Search results for "SUPER"

AI funding boom drives a 30% surge in startup investments... OpenAI and SpaceX become the dominant forces

In 2025, global startup investment amounts surged by 30% compared to the previous year, once again setting a new record high. Centered around AI-leading companies such as OpenAI, SpaceX, and Anthropic, large-scale investments flooded in, reversing the overall atmosphere of the venture capital ecosystem. The total investment last year reached $425 billion (approximately 612 trillion KRW), a significant increase from $328 billion (approximately 472 trillion KRW) in 2024.

According to Crunchbase statistics, this year's defining feature is undoubtedly "super investments." OpenAI set a record for the largest private funding round in history with $40 billion (approximately 576 trillion KRW), while SpaceX established a new milestone with a private market valuation of $800 billion (approximately 1,152 trillion KRW). Google (GOOGL) with $32 billion (approximately 460

TechubNews·1h ago

Gate 2026 New Year VIP Feedback Program: USDT Gacha Task System Officially Launched

The 2026 VIP Super Friday event will be held from January 2 to January 8. VIP users can earn USDT gacha rewards by completing multiple tasks, with a maximum of 888 USDT available to draw. The event features a 100% winning system with limited quantities, encouraging users to deposit funds and trade.

GateLearn·12h ago

Elon Musk's XAI aggressively raises 20 billion USD in funding! Not only selling shares, but also using NVIDIA GPUs as collateral

Elon Musk's AI startup xAI completes $20 billion Series E funding, valuing at $230 billion. The funds will expand the Colossus super data center and adopt innovative equity and debt financing models, collaborating with companies like NVIDIA, Cisco, and others to ensure technological and financial support, accelerating the development of the large language model Grok.

ChainNewsAbmedia·13h ago

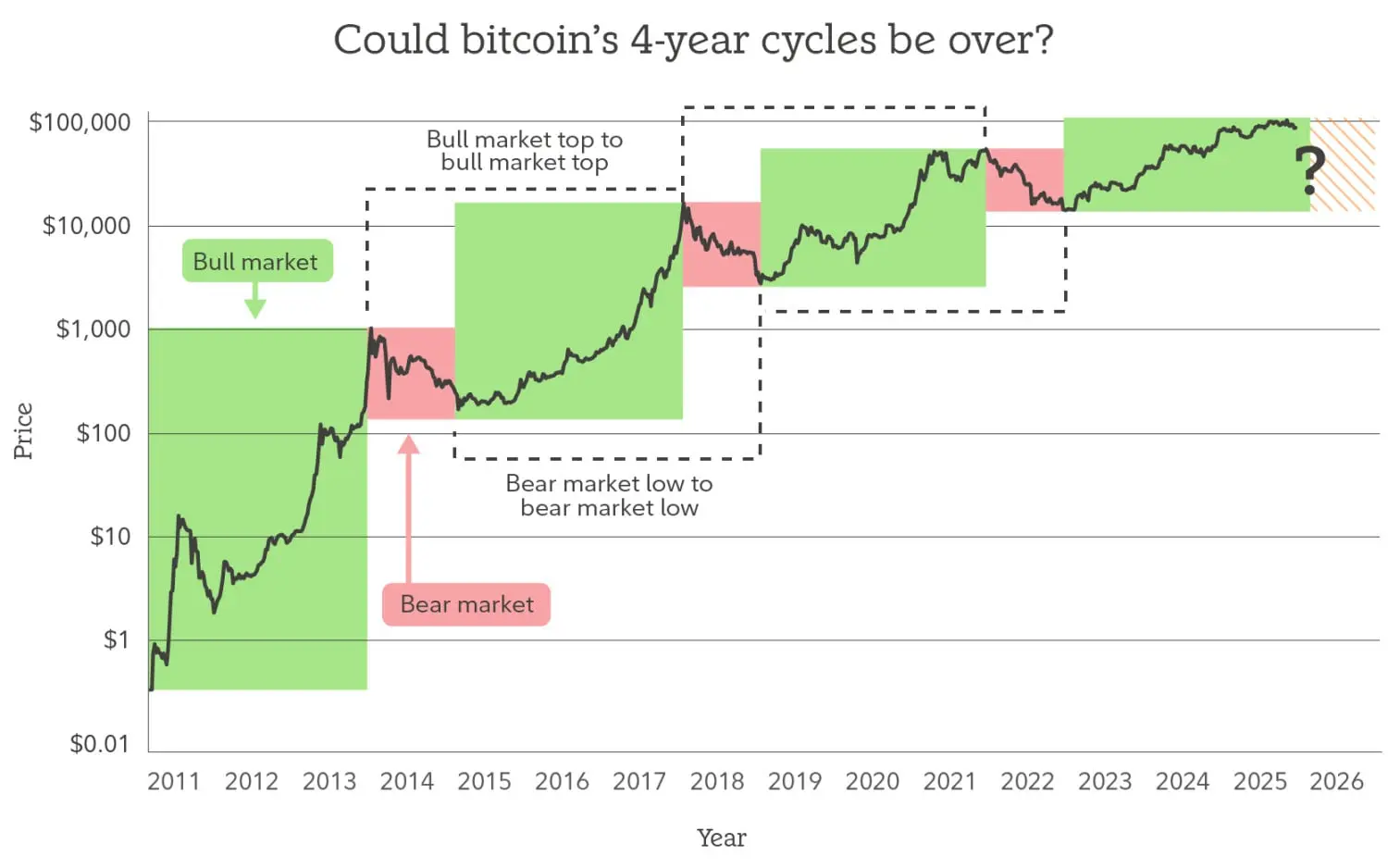

Fidelity 2026 Crypto Market Outlook: We May Be Entering a Super Cycle, with a Bull Market Lasting for Years

The cryptocurrency market is undergoing a transformation, with countries and corporations beginning to include it on their balance sheets. Trump has established Bitcoin reserves, indicating that cryptocurrencies are gradually gaining mainstream recognition. Despite price volatility, long-term investors remain optimistic about its value, especially in the context of the current market structural changes. Cryptocurrency demand may increase in the coming years, but price uncertainty should still be monitored.

BTC-2,45%

PANews·01-06 08:38

JupUSD Launches Shockingly! BlackRock BUIDL Fund Supports 90% Reserve Disclosure

Jupiter launches native stablecoin JupUSD, in collaboration with Ethena, with 90% reserves supported by the BAILD BUIDL Fund. It will be integrated into the entire Jupiter product suite, with a phased plan to exchange $500 million USDC collateral. JupUSD will become the key accounting unit of Jupiter's "super application."

MarketWhisper·01-06 04:04

Crypto giant spends $21 million to support Trump, launching the midterm election "policy defense battle"

The latest documents from the U.S. Federal Election Commission (FEC) show that two major cryptocurrency trading platforms, Gemini and Crypto.com, have contributed over $21 million to the super PAC "MAGA Inc.," which supports President Trump. They are among the largest single donors to the committee. Specifically, Gemini contributed 1.5 million USDC that has been settled, while Crypto.com's parent company, Foris DAX, invested $20 million in two separate transactions.

Although this massive donation occurred during a cycle when Trump does not need to run for re-election, its target is the critical midterm elections in 2026 that will determine control of Congress. The goal is to influence the direction of digital asset regulation policies in the coming years. This move marks that mainstream crypto companies are no longer content with behind-the-scenes lobbying but are instead engaging in the core political battles in the U.S. with unprecedented scale and directness, aiming to tilt legislation in favor of the industry.

MarketWhisper·01-06 02:56

2026, the Year of Hard Assets! Gold and silver enter a continuous ten-year super cycle

In 2025, silver rose by 165%, and gold increased by 66%, marking the best performance since 1979. Gold hit 91 new highs within 27 months, nearly breaking records every week. Experts point out that this is a structural re-pricing of global capital shifting towards hard assets. Goldman Sachs states that the market is still in the "beginning of a super cycle that could last ten years."

MarketWhisper·01-06 02:46

Last night's and this morning's important news (January 5th - January 6th)

Cryptocurrency exchanges Gemini and Crypto.com parent company donate $21 million to pro-Trump super PAC

According to FinanceFeeds, Gemini and Crypto.com parent company Foris Dax recently donated a total of $21 million to MAGA Inc., a super PAC supporting Trump, with Gemini providing $1.5 million in USDC and Foris Dax donating $10 million in cash twice.

Crypto data platform The

PANews·01-06 02:41

BlackRock Tokenized Fund BUIDL endorsement, Ethena support, Jupiter launches native stablecoin JupUSD

Solana's leading infrastructure aggregator Jupiter officially launches its native stablecoin JupUSD, which is provided with white-label services by Ethena Labs. Its reserve assets are 90% supported by BlackRock's tokenized fund BUIDL.

JupUSD is not an isolated product; its core strategy is to serve as a "unified accounting unit" deeply integrated into Jupiter's increasingly extensive "super app" matrix, including lending, perpetual contracts, spot trading, and prediction markets. As a signaling move, Jupiter plans to gradually convert approximately $500 million worth of USDC in the perpetual contract liquidity pool (JLP) into JupUSD. This marks a decisive step for Jupiter to evolve from a simple trading aggregator to a "super app" that controls the core financial layer, and introduces the first native stablecoin in the Solana DeFi ecosystem to receive deep endorsement from mainstream traditional financial giants.

MarketWhisper·01-06 02:30

Tom Lee outlines the 2026 crypto market roadmap: Bitcoin hits new highs in January, Ethereum enters a "super cycle"

Fundstrat Global Advisors Co-Founder and Chairman of Bitmine Immersion Technologies Tom Lee made bold predictions in a recent interview, stating that Bitcoin is expected to reach a new all-time high before the end of January 2026, while also emphasizing that Ethereum is currently "seriously undervalued."

Lee outlined a panoramic view of the 2026 crypto market: the first half will be volatile due to institutional position adjustments, but the second half may see a strong rally. Additionally, his company Bitmine, where he serves as Chairman, has increased its Ethereum holdings to 4.1435 million coins, accounting for 3.43% of the total supply, actively betting on the future development of the Ethereum ecosystem. This series of insights and actions provides a clear roadmap from a seasoned Wall Street observer for a market that was somewhat uncertain earlier this year.

MarketWhisper·01-06 02:03

On the eve of the US presidential election! Cryptocurrency exchanges bet 21 million on Trump's midterm election campaign

Cryptocurrency exchanges bet on the 2026 US elections. Trump's MAGA Inc. Super Political Action Committee (PAC) received over $21 million in crypto industry donations, with total reserves soaring to $294 million. These funds will be used to support midterm election candidates, when 435 House seats and 33 Senate seats are up for grabs, giving Democrats a chance to regain control of Congress.

MarketWhisper·01-06 00:44

Best Stocks to Buy Now: Alibaba vs. Tencent – Which Chinese Tech Giant Has More Upside?

Alibaba (NYSE: BABA) and Tencent (OTC: TCEHY) remain two of China's dominant tech players. Alibaba controls the country's leading e-commerce marketplaces and a top cloud platform, while Tencent owns the ubiquitous Wexin "super app" and the world's largest video game publisher.

CryptopulseElite·01-05 10:43

2026 New Year Opening|Gate VIP Super Friday Limited Time Launch, USDT New Year Red Envelope Daily

The 2026 New Year VIP Exclusive Feedback Event will be held from January 2 to 8. VIP users can earn USDT gacha by completing tasks, with a maximum of 888 USDT available to win. The event includes recharge, financial management, and trading tasks. The number of gacha draws is limited, and participants must complete identity verification and registration.

GateLearn·01-05 02:04

The biggest IPO wealth creation movement in history is about to begin: SpaceX, OpenAI, and Anthropic lead the way

SpaceX, OpenAI, and Anthropic are set to go public collectively in 2026, with a total valuation reaching up to 2.5 trillion USD, marking an unprecedented stress test for market funding.

(Background recap: Musk's net worth approaches 750 billion USD, the first in history! Court restores sky-high salaries, SpaceX IPO sparks imagination)

(Additional background: Tether reiterates: We will return to the US market! Targeting institutional clients, but not following Circle's IPO approach)

Table of Contents

Timeline and valuation of three super IPOs

SpaceX: Physical revenue as a backing

OpenAI, Anthropic: AGI valuation undergoes its first public scrutiny

Is the market capable of absorbing this?

2026 is just beginning, Financial Times reports that SpaceX, OpenA

動區BlockTempo·01-04 05:53

Not Ma Ji Da Ge! The mysterious buyer of Tao Zhu Yin Yuan revealed, a foreign woman with the surname Wu allegedly purchased it with 1.11 billion in cash.

The super luxury residence "Tao Zhu Yin Yuan" located in the Xinyi Planning District sold the 17th floor for 1.11 billion yuan, a decrease of 90 million yuan from the original price. The buyer is a foreign woman with a residence permit named Wu, paying in full cash. China Engineering stated that the price adjustment was made in response to media reports.

CryptoCity·01-04 04:10

Tom Lee strongly advocates for BitMine's 100x issuance, holding over 4.1 million ETH to stake in the Ethereum "super cycle"

Bitcoin renowned analyst and BitMine company chairman Tom Lee is pushing a groundbreaking capital operation: seeking shareholder approval to significantly increase the authorized share limit from 500 million shares to 50 billion shares. This move aims to pave the way for potential large-scale financing and stock splits in the future of BitMine, with the core goal of continuing to increase investment in Ethereum.

This publicly listed company, which has transitioned from a mining firm to an "Ethereum whale," currently holds over 4.1 million ETH, valued at approximately $12 billion, and has staked ETH worth about $1.6 billion to generate yields. This aggressive capital strategy not only reflects management's extreme optimism about Ethereum's price but also presents shareholders with a choice between "share dilution" and "cryptocurrency exposure."

MarketWhisper·01-04 02:36

Analysts Debate Over the Bitcoin Price Bottom Being Hit, Can BTC Hit a Lower Target Before ATHs Arrive?

Analysts debate over the Bitcoin price bottom being hit.

Can the price of BTC hit a lower target before ATHs arrive?

Could 2026 really be a super cycle year for crypto price pumps?

Opposing expectations take over for the price of Bitcoin (BTC), the pioneer crypto asset. Since Bitcoin’s

CryptoNewsLand·01-01 13:41

2026 Cryptocurrency Outlook Cheat Sheet: Highlights from Five Major Institutions' 500-Page Reports

The five major institutions in the crypto industry reach a consensus for 2026: the speculation cycle ends, and structural maturity takes the lead. The largest compliant crypto exchange in the US raises the "death of the cycle," Delphi is optimistic about AI-driven finance, Messari bets on privacy coin ZEC, a16z predicts KYA will replace KYC, and Four Pillars focuses on regulation fostering super apps.

ZEC-6,49%

MarketWhisper·2025-12-31 09:05

Lighter "55% Open" token distribution sparks public outrage: Is fair DeFi launch dead?

The rapidly rising on-chain perpetual contract exchange Lighter recently announced its governance token LIT's economic model, immediately sparking intense division and in-depth debate within the DeFi community. According to its plan, 50% of the total supply of LIT will be allocated to the team and investors, with a one-year lock-up and a three-year linear unlock schedule; the remaining 50% is reserved for user airdrops, partners, and future ecosystem incentives.

This "50/50" distribution model has received some praise from users for its transparent unlocking mechanism and clear revenue sharing path (protocol revenue will be used for buybacks and burning of LIT); however, its high allocation—up to half—to "insiders" with a clear value orientation has also led many community members to question whether this deviates from the spirit of a "fair launch" in DeFi. The background of this debate is that the on-chain derivatives market's monthly trading volume has exceeded 1 trillion USD, and Lighter itself has firmly ranked second in trading volume. The economics of the LIT token reflect far more than just a project's governance choices; it is a critical reflection on power, value, and fairness in the entire DeFi world amid the "super cycle" of large-scale institutional capital inflows.

MarketWhisper·2025-12-31 02:10

South Korea plans to limit the shareholding of major shareholders in the four major virtual asset exchanges, and Upbit, Bithumb may face significant governance structure reforms.

The Korean government plans to overhaul the governance structure of cryptocurrency exchanges, with financial regulators proposing to limit the shareholding ratio of major shareholders in the four largest virtual asset exchanges, sparking significant industry concern over operational control and market stability.

(Background recap: Korea's stablecoin internal conflict: central bank and Financial Services Commission clash draft, Seoul missing the initial launch opportunity)

(Additional background: Korea plans to implement "super strict anti-money laundering" measures to close small loopholes: transactions below $680 require KYC and personal data collection)

According to the latest report by Korea's public broadcasting media "KBS," the Financial Services Commission (FSC) has proposed a major regulatory recommendation in the "Digital Asset Basic Act" submitted to the National Assembly, suggesting to limit the shareholding ratio of major shareholders in the four domestic virtual asset exchanges Upbit, Bithumb, Coinone, and Korbit, with a proposed cap set between 15% and 20%.

Financial Commission

ATS-6,95%

動區BlockTempo·2025-12-30 14:20

Vibe Coding Experience Week: From "Disenchantment" to Rational Understanding

Written by: Haotian

After experiencing a week of Vibe coding, I created an RSS aggregation and reading AI interpretation website to replace the previous paid app that was not very user-friendly. It’s quite satisfying. However, during this process, I also gained a new insight into Vibe Coding as a "disenchantment," which I’d like to share:

1) Vibe Coding is essentially a productivity enhancement tool. It’s about multiplication, not addition. For "super individuals" who already possess product thinking, logical skills, and even some programming foundation, it can turn one person into a team, greatly expanding their capabilities.

But at its core, it’s just an augmented skill, not a survival skill. Knowing Vibe Coding doesn’t necessarily turn an ordinary job into a high-paying position at a big company earning millions annually. Not knowing Vibe Coding doesn’t necessarily mean the opposite either.

TechubNews·2025-12-30 08:52

Federal Reserve minutes released today! Bitcoin drops below 90,000 for the third time, is the super bull still alive?

Bitcoin fluctuated around $87,800 on Wednesday, failing to reach $90,000 earlier in the week. The market is focused on Thursday's Federal Reserve minutes for clues on interest rate cuts. QCP pointed out that open interest in options has dropped 50% after expiration, and market makers turning bearish on Gamma could amplify the rally. Market opinions are extremely divided: Standard Chartered and Cathie Wood predict reaching $500,000 by 2030, while analysts warn it could drop to $10,000.

MarketWhisper·2025-12-30 08:41

Japan Bond Cuts Signal Effort to Calm Rising Yields

Japan's Finance Ministry plans to issue ¥168.5 trillion in bonds but has reduced super-long JGB issuance to a 17-year low of ¥17.4 trillion to stabilize yields and encourage retail investment, aiming to manage fiscal risks while maintaining market confidence.

Coinfomania·2025-12-27 10:37

Elon Musk's net worth surpasses 700 billion USD! By 2025, global billionaire wealth will surge by 3.6 trillion USD, with the top ten winners raking in 7290 billion USD.

In 2025, the wealth of the world's super-rich skyrocketed by $3.6 trillion, led by Elon Musk with an increase of $333 billion. The combined net worth of the top ten winners grew by over $729 billion, with American tech billionaires occupying the top five spots. This article is based on a piece by Forbes, compiled, edited, and written by Foresight News.

(Previous summary: Elon Musk's net worth approaches $750 billion, a historic first! Courts restore sky-high salaries, SpaceX IPO sparks imagination)

(Additional background: When Chinese crypto billionaires start buying gold, you should wake up: the market has already changed)

Table of Contents

1. Elon Musk

2. Larry Page

3. Sergey Brin

4. Jensen Huang

5. Larry Ellison

6. Amancio Ortega

7. German

動區BlockTempo·2025-12-26 16:40

Elon Musk predicts the economy will double by 2026, but the crypto community questions: Will it necessarily drive a crypto bull market?

Elon Musk (Elon Musk) on 12/25 posted on Twitter (X) about the future economic outlook of the United States, issuing a super bearish forecast, predicting that by December 2026 at the latest, the US economy will enter a "double-digit" rapid growth period. If AI applications are properly utilized, there could even be a "triple-digit" explosive growth by 2030. This statement has drawn significant attention from the crypto community, which closely follows overall economic changes. However, behind the optimistic sentiment, some skeptics warn that economic growth may not necessarily lead to an increase in Bitcoin, and that 2026 could be a "big bear market" for Bitcoin.

Musk makes a bold prediction, expecting the 2026 economic growth to double

Musk stated that within the next 12 to 18 months, the US economy will experience double-digit rapid growth. He further explained that if AI applications are considered as an indicator of economic growth, then in

ChainNewsAbmedia·2025-12-26 05:44

Mysterious prophecy reappears: The 4chan trader who accurately predicted the October high confidently claims Bitcoin will surge to $250,000 by 2026

Recently, an anonymous 4chan trader who accurately predicted in December 2023 that Bitcoin would reach its cycle top on October 6, 2025, has spoken again, offering an even more aggressive new prediction: Bitcoin will rise to $250,000 in 2026. This prediction comes at a very delicate time: currently, multiple short-term technical indicators and on-chain data are showing a bearish trend, and market sentiment is becoming cautious. This forecast not only challenges the market's short-term bearish consensus but also rekindles the core debate over whether the long-term Bitcoin super cycle is still valid. This "prophecy versus data" confrontation once again reveals the profound contradiction between long-term narratives and short-term volatility in the Bitcoin market.

MarketWhisper·2025-12-26 04:01

Christmas market failure! Bitcoin fractal warning: 2026 super cycle may crash to 70,000

The 2025 Christmas market has completely failed, with Bitcoin struggling around $87,110. Analysts point out that Bitcoin's current pattern is almost identical to the 2021 bull market top. After reaching a peak of $51,700 on December 24th of that year, it plummeted 34% within a month. If the same pattern repeats, Bitcoin could drop to $70,000 in January. However, the "Mini Bat" pattern may indicate a super cycle brewing rather than a prolonged bear market.

BTC-2,45%

MarketWhisper·2025-12-26 00:56

2026 Bubble Will Ultimately Burst! Top Economist: Stock Market Drops 90%, Bitcoin Falls to 30,000

HS Dent Investment Company founder Harry Dent warns that the most severe market crash in history will arrive in 2026. He predicts that the current super bubble, which has lasted nearly 17 years, will burst, leading to a 90% decline in the stock market, described as the worst market environment since the Great Depression. Dent forecasts that by the end of 2026, Bitcoin could drop to $30,000, with downside potential as low as $15,600.

MarketWhisper·2025-12-25 00:53

Bitcoin falls below $88,000! $28.5 billion Deribit options are expiring, and the market is on high alert.

Crypto market experienced selling pressure today (23rd), falling into another round of volatility and correction. Last night, Bitcoin briefly surged above the $90,000 mark but failed to sustain the momentum, quickly reversing downward and falling below $88,000 this morning; Ethereum also struggled to resist the decline, simultaneously dropping below the $3,000 threshold.

Recently, Bitcoin has been highly volatile within the $85,000 to $90,000 range, mainly due to market anticipation ahead of the upcoming super settlement day on Friday (26th). The world's largest Crypto derivatives exchange, Deribit, will see options contracts worth a total of up to $28.5 billion expire.

Jean-David Pequignot, Chief Business Officer at Deribit, pointed out that this settlement amount is unprecedented, accounting for more than half of the platform's open interest of $52.2 billion.

ETH-3,45%

区块客·2025-12-24 09:28

2025 Cryptocurrency ETF Battle Report: Bitcoin's Dominance Remains Rock Solid, Ether's Share Quietly Expands

In 2025, the crypto assets exchange-traded fund (ETF) market presented a distinct "one strong, one super" pattern. The Bitcoin ETF solidified its position as the preferred choice for institutional deposits with an absolute market share of 70% to 85% throughout the year, attracting a total capital flow of up to $31 billion. Meanwhile, the Ethereum ETF share steadily climbed from the beginning of the year to 15% to 30% in December, indicating that institutional acceptance of the second-largest digital asset is increasing.

However, the unexpected delay of the U.S. "Clarity Act" at the end of the year triggered a net outflow of global crypto ETP funds of up to $952 million in a single week, with Ethereum products under the most pressure, adding a touch of uncertainty to the institutional narrative for 2025. This article will analyze the true preferences of institutional funds through detailed data and interpret how the regulatory process has become the "baton" of short-term market sentiment.

MarketWhisper·2025-12-24 05:23

The Hopes and Concerns Behind Web3 Super Unicorn Phantom

In 2025, the competition in the encryption Wallet market is fierce, and Phantom has attracted attention with a valuation of 3 billion and rapid user growth. Although its volume has been eroded by exchange wallets, Phantom is trying to expand its market and user base by launching new products such as the stablecoin CASH and debit cards. In the face of challenges, it seeks survival and development through a "trading + consumption" model.

PANews·2025-12-23 12:07

2 days big pump 20 times! The "automated market-making" snowball of pump.fun's Golden Dog Snowball can roll to how big?

$BALL Token, through a unique "automatic repurchase + Liquidity provision" mechanism, achieved an astonishing 20-fold increase in two days on pump.fun. The team even publicly promised to use 100% of the transaction Money Laundering for repurchasing, creating a rare "positive value cycle" model in the Meme coin space.

(Previous summary: What is the meme coin issuance platform Pump.fun? A complete analysis of the super simple token issuance process, fairness & risks)

(Background Information: DeFi Popular Science | Decentralized Finance is on the rise, what is "Automated Market Maker AMM"?)

Table of Contents

Snowball's core mechanism: automatic repurchase + liquidity market making

Differences from traditional repurchase models

Risks and Challenges: A snowball can also "avalanche"

Recently, a quite talked-about project appeared on pump.fun.

BALL2,09%

動區BlockTempo·2025-12-23 10:40

Bitcoin falls below $88,000! $28.5 billion Deribit options are set to expire, and the market is on high alert.

The cryptocurrency market today (23rd) is experiencing selling pressure, once again falling into turbulent correction. Bitcoin briefly rose above the $90,000 mark last night but was unable to maintain support and quickly reversed downward, breaking below $88,000 this morning; Ether also struggled against the downward trend, simultaneously losing the $3,000 threshold.

Bitcoin has recently experienced significant fluctuations in the range of $85,000 to $90,000, primarily due to the market's anticipation of the upcoming super settlement day on Friday (the 26th). The world's largest crypto assets derivatives exchange, Deribit, will have Bitcoin and Ether options worth up to $28.5 billion expiring.

Deribit Business Director Jean-David Pequignot pointed out that the scale of this settlement amount is unprecedented, accounting for more than half of the platform's $52.2 billion in Open Interest.

ETH-3,45%

区块客·2025-12-23 09:26

Trump's appointed conditions for the Federal Reserve chair: must be a "super dove" and immediately cut interest rates.

U.S. President Trump recently stated that he will soon announce his nomination for the next chairman of the Federal Reserve (FED) to replace the current chairman Powell, whose term ends in May next year, and said that the person he nominates must be a "super dove." The list of candidates has been narrowed down to four, and Trump indicated that he will make a decision this week or "in the coming weeks."

MarketWhisper·2025-12-22 08:14

Encryption super applications have arrived, and Coinbase is reconstructing a one-stop financial ecosystem.

Coinbase and Robinhood are breaking the fragmented landscape of Financial Service by launching a super app that integrates features such as stocks, Crypto Assets, futures, and prediction market, allowing users to trade across asset classes in real-time with a single account, ending a decade-long era of fragmented Financial Service. This article is sourced from a piece by Nishil Jain and was organized, translated, and written by Luffy, Foresight News.

(Previous summary: Coinbase launches stock trading, prediction market, perpetual contracts! Integrates Kalshi, Solana DEX upgrade "Universal Exchange")

(Background information: x402 upgrade V2 "supports single format cross-chain", how Coinbase

動區BlockTempo·2025-12-22 05:25

The financial sector is becoming "invisible": how stablecoins are becoming the new artery of the digital economy

Author: Cobo

Highlights of this issue:

This week, Coinbase held a system-level product upgrade conference reminiscent of WWDC, focusing on updates related to trading, derivatives, stablecoins, AI, and payment protocols. Coinbase's vision of "Everything Exchange" not only demonstrates its ambition to become a super app but also points to a new implementation path in the crypto era—an underlying financial structure centered around stablecoins, asset issuance, and on-chain clearing. Financial capabilities are thus becoming as fundamental as internet bandwidth, serving as core resources that can be called natively by software and AI, and automatically scheduled in the background. Stablecoins have evolved from investment assets into infrastructure supporting the operation of the digital economy. In this context, we can say that Coinbase's boundaries have surpassed traditional internet super apps, and finance is beginning to detach from

PANews·2025-12-22 05:09

When prediction markets become the new gambling table: Will involvement in betting cause super apps like Robinhood to decline?

The rise of prediction markets has led financial platforms like Robinhood, Coinbase, and Gemini to successively add related trading features. However, Inversion Capital CEO Santiago Santos warns that this trend is actually eroding the foundation of the financial super app (Super App).

He pointed out that while the prediction market can bring impressive income in the short term, its "casino-like" characteristics will accelerate user churn, causing the platform to lose long-term value in user retention.

(Introduction to Polymarket Ecosystem: An Overview of 10 Major prediction market Tools to Assist Traders' Decisions)

The prediction market's "gambling nature" has become a short-term highlight, but it also poses a long-term risk for financial applications.

Santos emphasized that while he agrees with the core concept of prediction markets, the entry of prediction markets into financial applications is entirely different.

APP-16,58%

ChainNewsAbmedia·2025-12-22 03:23

Coinbase Super App Bid, Saylor $1B Buy, and More — Week in Review

This week, Coinbase expanded its services, Saylor invested nearly $1 billion in Bitcoin as prices fell, Circle acquired Interop Labs raising concerns, and over 125 groups advocated for stablecoin rewards amid regulations. Additionally, Ripple's RLUSD surged in market cap.

Coinpedia·2025-12-21 21:19

The era of Web3 super individuals has arrived: How to let AI be your auxiliary brain and make Wallet your sovereignty?

The intersection of AI and encryption technology allows individuals to form a closed loop through content, transactions, and entrepreneurship, with super individuals replacing institutions and becoming the core driving force of Web3.

CryptoCity·2025-12-21 04:55

The largest Bitcoin options expiration in history is approaching! Glassnode: The market is still pricing in downside risk, and BTC volatility could erupt in the new year.

The largest Bitcoin options expiration in history is approaching. On-chain data analysis firm Glassnode pointed out that the market currently maintains a low-volatility, defensive structure, and short-term price movements are likely to remain constrained.

(Previous context: Has the Bitcoin super cycle ended? Fidelity warns: a cold winter may hit in 2026, supporting $65,000-$75,000)

(Additional background: Detailed review of the October crash: the fundamental reasons for Bitcoin's sharp decline)

Table of Contents

The market continues to price in downside risks

Options trading remains predominantly defensive

Market volatility is expected to pick up again in the new year

On October 19, on the X platform, on-chain data analysis firm Glassnode stated that the largest Bitcoin (BTC) options expiration event in history is imminent, but the spot price of Bitcoin remains limited within recent oscillation ranges.

BTC-2,45%

動區BlockTempo·2025-12-19 16:50

Will Bitcoin surge to $170,000 within three months? Analyst: A new bull market may emerge by 2026.

Bitcoin entered a correction phase after reaching a record high of $126,000, with market sentiment turning more conservative; however, several analysts point out that based on historical cycles and institutional fund movements, the possibility of Bitcoin entering a new bullish trend in 2026 has not been ruled out.

(Previous context: Has the Bitcoin super cycle ended? Fidelity warns: a cold winter may hit in 2026, supporting $65,000-$75,000)

(Additional background: Bitcoin keeps falling through $85,000! The Bank of Japan is expected to raise interest rates today, watch out for arbitrage unwinding and further selling)

Table of Contents

RSI enters oversold territory, historical experience favors bulls

Institutional funds become medium- to long-term support

Short-term volatility is inevitable, long-term structure is still evolving

Since October this year, Bitcoin briefly surged above the $126,000 historical high, but market momentum gradually cooled, and the price subsequently

動區BlockTempo·2025-12-19 15:50

Is the Bitcoin super cycle over? Fidelity warns: a cold winter may hit in 2026, with support at $65,000-$75,000

Fidelity Macro Director Jurrien Timmer predicts that after reaching a high of $124,000 in October 2025, Bitcoin will enter a year of consolidation, with prices expected to stay between $65,000 and $75,000. He also notes that gold is projected to increase by 65% in 2025, demonstrating its resilience amid uncertainty. He believes that the four-year cycle of Bitcoin may have ended, and market momentum is weakening.

BTC-2,45%

動區BlockTempo·2025-12-19 11:50

The Hidden and Concerns Behind Web3 Super Unicorn Phantom

Author: Zhou, ChainCatcher

The crypto wallet market in 2025 is witnessing a brutal battle for market share.

As the meme coin craze subsides, high-frequency trading users are flocking to exchange-based wallets with lower fees and stronger incentives. In the face of the closed-loop ecosystem of exchanges, independent players' survival space is continuously shrinking.

Against this backdrop, Phantom's performance has attracted attention. Earlier this year, it raised $150 million, pushing its valuation to $3 billion. Since Q4, the project has launched its own stablecoin CASH, a prediction market platform, and a crypto debit card, attempting to find new growth points outside of trading business.

$3 billion valuation, from starting on Solana to multi-chain expansion

Looking back at Phantom's development history, in 2021, the Solana ecosystem just exploded, on-chain

SOL-3,54%

金色财经_·2025-12-19 11:13

Flying towards a $1.5 trillion IPO, Musk almost lost everything

Author: Xiao Bing Deep Tide TechFlow

In the winter of 2025, the sea breeze in Boca Chica, Texas remains salty and fierce, but the air on Wall Street is unusually hot.

On December 13, a piece of news shot to the top of financial headlines like a heavy Falcon rocket: SpaceX's latest round of internal stock issuance has valued the company at $800 billion.

According to memos, SpaceX is actively preparing for an IPO in 2026, planning to raise over $30 billion. Musk hopes the company's overall valuation can reach $1.5 trillion. If successful, this would bring SpaceX's market cap close to the record level set by Saudi Aramco's 2019 IPO.

For Musk, this is an extremely magical moment.

As the world's richest person, his personal wealth will grow along with SpaceX, this "super rocket."

金色财经_·2025-12-19 11:13

Trump: The next Federal Reserve Chair must be a "super dovish" who regularly consults with me on interest rates. Has the Fed's independence been destroyed?

Trump explicitly stated that the next Federal Reserve Chair must believe in "large-scale rate cuts" and will soon announce a candidate. He demands lowering interest rates to the crisis level of 1% and believes the next Chair should consult with him on rate setting. This article is sourced from Wall Street Insights, compiled, translated, and written by Foresight News.

(Previous context: Trump named Kevin Warsh as his "preferred" candidate for the next Federal Reserve Chair, with Kevin Hassett's chances dropping by 30%)

(Additional background: Trump: Rate cuts are a litmus test for the Federal Reserve Chair, and tariffs may be adjusted to lower the prices of some goods)

Table of Contents

All three candidates support rate cuts, but to varying degrees

Trump demands the Federal Reserve Chair consult with him on rate decisions

Rate cuts have limited impact on mortgage rates

On Wednesday, U.S. time, President Trump made a nationwide speech in which

動區BlockTempo·2025-12-19 03:50

North Korean hackers set a record in 2025 by stealing $2 billion in cryptocurrency; 45-day money laundering scheme exposed

Blockchain analysis firm Chainalysis's latest report reveals that North Korea-linked hackers stole at least $2 billion in cryptocurrency in 2025, setting a record high and representing a 51% year-over-year increase, with their total stolen amount reaching $6.75 billion. The attack patterns are characterized by "small but precise" operations; despite a decrease in the number of incidents, each attack is massive, with 76% of service-layer attacks attributed to them. The $1.4 billion vulnerability incident at Bybit in March was a major driver.

The report systematically depicts North Korean hackers' unique money laundering pathways for the first time: relying on Chinese service providers and mixers, following a typical 45-day fund laundering cycle. This marks the emergence of a "super threat" in the cryptocurrency industry—state-sponsored, highly organized, and well-funded—posing unprecedented challenges to the security, protection, and compliance collaboration of global exchanges and protocols.

BAL-2,96%

MarketWhisper·2025-12-19 03:42

Tom Lee Dubai Speech: The Crypto Super Cycle Is Steady, Why I Still Persist

Author: Tom Lee, Translation: Wu Shuo Blockchain

At the 2025 Binance Blockchain Week held in Dubai from December 3 to 4, Fundstrat co-founder and BitMine Chairman Tom Lee delivered a speech titled "The Crypto Super Cycle Remains Steady," systematically elaborating on his long-term bullish outlook for the crypto market. The core points include: why 2025's main theme is "tokenization," why he believes Bitcoin and Ethereum prices have bottomed out, the breaking of the traditional four-year cycle, Ethereum's role as infrastructure in the global financial system, and how Digital Asset Treasury (DAT) companies will play a key role in the next wave of crypto financialization. He also explained BitMine's strategy, the business logic of the Ethereum treasury model, and forecasted market and tokenization trends.

金色财经_·2025-12-19 03:20

U.S. SEC charges Bitcoin mining company founder Don Vo of VBit: scam fundraising of $95.6 million, embezzling $48.5 million for gambling and gifts

The U.S. Securities and Exchange Commission (SEC) has officially filed a civil lawsuit against Bitcoin mining company VBit Technologies Corp., its founder and CEO Danh C. Vo. The SEC alleges that, from December 2018 to February 2022, Vo raised over $95.6 million from approximately 6,400 investors through VBit and its alleged successor company, Advanced Mining Group, by illegally soliciting investments. The main offerings involved unregistered investment contracts, including Bitcoin mining custody agreements.

(Background: The U.S. Bitcoin mining crash—"Is there actually profit?" Mining industry experts: Trump tariffs will make mining machines in other countries super cheap)

(Additional background: Cryptocurrency

動區BlockTempo·2025-12-18 15:55

Coinbase ushers in the era of the "All-in-One Exchange": integrating stocks, DEX, and prediction markets, aiming to become a financial super app

Author: Techub Hot Topics

Author: Yangz, Techub News

"The future of finance is on Coinbase. All in one app," Coinbase announced at today’s System Update event, setting a new course for its future in 2026 and even 10 years ahead.

As an industry leader with a market capitalization of over $65 billion and owning the largest cryptocurrency trading platform in the United States, Coinbase has no intention of settling within existing boundaries. It is launching its most aggressive and disruptive product expansion since its founding 13 years ago: breaking down traditional barriers in the financial world, integrating crypto assets, stocks, derivatives, on-chain ecosystems, and even prediction markets into a seamless, unified application.

PANews·2025-12-18 13:03

Load More