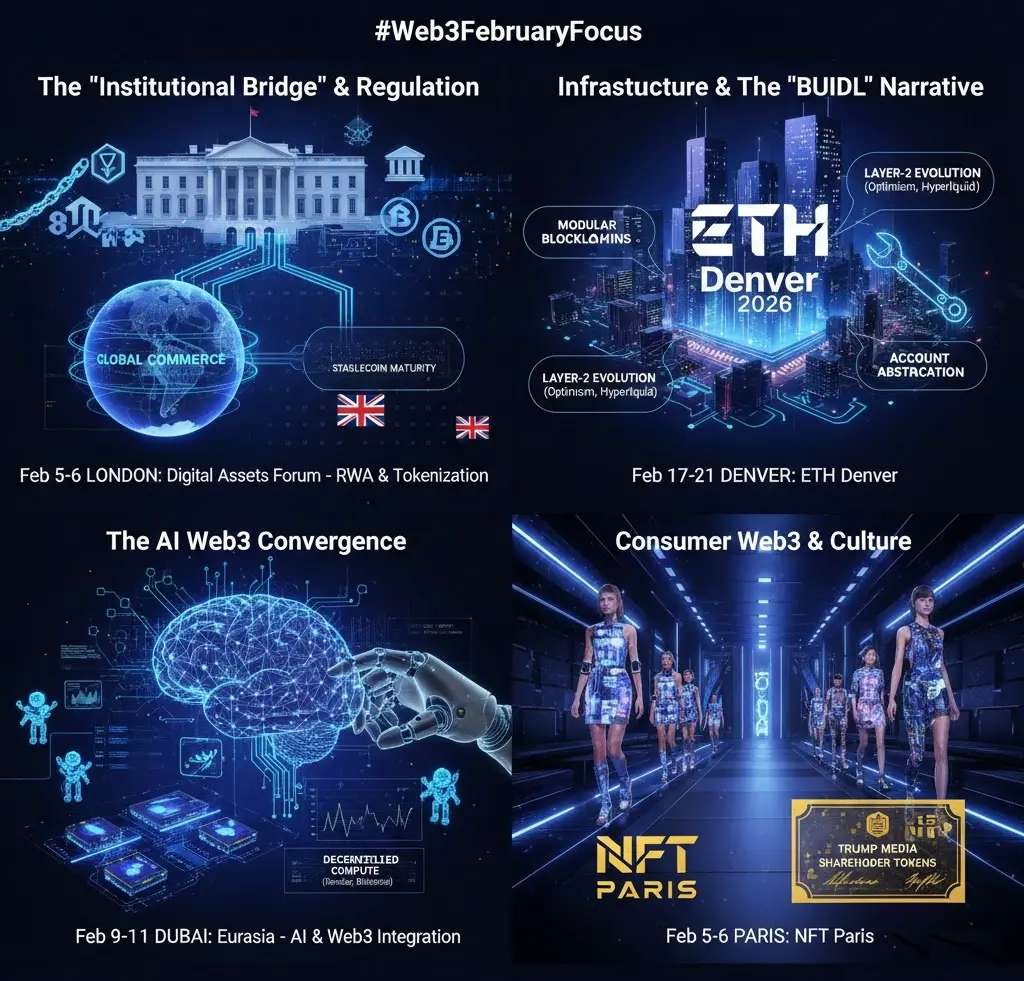

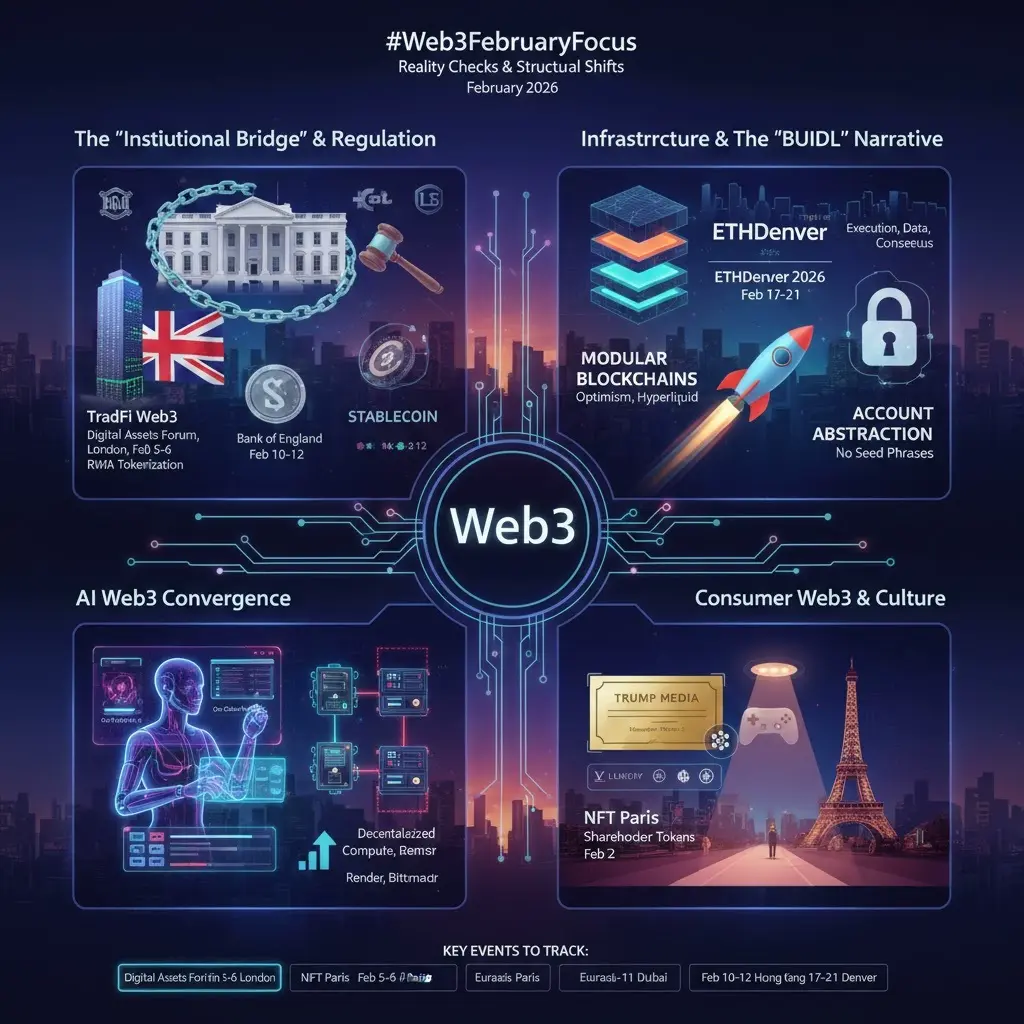

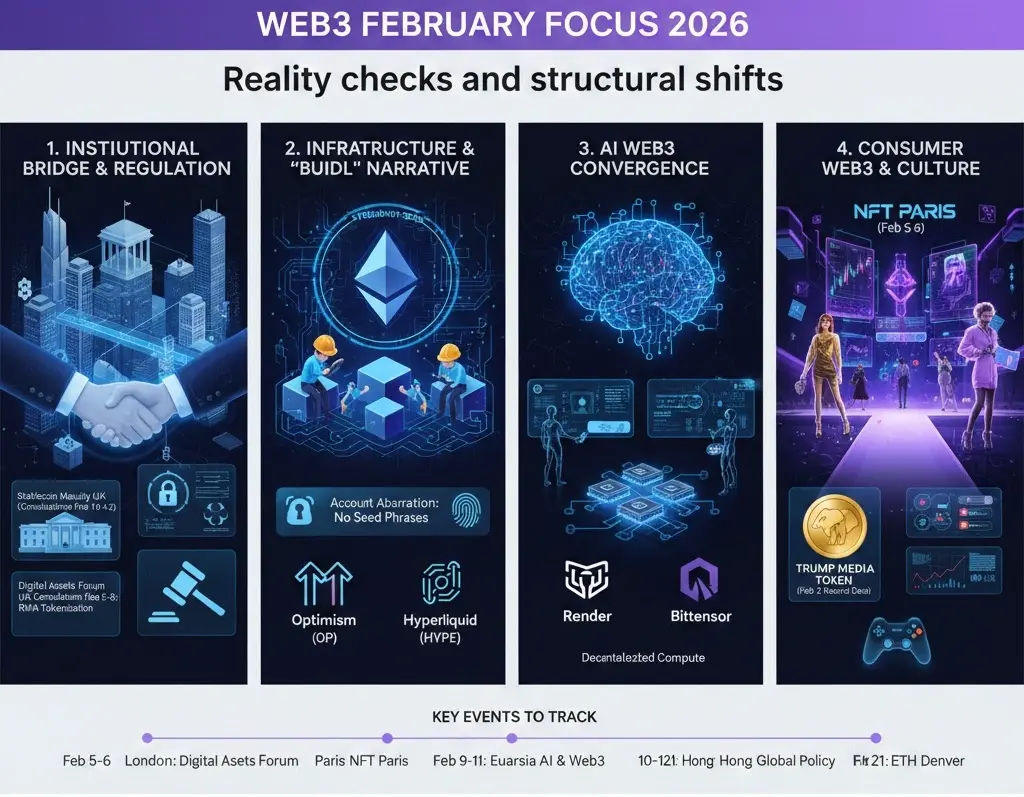

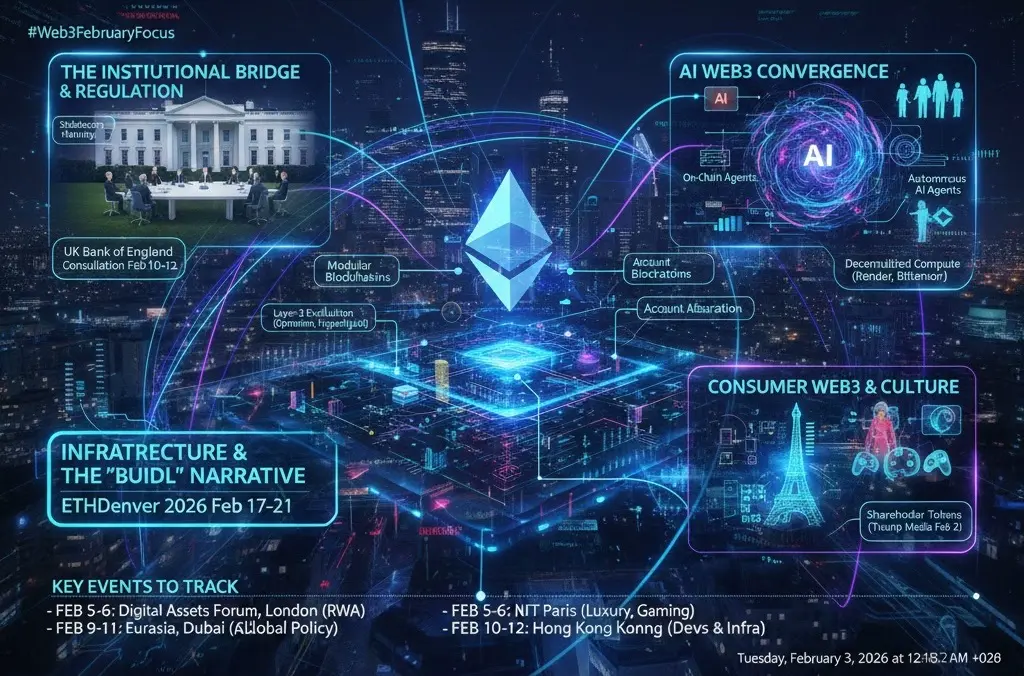

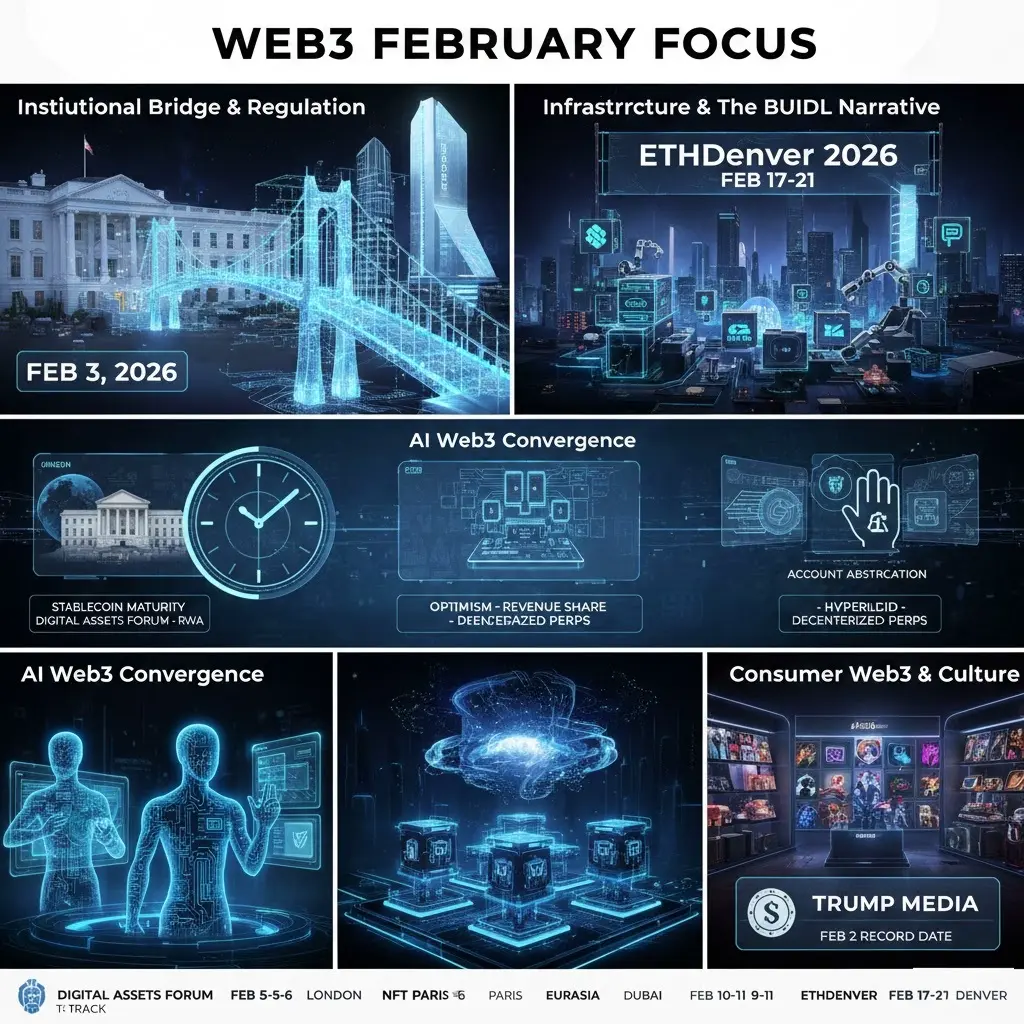

#Web3FebruaryFocus

📊 Web3 February Focus

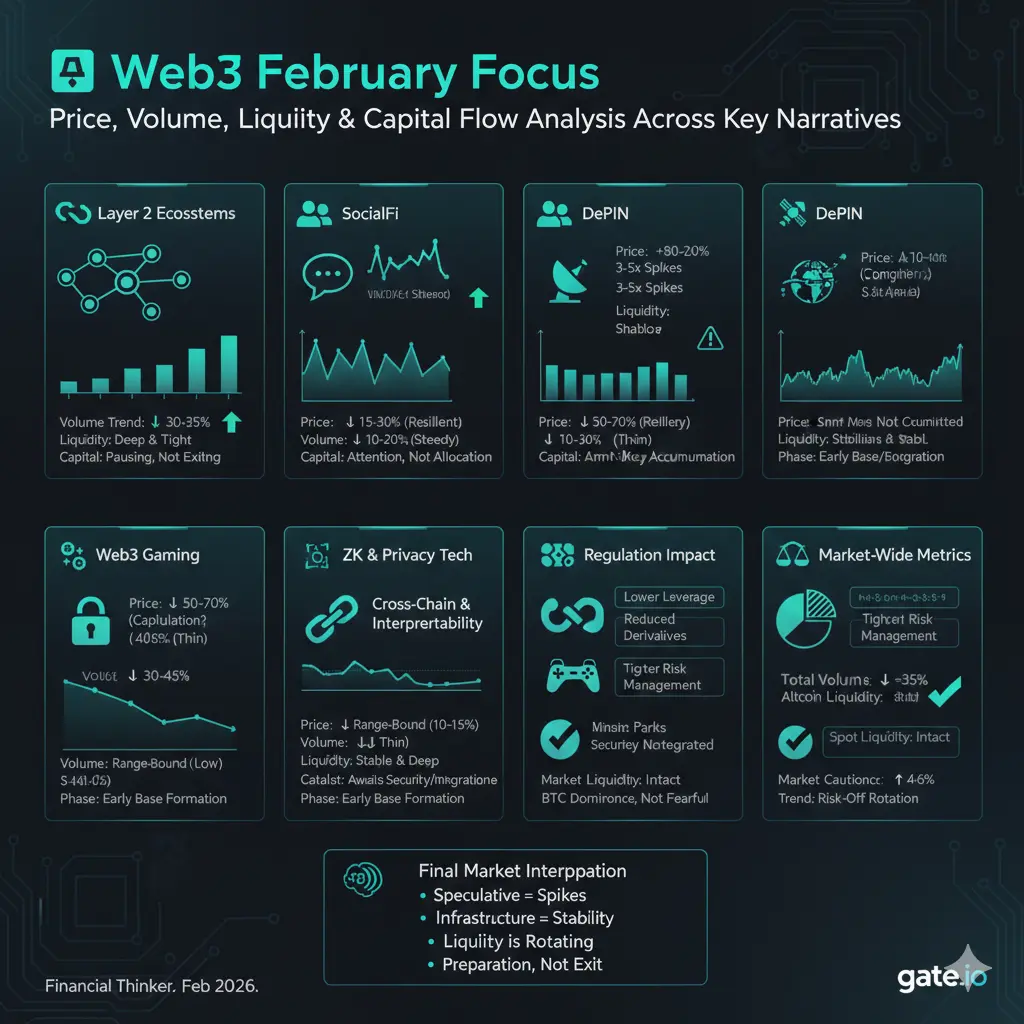

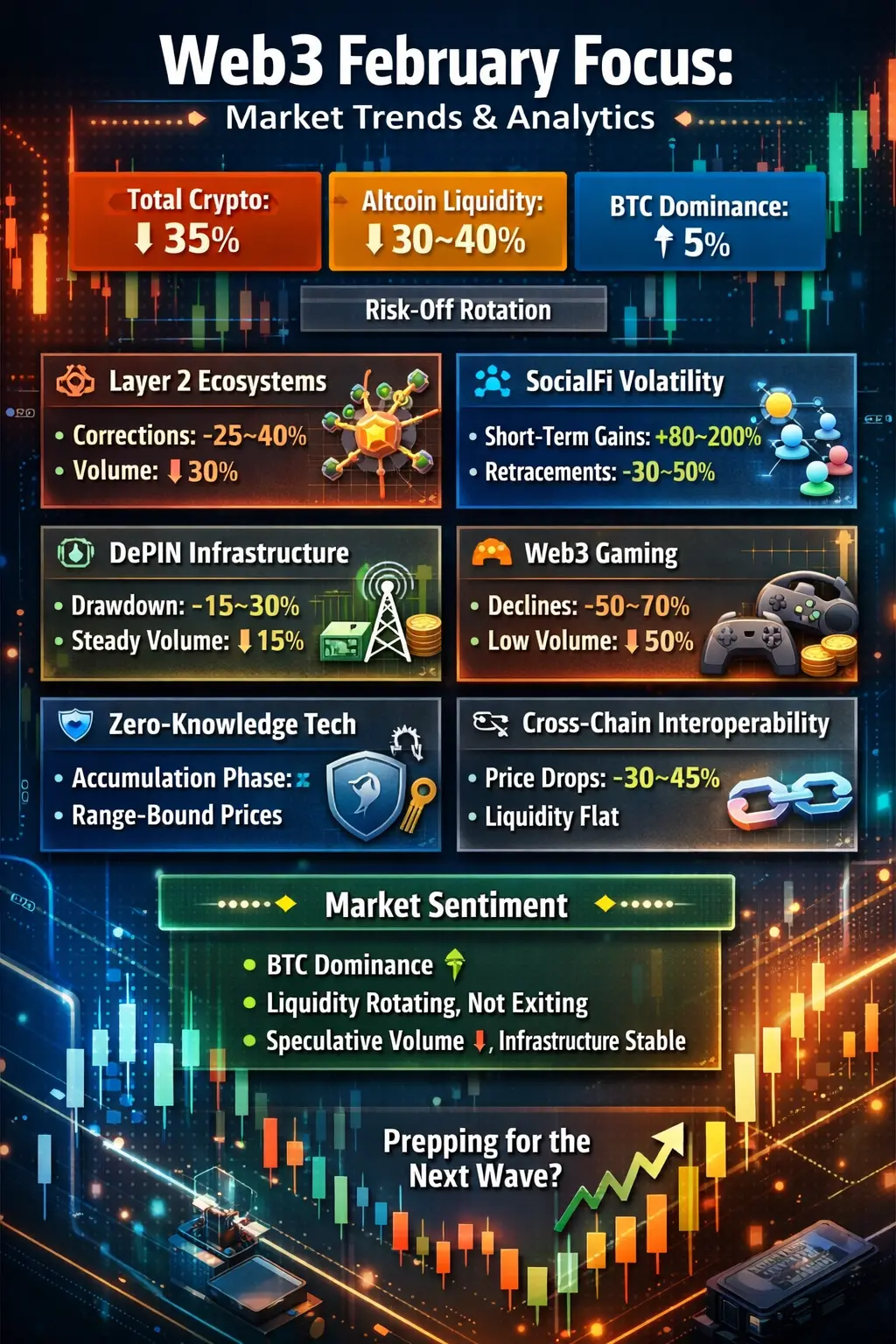

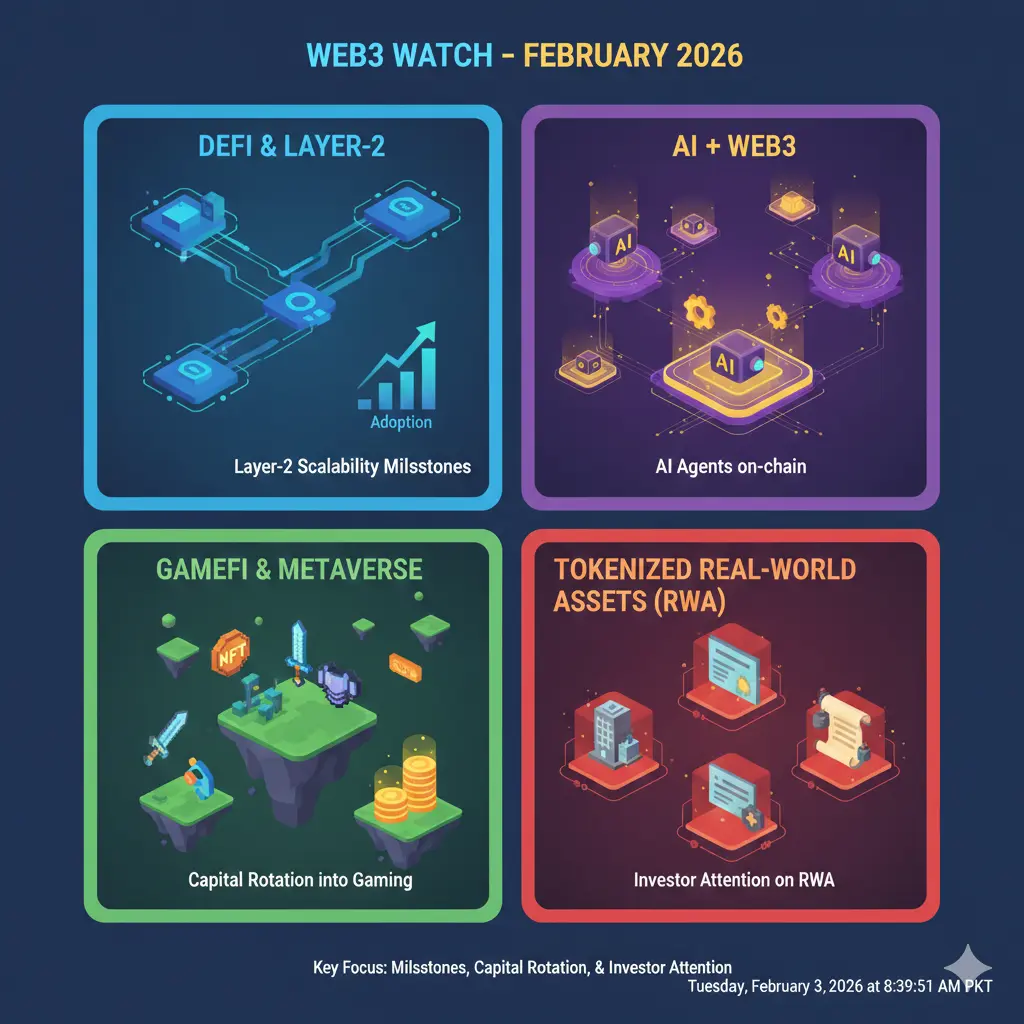

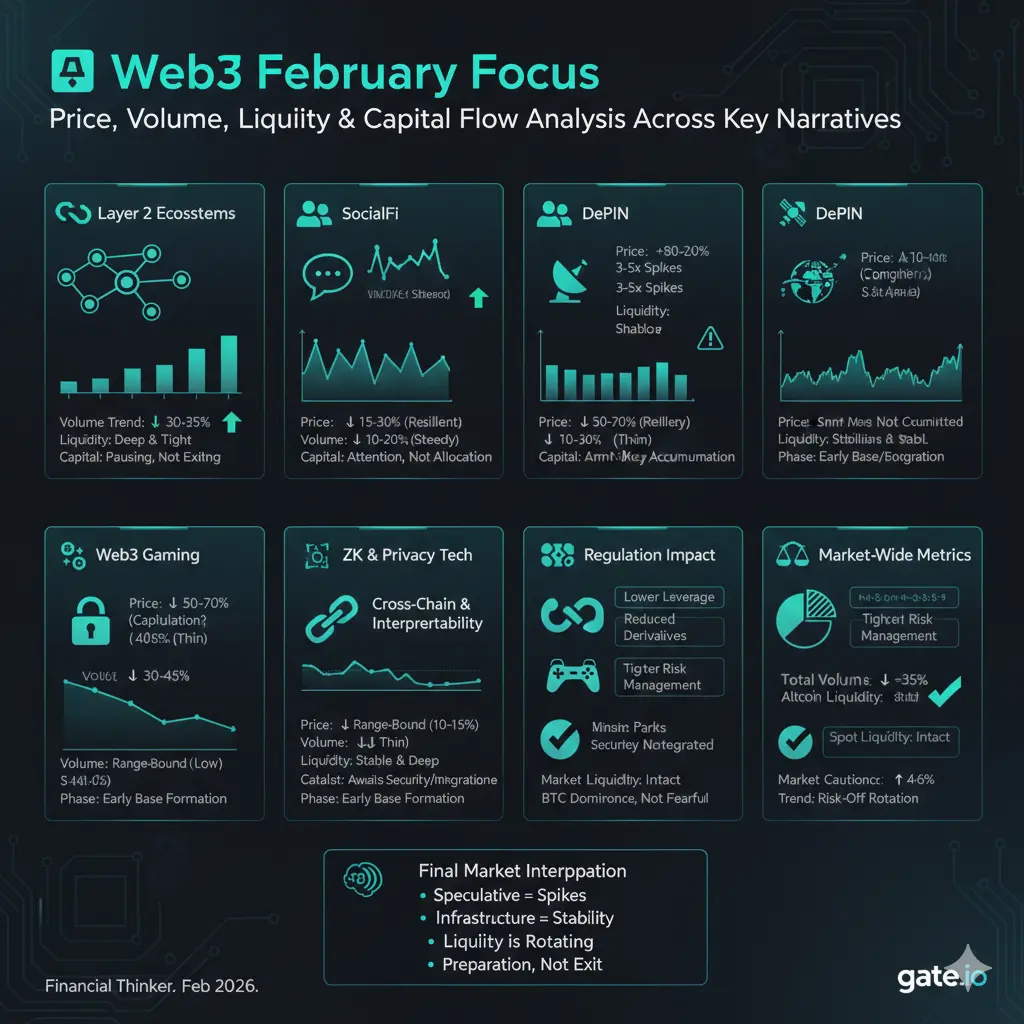

🔗 1. Layer 2 Ecosystems: Liquidity Concentration Over Expansion

From a market perspective, Layer 2 tokens are showing relative strength vs the broader altcoin market, even during periods of BTC weakness.

Price behavior:

Most major L2 tokens have corrected 25–40% from recent local highs, which is less severe than mid-cap altcoins that dropped 45–60%.

Volume trend:

Spot volume across L2 tokens is down roughly 30–35% month-over-month, signaling consolidation rather than distribution.

Liquidity profile:

Liquidity remains deep on major venues (Gate.io included), with tighter spreads compared to smaller narrative tokens — a sign that institutional and swing traders are still active.

Interpretation:

Capital is not exiting L2s — it is pausing, waiting for confirmation. This is typical behavior before trend continuation.

👥 2. SocialFi: High Volatility, High Speculation Volume

SocialFi tokens are experiencing sharp liquidity bursts followed by rapid cooldowns.

Price action:

Many SocialFi-related tokens have seen +80% to +200% short-term moves, followed by 30–50% retracements.

Volume spikes:

During peak hype days, volume expands 3–5x above average, then collapses quickly — a classic speculative cycle.

Liquidity risk:

Liquidity depth is shallow compared to infrastructure sectors, making price highly sensitive to sentiment shifts.

Market reality:

SocialFi is attracting attention capital, not long-term allocation capital — yet.

🛰️ 3. DePIN: Steady Volume, Sticky Liquidity

DePIN stands out as one of the most structurally healthy sectors in February.

Price structure:

DePIN tokens are generally down only 15–30% from highs, showing resilience.

Volume behavior:

Trading volume has declined just 10–20%, far less than the broader market.

Liquidity quality:

Liquidity is consistent, spreads are stable, and sell pressure is absorbed smoothly — indicating long-term holders and strategic buyers.

Capital signal:

Smart money prefers predictable, real-world-use narratives when volatility rises.

🎮 4. Web3 Gaming: Liquidity Drains, Selective Rebuild

GameFi remains in a reset phase.

Price performance:

Most gaming tokens are down 50–70% from cycle peaks.

Volume:

Spot volume has compressed 40–60%, confirming lack of speculative interest.

Liquidity:

Liquidity is thin, but stabilizing — suggesting capitulation may already be behind us.

Key insight:

Low volume + flat price = early base formation, not immediate upside.

🔐 5. ZK & Privacy Tech: Quiet Accumulation Phase

ZK-related tokens show low volatility and declining volume, which is often misunderstood.

Volume decline: ~25–30%

Price movement: Mostly range-bound within 10–15% bands

Liquidity: Stable and deep relative to market cap

What this means:

ZK tokens are in a technical accumulation zone, not a speculative phase.

🌉 6. Cross-Chain & Interoperability: Liquidity Without Momentum

Price: Down 30–45%

Volume: Down 35–50%

Liquidity: Present, but inactive

Capital is parked, not committed — waiting for a catalyst like security breakthroughs or major integrations.

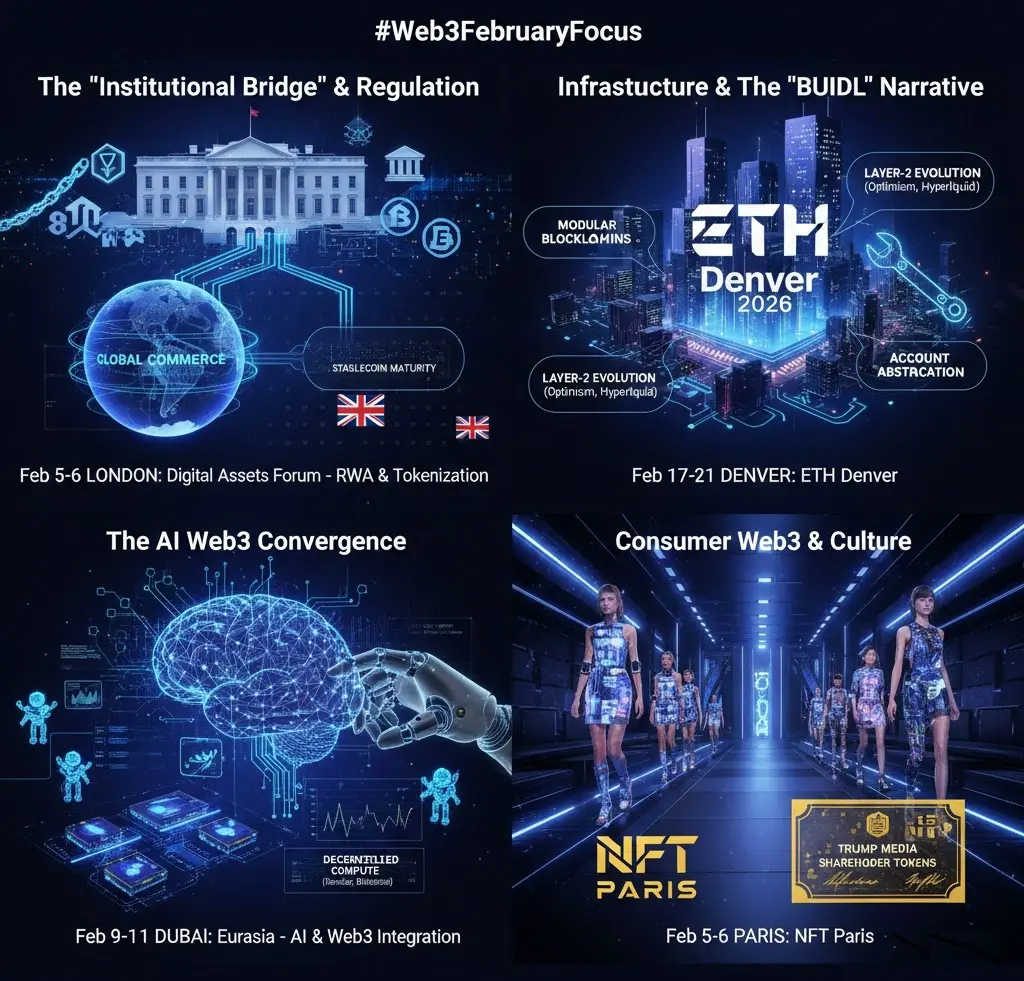

⚖️ 7. Regulation Impact: Volume Compression, Not Panic

Regulatory uncertainty has caused:

Lower leverage usage

Reduced derivatives volume

Tighter risk management

However, spot liquidity remains intact, meaning capital is cautious, not fearful.

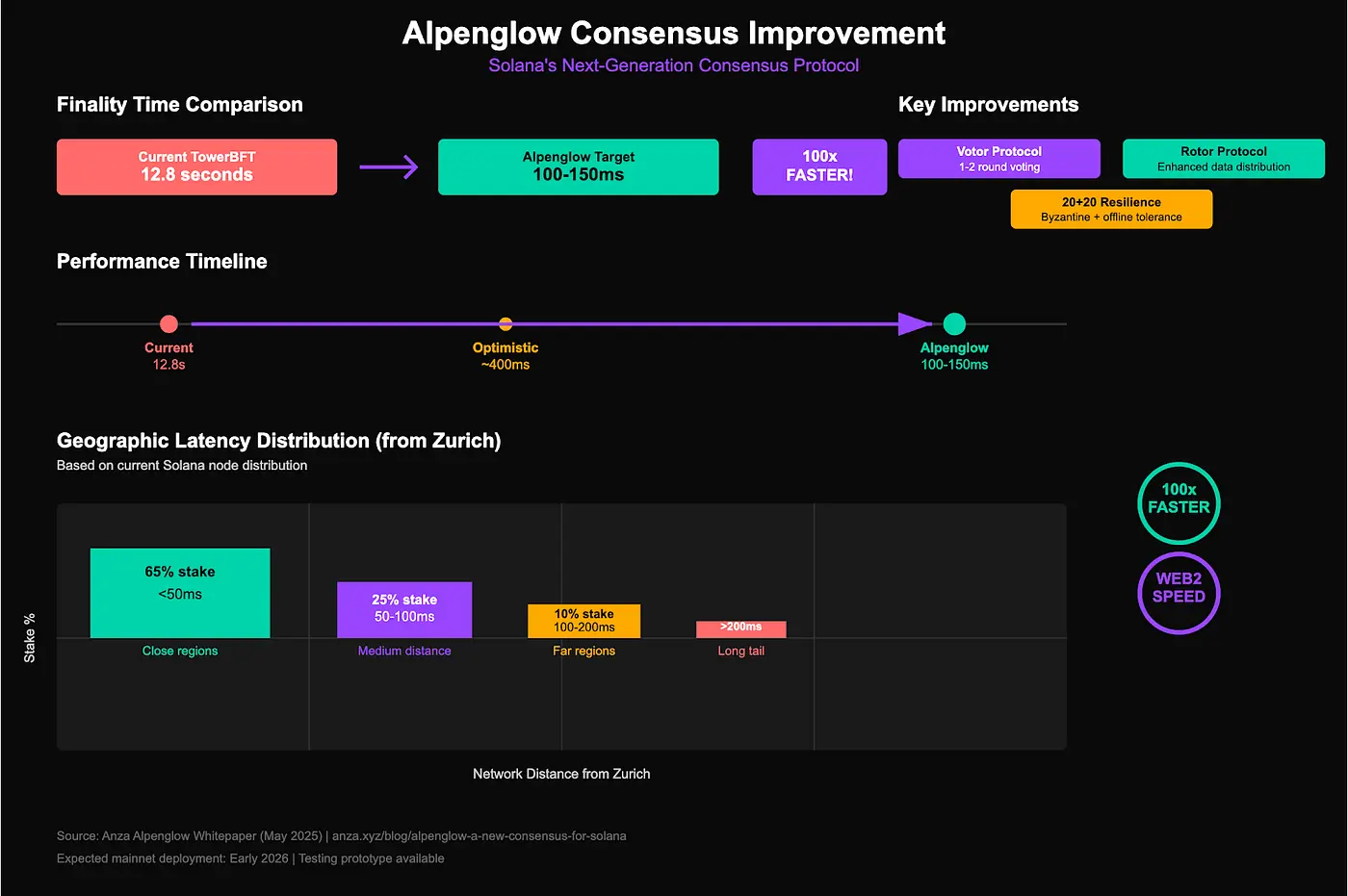

📊 8. Market-Wide Metrics Snapshot (February)

Total crypto market volume: ↓ ~35%

Altcoin liquidity: ↓ ~30–40%

BTC dominance: ↑ 4–6%

Infrastructure sector drawdown: Smaller than meme/speculative sectors by 15–25%

This confirms a risk-off rotation, not a market collapse.

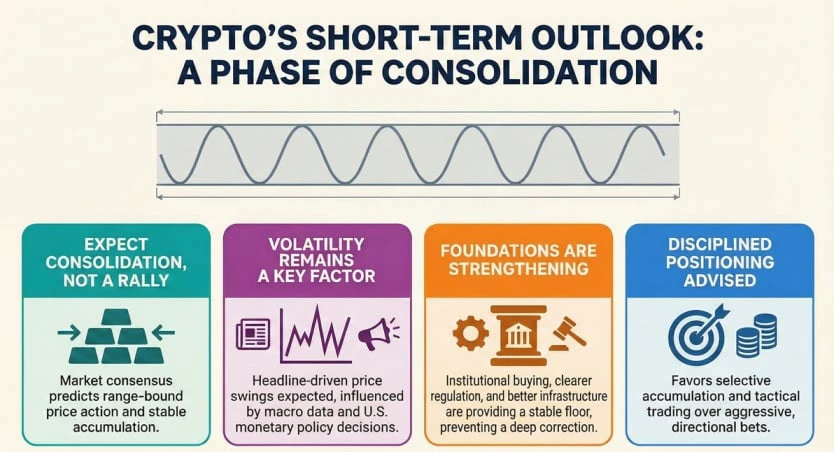

🧠 Final Market Interpretation

February’s Web3 focus shows a clear pattern:

Speculative narratives = volume spikes, weak liquidity

Infrastructure narratives = lower volatility, stable liquidity

Price is correcting faster than fundamentals

Liquidity is rotating, not leaving the ecosystem

This is preparation behavior, not exit behavior.

When volume returns, it will likely favor:

L2 scalability

DePIN

ZK infrastructure

Selective SocialFi winners

📊 Web3 February Focus

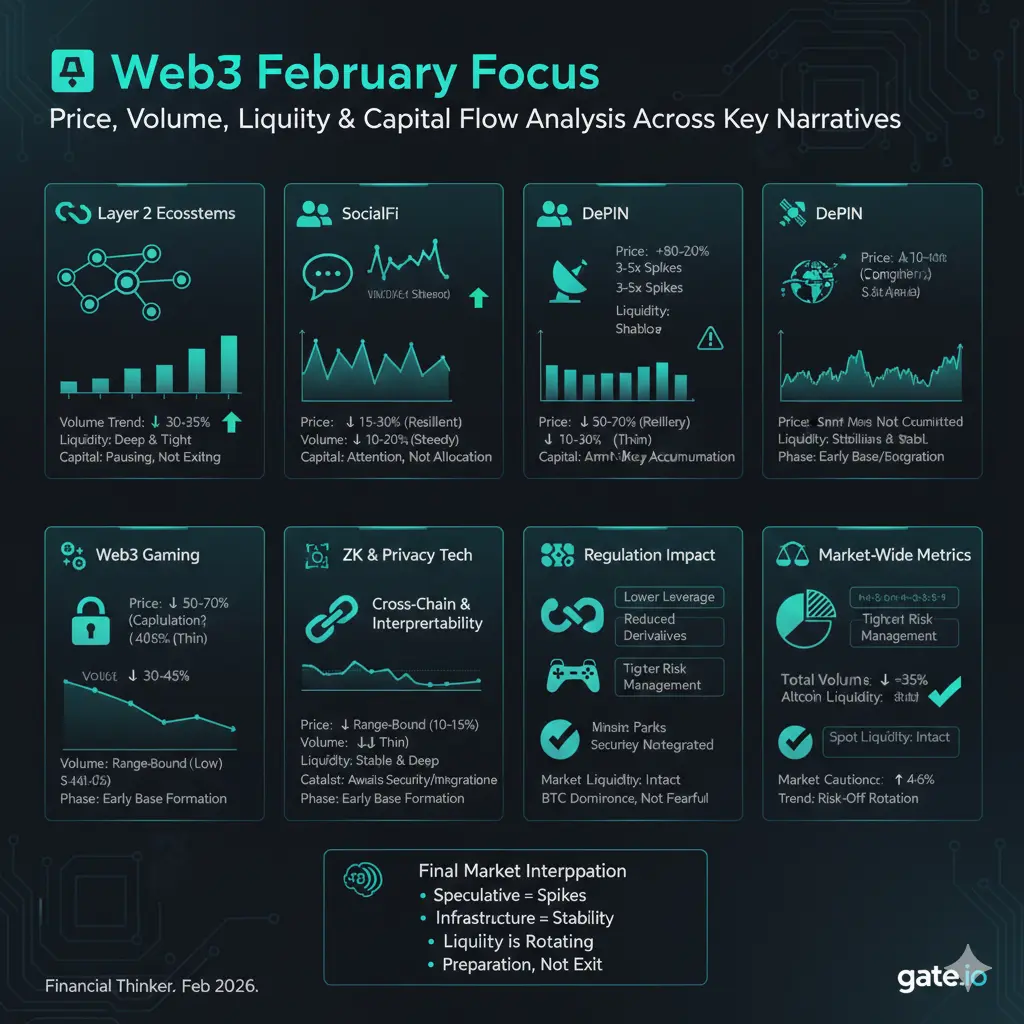

🔗 1. Layer 2 Ecosystems: Liquidity Concentration Over Expansion

From a market perspective, Layer 2 tokens are showing relative strength vs the broader altcoin market, even during periods of BTC weakness.

Price behavior:

Most major L2 tokens have corrected 25–40% from recent local highs, which is less severe than mid-cap altcoins that dropped 45–60%.

Volume trend:

Spot volume across L2 tokens is down roughly 30–35% month-over-month, signaling consolidation rather than distribution.

Liquidity profile:

Liquidity remains deep on major venues (Gate.io included), with tighter spreads compared to smaller narrative tokens — a sign that institutional and swing traders are still active.

Interpretation:

Capital is not exiting L2s — it is pausing, waiting for confirmation. This is typical behavior before trend continuation.

👥 2. SocialFi: High Volatility, High Speculation Volume

SocialFi tokens are experiencing sharp liquidity bursts followed by rapid cooldowns.

Price action:

Many SocialFi-related tokens have seen +80% to +200% short-term moves, followed by 30–50% retracements.

Volume spikes:

During peak hype days, volume expands 3–5x above average, then collapses quickly — a classic speculative cycle.

Liquidity risk:

Liquidity depth is shallow compared to infrastructure sectors, making price highly sensitive to sentiment shifts.

Market reality:

SocialFi is attracting attention capital, not long-term allocation capital — yet.

🛰️ 3. DePIN: Steady Volume, Sticky Liquidity

DePIN stands out as one of the most structurally healthy sectors in February.

Price structure:

DePIN tokens are generally down only 15–30% from highs, showing resilience.

Volume behavior:

Trading volume has declined just 10–20%, far less than the broader market.

Liquidity quality:

Liquidity is consistent, spreads are stable, and sell pressure is absorbed smoothly — indicating long-term holders and strategic buyers.

Capital signal:

Smart money prefers predictable, real-world-use narratives when volatility rises.

🎮 4. Web3 Gaming: Liquidity Drains, Selective Rebuild

GameFi remains in a reset phase.

Price performance:

Most gaming tokens are down 50–70% from cycle peaks.

Volume:

Spot volume has compressed 40–60%, confirming lack of speculative interest.

Liquidity:

Liquidity is thin, but stabilizing — suggesting capitulation may already be behind us.

Key insight:

Low volume + flat price = early base formation, not immediate upside.

🔐 5. ZK & Privacy Tech: Quiet Accumulation Phase

ZK-related tokens show low volatility and declining volume, which is often misunderstood.

Volume decline: ~25–30%

Price movement: Mostly range-bound within 10–15% bands

Liquidity: Stable and deep relative to market cap

What this means:

ZK tokens are in a technical accumulation zone, not a speculative phase.

🌉 6. Cross-Chain & Interoperability: Liquidity Without Momentum

Price: Down 30–45%

Volume: Down 35–50%

Liquidity: Present, but inactive

Capital is parked, not committed — waiting for a catalyst like security breakthroughs or major integrations.

⚖️ 7. Regulation Impact: Volume Compression, Not Panic

Regulatory uncertainty has caused:

Lower leverage usage

Reduced derivatives volume

Tighter risk management

However, spot liquidity remains intact, meaning capital is cautious, not fearful.

📊 8. Market-Wide Metrics Snapshot (February)

Total crypto market volume: ↓ ~35%

Altcoin liquidity: ↓ ~30–40%

BTC dominance: ↑ 4–6%

Infrastructure sector drawdown: Smaller than meme/speculative sectors by 15–25%

This confirms a risk-off rotation, not a market collapse.

🧠 Final Market Interpretation

February’s Web3 focus shows a clear pattern:

Speculative narratives = volume spikes, weak liquidity

Infrastructure narratives = lower volatility, stable liquidity

Price is correcting faster than fundamentals

Liquidity is rotating, not leaving the ecosystem

This is preparation behavior, not exit behavior.

When volume returns, it will likely favor:

L2 scalability

DePIN

ZK infrastructure

Selective SocialFi winners