# 美联储

770.53K

DropToZeroDon'tCry

⚡ Market Alert: Next Week's Volatility Warning: Are You Ready?

💥 Brothers, buckle up — next week could completely rewrite the market direction! The calendar is not only busy but packed with explosive events: central bank actions, employment data, global rate decisions — this is a week to create legends or cause major liquidations. Many will say: “The prices have already digested it.”

History tells us: real market moves always explode when everyone feels safe.

🔥 Next Week's Major Event Calendar 🔥

🟥 Monday — Federal Reserve Liquidity Injection

💵 $6.8 Billion Short-term Treasury Pu

💥 Brothers, buckle up — next week could completely rewrite the market direction! The calendar is not only busy but packed with explosive events: central bank actions, employment data, global rate decisions — this is a week to create legends or cause major liquidations. Many will say: “The prices have already digested it.”

History tells us: real market moves always explode when everyone feels safe.

🔥 Next Week's Major Event Calendar 🔥

🟥 Monday — Federal Reserve Liquidity Injection

💵 $6.8 Billion Short-term Treasury Pu

BTC0,28%

- Reward

- 1

- Comment

- Repost

- Share

The Fed's rate cut expectations turn into a shock reversal! CME and Polymarket stage a "life-and-death showdown," and the crypto market is about to迎来 a bloody moment?

Investors, are you ready to face the first storm of 2026? Just last night, two major indicators of the interest rate market—CME FedWatch and Polymarket prediction market—gave completely opposite signals on rate cuts. This is not just a data discrepancy but a cognitive rift between Wall Street and crypto-native capital, and the prelude to the market storm of 2026.

Data Shock: Rate Cut Probability Performs a "V-Shaped Reversal" in

Investors, are you ready to face the first storm of 2026? Just last night, two major indicators of the interest rate market—CME FedWatch and Polymarket prediction market—gave completely opposite signals on rate cuts. This is not just a data discrepancy but a cognitive rift between Wall Street and crypto-native capital, and the prelude to the market storm of 2026.

Data Shock: Rate Cut Probability Performs a "V-Shaped Reversal" in

BTC0,28%

MC:$222.1KHolders:143

100.00%

- Reward

- 1

- Comment

- Repost

- Share

Oh my goodness, can this still be #降息 ?

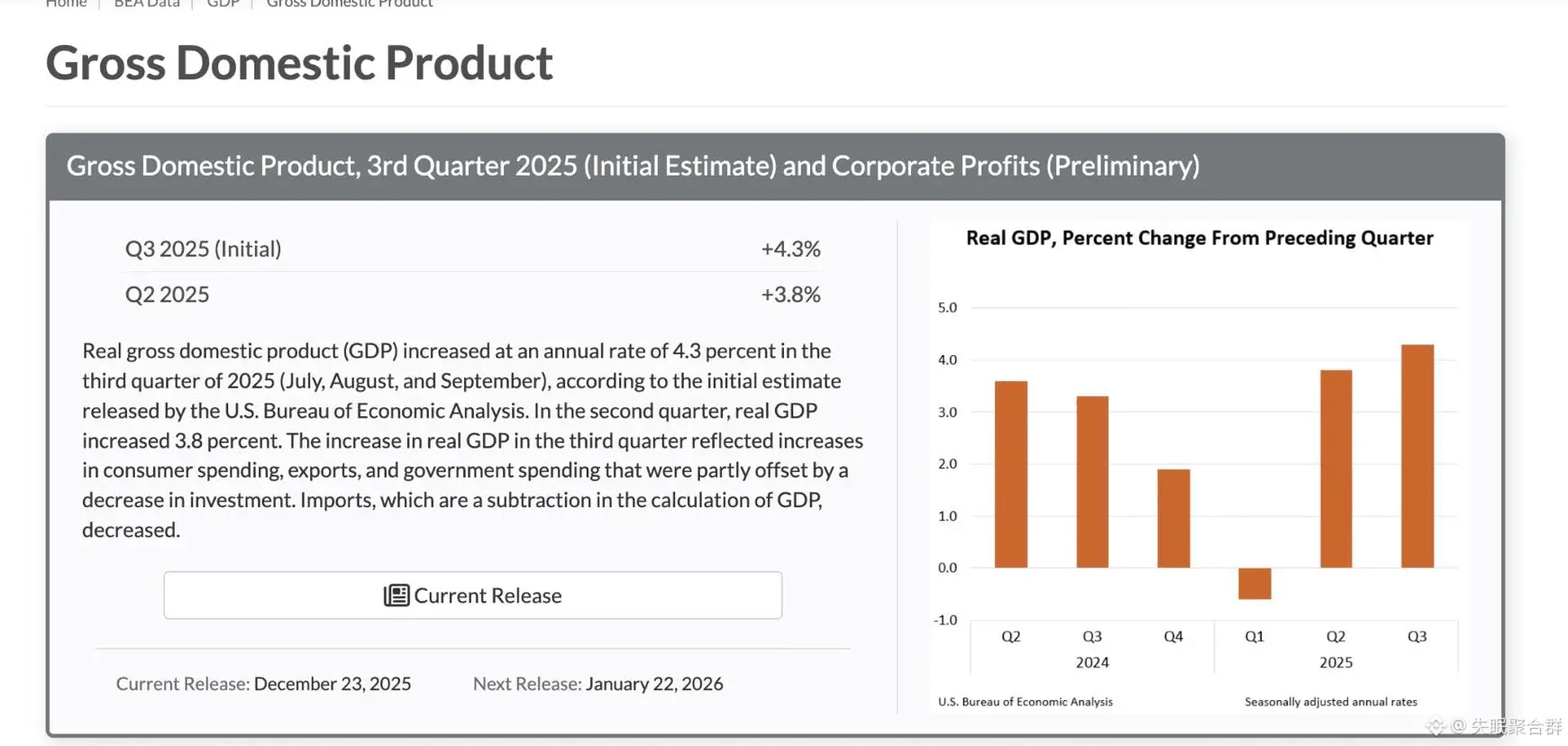

The U.S. economy unexpectedly strengthened in the third quarter, with an annualized growth rate of 4.3%.

Isn't this a bit too good? 😭😭

1、#GDP Exceeded expectations

Q3 GDP annualized growth rate of 4.3%, significantly higher than the expected 3.3%, and also higher than the previous value of 3.8%.

2. Consumption remains strong.

Personal consumption expenditure grew by 3.5%, far exceeding the expected 2.7%, with demand remaining strong.

3. Inflation is barely passing.

Core PCE 2.9%, basically in line with expectations

From July to September this year

View OriginalThe U.S. economy unexpectedly strengthened in the third quarter, with an annualized growth rate of 4.3%.

Isn't this a bit too good? 😭😭

1、#GDP Exceeded expectations

Q3 GDP annualized growth rate of 4.3%, significantly higher than the expected 3.3%, and also higher than the previous value of 3.8%.

2. Consumption remains strong.

Personal consumption expenditure grew by 3.5%, far exceeding the expected 2.7%, with demand remaining strong.

3. Inflation is barely passing.

Core PCE 2.9%, basically in line with expectations

From July to September this year

- Reward

- like

- Comment

- Repost

- Share

#美股 In a busy week where the Federal Reserve (FED) kept its stance unchanged and the Bank of England lowered interest rates by 25 basis points, the STOXX 600 index rose for the fourth consecutive week, up 0.2%. The US stock market continued to rise, driven by easing global trade tensions; the crypto world also experienced a strong rebound, providing relief to investors; #美联储 .

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- 1

- Repost

- Share

BlackRobeSatoshi :

:

Still haven't rested, teacher? It's up 50, 😂😂 16 Margin Replenishment went straight up.Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

20.02K Popularity

59K Popularity

66.97K Popularity

101.87K Popularity

4.53K Popularity

9.86K Popularity

175.07K Popularity

25.52K Popularity

89.77K Popularity

31.26K Popularity

220.1K Popularity

12.43K Popularity

13.59K Popularity

3.28K Popularity

232.06K Popularity

News

View MoreOverview of Major Whales: The bullish whales led by "BTC OG Insider Whale" have not adjusted their positions, while the "Shanzhai Air Force Leader" increased their LIT short position to $9.3 million.

7 h

The Farm2 community founded by AI16Z founder Shaw is about to launch the world's first 3D AI Agent

8 h

Solana founder Toly: Instead of buybacks, a long-term capital structure should be built through staking mechanisms

8 h

Deshare launches on-chain stock "IPO subscription" feature, unlocking a new way to participate in IPOs

8 h

Yili Hua: Before the 2026 big bull market, short sellers close early with small losses, and later close with huge and disastrous losses.

9 h

Pin