ตลาดอสังหาริมทรัพย์ของ Polymarket: เปลี่ยนกลุ่มสินทรัพย์ $400 ล้านล้านเป็นการเดิมพันเงินกาแฟ

Polymarket’s real estate prediction markets, launched on January 5, 2026, in partnership with Parcl, transform the world’s largest asset class—global real estate worth approximately $400 trillion—into simple binary bets accessible for as little as the price of a coffee.

(Sources: Polymarket)

ผู้ใช้เลือกเมือง เลือก “ขึ้น” หรือ “ลง” สำหรับราคาบ้านในเดือนถัดไป และวางเดิมพันด้วยเงินทุนที่อาจเพิ่มเป็นสองเท่าหากทายถูก หรือขาดทุนทั้งหมดหากทายผิด ข้อมูลเชิงวิเคราะห์นี้พิจารณาการขยายตลาดอสังหาริมทรัพย์ของ Polymarket กลไก ความท้าทายในการนำไปใช้ในช่วงแรก การเปรียบเทียบกับนวัตกรรมทางการเงินในอดีต และผลกระทบเชิงลึก รวมถึงความบังเอิญด้านเวลาและสัญญาณนโยบายของสหรัฐอเมริกา—ณ วันที่ 8 มกราคม 2026

กลไกของตลาดอสังหาริมทรัพย์ของ Polymarket

ตลาดอสังหาริมทรัพย์ของ Polymarket ใช้ข้อมูลอสังหาริมทรัพย์บนบล็อกเชนของ Parcl ซึ่งเป็นโปรโตคอลข้อมูลบน Solana เพื่อสร้างสัญญาผลลัพธ์แบบไบนารีที่เข้าใจง่าย:

- โครงสร้างการเดิมพัน: เลือกเขตเมือง (เช่น Miami, Los Angeles, New York) และทิศทาง (ราคาขึ้นหรือลงในเดือนถัดไป).

- การชำระเงิน: อิงจากดัชนีราคาบนบล็อกเชนของ Parcl ซึ่งได้มาจากข้อมูลอสังหาริมทรัพย์

- ต้นทุนเข้า: ต่ำมาก—มักต่ำกว่า $100 สำหรับตำแหน่งที่มีความหมาย

- ผลตอบแทน: 2 เท่าหากชนะ; ศูนย์หากแพ้ (classic binary option)

ไม่มีเลเวอเรจ ไม่มี perpetuals—เป็นเพียงการเก็งกำไรทิศทางบนดัชนีบ้านพักอาศัยเท่านั้น

- บทบาทของพันธมิตร: Parcl ให้ข้อมูลราคาบ้านที่ตรวจสอบได้และติดตามบนบล็อกเชน

- ความสามารถในการเข้าถึง: ไม่ต้องวางเงินดาวน์ สินเชื่อ หรือพ่อค้าคนกลาง

- ความเสี่ยง: สูง—อาจขาดทุนเต็มจำนวนหากทายผิด

การ “ประชาธิปไตย” นี้ลดขนาดของตลาดอสังหาริมทรัพย์มูลค่า $400 trillion ให้กลายเป็นการตัดสินใจ Yes/No ที่คลิกได้ง่าย

ความเป็นจริงของการนำไปใช้ในช่วงแรกของตลาดอสังหาริมทรัพย์ของ Polymarket

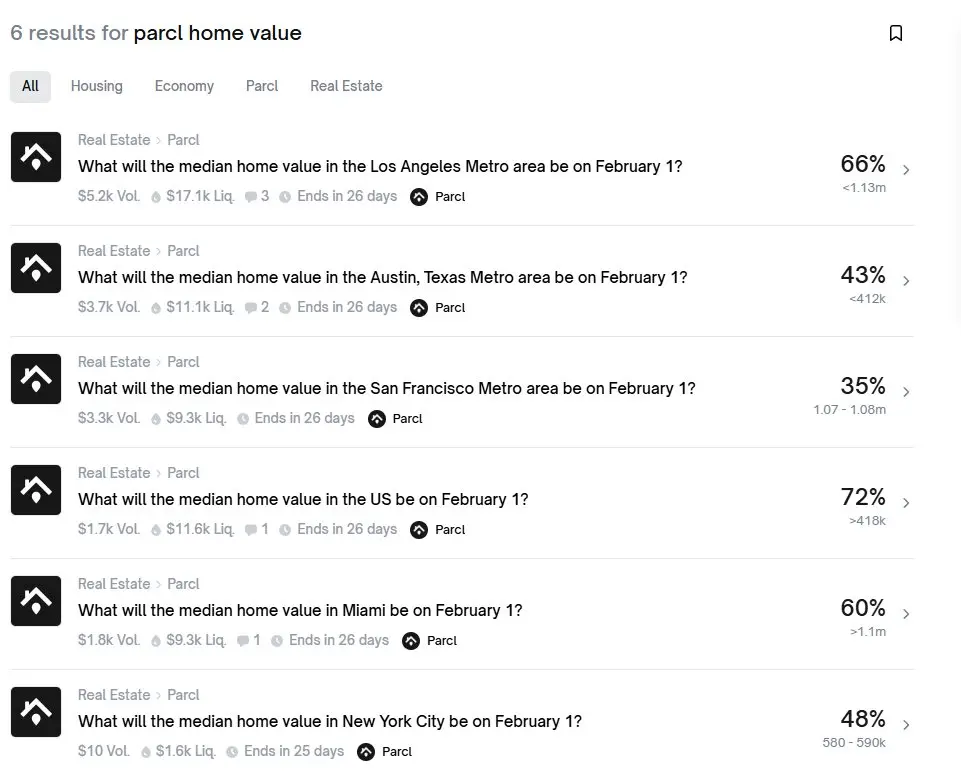

แม้จะมีการพูดถึง แต่สภาพคล่องในช่วงแรกยังเบาบาง:

- ตลาดที่มีปริมาณสูงสุด (Los Angeles): ประมาณ ~$17,000 รวม

- นิวยอร์ก: ประมาณ ~$1,600

- ปริมาณสองวันที่ผ่านมา: ตัวเลขสองหลักต่ำ

เมื่อเปรียบเทียบกับกิจกรรมที่พุ่งแรงในตลาดการเมืองหรือกีฬา แสดงให้เห็นช่องว่างของความคุ้นเคย—ผู้ใช้ชอบเดิมพันในการเลือกตั้งหรือการแข่งขัน แต่ลังเลในดัชนีบ้านพักอาศัย

- ความท้าทายด้านสภาพคล่อง: ตลาดในช่วงแรกครองโดยตำแหน่งเก็งกำไรขนาดเล็ก

- กลุ่มผู้เข้าร่วม: น่าจะเป็นเทรดเดอร์ที่มีความเชี่ยวชาญ หรือ “พื้นที่ล่าปลาวาฬ” มากกว่าการค้าขายแบบกลุ่มผู้ใช้ทั่วไป

- ศักยภาพในการเติบโต: ต้องการการศึกษาเกี่ยวกับดัชนีและความเชื่อมั่นในข้อมูลที่ได้รับ

วิสัยทัศน์กว้างของ Parcl และการเข้ากันได้ของตลาดอสังหาริมทรัพย์ของ Polymarket

Parcl ซึ่งได้รับการสนับสนุนจาก Dragonfly, Coinbase Ventures และ Solana Ventures (กว่า $11 ล้านดอลลาร์ที่ระดมทุน) เดิมเสนอ perpetuals ที่ใช้เลเวอเรจบนดัชนีอสังหาริมทรัพย์ (สูงสุด 10 เท่า) ความร่วมมือกับ Polymarket “ลดระดับ” ไปเป็นตัวเลือกไบนารีที่อ่อนลง เพื่อให้เป็นมิตรกับกฎระเบียบมากขึ้น ในขณะเดียวกันก็ยังคงการชำระเงินบนบล็อกเชน

- ผลิตภัณฑ์เดิม: การซื้อขายแบบ leverage long/short บนดัชนีอสังหาริมทรัพย์

- เวอร์ชันของ Polymarket: ลดเลเวอเรจ เป็นตัวเลือกไบนารีตามเวลา เพื่อความเป็นมิตรกับกฎระเบียบ

- ความร่วมมือเชิงกลยุทธ์: ผสมผสานความลึกของข้อมูลของ Parcl กับฐานผู้ใช้ของ Polymarket

ทิศทางและมูลค่าของ Polymarket และบริบทการประเมินค่า

การขยายกลุ่มตลาดอย่างรวดเร็วของ Polymarket—from การครองตลาดเลือกตั้งปี 2024 (ปริมาณสูงสุดจากผลลัพธ์ของทรัมป์) ไปสู่ความร่วมมือในการเดิมพันกีฬาของ UFC ในปี 2025—จบลงด้วยตลาดอสังหาริมทรัพย์ มูลค่าของบริษัทพุ่งจาก 1.2 พันล้านดอลลาร์ในปี 2024 สู่เกือบ $9 พันล้านดอลลาร์ในช่วงที่มีข่าวสนใจการลงทุนของ ICE (NYSE)

- ความก้าวหน้าของกลุ่มตลาด: การเมือง → ศิลปะการต่อสู้ → อสังหาริมทรัพย์

- ความเป็นไปได้ในอนาคต: ผลลัพธ์ที่สามารถวัดได้ เช่น อัตราการหย่าร้าง, อัตราการเกิด, ความอยู่รอดของธุรกิจท้องถิ่น

- หลักการสำคัญ: ถ้ามีข้อมูล ก็สร้างตลาดได้

การพนันกับการลงทุน: คำถามเชิงลึกในตลาดอสังหาริมทรัพย์ของ Polymarket

เกือบ 70% ของผู้ใช้ Polymarket ขาดทุน กำไรจะถูกรวมอยู่ในกระเป๋าไม่กี่ใบ—โครงสร้างที่สะท้อนแพลตฟอร์มการเทรด ตลาดอสังหาริมทรัพย์เพิ่มความซับซ้อน: ข้อมูลล่าช้า เสียงรบกวนตามฤดูกาล และการถกเถียงเกี่ยวกับวิธีการคำนวณดัชนี ทำให้การเดิมพันกลายเป็นการต่อสู้กันเรื่องคำจำกัดความ มากกว่าพื้นฐานทางเศรษฐศาสตร์

การเป็นเจ้าของบ้านแบบดั้งเดิม: วางเงินดาวน์ 30%, จำนอง 30 ปี, เป็นเจ้าของสินทรัพย์ เวอร์ชันของ Polymarket: $100 วางเดิมพัน, ระยะเวลาหนึ่งเดือน, ไม่มีการเป็นเจ้าของ—เป็นเพียงการเก็งกำไรทิศทางเท่านั้น

- ความแตกต่างสำคัญ: หนึ่งสร้างความมั่งคั่ง ส่วนอีกอันเป็นการเก็งกำไรแบบศูนย์ผลต่าง

- เสียงสะท้อนในประวัติศาสตร์: ปี 2008 มีการใช้อนุพันธ์ซับซ้อนบนที่อยู่อาศัย; ตอนนี้ผู้ค้ารายย่อยเข้าถึงเวอร์ชันที่ง่ายขึ้น

จังหวะนโยบายและข้อได้เปรียบด้านข้อมูลเชิงโครงสร้าง

การเปิดตัวเกิดขึ้นใกล้เคียงกับคำแถลงของประธานาธิบดีทรัมป์ สหรัฐฯ เรียกร้องให้มีข้อจำกัดในการซื้อบ้านเดี่ยวโดยสถาบัน—อ้างถึงความสามารถในการซื้อของเยาวชน ความเชื่อมโยงที่รู้จักกัน (การลงทุนของครอบครัวทรัมป์ใน Polymarket, บทบาทที่ปรึกษา) กระตุ้นการคาดเดา แต่การวิเคราะห์เชิงลึกชี้ให้เห็นถึงพลวัตเชิงโครงสร้าง:

ตลาดทำนายรวมความคาดหวังมากกว่าจะสร้างเหตุการณ์ ความกดดันด้านความสามารถในการซื้อบ้าน—การซื้อโดยสถาบัน, อัตราดอกเบี้ยสูง—ได้เริ่มต้นการพูดคุยด้านนโยบายแล้ว Polymarket วัดความเป็นไปได้ของความเห็นพ้อง

ความกังวลที่แท้จริง: “ข้อมูลเชิงอสมมาตรที่ถูกกฎหมาย”—ผู้ที่ใกล้ชิดกับสัญญาณนโยบายได้เปรียบในด้านการกำหนดราคาผลลัพธ์ในอนาคต ซึ่งเพิ่มช่องว่างความมั่งคั่งผ่านแพลตฟอร์มที่เป็นไปตามกฎหมาย

โดยสรุป ตลาดอสังหาริมทรัพย์ของ Polymarket สรุปมูลค่าทรัพย์สิน $400 trillion ให้กลายเป็นการเดิมพันไบนารีที่เข้าถึงง่ายและมีความเสี่ยงสูง ซึ่งเป็นการกระจายความเสี่ยงในเชิงเก็งกำไร ขณะเดียวกันก็เปิดโอกาสให้ผู้ใช้เสี่ยงต่อการขาดทุนแบบเข้มข้น ความสภาพคล่องในช่วงแรกต่ำชี้ให้เห็นถึงอุปสรรคด้านการศึกษา แต่โมเดลนี้มีแนวโน้มขยายตัวได้ในวงกว้าง เบื้องหลังความบังเอิญด้านเวลา คือการเปลี่ยนแปลงที่ลึกซึ้งกว่า: แพลตฟอร์มทำนายเป็นตัวเร่งของข้อได้เปรียบด้านข้อมูลเชิงโครงสร้างในยุคที่เศรษฐกิจและการเมืองกลายเป็นเรื่องที่ถูกพูดถึงอย่างมาก ขณะที่กลุ่มตลาดขยายตัว ผู้เข้าร่วมต้องพิจารณาว่าพวกเขากำลังลงทุนในข้อมูลเชิงลึก หรือเล่นการพนันกับความใกล้ชิดอำนาจ ติดตามปริมาณการเติบโตและพัฒนาการด้านนโยบายอย่างใกล้ชิด ใช้เครื่องมือที่ได้รับการควบคุมเพื่อความปลอดภัยในการเข้าร่วมทุกครั้ง