Tether (USDT) News Today

Latest crypto news and price forecasts for USDT: Gate News brings together the latest updates, market analysis, and in-depth insights.

“Tether’s favorite” botched its debut—can Stable turn the tide?

Author: Jae, PANews

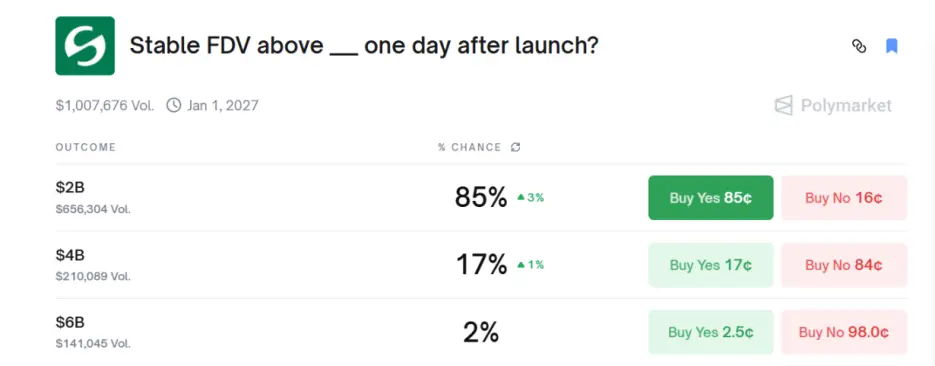

Another stablecoin branded as a “Tether offspring” has officially launched, but the market doesn’t seem to be buying into it.

On the evening of December 8, the highly anticipated stablecoin-specific public chain, Stable, officially launched its mainnet and the STABLE token. As a Layer 1 project deeply incubated by the core teams of Bitfinex and Tether, the “Tether offspring” narrative drew widespread market attention to Stable as soon as it debuted.

However, amid tightening market liquidity, Stable didn’t have a strong start like its competitor Plasma. Not only did its price remain sluggish, but it also fell into a trust crisis over alleged insider trading. Is Stable’s script to first dip before rising, or will it continue to open low and go lower?

STABLE drops 60% from launch high, mired in an insider trading trust crisis

Stab

STABLE-23.55%

PANews·36m ago

Tether achieves another major milestone! Abu Dhabi approves compliant use of USDT on nine major blockchains, with an additional 1 billion USDT issued as reserve.

Stablecoin giant Tether has achieved a key breakthrough in the Middle East’s regulatory landscape. On December 9, the regulatory authority of Abu Dhabi Global Market (ADGM) officially approved licensed institutions within its jurisdiction to conduct regulated activities involving USDT on nine major blockchains, including Aptos, Polkadot, and TON. This move further expands upon previous approvals for USDT on Ethereum, Solana, and Avalanche, now covering nearly all major networks where USDT is circulated. At the same time, one of the world’s largest cryptocurrency exchanges also announced that it has obtained a full operating license from ADGM. These developments mark Abu Dhabi’s accelerated efforts to build its “Global Crypto Wall Street” blueprint through a systematic compliance framework.

BTC-0.96%

MarketWhisper·8h ago

Tether Secures $81M Funding Boost for Cutting-Edge Generative Bionics Innovation

Stablecoin giant Tether invests in Italian humanoid robotics startup

In a strategic move supporting advancements in artificial intelligence and robotics, Tether has announced its participation as a key backer in an €70 million ($81 million) funding round for Generative Bionics, an Italian AI startu

CryptoBreaking·8h ago

Tether deepens AI bet, backs Italian firm’s humanoid robots

Stablecoin giant Tether has announced it is one of the backers of an $81 million funding round for an Italian artificial intelligence startup aiming to build advanced humanoid robots

The 70 million euro funding round for startup Generative Bionics was led by the AI fund of CDP Venture Capital,

Cointelegraph·9h ago

Tether enters the humanoid industrial robot sector, participates in $81.5 million Italian fundraising project

Tether has recently continued to expand its presence in the AI and robotics sectors, and on 12/9 participated in the $81.5 million funding round for the Italian startup Generative Bionics. The company was spun off from the Italian Institute of Technology (IIT), focusing on humanoid industrial robots capable of working in hazardous and high-labor-demand production environments. Generative Bionics plans to gradually deploy its first batch of mass-produced models in the manufacturing, logistics, healthcare, and retail industries starting in early 2026.

Tether and multiple institutions participate in funding, aiming to create humanoid industrial robots

Generative Bionics recently completed its $81.5 million funding round, with capital coming from Tether,

BTC-0.96%

ChainNewsAbmedia·10h ago

When Chinese crypto tycoons start buying gold

Written by: Lin Wanwan

Twelve minutes’ drive north of Singapore Changi Airport stands one of the world’s most secure private vaults, Le Freeport, at the end of the runway.

This building, which cost around 100 million Singapore dollars, is known as the “Fort Knox of Asia.” It has no windows, yet maintains a constant temperature of 21°C and a humidity level of 55% year-round, perfectly suited for storing artwork.

Behind its heavily guarded steel doors lie hundreds of millions of dollars’ worth of gold, silver, and rare artworks: all kept tax-free and customs-free.

Three years ago, one of Asia’s youngest crypto billionaires, Bitdeer founder Wu Jihan, acquired this vault—rumored to have cost as much as 100 million Singapore dollars—for just 40 million SGD (about 210 million RMB).

This deal was confirmed that year by Bloomberg, and behind the purchase was Bitdeer, operated by Wu Jihan.

DeepFlowTech·11h ago

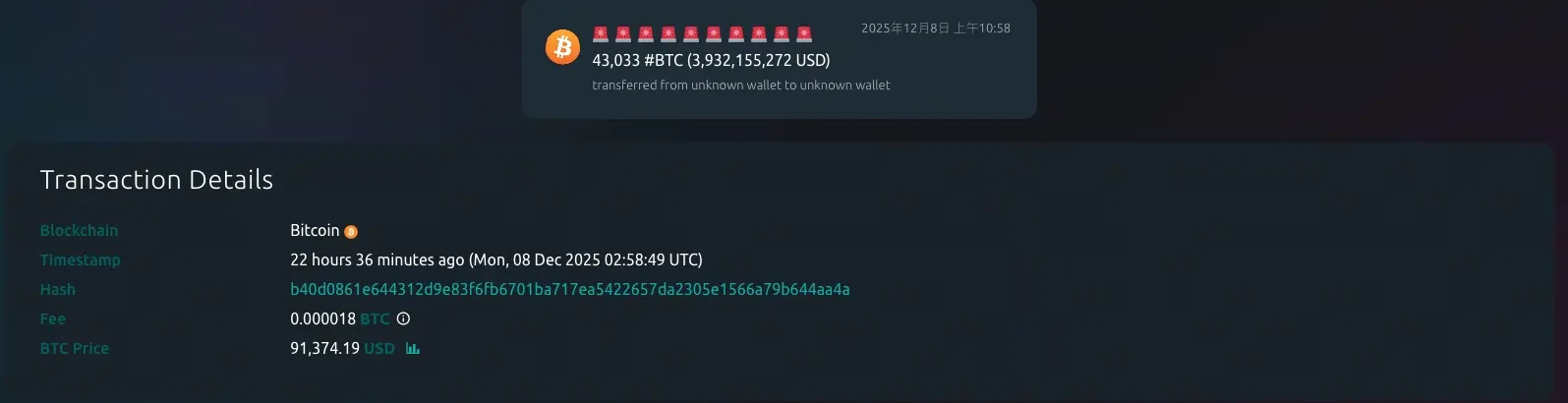

Tether spends 4 billion to buy Bitcoin? Twenty One on-chain data reveals liquidity trap

Whale Alert flagged a transfer of 43,033 bitcoins (worth approximately $3.9 billion) to an address associated with Twenty One (stock ticker XXI). However, on-chain analysts warn that interpreting this as a new Tether buy order would misrepresent the flow of funds—the source and pricing of these bitcoins had already been determined before the alert was issued.

BTC-0.96%

MarketWhisper·12h ago

Tether Invests in Italian Robotics Startup Generative Bionics Amid Humanoid Hype

In brief

Tether took part in a €70 million funding round for Italian humanoid robotics startup Generative Bionics.

The firm plans industrial testing and a production facility ahead of deployments targeted for 2026.

The deal adds Tether to a surge of investment in humanoid robots from tech, indu

Decrypt·14h ago

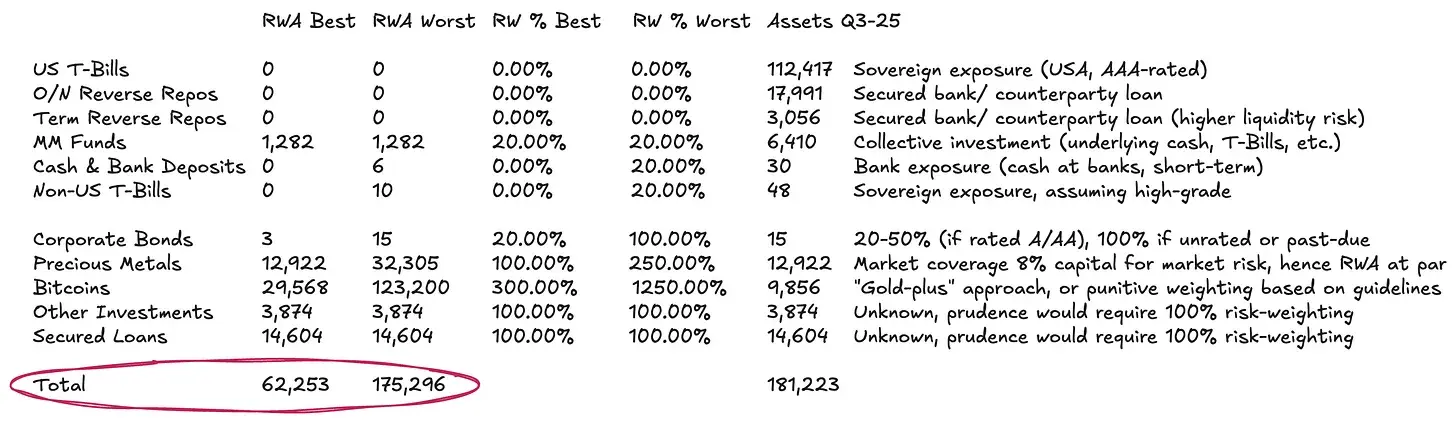

Tether Financial Analysis: Needs an Additional $4.5 Billion in Reserves to Achieve Stability

Author: Luca Prosperi

Translated by: TechFlow

When I graduated from university and applied for my first management consulting job, I did what many ambitious yet timid male graduates often do: I chose a company that specialized in serving financial institutions.

In 2006, the banking industry was the epitome of “cool.” Banks were usually located in the most magnificent buildings on the most beautiful streets in Western Europe, and at the time, I was eager to seize the opportunity to travel around. However, no one told me that this job came with a more hidden and complicated condition: I would be “married” to one of the largest yet most specialized industries in the world—the banking industry, and for an indefinite period. The demand for banking experts has never disappeared. During economic expansion, banks become more creative and need capital; during economic contraction, banks need restructuring, and they still need capital. I once tried to escape this vortex, but just

BTC-0.96%

金色财经_·12-08 12:58

2025 Tether Financial Analysis: Needs an Additional $4.5 Billion in Reserves to Maintain Stability

According to an analysis based on the Basel capital framework, Tether basically meets the minimum regulatory requirements under the baseline assumption, but still needs an additional approximately $4.5 billion in capital compared to large banks. If a stringent approach to handling Bitcoin is adopted, the capital shortfall could range from $12.5 billion to $25 billion.

(Previous context: $30 billion stablecoin defense battle: Tether CEO attacks Wall Street rating agencies and Arthur Hayes)

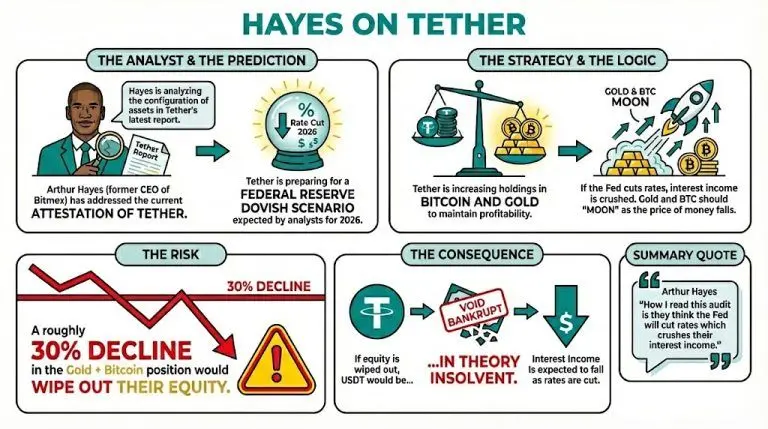

(Background supplement: Arthur Hayes: If Tether's Bitcoin and gold drop by 30%, USDT will be insolvent)

If an even stricter, fully punitive $BTC approach is adopted, the capital shortfall could range from $12.5 billion to $25 billion.

When I graduated from college and applied for my first management consulting job, I did what many ambitious but timid male graduates often do:

BTC-0.96%

動區BlockTempo·12-08 08:14

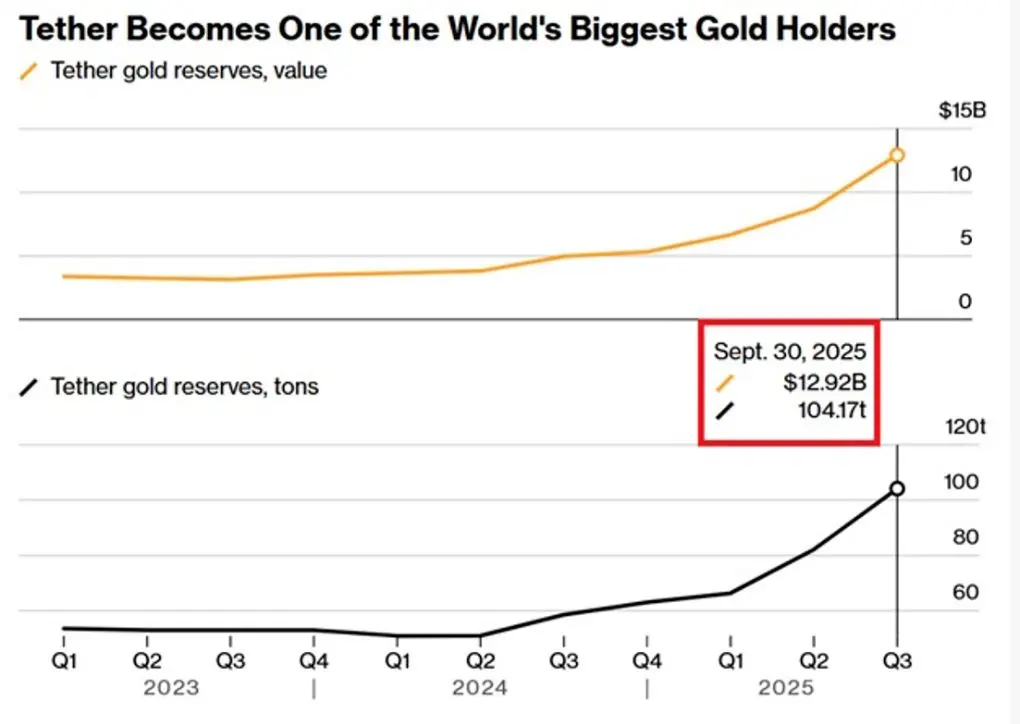

The driving force behind gold's surge? Tether stockpiles 1 ton in a week, reserves surpass those of many central banks

The world’s largest stablecoin issuer, Tether, has recently accelerated its gold purchases, attracting significant market attention. Latest data shows that as of September 2025, Tether holds 116 tons of gold, valued at approximately $12.9 billion, surpassing the central banks of countries such as Australia, Czech Republic, and Denmark, and ranking among the world’s top 30 gold holders.

XAUT-0.21%

MarketWhisper·12-08 07:33

2025 Tether Financial Analysis: An Additional $4.5 Billion in Reserves Needed to Maintain Stability

Author: Luca Prosperi

Translated by: TechFlow

When I graduated from college and applied for my first management consulting job, I did what many ambitious yet timid male graduates often do: I chose a company that specialized in serving financial institutions.

In 2006, banking was the epitome of "cool." Banks were usually housed in the grandest buildings on the most beautiful streets of Western Europe, and at the time, I was eager to use this opportunity to travel around. However, no one told me that this job came with a more subtle and complex condition: I would be "married" to one of the world's largest yet most specialized industries—banking—and for an indefinite period. The demand for banking experts has never disappeared. During economic expansion, banks become more creative and need capital; during contractions, banks need restructuring, and they still need capital. I once tried to escape this vortex, but

BTC-0.96%

DeepFlowTech·12-08 06:30

A Fresh Look at Tether

Tether is undergoing a transformation, shifting from reliance on USD-backed stablecoins toward building a more independent financial ecosystem. Its holdings of 116 tons of gold and Bitcoin, participation in commodity financing, and development of its own public blockchain all demonstrate an ambition to strengthen its role as a central bank. At the same time, Tether is establishing compliance pathways to penetrate traditional markets. This series of initiatives is set to redefine its position in both the crypto world and traditional finance.

金色财经_·12-08 06:10

2025’s Stablecoin Shifts: Massive Outflows for Tether, Big Gains for USD0 and USDX

The stablecoin market, valued at $206 billion, faces significant changes, particularly with Tether losing nearly $3.8 billion and Ethena USD dropping by $190 million. Meanwhile, USD0 and USDX have seen substantial growth, reshuffling the market ranks.

Coinpedia·12-07 01:46

CoinShares dismisses new concerns over Tether's solvency after Arthur Hayes' warning

CoinShares dismissed concerns about Tether's ability to meet USDT obligations, highlighting a $6.55 billion reserve surplus. Despite warnings about Bitcoin and gold volatility, they assert strong profits mitigate risks. Tether remains the largest stablecoin.

BTC-0.96%

TapChiBitcoin·12-06 01:28

Tether CEO Warns Paper Gold Era Could End “Gradually, Then Suddenly”

Tether CEO Paolo Ardoino suggests the impending collapse of "paper gold," referencing a Blockchain Research Lab study on leveraged investments.

BitcoinInsider·12-05 22:48

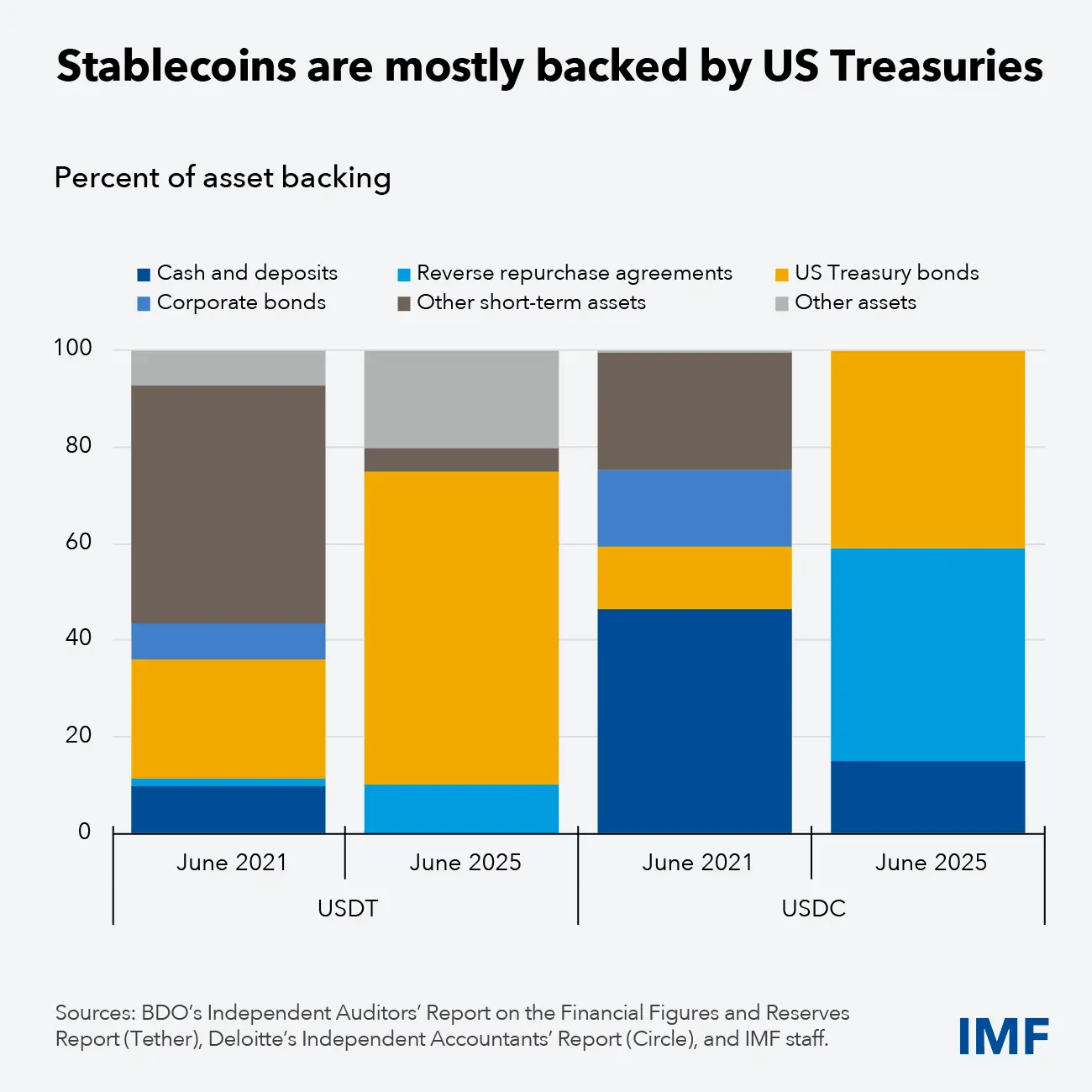

IMF warns of stablecoin fragmentation crisis! $300 billion market faces major regulatory hurdles

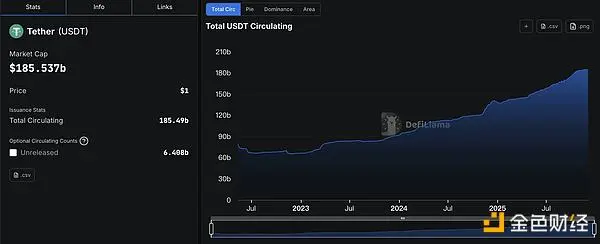

The International Monetary Fund (IMF) has released the "Understanding Stablecoins" report, warning that the fragmentation of regulatory frameworks across countries is creating structural "barriers," threatening financial stability, weakening regulation, and slowing the development of cross-border payments. The global stablecoin market capitalization has exceeded $300 billion, with Tether's USDT and Circle's USDC accounting for the majority of the supply.

USDC0.01%

MarketWhisper·12-05 00:43

Bitcoin consolidates above 90,000; is DAT poised for a rebound?

The S&P 500 Index and the Nasdaq Index edged higher as investors prepared for the Federal Reserve's interest rate decision next week. Bitcoin is consolidating above $90,000. Although market sentiment has moved out of the extreme fear zone, it remains cautious. Twenty One, a US Bitcoin company directly invested in with Bitcoin by Tether, the world’s largest stablecoin issuer, will begin trading next Monday (12/8) on the New York Stock Exchange under the ticker "XXI." The stock price rose 22% yesterday. Ethereum reserve company BitMine continues to buy ETH, and BMNR stock also rose nearly 8% yesterday, closing at $36.32.

Good data is good news, bad data is still good news—will a Fed rate cut become a certainty?

On Thursday, investors largely ignored the latest weekly jobless claims, which showed that the number of first-time unemployment benefit applicants fell to the 2022

ETH-0.21%

ChainNewsAbmedia·12-05 00:03

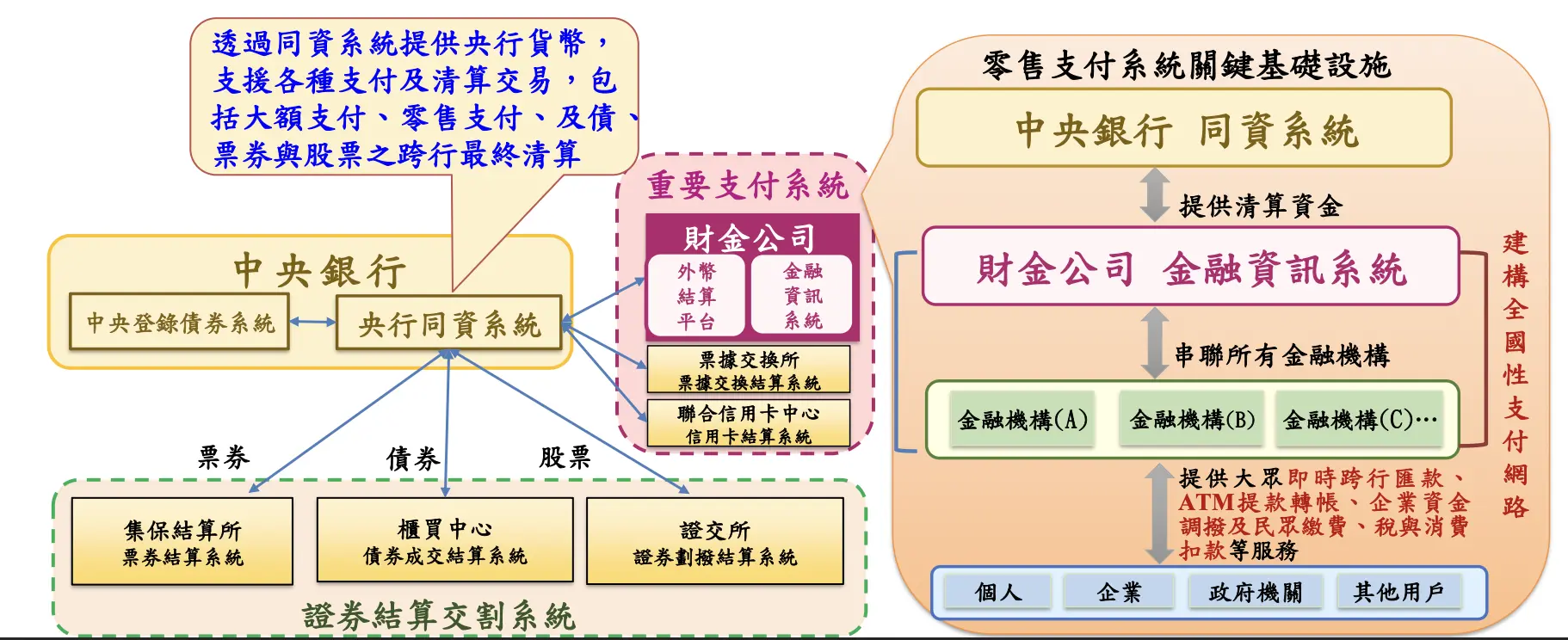

Central Bank Governor Yang Chin-long: Stablecoins are "wildcat banks," TWQR annual transactions reach 592 trillion

Taiwan Central Bank Governor Yang Chin-long stated that future payments will adopt a dual-track parallel strategy. On one hand, the bank will continue to optimize TWQR and promote cross-border interoperability; on the other hand, it will steadily advance wholesale CBDC and tokenized financial infrastructure. In 2024, TWQR's operational volume reached NT$582 trillion, 23 times the GDP for that year. Yang Chin-long warned of the risks of stablecoins, comparing them to "wildcat banks," which historically caused large-scale bank runs due to lack of regulation and insufficient reserves.

USDC0.01%

MarketWhisper·12-04 07:29

Tether's Decade-Long Gamble: How Did It Evolve from a "Stablecoin" to the "Shadow Central Bank" of the Crypto World?

Author: BlockWeeks

What supports the $2.6 trillion crypto market’s liquidity is not the sovereign credit of any nation, but a private company that moved its headquarters from Hong Kong to Switzerland, and ultimately settled in El Salvador—Tether. Its issued US dollar stablecoin, USDT, holds over 70% of the market share. Over the past decade, it has expanded amid crises and doubts, and is now attempting to define the industry's boundaries with its profits.

However, a recent “weak” rating from S&P Global has once again revealed the core contradiction of this grand experiment: a currency tool designed to be “stable” is itself becoming the system’s greatest point of risk.

>

> It’s like an elephant dancing on a tightrope, with a base of hundreds of billions of dollars in US Treasury bonds, but taking adventurous steps into AI, brain-computer interfaces, and Argentine farmland. — This is how the BlockWeeks editorial team describes it.

>

Part I

PANews·12-04 02:06

Tether Data Introduces QVAC Fabric, Bringing AI Fine-Tuning to Consumer Hardware

2 December, 2025 – Tether Data today announced the launch of QVAC Fabric LLM, a new comprehensive LLM inference runtime and fine-tuning framework that makes it possible to execute, train and personalize large language models directly on everyday hardware, including consumer GPUs, laptops, and even s

CryptoBreaking·12-03 17:04

Tether Data Unveils QVAC Fabric LLM Inference And Fine-Tuning Framework For Modern AI Models

In Brief

Tether Data has launched QVAC Fabric LLM framework that enables LLM inference and fine-tuning across consumer devices and multi-vendor hardware, supporting decentralized, privacy-focused, and scalable AI development.

Department of Financial Services company Tether, focused on

MpostMediaGroup·12-03 08:40

Gate Research: Tether Data Launches QVAC Fabric LLM|Bitcoin Mining Profits Hit Historic Lows

Crypto Market Overview

BTC (+0.25% | Current price 91,878 USDT): After completing its decline near $83,800, BTC began a gradual rebound on December 2, moving up to the $91,000–93,000 range, with a clearly strengthened short-term structure. In terms of moving averages, the MA5 and MA10 have quickly crossed above the MA30, forming a short-term bullish alignment, indicating that the market has entered a phase of rhythmic recovery after a sharp decline. Although the rebound is relatively steep, it has not yet broken through the resistance zone above $93,000. The price needs to consistently hold above $91,500–92,000 to consolidate the short-term bullish advantage. On December 2, the MACD showed a strong golden cross, with the red bars expanding significantly, indicating a substantial improvement in buying momentum compared to earlier. However, as it approaches the $93,000 high...

GateResearch·12-03 06:55

Tether-Backed Stable L1 Unveils STABLE Tokenomics Ahead of Dec 8 Launch

The Tether-backed Layer 1 blockchain Stable has officially revealed the full economic model for its native token, STABLE. Just days before its mainnet launch on December 8. The project confirmed that the network will run entirely on USDT for transactions. While STABLE will serve as the system’s

STABLE-23.55%

Coinfomania·12-03 05:50

10 EU Banks Join Forces! Euro Stablecoin to Launch in 2026, Challenging US Dollar Dominance

A consortium of 10 banks plans to launch a euro-pegged stablecoin in 2026 through an entity authorized by the Dutch central bank. BNP Paribas announced on Tuesday that it will cooperate with nine other EU banks to launch a euro-backed stablecoin “in the second half of 2026.” Currently, the market capitalization of euro-denominated stablecoins is less than €350 million (about $407 million), accounting for only 1% of the global market share, with US dollar stablecoins continuing to dominate the market.

USDC0.01%

MarketWhisper·12-03 01:37

Evening Must-Read 5 Articles | Tether with $184 Billion is Walking a Tightrope

The article discusses the investment returns and risks of Bitcoin, the dynamics of Trump's potential nomination for Fed chair, the evolution and significance of Ethereum, the redemption mechanisms of stablecoins, and the challenges faced by Tether, showcasing the complexity and future potential of the crypto market.

金色财经_·12-02 12:42

With Tether's investment and the endorsement of the Central Bank of Brazil, why is the enterprise-level Blockchain Rayls well-received but not popular?

Author: Frank, PANews

Recently, amidst the overall silence in the market, the niche project Rayls officially launched its TGE on December 1st. This project, which had almost no prior attention, received support from two major overseas exchanges known for their strict compliance and risk control, Coinbase and Kraken, at the initial phase. It also simultaneously launched on multiple exchanges including Binance Alpha, Gate, and Bitget.

This inevitably causes the market to cast curious glances at Rayls. What kind of background and resources can attract the favor of a compliant exchange? This project, which attempts to bridge the "permissioned chain" and "public chain," holding the ticket for the Brazilian Central Bank's DREX pilot program, has it opened a new era for RWA, or is it just "new wine in an old bottle"?

Brazil's central bank endorsement attracts Tether investment in Latin American resources.

Rayls

PANews·12-02 08:14

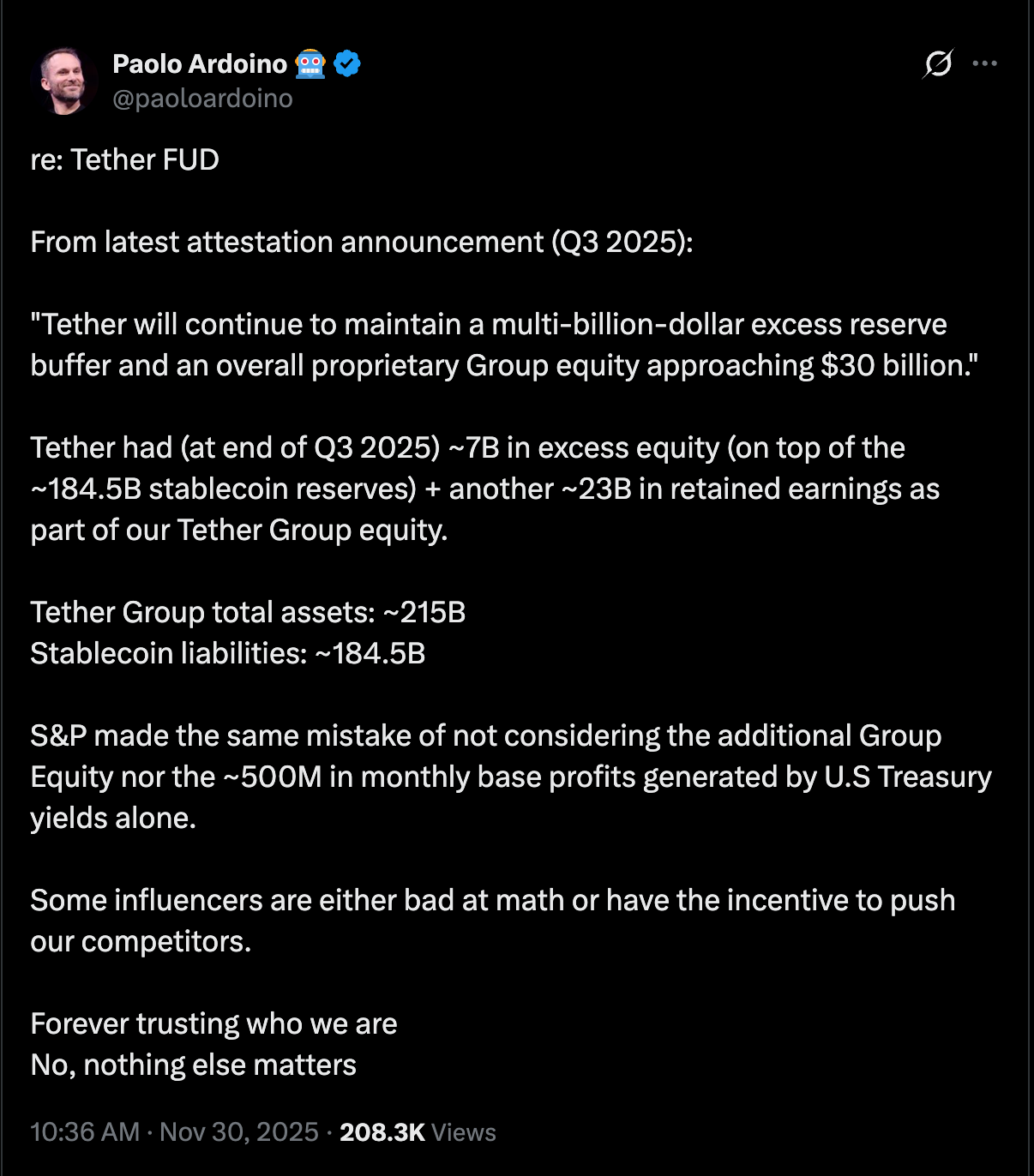

Tether CEO Counters Hayes’ Warning With Q3 Data Showing a Major Equity Cushion

Tether CEO Paolo Ardoino refuted claims of USDT stress due to potential drops in Bitcoin or gold, presenting Q3 2025 data showing $215 billion in assets and $30 billion in equity. S&P downgraded USDT citing high asset exposure, but Ardoino emphasized Tether's strong financial position.

BTC-0.96%

CryptoFrontNews·12-01 23:31

Arthur Hayes: Tether's Gold and BTC Hoarding Anticipates Major Interest-Rate Cuts

Arthur Hayes believes Tether, the largest stablecoin issuer, is positioning for upcoming dovish Federal Reserve moves. Hayes pointed to rising gold and bitcoin as evidence, saying these assets would likely rally in a low‑interest‑rate scenario.

Arthur Hayes: Tether Prepares For Low Interest Rate

Coinpedia·12-01 22:09

Tether Equity Debate Grows as Analysts Split on Risks

The debate over Tether's equity strength has intensified, with analysts questioning its reserve strategy and risk exposure amid concerns about Bitcoin and gold holdings potentially impacting equity.

BTC-0.96%

CryptoFrontNews·12-01 17:04

Wu's Daily Selected Encryption News + This Week's Macroeconomic Indicators

1. Yearn yETH pool suffered an attack leading to abnormal minting, resulting in a loss of approximately 9 million USD.

The yETH product of Yearn Finance was attacked, and the attacker seems to have exploited a vulnerability to mint nearly an unlimited amount of yETH, draining the pool in a single transaction and profiting around 1,000 ETH, some of which has been transferred to Tornado Cash; on-chain data shows that the attack involved multiple newly deployed contracts that self-destructed afterwards. Yearn officials stated that this abnormal minting incident resulted in a loss of approximately 9 million USD. Slow Mist founder Yu Xian tweeted that the "white hat negotiation" messages that appeared on-chain after the Yearn attack were fabricated and were actually phishing activities, related to the previous Balancer.

WuSaidBlockchainW·12-01 14:05

Former Citi Analyst Refutes Arthur Hayes’ Tether Insolvency Claims

A former Citi crypto research head contests Arthur Hayes' solvency concerns regarding Tether, highlighting undisclosed corporate assets and significant profits that suggest USDT's strength and profitability surpass criticisms.

BitcoincomNews·12-01 10:35

Tether Theory: The Architecture of Monetary Sovereignty and Private Dollarization

I. Core Argument

The international monetary order is undergoing a fundamental reorganization, which is not the result of deliberate actions by central banks or multilateral institutions, but rather stems from the emergence of an offshore entity that most policymakers still find difficult to categorize. Tether Holdings Limited (the issuer of the USDT stablecoin) has constructed a financial architecture that extends the United States' monetary hegemony to the deepest parts of the global informal economy, while simultaneously laying the groundwork for ultimately circumventing this hegemony.

This is not a story about cryptocurrency, but rather a story about the privatization of US dollar issuance, the fragmentation of monetary sovereignty, and the emergence of a new type of systemic actor that exists in the gray area between regulated finance and borderless capital. The passage of the GENIUS Act in July 2025 will solidify this shift into a binary choice faced by global dollar users: either accept the United States.

金色财经_·12-01 10:26

Former Head of Encryption Research at Citigroup: Tether has a "money printer" with no external bankruptcy risk concerns.

According to a TechFlow report, on December 1st, Joseph, the former head of encryption research at Citigroup, stated on social media that Tether operates a "printing press," far from the bankruptcy risks that the outside world is worried about.

Joseph pointed out that Tether's public disclosure of assets does not represent all of the company's assets. The company has a separate equity asset balance sheet, which includes equity investments, mining operations, corporate reserves, and possibly more Bitcoin, with the rest distributed as dividends to shareholders.

Secondly, Tether holds approximately 120 billion USD in interest-bearing government bonds, with a yield of about 4% since 2023, generating an annual income of around 10 billion USD. With a low-cost operation of only 150 employees, it has become one of the most efficient cash-generating businesses in the world.

Third, Joseph estimates the equity value of Tether to be between 500 and 1.

BTC-0.96%

DeepFlowTech·12-01 10:03

Former Citibank encryption research head: Arthur Hayes missed 3 key points on Tether's FUD.

According to Mars Finance news, in response to Arthur Hayes' doubts about the operation of USDT, former head of crypto research at Citibank, Joseph, stated on the X platform that @CryptoHayes' analysis missed several key points: 1. Disclosure of assets ≠ total corporate assets USDT discloses reserves according to the "matching principle", but its undisclosed balance sheet includes equity investment income, mining business, corporate reserves, and potential Bitcoin holdings, with remaining profits distributed to shareholders in the form of dividends. 2. Ultra-high profit margins and equity value Tether holds $120 billion in US Treasury bonds (annualized 4% yield), with an annual net profit of about $10 billion starting from 2023 (with only 150 employees), making it the world's most efficient money printer; equity valuation could reach $50-100 billion (close to...

BTC-0.96%

MarsBitNews·12-01 10:01

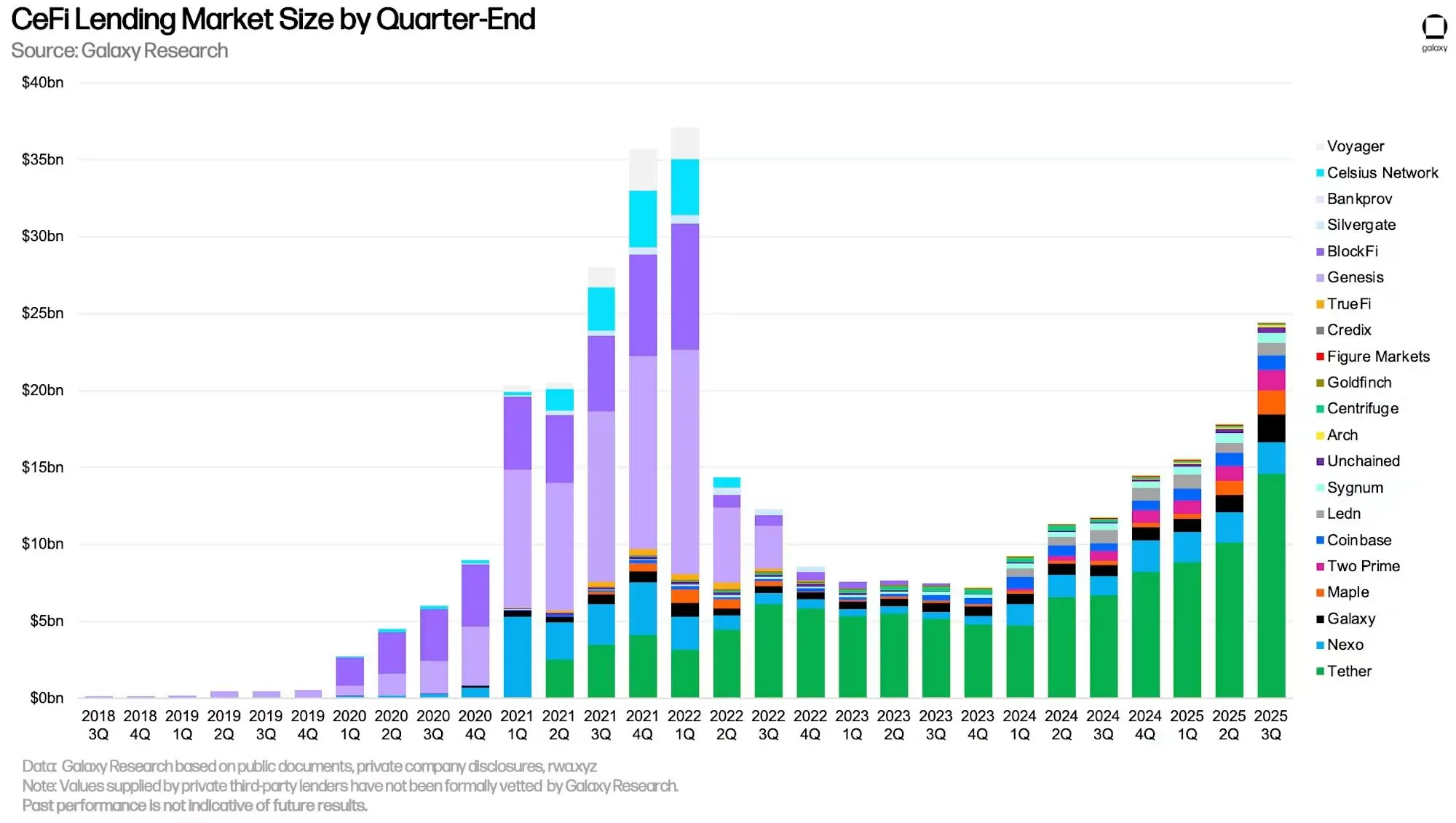

The lending market has exploded! CeFi recovers losses of 25 billion, with Tether issuers monopolizing 60%.

The total amount of outstanding loans in the cryptocurrency lending market in the third quarter has approached $25 billion, according to data from Galaxy Research. Since the beginning of 2024, the CeFi lending market has grown by over 200%, reaching its highest level since the peak in the first quarter of 2022. As of September 30, the outstanding loans of stablecoin issuer Tether amount to $14.6 billion, with a market share of 60%.

MarketWhisper·12-01 06:59

Tether CEO Fires Back at S&P Downgrade: “They Didn’t Do Their Homework”

Tether CEO Paolo Ardoino has strongly rejected S&P Global Ratings’ recent downgrade of USDt’s peg stability to the lowest possible score, calling the assessment “incomplete and misleading.”

BTC-0.96%

CryptoPulseElite·12-01 06:18

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27