Derivatives Data

Explore crypto news and in-depth articles related to Derivatives Data, covering market updates, data-driven analysis, trend insights, and key developments to help you fully grasp key information about Derivatives Data in the crypto market.

Solana open interest contracts drop 2%! Financing rate turns negative, retail demand crashes

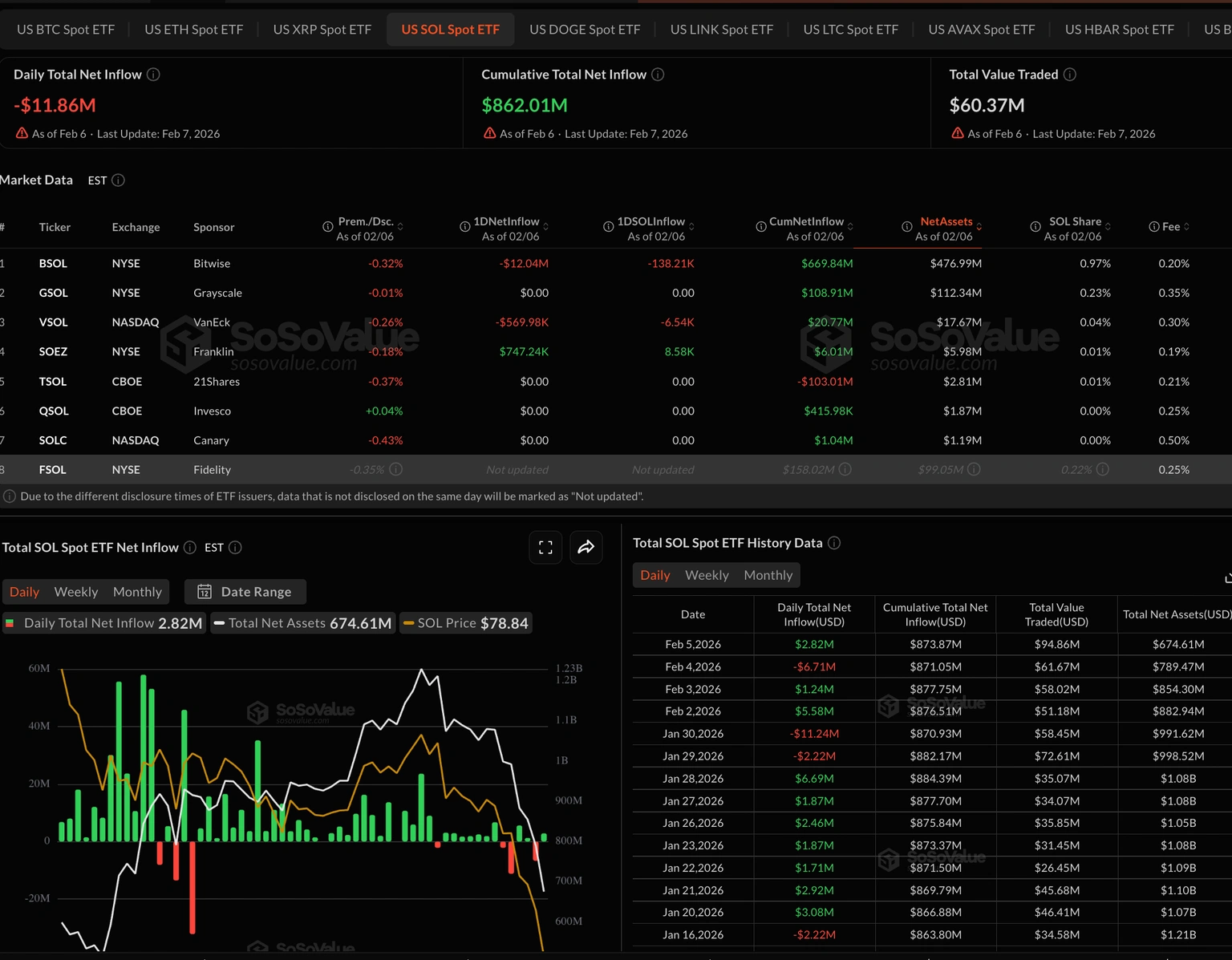

Solana's price approached $90 on Monday, holding onto last Friday's 11% rebound, but it has been consolidating for the third consecutive day. Derivative product data shows retail interest continues to decline, with SOL futures open interest decreasing by 2% to $5.32 billion within 24 hours, and financing rates remaining negative. The US spot Solana ETF experienced an outflow of $11.86 million, and technically, the RSI dropped to 29, indicating an oversold condition.

SOL-1,11%

MarketWhisper·02-09 06:50

Bitcoin plunges to $60,000! The "Trump rally" has completely retraced, with the 200-day moving average acting as a potential support

Bitcoin price accelerates downward to $60,000, with nearly $2.7 billion in liquidations across the network, marking the worst single-day decline since 2022. Although capital outflows are only 6.6%, analysts point out that the 200-day moving average is a key support level. Market liquidity is weak, and there are no signs of a bottom yet, with a potential risk of further decline to $38,000.

BTC-2,05%

CryptoCity·02-06 02:40

XRP crashes leading the crypto market down! $47 million liquidated in a single day, fear index drops to 11

XRP plummeted 24% to $1.17, leading the crypto market lower, with $47 million in daily liquidations, and trading volume surged 57% to over $11 billion. The Fear Index dropped to 11, indicating extreme panic, with market capitalization falling from $4.2 trillion to $2.27 trillion. Evernorth's holdings are at a loss of $446 million. Analyst Egrag Crypto warns that if the decline reaches 50-60%, the rebound should be considered a signal to exit.

MarketWhisper·02-06 01:30

Bitcoin crashes 40%, derivatives remain calm! Four key indicators reveal that the 75,000 support level is hard to break

Bitcoin plummeted 40.8% to $74,680, but four major indicators show it’s unlikely to fall further. U.S. Treasury yields are stable at 3.54%, futures basis is at 3% and not inverted, ETF outflows amount to only $3.2 billion, accounting for just 3%, and MicroStrategy holds $1.44 billion in cash with no liquidation risk. Oracle raises $50 billion to ease concerns over tech stocks.

MarketWhisper·02-04 02:15

Leverage nightmare! Ethereum whales with over $700 million long positions liquidated, suffering a loss of $250 million

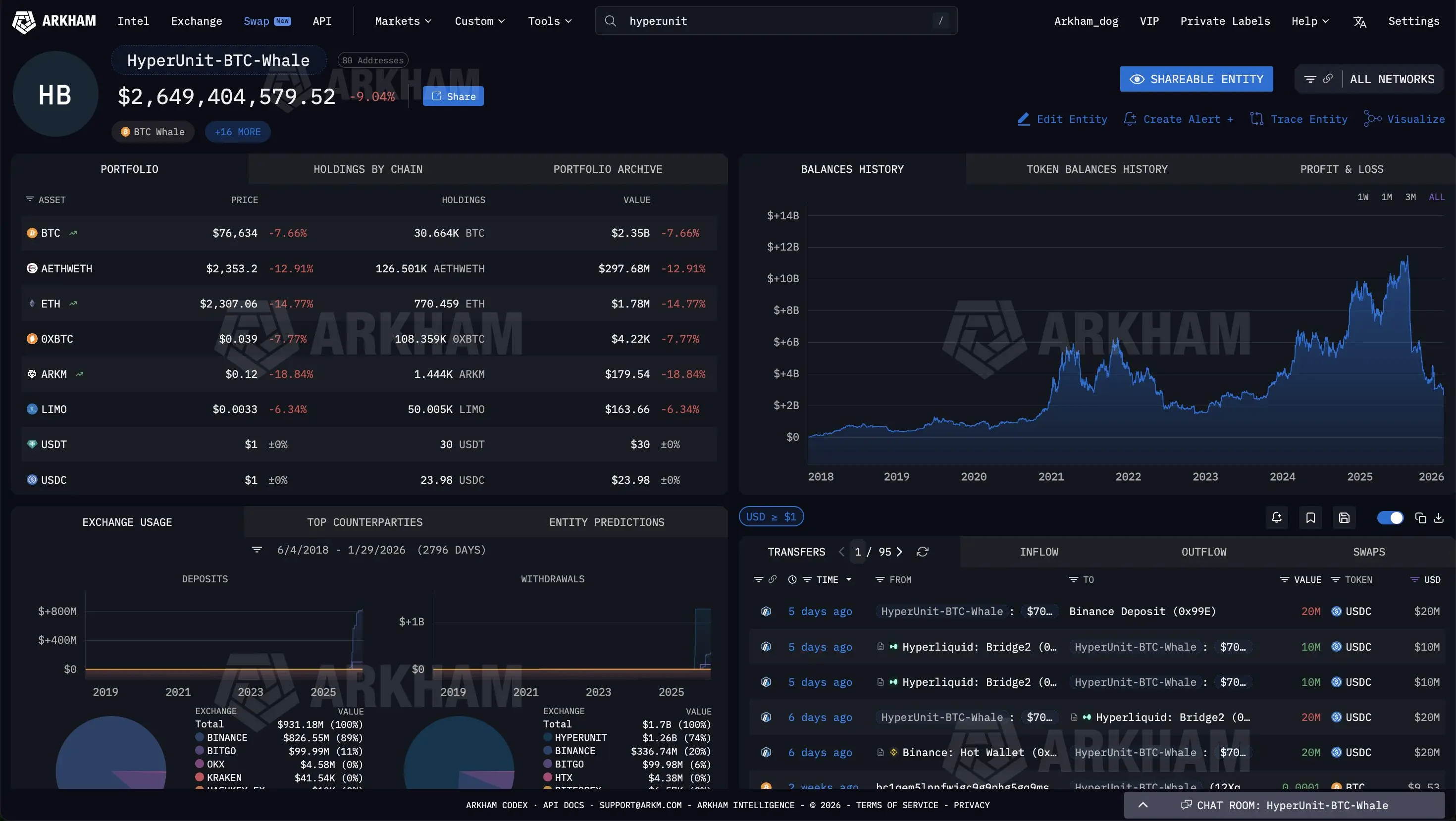

"Hyperunit Whale" completely crashed, the whale liquidated all Ethereum leveraged positions, incurring losses of approximately $250 million, with only $53 remaining in the account. Previously, he made a profit of $200 million from shorting before Trump's tariffs in October, then switched to long positions, building a $730 million position. This week, Ethereum plummeted to $2,400, leading to a full liquidation.

MarketWhisper·02-02 02:16

Glassnode Report: Bitcoin's 3% leverage ratio hits new low, open interest surpasses futures for the first time

Glassnode and Coinbase Institutional jointly release the 2026 Q1 report, revealing a structural market shift after deleveraging: BTC market share approaches 59%, systemic leverage drops to 3% of the total cryptocurrency market cap, and options open interest for the first time surpasses perpetual futures.

MarketWhisper·01-28 02:03