Huang Licheng's old case resurfaces after liquidation! The 2018 embezzlement of 22,000 ETH remains unresolved with lingering doubts

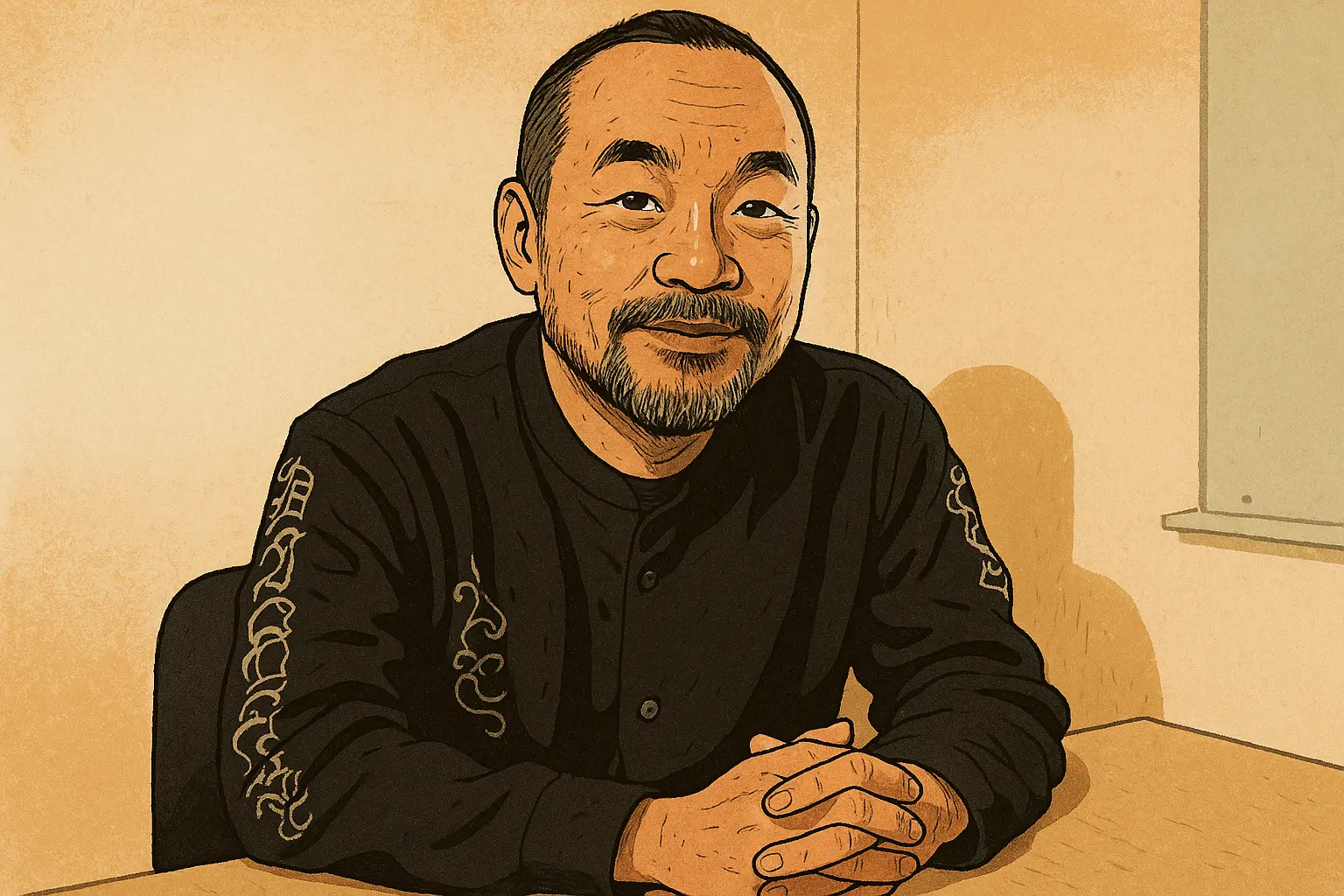

After Huang Licheng was fully liquidated on January 31, 2026, his 2018 embezzlement case involving Treasure Island Finance was brought back into the spotlight. ZachXBT revealed in June 2022 that Huang Licheng allegedly withdrew 22,000 ETH and launched 10 plummeting projects. Huang Licheng responded with defamation claims but did not provide detailed rebuttals, and the controversy remains unresolved.

2018 Treasure Island Finance 22,000 ETH Embezzlement Shocks the Crypto Community

Rewinding to 2018, the most shocking scandal in Taiwan’s crypto scene was the Treasure Island Finance (FMF) incident. Treasure Island Finance was a B2B blockchain asset management platform, with members including Kuomintang member Xie Guoliang, Czhang Lin, Ryan Terribilini, and others. The project raised a total of 44,000 ETH, with investors including Binance, Block One (EOS developer), Huang Licheng, Maicoin, and other well-known institutions and individuals.

Treasure Island Finance was listed on the decentralized exchange IDEX in June 2018, and three months later on the centralized exchange UEX. Investors were attracted by promotional slogans claiming it would soon be listed on top exchanges, but FMF’s price plummeted immediately after listing on IDEX. Three weeks after listing, the company’s operations deteriorated; on June 22, 2018, Xie Guoliang, as the sole director, promoted a bidirectional stock buyback, while the company’s accounts were consecutively drained twice, transferring a total of 22,000 ETH out.

ZachXBT’s investigation shows that Xie Guoliang transferred 10,500 ETH to Binance, but the KYC status of that account is unknown. The 11,000 ETH withdrawn by Huang Licheng was divided into five batches and transferred to Binance from late June to early July, with 2,000 ETH sent to czhang.eth. Investigations revealed that the owner of the Binance wallet Huang Licheng transferred funds to was Bun Hsu, a core engineer at Cream Finance (whose personal Twitter had been deleted at the time); another was Treasure Island Finance advisor Czhang Ling, who three weeks later transferred funds to COO Yalu Lin.

What angered investors most was that they only learned three months later that half of the company’s assets had been embezzled. At that time, ETH was about $500, so 22,000 ETH was worth approximately $11 million. The whereabouts of this huge sum remain a mystery to this day, although ZachXBT tracked some funds flowing to Cream Finance team members, the complete fund flow chain has never been fully revealed.

10 Projects All Follow Similar Pump-and-Dump Patterns

In addition to Treasure Island Finance, ZachXBT also exposed nine other projects involving Huang Licheng. Their common features are: attracting large amounts of capital in a short period, then crashing or being abandoned. Cream Finance is a decentralized lending platform founded in July 2020 by Leo Cheng, Bun Hsu, Jeremy Yang, and others. Due to technical negligence, Cream Finance was hacked, losing over $192 million, making it one of the most damaging DeFi projects in history.

Wifey Finance is a fork of Yearn Finance, established in August 2020, with members including Huang Licheng, Leo Chang, Wilson Huang, and others. After multiple transfers of funds to Wilson Huang by one of the validators, Wifey Finance was abandoned, with operations lasting only five days. This extremely short operational period raised suspicions about whether it was a carefully planned scam from the start.

Swag.live is a governance token for an adult entertainment website, established in October 2020. After Swag was listed as collateral for Cream Finance, its transparency was questioned by the community, leading to massive sell-offs and eventual delisting from Cream. MITH Cash is a clone of the Basis Cash protocol; within days of launch, its locked-in amount reached $1 billion, but large-scale cashouts by holders caused a crash. Huang Licheng still claims he was only an advisor to the project, and like his other projects, MITH Cash’s members are anonymous.

Typhoon Cash is a clone of Tornado Cash, abandoned weeks after being hacked due to rushed development and reward deposit theft. Since February 2021, no project updates have been issued. Heroes of Evermore is a clone of Loot for Adventurers (NFT), where the probability of minting high-value NFTs was not random; the team members had secretly minted the most valuable NFTs long ago, but holders were kept in the dark. Squid DAO is a clone of OHM/Nouns DAO; Huang Licheng was an early holder and was abandoned in January 2022 on Huang Licheng’s advice.

These 10 projects exhibit an astonishingly similar pattern: either they are forks of popular projects at the time or they attract large capital quickly and then crash or are abandoned. This “hype, quick entry and exit” operation method sparked widespread suspicion of Huang Licheng in the crypto community when ZachXBT exposed it in 2022.

Four Years Later, Old Cases Resurface, Cloud of Suspicion Remains

On January 31, 2026, Huang Licheng’s leveraged position was fully liquidated, drawing renewed market attention to his past. After four years, the 10 projects’ crashes and Treasure Island Finance’s embezzlement case once again became hot topics. Many investors began questioning why a person involved in so many controversies could still maintain influence in the crypto scene.

The controversy from that time has yet to be fully clarified. Cointelegraph reporters pointed out key issues: on-chain data can prove fund flows but cannot directly verify that the wallet’s true owner is Huang Licheng himself. ZachXBT’s investigation relied on on-chain tracking, community testimonies, and indirect evidence, but lacked direct identity verification like bank KYC.

However, ZachXBT’s reputation in blockchain investigation lends credibility to his reports. He has successfully uncovered multiple crypto scams, including tracing stolen funds and identifying hackers, with a high accuracy rate. His months-long investigation into Huang Licheng, involving a complete timeline of 10 projects, demonstrates his seriousness.

Looking back after four years, the failure trajectories of these projects have become part of the history of the crypto industry’s development. From the ICO frenzy of MITH to the rise and fall of various DeFi forks, they witnessed the market’s transition from frenzy to calm between 2018 and 2022. As the central figure behind these projects, Huang Licheng’s role and responsibilities remain an unresolved mystery.

Related Articles

Tom Lee's Bitmine Purchases 35,000 ETH Worth $69.37M in Single Day

Can AI Agents Boost Ethereum Security? OpenAI and Paradigm Created a Testing Ground

Lower High in BTC Dominance Points to ETH-Led Market Phase

Peter Thiel Exits ETHZilla Investment After Ethereum Treasury Stock Craters