Ethereum (ETH) News Today

Latest crypto news and price forecasts for ETH: Gate News brings together the latest updates, market analysis, and in-depth insights.

Historic Breakthrough for CFTC! Bitcoin, Ethereum, and USDC Approved as Collateral

The U.S. Commodity Futures Trading Commission (CFTC) has launched a digital asset pilot program, allowing Bitcoin, Ethereum, and USDC, among other payment stablecoins, to be used as collateral in the U.S. derivatives market. The program is only applicable to futures commission merchants (FCMs) that meet specific conditions. These firms can accept BTC, ETH, and USDC as margin collateral for futures and swaps trading, but must comply with strict reporting and custody requirements.

MarketWhisper·1h ago

ETH Pattern Targets $7.6K Amid Historic Supply Squeeze

Ethereum is showing signs of recovery with a giant inverted head and shoulders pattern aiming for $7,600. Exchange supply has dropped to a 10-year low, while historic liquidations indicate market reset, creating favorable conditions for a bullish breakout.

LiveBTCNews·1h ago

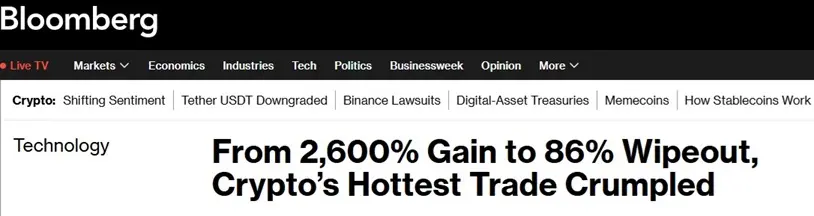

The "Infinite Money Glitch" is Invalid! The Survival Battle Between Crypto Giants Strategy and BitMine

The crypto asset company arbitrage model, once hailed as the “infinite money glitch,” is now unraveling. This week, even as the premium of stock prices relative to net asset value (NAV) shrank sharply, the two giants, Strategy and BitMine, still made significant purchases against the trend. Strategy spent $962.7 million to acquire 10,624 bitcoins, while BitMine bought 138,000 ether. However, the core engine that fueled their years of expansion— the “perpetual motion” model of financing coin purchases by issuing shares at a high premium— is now on the verge of failure. Facing “channel parity” brought by ETFs, these two companies, which together hold over $72 billion in crypto assets, are being forced into a difficult transformation crucial to their survival.

MarketWhisper·1h ago

Splashing $429 Million! Tom Lee's BitMine Bets on Ethereum "Crypto Supercycle"

The world’s largest Ethereum treasury company, BitMine Immersion Technologies, has made another move, purchasing 138,452 ETH worth approximately $429 million last week. This brings its total Ethereum holdings to an astonishing 3.864 million ETH, valued at about $12 billion, firmly securing its position as the top Ethereum holder in the world. According to the company’s chairman and renowned analyst Tom Lee, this increase is a bet on the arrival of an “encrypted supercycle” for Ethereum, driven by multiple positive factors such as the Fusaka upgrade, a shift in Federal Reserve policy, and the trend of asset tokenization on Wall Street. Despite Ethereum rebounding nearly 11% in a week, market prediction platforms indicate that investors remain cautious about whether it can break through the $4,000 mark.

MarketWhisper·2h ago

DeMark indicator shows ETH has bottomed out, BitMine adds nearly 140,000 ETH

Ethereum reserve enterprise BitMine announced an additional purchase of nearly 140,000 ETH, bringing its total holdings to 3.86 million ETH. In this month’s chairman’s address, Tom Lee specifically mentioned that about five weeks ago, the BitMine team hired Tom DeMark, known for his "market timing" expertise, to analyze cryptocurrency price trends. DeMark indicators show that ETH has bottomed out, and BitMine will step up its efforts to continue buying Ethereum.

BitMine buys more ETH, total holdings reach 3.72 million

Yesterday, BitMine revealed its latest cryptocurrency holdings. As of December 7, BitMine held assets worth $13.2 billion, including:

3,864,951 ETH

192 BTC

$36 million in

ETH-0.01%

ChainNewsAbmedia·2h ago

XRP News Today: ETF Inflows Near $1 Billion, Institutional Demand Surpasses Bitcoin? Short-term Target $2.35

The XRP spot ETF market has shown remarkable explosive growth. Since its launch until December 5, in just a few weeks, only 4 ETF products have accumulated a net inflow of nearly $897 million, approaching the $1 billion mark, with a single-week net capital inflow reaching $230 million. This performance far exceeds that of the US Bitcoin spot ETFs, which saw net outflows during the same period. Meanwhile, Ripple has obtained an upgraded payment license in Singapore, and the expansion of its utility continues to make progress. Driven by both rising expectations of Fed rate cuts and strong inflows of institutional funds, the short- to mid-term price outlook for XRP is widely regarded as optimistic by the market, with analysts setting a short-term target of $2.35.

MarketWhisper·2h ago

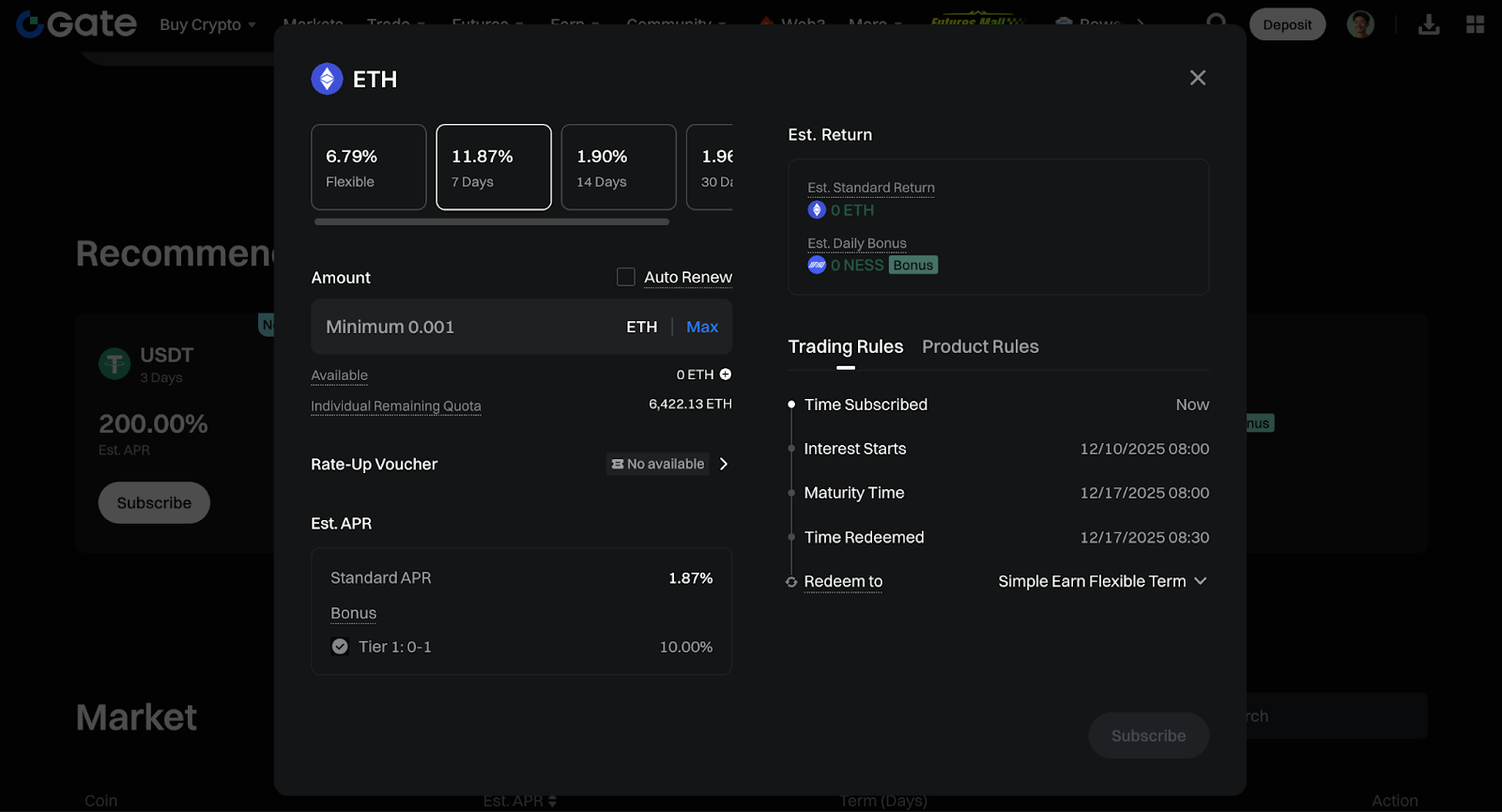

Gate ETH 7-day Fixed Term Savings Extra Reward Pool: Up to 11.9% APR, Limited Distribution of 750,000 NESS

Gate Earn launches an additional ETH 7-day fixed-term reward pool, allowing users to enjoy an extra 10% annualized reward, with total returns up to 11.9%. The event is limited to 750,000 NESS tokens, first come, first served, encouraging users to participate in Web3 innovative projects and achieve asset appreciation.

GateLearn·3h ago

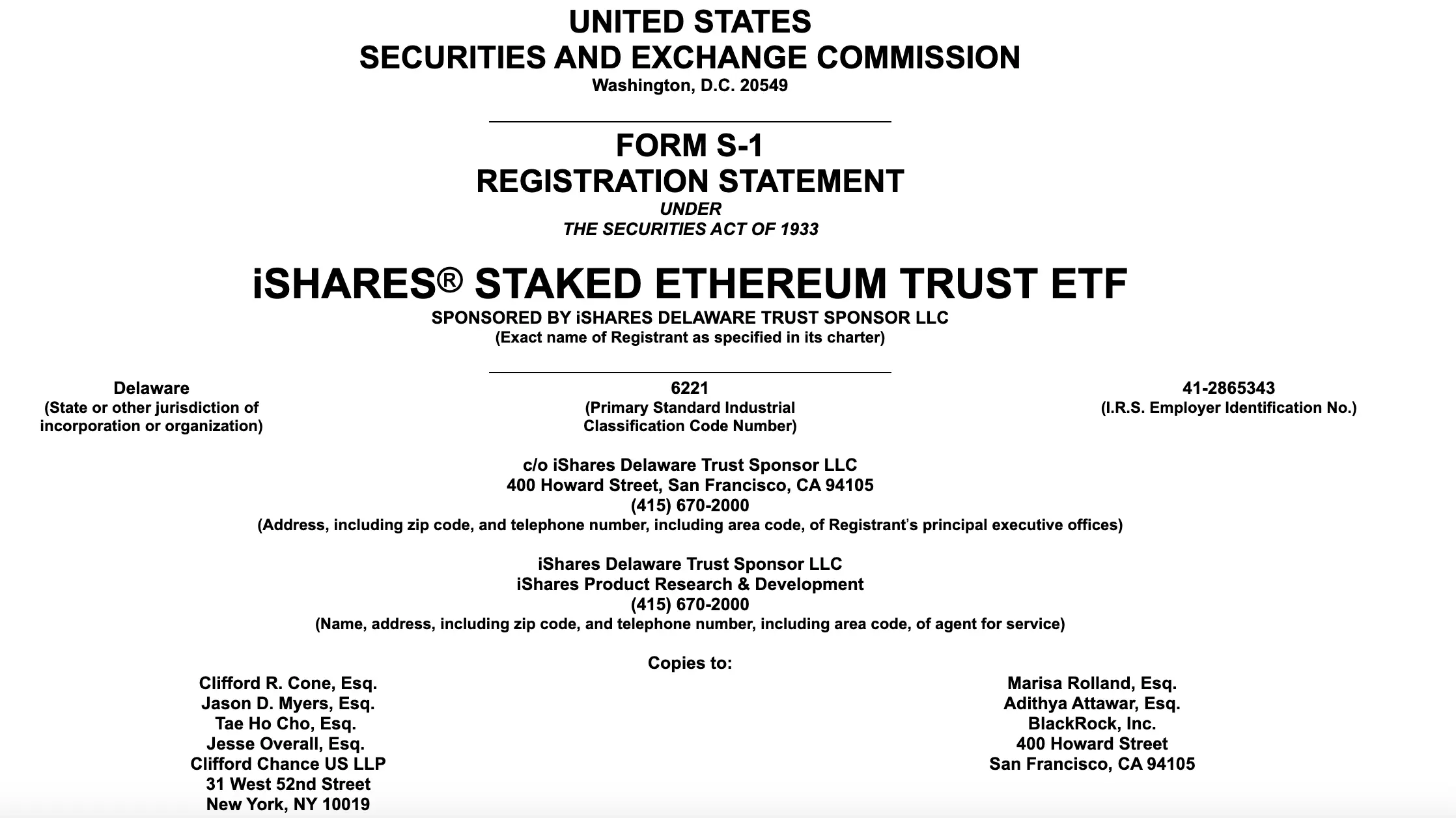

Double Positive News! BlackRock Applies for Staked Ethereum ETF, Vitalik Proposes Gas Fee Overhaul: Is ETH Headed for $10,000?

The world's largest asset management firm, BlackRock, has submitted an application to the U.S. Securities and Exchange Commission to launch the iShares Staked Ethereum ETF. The plan is to stake most of the fund's assets to generate yield, providing traditional investors with a convenient, one-click channel to participate in Ethereum staking. Meanwhile, Ethereum co-founder Vitalik Buterin has proposed a revolutionary idea aimed at solving the network's high gas fee issue—establishing an on-chain gas fee prediction market. Together, these two major developments have driven the price of Ethereum up by more than 2% in the past 24 hours, with market sentiment showing a significant rebound. Analysts point out that if the staking ETF is approved, it could open the floodgates for large-scale institutional allocation to Ethereum yield-generating assets.

MarketWhisper·3h ago

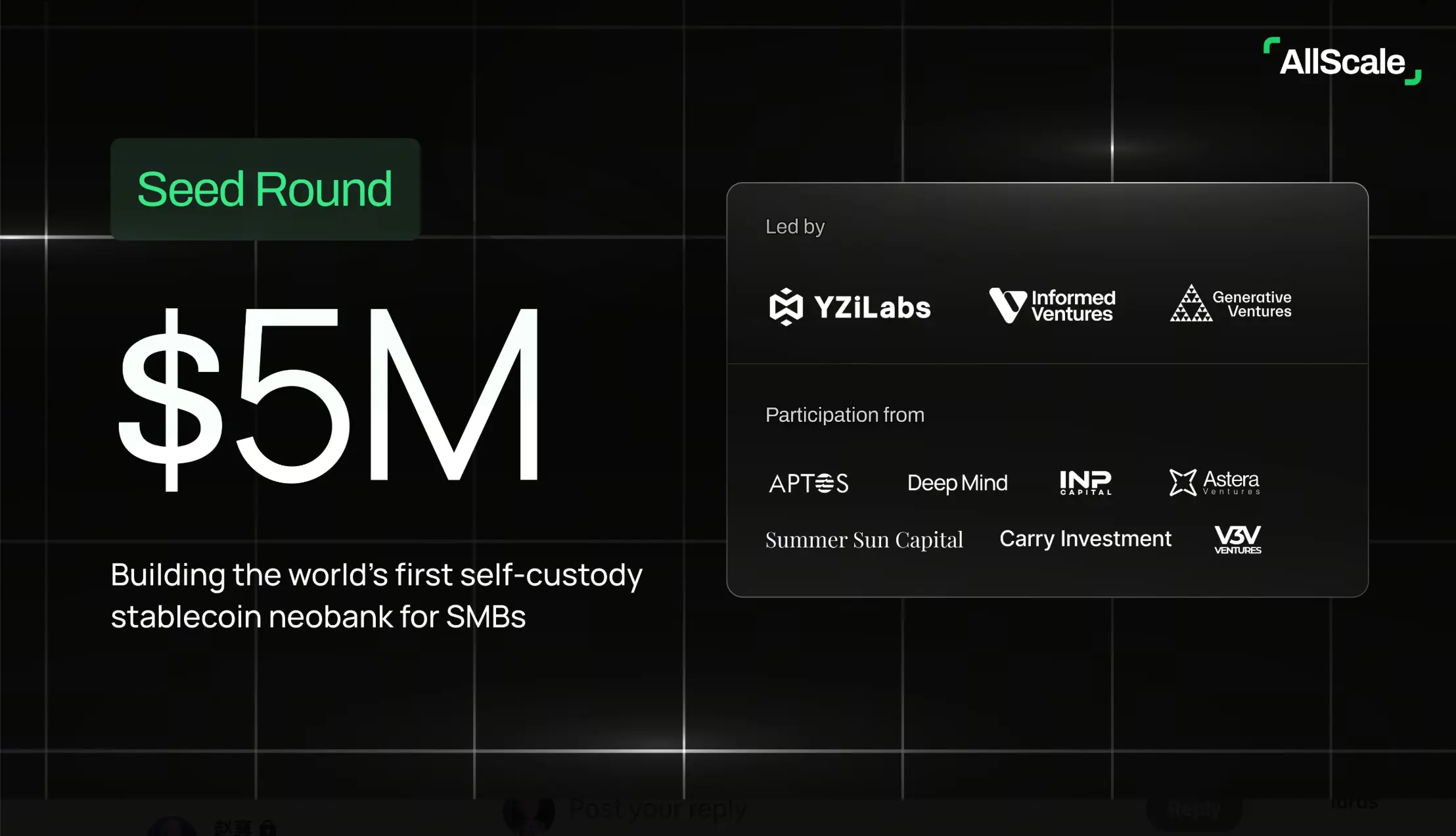

Targeting a market of 1.4 billion people! AllScale secures $5 million in funding to build the first self-custodial stablecoin digital bank

AllScale, a self-custody financial platform focused on serving small and micro businesses worldwide, recently announced the completion of a $5 million seed funding round. The round was led by YZi Labs, with participation from Infomed Ventures, Generative Ventures, and other institutions. The project aims to build the world’s first self-custody stablecoin digital bank, providing instant, low-cost, and borderless stablecoin payment and invoicing solutions for freelancers and small and micro businesses globally through account abstraction and an AI-driven financial assistant. Its vision is to become the underlying payment infrastructure powering the “super individual” economy.

MarketWhisper·3h ago

Vitalik Buterin proposes introducing Gas futures on Ethereum (ETH) to hedge against the risks caused by surging transaction fees.

Ethereum co-founder Vitalik Buterin has proposed establishing an on-chain gas futures market to help users lock in future transaction fees and provide greater certainty. This mechanism would offer users tools to hedge against future price volatility, while also providing the ecosystem with critical reference indicators.

ETH-0.01%

MetaEra·3h ago

Historic Breakthrough! US CFTC Approves Bitcoin and Ethereum as Futures Collateral

On December 9, the U.S. Commodity Futures Trading Commission announced the launch of a groundbreaking digital asset pilot program, officially allowing regulated futures commission merchants to accept Bitcoin, Ethereum, and payment stablecoins such as USDC as customer margin collateral in derivatives trading. This move aims to bring digital asset activities into the regulated U.S. market and reduce reliance on offshore trading venues. The program establishes strict safeguards, including weekly position reporting, and provides clear guidance for a broader range of real-world assets as collateral, such as tokenized Treasury bonds. This marks the most substantial step the United States has taken toward integrated crypto asset regulation since the passage of the GENIUS Act.

MarketWhisper·3h ago

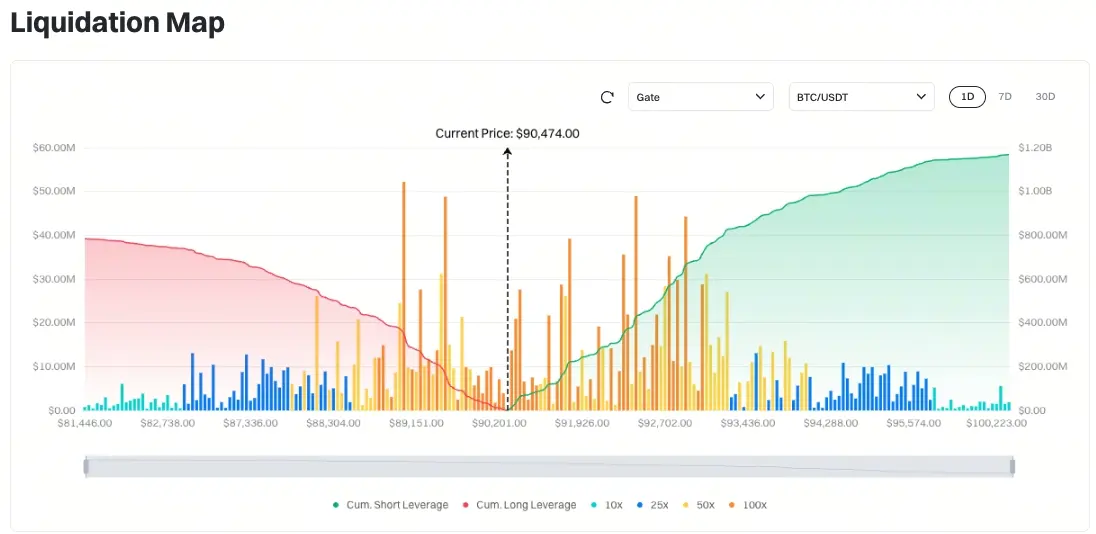

Gate Daily (December 9): Bank of America, Wells Fargo, and the US government negotiate crypto legislation; MicroStrategy commits to holding Bitcoin until 2065

Bitcoin (BTC) saw a slight pullback, temporarily trading around $90,370 on December 9. BlackRock has filed an application to list an Ethereum staking ETF, planning to trade it on the Nasdaq exchange. The CEOs of Bank of America, Wells Fargo, and Citi will meet with US senators on Thursday to discuss crypto market legislation. MicroStrategy’s CEO stated that the company will hold Bitcoin at least until 2065, maintaining a long-term accumulation strategy.

MarketWhisper·3h ago

BlackRock submits Ethereum staking ETF application! Wall Street replicates IBIT success story

BlackRock has submitted an S-1 registration statement to the U.S. Securities and Exchange Commission for its iShares Staked Ethereum Trust exchange-traded fund, which plans to list on Nasdaq under the ticker symbol ETHB. If approved, this will become one of the first ETF products linked to Ethereum staking, allowing investors to indirectly earn staking rewards.

MarketWhisper·4h ago

CFTC to Pilot Tokenized Collateral in Derivatives Markets Starting With Bitcoin, Ethereum and USDC

In brief

The pilot program permits FCMs to accept Bitcoin, Ethereum, and USDC as margin with enhanced reporting requirements.

New guidance outlines how tokenized Treasuries and money-market funds can be used within existing CFTC rules.

Staff advisory limiting the use of digital assets as

Decrypt·6h ago

Crypto Markets Flash Green, But Bitcoin and Ethereum Are in a Death Cross: Analysis

In brief

The total crypto market cap sits at $3.08 trillion, down 1% from Sunday but back above $3T after last week's panic.

The Fear and Greed Index has recovered to 24 (Fear) from Extreme Fear levels of 10 in late November.

Both BTC and ETH are trading under death cross conditions---if

Decrypt·8h ago

Bitcoin ETF Giant BlackRock Files to Launch Ethereum Staking ETF

BlackRock has filed for an S-1 for a new Ethereum staking ETF, ETHB, which will track Ethereum's price and include staking rewards. This follows the firm's success with existing spot ETFs, ETHA and IBIT, while also reflecting the growing market for staking ETFs.

Decrypt·10h ago

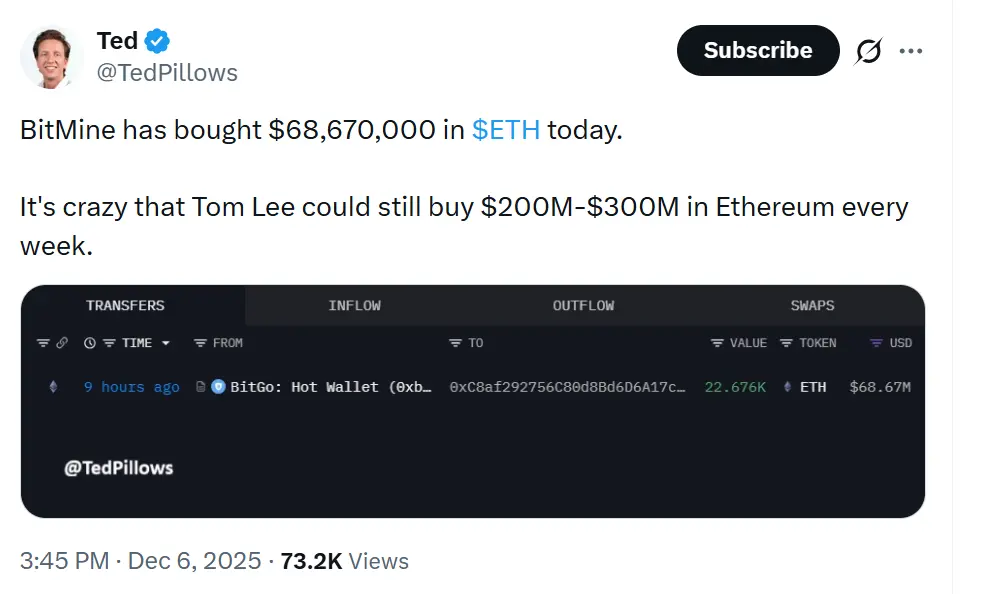

Tom Lee’s BitMine Buys $429 Million in Ethereum as ETH Rebounds

In brief

BitMine Immersion Technologies now holds about $12 billion in ETH after buying about $429 million worth last week.

It was the company's biggest ETH purchase in nearly two months.

Ethereum is up almost 11% over the last week, but Myriad users remain cautious about further gains.

Decrypt·12h ago

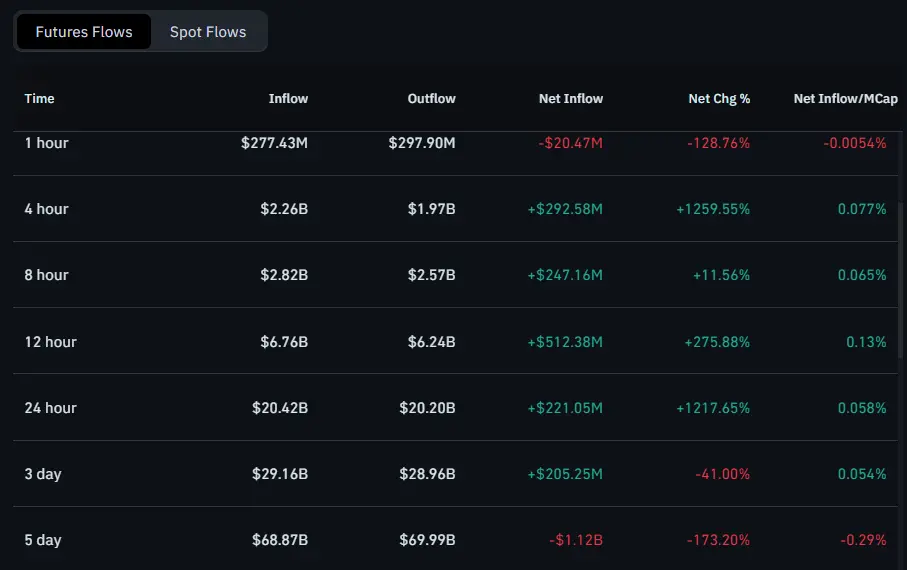

Here are Ethereum Price Scenarios as ETH Sees $512.38M Net Inflow

Ethereum sees over $500M net futures flows, recording bullish momentum as price tests key resistance levels.

Ethereum (ETH) is currently trading at $3,158, reflecting a 4.2% increase over the past 24 hours. The daily price range for Ethereum has remained between $2,941.77 and $3,171.62, showing a s

ETH-0.01%

TheCryptoBasic·14h ago

BitMine adds 138,000 Ethereum to its holdings, total holdings surpass 3.86 million! Tom Lee: ETH is expected to strengthen in the coming months

The world's largest Ethereum reserve company, BitMine Immersion (BMNR), announced this evening (8th) that it has once again increased its holdings by 138,452 ETH over the past week. After this accumulation, BitMine's total Ethereum holdings have officially surpassed the 3.86 million mark, reaching 3,864,951 ETH, which accounts for approximately 3.2% of the global ETH supply.

(Previous context: BitMine buys another $199 million worth of Ethereum! But smart money is shorting ETH)

(Background supplement: BitMine bought 97,000 ETH last week, Tom Lee: Optimistic about the Fusaka upgrade and the Fed's liquidity boost for ETH)

The world's largest Ethereum reserve company, BitMine Immersion (BMNR)

動區BlockTempo·14h ago

Ethereum Eyes Onchain Gas Futures to Stabilize Fees

Ethereum co-founder Vitalik Buterin proposed an onchain gas futures market to stabilize transaction fees, allowing users to lock in prices and reduce operational uncertainty. This market aims to provide predictability for traders, developers, and investors amidst growing fee volatility.

ETH-0.01%

CryptoFrontNews·16h ago

Top 3 Cryptocurrency Price Predictions: BTC and ETH Aim for Breakout as XRP Holds at 2 USD

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) all saw slight increases at the start of the week, signaling a positive beginning for the cryptocurrency market. Notably, demand from retail investors remains high, even as Bitcoin and Ethereum ETFs record outflows. In terms of

TapChiBitcoin·17h ago

Short the prediction market, long real life

I am not a gambler, nor do I understand the thrill of watching candlestick charts with a racing heartbeat. But when CNN and CNBC respectively announced that they would integrate digital odds from prediction markets into their news broadcasts, I felt as if we were being toyed with by a new kind of "truth."

Crypto bros are preaching: traditional polls will be replaced, experts are the high priests of an old era, and only odds built on real money can reflect the wisdom of the crowd and the reality of the truth. However, the trading logic fostered by prediction markets aligns perfectly with the "beauty contest" described by Keynes: you no longer care who is the most beautiful, you only care about "who others think is the most beautiful." The very concept of beauty is thereby "dissolved," much like Duchamp's urinal displayed in an art museum. Prediction markets will continue to accelerate and then stall, until more and more clear-headed people start "shorting" this frenzy—"shorting" the very narrative of prediction markets.

Exchanges and casinos are two distinctly different worlds. Farmers

ETH-0.01%

PANews·17h ago

Which Top Crypto Can Double Your Money Soon? Ethereum (ETH) or BlockchainFX (BFX): Finding the Be...

As 2025 heads into its final stretch, traders are scrambling to lock in what they believe could be the best crypto to buy now before the next major leg up. Ethereum is back in the spotlight, with momentum building as analysts point toward a possible move to $4,200 by year-end, driven by ongoing

ETH-0.01%

CaptainAltcoin·18h ago

2025 Ultimate Champion! Zcash(ZEC) Outperforms Bitcoin, 20% Upside Potential Unlocked?

In 2025, when most mainstream cryptocurrencies experienced widespread corrections, the veteran privacy coin Zcash stood out as one of the best-performing large-cap assets, even outperforming Bitcoin. This unusually strong performance has prompted top research institutions such as Delphi Digital and Electric Capital to re-examine it. Analysts point out that ZEC is structurally undervalued, its circulating supply continues to shrink, and developer activity has rebounded for the first time since 2021—all of which provide solid fundamental support. Technical charts show that the ZEC/BTC rate is pushing up against the key 0.0044 BTC resistance level; a breakout could open the way toward 0.0056 BTC. Meanwhile, ZEC also has a 20% short-term rebound potential against the US dollar, targeting the $420 to $450 range.

MarketWhisper·18h ago

Ethereum Whales Bet Big: 136K ETH Longs as Price Poised for 28% Surge

Ethereum whales are making a significant move, opening large long positions on Ether valued at nearly $426 million, signaling confidence in a potential recovery and upward trend. The recent activity coincides with technical patterns suggesting a possible surge toward $4,000.

In a notable

ETH-0.01%

CryptoBreaking·19h ago

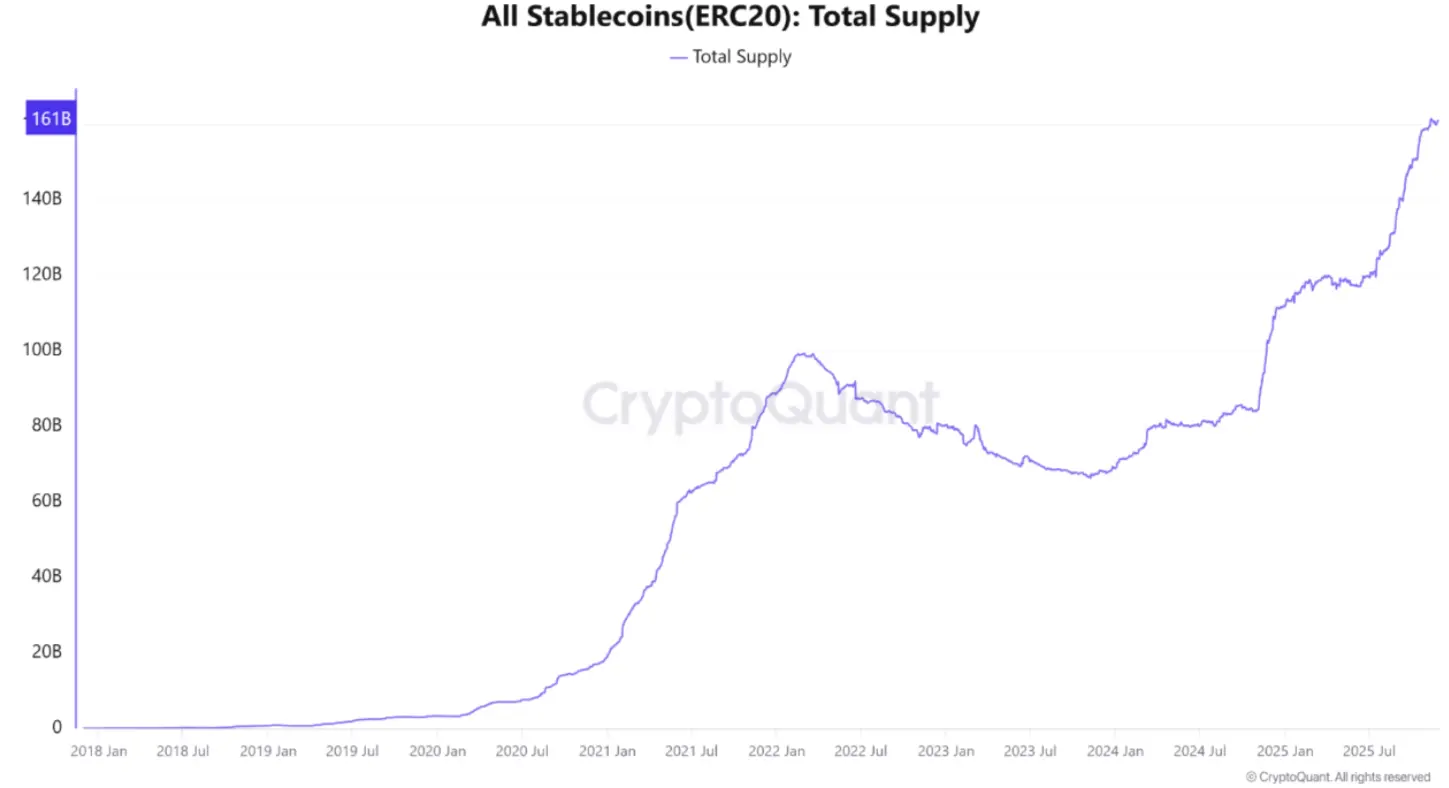

$185 Billion in Stablecoin Dry Powder Ready! CryptoQuant Reveals Countdown to Bull Market Explosion

On December 8, Bitcoin rebounded above $91,000, and on-chain analytics platform CryptoQuant revealed key bull market signals. The supply of stablecoins on Ethereum ERC-20 reached a new high of $185 billion and has maintained this level throughout the month. Stablecoin reserves at major global exchanges have surged, in stark contrast to the declining reserves of Bitcoin and Ethereum, indicating that traders are holding a large amount of "dry powder" on the sidelines, waiting for an entry opportunity.

MarketWhisper·21h ago

Robinhood enters Indonesia's market of 270 million people! Dual acquisitions cause stock price to drop 3.74%

Robinhood (HOOD) officially announced on December 8 that it has signed agreements to acquire Indonesian local brokerage Buana Capital Sekuritas and licensed digital asset trader PT Pedagang Aset Kripto. Following the announcement, HOOD's stock price dropped by 3.74%, closing at around $22.50, with trading volume increasing by 25%.

ETH-0.01%

MarketWhisper·22h ago

Can ETH price stay above $3,000?

According to top expert Ted Pillows' analysis, Ethereum (ETH) needs to maintain its upward momentum above $3,000 to avoid the risk of a sharp decline to the key support zone at $2,800. At the moment, the largest altcoin in the market is hovering slightly above $3,000, in the context of Bitmine having just executed a transac

TapChiBitcoin·22h ago

The hottest trading crash in the crypto world! Stock prices of 138 treasury companies halved, the MicroStrategy myth shattered

Bloomberg reported on December 7 that the crypto industry's craziest investment strategy of the year is undergoing an epic collapse. In the first half of 2025, more than 138 publicly listed companies in the US and Canada transformed into "digital asset treasuries," borrowing over $45 billion to purchase Bitcoin and other tokens. However, Bloomberg data shows that the median stock price of these listed companies emulating MicroStrategy has already dropped 43% this year, while Bitcoin has only fallen 6%.

MarketWhisper·22h ago

Whale Bets $61M on ETH Price Surge

Crypto whale pension-usdt.eth initiates massive 2x leveraged long position at value of 20,000 ETH at a value of $60.93 on entry price of 3,040 and liquidation value of 1,190.

The post is a big one. The total notional value goes up to $60.93 million. The price of the entry is 3,040.92 per ETH

LiveBTCNews·23h ago

Seven Years of Waiting Finally Pays Off: Aztec Public Sale Raises 19,000 ETH, Privacy Sector Giant Officially Sets Sail

After seven years of intensive development and multiple strategic transformations, Aztec, a veteran project in the zero-knowledge privacy sector, officially announced the successful conclusion of its AZTEC token public sale on December 7. The public sale was conducted entirely on-chain, ultimately raising 19,476 ETH and attracting participation from over 16,700 users worldwide, with as much as 50% of the funds coming from community members.

This sale not only marks a key step for the Aztec network toward decentralized governance, but its innovative "delayed TGE" mechanism—where the Token Generation Event can only be triggered by a community vote no earlier than February 11, 2026—also provides a new paradigm for token issuance models in crypto projects, sparking a reevaluation of the value of privacy infrastructure and community-driven projects in the market.

ETH-0.01%

MarketWhisper·23h ago

Philippine digital bank GoTyme launches cryptocurrency services, supporting 11 assets including BTC, ETH, SOL, and more

According to TechFlow on December 8, as reported by Cointelegraph, Philippine digital bank GoTyme has launched cryptocurrency services. The bank, which has 6.5 million customers, has integrated crypto features into its banking app through a partnership with US fintech company Alpaca.

Users can now purchase and store 11 types of crypto assets through the app, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Polkadot (DOT), and others. The system supports automatic conversion from Philippine Peso to US Dollar for transactions.

GoTyme CEO Nate

DeepFlowTech·23h ago

Aztec Network Token Sale Concludes: $60M Raised in ETH, TGE Vote Possible as Early as February 11, 2026

Aztec Network, the privacy-focused Ethereum Layer 2 solution, has successfully wrapped up its public token sale on December 6, 2025, raising a total of 19,476 ETH (approximately \$60 million at prevailing prices) from over 16,741 participants.

CryptoPulseElite·23h ago

Tom Lee Predicts Crypto Supercycle Break: Bitcoin to $250,000, Ethereum Surge to $62,000 in 2026

At Blockchain Week in Dubai , Fundstrat Global Advisors co-founder Tom Lee delivered a bullish forecast, predicting Bitcoin (BTC) could reach \$250,000 and Ethereum (ETH) climb to \$62,000, driven by accelerating Wall Street adoption and the tokenization of traditional assets like stocks and real estate.

CryptoPulseElite·23h ago

Amazing Prediction! Tom Lee Predicts Ethereum Will Soar to $62,000—Is It Realistic?

Renowned analyst and Fundstrat co-founder Tom Lee dropped a “deepwater bomb” at a recent industry conference, predicting that the price of Ethereum could reach an astonishing $62,000, with its market cap reaching 25% of Bitcoin's. The core logic behind this prediction is that Tom Lee believes Ethereum is experiencing a moment similar to the "1971 decoupling of the US dollar from gold," fundamentally transforming global finance through asset tokenization.

However, market traders and technical analysts have raised sharp doubts: although Ethereum dominates the real-world asset sector with $10.7 billion in value locked, current technical charts do not show a structure that supports such an explosive rally. This intense clash between long-term narratives and short-term technicals is sparking deep reflection within the community about Ethereum's future value.

MarketWhisper·23h ago

End of Ethereum Gas Fee Nightmare? Vitalik Buterin Proposes On-Chain Futures for Price Locking

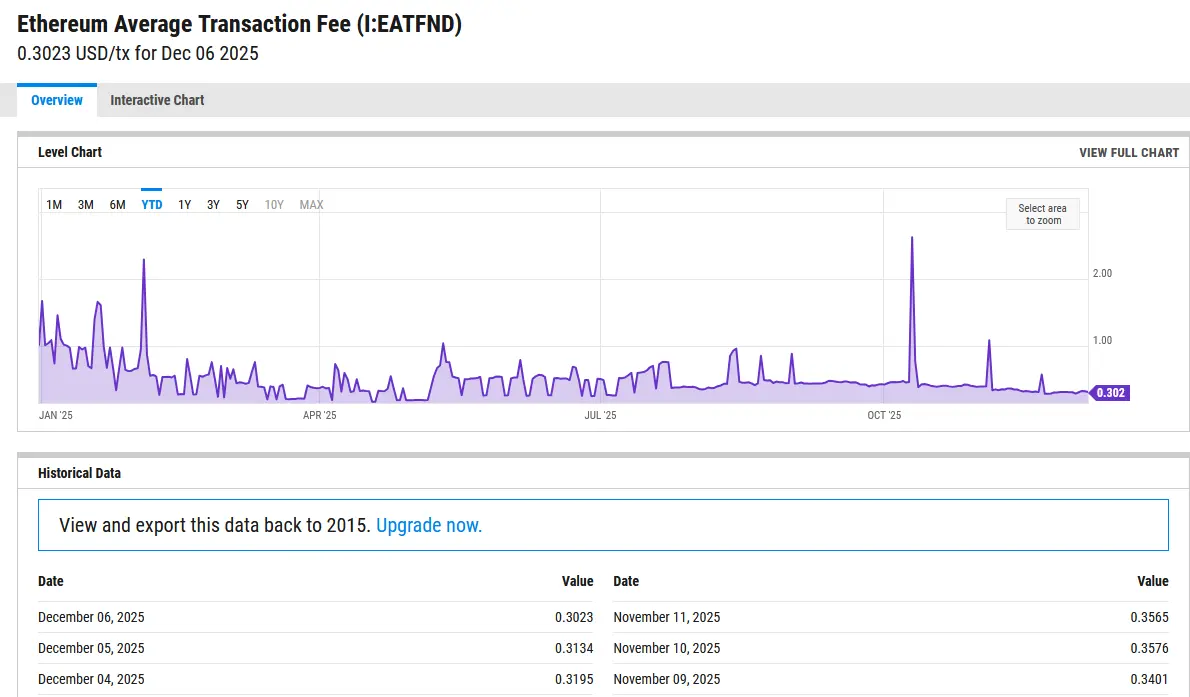

Ethereum co-founder Vitalik Buterin has proposed the idea of establishing an on-chain gas futures market to address the issue of transaction fee uncertainty. According to Etherscan data, as of the time of writing, the average base transaction gas fee on Ethereum is about 0.474 gwei. However, Ycharts data shows that fees in 2025 have experienced significant volatility, with this year's peak soaring to $2.60.

ETH-0.01%

MarketWhisper·12-08 05:12

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreAbu Dhabi Buluşması

Helium, 10 Aralık'ta Abu Dhabi'de Helium House networking etkinliğine ev sahipliği yapacak ve bu etkinlik, 11-13 Aralık tarihlerinde düzenlenecek olan Solana Breakpoint konferansının öncesi olarak konumlandırılacak. Tek günlük toplantıda, Helium ekosistemindeki profesyonel ağ kurma, fikir alışverişi ve topluluk tartışmalarına odaklanılacak.

2025-12-09

Hayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27