Search results for "BERA"

"Balancer Hacked: Update on the $128 Million Case" Gnosis Chain announces the initiation of a Hard Fork to recover the stolen funds.

Gnosis Chain official X account announced the launch of a Hard Fork to recover the funds lost in the Balancer hack.

(Previous summary: Balancer issues a "final ultimatum" to the hacker with 96 hours to return the money: otherwise, all means will be used to find you)

(Background Information: Berachain: Victims of the "Balancer Hacking Incident" must check their own status and promptly retrieve ETH and BERA)

Less than a month after the major market crash on October 1011, the decentralized finance (DeFi) protocol Balancer V2 suffered a severe hacking attack in early November, where hackers exploited a rounding error in the precision of the protocol's Composable Stable Pools.

動區BlockTempo·2025-12-23 16:35

Berachain exposed VC refundable "secret protocol" destroys user trust? Encryption lawyer: practically unable to exercise rights

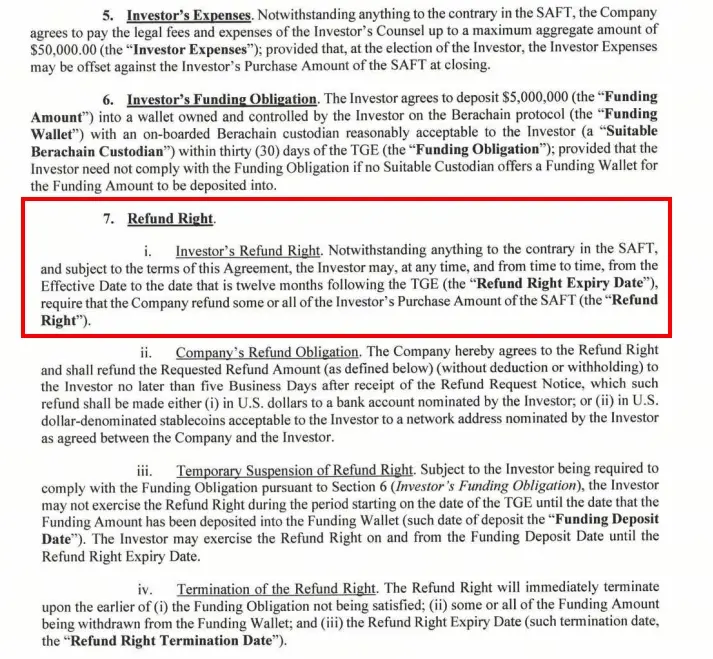

Berachain has been exposed for a $25 million VC refund clause, plunging the community into a legal dispute. (Background: Berachain: "Victims of the Balancer hacking incident must check their status and timely reclaim ETH and BERA") (Additional context: Let the liquidity flywheel turn, Berachain bear chain mining full guide) Berachain, claimed to be built specifically for "encryption-native institutions," is now facing a Crisis of Confidence, with the BERA Token plummeting 93% since its TGE peak. A leaked document recently revealed that the hedge fund Brevan Howard's Nova Digital holds a $25 million "refund anytime" privilege, shaking the market. The institution-exclusive "capital protection clause" unexpectedly guarantees capital protection for VC.

動區BlockTempo·2025-11-26 08:54

Berachain Faces Pressure After Investor Refund Clause Sparks Transparency Concerns

Berachain faces pressure as a rare refund clause for Nova Digital raises concern and brings new focus to investor rights.

The BERA token trades far below entry levels and this fuels questions about fairness and the structure of Series B terms.

Network outflows and halted operations add strain as i

BERA-3,83%

CryptoNewsLand·2025-11-25 14:14

Berachain Faces Investor Refund Pressure Ahead of 2026 Deadline

Nova Digital can demand $25M refund, leaving Berachain at risk, as BERA trades far below Series B $3 price.

Framework Ventures holds $72.4M in BERA, facing $50M+ losses amid refund rights and token outflows.

Technical issues and app migrations have shrunk Berachain’s ecosystem, challenging

BERA-3,83%

CryptoFrontNews·2025-11-25 12:02

The price fell by 90%, but the leading VC is performing a capital preservation act? Berachain urgently clarifies.

Author: Nancy, PANews

Reprint: White55, Mars Finance

On November 25, overseas media Unchained published an in-depth investigative report, revealing that the star public chain Berachain signed privacy agreements with VCs, secretly granting its lead investor Nova Digital a no-risk exit privilege. As the coin price and ecosystem were still weak, this news immediately caused an uproar in the Berachain community. However, Berachain's official response denied this, stating that Nova remains one of the largest holders of BERA tokens.

It was revealed that the leading investment institution Nova enjoys exclusive refund rights, while Berachain denies any preferential treatment.

In this round of the crypto cycle, the golden age of crypto VC is gradually fading, returns are shrinking, influence is no longer, and the industry's impact is greatly diminished. There is even a wave of resistance against VC coins, and investment institutions are finding it difficult to make profits.

MarsBitNews·2025-11-25 11:54

Berachain rocked by privilege scandal! Hedge fund Brevan Howard granted exclusive "full refund" clause

L1 blockchain Berachain has been exposed for secretly granting a special "full refund within one year" clause to Nova Digital, a fund under the world-renowned hedge fund Brevan Howard, during its Series B financing round. Investors can request a refund of $25 million in cash if BERA underperforms. Senior crypto lawyers warn that this disclosure controversy may violate SEC anti-fraud requirements.

MarketWhisper·2025-11-25 07:37

Berachain Faces Refund Rights Controversy: Brevan Howard Fund Receives $25 Million Special Terms

After the token generation event on February 6, 2025, it was revealed that Berachain granted Nova Digital Fund, under Brevan Howard, a refund right for its $25 million investment, valid until February 6, 2026. This rare clause allows the fund to recover its principal even if the price of the BERA token plummets by 66%, while other investors such as Framework Ventures have already incurred over $50 million in unrealized losses. Legal experts point out that such clauses may violate securities law disclosure requirements and most-favored-nation clauses, sparking renewed scrutiny in the industry over the transparency of venture capital terms.

BERA-3,83%

MarketWhisper·2025-11-25 06:30

Berachain was exposed for giving Brevan Howard Fund privileges: "Poor coin performance" allows for a refund of ten million dollars?

L1 Blockchain Berachain was exposed for secretly granting a special "full refund within one year" clause to Brevan Howard's fund, a globally renowned hedging fund, during the B round financing. Investors can request a refund of $25 million in cash if BERA performs poorly. As the price of BERA coins weakens and the ecosystem declines, this revelation has triggered a serious Crisis of Confidence.

From Meme Chain to Glamorous Investment Background: The Charm and Risks of Berachain

Founded in 2021 from the "Bear Smoking Weed" NFT, Berachain has quickly risen from meme culture to become one of the most notable new public chains in the crypto space within just three years.

The project has raised at least $142 million to date, with the latest round valuing it at $1.5 billion, by Framework Ventures and Brevan.

ChainNewsAbmedia·2025-11-25 02:53

Berachain co-founder responds to "Nova Digital has the right to a refund": the information is incomplete and inaccurate, Nova is still one of the largest Token holders.

According to Deep Tide TechFlow news, on November 25, Berachain co-founder Smokey the Bera responded on social media to recent media reports, stating that the reports are "incomplete and inaccurate."

Smokey the Bera clarified the details of Brevan Howard's investment agreement: Brevan Howard through its Abu Dhabi office

BERA-3,83%

DeepFlowTech·2025-11-25 02:14

Berachain has been reported to provide a $25 million refund option to Nova Digital in its Series B financing.

Berachain has been disclosed to have granted Nova Digital, a subsidiary of Brevan Howard, a $25 million "refund right" in its Series B funding round in 2024, which can be requested to return the full principal investment within one year after the TGE on February 6, 2025; according to additional terms, Nova must deposit $5 million into Berachain within 30 days after the TGE to exercise this right. This rare clause was not disclosed to other investors, raising questions about whether it violates the MFN clause and information disclosure obligations, while the price of BERA has fallen by about 66% compared to Nova's investment price of $3. Berachain co-founder Smokey the Bera responded that all parties are using the same documents.

BERA-3,83%

WuSaidBlockchainW·2025-11-24 16:40

Berachain: "Victims of the 'Balancer hack incident' must check their status and promptly reclaim ETH and BERA"

The Berachain Foundation has released the latest announcement, urging all users who provided liquidity on BEX (Berachain ecological DEX) during the "Balancer incident" to immediately check their status and timely withdraw their funds. (Background: Balancer released an official report: $125 million lost due to rounding function bug) (Additional context: Balancer gives hackers a "final ultimatum" with a 96-hour countdown to pay back: otherwise, all means will be used to find you) The Berachain Foundation issued the latest announcement through the official X account on the evening of November 18, urging all users who provided liquidity on BEX (Berachain ecological DEX) during the "Balancer incident" to immediately check their status. The announcement content is as follows: As

動區BlockTempo·2025-11-18 16:32

Berachain Recovers $12.8 Million Lost in Balancer V2 Exploit After Coordinated Effort With White-...

Berachain fully recovered $12.8 million lost in the Balancer V2 exploit, showing strong security action.

Over 1000 users will receive recovered funds through a verified redistribution system, ensuring fairness.

The BERA token regained value after the recovery, reflecting renewed trust in the Berac

CryptoNewsLand·2025-11-05 10:25

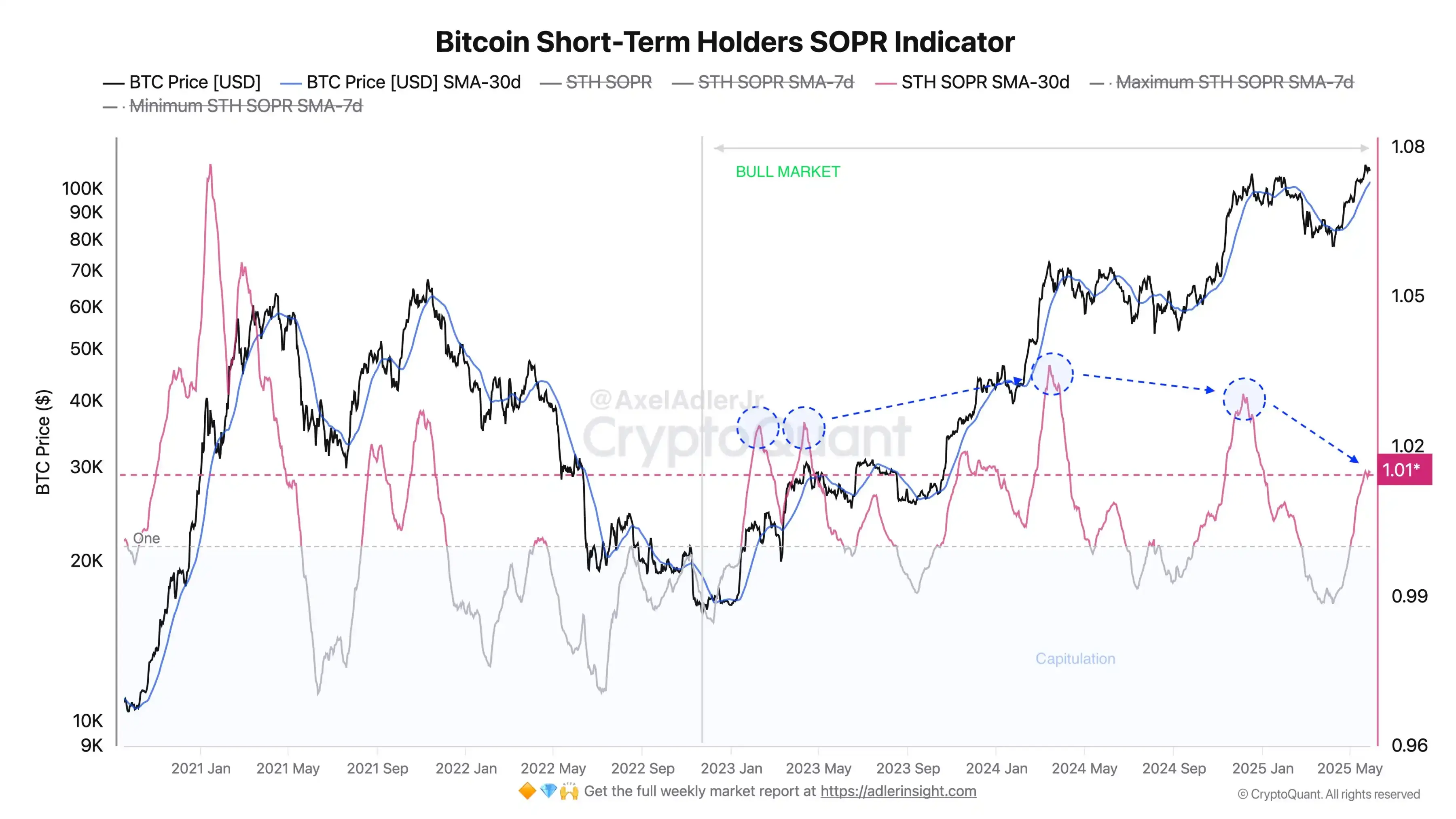

BERA holds above $1.5 as the broader market bleeds: check forecast

It is an extremely bearish start to November as the cryptocurrency market has been underperforming over the past few days.

Bitcoin, the leading cryptocurrency by market cap, has dropped to the $103k level and risks trading below $100k for the first time since June.

Altcoins are suffering even

BitcoinInsider·2025-11-05 09:01

How does the timing of TGE affect project development? Identify investment opportunities in valuable tokens by distinguishing between strong and weak TGEs.

Looking back at the price performance of Berachain ($BERA), Movement ($MOVE), and Hyperliquid ($HYPE), it can be observed that the "token generation event (TGE)" can serve as a starting point for project value discovery or as the beginning of a bubble burst. Distinguishing between strong and weak TGE, mastering the timing of issuance, and understanding market liquidity are becoming essential courses for a new generation of investors.

From high-heat TGE to product cold launch: hype does not guarantee success.

According to Justin Vogel, co-founder of Safary, the TGE data from the past 18 months reveals a harsh reality: "Almost all high-profile and highly anticipated TGEs have crashed within 48 hours of issuance. The new strategy is to wait until there is adoption before the TGE, or to issue on a small scale and accumulate value over time."

ChainNewsAbmedia·2025-10-22 09:14

Gate Research Institute: VanEck submits application for Lido stake Ethereum ETF | Greenlane launches BERA treasury strategy

crypto market panorama

BTC (+1.96% | Current price 110,160 USDT): In the past 24 hours, the crypto market has experienced a significant recovery, with the total market capitalization returning to approximately $3.87 trillion, an increase of about $150 billion in a single day. Bitcoin has broken through the $111,000 mark, rising nearly 2% during the day, with bullish sentiment clearly warming up. From a technical perspective, Bitcoin's daily K-line has recorded three consecutive bullish candles, and the MACD death cross is further narrowing, indicating that bearish momentum is weakening and bulls are gradually gaining the upper hand. The price has successfully broken through the 5-day moving average and has gained support near the 10-day moving average. If it can maintain its current position, it is expected to further open up upward space. Overall, this round of rebound is closely related to favorable macro news—the market expects that the two major global economies are likely to reach a fair trade agreement in the coming week, thus alleviating risk-averse sentiment. Bit.

GateResearch·2025-10-21 05:40

Berachain rises as Greenlane launches $110M treasury strategy: can BERA extend the rally?

Berachain price gained slightly amid news of a first BERA treasury strategy.

Greenlane Holdings bet not only fortifies its treasury playbook but may herald a wave of corporate adoption, boosting price.

The crypto industry is witnessing an explosion in digital asset treasuries.

Berachain price

BERA-3,83%

BitcoinInsider·2025-10-20 17:43

Greenlane Holdings invests 110 million USD in a cryptocurrency reserve strategy with Berachain token (BERA)

Greenlane Holdings announced a $110 million private investment to support its new cryptocurrency reserve strategy focused on Berachain (BERA). Led by Polychain Capital, the funding will enhance liquidity and strengthen the balance sheet as Greenlane integrates decentralized infrastructure to innovate in Web3.

BERA-3,83%

TapChiBitcoin·2025-10-20 13:41

Berachain’s 700% Surge Sparks Buzz While BERA Holds, ATOM Declines, and VeChain Faces Pressure

The altcoin market shows mixed movements as BERA consolidates after volatility, ATOM declines with weak momentum, and VeChain experiences sustained bearish pressure, indicating uncertainty in short-term trading dynamics.

CryptoNewsLand·2025-08-31 00:24

Berachain price holds at $2.75 as bulls target continuation of the uptrend

price is up 5% in the past 24 hours as the altcoin trends among top gainers today.

With BERA benefiting from a 60% spike in daily volume, bulls are attempting to stabilize at $2.75, which could see the cryptocurrency’s price target $4.00.

Although profit taking across the crypto market has

BERA-3,83%

BitcoinInsider·2025-08-29 13:06

Berachain (BERA) price outlook post RFRV Batch 22 governance proposal

is in the spotlight after a notable price surge coincided with the approval of the RFRV Batch 22 governance proposals.

The RFRV Batch 22 aims to strengthen liquidity in two major trading pairs while setting the stage for deeper integration of BTC and ETH into the network.

Governance shift

BitcoinInsider·2025-08-28 19:02

BERA Token Shows Signs of Reversal After Key Support

BERA token is showing signs of recovery after bouncing off key support at 1.400 USDT, with higher trading volume and a double-bottom formation indicating potential bullish momentum. It may reach 2.800 USDT if it maintains solid resistance levels.

CryptoFrontNews·2025-08-24 18:47

25% of wBERA Now Locked in Berachain's PoL V2, Yields Reach 180% - Crypto News Flash

25% of all on-chain wBERA is now locked in PoL V2, doubling from just three days ago.

PoL V2 offers 180% yield while enabling direct BERA staking rewards through a new protocol module.

---

Around a quarter of the total wBERA circulating on the network is now officially parked in PoL V2. This

BERA-3,83%

CryptoNewsFlash·2025-07-27 11:11

Berachain Guardians Approve PoL V2 and Expand Vault Access - Crypto News Flash

PoL V2 approval enables native yield generation for BERA directly within the Berachain ecosystem.

RFRV Batch 17 introduces new vaults from community builders Henlo and Ultraviolet.

---

The recent approval of the Berachain Guardians has sparked renewed enthusiasm within the community. After a

CryptoNewsFlash·2025-07-23 08:17

Berachain launches "PoL v2", initiating the $BERA native yield mechanism.

July 21, 2025 — Berachain announced the official launch of its core incentive module "Proof of Liquidity v2 (PoL v2)", marking the first time that $BERA holders can directly participate in the protocol's native revenue channels through staking, enhancing the token's value capture capability.

This upgrade introduces a buyback mechanism driven by PoL incentives, where all non-$BERA incentives will be automatically converted into $BERA for distributing rewards to stakers. This mechanism does not change the existing operation of PoL within the DApp and treasury, and users can directly participate in staking through hub.berachain.com/stake to enjoy a simple and transparent on-chain reward experience.

The specific characteristics of the staking mechanism include:

● Native yield path: Users stake $BERA to earn protocol rewards after $BERA buyback;

● 7 days解

BERA-3,83%

TechubNews·2025-07-22 04:31

BERA Price Prediction: On-chain Activity Surge, Technical Breakthrough May Hit $3

According to CoinMarketCap data, Meme coins are leading the top 200 cryptocurrency assets, with SPX6900 (SPX) rising by 21%, followed closely by BERA with a 20% increase. The rise of BERA is mainly driven by on-chain data and governance. The protocol layer buyback mechanism, a 33% block reward proposal, and a 7-day unstaking window have increased long-term appeal. In terms of price, BERA has successfully broken through the key high and low points on the daily chart; if it holds above $2, it is expected to successively challenge $2.5, $3.5, and even $4.5. On-chain transactions, active addresses, and whale movements indicate that the market is turning positive. If the market maintains its strength, BERA still has upward potential.

BERA-3,83%

MarketWhisper·2025-07-17 09:01

Can BERA reach 3 USD?

Giá của Berachain (BERA) đã vượt qua các mức cao gần đây, cho thấy một sự đảo chiều xu hướng tiềm năng. Sự gia tăng đáng kể về khối lượng giao dịch và sự gia tăng trong số lượng địa chỉ ví duy nhất cho thấy sự tham gia mạnh mẽ của người dùng. Nếu BERA duy trì hỗ trợ trên $2, nó có thể đạt $3, với tiềm năng tiếp cận $4.5. Tuy nhiên, sự hỗ trợ giá không đủ có thể dẫn đến một sự đảo chiều. Tổng thể, một thị trường tiền điện tử thống nhất là rất cần thiết cho sự tăng trưởng bền vững.

BERA-3,83%

TapChiBitcoin·2025-07-17 01:30

How does PoL v2 reshape the value capture path of $BERA?

The PoL v2 mechanism of Berachain captures the value of the main coin BERA by reconstructing the incentive model, thereby dropping the user participation threshold and providing new revenue mechanisms and valuation models for the project party and investors. This innovative model may lead other public chains to shift in value distribution, enhancing ecological health.

BERA-3,83%

星球日报·2025-07-15 05:53

Berachain launches PoL v2, opening the $BERA revenue channel and strengthening Token value capture.

The new generation public chain Berachain has launched the PoL v2 proposal, aimed at upgrading the core incentive mechanism Proof of Liquidity, providing native yield pathways for BERA token holders, enhancing token demand and long-term value. The new module introduces a 7-day unbinding period, encouraging long-term holding while maintaining the stability of the BGT ecosystem. The proposal will go live after the governance vote on July 21, and the official team calls on the community to actively participate in discussions.

BERA-3,83%

TechubNews·2025-07-14 16:14

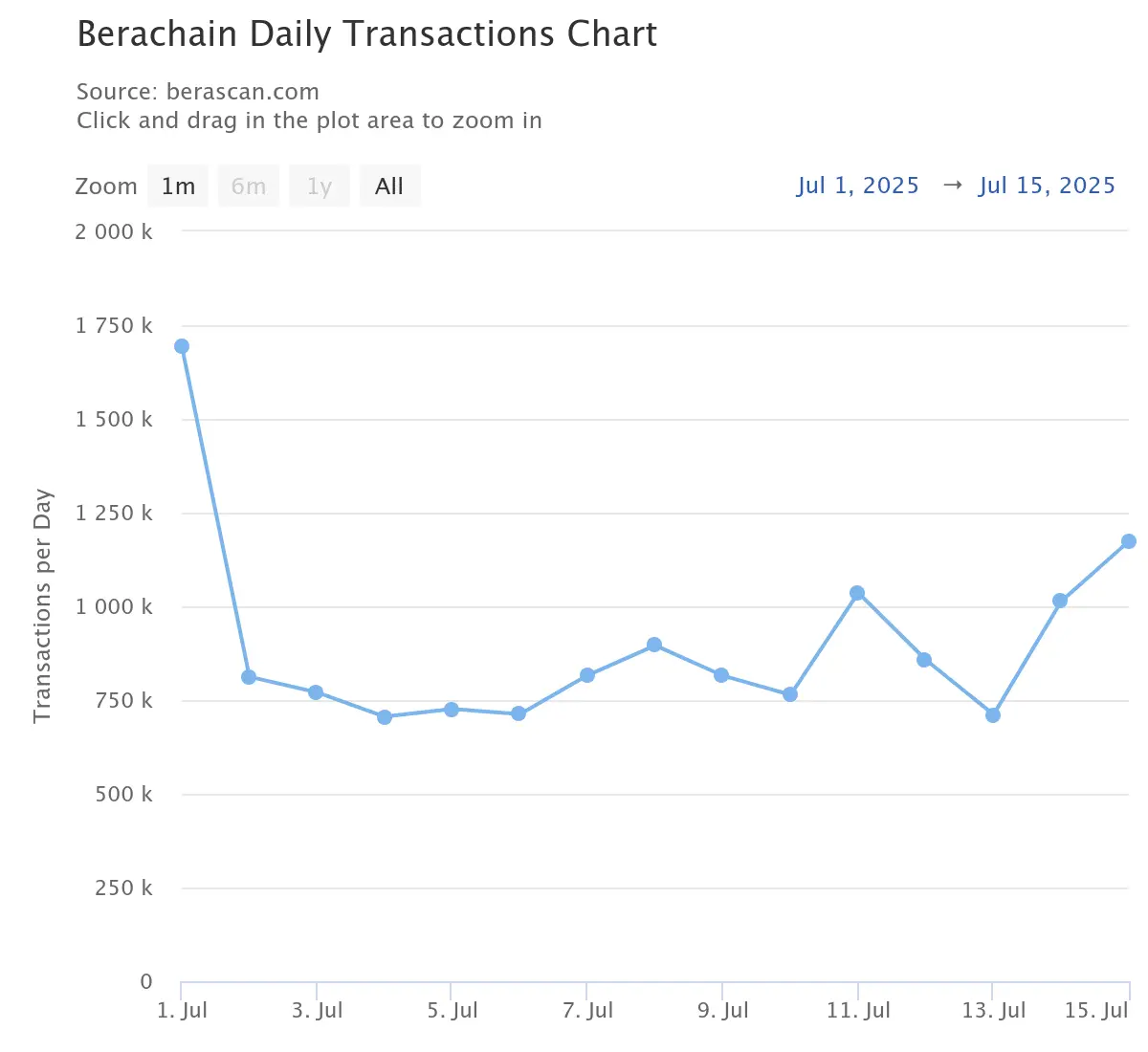

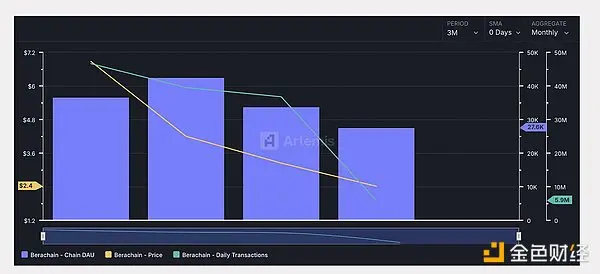

On-chain data reveals the current status of 5 new public chains.

Author: Stacy Muur Translator: Shan Ouba, Jinse Finance

At the beginning of 2025, the blockchain industry welcomed the launch of several new public chains that garnered high attention, each claiming to possess unique value propositions. Six months later, data revealed a more sobering reality: the actual popularity post-launch differed from expectations.

Performance Overview: Monthly Key Indicator Changes

On-chain performance analysis

Berachain: A Reality Test of Market Cycles

Key Highlights: Adopts the "Proof of Liquidity (PoL)" consensus mechanism, combining network security with liquidity provision.

Token: BERA, initial price $6.90, current price $2.45 (drop 58%)

Berachain attracted $3.1 billion in liquidity before its launch, with a total value locked (TVL) within 20 days of the mainnet launch.

金色财经_·2025-06-16 12:50

Cross-chain bridge fund flow in the past week: Arbitrum net inflow of $162 million, Ethereum net outflow of $123 million.

According to a report from 深潮 TechFlow on June 9, data from DefiLlama shows that the net inflow of funds into the Arbitrum cross-chain bridges reached 162 million USD, ranking first among all public chains. Following are Bsc and Unichain, with net inflows of 68.47 million USD and 43.7 million USD, respectively.

Ethereum, Avalanche, and Bera saw net outflows of $123 million, $80.07 million, and $64.49 million, respectively.

DeepFlowTech·2025-06-09 01:33

Bithumb Announces Crucial BERA Suspension for Network Upgrade

Hey crypto enthusiasts! Important news from the South Korean crypto exchange giant, Bithumb. If you’re holding or trading Berachain (BERA) tokens on their platform, there’s a crucial update you need to be aware of. Bithumb has officially announced a temporary suspension of deposits and withdrawals f

BERA-3,83%

BitcoinWorldMedia·2025-06-02 19:45

Bitcoin falls below $105,000, is the bull gone or is it consolidating?

Original author: 1912212.eth, Foresight News

On May 30, the last day of the Bitcoin 2025 conference, the market once again fell victim to the curse of significant declines during the event.

Bitcoin fell below $105,000 this morning, reaching a low of $104,600. Ethereum also dropped from a high of $2,788 to a low of $2,557. The altcoin market is generally experiencing a correction, with some altcoins like BERA even hitting all-time lows.

In the futures market, according to Coinglass data, the total liquidations across the network in the past hour amounted to 330 million USD, with long positions liquidated at 321 million USD and short positions liquidated at 7.89 million USD.

In the macro market, both COIN and MSTR in the U.S. crypto stocks fell after hours. Regarding the Fed's interest rate cuts, there has been persistent indecision, with Fed's Daly stating this week.

BTC-1,68%

星球日报·2025-05-30 08:12

Data: Arbitrum, Sei, and Optimism ranked in the top three for net inflows of funds across cross-chain bridges in the past 7 days.

According to Deep Tide TechFlow news on May 26, data from DefiLlama shows that the net inflow of funds into the Arbitrum cross-chain bridges reached $1.074 billion in the past 7 days, ranking first among all public chains. Following are Sei and Optimism, with net inflows of $43.01 million and $32.98 million, respectively.

Ethereum, Bera, and Noble had net outflows of $293 million, $79.2 million, and $46.79 million, respectively.

DeepFlowTech·2025-05-26 04:48

Berachain (BERA) Price Dropped to $3.61 Amid Crypto Market Fluctuations

The BERA token price has taken a significant hit over the past few months, slipping from its peak of $7.624 to around $3.7. Investors and traders who once had high hopes for Berachain are now worrying about its downward trend. Currently, BERA is trading at $3.61, reflecting a slight dip of 1% over t

Coinfomania·2025-04-30 12:11

Berachain has seen a net capital outflow of 300 million dollars in the past 9 days.

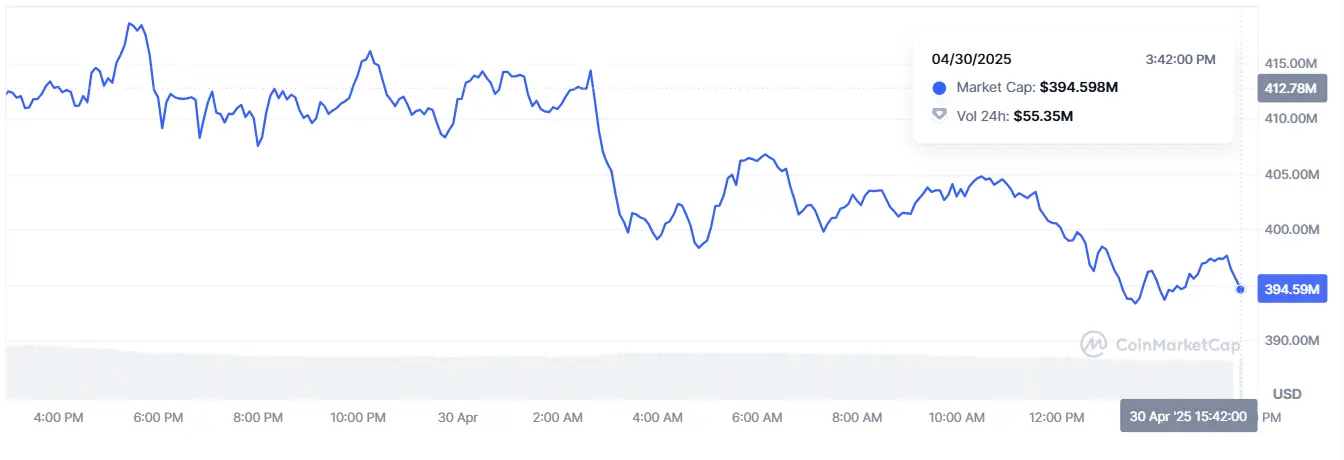

TokenTerminal data shows that the daily active users of a certain chain dropped sharply from a historical high of 60,000 to 23,000, a year-on-year decrease of 61%. At the same time, the market capitalization of the on-chain token BERA recently experienced a big dump of 40%, and the TVL also fell by 23% to 2.7 billion USD.

BERA-3,83%

TechubNews·2025-04-10 09:41

Berachain (BERA) falls 50% in one month as warning indicators continue to decline

Berachain (BERA) is under significant pressure, down 50% over the past 7 days as technical indicators continue to issue warnings. Momentum still leans towards the downside, with the RSI remaining low in the oversold territory and DMI indicating that sellers remain dominant.

The EMA structure also indicates the risk of further fall, making

TapChiBitcoin·2025-04-09 11:58

Berachain (BERA) Slides 50% In a Month As Indicators Warn Of Further Downside

Berachain (BERA) has dropped 50% in the past week with technical indicators showing bearish signals. Momentum is low, RSI is oversold, and DMI indicates sellers dominating.

BeInCrypto·2025-04-08 16:00

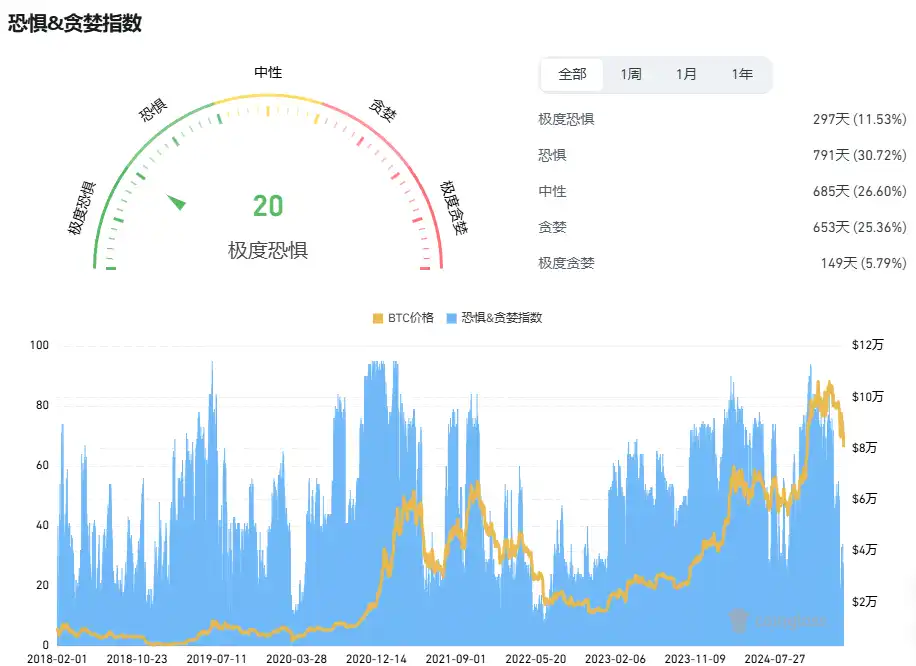

The Cryptocurrency War Becomes Worse After the Stock Market Crash on Black Monday

President Donald Trump's declaration of April 6 as "Liberation Day" stirred global financial turmoil. Stock markets in China, Japan, Germany, UK, and the US plummeted for two consecutive days. The cryptocurrency market reflected the stock market decline. Global cryptocurrency market cap dropped significantly by 8.49% to $2.44 trillion as investor fears rose. Bitcoin, Ethereum, Solana, and XRP all suffered significant losses, with Ethereum and XRP dropping over 14%. Transaction volume surged by 186%. Over $1.02 billion in cryptocurrency liquidations occurred, with Fear & Greed Index hitting Extreme Fear at 17. While most cryptocurrencies suffered losses, KAVA showed minimal gains, while BERA, LTC, and LDO were among the biggest losers. Stay informed with timely updates from the cryptocurrency market as the Black Monday crash continues to impact the industry.

Blotienso·2025-04-07 08:35

BERA Price Consolidates At $7.90 As Buyers Aim for a Breakout Past $8.488

BERA maintains support at $6.625, while resistance at $8.488 holds firm, keeping price action within a tight trading range.

RSI at 52.17 signals a neutral stance, but a breakout above 55 could drive bullish momentum toward higher resistance.

Price consolidation near $7.90 suggests accumulation, wi

CryptoNewsLand·2025-04-03 23:56

Crypto market wrap: tariffs jitters continue as HYPE, BERA and BONK crash

The cryptocurrency market experienced significant volatility late Wednesday and early Thursday.

As such, several altcoins, including Hyperliquid, Berachain, and Bonk, crashed by double digits.

Furthermore, Bitcoin (BTC) gave up gains from above $88k

Notably, markets remained jittery after US

BitcoinInsider·2025-04-03 12:40

Today's rise and fall of the top 100 crypto assets by market capitalization: EOS rise 8.22%, BERA fall 6.68%

According to the news from 深潮 TechFlow on March 30, based on Coinmarketcap data, the performance of the top 100 crypto assets by market capitalization today is as follows,

Top five gains:

EOS (EOS) rose 8.22%, current price 0.6006 USD;

Jupiter (JUP) rose 4.05%, current price 0.4827 USD;

Jito (JTO) rose 3.65%, current price 2.20 dollars;

Cronos (CRO) rose by 3.44%, current price is 0.1041 dollars;

Toncoin (TON) rose by 3.18%, current price is 3.81 USD.

Top five declines:

Berachain (BERA) dropped 6.68%, current price 7.42

DeepFlowTech·2025-03-30 15:28

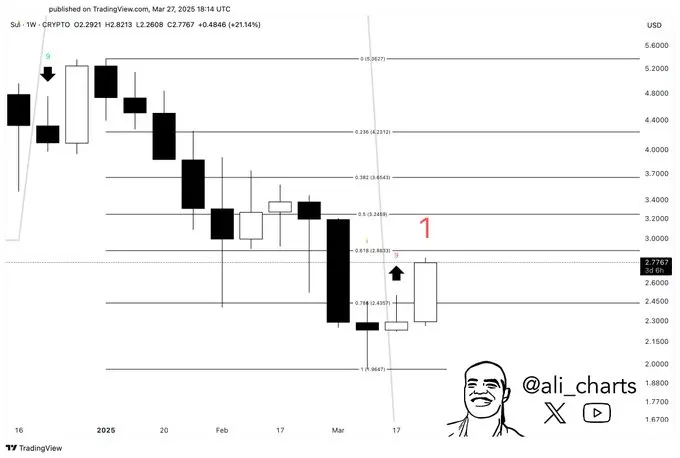

Trader Says Newly Launched Altcoin About To ‘Open the Gates’ to 70% Rally, Updates Outlook on XRP and SUI - The Daily Hodl

Cryptocurrency trader and analyst Ali Martinez is leaning bullish on an altcoin that’s less than two months old while unveiling his forecast for XRP (XRP) and Sui (SUI).

Martinez tells his 134,300 followers on the social media platform X that the native token of Berachain (BERA), the newly

GateUser-299f2bac·2025-03-29 05:30

🔥 Annualized 500%+ Want to know more? This article teaches you how to mine with Berachain!

Berachain's TVL has risen by 40% in the last month, of course, because there are many high-quality mining opportunities on it! Today, let's go to Bear Chain to dig for gold 👇

Step 1: First find high-yield pools

hub.berachain.com/vaults/

On berahub, you can view information about Reward Vaults, including trading pairs and the DEX for group LPs. For example, the first NAV-Bera Kodiak represents the NAV-Bera trading pair on Kodiak.

BGT Capture represents the current BGT emission ratio obtained by this LP, with higher data indicating higher rewards.

BGT APR is the BGT yield divided by the corresponding pool.

BERA-3,83%

Biteye·2025-03-28 04:11

Today's Crypto Assets market capitalization top 100 Tokens rise and fall: BERA rises 10.04%, IP falls 4.42%

Today, among the top 100 Crypto Assets in the market, the top five Tokens with the highest rise include Berachain, Toncoin, Curve DAO Token, Maker, and Celestia; the top five Tokens with the highest fall are Story, Helium, Cronos, Bonk, and Injective.

DeepFlowTech·2025-03-27 15:46

Crypto Market Today (21st March 2025): Bitcoin Volatility Hits 6-Month High!

Fear and Greed Index drops to 27, showing market fear. Bitcoin sees high volatility. Kava, Bera, and Bonk surge in the top 100 cryptocurrencies today.

BitcoincomNews·2025-03-21 06:43

Berachain (BERA) Might Reclaim $7 As Selling Pressure Eases

Berachain (BERA) is currently trading around $6.05, with a market cap sitting near $653 million, after pulling back from a recent high of $7.08 reached on March 17.

BeInCrypto·2025-03-20 16:00

Funding inflow ranks second among public chains. Can Berachain's liquidity narrative reverse the Crisis of Confidence?

Original author: Frank, PANews

In the context of the overall downturn in the cryptocurrency market recently, Berachain ranks second in the public chain sector with a net inflow of $360 million in funds over the past month, becoming one of the few Layer 1 projects to experience growth against the trend. After the mainnet launch, its Total Value Locked (TVL) stabilized at $2.9 billion, placing it sixth in the entire network, validating the attractiveness of its Proof of Liquidity (PoL) mechanism for staked funds.

However, the ecosystem is also facing some controversies, such as the sharp fluctuations in the price of the token BERA, the disparity in airdrop distribution raising questions about fairness, and the co-founders publicly reflecting on the token economic model. After the airdrop ends, can Berachain rely on the liquidity narrative of the PoL mechanism to regain community trust and transform from a new force into an evergreen entity?

Net capital inflow in the month ranks second, and TVL enters the top six.

Capital flow

BERA-3,83%

星球日报·2025-03-19 12:10

$112 mln flows into Berachain, but why is BERA still bearish?

Berachain [BERA] has seen a 4.58% decrease in the last 24 hours, following a trend of declining prices. Despite significant liquidity inflows, selling pressure prevails. Investors are selling BERA across platforms, influencing market sentiment. Bearish trends dominate spot and derivative markets, yet there is potential for a price rebound if support levels hold.

CryptoGlobalNews·2025-03-12 08:10

Gate Research: 2025-02-02 Web3 On-Chain Insights

This report summarizes the Web3 on-chain data for February 2025, with the cryptocurrency market experiencing a pullback after hitting highs, with some holders in the red. However, while the market is in a correction, ecological development is still progressing steadily. On February 6th, the Berachain mainnet was officially launched, and quickly became the focus of the market with its proof-of-liquidity (PoL) mechanism and three-token model. With the rapid development of the Berachain ecosystem, the value of $BERA tokens is not only reflected in trading activities, but also gradually becomes the core asset of internal liquidity in the ecosystem, driving on-chain applications and user growth.

GateResearch·2025-03-10 05:39

Bitcoin has fallen to $80,000 again, where are the key support and resistance levels?

introduction

The cryptocurrency market is in turmoil. Yesterday, March 9, Bitcoin – the bellwether of the crypto world – plunged 7% and the price retreated from its highs, triggering widespread panic in the market. According to The Block, the centralized exchange (CEX) spot market turnover reached $1.77 trillion in February, a new low for the year, but down 23.7% from $2.32 trillion in January, indicating a significant contraction in market activity. Meanwhile, crypto analyst Miles Deutscher noted on social media that only 12 of the top 100 crypto tokens by market capitalization have achieved positive returns over the past 90 days. FOR EXAMPLE, BERA SKYROCKETED 579.63%, TRUMP ROSE 85.61%, AND BITCOIN FELL 13.47%, LI

律动·2025-03-10 04:02

Load More