🚨 ETH Price Under Pressure, But Fundamentals Remain Strong

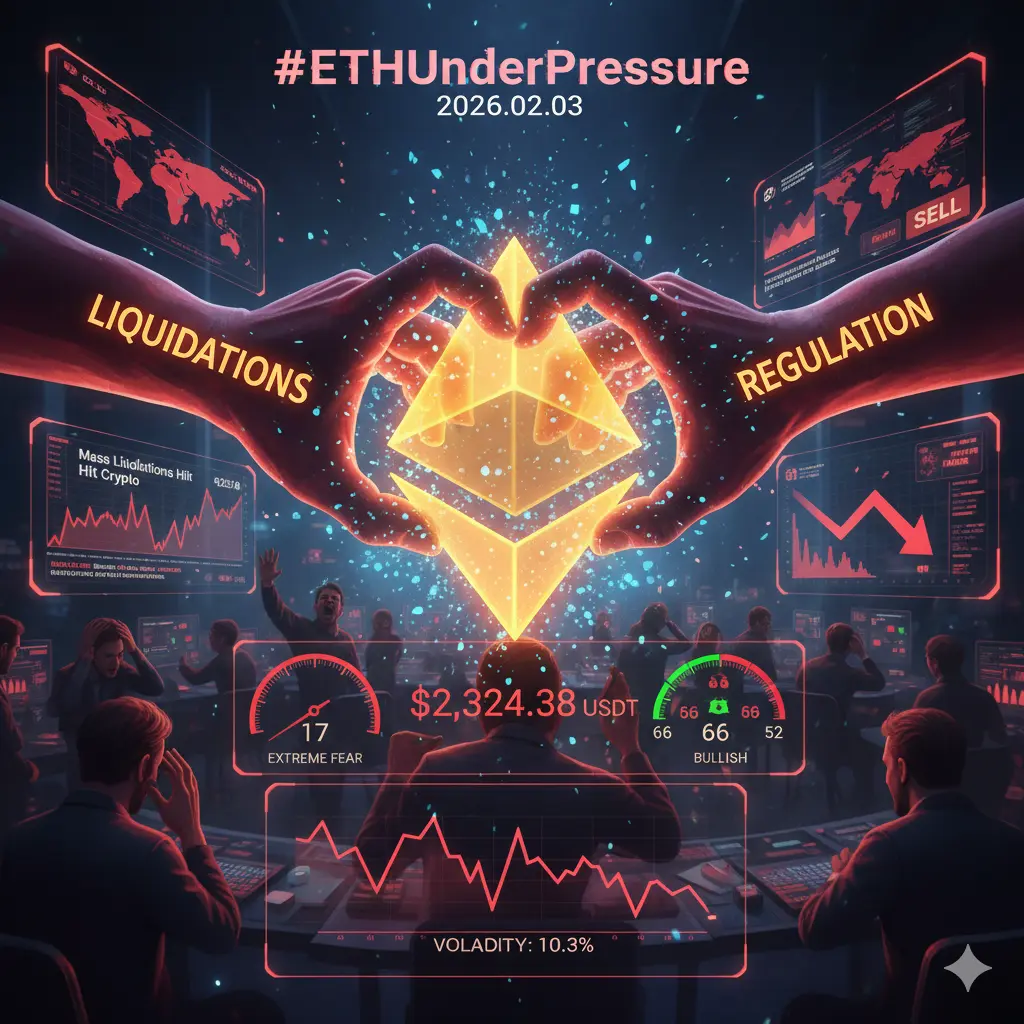

Current Price: $2,286.86

Daily Change: -$142.05 (-5.85%)

Intraday High / Low: $2,429.09 / $2,163.14

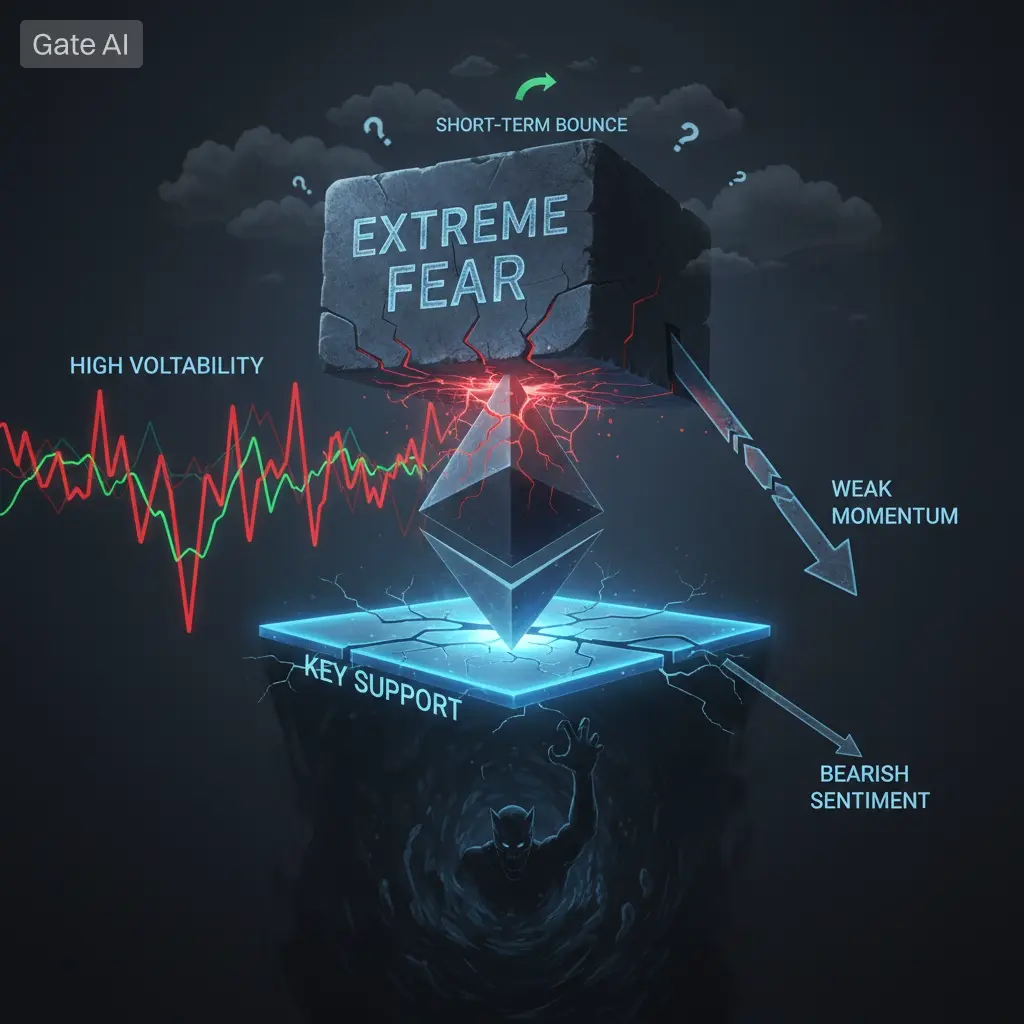

📉 Price vs. Fundamentals: The Divergence

Ethereum is showing short-term price weakness while network fundamentals continue to grow:

Price Signals:

ETH is consolidating below key resistance levels.

Short-term sentiment is cautious, with traders hesitant to push prices higher.

Fundamentals:

On-chain activity and active addresses are rising steadily.

Layer-2 solutions (Arbitrum, Optimism, Base) are processing tens of millions of transactions weekly.

Ethereum upgrades, including Fusaka improvements, enhance throughput and reduce fees.

Institutional flows, staking, and ETF activity indicate structural demand for ETH.

Insight: Price is temporarily lagging behind the real economic activity on Ethereum, presenting potential accumulation opportunities.

🔎 Why Price and Fundamentals Diverge

Macro Headwinds: Global risk-off sentiment affects crypto markets.

Layer-2 Pivot: Increased L2 activity doesn’t immediately push ETH price up.

Burn & Fee Dynamics: Post-upgrade burn rates temporarily slowed, reducing short-term price support.

Holder Behavior: Large investors (whales) are accumulating, while smaller holders take profits.

💡 How to Position ETH

Accumulate on Weakness:

Support zone: ~$2,700–$3,000. Use dollar-cost averaging to manage timing risk.

Focus on Fundamentals:

Medium-to-long-term positioning is preferable when network activity is strong.

Monitor Layer-2 Growth:

Rising L2 transactions, TVL, and fees often precede price movements.

Manage Risk:

Be prepared for further consolidation, but watch upside targets at $3,300–$3,500 for potential breakout.

📈 Long-Term ETH Thesis (2026+)

Strong Layer-2 adoption, ongoing network upgrades, and institutional flows make ETH a structural long-term play.

Short-term price dips may persist, but fundamentals suggest higher medium-to-long-term targets ($4k–$8k+) remain plausible.

📊 Summary Table

Price TrendWeak, consolidatingOn-Chain ActivityRising stronglyLayer-2 AdoptionRapid growthFundamental HealthStrong, expanding ecosystemMarket SentimentWeak vs. fundamentals

Key Takeaway: ETH may feel weak in price now, but strong network growth and Layer-2 adoption create long-term accumulation opportunities.

⚠️ Risk Warning

Trading or investing in Ethereum (ETH) involves significant risk:

Price can be highly volatile, and short-term losses may occur even if fundamentals are strong.

Past performance does not guarantee future results.

Market sentiment can remain disconnected from fundamentals for extended periods.

Use proper risk management: invest only what you can afford to lose.

Consider stop-losses and position sizing to protect your capital.

Always do your own research before making any trading or investment decisions.

#ETHUnderPressure

Current Price: $2,286.86

Daily Change: -$142.05 (-5.85%)

Intraday High / Low: $2,429.09 / $2,163.14

📉 Price vs. Fundamentals: The Divergence

Ethereum is showing short-term price weakness while network fundamentals continue to grow:

Price Signals:

ETH is consolidating below key resistance levels.

Short-term sentiment is cautious, with traders hesitant to push prices higher.

Fundamentals:

On-chain activity and active addresses are rising steadily.

Layer-2 solutions (Arbitrum, Optimism, Base) are processing tens of millions of transactions weekly.

Ethereum upgrades, including Fusaka improvements, enhance throughput and reduce fees.

Institutional flows, staking, and ETF activity indicate structural demand for ETH.

Insight: Price is temporarily lagging behind the real economic activity on Ethereum, presenting potential accumulation opportunities.

🔎 Why Price and Fundamentals Diverge

Macro Headwinds: Global risk-off sentiment affects crypto markets.

Layer-2 Pivot: Increased L2 activity doesn’t immediately push ETH price up.

Burn & Fee Dynamics: Post-upgrade burn rates temporarily slowed, reducing short-term price support.

Holder Behavior: Large investors (whales) are accumulating, while smaller holders take profits.

💡 How to Position ETH

Accumulate on Weakness:

Support zone: ~$2,700–$3,000. Use dollar-cost averaging to manage timing risk.

Focus on Fundamentals:

Medium-to-long-term positioning is preferable when network activity is strong.

Monitor Layer-2 Growth:

Rising L2 transactions, TVL, and fees often precede price movements.

Manage Risk:

Be prepared for further consolidation, but watch upside targets at $3,300–$3,500 for potential breakout.

📈 Long-Term ETH Thesis (2026+)

Strong Layer-2 adoption, ongoing network upgrades, and institutional flows make ETH a structural long-term play.

Short-term price dips may persist, but fundamentals suggest higher medium-to-long-term targets ($4k–$8k+) remain plausible.

📊 Summary Table

Price TrendWeak, consolidatingOn-Chain ActivityRising stronglyLayer-2 AdoptionRapid growthFundamental HealthStrong, expanding ecosystemMarket SentimentWeak vs. fundamentals

Key Takeaway: ETH may feel weak in price now, but strong network growth and Layer-2 adoption create long-term accumulation opportunities.

⚠️ Risk Warning

Trading or investing in Ethereum (ETH) involves significant risk:

Price can be highly volatile, and short-term losses may occur even if fundamentals are strong.

Past performance does not guarantee future results.

Market sentiment can remain disconnected from fundamentals for extended periods.

Use proper risk management: invest only what you can afford to lose.

Consider stop-losses and position sizing to protect your capital.

Always do your own research before making any trading or investment decisions.

#ETHUnderPressure