Gate Daily (February 13): Standard Chartered Bank warns Bitcoin may drop to $50,000; PGI CEO sentenced to 20 years in prison for $200 million scam

Bitcoin (BTC) continues its downward trend, currently around $66,050 as of February 13. Standard Chartered Bank warns that Bitcoin may fall to $50,000 before rebounding, with its year-end target price lowered to $100,000. The U.S. Department of Justice announced that PGI CEO Ramil Ventura Palafox was sentenced to 20 years in prison for operating a $200 million Bitcoin Ponzi scheme.

Macro Events & Crypto Hotspots

-

Standard Chartered expects Bitcoin to drop to around $50,000 in the coming months, with Ethereum prices falling to about $1,400. The bank has lowered its 2026 year-end target for Bitcoin to $100,000 and for Ethereum to $4,000. Its long-term forecast for 2030 remains unchanged, and the bank remains optimistic about the asset class. The bank has revised down its short-term and full-year price expectations for major cryptocurrencies due to outflows from ETFs and a challenging macroeconomic environment, which continue to pose downside risks.

-

The U.S. Department of Justice announced that Praetorian Group International (PGI) CEO Ramil Ventura Palafox was sentenced to 20 years for running a Bitcoin Ponzi scheme that defrauded over 90,000 investors worldwide. Palafox falsely claimed PGI was engaged in Bitcoin trading and promised daily returns of 0.5% to 3%, but in reality, it was a Ponzi scheme. From December 2019 to October 2021, investors invested over $201 million in PGI, including $30.25 million in fiat currency and Bitcoin valued at approximately $171.50 million, resulting in at least $62.69 million in losses.

News Highlights

-

South Korean Finance Minister: Will strengthen regulation of the cryptocurrency market.

-

Key U.S. Democratic Senator calls for crypto legislation; SEC Chair warns that legislative gaps could lead to policy setbacks.

-

Federal Reserve documents propose setting initial margin requirements for crypto derivatives.

-

Aave Labs proposes transferring 100% of protocol revenue to DAO in exchange for operational funding.

-

SEC Chair predicts the market is a “huge problem,” with legal attention continuing to rise.

-

CFTC Chair appoints several crypto company executives to a 35-member innovation advisory group.

-

Japanese digital finance platform PayPay submits an IPO application in the U.S.

-

Lighter reaches an agreement with Circle to share USDC deposit yields.

-

Vitalik comments on Fileverse token incentives: Crypto applications should focus on refining practical, usable products.

-

Mining company Cango secures approximately $75.8 million in equity investment to advance AI and computing power deployment.

Market Trends

-

Latest Bitcoin news: BTC continues its sluggish trend, currently around $66,050. In the past 24 hours, liquidations exceeded $108 million, mostly long positions.

-

Due to concerns over disruptive impacts from artificial intelligence, investors increased selling of tech stocks. On February 13, Wall Street stocks plunged sharply, with the Dow Jones down 669 points (1.34%), S&P 500 down 1.57%, Nasdaq down 2.03%, Philadelphia Semiconductor Index down 2.5%, and TSMC ADR down 1.6%, closing at $368.10.

(Source: Gate)

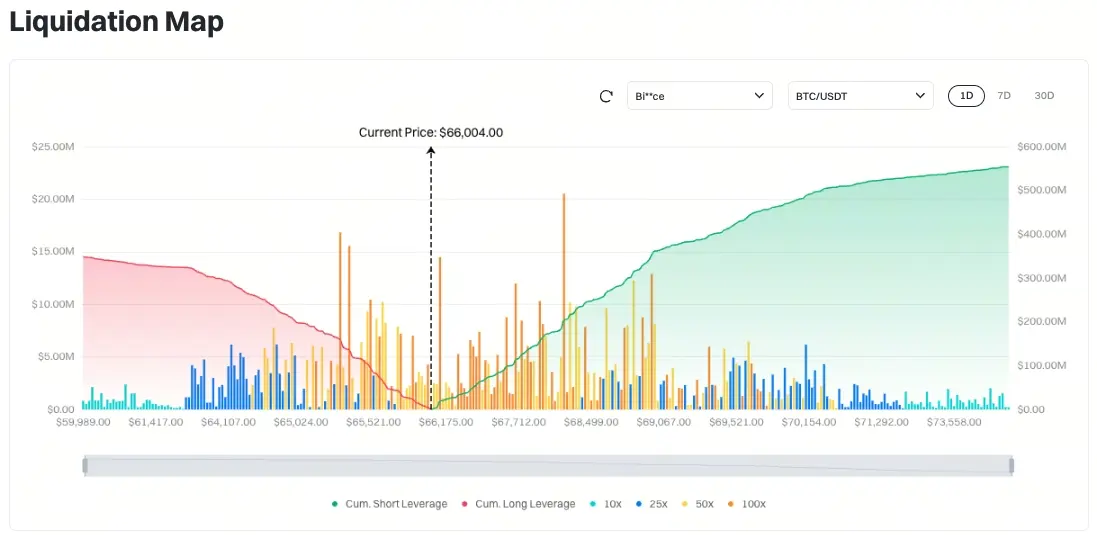

- According to Gate’s BTC/USDT liquidation map, with the current price at $66,004, if it drops to around $65,316, total long liquidations will exceed $158 million; if it rises to about $68,301, total short liquidations will surpass $204 million. Short positions are significantly more liquidated than longs, so traders should control leverage wisely to avoid large-scale liquidations during market volatility.

(Source: Coinglass)

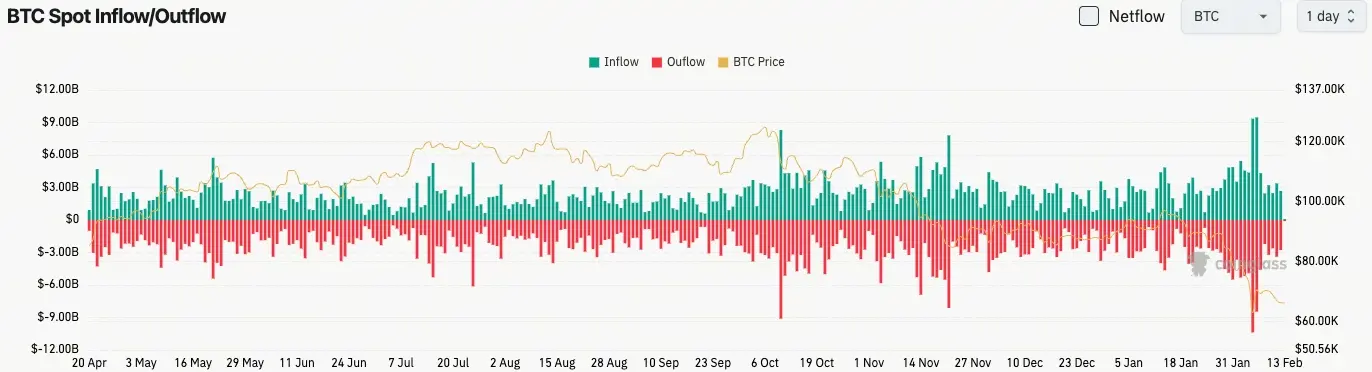

- In the past 24 hours, spot inflows totaled $2.68 billion, outflows $2.77 billion, net outflow $90 million.

(Source: Coinglass)

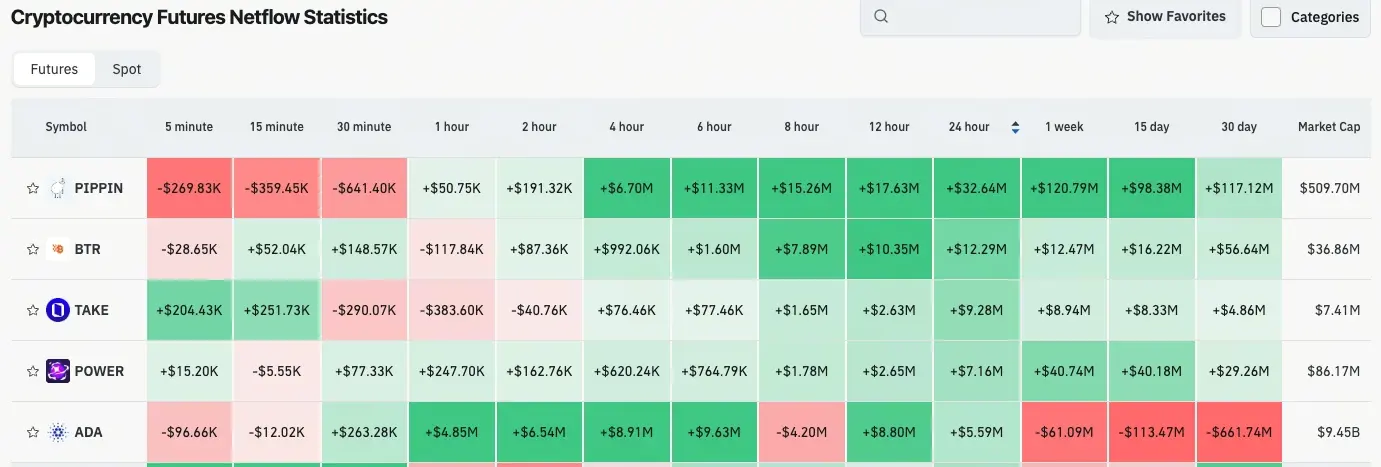

- In the past 24 hours, contracts for $PIPPIN, $BTR, $TAKE, $POWER, $ADA, and others saw net outflows, indicating trading opportunities.

X KOL Selected Opinions

Phyrex Ni (@Phyrex_Ni): “Lately, daily tasks have been tough, and today’s sharp market decline seems to be based on expectations that Friday’s CPI data will be very poor, exceeding both previous and forecasted values. Even JPMorgan has predicted that the monthly inflation rate will rise by 0.4%. Given the positive economic data from non-farm payrolls, inflation is the most closely watched indicator. A 0.4% monthly increase suggests broad CPI will also rise, so today’s decline might be a risk-averse move by investors.”

“This indicates that if next Friday’s CPI data is indeed very bad, the decline could continue. After Friday, it’s the Chinese New Year (markets in China, Korea, Vietnam, Taiwan, and Hong Kong will be closed), and it’s also a three-day holiday in the U.S., which will significantly reduce market liquidity. If any surprises occur during this period, it could be quite chaotic.”

“However, I believe short-term data isn’t enough to determine the Federal Reserve’s monetary policy. Trump doesn’t need another Powell; Powell’s long-term successor, Waller, might surprise us or shock Trump. We won’t know until June. Until then, things might be tough, including Trump’s tariffs.”

“Looking at Bitcoin data, turnover continues to increase, and investor sentiment remains tested. But from the data on BTC transferred to exchanges, new sell-offs aren’t significant, though exchange reserves are rising, indicating decreasing buying power. From sentiment to capital flow, everything looks bearish, showing signs of entering a bear market.”

“However, URPD data shows the chip structure remains healthy; early investors and high-loss investors haven’t changed much. Most investors are still relatively stable emotionally. But due to a lack of buying power and liquidity gaps, even small sell-offs can’t be absorbed well.”

“Let’s see what Friday’s CPI brings.”

Today’s Outlook

-

China’s M2 money supply at the end of January (yearly rate), previous 8.5%

-

Eurozone December seasonally adjusted trade balance (billion euros), previous 10.7

-

Eurozone Q4 GDP revision (quarterly rate), previous 0.3%

-

Eurozone Q4 GDP revision (annual rate), previous 1.3%

-

U.S. January core CPI (annual rate), previous 2.6%

-

U.S. January CPI (annual rate), previous 2.7%

Related Articles

Polymarket and Substack have reached an exclusive partnership to integrate market data into news content.

Project Hunt: Web3 Loyalty Reward Platform RoveWorld for the projects unfollowed the most by top figures in the past 7 days

Overview of popular cryptocurrencies on February 19, 2026, with the top three in popularity being: Espresso, Helium, Naoris Protocol

U.S. stocks closed with mixed gains and losses in the crypto sector, HOOD rose over 10.65%

U.S. stocks closed with mixed gains and losses in the crypto sector, HOD up over 10.65%

Market Report: Top 5 Cryptocurrency Declines on February 19, 2026, with the Largest Drop in Optimism