ประกาศรายชื่อผู้ได้รับรางวัลใหม่จากกิจกรรมในจัตุรัส|รอบส่งเสริมผู้สร้างสรรค์รุ่นที่สี่

1️⃣ รางวัลโพสต์ยอดเยี่ยม: ของขวัญตรุษจีน Gate, เสื้อแจ็คเก็ต Red Bull Gate, คูปองประสบการณ์ตำแหน่งใหญ่, VIP+1

HighAmbition, Ryakpanda, User_any, MrFlower_...

2️⃣ รางวัลโพสต์โชคดี: 1 GT, หมวกแก๊ป Gate

BeiPai ErGe, Surrealist5N1K, Supporter JiTian, Jinshan Yinshan, Gu Jingci...

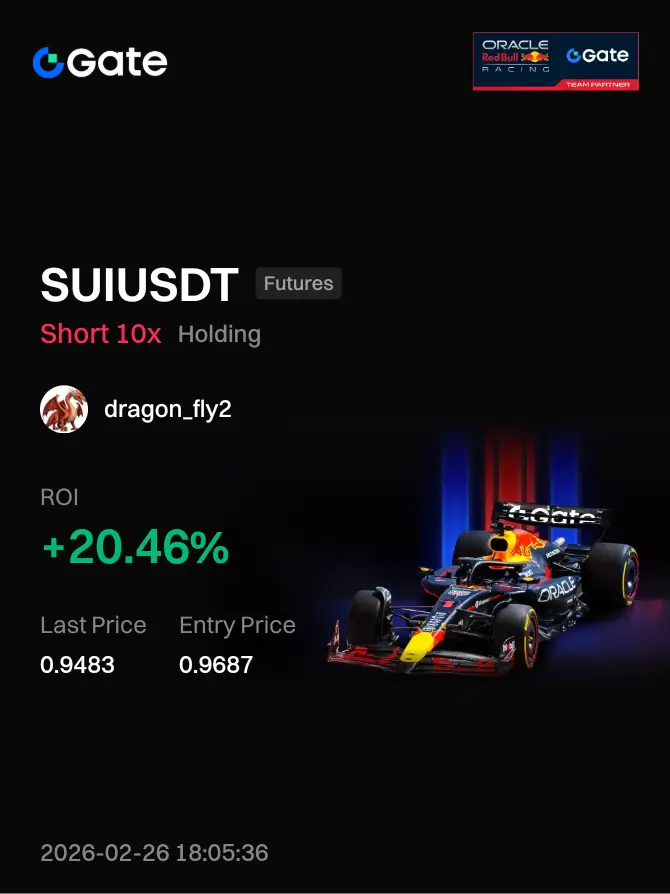

3️⃣ สระน้ำรางวัลแสงอาทิตย์: สระคูปองประสบการณ์ตำแหน่งมูลค่า 24,000 ดอลลาร์

RuiLing, Zhang Shukai ชนะในจุดเปลี่ยนของเส้นเทคนิค, ฉันนอนดึกทุกวัน, Plastikkid...

4️⃣ สระสำหรับมือใหม่เท่านั้น: สระคูปองประสบการณ์ตำแหน่งมูลค่า 20,000 ดอลลาร์

Thynk, กระต่ายน้อย, หมาป่าแห่งคริปโต, Pi ที่อนาคตสดใส...

รายชื่อรายละเอียดสามารถดูได้ในตาราง:

https://docs.google.com/spreadsheets/d/1iiHSHEFWl92qRCdmHd8zdGy_OU7xkPCI9uhGUrBMXRs/edit?gid=0#gid=0

ขอขอบคุณทุกท่านที่เข้าร่วมอย่างกระตือรือร้น รอติดตามกิจกรรมสนุกๆ ในจัตุรัสกันต่อไป!

1️⃣ รางวัลโพสต์ยอดเยี่ยม: ของขวัญตรุษจีน Gate, เสื้อแจ็คเก็ต Red Bull Gate, คูปองประสบการณ์ตำแหน่งใหญ่, VIP+1

HighAmbition, Ryakpanda, User_any, MrFlower_...

2️⃣ รางวัลโพสต์โชคดี: 1 GT, หมวกแก๊ป Gate

BeiPai ErGe, Surrealist5N1K, Supporter JiTian, Jinshan Yinshan, Gu Jingci...

3️⃣ สระน้ำรางวัลแสงอาทิตย์: สระคูปองประสบการณ์ตำแหน่งมูลค่า 24,000 ดอลลาร์

RuiLing, Zhang Shukai ชนะในจุดเปลี่ยนของเส้นเทคนิค, ฉันนอนดึกทุกวัน, Plastikkid...

4️⃣ สระสำหรับมือใหม่เท่านั้น: สระคูปองประสบการณ์ตำแหน่งมูลค่า 20,000 ดอลลาร์

Thynk, กระต่ายน้อย, หมาป่าแห่งคริปโต, Pi ที่อนาคตสดใส...

รายชื่อรายละเอียดสามารถดูได้ในตาราง:

https://docs.google.com/spreadsheets/d/1iiHSHEFWl92qRCdmHd8zdGy_OU7xkPCI9uhGUrBMXRs/edit?gid=0#gid=0

ขอขอบคุณทุกท่านที่เข้าร่วมอย่างกระตือรือร้น รอติดตามกิจกรรมสนุกๆ ในจัตุรัสกันต่อไป!