# What’sNextforBitcoin?

27.63K

Asiftahsin

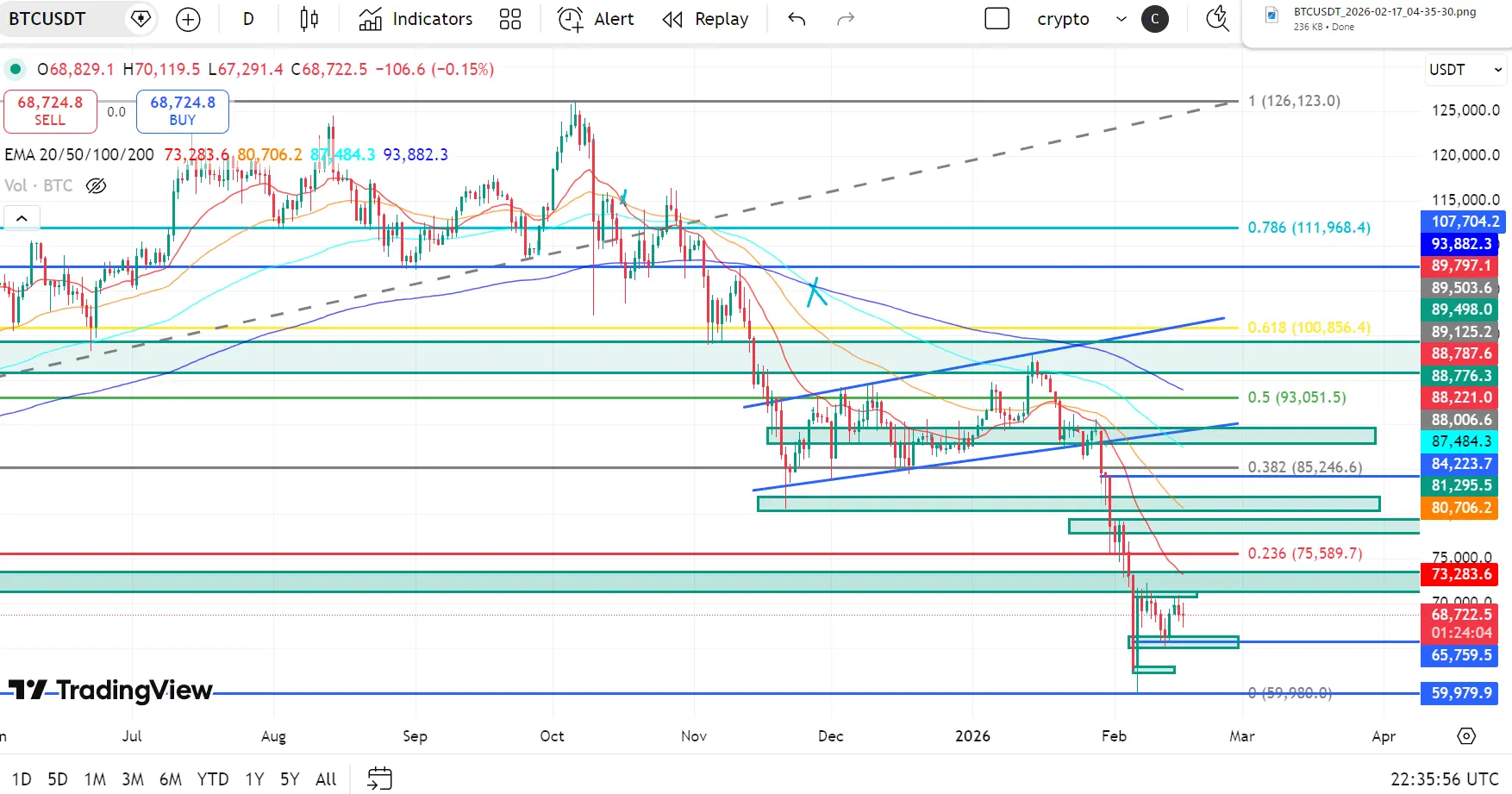

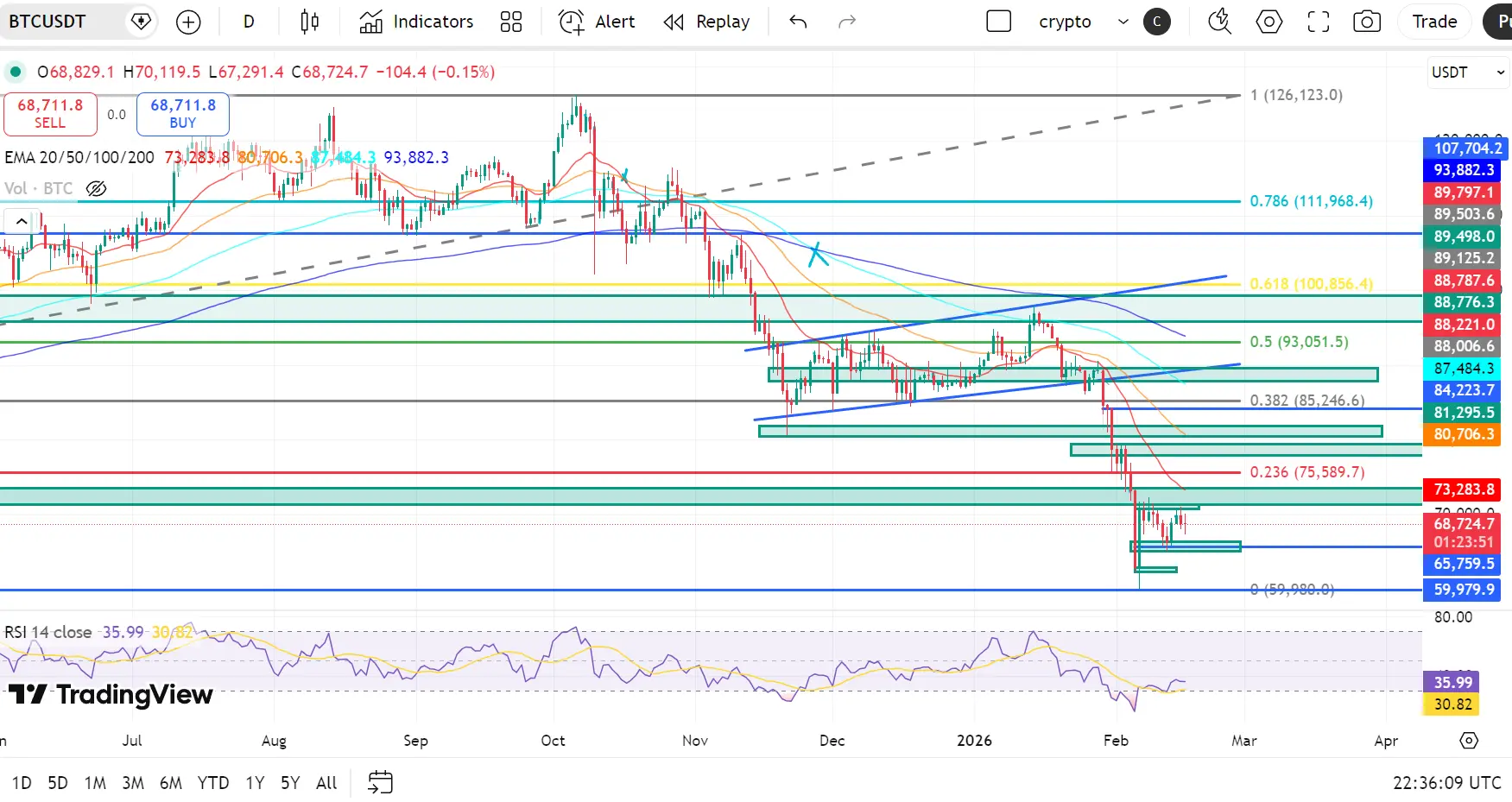

BTC Technical Outlook: Breakdown Below 0.236, Testing Macro Support

BTC has completed a clear distribution → breakdown → markdown phase after rejecting from the 0.786 supply region near 112K.

Price failed to sustain above 0.618 (100,856) and 0.5 (93,051), then decisively broke below 0.382 (85,246) and 0.236 (75,589) — confirming strong bearish continuation.

BTC is now consolidating near 68,000–70,000, just above macro support.

EMA Structure (Strong Bearish Alignment)

20 EMA: 73,283

50 EMA: 80,706

100 EMA: 87,484

200 EMA: 93,882

Price is trading below all major EMAs, confirming full bearish str

BTC has completed a clear distribution → breakdown → markdown phase after rejecting from the 0.786 supply region near 112K.

Price failed to sustain above 0.618 (100,856) and 0.5 (93,051), then decisively broke below 0.382 (85,246) and 0.236 (75,589) — confirming strong bearish continuation.

BTC is now consolidating near 68,000–70,000, just above macro support.

EMA Structure (Strong Bearish Alignment)

20 EMA: 73,283

50 EMA: 80,706

100 EMA: 87,484

200 EMA: 93,882

Price is trading below all major EMAs, confirming full bearish str

BTC-0,01%

- Reward

- 4

- 6

- Repost

- Share

GateUser-72918cdd :

:

Ape In 🚀View More

#What’sNextforBitcoin? ⚡ The Transition Phase

Bitcoin is entering a transition phase not just another cycle, not just another rally, but a structural shift in how the world perceives value, money, and digital ownership. The conversation around Bitcoin is no longer limited to crypto communities. It now echoes in boardrooms, central banks, hedge funds, and government policy discussions.

The market is evolving and so is Bitcoin’s identity.

📉 Volatility Meets Maturity

For years, Bitcoin was synonymous with extreme volatility. Massive rallies followed by brutal corrections became the norm. But tod

Bitcoin is entering a transition phase not just another cycle, not just another rally, but a structural shift in how the world perceives value, money, and digital ownership. The conversation around Bitcoin is no longer limited to crypto communities. It now echoes in boardrooms, central banks, hedge funds, and government policy discussions.

The market is evolving and so is Bitcoin’s identity.

📉 Volatility Meets Maturity

For years, Bitcoin was synonymous with extreme volatility. Massive rallies followed by brutal corrections became the norm. But tod

BTC-0,01%

- Reward

- 5

- 9

- Repost

- Share

CryptoEye :

:

2026 GOGOGO 👊View More

BREAKING: Harvard just moved from Bitcoin to Ethereum

They sold about 21% of their Bitcoin ETF and used some of that cash to buy $87M in an Ethereum ETF.

Simple version: they didn’t leave crypto — they just swich some money from Bitcoin → Ethereum.

#GateSquare$50KRedPacketGiveaway #USCoreCPIHitsFour-YearLow #What’sNextforBitcoin? #GateSpringFestivalHorseRacingEvent #AIAgentProjectsI’mWatching

They sold about 21% of their Bitcoin ETF and used some of that cash to buy $87M in an Ethereum ETF.

Simple version: they didn’t leave crypto — they just swich some money from Bitcoin → Ethereum.

#GateSquare$50KRedPacketGiveaway #USCoreCPIHitsFour-YearLow #What’sNextforBitcoin? #GateSpringFestivalHorseRacingEvent #AIAgentProjectsI’mWatching

- Reward

- like

- Comment

- Repost

- Share

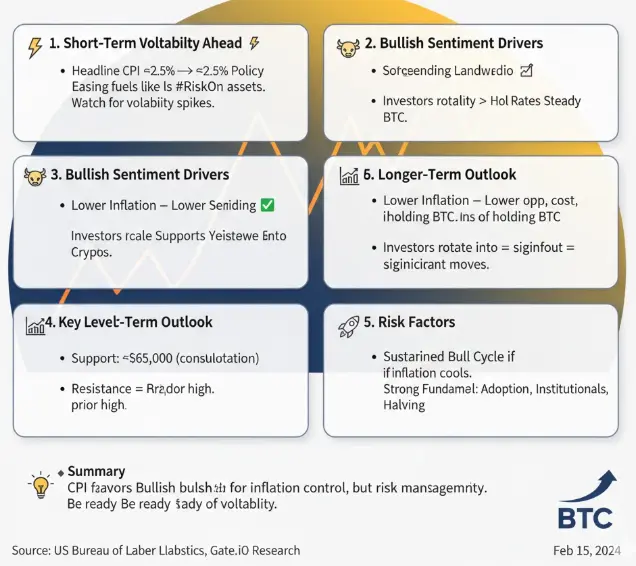

#What’sNextforBitcoin?

CPI Market Outlook

With the U.S. Core CPI hitting a four-year low, markets are adjusting their expectations for interest rates and economic growth. Here’s what it could mean for Bitcoin:

1️⃣ Short-Term Volatility Ahead

Disinflation signals potential easing of monetary policy, which often fuels risk-on assets like BTC.

Expect heightened volatility as traders react to CPI, jobs data, and Fed statements.

2️⃣ Bullish Sentiment Drivers

Lower inflation reduces pressure on rates → lower opportunity cost of holding BTC.

Investors may rotate from cash and bonds into crypto for y

CPI Market Outlook

With the U.S. Core CPI hitting a four-year low, markets are adjusting their expectations for interest rates and economic growth. Here’s what it could mean for Bitcoin:

1️⃣ Short-Term Volatility Ahead

Disinflation signals potential easing of monetary policy, which often fuels risk-on assets like BTC.

Expect heightened volatility as traders react to CPI, jobs data, and Fed statements.

2️⃣ Bullish Sentiment Drivers

Lower inflation reduces pressure on rates → lower opportunity cost of holding BTC.

Investors may rotate from cash and bonds into crypto for y

BTC-0,01%

- Reward

- 4

- 5

- Repost

- Share

ybaser :

:

LFG 🔥View More

Bitcoin Weekly Analysis

On the weekly chart, the 20W MA has dropped below the 50W MA. This same crossover occurred in 2022, right before Bitcoin entered a deeper correction phase.

After that signal in the last cycle, BTC printed 9 straight red weekly candles.

In this cycle so far, Bitcoin has never printed more than 4 in a row, making this moment critical.

If this week also closes red, it would confirm continued structural weakness. Price has already lost the $75K weekly support, opening the door to the $60K zone near long-term support.

From here the structure remains clear:

• Reclaim $75K me

On the weekly chart, the 20W MA has dropped below the 50W MA. This same crossover occurred in 2022, right before Bitcoin entered a deeper correction phase.

After that signal in the last cycle, BTC printed 9 straight red weekly candles.

In this cycle so far, Bitcoin has never printed more than 4 in a row, making this moment critical.

If this week also closes red, it would confirm continued structural weakness. Price has already lost the $75K weekly support, opening the door to the $60K zone near long-term support.

From here the structure remains clear:

• Reclaim $75K me

BTC-0,01%

- Reward

- 4

- 2

- Repost

- Share

HighAmbition :

:

thnxx for the update information about cryptoView More

#What’sNextforBitcoin?

Based on the latest analysis from major financial institutions and market data as of mid-February 2026, the outlook for Bitcoin is a tale of two narratives. While the short-term price action remains under pressure, the long-term forecasts from major banks and asset managers remain remarkably bullish, clustering firmly in the six-figure range.

To understand where Bitcoin is going, it's helpful to look at where it stands today. After a disappointing 2025 and a volatile start to 2026, the market is showing signs of significant structural change rather than a simple downtur

Based on the latest analysis from major financial institutions and market data as of mid-February 2026, the outlook for Bitcoin is a tale of two narratives. While the short-term price action remains under pressure, the long-term forecasts from major banks and asset managers remain remarkably bullish, clustering firmly in the six-figure range.

To understand where Bitcoin is going, it's helpful to look at where it stands today. After a disappointing 2025 and a volatile start to 2026, the market is showing signs of significant structural change rather than a simple downtur

BTC-0,01%

- Reward

- 4

- 5

- Repost

- Share

GateUser-6857559e :

:

thanks for the useful information 😊View More

#What’sNextforBitcoin? As of today, Bitcoin (BTC) is trading around $69,400, positioned in a critical zone where short-term volatility meets strong medium-term structural support. The $65,000–$70,000 range has become a key decision area for the market, where traders are evaluating whether BTC is preparing for its next bullish expansion or facing a deeper corrective phase.

Macro and Institutional Landscape

Bitcoin continues to react strongly to macroeconomic signals and institutional capital flows. Recent inflation data showing moderation in core CPI has eased pressure on central banks to tight

Macro and Institutional Landscape

Bitcoin continues to react strongly to macroeconomic signals and institutional capital flows. Recent inflation data showing moderation in core CPI has eased pressure on central banks to tight

BTC-0,01%

- Reward

- 3

- 4

- Repost

- Share

Lock_433 :

:

Ape In 🚀View More

#What’sNextforBitcoin?

February 16, 2026 ,The question dominating the market right now is simple: #What’sNextforBitcoin? After recent volatility, strong rebounds, and macro-driven sentiment shifts, investors are trying to determine whether the next move is continuation… or correction.

Let’s break this down step by step.

First, we assess the current structure.

Bitcoin has recently shown resilience during macro uncertainty. Each dip has attracted buyers, suggesting strong underlying demand. That’s typically a bullish characteristic in mid-to-late cycle environments.

However, price action alone

February 16, 2026 ,The question dominating the market right now is simple: #What’sNextforBitcoin? After recent volatility, strong rebounds, and macro-driven sentiment shifts, investors are trying to determine whether the next move is continuation… or correction.

Let’s break this down step by step.

First, we assess the current structure.

Bitcoin has recently shown resilience during macro uncertainty. Each dip has attracted buyers, suggesting strong underlying demand. That’s typically a bullish characteristic in mid-to-late cycle environments.

However, price action alone

BTC-0,01%

- Reward

- 7

- 8

- Repost

- Share

Lock_433 :

:

2026 GOGOGO 👊View More

#What’sNextforBitcoin?

Bitcoin continues to stand at a critical crossroads as global markets balance optimism with caution. After periods of strong momentum and sharp corrections, the market is now entering a phase where structure, liquidity, and institutional interest will play a bigger role than short-term hype. Investors are closely watching how price consolidates around key support zones, as this phase often sets the foundation for the next major move. Whether the market leans bullish or defensive will depend on how macroeconomic signals, regulatory clarity, and broader risk sentiment evol

Bitcoin continues to stand at a critical crossroads as global markets balance optimism with caution. After periods of strong momentum and sharp corrections, the market is now entering a phase where structure, liquidity, and institutional interest will play a bigger role than short-term hype. Investors are closely watching how price consolidates around key support zones, as this phase often sets the foundation for the next major move. Whether the market leans bullish or defensive will depend on how macroeconomic signals, regulatory clarity, and broader risk sentiment evol

BTC-0,01%

- Reward

- 6

- 12

- Repost

- Share

CryptoChampion :

:

DYOR 🤓View More

🚀 Massive momentum on $LABUBU/USDT!

Price: $0.0020586

Gain: +233.11% 🔥

This kind of explosive move shows strong buying pressure and growing market interest. If volume continues to support, we could see further upside and potential continuation after consolidation.

📊 Trade Setup:

• Entry: On pullback to support zone

• Targets: 20–40% short-term

• Stop-loss: Below recent breakout level

Always manage risk and avoid FOMO. Are you already in $LABUBU or waiting for the dip? 👇

$LABUBU $CWS $RFC #GateSquare$50KRedPacketGiveaway #CelebratingNewYearOnGateSquare #GateSpringFestivalHorseRacingEv

Price: $0.0020586

Gain: +233.11% 🔥

This kind of explosive move shows strong buying pressure and growing market interest. If volume continues to support, we could see further upside and potential continuation after consolidation.

📊 Trade Setup:

• Entry: On pullback to support zone

• Targets: 20–40% short-term

• Stop-loss: Below recent breakout level

Always manage risk and avoid FOMO. Are you already in $LABUBU or waiting for the dip? 👇

$LABUBU $CWS $RFC #GateSquare$50KRedPacketGiveaway #CelebratingNewYearOnGateSquare #GateSpringFestivalHorseRacingEv

[The user has shared his/her trading data. Go to the App to view more.]

MC:$2.48KHolders:1

0.00%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

159.23K Popularity

30.78K Popularity

27.63K Popularity

72.96K Popularity

13.7K Popularity

277.87K Popularity

359.51K Popularity

25.62K Popularity

15.07K Popularity

13.65K Popularity

13.73K Popularity

12.91K Popularity

12.63K Popularity

40.41K Popularity

News

View MoreWintermute launches institutional-grade tokenized gold trading, with an expected market size of $15 billion by 2026

13 m

The Crypto Fear and Greed Index drops to its lowest point in history, and market sentiment remains bearish.

14 m

ETH Breaks Through 2000 USDT

1 h

Data: In the past 24 hours, the entire network has liquidated $222 million, with long positions liquidated at $143 million and short positions at $78.9452 million.

3 h

Data: If BTC breaks through $71,463, the total liquidation strength of mainstream CEX short positions will reach $1.205 billion.

5 h

Pin