Bitcoin Ethereum Structure Breakdown: The End of the诱多 is Here, Pursuing Shorts Requires Precise Swordsmanship!

1. Daily + Weekly Structure Core Insights

Bitcoin (BTC)

- Daily: Looks like a “small consecutive bullish days + moving average bullish alignment” illusion, but MACD red bars continue to shrink, RSI hits 74.1 in overbought territory, after reaching the high of $94,400, it repeatedly pushes higher then falls back, with frequent upper shadows revealing selling pressure. The $93,000-$95,000 zone is a dense area of December trapped positions; breaking through lacks volume support, purely a “false alarm.”

- Weekly: Appears to stand above the EMA7, but has not broken the weekly TBO resistance at $98,637, and funds continue to flow into altcoins. BTC dominance drops below 59%, upward momentum is severely diverted. The so-called “W bottom breakout” is actually a诱多 trap.

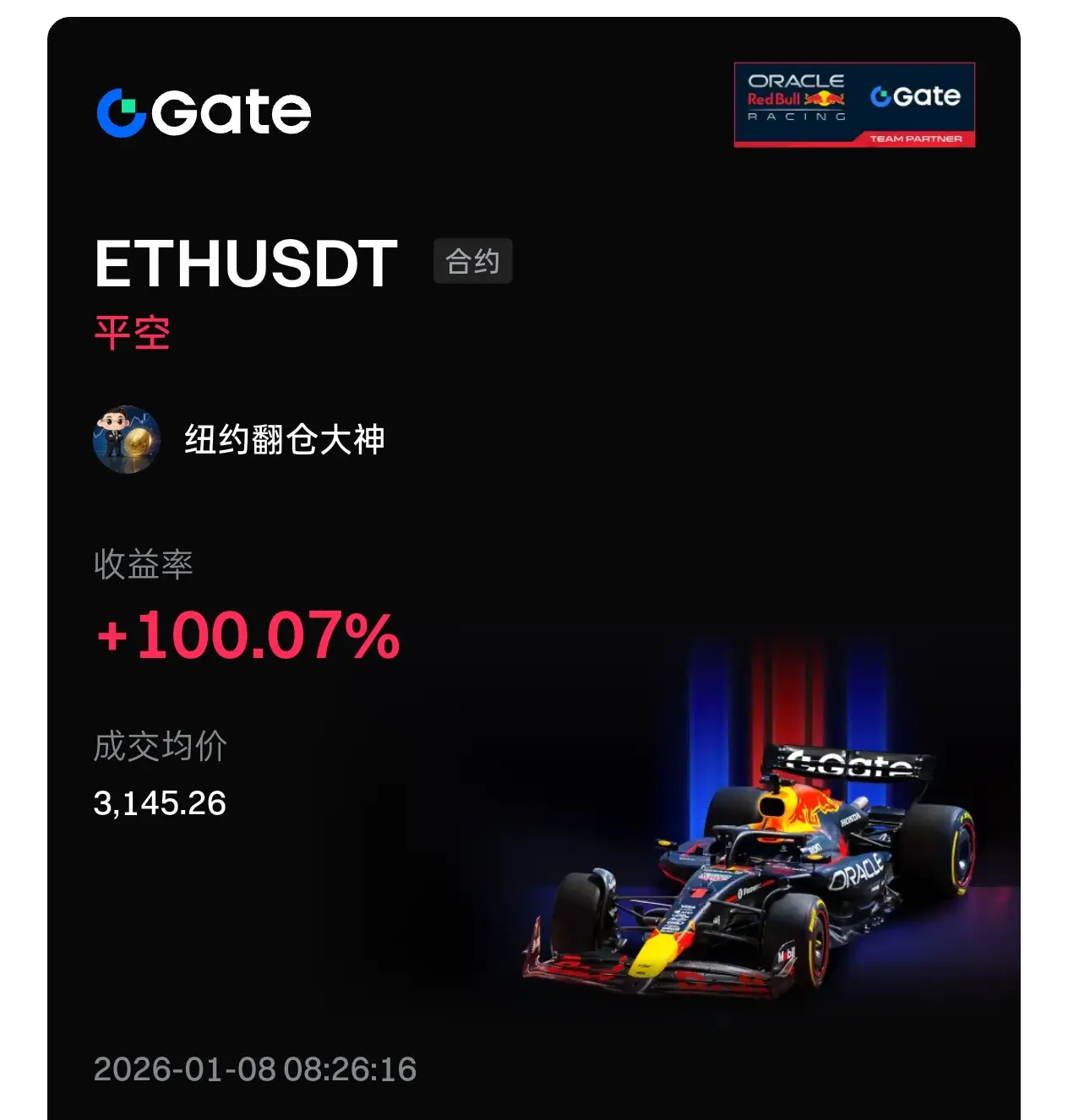

Ethereum (ETH)

- Daily: Follows Bitcoin’s rally but shows weakness, heavy selling pressure in the $3,250-$3,300 range, multiple attempts to hit the $3,307 high failed, volume decreases and bearish divergence signals appear. Moving average support seems solid but is actually fragile.

- Weekly: Although Blob indicator updates provide some positive support, the $3,435 weekly resistance is far away. The current trend is entirely dependent on Bitcoin, lacking independent upward momentum. High-level oscillation is purely “passive survival.”

2. Clear View:诱多 is Reaching the End, Be Cautious About Shorting!

1. Proof of诱多 End: 128,000 traders wiped out in 24 hours, with $288 million long positions liquidated. Main force uses “institutional ETF capital inflow” narrative to pump, but in reality, they are疯狂出货 at high levels of $94,000+ and $3,300+. Retail traders are clearly taking the bait. Meme coins surged 300%, essentially a “last round of hype” with no real funds left, historically a precursor to market reversal.

2. Core Logic of Shorting: Bitcoin 4-hour bearish divergence + Ethereum inverted hammer line, technical correction pressure is overwhelming; $90,000 and $3,200 are critical thresholds. Once broken, chain reaction of stop-losses will trigger, targeting the CME gap at $91,500 and support at $3,150. After breaking these levels, focus shifts to the round numbers of $90,000 and $3,000.

3. Risk Warning:诱多 volatility is extreme at this stage, do not blindly short! Wait for “volume breakdown of support” confirmation signals. Set stop-loss above previous highs ($94,400, $3,307) to avoid being swept by the main force’s final “pin-in诱多.” The key to flipping positions is “precise ambush,” not “gambler’s follow-the-leader.”

3. Trading Tips from the Flip-Your-Position Master

The current market is a classic “main force harvesting retail traders” script. It looks bullish but is actually “the last gasp of a broken bow.” The real opportunity to flip positions lies in “trend-following shorts after诱多 breakdown,” not chasing high to buy in! Remember: only enter after support levels break, firmly set stop-losses, and gradually increase positions. This is the underlying logic for flipping positions in the crypto world.

1. Daily + Weekly Structure Core Insights

Bitcoin (BTC)

- Daily: Looks like a “small consecutive bullish days + moving average bullish alignment” illusion, but MACD red bars continue to shrink, RSI hits 74.1 in overbought territory, after reaching the high of $94,400, it repeatedly pushes higher then falls back, with frequent upper shadows revealing selling pressure. The $93,000-$95,000 zone is a dense area of December trapped positions; breaking through lacks volume support, purely a “false alarm.”

- Weekly: Appears to stand above the EMA7, but has not broken the weekly TBO resistance at $98,637, and funds continue to flow into altcoins. BTC dominance drops below 59%, upward momentum is severely diverted. The so-called “W bottom breakout” is actually a诱多 trap.

Ethereum (ETH)

- Daily: Follows Bitcoin’s rally but shows weakness, heavy selling pressure in the $3,250-$3,300 range, multiple attempts to hit the $3,307 high failed, volume decreases and bearish divergence signals appear. Moving average support seems solid but is actually fragile.

- Weekly: Although Blob indicator updates provide some positive support, the $3,435 weekly resistance is far away. The current trend is entirely dependent on Bitcoin, lacking independent upward momentum. High-level oscillation is purely “passive survival.”

2. Clear View:诱多 is Reaching the End, Be Cautious About Shorting!

1. Proof of诱多 End: 128,000 traders wiped out in 24 hours, with $288 million long positions liquidated. Main force uses “institutional ETF capital inflow” narrative to pump, but in reality, they are疯狂出货 at high levels of $94,000+ and $3,300+. Retail traders are clearly taking the bait. Meme coins surged 300%, essentially a “last round of hype” with no real funds left, historically a precursor to market reversal.

2. Core Logic of Shorting: Bitcoin 4-hour bearish divergence + Ethereum inverted hammer line, technical correction pressure is overwhelming; $90,000 and $3,200 are critical thresholds. Once broken, chain reaction of stop-losses will trigger, targeting the CME gap at $91,500 and support at $3,150. After breaking these levels, focus shifts to the round numbers of $90,000 and $3,000.

3. Risk Warning:诱多 volatility is extreme at this stage, do not blindly short! Wait for “volume breakdown of support” confirmation signals. Set stop-loss above previous highs ($94,400, $3,307) to avoid being swept by the main force’s final “pin-in诱多.” The key to flipping positions is “precise ambush,” not “gambler’s follow-the-leader.”

3. Trading Tips from the Flip-Your-Position Master

The current market is a classic “main force harvesting retail traders” script. It looks bullish but is actually “the last gasp of a broken bow.” The real opportunity to flip positions lies in “trend-following shorts after诱多 breakdown,” not chasing high to buy in! Remember: only enter after support levels break, firmly set stop-losses, and gradually increase positions. This is the underlying logic for flipping positions in the crypto world.