# Cryptoanalysis

17.82K

Crypto_Exper

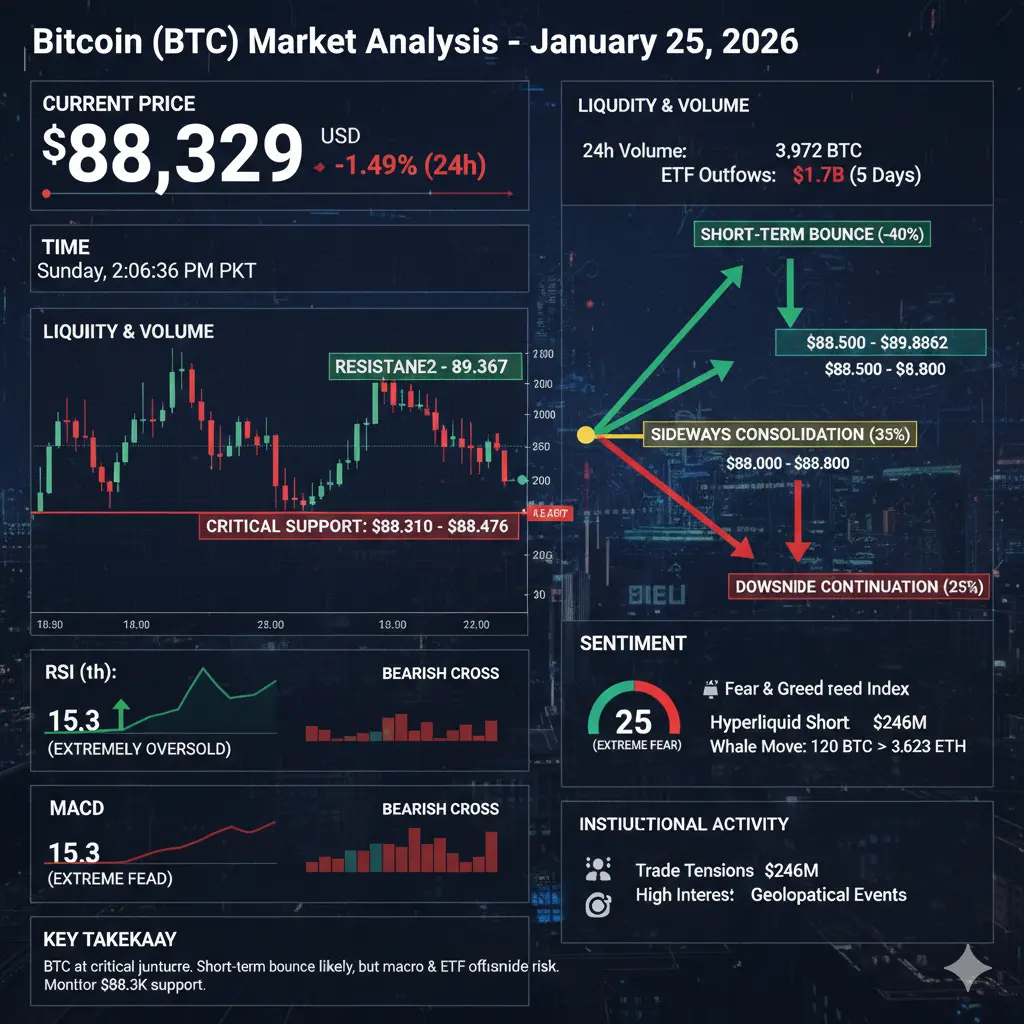

🚨 #BTCMarketAnalysis – Bitcoin Update

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC-0,61%

- Reward

- 2

- 1

- Repost

- Share

Karik254 :

:

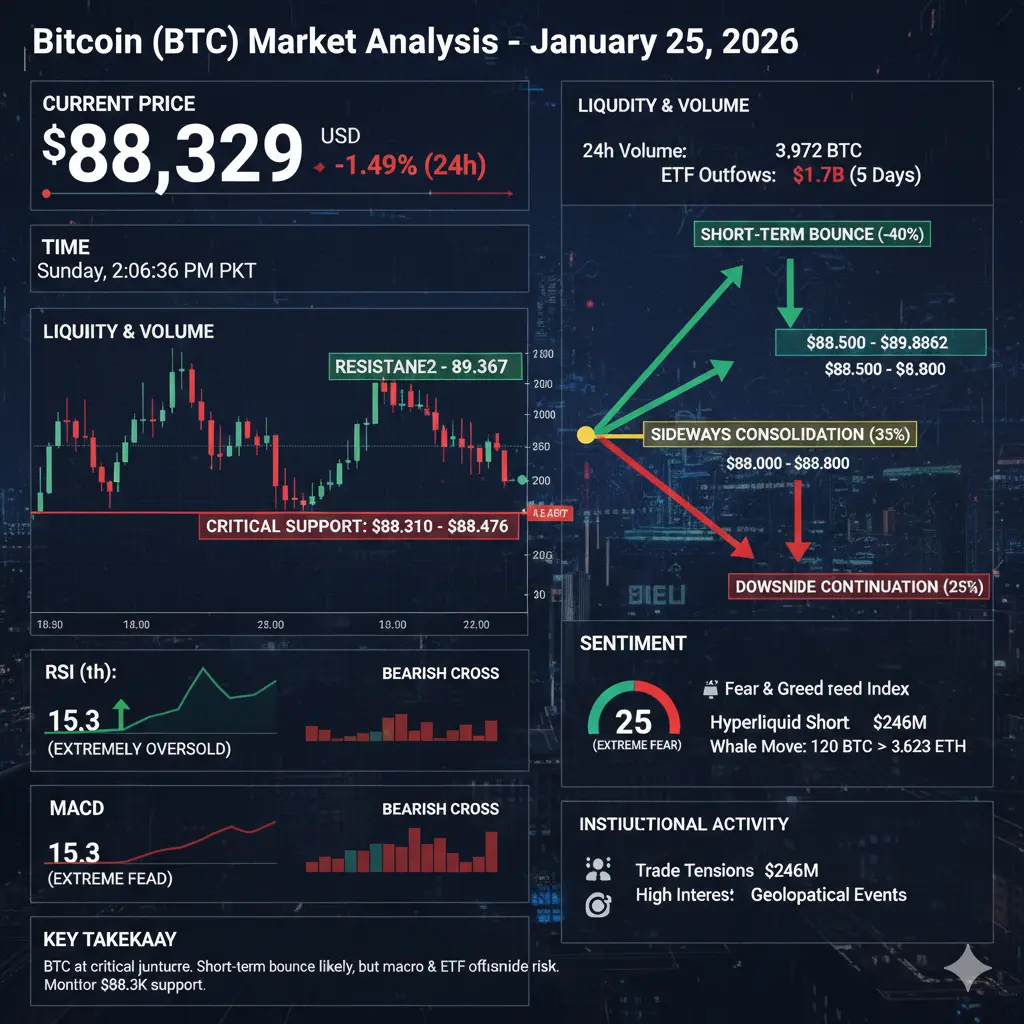

2026 GOGOGO 👊🚨 #BTCMarketAnalysis – Bitcoin Update

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

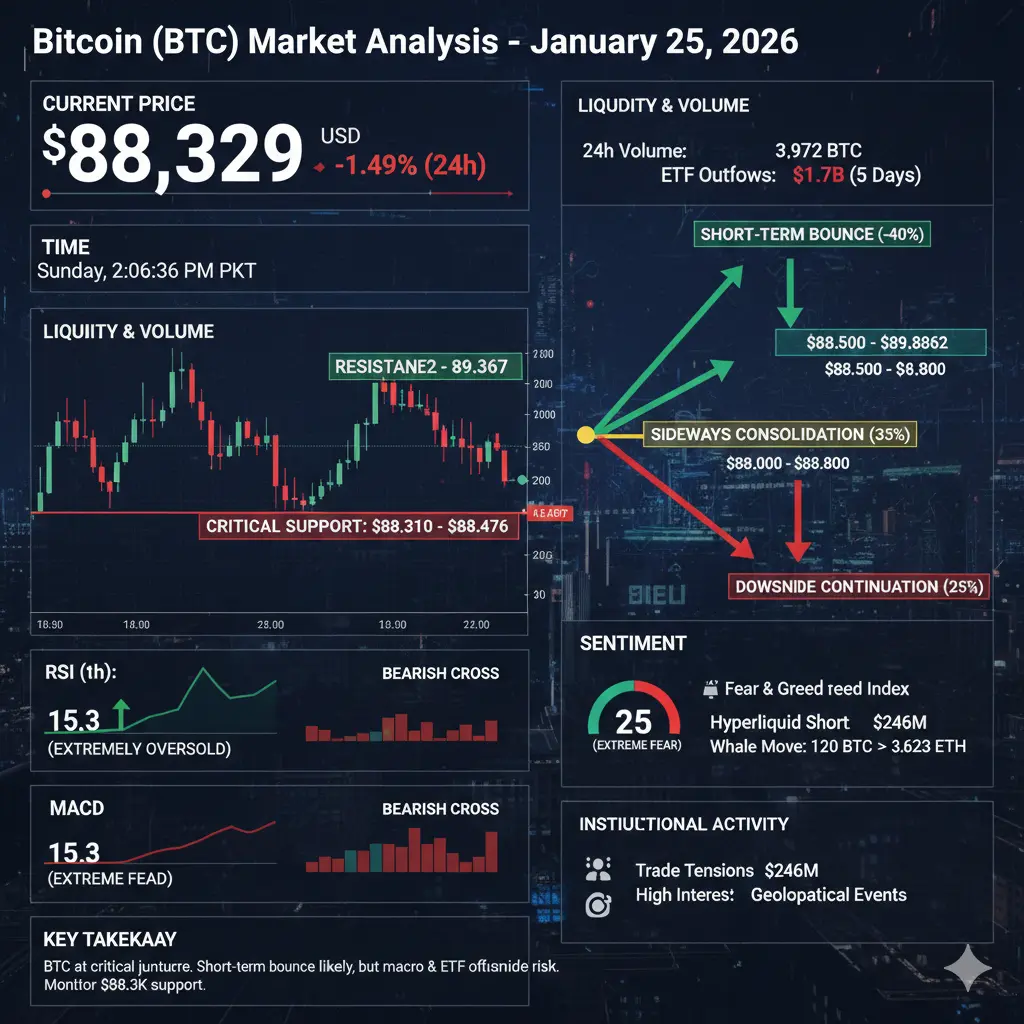

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC-0,61%

- Reward

- 1

- Comment

- Repost

- Share

🚀 #RIVERUp50xinOneMonth

RIVER’s Breakout — Real Move or Excessive Risk?

Overview:

RIVER exploded from a few dollars → $60s, fueled by strategic capital, hype & speculative flow.

What RIVER Is:

Cross-chain stablecoin & liquidity protocol (satUSD).

Collateralize on one chain, mint on another without bridges.

Token powers governance, staking, rewards & fee incentives.

Key Rally Drivers:

✅ Strategic Backing – Justin Sun & others pumped $8M into ecosystem growth.

✅ Innovation Narrative – Cross-chain liquidity solves real DeFi friction.

✅ Volume & Momentum – Massive trading volumes, especially in d

RIVER’s Breakout — Real Move or Excessive Risk?

Overview:

RIVER exploded from a few dollars → $60s, fueled by strategic capital, hype & speculative flow.

What RIVER Is:

Cross-chain stablecoin & liquidity protocol (satUSD).

Collateralize on one chain, mint on another without bridges.

Token powers governance, staking, rewards & fee incentives.

Key Rally Drivers:

✅ Strategic Backing – Justin Sun & others pumped $8M into ecosystem growth.

✅ Innovation Narrative – Cross-chain liquidity solves real DeFi friction.

✅ Volume & Momentum – Massive trading volumes, especially in d

- Reward

- 2

- 1

- Repost

- Share

NaeteeINDY :

:

hot⚖️ Bitcoin vs Gold — A Shift Toward Safety in Uncertain Markets

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run.

While BTC remains a powerful long-term digital asset, short-term momentum is slowing due to:

Reduced liquidity

Slower ETF inflows

Profit-taking

Persistently high global interest rates

Volatility remains elevated — opportunities exist for skilled traders, but downside risks increase if key support levels fail.

🏆 Gold: The Classic Safe Haven

Gold is trading near 5,033, maintaining strength as investors rotate towa

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run.

While BTC remains a powerful long-term digital asset, short-term momentum is slowing due to:

Reduced liquidity

Slower ETF inflows

Profit-taking

Persistently high global interest rates

Volatility remains elevated — opportunities exist for skilled traders, but downside risks increase if key support levels fail.

🏆 Gold: The Classic Safe Haven

Gold is trading near 5,033, maintaining strength as investors rotate towa

BTC-0,61%

- Reward

- 1

- Comment

- Repost

- Share

🚀 $CYBER Spot Analysis: Identifying the Reversal Floor for a Long-Term Move

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

CYBER-3,45%

- Reward

- like

- Comment

- Repost

- Share

📉 SOMIUSDT | Short scenario on the table

Price is struggling around the 0.29 – 0.30 range after a strong rise.

There are attempts to go higher, but no continuation.

This tells us: momentum is weakening, the market is at a decision point.

🔍 Technical side:

No persistence above 0.30

RSI has dropped below 50

Price is moving sideways–downward trend

This setup keeps the controlled short scenario on the table.

📌 Important levels

Close above 0.300 – 0.305 → Scenario invalidates

Below 0.285 → Movement may accelerate

0.26 – 0.24 range → Main support / profit zones

⚠️ It’s especially important to say

View OriginalPrice is struggling around the 0.29 – 0.30 range after a strong rise.

There are attempts to go higher, but no continuation.

This tells us: momentum is weakening, the market is at a decision point.

🔍 Technical side:

No persistence above 0.30

RSI has dropped below 50

Price is moving sideways–downward trend

This setup keeps the controlled short scenario on the table.

📌 Important levels

Close above 0.300 – 0.305 → Scenario invalidates

Below 0.285 → Movement may accelerate

0.26 – 0.24 range → Main support / profit zones

⚠️ It’s especially important to say

- Reward

- 11

- 11

- Repost

- Share

ybaser :

:

Hold tight 💪View More

Bitcoin vs Gold: A Shift Toward Safety in Uncertain Markets

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run. While BTC remains a powerful long-term digital asset, short-term momentum is weakening due to reduced liquidity, slower ETF inflows, profit-taking, and persistently high global interest rates. Price volatility remains elevated, creating opportunities for skilled traders—but also increasing downside risk if key support levels fail.

In contrast, Gold is trading near 5033, showing sustained strength as investors rotate

Bitcoin is currently trading around $88,762, consolidating near a critical psychological level after a strong bull run. While BTC remains a powerful long-term digital asset, short-term momentum is weakening due to reduced liquidity, slower ETF inflows, profit-taking, and persistently high global interest rates. Price volatility remains elevated, creating opportunities for skilled traders—but also increasing downside risk if key support levels fail.

In contrast, Gold is trading near 5033, showing sustained strength as investors rotate

BTC-0,61%

- Reward

- 5

- 8

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

ETHUSDT | 1s

Price responded with a V-shaped reaction after a sharp decline, but the upward movement is currently controlled and limited.

As long as it stays below the purple trend line, interpreting this rise as a main trend reversal is difficult.

📌 3,000 – 3,030 range is a clear supply / sell zone.

The reaction here is already weakening.

🔻 The first support zone below is 2,950 – 2,910.

If this area is lost, liquidity could drop back to around 2,865.

📈 In the bullish scenario:

Hourly close above 3,030

Followed by breaking the purple trend

beforehand, it’s premature to get excited.

The RSI

Price responded with a V-shaped reaction after a sharp decline, but the upward movement is currently controlled and limited.

As long as it stays below the purple trend line, interpreting this rise as a main trend reversal is difficult.

📌 3,000 – 3,030 range is a clear supply / sell zone.

The reaction here is already weakening.

🔻 The first support zone below is 2,950 – 2,910.

If this area is lost, liquidity could drop back to around 2,865.

📈 In the bullish scenario:

Hourly close above 3,030

Followed by breaking the purple trend

beforehand, it’s premature to get excited.

The RSI

ETH-1,46%

- Reward

- 11

- 7

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

🌐 Ethereum ($ETH) Roadmap: Why the $6,000–$8,000 Target is Within Reach

The Accumulation Thesis:

While the broader market experiences localized volatility, Ethereum ($ETH) remains in a textbook "Strategic Accumulation Zone". Currently trading between the $2,600 and $3,400 range, ETH is building a massive base of support. Historically, these consolidation phases in Ethereum lead to explosive parabolic moves once the supply on exchanges hits critical lows.

Institutional Catalysts for 2026:

The path to $6,000–$8,000 is not just driven by speculation but by solid fundamental shifts:

1. The Glamst

The Accumulation Thesis:

While the broader market experiences localized volatility, Ethereum ($ETH) remains in a textbook "Strategic Accumulation Zone". Currently trading between the $2,600 and $3,400 range, ETH is building a massive base of support. Historically, these consolidation phases in Ethereum lead to explosive parabolic moves once the supply on exchanges hits critical lows.

Institutional Catalysts for 2026:

The path to $6,000–$8,000 is not just driven by speculation but by solid fundamental shifts:

1. The Glamst

ETH-1,46%

- Reward

- like

- 1

- Repost

- Share

Crypt_Panda :

:

ETH is going down soon📊 ETHUSDT – Has the Structure Been Broken, or Is This a Healthy Correction?

ETH is maintaining its upward channel structure.

After the recent sharp increase, the price has pulled back to the middle band of the channel and the ascending trend line, consolidating.

📌 The technical setup is clear:

The upward channel is still active

3.10k–3.12k region is a short-term balance zone

Upper band: 3.15k – 3.20k

Lower band / trend support: 3.00k – 3.03k

🧠 What does this mean?

Such pullbacks are usually a pause within the trend.

As long as the price stays above support, the structure is not considered b

View OriginalETH is maintaining its upward channel structure.

After the recent sharp increase, the price has pulled back to the middle band of the channel and the ascending trend line, consolidating.

📌 The technical setup is clear:

The upward channel is still active

3.10k–3.12k region is a short-term balance zone

Upper band: 3.15k – 3.20k

Lower band / trend support: 3.00k – 3.03k

🧠 What does this mean?

Such pullbacks are usually a pause within the trend.

As long as the price stays above support, the structure is not considered b

- Reward

- 17

- 12

- Repost

- Share

Lock_433 :

:

Just Go for it 💪View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

4.86K Popularity

87.35K Popularity

60.37K Popularity

16.17K Popularity

35.21K Popularity

29.84K Popularity

21.52K Popularity

92.72K Popularity

60.8K Popularity

30.98K Popularity

21.25K Popularity

14.89K Popularity

141.16K Popularity

31.41K Popularity

170.28K Popularity

News

View MorePre-market US stocks see mixed gains and losses in the crypto concept stocks, Strategy (MSTR) up 1.32%

7 m

CoinShares: Digital asset investment products saw a net outflow of $1.73 billion last week

27 m

Alpha Token Launch: AMELIA is now live

28 m

Yili Hua: Will buy the dip and hold more ETH with various strategies

33 m

Today's Cryptocurrency News (January 26) | Japan plans to open crypto ETFs in 2028; Cathie Wood increases holdings in crypto stocks

36 m

Pin