Bitcoin Stocks: Latest News and Market Analysis

Discover Bitcoin related stocks in U.S. tech: Strategy (MSTR) holds 600K+ BTC, CRCL stock operates USDC stablecoin, BMNR stock builds crypto reserves.

MSCI temporarily lifts ban! MicroStrategy surges 5% after hours, Bitcoin-related stocks escape unscathed

MSCI will not remove the digital asset universe (DAT) from the index for now, and MicroStrategy (MSTR) rose 4.36% after hours. MSCI's proposal in October to exclude companies with digital asset holdings over 50% faced a backlash. Currently, the approach to DAT companies remains unchanged, but ongoing review will continue.

MarketWhisper·18h ago

Metaplanet 狂掃 4279 BTC!總持倉 3.5 萬枚,股價飆 10.7%

Japan Bitcoin Vault Metaplanet's stock price rose 10.7% on Tuesday, and US OTC increased 19.17% on Monday. In Q4, 4,279 BTC were purchased, bringing the total holdings to 35,102 BTC. MicroStrategy rose 4.81%, Mara Holdings increased 6.86%, and Bakkt surged 31.47%. Goldman Sachs upgraded Coinbase to "Buy," with the stock price up 7.77%.

MarketWhisper·01-06 06:37

MicroStrategy disrupts private equity! $21 billion creates a permanent Bitcoin capital engine

Saylor issued another Tracker message on January 4th, expecting to reveal the increased holdings data this week. MicroStrategy holds 672,497 Bitcoins, with a cost of $50.4 billion and a market value of $61.4 billion. MicroStrategy plans to raise $21 billion in 2025, converting Bitcoin into institutional-grade collateral through digital equity and credit.

MarketWhisper·01-05 01:52

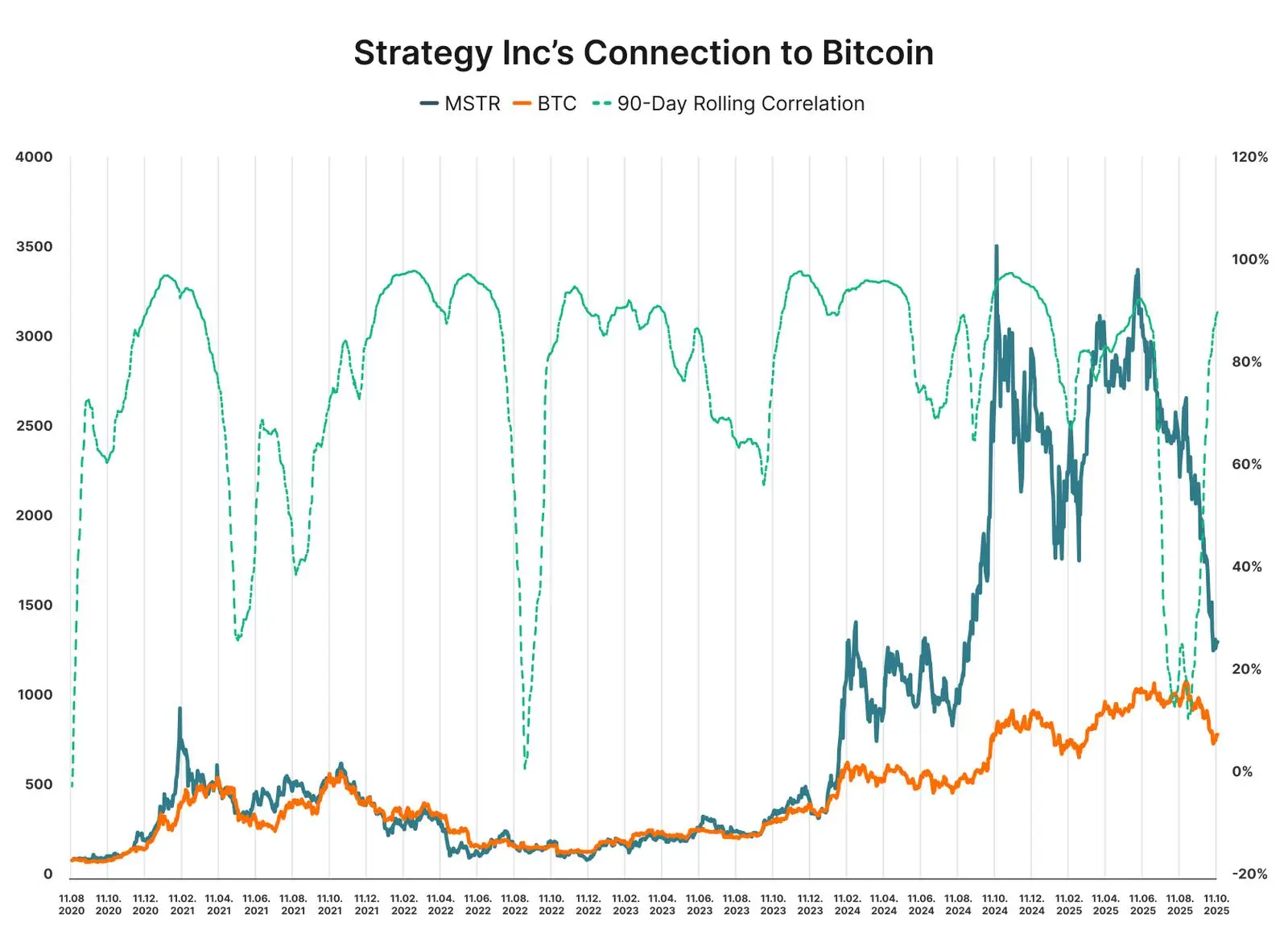

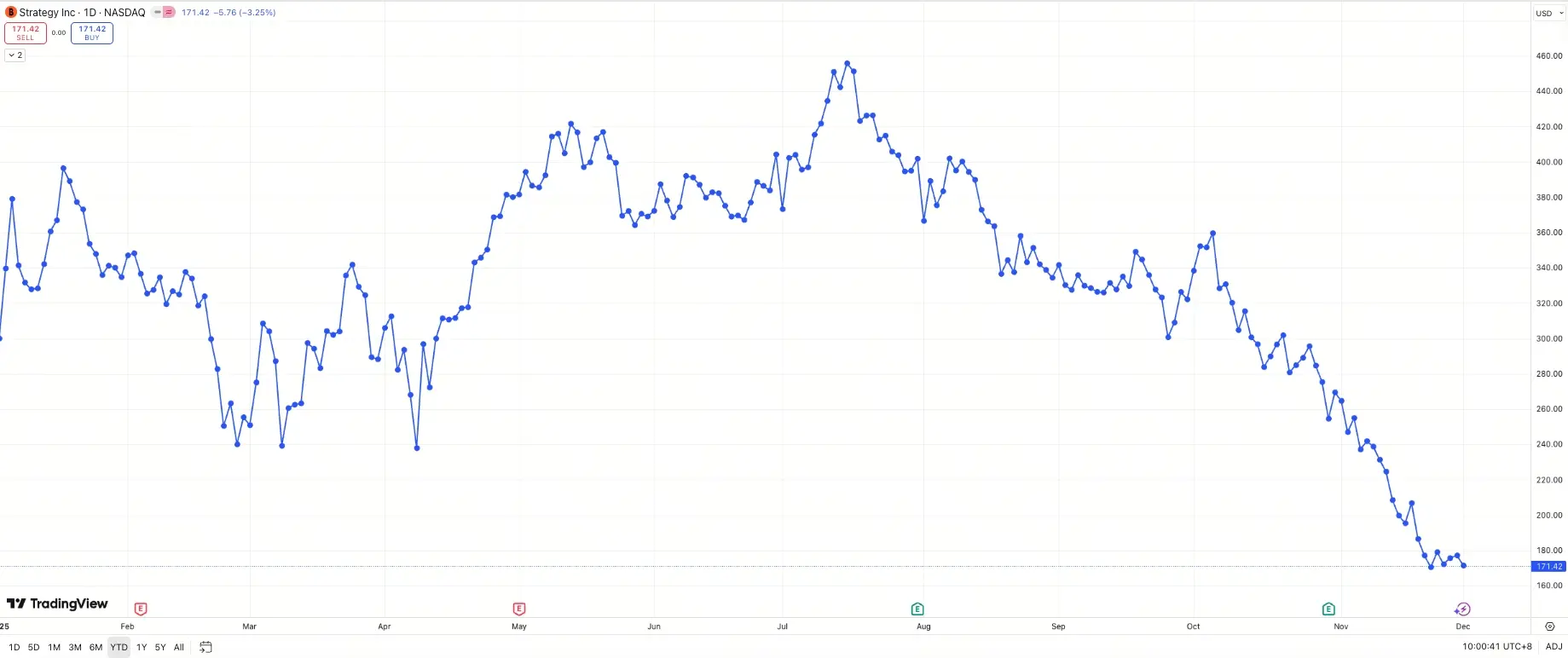

MicroStrategy's collapse countdown? Once "this indicator" drops below the critical point, holding the stock will be meaningless

Michael Saylor's MicroStrategy (MSTR) rose 1.22% in early trading today, but has plummeted 66% since its peak in July 2024. The key indicator mNAV is only 1.02; once it falls below 1, it indicates that the company's value is less than the Bitcoin it holds, and the holding becomes illogical, potentially triggering a sell-off.

MarketWhisper·01-04 06:29

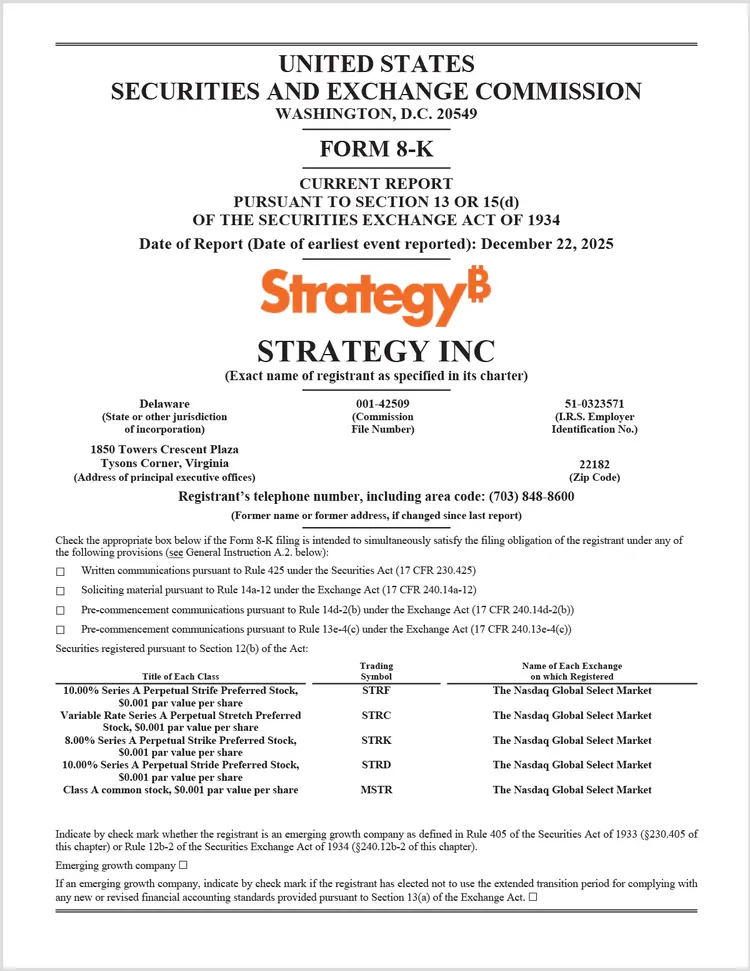

MicroStrategy increases holdings again! Spent 108 million to buy Bitcoin, stock price did not rise but fell instead

MicroStrategy last week purchased 1,229 Bitcoins for $108.8 million, with an average cost of $88,568 per Bitcoin, bringing the total holdings to 672,497 Bitcoins. The total investment amounts to $50.44 billion, with an overall average cost of $74,997. After the announcement, MSTR's stock price fell 1% to $157, and Bitcoin also dropped to around $87,000.

MarketWhisper·01-04 01:55

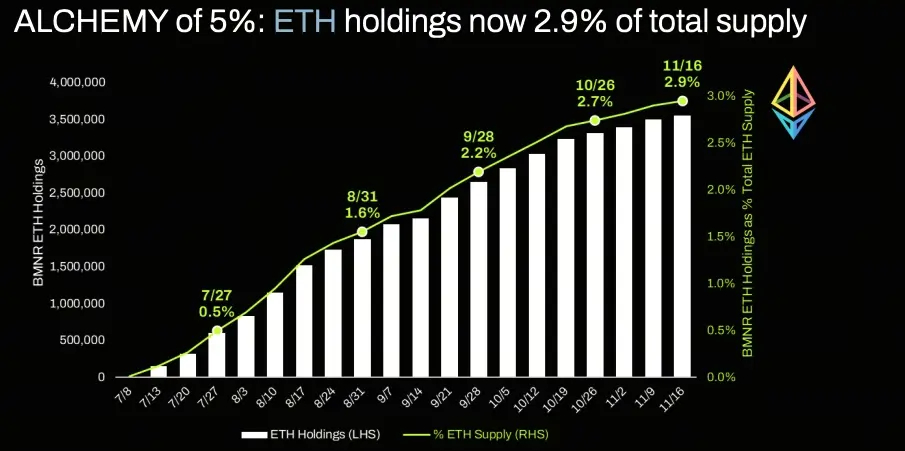

以太坊巨鯨 BitMine 持倉破 410 萬枚!股東會前提案擴大質押

BitMine holds 4.11 million ETH, accounting for 3.41% of the supply, plus $1 billion in cash, with total assets reaching $13.2 billion, and has staked 408,000 ETH. On Tuesday, the stock price fell 3% to $27.72. The company will launch the staking platform MAVAN in early 2026, and the shareholder meeting on January 15 will vote to increase authorized shares and expand the staking scale.

ETH-2,43%

MarketWhisper·2025-12-31 02:01

BitMine Daily Revenue of 1 Million USD! MAVAN Validator Network Launches in 2026

BitMine plans to launch the MAVAN validator network in early 2026, shifting $12 billion worth of ETH vaults to staking for profit. The company holds 4.11 million ETH, making it the largest public ETH vault. Chairman Thomas Tom Lee estimates that fully staked, annual returns could reach $374 million, with daily earnings exceeding $1 million. Currently, 408,000 ETH have been staked for testing.

ETH-2,43%

MarketWhisper·2025-12-30 07:04

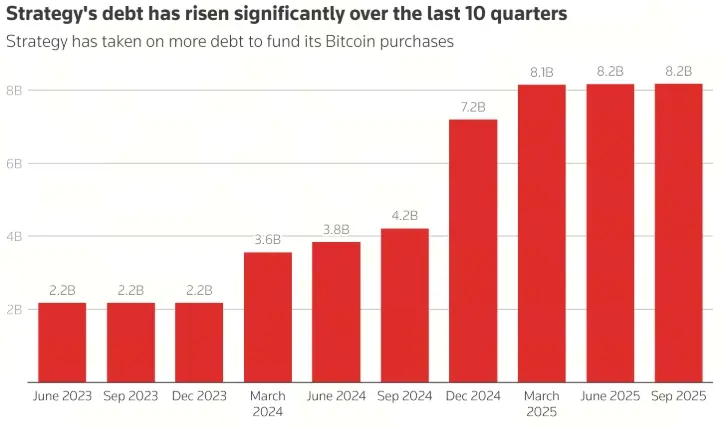

The biggest black swan in the crypto world in 2026! MicroStrategy's 45 billion empire faces collapse pressure

MicroStrategy holds 671,268 Bitcoins with a market value of $45 billion but has $60 billion in BTC assets, resulting in a $15 billion valuation discount. Carrying $8.2 billion in debt and $7.5 billion in preferred stock, with annual fixed expenses of $779 million. If Bitcoin falls below $13,000, the company will go bankrupt, and the selling pressure from 6.7 million BTC could trigger a black swan event more severe than FTX.

BTC-1,22%

MarketWhisper·2025-12-30 02:34

BitMine increases position against the trend, purchasing 44,463 ETH, with holdings surpassing $12 billion.

BitMine (BMNR) disclosed on December 28th that last week they added 44,463 ETH (approximately $130 million), bringing the total holdings to 4,110,525 ETH, accounting for 3.41% of ETH's circulating supply, with a market value of about $12.04 billion. Among these, 408,627 ETH have been staked, with an annualized yield of 2.81%, and an estimated annual income of $374 million.

MarketWhisper·2025-12-30 01:00

MicroStrategy purchased 1,229 Bitcoins in the last week of 2025, with a total holding of 672,000 Bitcoins.

MicroStrategy (MSTR) purchased 1,229 Bitcoins for $108.8 million between December 22 and 28, 2025, at an average cost of $74,997 per Bitcoin. This transaction brings the company's total Bitcoin holdings to 672,497 coins, solidifying its position as the world's largest corporate Bitcoin holder. Currently, MicroStrategy's Bitcoin yield has reached 23.2%.

MarketWhisper·2025-12-30 00:37

2025 Cryptocurrency Concept Stock Ranking! IREN Surges, MicroStrategy Stock Price Halved

In 2025, cryptocurrency concept stocks experienced intense polarization, with winners being IREN up 327%, Cipher Mining up 249%, and Bitmine up 257%. Losers include MicroStrategy down 47%, MARA down 40%, and Fold down 71%. Those transitioning to AI or adopting financial asset strategies emerged victorious, while pure mining holders suffered heavy losses. Wall Street has taken control of pricing through ETFs and DAT, with execution power being more critical than the coin price.

MarketWhisper·2025-12-29 07:20

Gate Daily (December 29): BitMine begins staking Ethereum holdings; plans to acquire a Korean exchange for 100 million in the future.

Bitcoin (BTC) started the week with a rebound, currently around $80,082 as of December 29. BitMine has begun staking ETH and deposited $219 million into the Ethereum PoS contract. Mirae Asset Financial Group is in talks to acquire the Korean cryptocurrency exchange Korbit for $100 million.

MarketWhisper·2025-12-29 01:22

Why did Bitcoin rise today? MicroStrategy hints at adding more positions, TradFi banks rush to deploy assets

December 29, Bitcoin opened this week's trading near $87,800, with a slight increase of about 0.8% during the day, and a 24-hour trading volume reaching $13.6 billion. Despite remaining in extreme fear territory, institutional investors are adding to their positions against the trend. MicroStrategy currently holds 671,000 BTC, valued at up to $58.6 billion. The TradFi banking sectors in the US and the UAE are showing unprecedented interest.

BTC-1,22%

MarketWhisper·2025-12-29 00:31

Bitmine has amassed a total of 4.06 million ETH holdings, ranking first globally, with a target of 5% of the total supply.

Ethereum treasury company Bitmine Immersion Technologies (BMNR) announced that the total holdings of Crypto Assets and cash have reached $13.2 billion, which includes 4.066 million ETH, accounting for 3.37% of the total supply, with two-thirds of the "5% alchemy" target already achieved. The company added nearly 100,000 ETH in just one week last week, demonstrating an impressive Accumulation speed.

ETH-2,43%

MarketWhisper·2025-12-23 03:01

TD Cowen: MicroStrategy holds $2.2 billion in cash to prepare for the crypto winter, which can last for 32 months.

MicroStrategy (MSTR) last week raised approximately $748 million by selling common stock, causing its dollar reserves to surge to $2.19 billion, which has attracted significant market attention. Investment bank TD Cowen's TD Securities division pointed out that this cash is sufficient to cover the company's interest and dividends for about 32 months, and even in the face of a "long-term cryptocurrency winter," MicroStrategy's continued viability is not in question.

BTC-1,22%

MarketWhisper·2025-12-23 00:38

Metaplanet approves dividend priority shares! Global institutions rush in for 30,000 BTC open positions.

Japan's largest Bitcoin holder Metaplanet has approved a comprehensive reform of its capital structure, allowing this Asian Bitcoin giant to raise funds from institutional investors through preferred shares with dividends. Metaplanet currently holds approximately 30,823 Bitcoins, worth 2.75 billion USD, making it the largest corporate Bitcoin holder in Asia and the fourth largest in the world. The company will begin trading on the US OTC Trading market through American Depositary Receipts (ADRs).

BTC-1,22%

MarketWhisper·2025-12-23 00:33

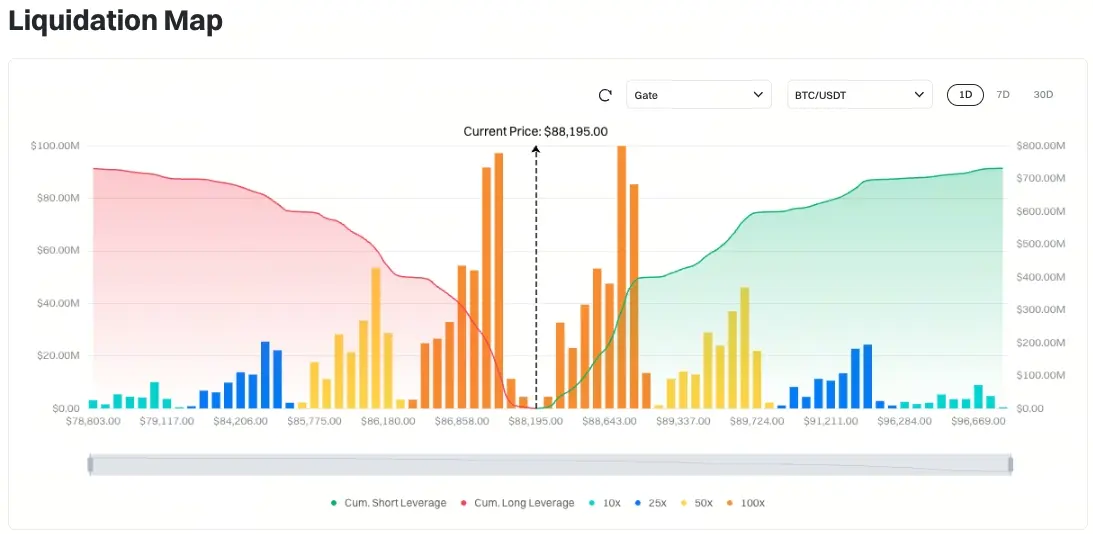

Why did Bitcoin fall today? MicroStrategy pauses buying and hoards $2.2 billion in cash to sound the alarm.

Bitcoin tested the key support level of $88,000 today, and the largest buyer, MicroStrategy (MSTR), suddenly hit the brakes. The company cashed out $747.8 million last week by selling 4.535 million shares of common stock, raising its cash reserves to $2.19 billion, yet paused its years-long Bitcoin purchase plan. This is the first time since 2020 that MicroStrategy has chosen to hoard cash instead of buying the dip during a downturn in the crypto market.

BTC-1,22%

MarketWhisper·2025-12-23 00:27

MicroStrategy's stock price fell 43%! Saylor hints at buying the dip in Bitcoin.

Michael Saylor hinted that MicroStrategy (MSTR) will once again make a large purchase of Bitcoin to strengthen its fully committed reserve strategy. However, this move comes at a time when MicroStrategy faces the risk of being removed from the MSCI index, as MSCI is considering excluding MicroStrategy from its global index in the February evaluation, believing that the company operates more like an investment institution rather than an operating company. JPMorgan estimates that exclusion would trigger approximately $11.6 billion in forced selling.

BTC-1,22%

MarketWhisper·2025-12-22 02:15

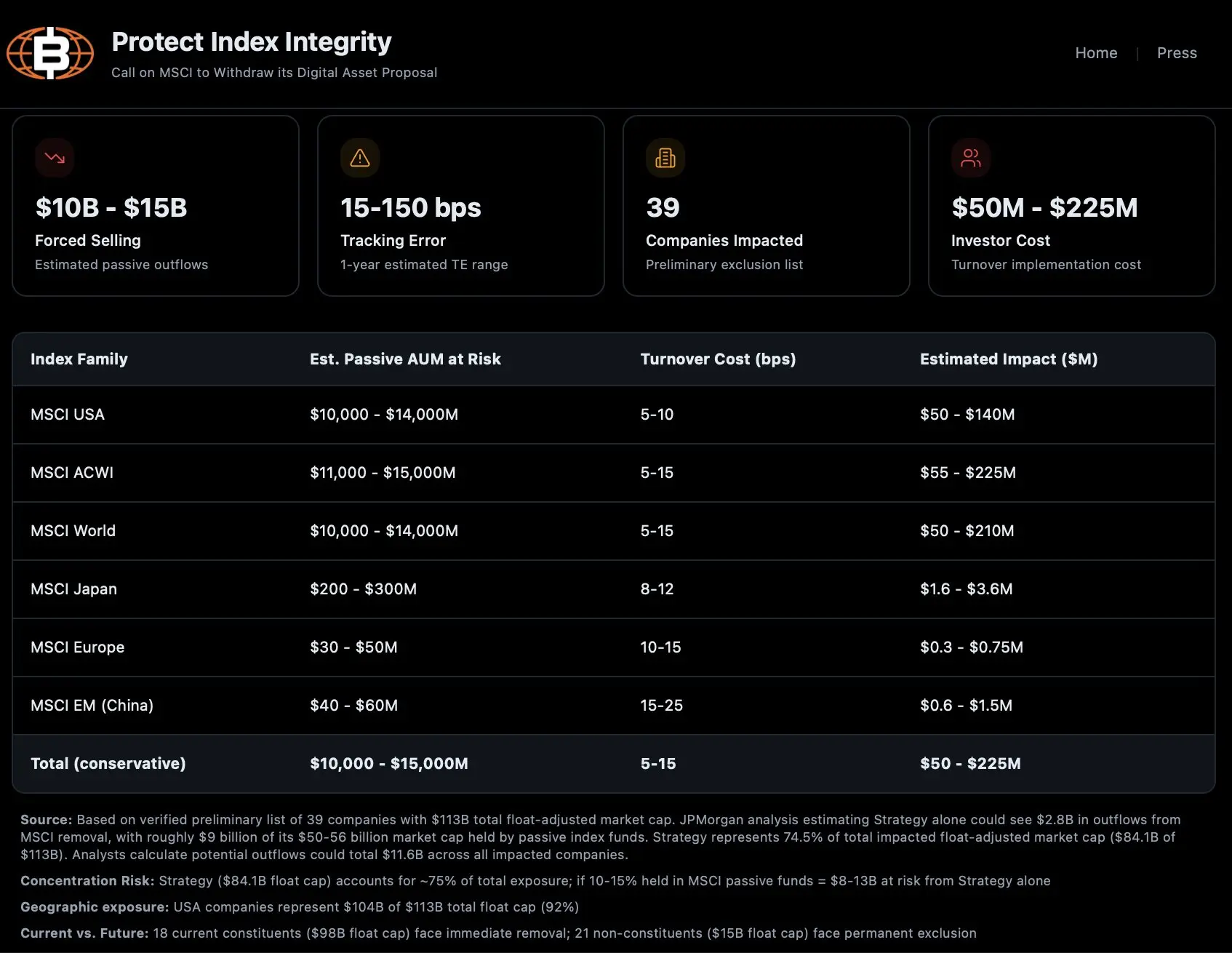

MicroStrategy delisted by MSCI? Opposition group: $15 billion in passive funds may exit

Morgan Stanley Capital International Index (MSCI) announced in October that it is consulting on whether to exclude companies with most of their balance sheets in crypto, which could trigger forced sales of $10 billion to $15 billion. The opposition group BitcoinForCorporations predicts this scale based on a list of 39 companies with a combined market capitalization of $113 billion after float adjustment.

MarketWhisper·2025-12-18 06:45

Vanguard invests $3.2 billion to buy MicroStrategy stock, indirectly holding Bitcoin and shocking Wall Street

The asset management giant Vanguard, which manages over 10 trillion USD in assets, recently disclosed holdings of $3.2 billion in MicroStrategy (MSTR) stock. This investment has shocked Wall Street because MicroStrategy is known for holding a large amount of Bitcoin on its balance sheet. Vanguard's move is equivalent to holding Bitcoin indirectly without directly purchasing cryptocurrencies. Analysts believe this could encourage other large asset management firms to invest in digital assets indirectly.

MarketWhisper·2025-12-18 02:30

Cryptocurrency concept stocks crash! Ark invests 17 million to buy BMNR and CRCL, reduces Tesla holdings

Bitcoin plummeted to $85,000, triggering a全面崩跌 in crypto concept stocks. Ark Invest, through its funds, aggressively bought BMNR, COIN, CRCL, XYZ, BLSH, SLMT, and ARKB, while also adjusting Tesla (TSLA) shares on rallies. Tesla's stock price approached its all-time high, and Ark took profits by selling 124,867 shares valued at $59 million.

ETH-2,43%

MarketWhisper·2025-12-16 07:20

MicroStrategy increases position against the trend with $980 million in BTC, but MSTR's return rate turns negative for the first time

MicroStrategy (MSTR) disclosed on Monday that between December 8 and 14, it spent approximately $980.3 million to purchase 10,645 Bitcoins, with an average price of $92,098. However, MicroStrategy's BTC return (a core indicator tracking the amount of Bitcoin held per share of MSTR) turned negative for the first time in years, with a quarterly return of -1%, meaning that the number of Bitcoins held per share is now less than at the end of September.

BTC-1,22%

MarketWhisper·2025-12-16 00:44

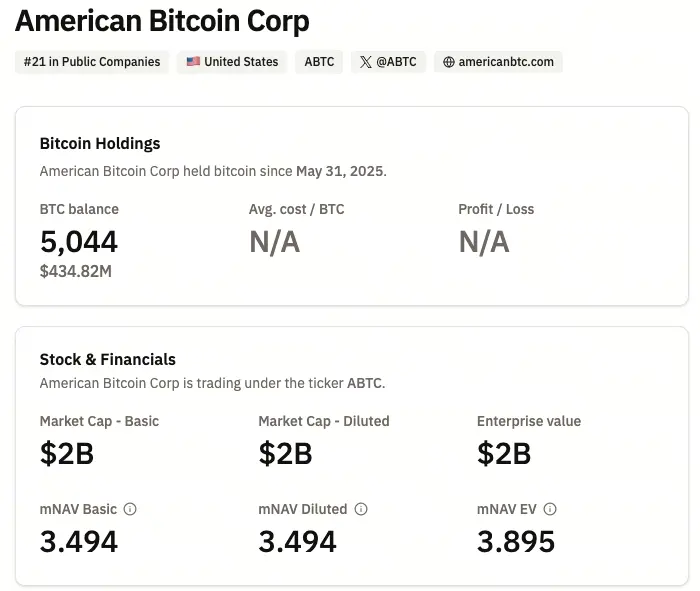

Trump's son buys the dip! American Bitcoin purchases 1000 Bitcoins on a dip

American Bitcoin, endorsed by Donald Trump Jr. and Eric Trump, has surpassed ProCap Financial in total Bitcoin holdings. Since early December, American Bitcoin has added over 1,000 Bitcoins to its reserves, bringing the total holdings to 5,044 Bitcoins, valued at approximately $443 million, ranking it 21st among corporate holders.

MarketWhisper·2025-12-16 00:37

MicroStrategy remains in the NASDAQ 100! Saylor defies criticism and continues to buy Bitcoin aggressively

MicroStrategy (MSTR) successfully retained its status as a component of the NASDAQ 100 Index. Founder and Executive Chairman Michael Saylor immediately declared, "We will continue to increase our Bitcoin holdings until the market stops complaining." Although MSCI has expressed concerns about including crypto assets in its index framework and plans to decide in mid-January whether to remove MicroStrategy from its index, NASDAQ still maintains MicroStrategy's status as a benchmark index component.

MarketWhisper·2025-12-15 00:36

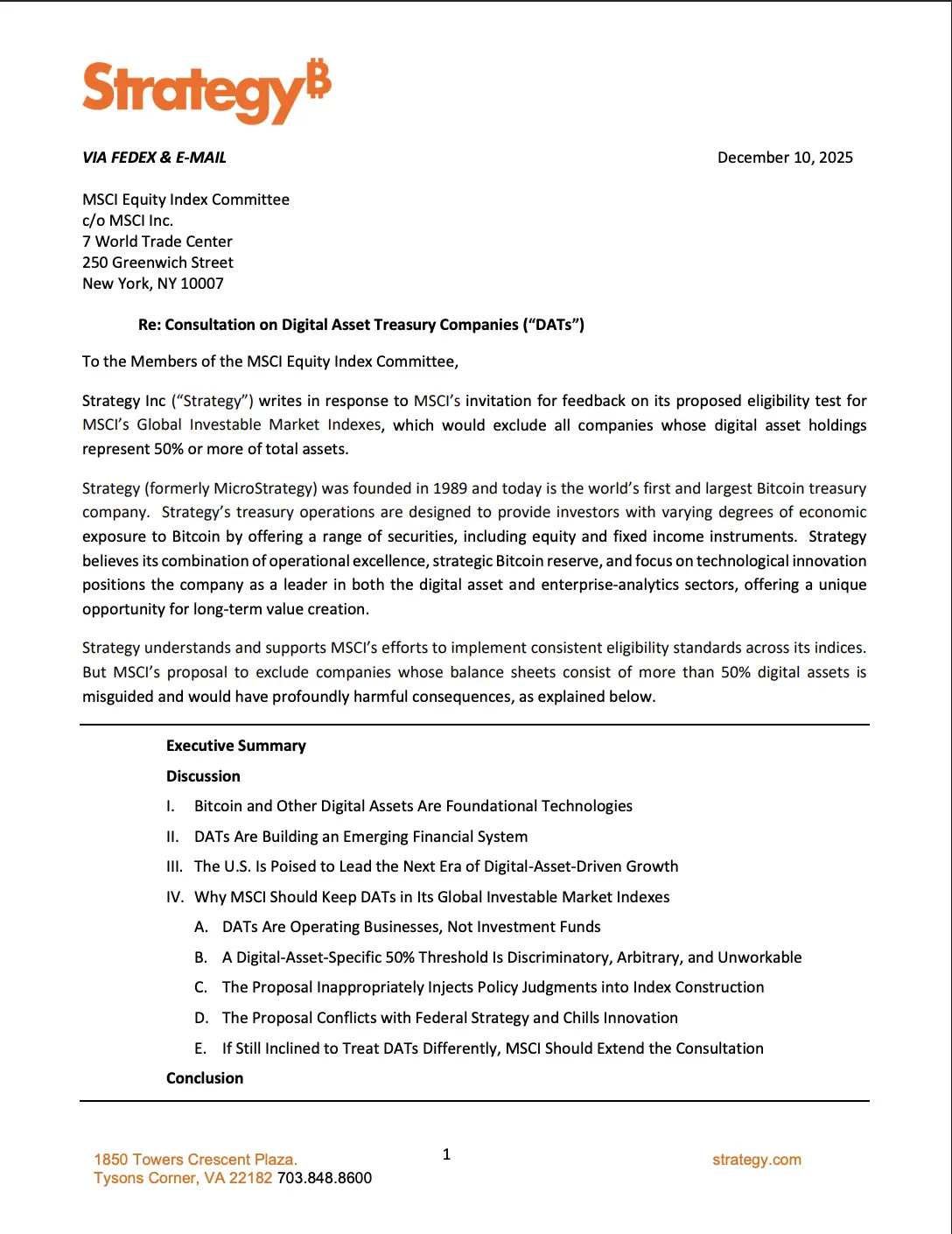

MicroStrategy writes back to counter MSCI delisting order! January implementation may trigger a Bitcoin sell-off wave

The largest Bitcoin treasury company MicroStrategy (MSTR) has sent a letter to index provider MSCI opposing a proposed policy change that would exclude crypto asset pools (DAT) holding 50% or more cryptocurrencies on their balance sheets from stock market indexes. MicroStrategy states that DAT are operating companies capable of actively adjusting their businesses and questions why MSCI does not exclude real estate investment trusts, oil companies, and other enterprises focused on single assets.

MarketWhisper·2025-12-11 00:33

MicroStrategy and BitMine Arbitrage Crash! 600 billion "unlimited capital loopholes" are in a structural crisis

The disappearance of the "unlimited money loophole" that underpins microstrategies and BitMine has forced the crypto asset bank (DAT) to transform. On December 8, MicroStrategy revealed that it spent $9.627 billion to purchase 10,624 Bitcoins last week, the largest weekly expenditure since July, but the stock price fell 51% year-on-year to $178.99. BitMine similarly added 138,452 ETH to its balance sheet.

ETH-2,43%

MarketWhisper·2025-12-10 06:10

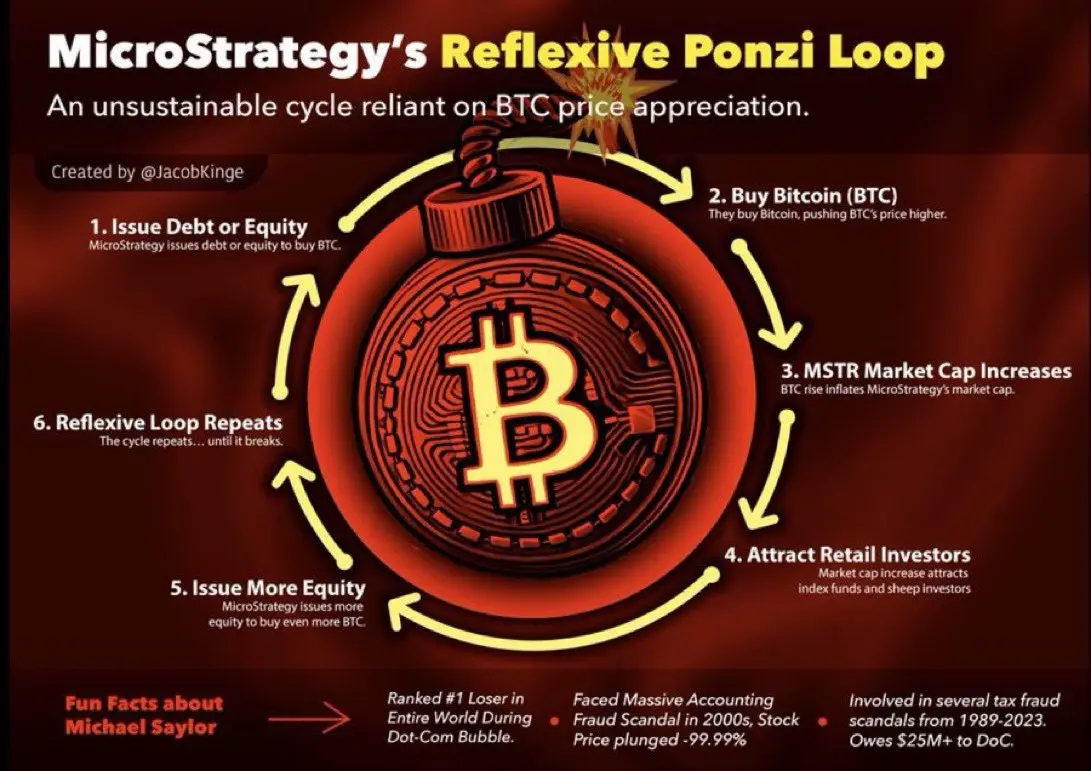

Micro-strategy buying coins to manipulate public opinion? Analysts reveal Saylor's dark history of dot-com bubble fraud

Analyst Jacob King questioned MicroStrategy's recent purchase of 10,624 Bitcoins (approximately $10 billion), claiming that the move had a perceived impact but had no real impact. King pointed out that this acquisition is more of a manipulation of public opinion. He reiterated Saylor's settlement agreement with the SEC during the dot-com bubble, when Saylor paid $830k for falsely reported income.

MarketWhisper·2025-12-10 05:14

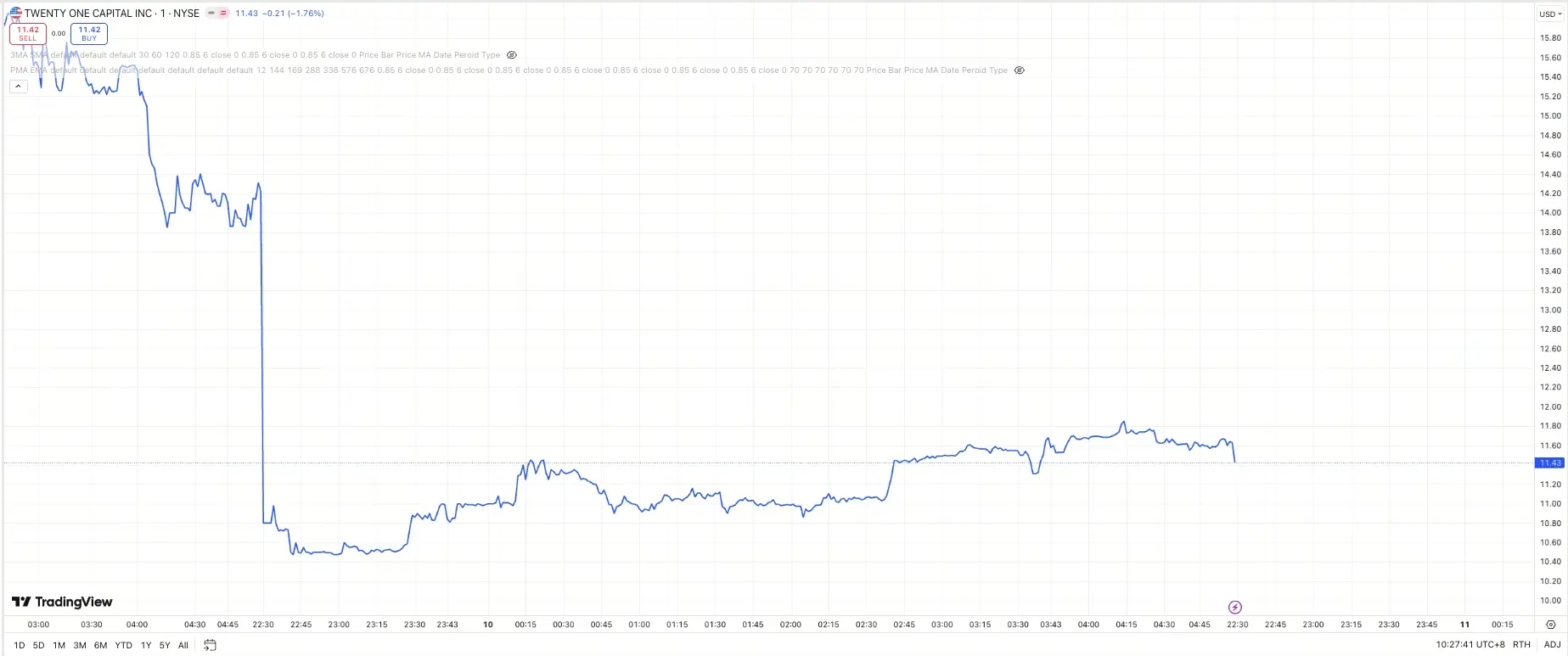

Twenty One plunges 25% on its first day of listing! $3.9 billion Bitcoin holdings severely undervalued

On December 9th, Twenty One Capital Inc. saw its stock price plummet by 25% on its first day of listing through a SPAC merger, with an opening price of $10.74, significantly lower than Cantor Equity Partners' closing price of $14.27. This Bitcoin treasury company, founded by Tether, SoftBank Group, and others, holds approximately $3.9 billion worth of Bitcoin.

MarketWhisper·2025-12-10 02:29

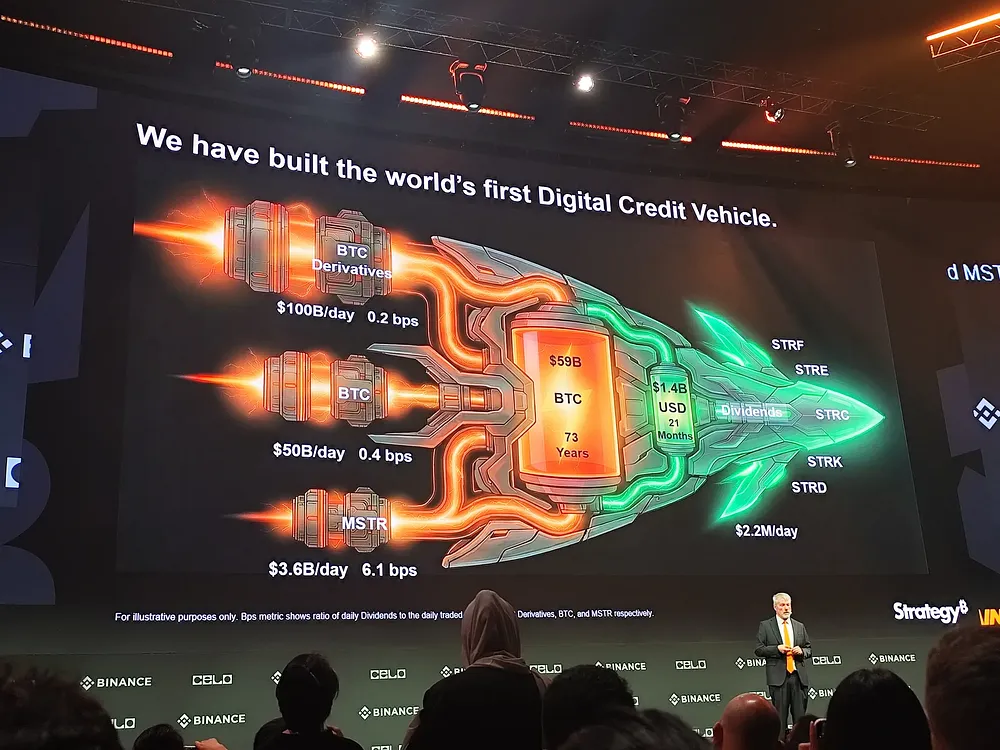

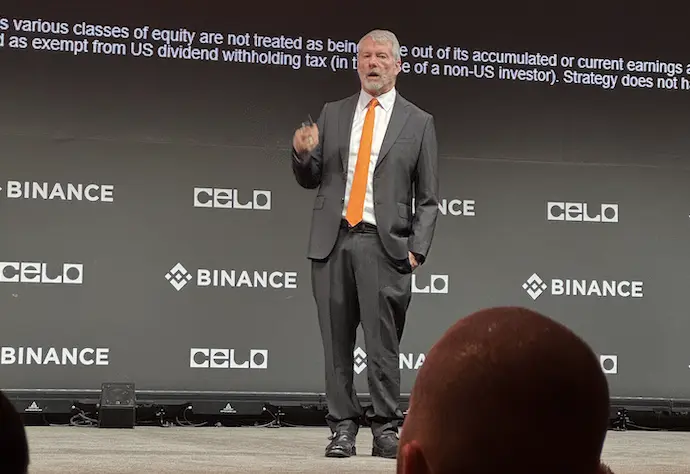

Full Text of Michael Saylor's Dubai Speech: What is DAT? When Will MicroStrategy Sell Its Coins?

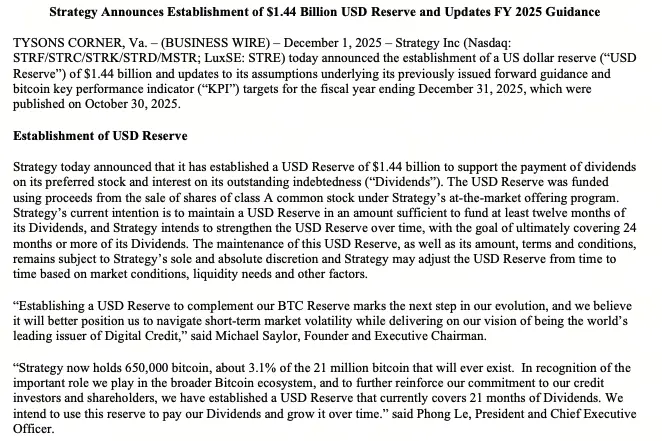

MicroStrategy founder Michael Saylor, in a speech in Dubai on December 4, fully revealed the DAT (Digital Asset Treasury) business model for the first time. MicroStrategy currently holds 650,000 Bitcoins, with an investment of approximately $4.8 billion. Saylor explicitly stated that they will never sell their coins; as long as Bitcoin’s annualized growth rate exceeds 1.36%, it will cover their costs. The company holds $1.44 billion in cash reserves, which can support 21 months of operations.

MarketWhisper·2025-12-09 08:24

Bitcoin MENA debuts! MicroStrategy keynote: Bitcoin banks attract 20 trillion in capital

MicroStrategy (MSTR) CEO Michael Saylor presented a bold vision at the Bitcoin MENA event in Abu Dhabi: countries can use overcollateralized Bitcoin reserves and tokenized credit instruments to create regulated digital bank accounts with high yields and low volatility, attracting $50 trillion in capital flows. He pointed out that bank deposit yields in Japan and Europe are near zero, while the digital banking system designed by MicroStrategy can offer returns far surpassing those of traditional finance.

BTC-1,22%

MarketWhisper·2025-12-09 00:55

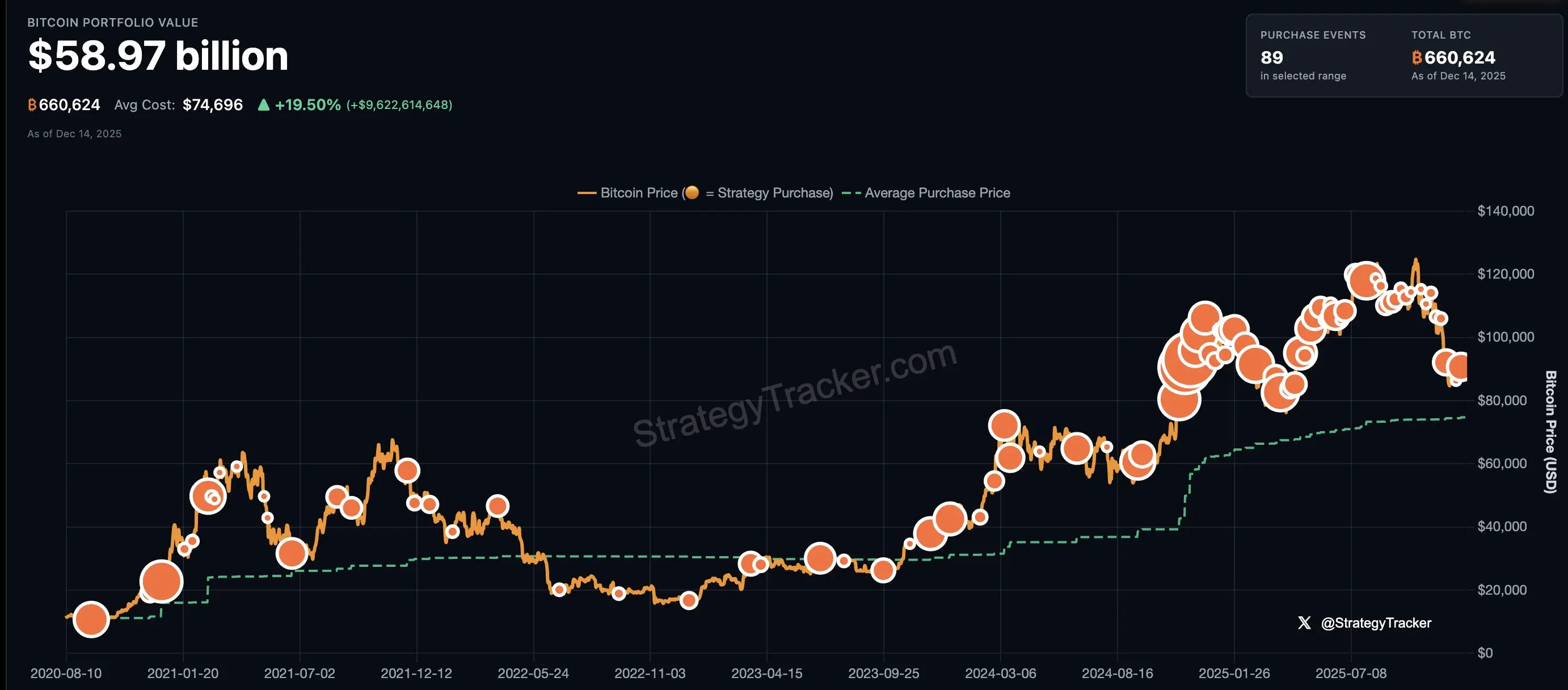

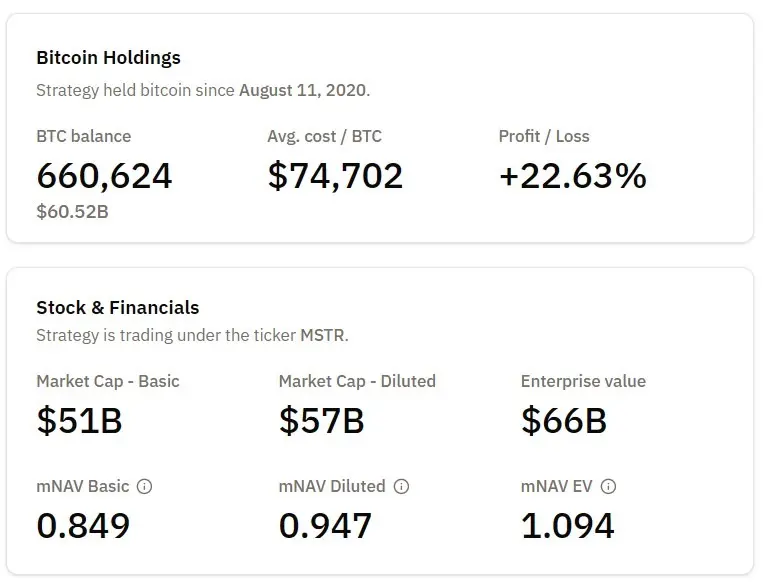

MicroStrategy invests another $960 million! Bitcoin holdings surpass 660,000, reaching a new all-time high

MicroStrategy (MSTR) Chairman Michael Saylor announced on the X platform that the company purchased 10,624 bitcoins last week at an average price of $90,615 per bitcoin, for a total value of approximately $962.7 million. This purchase brings MicroStrategy's total bitcoin holdings to 660,624 bitcoins, with a total acquisition cost of about $4.935 billion, at an average price of $74,696 per bitcoin.

ETH-2,43%

MarketWhisper·2025-12-09 00:26

Robinhood enters Indonesia's market of 270 million people! Dual acquisitions cause stock price to drop 3.74%

Robinhood (HOOD) officially announced on December 8 that it has signed agreements to acquire Indonesian local brokerage Buana Capital Sekuritas and licensed digital asset trader PT Pedagang Aset Kripto. Following the announcement, HOOD's stock price dropped by 3.74%, closing at around $22.50, with trading volume increasing by 25%.

ETH-2,43%

MarketWhisper·2025-12-08 06:33

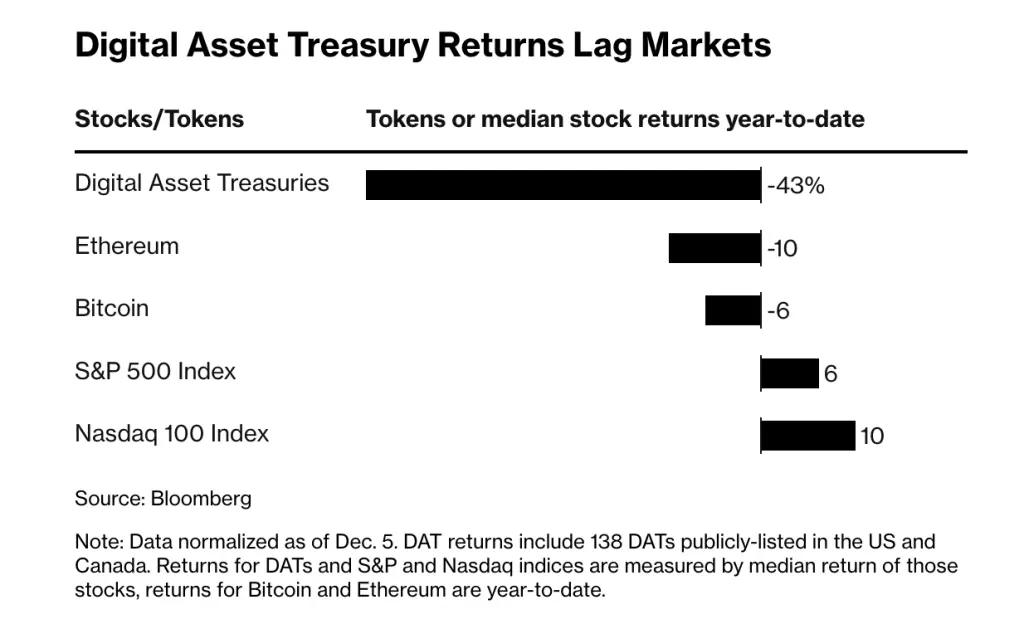

The hottest trading crash in the crypto world! Stock prices of 138 treasury companies halved, the MicroStrategy myth shattered

Bloomberg reported on December 7 that the crypto industry's craziest investment strategy of the year is undergoing an epic collapse. In the first half of 2025, more than 138 publicly listed companies in the US and Canada transformed into "digital asset treasuries," borrowing over $45 billion to purchase Bitcoin and other tokens. However, Bloomberg data shows that the median stock price of these listed companies emulating MicroStrategy has already dropped 43% this year, while Bitcoin has only fallen 6%.

MarketWhisper·2025-12-08 06:17

The MicroStrategy Myth Has Collapsed! US Stock Imitators See Their Share Prices Halved, But Saylor Still Hints at Further Accumulation

MicroStrategy founder and executive chairman Michael Saylor released Bitcoin Tracker information, hinting at another increase in holdings. However, digital asset management companies rushing to emulate MicroStrategy have suffered heavy stock price losses, with the median share price of these companies falling 43% year to date, while the broader market is rising. In the first half of this year, more than 100 publicly listed companies transformed into crypto holding vehicles, borrowing billions of dollars to purchase tokens, but their debt obligations have exposed structural weaknesses.

MarketWhisper·2025-12-08 02:08

JPMorgan: Bitcoin to Surge to $170,000 Within a Year, MicroStrategy's HODLing Is the Key Catalyst

JPMorgan's latest analyst report maintains a long-term optimistic outlook for Bitcoin, predicting that based on a volatility-adjusted gold comparison model, Bitcoin could reach $170,000 within 6 to 12 months. The bank believes that whether MicroStrategy (MSTR) can keep its enterprise value to Bitcoin holdings ratio (mNAV) above 1.0, and avoid selling its approximately 650,000 Bitcoins, will be the key driving factors for Bitcoin's price movement in the near term.

MarketWhisper·2025-12-08 00:49

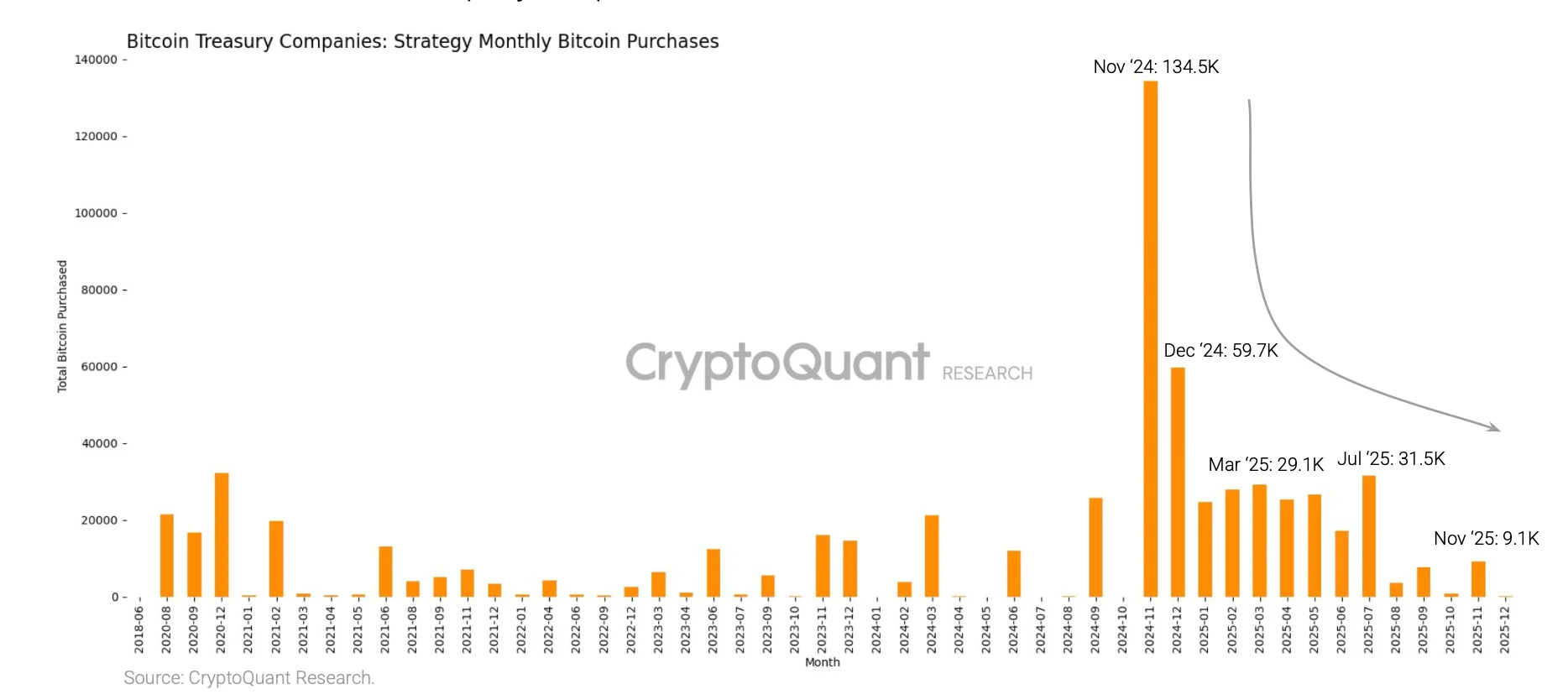

MicroStrategy’s $1.4 Billion Reserves Brace for Bear Market! CryptoQuant: Bitcoin Could Drop to $55,000 Next Year

MicroStrategy announced the establishment of a $1.44 billion reserve fund to pay for preferred stock dividends and debt interest over the next 12 to 24 months, drawing widespread market attention and bearish expectations. On-chain analytics firm CryptoQuant noted that this move shows MicroStrategy is preparing in advance to cope with a potential Bitcoin bear market. If the bearish trend continues, Bitcoin prices may fluctuate between $55,000 and $70,000 next year.

MarketWhisper·2025-12-05 06:38

JPMorgan: MicroStrategy's Bitcoin holding ratio is "safe," concept stocks more resilient than miners

A report issued by the JPMorgan analyst team led by Nikolaos Panigirtzoglou pointed out that the balance sheet resilience of MicroStrategy (MSTR), a leading Bitcoin concept stock, has a greater influence on Bitcoin's recent price trends than selling pressure from miners. The ratio of MicroStrategy's enterprise value to its Bitcoin holdings is currently 1.13, still above the safety threshold of 1.0, indicating that the company is unlikely to face pressure to sell Bitcoin to pay dividends or interest.

MarketWhisper·2025-12-05 02:56

Robinhood dominates the S&P 500! Up 241% this year, outperforming tech stocks to become the annual champion

In 2025, the US stock market is experiencing dramatic sector rotation, and the brightest star in the S&P 500 is a new member that joined the index less than three months ago: Robinhood (HOOD). Robinhood's stock price has soared nearly 241% so far this year, far outpacing all major tech stocks and becoming the best-performing stock in the S&P 500.

ETH-2,43%

MarketWhisper·2025-12-04 07:37

IREN completes $3.6 billion financing! Stock price reverses downtrend and rebounds 7.6% in a single day

Bitcoin miner IREN announced on Wednesday that it will raise $3.6 billion through a stock sale and convertible bond issuance to accelerate the deployment of computers to meet artificial intelligence demand. After the news was released, IREN's stock price rose as much as 7.6% during Wednesday's trading session, reaching a high of $44.25, and ultimately closed at $43.96, up 6.9%. Previously, after IREN announced plans to raise additional capital on Tuesday, its stock price had fallen more than 15%.

MarketWhisper·2025-12-04 05:08

MicroStrategy’s Saylor Holds Private Talks with MSCI! JPMorgan: Index Exclusion Could Trigger $8.8 Billion Capital Outflow

MicroStrategy Chairman Michael Saylor told Reuters on Wednesday that the company is in talks with MSCI regarding the decision on whether to exclude it from the index. MSCI said it plans to decide by January 15 whether to remove companies whose business model centers on buying cryptocurrency, due to concerns that they resemble investment funds. JPMorgan estimates that if other index providers follow suit, MSCI's restructuring could lead to $8.8 billion in outflows from MicroStrategy stock.

MarketWhisper·2025-12-04 03:44

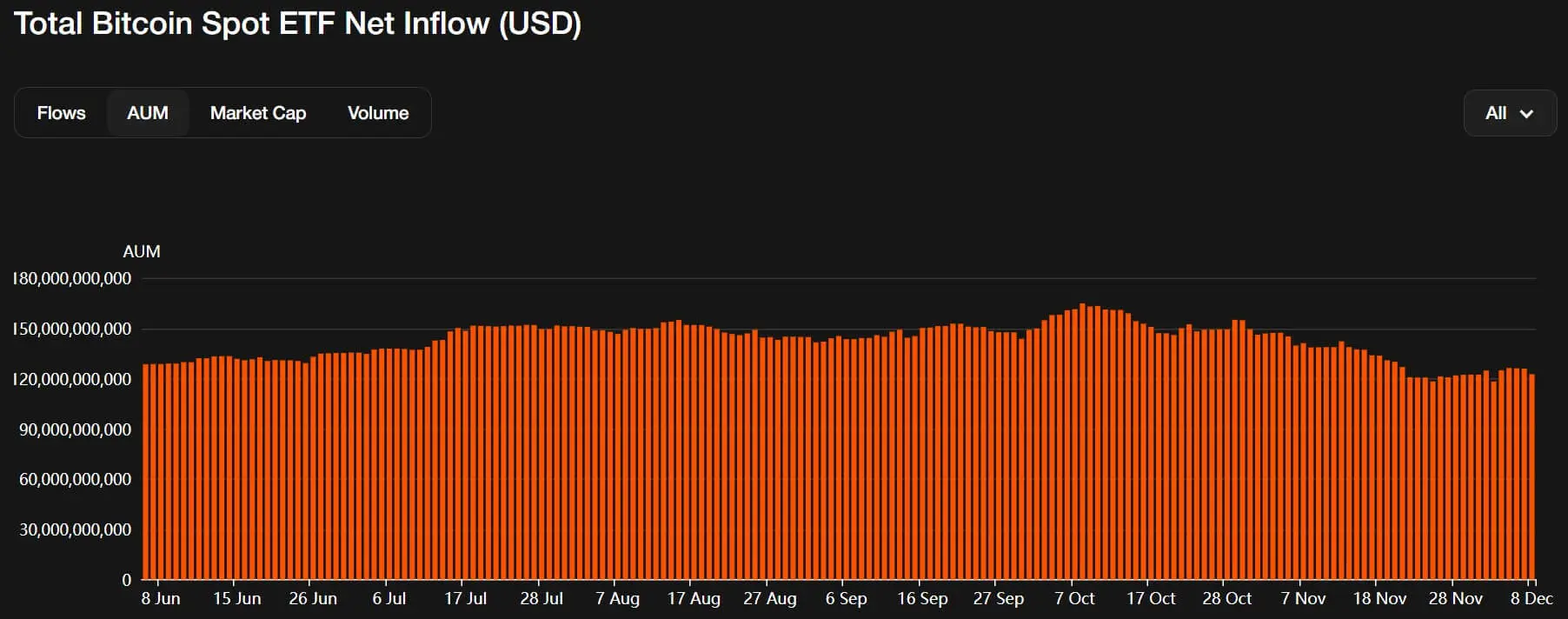

MicroStrategy CEO Saylor: Bitcoin ETF surpasses $150 billion in scale, Trump is the key to success

At this week's Binance Blockchain Week event, MicroStrategy Executive Chairman Michael Saylor called Bitcoin the cornerstone of the economic market and pointed out that US Bitcoin ETFs managed by Wall Street giants such as BlackRock and Fidelity are approaching $150 billion in scale. He emphasized that this is closely related to the executive order signed by President Trump at the beginning of 2025 to establish strategic Bitcoin reserves.

MarketWhisper·2025-12-04 02:33

CryptoQuant: MicroStrategy hoards $1.44 billion to prepare for the bear market, Bitcoin could fall below $55,000

According to a report by CryptoQuant, MicroStrategy established $1.44 billion in USD reserves earlier this week, indicating that the company is preparing for a Bitcoin bear market. Julio Moreno from CryptoQuant stated that the bear market began at the start of last month, and if this trend continues, Bitcoin could be trading between $55,000 and $70,000 next year.

BTC-1,22%

MarketWhisper·2025-12-04 01:52

CRCL stock plummets 75%! Stablecoin No.2 Circle faces its "darkest moment" on the US stock market

The world’s second-largest stablecoin issuer, Circle, saw its stock price plummet from $299 to $76—a staggering 75% drop in just a few months, leaving a large number of investors trapped. Behind the CRCL stock crash lies the stablecoin business model being hit by both the interest rate cut cycle and the tokenization of RWA money market funds. Institutional estimates show that for every 1% rate cut by the Federal Reserve, Circle’s revenue declines by 27%.

MarketWhisper·2025-12-03 06:13

BitMine sweeps up 100,000 ETH! Tom Lee bets on a December rebound, with total holdings at 3.72 million

Ethereum reserve company BitMine announced an additional purchase of nearly 100,000 ETH, bringing its total holdings to 3.72 million ETH and total asset value to $12.1 billion. As of November 30, BitMine acquired 96,798 ETH over the past week, and also holds 192 BTC, $36 million worth of Eightco Holdings stock, and $882 million in cash.

ETH-2,43%

MarketWhisper·2025-12-03 05:09

Trump’s son’s mining company plunges 51% in 30 minutes! Family’s crypto empire evaporates $800 million

As Bitcoin fell more than 30% from its all-time high and the market experienced intense volatility, American Bitcoin, a Bitcoin mining company supported by Trump’s son, suffered a major blow to its stock price on December 2. Within 30 minutes, half of its market value was wiped out, triggering multiple trading halts. The mining company, co-founded by Eric Trump, saw its intraday price drop as low as $1.75, a decline of 51%.

MarketWhisper·2025-12-03 00:41

Will MicroStrategy's empire collapse? The myth of never selling 650,000 BTC encounters the shattering of 700 million debt.

MicroStrategy (MSTR) has acknowledged for the first time that if its stock price remains below 1 times its book value for an extended period, the company may sell some Bitcoin. This company, which has made "never selling Bitcoin" a corporate belief over the past five years, holds approximately 650,000 Bitcoins, accounting for about 3% of the global Circulating Supply. The company is burdened with a mandatory annual preferred stock dividend of 750-800 million USD, which is not the type of expense that can be reduced during poor market conditions, but rather a rigid expenditure written into the contract.

BTC-1,22%

MarketWhisper·2025-12-02 06:13

MicroStrategy may become the next LUNA! Polygon CEO warns that 650,000 BTC is trapped in a death spiral.

Polygon CEO Sandeep Nailwal warned that MicroStrategy could become the "LUNA of this cycle," as MSTR stock is falling faster than Bitcoin. MicroStrategy's stock price plummeted nearly 10% to $159.77, down an astonishing 66% from a high of about $473 in July. The 650,000 Bitcoins held by MicroStrategy account for 3.1% of the total supply, facing the risk of a "death spiral."

MarketWhisper·2025-12-02 02:01

MicroStrategy Fiscal Year 2025 Profit Expectation: If Bitcoin rebounds to 110,000 by the end of the year, revenue could reach 9.5 billion USD.

MicroStrategy (MSTR) updated its profit expectations for the fiscal year 2025 on December 1, estimating that if the Bitcoin price range is between $85,000 and $110,000 by the end of 2025, the fiscal year 2025 revenue would be approximately between $7 billion and $9.5 billion, with a net income ranging from $5.5 billion to $6.3 billion, and diluted earnings per share of $17.0 to $19.0.

BTC-1,22%

MarketWhisper·2025-12-02 00:47

Hong Kong Crypto Assets concept stocks face a bloodbath! Boya plummets over 6%, the Central Bank of China cracks down on Cryptocurrency Trading.

Bitcoin has fallen below the $87,000 mark, and with the People's Bank of China speaking out on strict control of Crypto Assets, Hong Kong's Crypto Assets concept stocks have all suffered heavy losses. Boyaa Interactive (0434) dropped 6.7%, Okex Cloud Chain (1499) fell 9.7%, and Yunfeng Financial (0376) decreased by 11.3%. The Central Bank of China has rarely mentioned stablecoins in its meetings, stating that there are risks of them being used for Money Laundering, fundraising fraud, and illegal cross-border fund transfers.

MarketWhisper·2025-12-01 07:51

MicroStrategy hints at continuing to increase the position! Saylor insists on buying the dip, CEO reveals the only condition for selling coins.

Michael Saylor hinted at a new Bitcoin purchase by MicroStrategy in a post with a "green dot". The chart shows that MicroStrategy's Bitcoin portfolio is worth approximately $59 billion, with a total of 649,870 Bitcoins purchased over 87 transactions. MicroStrategy CEO Phong Le stated that the company will only sell coins when mNAV falls below net asset value and cannot obtain new funds.

BTC-1,22%

MarketWhisper·2025-12-01 05:30

Load More