#What’sNextforBitcoin?

Current Market Pulse

• Bitcoin recently surged past $69,000 following a softer US CPI print, as inflation dropped to multi-year lows — a development that generally supports risk assets.

• Despite the rebound, macro sentiment remains cautious with price near the $66K–$70K range, and traders watching support around $65K and resistance near $68–70K.

• On-chain and technical data show recent weakness and volatility, signaling short-term pressure and potential swings ahead.

➡ In short: BTC has strength in its range but is not yet consistently breaking higher, making the upcoming macro drivers crucial.

📈 Why Inflation & Fed Policy Matter

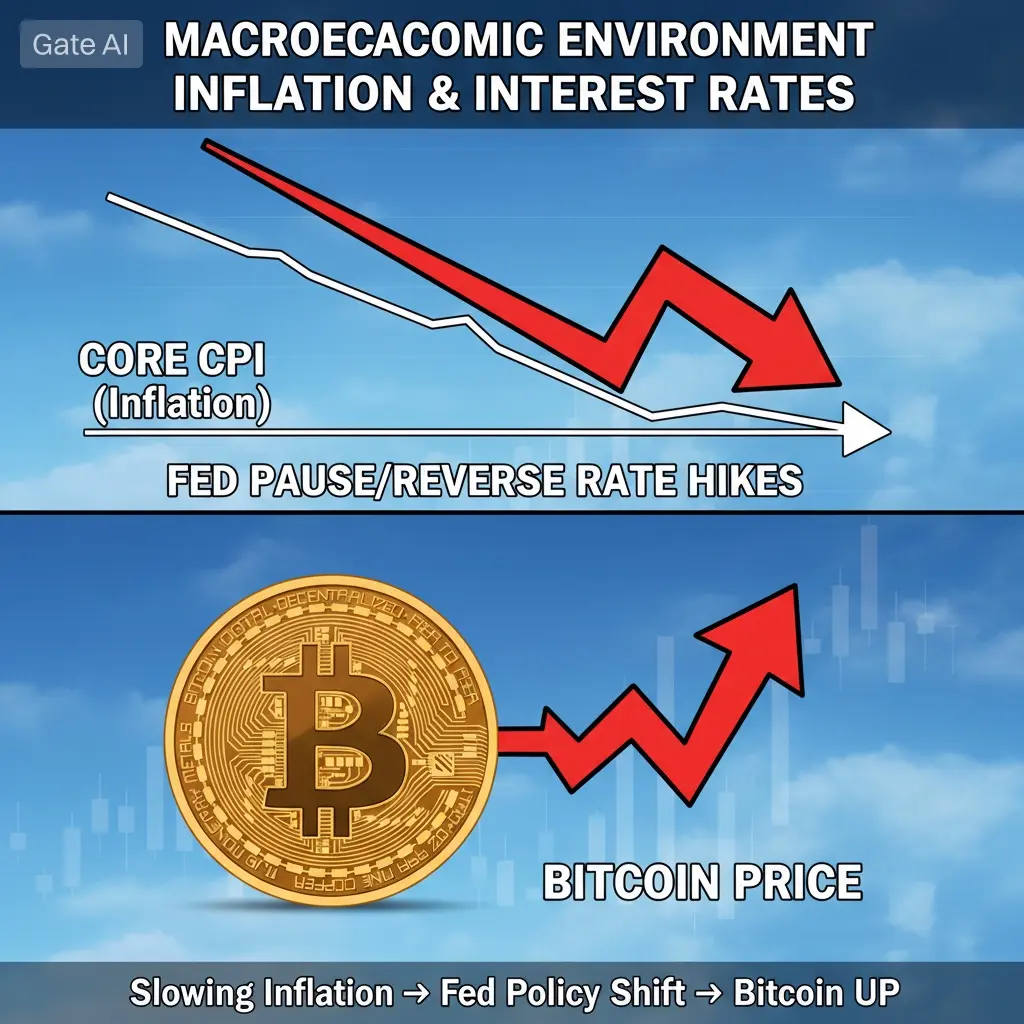

Bitcoin’s price action in 2026 is strongly tied to inflation trends and expectations around Federal Reserve policy:

• Slowing inflation data reduces market fear of aggressive rate hikes, which can improve liquidity and support Bitcoin.

• However, despite cooler CPI, Fed rate-cut odds remain muted — markets are cautious about early monetary easing.

🔎 What to watch:

Upcoming macro data, CPI prints, and Fed minutes — these can quickly influence BTC risk appetite and volatility.

📈Forecasts & Institutional Views (2026)

Analyst forecasts for Bitcoin in 2026 vary widely — reflecting both optimism and caution:

Bullish scenarios

• Several analysts see Bitcoin climbing into the mid-six figures — $120K to $225K — driven by institutional demand, ETF growth, and macro liquidity.

Neutral to cautious scenarios

• Other forecasts expect Bitcoin to trade in a wide volatility range (e.g., $75K-$150K) if adoption is slower or macro risks remain.

⚠️ Why such a range?

Analyst differences come from how much weight they place on institutional flows, regulatory clarity, dollar strength, and broader economic conditions.

🧠Bullish Drivers Supporting BTC

✔ Institutional adoption: ETF inflows and bigger financial players entering crypto add structural demand.

✔ Supply constraints: Post-halving reduced Bitcoin issuance, tightening new supply over time.

✔ Macro tailwinds: Lower inflation and eventual rate cuts could re-energize risk assets including Bitcoin.

If macro pressures ease and adoption accelerates, BTC could revisit higher targets later in the cycle.

⚠️ Bearish Risks to Watch

❌ Volatility & breakdown risk: Slippage below key support can trigger larger corrections, especially if market sentiment falters.

❌ Fed tightening risk: If inflation remains sticky or rate cuts delay, Bitcoin could struggle for momentum.

❌ Historical cycle uncertainty: Some analysts believe the classic “four-year cycle” pattern may be tested or weakening in 2026.

These factors could keep markets choppy and lead to deeper pullbacks before the next rally.

📍So, What’s Next for Bitcoin?

Short-term

✔ Watch how Bitcoin holds $65K support and reacts at $68-70K resistance.

✔ Inflation and Fed commentary will likely drive volatility.

Mid-term (H1-H2 2026)

✔ If macro eases and institutional demand remains strong, Bitcoin could trend higher toward six-figure territory.

✔ Bearish scenarios still possible if macro tightening returns or liquidity dries up.

Long-term (end of cycle)

✔ Continued adoption, ETF growth, and supply scarcity could support a sustained bullish trend through 2026 and beyond.

📌 Key Levels to Watch (for Traders)

🔹 Support: $60K–$65K

🔹 Resistance: $68K–$70K

🔹 Breakouts above: New bullish momentum

🔹 Breakdown below support: Larger correction risk

Current Market Pulse

• Bitcoin recently surged past $69,000 following a softer US CPI print, as inflation dropped to multi-year lows — a development that generally supports risk assets.

• Despite the rebound, macro sentiment remains cautious with price near the $66K–$70K range, and traders watching support around $65K and resistance near $68–70K.

• On-chain and technical data show recent weakness and volatility, signaling short-term pressure and potential swings ahead.

➡ In short: BTC has strength in its range but is not yet consistently breaking higher, making the upcoming macro drivers crucial.

📈 Why Inflation & Fed Policy Matter

Bitcoin’s price action in 2026 is strongly tied to inflation trends and expectations around Federal Reserve policy:

• Slowing inflation data reduces market fear of aggressive rate hikes, which can improve liquidity and support Bitcoin.

• However, despite cooler CPI, Fed rate-cut odds remain muted — markets are cautious about early monetary easing.

🔎 What to watch:

Upcoming macro data, CPI prints, and Fed minutes — these can quickly influence BTC risk appetite and volatility.

📈Forecasts & Institutional Views (2026)

Analyst forecasts for Bitcoin in 2026 vary widely — reflecting both optimism and caution:

Bullish scenarios

• Several analysts see Bitcoin climbing into the mid-six figures — $120K to $225K — driven by institutional demand, ETF growth, and macro liquidity.

Neutral to cautious scenarios

• Other forecasts expect Bitcoin to trade in a wide volatility range (e.g., $75K-$150K) if adoption is slower or macro risks remain.

⚠️ Why such a range?

Analyst differences come from how much weight they place on institutional flows, regulatory clarity, dollar strength, and broader economic conditions.

🧠Bullish Drivers Supporting BTC

✔ Institutional adoption: ETF inflows and bigger financial players entering crypto add structural demand.

✔ Supply constraints: Post-halving reduced Bitcoin issuance, tightening new supply over time.

✔ Macro tailwinds: Lower inflation and eventual rate cuts could re-energize risk assets including Bitcoin.

If macro pressures ease and adoption accelerates, BTC could revisit higher targets later in the cycle.

⚠️ Bearish Risks to Watch

❌ Volatility & breakdown risk: Slippage below key support can trigger larger corrections, especially if market sentiment falters.

❌ Fed tightening risk: If inflation remains sticky or rate cuts delay, Bitcoin could struggle for momentum.

❌ Historical cycle uncertainty: Some analysts believe the classic “four-year cycle” pattern may be tested or weakening in 2026.

These factors could keep markets choppy and lead to deeper pullbacks before the next rally.

📍So, What’s Next for Bitcoin?

Short-term

✔ Watch how Bitcoin holds $65K support and reacts at $68-70K resistance.

✔ Inflation and Fed commentary will likely drive volatility.

Mid-term (H1-H2 2026)

✔ If macro eases and institutional demand remains strong, Bitcoin could trend higher toward six-figure territory.

✔ Bearish scenarios still possible if macro tightening returns or liquidity dries up.

Long-term (end of cycle)

✔ Continued adoption, ETF growth, and supply scarcity could support a sustained bullish trend through 2026 and beyond.

📌 Key Levels to Watch (for Traders)

🔹 Support: $60K–$65K

🔹 Resistance: $68K–$70K

🔹 Breakouts above: New bullish momentum

🔹 Breakdown below support: Larger correction risk