MemeCoinPlayer

#美联储联邦公开市场委员会决议 $1000LUNC

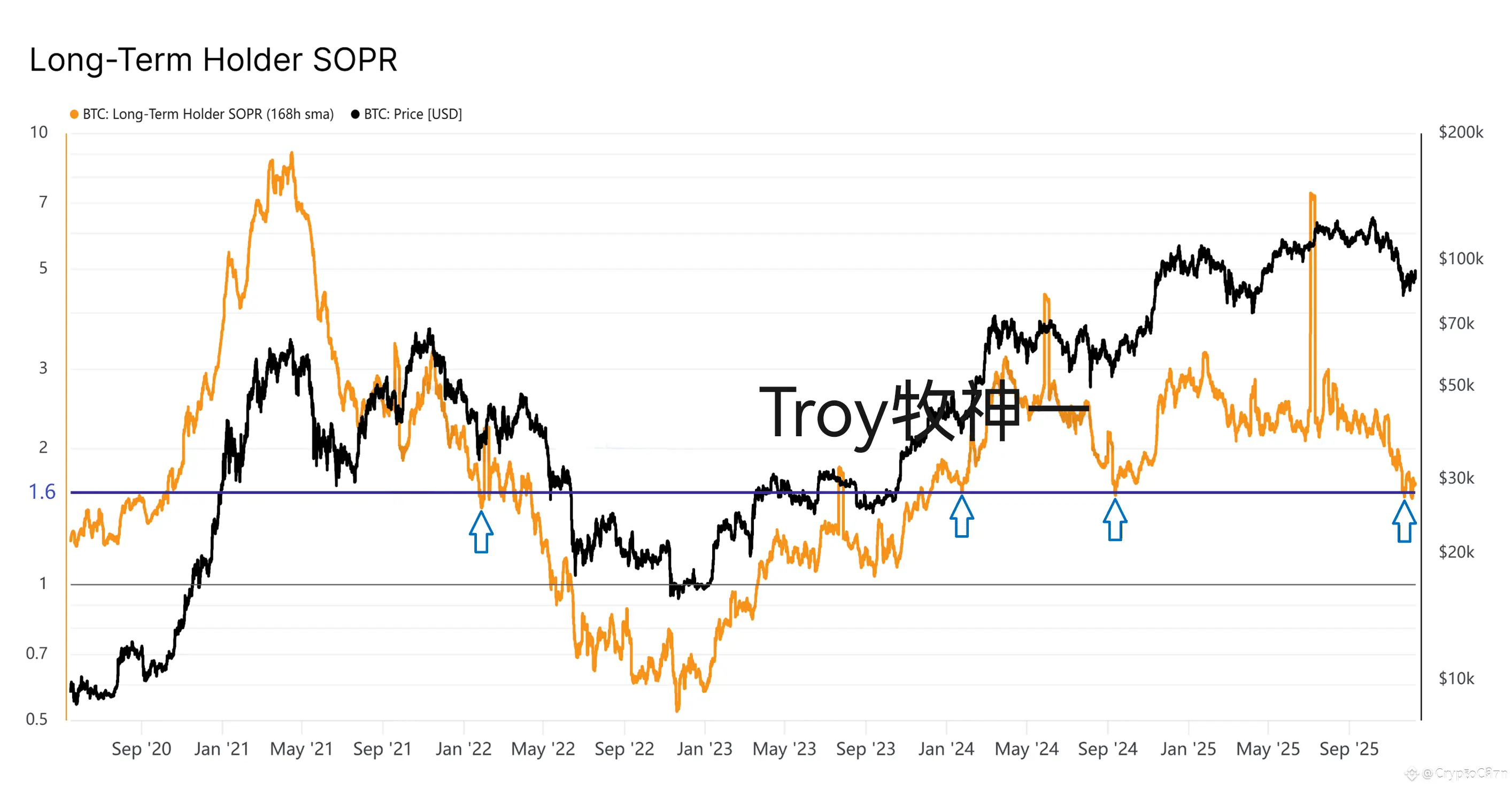

The Federal Reserve's final "big test" lands at 3 a.m., with an 89% bet on a 25 basis point rate cut—this meeting directly impacts BTC's trajectory, the rhythm of the US stock market, and the tightening or loosening of global liquidity.

CME Fed Funds Futures data shows: an 89.4% probability of a 25 basis point cut. Once implemented, this will be the third consecutive rate cut this year, pushing the federal funds rate range to 3.5%-3.75%. But honestly, whether they cut or not is no longer the main issue—the key is the "hawkish rate cut" sword hanging over us. The Fed j

The Federal Reserve's final "big test" lands at 3 a.m., with an 89% bet on a 25 basis point rate cut—this meeting directly impacts BTC's trajectory, the rhythm of the US stock market, and the tightening or loosening of global liquidity.

CME Fed Funds Futures data shows: an 89.4% probability of a 25 basis point cut. Once implemented, this will be the third consecutive rate cut this year, pushing the federal funds rate range to 3.5%-3.75%. But honestly, whether they cut or not is no longer the main issue—the key is the "hawkish rate cut" sword hanging over us. The Fed j

BTC-1.1%