# WhiteHouseTalksStablecoinYields

6.61K

EagleEye

#WhiteHouseTalksStablecoinYields

The Quiet Battle Over Money’s Future

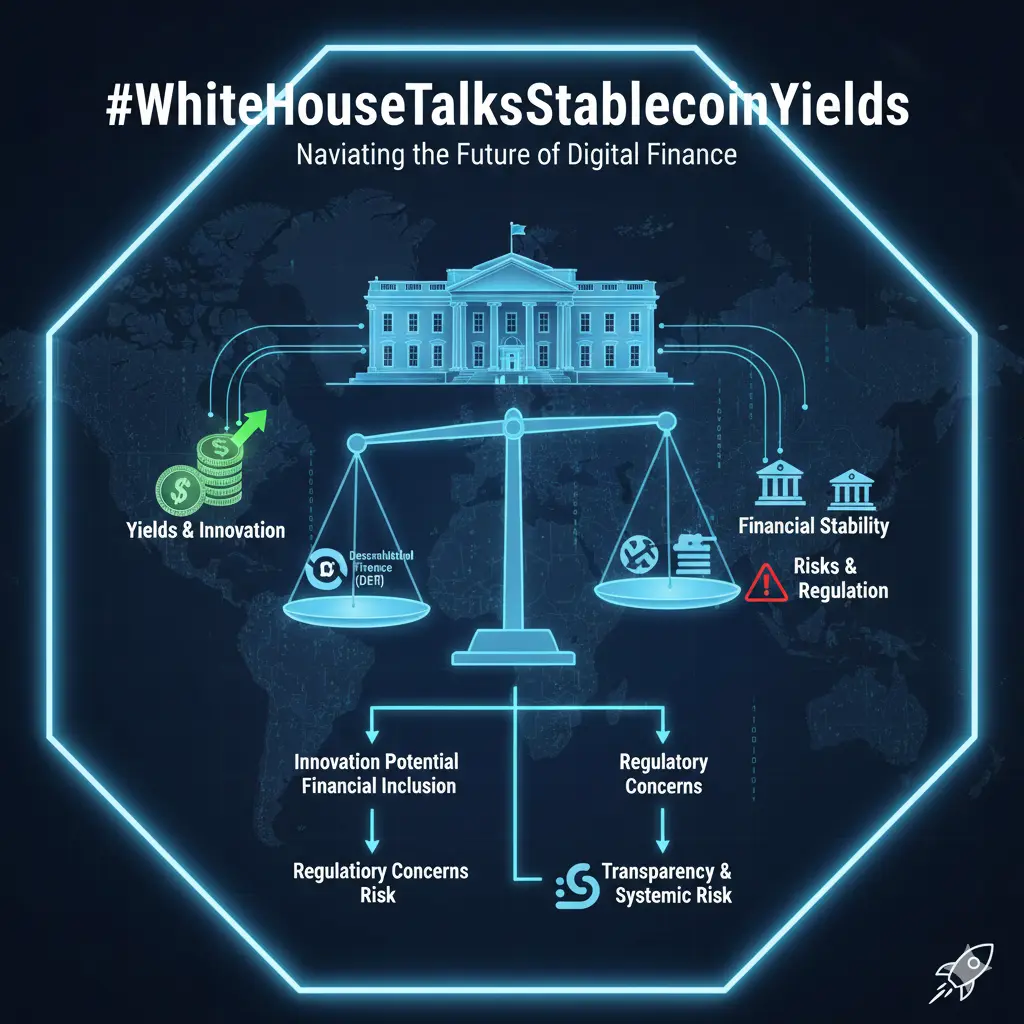

The recent White House discussions around stablecoin yields signal that digital assets have moved from the periphery of finance into the center of monetary policy. What was once treated as a niche experiment is now being examined as a potential pillar of the payments system, carrying implications for banks, savers, and the state itself. Yields on stablecoins are not merely a product feature; they represent a new contest over who controls the return on dollar liquidity and how that return is distributed across society.

At t

The Quiet Battle Over Money’s Future

The recent White House discussions around stablecoin yields signal that digital assets have moved from the periphery of finance into the center of monetary policy. What was once treated as a niche experiment is now being examined as a potential pillar of the payments system, carrying implications for banks, savers, and the state itself. Yields on stablecoins are not merely a product feature; they represent a new contest over who controls the return on dollar liquidity and how that return is distributed across society.

At t

- Reward

- 5

- 5

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields

Why This Is Bigger Than It Sounds

This isn’t just policy chatter — it’s a signal that stablecoins are being pulled closer to the core of the financial system. Here’s the real read 👇

🏛️ 1. Why the White House Cares About Stablecoin Yields

Capital flows: Yield-bearing stablecoins can pull funds away from banks and money-market funds.

Monetary control: If private stablecoins offer competitive yields, they start competing with policy tools.

Systemic risk: Unregulated yields = hidden leverage risk regulators don’t want repeating.

💵 2. What “Stablecoin Yields” Ac

Why This Is Bigger Than It Sounds

This isn’t just policy chatter — it’s a signal that stablecoins are being pulled closer to the core of the financial system. Here’s the real read 👇

🏛️ 1. Why the White House Cares About Stablecoin Yields

Capital flows: Yield-bearing stablecoins can pull funds away from banks and money-market funds.

Monetary control: If private stablecoins offer competitive yields, they start competing with policy tools.

Systemic risk: Unregulated yields = hidden leverage risk regulators don’t want repeating.

💵 2. What “Stablecoin Yields” Ac

DEFI-2,92%

- Reward

- 5

- 8

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#WhiteHouseTalksStablecoinYields

As of today, discussions around stablecoin yields reaching the White House signal just how deeply crypto has entered mainstream financial policy conversations. What once felt like a niche DeFi topic is now being examined at the highest regulatory levels, highlighting growing concern over how yield-bearing stablecoins could impact financial stability and consumer protection.

The core issue being discussed is not simply yield itself, but where that yield comes from. Stablecoins offering returns blur the line between payment instruments, savings products, and inv

As of today, discussions around stablecoin yields reaching the White House signal just how deeply crypto has entered mainstream financial policy conversations. What once felt like a niche DeFi topic is now being examined at the highest regulatory levels, highlighting growing concern over how yield-bearing stablecoins could impact financial stability and consumer protection.

The core issue being discussed is not simply yield itself, but where that yield comes from. Stablecoins offering returns blur the line between payment instruments, savings products, and inv

DEFI-2,92%

- Reward

- 4

- 4

- Repost

- Share

xxx40xxx :

:

Thank you for the information🙏🙏🙏View More

#WhiteHouseTalksStablecoinYields

The recent White House meetings are indeed focused on the future of stablecoin yields, which has become a major roadblock for U.S. crypto legislation. The goal is to break a political deadlock over a key bill.

Stablecoin Yield: The Core Dispute

The central conflict is between the traditional banking industry and the crypto sector over whether stablecoins should be allowed to offer interest-like "yield" or "rewards."

Banking Industry Position (Against Yield):

· Core Concern: High-yield stablecoins could trigger a massive migration of deposits away from traditi

The recent White House meetings are indeed focused on the future of stablecoin yields, which has become a major roadblock for U.S. crypto legislation. The goal is to break a political deadlock over a key bill.

Stablecoin Yield: The Core Dispute

The central conflict is between the traditional banking industry and the crypto sector over whether stablecoins should be allowed to offer interest-like "yield" or "rewards."

Banking Industry Position (Against Yield):

· Core Concern: High-yield stablecoins could trigger a massive migration of deposits away from traditi

- Reward

- 4

- 5

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields: Spotlight on the Future of Crypto Returns

The recent discussions at the White House regarding stablecoin yields have brought renewed attention to one of the fastest-growing areas of the cryptocurrency ecosystem. Stablecoins—digital assets pegged to fiat currencies like the US dollar—have become integral to the crypto market, providing liquidity, facilitating decentralized finance (DeFi) operations, and enabling seamless global transactions.

However, the government’s focus on the yields generated by these coins underscores the increasing regulatory scrutiny th

The recent discussions at the White House regarding stablecoin yields have brought renewed attention to one of the fastest-growing areas of the cryptocurrency ecosystem. Stablecoins—digital assets pegged to fiat currencies like the US dollar—have become integral to the crypto market, providing liquidity, facilitating decentralized finance (DeFi) operations, and enabling seamless global transactions.

However, the government’s focus on the yields generated by these coins underscores the increasing regulatory scrutiny th

- Reward

- 1

- 1

- Repost

- Share

xxx40xxx :

:

Thank you for the information🙏🙏🙏#WhiteHouseTalksStablecoinYields

The White House’s recent discussions around stablecoin yields mark a pivotal moment in the evolution of digital finance in the United States. As stablecoins continue to bridge the gap between traditional finance and blockchain-based systems, policymakers are now turning their attention to how yield-generating stablecoins could reshape markets, consumer protection, and financial stability.

Stablecoins were originally designed to maintain price stability by being pegged to fiat currencies like the US dollar. Over time, however, many issuers and platforms began o

The White House’s recent discussions around stablecoin yields mark a pivotal moment in the evolution of digital finance in the United States. As stablecoins continue to bridge the gap between traditional finance and blockchain-based systems, policymakers are now turning their attention to how yield-generating stablecoins could reshape markets, consumer protection, and financial stability.

Stablecoins were originally designed to maintain price stability by being pegged to fiat currencies like the US dollar. Over time, however, many issuers and platforms began o

DEFI-2,92%

- Reward

- 5

- 9

- Repost

- Share

xxx40xxx :

:

Happy New Year! 🤑View More

🏛️📊 #WhiteHouseTalksStablecoinYields

Recent discussions from the White House are focusing on stablecoin yield regulations and oversight, capturing the attention of both traditional finance and the crypto community.

🔍 Why It Matters:

• Stablecoin yields influence how users earn from digital assets like USDT & USDC

• Regulatory clarity could affect investor confidence and institutional participation

• Markets may react to policy shifts with volatility as traders price in outcomes

📈 Potential Impact:

• Stricter yield rules → could reduce aggressive yield farming

• Clearer regulations → could

Recent discussions from the White House are focusing on stablecoin yield regulations and oversight, capturing the attention of both traditional finance and the crypto community.

🔍 Why It Matters:

• Stablecoin yields influence how users earn from digital assets like USDT & USDC

• Regulatory clarity could affect investor confidence and institutional participation

• Markets may react to policy shifts with volatility as traders price in outcomes

📈 Potential Impact:

• Stricter yield rules → could reduce aggressive yield farming

• Clearer regulations → could

- Reward

- 7

- 11

- Repost

- Share

MoonGirl :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields Stablecoins, Regulation, and the Future of Digital Finance

The ongoing discussions within the White House regarding stablecoin yields mark a pivotal moment for the broader cryptocurrency and digital finance ecosystem. For years, stablecoins functioned primarily as transactional tools and hedging instruments — bridges between fiat and crypto markets. Today, they are evolving into complex financial products capable of generating yield, facilitating liquidity provision, and supporting leveraged structures. High-level policy engagement reflects a growing recognitio

The ongoing discussions within the White House regarding stablecoin yields mark a pivotal moment for the broader cryptocurrency and digital finance ecosystem. For years, stablecoins functioned primarily as transactional tools and hedging instruments — bridges between fiat and crypto markets. Today, they are evolving into complex financial products capable of generating yield, facilitating liquidity provision, and supporting leveraged structures. High-level policy engagement reflects a growing recognitio

- Reward

- 3

- 6

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#WhiteHouseTalksStablecoinYields

The ongoing discussions within the White House regarding stablecoin yields mark a pivotal moment for the broader cryptocurrency and digital finance ecosystem. For years, stablecoins have been treated primarily as transactional or hedging tools — a bridge between fiat and crypto markets. Today, however, they are evolving into complex financial instruments capable of offering yield, liquidity provision, and systemic leverage. The fact that the highest levels of U.S. governance are actively debating yield structures, risk oversight, and regulatory frameworks unde

The ongoing discussions within the White House regarding stablecoin yields mark a pivotal moment for the broader cryptocurrency and digital finance ecosystem. For years, stablecoins have been treated primarily as transactional or hedging tools — a bridge between fiat and crypto markets. Today, however, they are evolving into complex financial instruments capable of offering yield, liquidity provision, and systemic leverage. The fact that the highest levels of U.S. governance are actively debating yield structures, risk oversight, and regulatory frameworks unde

- Reward

- 6

- 4

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

#WhiteHouseTalksStablecoinYields

The conversation around stablecoins has entered a new and critical phase as the White House begins serious discussions on stablecoin yields and their implications for the U.S. financial system. Once considered a niche innovation within the crypto ecosystem, stablecoins have now grown into a multi-billion-dollar market that bridges traditional finance and blockchain technology. With this growth comes increased scrutiny, especially when yields are involved.

Stablecoins are designed to maintain a fixed value, usually pegged to the U.S. dollar. However, recent dev

The conversation around stablecoins has entered a new and critical phase as the White House begins serious discussions on stablecoin yields and their implications for the U.S. financial system. Once considered a niche innovation within the crypto ecosystem, stablecoins have now grown into a multi-billion-dollar market that bridges traditional finance and blockchain technology. With this growth comes increased scrutiny, especially when yields are involved.

Stablecoins are designed to maintain a fixed value, usually pegged to the U.S. dollar. However, recent dev

- Reward

- 2

- 3

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

200.25K Popularity

2.07K Popularity

3.07K Popularity

6.61K Popularity

1.13K Popularity

37.17K Popularity

510 Popularity

820 Popularity

54.71K Popularity

496 Popularity

1.05K Popularity

10.56K Popularity

1.57K Popularity

17.98K Popularity

9.77K Popularity

News

View MoreU.S. Bitcoin ETF rebounds after decline, with two consecutive days of net capital inflows signaling market stabilization

1 m

PI (Pi) decreased by 4.56% in the past 24 hours

2 m

PIPPIN (pippin) 24-hour increase of 17.28%

2 m

Sahara AI teams up with Danal to launch a stablecoin AI payment system, targeting cross-border payments and intelligent risk control

4 m

Ray Dalio Warns Again: CBDCs Could Become "Surveillance Currencies," Central Bank Digital Currency Privacy Risks Fully Exposed

6 m

Pin