maioria dos investidores que optaram por parar a perda já saiu após cinco semanas consecutivas de queda. Ele destacou que, se o mercado sofrer uma recuperação, tokens de qualidade impulsionados por fundamentos poderão ter um desempenho melhor, sendo que o Uniswap tem recebido mais atenção devido ao recente progresso na mudança das taxas. Eugene afirmou que o UNI, devido à falta de uma posição pesada histórica, à narrativa de receita reforçada e ao atual preço próximo aos níveis antes da proposta de ajuste de taxas, pode ter potencial de subir nas próximas semanas, com um intervalo de invalidação de sua visão abaixo de 6,50 dólares.

UNI-3.45%

MarsBitNews·11-17 08:44

Traders de UNI Olham Para Esta Zona de Preço Crucial Para a Próxima Oportunidade de Compra

O ensaio discute o recente momentum em alta da Uniswap, destacando zonas de compra potenciais em $6.86 e $5.92. Nota resistência de curto prazo perto de $8.6 e sinais de uma retração devido à diminuição do Interesse Aberto e liquidações longas, indicando cautela apesar dos ganhos recentes.

UNI-3.45%

CryptoNewsLand·11-17 05:54

a16z: os tokens de arcade superam as moedas estáveis! O modelo de milhas aéreas transforma a encriptação econômica

A empresa de capital de risco a16z acredita que os tokens de ecossistema que bloqueiam como milhas aéreas podem ser a chave para os desenvolvedores criarem uma economia digital estável. A a16z aponta que um dos tipos de token mais subestimados no espaço das criptomoedas são os "tokens de arcade" (Arcade Tokens). Esses tokens mantêm um valor relativamente estável dentro de um ecossistema de software ou produto específico, semelhante às recompensas de milhas aéreas, permitindo que os usuários executem funções específicas dentro do ecossistema, em vez de especular.

USDC0.01%

MarketWhisper·11-17 05:38

Dados: 54,45 mil UNI transferidos para o Coinbase Prime, no valor de cerca de 4,0671 milhões de dólares.

Notícias da Mars Finance, de acordo com os dados da Arkham, às 23:02, 54.45 mil UNI (no valor de cerca de 406.71 mil dólares) foram transferidos de um endereço anônimo (começando com 0xAFA7...) para o Coinbase Prime.

MarsBitNews·11-16 15:54

A controvérsia do Uniswap revela o antigo conflito entre DeFi e Washington

Quatro dias depois que a Uniswap Labs e a Uniswap Foundation propuseram a fusão de operações e a ativação do "fee switch" tão aguardado, uma controvérsia no X entre o fundador do protocolo e o ex-chefe de gabinete de Gary Gensler fez com que feridas na indústria cripto, que pareciam ter cicatrizado, fossem reabertas.

UNI-3.45%

TapChiBitcoin·11-16 11:20

Dinâmicas de projetos populares da semana: Proposta do Uniswap para iniciar taxas de protocolo, Magic Eden inicia recompra, Aave pode excluir garantias de tokens de alta flutuação, etc. (1109–1115)

1. A proposta do Uniswap inicia o protocolo de taxas e o Mecanismo de queima do UNI, as funções da fundação serão integradas ao Labs link

A Fundação Uniswap e a Uniswap Labs propuseram em conjunto uma proposta de governança, que visa iniciar o mecanismo de taxas do protocolo, reduzir o suprimento total de UNI e desencadear a queima de UNI através do uso do protocolo, a fim de reestruturar o modelo de incentivos ecológicos. A proposta também inclui a criação do Orçamento de Crescimento Uniswap, destinado a financiar o desenvolvimento do protocolo e da ecologia dentro do quadro de serviços do protocolo, ao mesmo tempo que a maior parte das funções e da equipe da fundação será incorporada à Uniswap Labs. A fundação continuará a cumprir os compromissos de subsídios existentes e encerrará suas operações após completar cerca de 100 milhões de dólares em orçamento de subsídios restantes.

2.

WuSaidBlockchainW·11-16 10:44

Baleia Uniswap Vende $75M UNI Enquanto ‘UNIficação’ Dispara 44% – um Sinal de Problema?

Baleia do Uniswap vendeu $75M UNI durante a euforia, levantando preocupações sobre o tempo de insider.

A proposta de UNIficação ativa taxas, queima tokens e funde Labs com a Foundation.

As compras no varejo dispararam, mas as saídas de baleias sugerem uma distribuição disfarçada de crescimento.

Recentemente, a comunidade cripto vibrou quando o UNI da Uniswap t

CryptoNewsLand·11-16 10:25

Cripto Weekly Roundup: Circle Reports Gains, Uniswap Launches New Features, & More

Esta semana, a Circle reportou um crescimento substancial de 66% na receita, superando as expectativas do terceiro trimestre devido ao aumento da receita de reservas e ao crescimento da circulação de USDC. A Uniswap anunciou o lançamento do revolucionário Protocolo de Leilão de Liquidação Contínua.

O novo protocolo é projetado para descoberta de preços e

CryptoDaily·11-16 09:03

Notícias Cripto Hoje: AB cai 19%, notícias de preço do UNI mostram força a $7.08, e LivLive emerge como t...

O melhor pré-venda de criptomoedas para comprar agora é o tópico principal no quarto trimestre de 2025, à medida que novos projetos tecnológicos ultrapassam limites mais antigos. Novas utilidades, modelos mais fortes e novas camadas de recompensa estão criando interesse no mercado em vários setores. LivLive ($LIVE) junta-se a esta lista transformando ações reais em valor digital,

CaptainAltcoin·11-15 16:34

UNI Retesta sua quebra de cunha de baixa enquanto analistas apontam para $8.25 como o nível de preço chave

Uniswap (UNI) está passando por um reteste de um padrão de falling wedge, com analistas observando um breakout acima de $8,25 para confirmar o momento de alta. Indicadores atuais mostram estabilidade e potencial para novos ganhos em direção a $9 e $10.

UNI-3.45%

CryptoFrontNews·11-15 03:47

Uniswap Lança Protocolo de Leilão de Liquidação Contínua

A Uniswap revelou Leilões de Limpeza Contínuos, um potencial divisor de águas em finanças descentralizadas (DeFi). O protocolo é projetado para descoberta de preços e impulsionamento de liquidez de pools na Uniswap v4.

O novo protocolo oferecerá uma experiência fluida para traders e projetos, e abordará

CryptoDaily·11-14 17:33

Uniswap Introduz Novo Protocolo de Leilão para Transformar Mercados de Tokens Iniciais

A Uniswap lançou um novo mecanismo destinado a reformular como os mercados de tokens em estágio inicial se formam em cadeia e como o valor é capturado em finanças descentralizadas. Na quinta-feira, a exchange descentralizada revelou seu modelo de Leilões de Liquidação Contínua (CCA), um sistema sem permissões que permite

ICOHOIDER·11-14 10:28

Dados: uma Baleia continua a injetar UNI, LINK e vários outros ativos na Binance, suportando grandes perdas não realizadas.

De acordo com informações do Mars Finance, um baleia fez um depósito de 1,19 milhão de UNI (cerca de 10,54 milhões de USD) na Binance e, em seguida, continuou a depositar vários ativos, encontrando-se em uma situação de perdas significativas: 74.281 LINK, atualmente avaliados em cerca de 1,07 milhão de USD, com uma perda de 752 mil USD em relação ao preço de compra; 764.376 PENDLE, atualmente avaliados em cerca de 1,85 milhão de USD, com uma perda de 177 mil USD; 8.936 AAVE, atualmente avaliados em cerca de 1,66 milhão de USD, com uma perda de 57 mil USD. Este endereço também vendeu 220.351 AERO em troca de 186 mil USD USDC, ainda mantendo 150 mil AERO.

UNI-3.45%

MarsBitNews·11-14 10:21

Uniswap Labs Lança Leilão de Liquidação Contínua (CCA): Revolucionando Lançamentos Justos de Tokens no v4

A Uniswap Labs apresentou o protocolo Continuous Clearing Auction (CCA), um mecanismo inovador para a descoberta de preços transparente na cadeia e a criação de liquidez para novos tokens no Uniswap v4.

CryptoPulseElite·11-14 09:26

Detalhes sobre as características únicas do novo protocolo de leilão CCP lançado pela Uniswap

Uniswap Labs lançou o protocolo de leilão de liquidação contínua CCA, destinado a ajudar novos Tokens a estabelecer preços de mercado justos. O protocolo foi projetado em conjunto pela Uniswap e pela Aztec Network, suportando leilões transparentes e descoberta de preços justa, prevenindo a manipulação de mercado. A Aztec torna-se o primeiro projeto a usar este protocolo, a venda pública ocorrerá em dezembro, e o CCA pode se tornar um novo marco para a emissão em Finanças Descentralizadas.

PANews·11-14 08:53

Depositar mais

Tags em alta

Assuntos populares

MaisCalendário Cripto

MaisEncontro em Abu Dhabi

A Helium irá sediar o evento de networking Helium House no dia 10 de dezembro em Abu Dhabi, posicionado como um prelúdio para a conferência Solana Breakpoint programada para os dias 11 a 13 de dezembro. O encontro de um dia terá foco em networking profissional, troca de ideias e discussões comunitárias dentro do ecossistema Helium.

2025-12-09

Atualização Hayabusa

A VeChain revelou planos para a atualização Hayabusa, agendada para dezembro. Esta atualização visa melhorar significativamente tanto o desempenho do protocolo quanto a economia de tokens, marcando o que a equipe chama de a versão mais focada em utilidade da VeChain até hoje.

2025-12-27

Sunset do Litewallet

A Litecoin Foundation anunciou que o aplicativo Litewallet será oficialmente descontinuado em 31 de dezembro. O aplicativo não está mais sendo mantido ativamente, com apenas correções críticas de bugs sendo tratadas até essa data. O chat de suporte também será descontinuado após esse prazo. Os usuários são incentivados a migrar para a Carteira Nexus, com ferramentas de migração e um guia passo a passo fornecidos dentro do Litewallet.

2025-12-30

Fim da Migração dos Tokens OM

A MANTRA Chain emitiu um lembrete para os usuários migrarem seus tokens OM para a mainnet da MANTRA Chain antes de 15 de janeiro. A migração garante a continuidade da participação no ecossistema à medida que $OM transita para sua cadeia nativa.

2026-01-14

Mudança de Preço do CSM

A Hedera anunciou que, a partir de janeiro de 2026, a taxa fixa em USD pelo serviço ConsensusSubmitMessage aumentará de $0.0001 para $0.0008.

2026-01-27