Yusfirah

No content yet

Yusfirah

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/campaigns/4044?ref=VLJNBLTXUG&ref_type=132

- Reward

- 1

- 1

- Repost

- Share

MemecoinCommunity :

:

Where are you originally from?#WhiteHouseTalksStablecoinYields

The recent discussions by the White House on stablecoin yields mark a significant moment in the evolution of digital finance, one that goes far beyond headlines and speculative sentiment. These conversations represent a clear recognition by the highest level of U.S. government that stablecoins are no longer fringe digital tokens, but rather important components of the modern financial ecosystem with implications for monetary policy, banking stability, consumer protection, and the future of payments. The fact that policymakers are now openly debating not just

The recent discussions by the White House on stablecoin yields mark a significant moment in the evolution of digital finance, one that goes far beyond headlines and speculative sentiment. These conversations represent a clear recognition by the highest level of U.S. government that stablecoins are no longer fringe digital tokens, but rather important components of the modern financial ecosystem with implications for monetary policy, banking stability, consumer protection, and the future of payments. The fact that policymakers are now openly debating not just

- Reward

- 2

- Comment

- Repost

- Share

#HongKongPlansNewVAGuidelines

Hong Kong’s announcement that it is planning new Virtual Asset (VA) guidelines marks a moment of strategic importance for the broader crypto ecosystem. At a time when jurisdictions around the world are struggling to find the right balance between innovation and regulation, Hong Kong’s plans signal a serious effort to establish clear, comprehensive rules that govern digital assets, digital trading platforms, and investor protection. The city has long been a major financial hub, and its approach to virtual assets now positions it as a leading jurisdiction trying to

Hong Kong’s announcement that it is planning new Virtual Asset (VA) guidelines marks a moment of strategic importance for the broader crypto ecosystem. At a time when jurisdictions around the world are struggling to find the right balance between innovation and regulation, Hong Kong’s plans signal a serious effort to establish clear, comprehensive rules that govern digital assets, digital trading platforms, and investor protection. The city has long been a major financial hub, and its approach to virtual assets now positions it as a leading jurisdiction trying to

- Reward

- 2

- Comment

- Repost

- Share

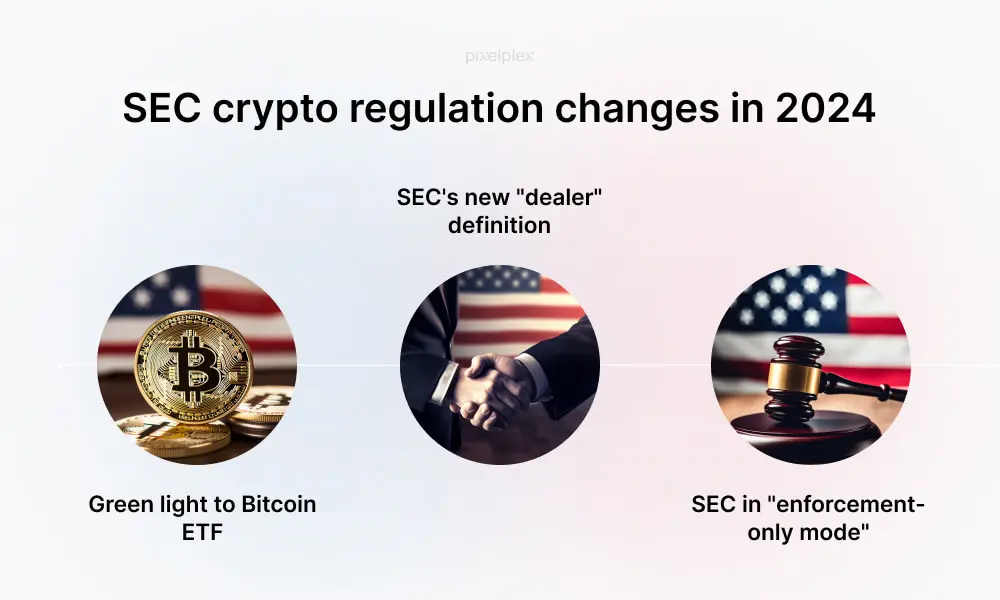

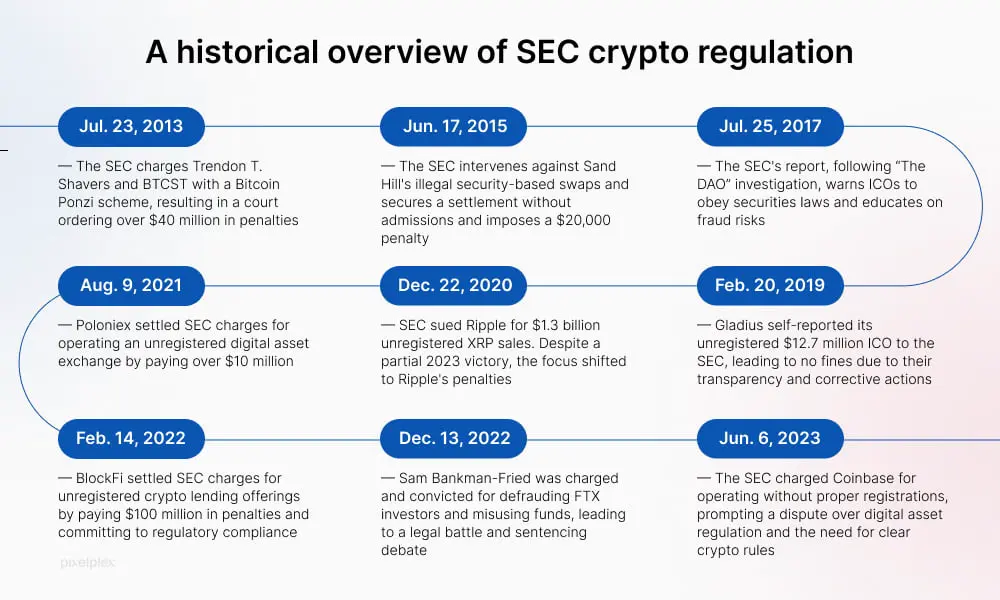

#USSECPushesCryptoReform

The U.S. Securities and Exchange Commission’s recent push for comprehensive crypto reform represents a pivotal moment in the evolution of the American digital asset ecosystem, signaling a shift from reactive enforcement toward proactive regulatory structuring. For years, cryptocurrency markets have operated in a space of legal ambiguity, where tokens, exchanges, and decentralized finance platforms functioned without clearly defined rules. Investors, developers, and institutional participants alike navigated this uncertainty with caution, often constrained by the fear

The U.S. Securities and Exchange Commission’s recent push for comprehensive crypto reform represents a pivotal moment in the evolution of the American digital asset ecosystem, signaling a shift from reactive enforcement toward proactive regulatory structuring. For years, cryptocurrency markets have operated in a space of legal ambiguity, where tokens, exchanges, and decentralized finance platforms functioned without clearly defined rules. Investors, developers, and institutional participants alike navigated this uncertainty with caution, often constrained by the fear

DEFI8,47%

- Reward

- 1

- Comment

- Repost

- Share

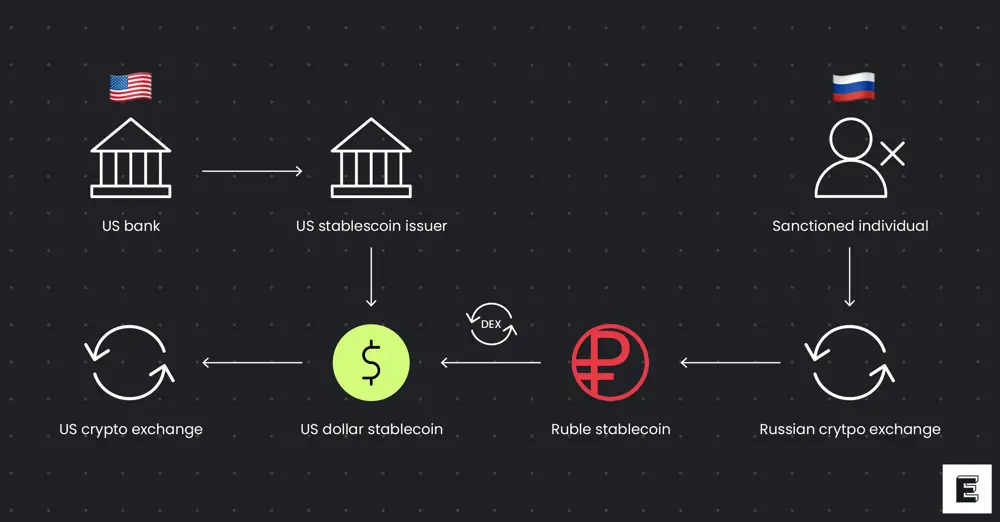

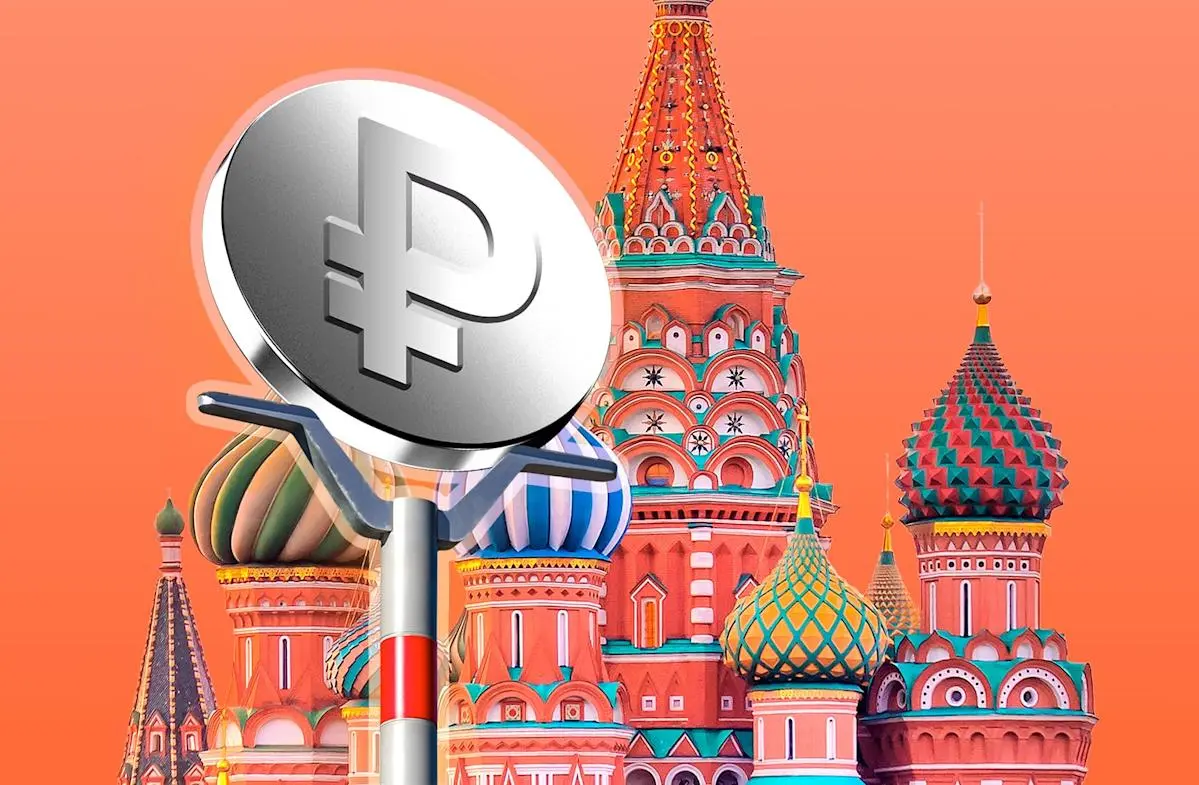

#RussiaStudiesNationalStablecoin

Russia’s consideration of a national stablecoin represents a significant development in global digital finance and monetary policy. As central banks and governments increasingly evaluate digital currencies, Russia’s exploration of a state‑backed stablecoin is noteworthy not only for its domestic financial implications but also for its potential impact on international payment systems, sanctions dynamics, and the evolving role of digital currencies in sovereign economies. Unlike decentralized cryptocurrencies such as Bitcoin or Ethereum, a national stablecoin w

Russia’s consideration of a national stablecoin represents a significant development in global digital finance and monetary policy. As central banks and governments increasingly evaluate digital currencies, Russia’s exploration of a state‑backed stablecoin is noteworthy not only for its domestic financial implications but also for its potential impact on international payment systems, sanctions dynamics, and the evolving role of digital currencies in sovereign economies. Unlike decentralized cryptocurrencies such as Bitcoin or Ethereum, a national stablecoin w

- Reward

- 4

- 3

- Repost

- Share

MrPi27111 :

:

I notice this text appears to be encoded or corrupted and doesn't contain recognizable content in any language I can identify. It consists mainly of random letters, accents, and symbols that don't form coherent words or sentences in English, Spanish, or any other language I'm familiar with. I cannot provide a meaningful translation of this content. If you have cryptocurrency, Web3, or financial content that needs translation to American English, please provide clear, readable text and I'll be happy to help.

View More

#ApollotoBuy90MMORPHOin4Years

The announcement that Apollo Fund intends to acquire 90 million MORPHO tokens over the next four years represents one of the most significant institutional commitments to a decentralized finance (DeFi) infrastructure token in recent memory, reflecting not only confidence in the long-term viability of the MORPHO protocol but also a broader shift in institutional appetite toward deep, utility-driven crypto assets beyond Bitcoin and Ethereum. Unlike typical speculative trades, this multi-year accumulation plan demonstrates disciplined strategy, measured risk managem

The announcement that Apollo Fund intends to acquire 90 million MORPHO tokens over the next four years represents one of the most significant institutional commitments to a decentralized finance (DeFi) infrastructure token in recent memory, reflecting not only confidence in the long-term viability of the MORPHO protocol but also a broader shift in institutional appetite toward deep, utility-driven crypto assets beyond Bitcoin and Ethereum. Unlike typical speculative trades, this multi-year accumulation plan demonstrates disciplined strategy, measured risk managem

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

Thank you for the information, Yusfirah.#GrayscaleEyesAVESpotETFConversion

Grayscale’s move toward converting its Aave Trust into a spot Exchange‑Traded Fund (ETF) marks a pivotal moment in the evolution of digital asset investment products, signaling that institutional interest and market infrastructure are extending beyond Bitcoin and Ethereum into broader decentralized finance (DeFi) ecosystems. This development reflects not only Grayscale’s strategic ambition but also the maturation of digital assets as investable, regulated instruments. Historically, Grayscale has played a key role in bridging traditional financial markets and

Grayscale’s move toward converting its Aave Trust into a spot Exchange‑Traded Fund (ETF) marks a pivotal moment in the evolution of digital asset investment products, signaling that institutional interest and market infrastructure are extending beyond Bitcoin and Ethereum into broader decentralized finance (DeFi) ecosystems. This development reflects not only Grayscale’s strategic ambition but also the maturation of digital assets as investable, regulated instruments. Historically, Grayscale has played a key role in bridging traditional financial markets and

- Reward

- 4

- 3

- Repost

- Share

SheenCrypto :

:

2026 GOGOGO 👊View More

#CelebratingNewYearOnGateSquare

The arrival of the New Year on Gate Square is not merely a celebration it is a culmination of community energy, innovation, and opportunity, creating a festival unlike any other, where the vibrancy of human interaction, the thrill of competition, and the promise of digital assets converge into a singular, immersive experience that participants will remember long after the final event. From the moment the festival begins, every aspect of Gate Square is designed to engage, excite, and challenge, combining the spectacle of live competitions, the strategy of intera

The arrival of the New Year on Gate Square is not merely a celebration it is a culmination of community energy, innovation, and opportunity, creating a festival unlike any other, where the vibrancy of human interaction, the thrill of competition, and the promise of digital assets converge into a singular, immersive experience that participants will remember long after the final event. From the moment the festival begins, every aspect of Gate Square is designed to engage, excite, and challenge, combining the spectacle of live competitions, the strategy of intera

TOKEN-9,54%

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

#CryptoSurvivalGuide

Surviving in cryptocurrency markets in 2026 requires more than luck; it demands discipline, structure, strategy, and constant awareness of both macro and micro factors that influence prices, adoption, and investor sentiment. Crypto is not just a market it is a technological ecosystem, a speculative environment, a social narrative machine, and a financial experiment all at once, which makes price behavior unpredictable and sometimes extreme. To navigate this environment, investors must first understand the market cycle, distinguishing between accumulation phases, markup ra

Surviving in cryptocurrency markets in 2026 requires more than luck; it demands discipline, structure, strategy, and constant awareness of both macro and micro factors that influence prices, adoption, and investor sentiment. Crypto is not just a market it is a technological ecosystem, a speculative environment, a social narrative machine, and a financial experiment all at once, which makes price behavior unpredictable and sometimes extreme. To navigate this environment, investors must first understand the market cycle, distinguishing between accumulation phases, markup ra

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕#BuyTheDipOrWaitNow?

The question of whether to buy the dip or wait has become one of the most pressing dilemmas for crypto investors, traders, and even traditional market participants amid volatile market conditions. Dips in asset prices sudden declines in value following periods of growth can present lucrative opportunities, but they also carry inherent risks. Understanding the dynamics behind a dip, the broader market context, and individual risk tolerance is critical before committing capital.

At its core, buying the dip relies on the assumption that the asset’s intrinsic value or long-te

The question of whether to buy the dip or wait has become one of the most pressing dilemmas for crypto investors, traders, and even traditional market participants amid volatile market conditions. Dips in asset prices sudden declines in value following periods of growth can present lucrative opportunities, but they also carry inherent risks. Understanding the dynamics behind a dip, the broader market context, and individual risk tolerance is critical before committing capital.

At its core, buying the dip relies on the assumption that the asset’s intrinsic value or long-te

- Reward

- like

- Comment

- Repost

- Share

#GateSpringFestivalHorseRacingEvent

The Gate Spring Festival Horse Racing Event is shaping up to be one of the most spectacular and immersive experiences in the digital asset and gaming community this year. Far beyond a simple competition, the festival is a celebration of strategy, skill, and community engagement, blending the thrill of horse racing with the innovation of blockchain-based assets and gamified experiences. It is a platform where participants are not merely spectatorsthey are active players whose decisions, timing, and strategic thinking directly influence outcomes.

At the cente

The Gate Spring Festival Horse Racing Event is shaping up to be one of the most spectacular and immersive experiences in the digital asset and gaming community this year. Far beyond a simple competition, the festival is a celebration of strategy, skill, and community engagement, blending the thrill of horse racing with the innovation of blockchain-based assets and gamified experiences. It is a platform where participants are not merely spectatorsthey are active players whose decisions, timing, and strategic thinking directly influence outcomes.

At the cente

- Reward

- like

- Comment

- Repost

- Share

#CLARITYActAdvances

The CLARITY Act, formally known as the Digital Asset Market Clarity Act, is poised to become one of the most influential pieces of cryptocurrency legislation in U.S. history. Its progression reflects a rare convergence of political will, industry pressure, and market necessity, as the United States grapples with the growing influence of digital assets, decentralized finance (DeFi), and blockchain-based financial innovation. For years, the lack of a comprehensive regulatory framework has left crypto projects, exchanges, institutional investors, and even retail participants

The CLARITY Act, formally known as the Digital Asset Market Clarity Act, is poised to become one of the most influential pieces of cryptocurrency legislation in U.S. history. Its progression reflects a rare convergence of political will, industry pressure, and market necessity, as the United States grapples with the growing influence of digital assets, decentralized finance (DeFi), and blockchain-based financial innovation. For years, the lack of a comprehensive regulatory framework has left crypto projects, exchanges, institutional investors, and even retail participants

DEFI8,47%

- Reward

- 1

- Comment

- Repost

- Share

#WhenisBestTimetoEntertheMarket

Understanding the best time to enter the market is one of the most foundational yet misunderstood aspects of successful investing and trading. Many participants chase the illusion of the “perfect entry” as if there were a specific minute or price where entering guarantees profit. In reality, what defines the best time to enter is not a single point on a chart, but a systematic alignment of market context, personal strategy, risk tolerance, and disciplined timing frameworks that together improve probability and protect capital.

To begin with, markets are driven

Understanding the best time to enter the market is one of the most foundational yet misunderstood aspects of successful investing and trading. Many participants chase the illusion of the “perfect entry” as if there were a specific minute or price where entering guarantees profit. In reality, what defines the best time to enter is not a single point on a chart, but a systematic alignment of market context, personal strategy, risk tolerance, and disciplined timing frameworks that together improve probability and protect capital.

To begin with, markets are driven

- Reward

- like

- Comment

- Repost

- Share

#TrumpAnnouncesNewTariffs

The announcement of new tariffs by Donald Trump should be viewed within the broader framework of economic nationalism and strategic leverage rather than as an isolated policy decision. Tariffs, in Trump’s political and economic philosophy, are not merely fiscal tools but instruments of negotiation, pressure, and signaling. By raising or reintroducing tariffs, the message being sent is clear: the United States is willing to prioritize domestic economic interests even at the cost of short-term global friction. This approach reflects a belief that decades of liberalized

The announcement of new tariffs by Donald Trump should be viewed within the broader framework of economic nationalism and strategic leverage rather than as an isolated policy decision. Tariffs, in Trump’s political and economic philosophy, are not merely fiscal tools but instruments of negotiation, pressure, and signaling. By raising or reintroducing tariffs, the message being sent is clear: the United States is willing to prioritize domestic economic interests even at the cost of short-term global friction. This approach reflects a belief that decades of liberalized

- Reward

- 2

- 2

- Repost

- Share

User_any :

:

To The Moon 🌕View More

#GateSquare$50KRedPacketGiveaway

The GateSquare $50K Red Packet Giveaway can be understood as a carefully designed move to shift the focus of crypto participation from short-term reaction to long-term contribution. Instead of rewarding only activity that generates volume, this initiative highlights the importance of ideas, analysis, and consistent engagement. In an industry where attention is often fragmented and narratives change rapidly, creating incentives around thoughtful participation helps stabilize discussion quality and encourages users to slow down, reflect, and share perspectives g

The GateSquare $50K Red Packet Giveaway can be understood as a carefully designed move to shift the focus of crypto participation from short-term reaction to long-term contribution. Instead of rewarding only activity that generates volume, this initiative highlights the importance of ideas, analysis, and consistent engagement. In an industry where attention is often fragmented and narratives change rapidly, creating incentives around thoughtful participation helps stabilize discussion quality and encourages users to slow down, reflect, and share perspectives g

- Reward

- 1

- 1

- Repost

- Share

User_any :

:

LFG 🔥#我在Gate广场过新年

Wall Street’s Digital Dominion: How Ethereum Staking ETFs Are Rewriting the Rules of Finance

As February 2026 unfolds, Bitcoin wavers around $67,000, swaying like a performer on a tightrope, while retail traders scramble to hedge against volatility, scanning candlestick charts with anxious eyes. But if you step back from the hype and fleeting memecoins, a much larger transformation is quietly reshaping the financial landscape: BlackRock’s Ethereum staking ETF is not merely a product it’s a strategic maneuver to redefine digital finance, turning decentralized protocols into instit

Wall Street’s Digital Dominion: How Ethereum Staking ETFs Are Rewriting the Rules of Finance

As February 2026 unfolds, Bitcoin wavers around $67,000, swaying like a performer on a tightrope, while retail traders scramble to hedge against volatility, scanning candlestick charts with anxious eyes. But if you step back from the hype and fleeting memecoins, a much larger transformation is quietly reshaping the financial landscape: BlackRock’s Ethereum staking ETF is not merely a product it’s a strategic maneuver to redefine digital finance, turning decentralized protocols into instit

- Reward

- 15

- 21

- Repost

- Share

User_any :

:

LFG 🔥View More

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/campaigns/4044?ref_type=132

- Reward

- 18

- 17

- Repost

- Share

User_any :

:

LFG 🔥View More

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&ref=VLJNBLTXUG

- Reward

- 16

- 17

- Repost

- Share

User_any :

:

LFG 🔥View More

#RussiaStudiesNationalStablecoin

Russia’s recent study and exploration of a national stablecoin represents a landmark moment in the intersection of technology, finance, and geopolitics. From my perspective, this initiative is not merely a technological experiment but a strategic effort to assert financial sovereignty, improve domestic and cross-border payment systems, and navigate ongoing geopolitical challenges. Over the past several years, I have observed that countries venturing into digital national currencies aim not only to modernize their financial infrastructure but also to create mec

Russia’s recent study and exploration of a national stablecoin represents a landmark moment in the intersection of technology, finance, and geopolitics. From my perspective, this initiative is not merely a technological experiment but a strategic effort to assert financial sovereignty, improve domestic and cross-border payment systems, and navigate ongoing geopolitical challenges. Over the past several years, I have observed that countries venturing into digital national currencies aim not only to modernize their financial infrastructure but also to create mec

- Reward

- 14

- 16

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

#USSECPushesCryptoReform

The recent push by the U.S. Securities and Exchange Commission (SEC) toward crypto reform marks a pivotal moment in the evolution of the digital asset market. From my perspective, this is not just a regulatory announcement; it is a clear signal that the crypto ecosystem is maturing, and that government agencies are increasingly focused on transparency, investor protection, and market integrity. Over the years, I have observed that meaningful reform often comes after periods of rapid innovation and market expansion a natural cycle where regulators seek to balance inno

The recent push by the U.S. Securities and Exchange Commission (SEC) toward crypto reform marks a pivotal moment in the evolution of the digital asset market. From my perspective, this is not just a regulatory announcement; it is a clear signal that the crypto ecosystem is maturing, and that government agencies are increasingly focused on transparency, investor protection, and market integrity. Over the years, I have observed that meaningful reform often comes after periods of rapid innovation and market expansion a natural cycle where regulators seek to balance inno

- Reward

- 15

- 15

- Repost

- Share

HighAmbition :

:

good informationView More

Trending Topics

View More362.57K Popularity

118.2K Popularity

429.65K Popularity

12.8K Popularity

130.95K Popularity

Pin