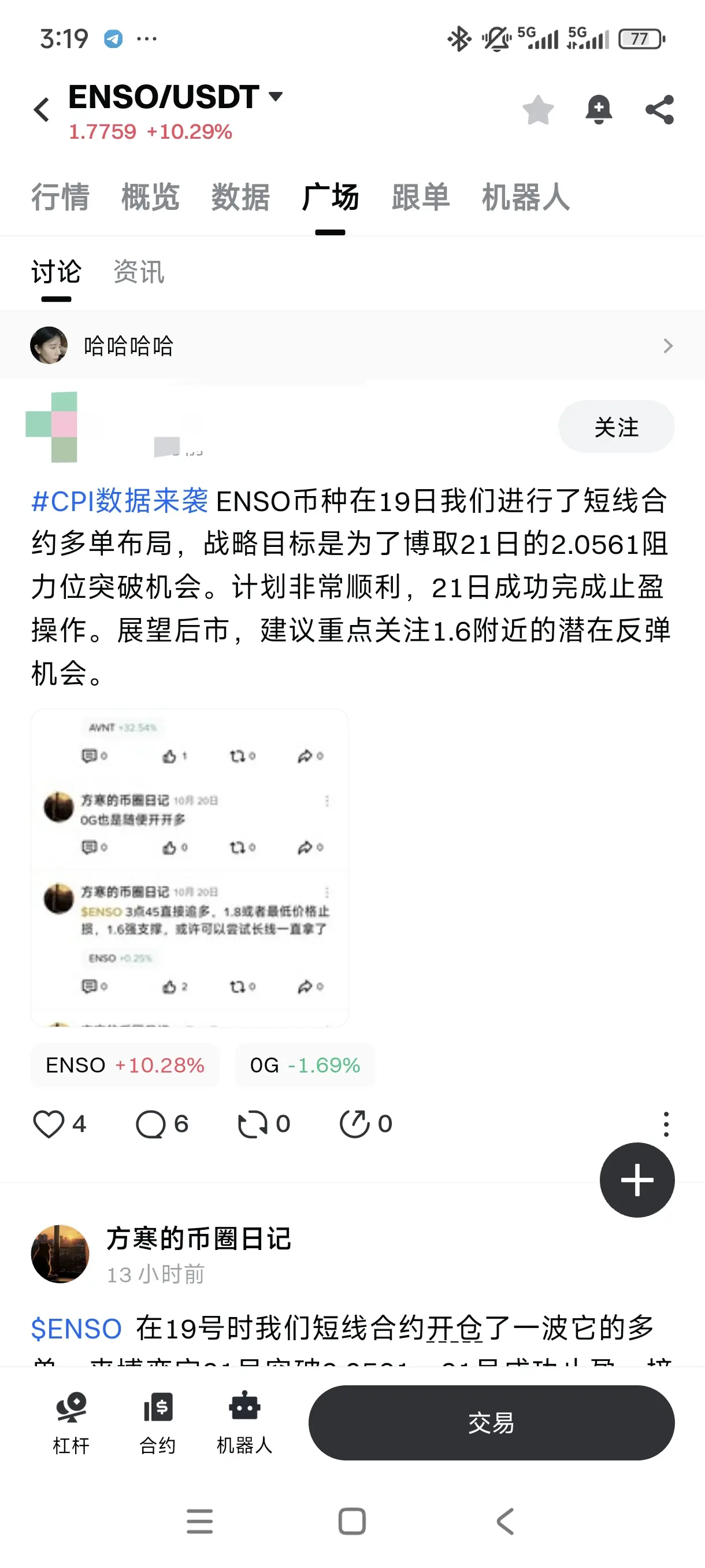

#BTC According to what I mentioned earlier, after the 20th is a good rebound point. Currently, $BTC 's trend is worth following, and you can refer to the selling price in my chart, around 1140055.36. As long as it breaks through, there is basically no need to panic.

Currently, the market's interest rate cuts are said to have been almost completely digested, due to the surge of various coins after the entry of a significant percentage of whales. But I want to tell you, that is not the case. We need to consider that the second major positive factor, which is also the biggest positive factor, is Powell's announcement of the end of QT (which is likely to be announced not long after the interest rate cut information). It can be understood as:

QE (Quantitative Easing) = Printing money + Spraying water

The central bank is turning on the printing press to inject money into the market, aiming to stimulate the economy and make money more abundant and cheaper.

QT (Quantitative Tightening) = Collecting Money + Draining

The central bank is taking back and "destroying" the money previously injected into the market, with the aim of cooling down the economy, suppressing inflation, and making money scarcer and more expensive.

Stopping QT combined with interest rate cuts can be understood as a super bullish signal, which is one of the reasons for the stock surge. In the past few decades, there have been many bull market triggers due to this.

How to understand it?

Stopping QT can be understood as a water tank that is too full (excess market funds leading to inflation) and is continuously scooping water out of the tank (QT siphoning). Now, the scooping action has stopped. However, while the scooping action has ceased, it only means that the water level will not decrease; no new water is being added. This signifies that the liquidity of the financial system has reached its bottom line, and the most tense moments have passed. The market regains confidence! A signal of policy shift.

Interest rate cuts can be understood as a form of monetary easing. After stopping the flow of water, it assesses that the water level in the tank is insufficient (there is a risk of economic recession), so it opens the faucet and begins to inject cheaper and more abundant new water into the tank. In other words, lowering interest rates directly reduces borrowing costs (making corporate loans, personal mortgages, and auto loans cheaper), while the returns on the money held by banks decrease. This strongly stimulates companies and individuals to invest and consume. Funds will flow out of conservative bonds and deposits, desperately searching for places that can provide higher returns. With an overflow of funds, the cryptocurrency market, as a high-risk, high-return, and highly volatile "risk asset"...

Especially mainstream cryptocurrencies like Bitcoin are seen as "digital gold" and a hedge against inflation, attracting a large influx of funds. (Directly beneficial)

Friendly reminder, the real estate sector will also be stimulated. Increase activity.

The market has completely shifted from the fear of "funds continuously tightening" to the frenzy of "funds are about to become abundant". (This is why we can see various virtual currencies soaring one after another.)

The cost of funds has significantly decreased in a short period: interest rate cuts have made the "price" of global funds cheaper. For example, buying U.

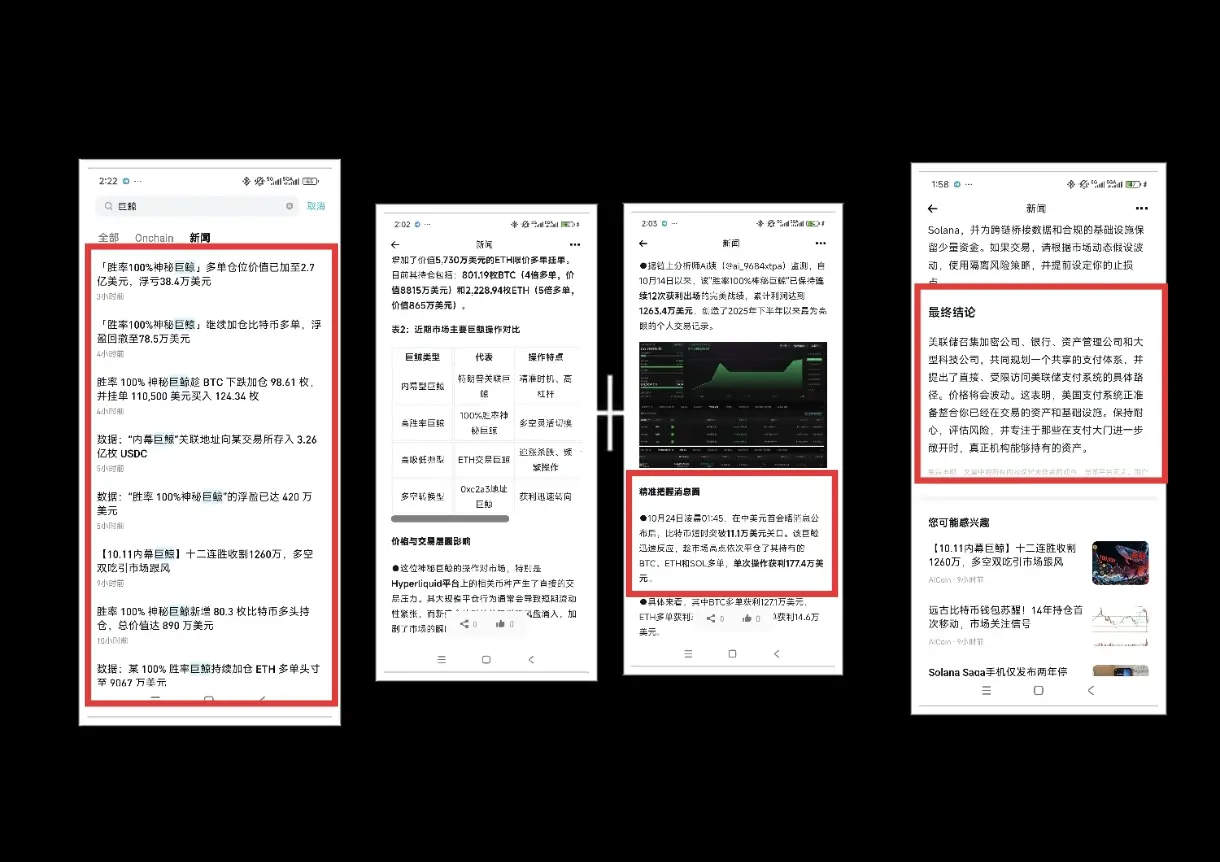

So the 100% win rate giant whale No. 26 added more than 100 BTC long positions in the morning, perhaps because of this.

Overall, the focus is on the resistance level of BTC 114,000 to 115,000, with a significant breakthrough concept.

Alright, that's all for now, follow me, a detail-rich blogger #CPI数据来袭

Currently, the market's interest rate cuts are said to have been almost completely digested, due to the surge of various coins after the entry of a significant percentage of whales. But I want to tell you, that is not the case. We need to consider that the second major positive factor, which is also the biggest positive factor, is Powell's announcement of the end of QT (which is likely to be announced not long after the interest rate cut information). It can be understood as:

QE (Quantitative Easing) = Printing money + Spraying water

The central bank is turning on the printing press to inject money into the market, aiming to stimulate the economy and make money more abundant and cheaper.

QT (Quantitative Tightening) = Collecting Money + Draining

The central bank is taking back and "destroying" the money previously injected into the market, with the aim of cooling down the economy, suppressing inflation, and making money scarcer and more expensive.

Stopping QT combined with interest rate cuts can be understood as a super bullish signal, which is one of the reasons for the stock surge. In the past few decades, there have been many bull market triggers due to this.

How to understand it?

Stopping QT can be understood as a water tank that is too full (excess market funds leading to inflation) and is continuously scooping water out of the tank (QT siphoning). Now, the scooping action has stopped. However, while the scooping action has ceased, it only means that the water level will not decrease; no new water is being added. This signifies that the liquidity of the financial system has reached its bottom line, and the most tense moments have passed. The market regains confidence! A signal of policy shift.

Interest rate cuts can be understood as a form of monetary easing. After stopping the flow of water, it assesses that the water level in the tank is insufficient (there is a risk of economic recession), so it opens the faucet and begins to inject cheaper and more abundant new water into the tank. In other words, lowering interest rates directly reduces borrowing costs (making corporate loans, personal mortgages, and auto loans cheaper), while the returns on the money held by banks decrease. This strongly stimulates companies and individuals to invest and consume. Funds will flow out of conservative bonds and deposits, desperately searching for places that can provide higher returns. With an overflow of funds, the cryptocurrency market, as a high-risk, high-return, and highly volatile "risk asset"...

Especially mainstream cryptocurrencies like Bitcoin are seen as "digital gold" and a hedge against inflation, attracting a large influx of funds. (Directly beneficial)

Friendly reminder, the real estate sector will also be stimulated. Increase activity.

The market has completely shifted from the fear of "funds continuously tightening" to the frenzy of "funds are about to become abundant". (This is why we can see various virtual currencies soaring one after another.)

The cost of funds has significantly decreased in a short period: interest rate cuts have made the "price" of global funds cheaper. For example, buying U.

So the 100% win rate giant whale No. 26 added more than 100 BTC long positions in the morning, perhaps because of this.

Overall, the focus is on the resistance level of BTC 114,000 to 115,000, with a significant breakthrough concept.

Alright, that's all for now, follow me, a detail-rich blogger #CPI数据来袭