Tokenized goods surpass $6 billion! The gold on-chain trend exceeds stocks and funds RWA

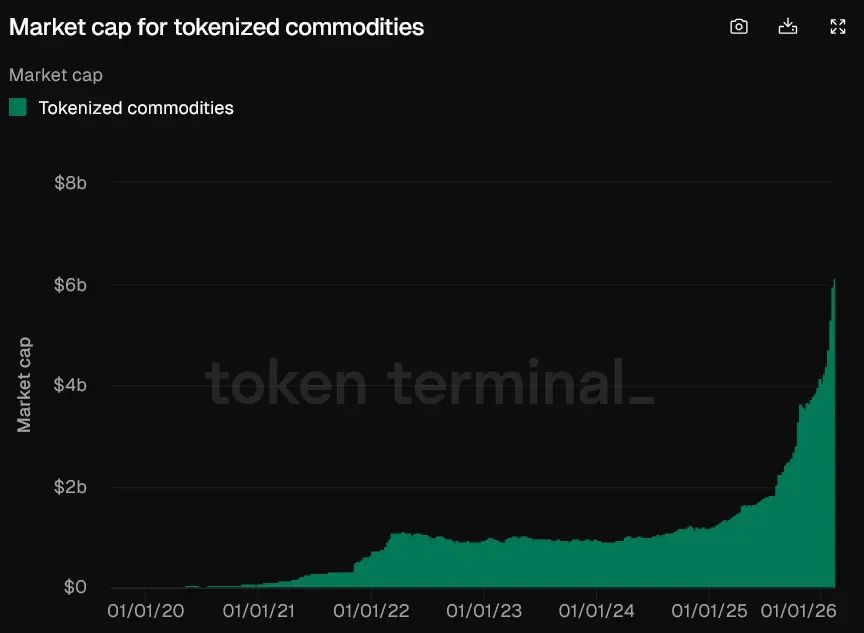

The tokenized commodities market has increased by 53% in six weeks, reaching $6.1 billion, as gold transfers onto the blockchain, making it the fastest-growing vertical in the real-world asset tokenization market. By early 2026, the tokenized commodities market is valued at just over $4 billion, dominated by gold products, with Tether Gold and Paxos-listed PAX Gold accounting for over 95% of the market share. Its growth rate surpasses that of tokenized stocks and funds.

Explosive Growth of $2 Billion in Six Weeks

(Source: Token Terminal)

The tokenized commodities market surged 53% in less than six weeks, surpassing $6.1 billion, as more gold moves onto the blockchain, making it the fastest-growing vertical in the real-world asset tokenization space. According to data from crypto analytics platform Token Terminal, the market value at the start of the year was just over $4 billion, meaning the market has increased by about $2 billion since January 1.

Adding $2 billion in six weeks equates to roughly $333 million per week, a growth rate rare in the RWA (real-world asset) tokenization field. To understand the significance of this figure, compare it with other RWA categories. The tokenized stock market size is only $53.8 million, with growth in six weeks not even matching that of tokenized commodities; the tokenized fund market is larger at $17.2 billion, but only grew by 3.6% or about $620 million in six weeks, still far less than the $2 billion increase in commodities.

This explosive growth is mainly driven by the surge in gold prices. The rise of tokenized gold coincides with gold spot prices increasing over 80% in the past year, reaching a record high of $5,600 on January 29. When gold prices soar, investors holding tokenized gold benefit equally while enjoying blockchain’s convenience (24/7 trading, instant settlement, divisibility). This combination of “traditional asset returns + blockchain convenience” has attracted substantial capital inflows.

Comparison of Tokenized Commodities vs Other RWA Categories

Tokenized Commodities: $6.1 billion, up 53% in six weeks, +360% annually

Tokenized Funds: $17.2 billion, up 3.6% in six weeks

Tokenized Stocks: $538 million (smallest scale)

Growth Rate Ranking: Commodities > Stocks > Funds

Data shows that the tokenized commodities market is dominated by gold products. Tether Gold and Paxos-listed PAX Gold account for over 95% of the tokenized commodities market. This extreme market concentration is both an advantage and a risk. The advantage lies in liquidity concentration—small slippage and good depth when trading these two products. The risk is that if Tether or Paxos encounter issues (such as regulatory penalties, technical failures, reserve disputes), the entire tokenized commodities market could collapse.

Tether’s $150 Million Acquisition of Gold.com and Strategic Ambitions

On Thursday, Tether expanded its tokenized commodities strategy by acquiring a stake worth $150 million in precious metals platform Gold.com, aiming to broaden access to tokenized gold. This acquisition is highly strategic, indicating Tether’s desire not only to dominate the stablecoin market (USDT’s market share exceeds 70%) but also to establish a monopoly in the tokenized gold market.

Gold.com is a well-known US-based precious metals retail platform offering physical gold and silver purchase and storage services. After acquiring its stake, Tether may direct Gold.com users toward Tether Gold (XAUt) or directly integrate tokenized gold purchase options on the platform. This “online + offline” integration can reach a broader investor base, including traditional investors unfamiliar with blockchain but interested in gold.

The $150 million purchase price suggests Gold.com’s valuation could be in the hundreds of millions of dollars, which is above average for a precious metals retailer. Tether’s willingness to pay such a premium reflects its long-term optimism about the tokenized gold market. As gold prices continue to hit new highs, demand for tokenized gold could grow exponentially. Tether’s early positioning in the supply chain and distribution channels will give it a competitive advantage in future market competition.

Bitcoin Declines, Gold Rises: Price Divergence

Earlier this month, gold prices dipped slightly to $4,700 per ounce, but by the time of writing, gold has rebounded to $5,050 per ounce. CoinGecko data shows Bitcoin’s price fell 52.4% from its early October high of $126,080, dropping to around $60,000 on Friday, then rebounding to $69,050.

While traditional safe-haven assets rose, Bitcoin’s price declined, leading some industry commentators, such as Strike CEO Jack Mallers, to speculate that despite Bitcoin’s characteristics as a hard currency, it is still viewed as a software stock. Grayscale, a crypto asset management firm, also stated that Bitcoin’s long-standing narrative as “digital gold” has been challenged, noting its recent price movements increasingly resemble high-risk growth assets rather than traditional safe havens.

This extreme divergence—gold up 80%, Bitcoin down 52%—shatters the narrative of Bitcoin as digital gold. Amid rising global uncertainty and geopolitical risks, investors are favoring the thousands-of-years-old proven store of value, gold, over Bitcoin, which has only been around for 15 years. This choice indicates that, at least in the current market environment, Bitcoin’s safe-haven qualities are inferior to those of gold.

The rise of tokenized commodities, to some extent, represents a victory for “traditional safe assets + blockchain technology.” It demonstrates that investors prefer incremental technological improvements—making traditional assets like gold easier to trade—rather than radical technological revolutions (such as Bitcoin’s attempt to replace fiat currency). This pragmatic approach may be more palatable to mainstream acceptance than revolutionary change.

For Bitcoin believers, this is a heavy blow. If Bitcoin cannot demonstrate safe-haven properties even in crises, its core value proposition will be fundamentally questioned. However, optimists argue that Bitcoin’s value lies not in short-term hedging but in long-term protection against fiat devaluation and systemic risks. Its poor recent performance does not invalidate its long-term narrative.

Related Articles

U.S. SOL spot ETF had a total net inflow of $2,398,000 in a single day

An address sold 886.31 WBTC, valued at 58.53 million US dollars

BitMine invests another $70 million to buy 35,000 ETH! Holdings surpass 4.4 million ETH, with an unrealized loss of $8 billion, still adding to their position without hesitation

Pump.fun-Linked Wallet Sells Over 2 Billion PUMP Tokens for $4.55M

Mysterious entity in Hong Kong becomes the largest IBIT holder

Tom Lee's Bitmine Purchases 35,000 ETH Worth $69.37M in Single Day