In a few hours, the FOMC results will be announced. The market currently largely considers a 25bp rate cut as a given, and in fact, this expectation has already been priced in. The real uncertainties remaining are actually twofold— the stance of the dot plot and Powell’s statements. At this stage, making a directional move is similar to gambling on size; if you get the direction right, it's satisfying, but if wrong, you get swept away. The initiative is actually in your own hands—you can either stay completely flat and wait for things to settle, or preemptively close positions to capitalize on

View OriginalCryptoPhineas

No content yet

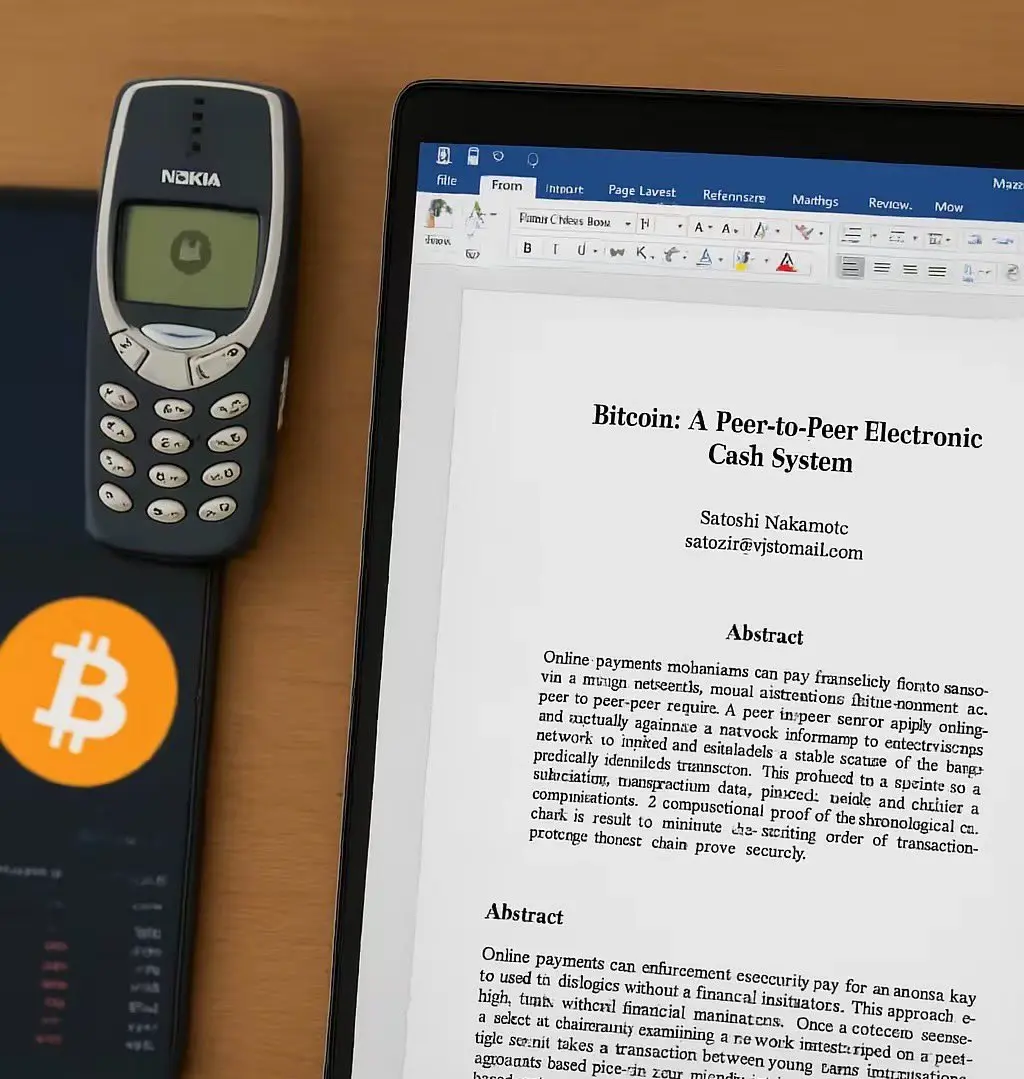

Revisiting the Bitcoin White Paper

In recent days, I rediscovered a familiar PDF file: the Bitcoin White Paper. Not to speculate on coins, nor to review the market trends, but to once again experience the design journey of this system.

"That author from 16 years ago had a thinking logic far deeper than ours in the 2020s."

As early as 2008, when feature phones still dominated the mobile market and payments relied on U-shields and verification codes, Satoshi Nakamoto wrote a document outlining:

1️⃣ A global payment settlement system that doesn't rely on any central authority;

2️⃣ A trust mechani

In recent days, I rediscovered a familiar PDF file: the Bitcoin White Paper. Not to speculate on coins, nor to review the market trends, but to once again experience the design journey of this system.

"That author from 16 years ago had a thinking logic far deeper than ours in the 2020s."

As early as 2008, when feature phones still dominated the mobile market and payments relied on U-shields and verification codes, Satoshi Nakamoto wrote a document outlining:

1️⃣ A global payment settlement system that doesn't rely on any central authority;

2️⃣ A trust mechani

BTC-1.55%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- 1

- Repost

- Share

BraveTheWindAndWaves :

:

Volatility is an opportunity 📊When will China’s next upward cycle of national fortune begin? And how long will it last?

This is not fortune-telling, but rather an attempt to find the “potentially historically chosen window” by analyzing historical patterns, structural conditions, and current realities.

My prediction (combining current realities and structural variables) is:

The next upward cycle of China’s national fortune could start as early as 2026-2027,

with the real takeoff occurring between 2028-2030,

and, if all goes well, it could last until around 2040.

Why this prediction? (Core variable analysis)

1. The shift fr

View OriginalThis is not fortune-telling, but rather an attempt to find the “potentially historically chosen window” by analyzing historical patterns, structural conditions, and current realities.

My prediction (combining current realities and structural variables) is:

The next upward cycle of China’s national fortune could start as early as 2026-2027,

with the real takeoff occurring between 2028-2030,

and, if all goes well, it could last until around 2040.

Why this prediction? (Core variable analysis)

1. The shift fr

- Reward

- 1

- 1

- Repost

- Share

AllInstantNoodles :

:

Brother Jiu, is Polkadot still saved?- Reward

- 1

- Comment

- Repost

- Share

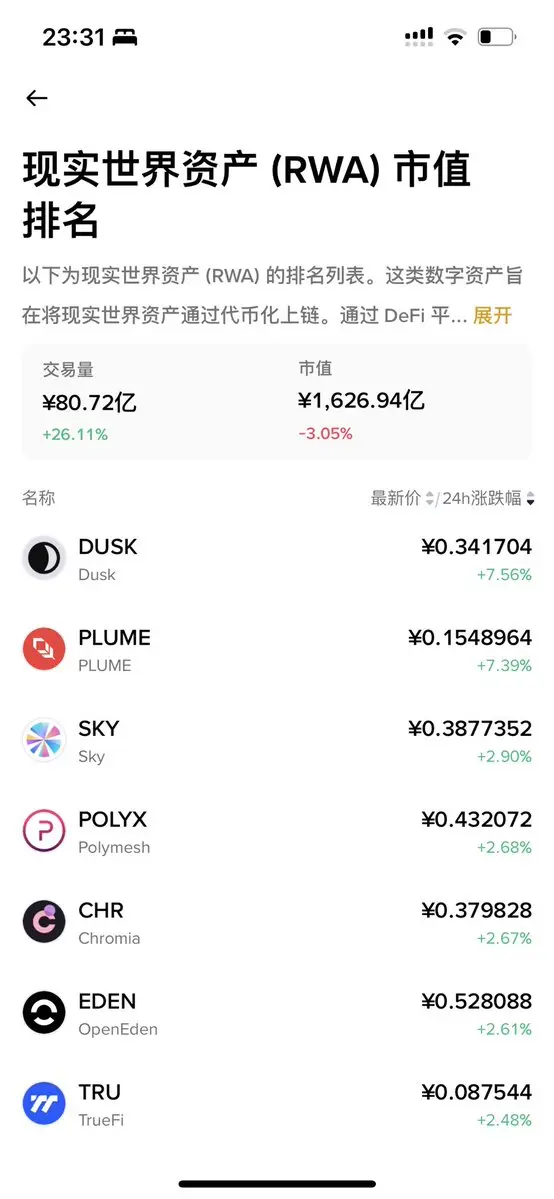

The next innovation boom in the cryptocurrency industry will definitely be in RWA.

The DeFi track in the crypto space has basically reached its peak, having produced phenomenal products like $AAVE , which, as the largest blockchain bank, is now mature.

People have played around in the MEME track only to find that most are scams—when the hype fades, there's nothing left, and only a very few MEME coins manage to survive.

The L2 narrative has been disproved; after Ethereum’s upgrade, there’s really no need for so many L2s. In fact, L2s are just leeching off Ethereum and dragging down $ETH ’s deve

View OriginalThe DeFi track in the crypto space has basically reached its peak, having produced phenomenal products like $AAVE , which, as the largest blockchain bank, is now mature.

People have played around in the MEME track only to find that most are scams—when the hype fades, there's nothing left, and only a very few MEME coins manage to survive.

The L2 narrative has been disproved; after Ethereum’s upgrade, there’s really no need for so many L2s. In fact, L2s are just leeching off Ethereum and dragging down $ETH ’s deve

- Reward

- like

- Comment

- Repost

- Share

Value investing, value reversion, and trend following

Trend following generally refers to technical trend following. I’m not a big fan of this trading method, and in most cases, it’s unlikely to be profitable because it’s easy to falsify. For example, if you use the simplest dual moving average crossover for backtesting, it’s basically dominated by losses.

Moreover, I believe that trend following based on tracking candlestick charts lacks investment logic, because you’re not buying the candlesticks themselves, but rather the assets represented by the candlesticks. In this regard, I’m more in f

View OriginalTrend following generally refers to technical trend following. I’m not a big fan of this trading method, and in most cases, it’s unlikely to be profitable because it’s easy to falsify. For example, if you use the simplest dual moving average crossover for backtesting, it’s basically dominated by losses.

Moreover, I believe that trend following based on tracking candlestick charts lacks investment logic, because you’re not buying the candlesticks themselves, but rather the assets represented by the candlesticks. In this regard, I’m more in f

- Reward

- like

- Comment

- Repost

- Share

These two doomed projects, $ARB and $OP , probably trapped quite a few people. Looking at the monthly chart, the trend is still downward. From a technical development perspective, isn't L2 just a pseudo-demand? After Ethereum's technical upgrade, there really won't be a need for so many L2s. Friends who are stuck holding these two coins, it's time to wake up and stop fantasizing. However, after a significant drop, there will always be some rebound. If ARB rebounds to around 0.5 and OP rebounds to around 0.7, those are good opportunities to exit—don't get trapped even deeper, or it will be pai

View Original

- Reward

- 3

- 1

- Repost

- Share

BraveTheWindAndWaves :

:

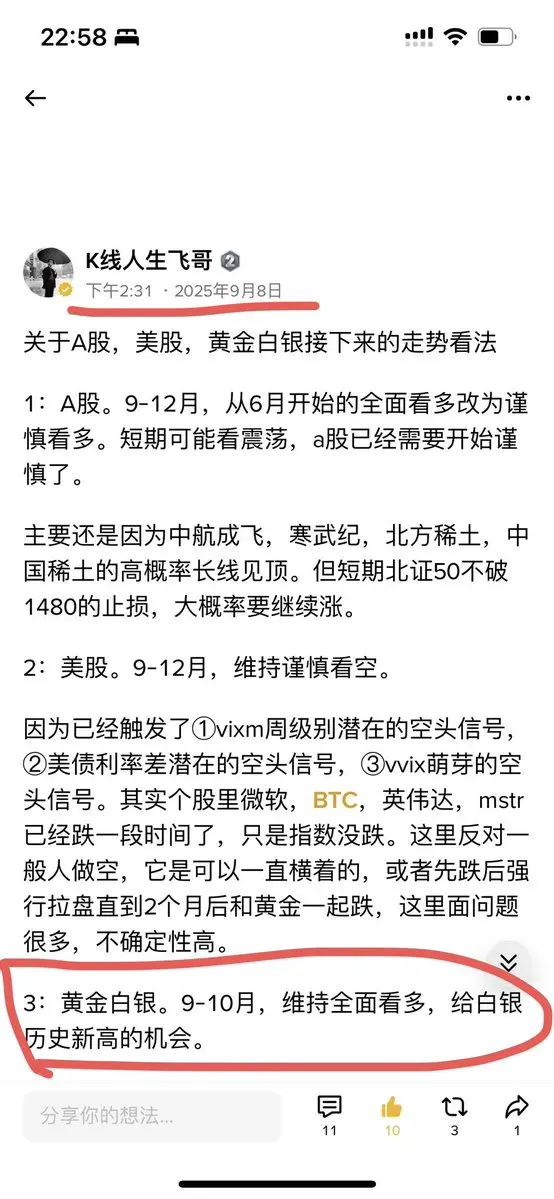

Getting lower and lowerAlthough silver's all-time high came two months later, the direction was still correct. I only bought a small position in silver for fun, unlike gold where I invested several hundred in funds.

After gold hit a new high, silver once again reached a historic high. After years of stagnation, silver has entered a bull market cycle.

Just as I anticipated and mentioned to everyone in the plaza before, I remain fully bullish on both gold and silver, giving silver the opportunity to reach a new all-time high. Silver has become the most outstanding major asset this year.

Don’t limit your investment vis

View OriginalAfter gold hit a new high, silver once again reached a historic high. After years of stagnation, silver has entered a bull market cycle.

Just as I anticipated and mentioned to everyone in the plaza before, I remain fully bullish on both gold and silver, giving silver the opportunity to reach a new all-time high. Silver has become the most outstanding major asset this year.

Don’t limit your investment vis

- Reward

- like

- 1

- Repost

- Share

GoodLuckAndEverything :

:

Hop on board!🚗Lan Zhanfei was kidnapped in South Africa. The kidnappers bribed airport and hotel staff six months in advance and monitored his itinerary. After a fake fan invitation was refused, they held him at knifepoint in his hotel for 4-5 hours, extorted money via transfer, and collected his biometric information (hair, semen) to threaten to fabricate a "rape case." Even after escaping a taxi trap, Lan Zhanfei was still followed and eventually reported to the police back in China.

What's curious is, how did they collect the semen? Did they masturbate him? Is it even possible to get hard in that situati

View OriginalWhat's curious is, how did they collect the semen? Did they masturbate him? Is it even possible to get hard in that situati

- Reward

- like

- Comment

- Repost

- Share

Let me briefly share my reference for gold prices. After all, I personally hold a few million in gold positions. My approach is mainly based on my own observation method using star lines—I don’t follow the news; it’s just a rough cycle deduction. Don’t take this as direct trading advice, as I don’t track gold daily for updates.

If we consider the sideways movement of gold in 2020 as an accumulation phase (like pulling a bow), projecting forward, the targets I see for March–April 2024 are around 4370 and 4737. The current price has already reached a relatively high level, and new time pivot poi

View OriginalIf we consider the sideways movement of gold in 2020 as an accumulation phase (like pulling a bow), projecting forward, the targets I see for March–April 2024 are around 4370 and 4737. The current price has already reached a relatively high level, and new time pivot poi

- Reward

- like

- Comment

- Repost

- Share

$TRUMP coin has no chance at all in this bull run. If Trump can make it through the midterm elections and is still president in 2027-2028, then Trump coin will be the hottest meme in the next bull market.

There are several reasons:

1. The bear market will continue to fall, thoroughly shaking out weak hands and driving the price down to a very low level, for example, $0.5, which is another 10x drop from the current price.

2. The token is not fully unlocked yet, so there’s no incentive for a price pump. It will take another two years for the tokens to be fully unlocked, allowing the whales to f

There are several reasons:

1. The bear market will continue to fall, thoroughly shaking out weak hands and driving the price down to a very low level, for example, $0.5, which is another 10x drop from the current price.

2. The token is not fully unlocked yet, so there’s no incentive for a price pump. It will take another two years for the tokens to be fully unlocked, allowing the whales to f

TRUMP-1.81%

- Reward

- 1

- 1

- Repost

- Share

囤主流享自由 :

:

See you in the next bull market, remember 2025/10/9.The Fundamentals, News, and Technical Aspects in Trading

I believe that fundamentals and technicals are two sides of the same coin; essentially, they are one and the same. If the fundamentals are very strong—for example, if the project is performing exceptionally well—then the technicals will reflect this through a consistently rising long-term moving average, spiraling upward. Before trading, you must thoroughly research the asset you’re trading to determine what it truly is and whether it has long-term value. If the fundamentals are lacking, then the entire technical analysis becomes invalid

I believe that fundamentals and technicals are two sides of the same coin; essentially, they are one and the same. If the fundamentals are very strong—for example, if the project is performing exceptionally well—then the technicals will reflect this through a consistently rising long-term moving average, spiraling upward. Before trading, you must thoroughly research the asset you’re trading to determine what it truly is and whether it has long-term value. If the fundamentals are lacking, then the entire technical analysis becomes invalid

TON-0.65%

- Reward

- like

- Comment

- Repost

- Share

$BTC is a highly rhythmic coin. If you follow its rhythm, everything feels smooth and easy; if you miss the beat, you’re left feeling played. On the weekly chart, it’s clear that it’s following its own playbook: after the trendline was smashed through, it immediately rebounded and closed bullish as soon as it touched the long-term trendline below. But right after that, the next week gave a doji, clearly showing that both sides are really clashing hard at this level.

So in the short term, the overall direction still leans toward a rebound, but you need to watch out: this doji could also mean t

So in the short term, the overall direction still leans toward a rebound, but you need to watch out: this doji could also mean t

BTC-1.55%

- Reward

- like

- Comment

- Repost

- Share

Talking about XRP and LTC

$XRP spot ETF saw a net inflow of $231 million last week, marking four consecutive weeks of net inflows. The total net asset value of the XRP spot ETF is $861 million. Currently, all mainstream coins available through ETFs include $LTC $HBAR $XRP $SOL &LINK $DOGE , among which XRP has the strongest capital inflow. Wall Street institutions are showing the most interest in the XRP (Ripple) ETF. From a technical perspective, XRP is also around the key support level of 2. In previous shakeouts, the price dropped below 2 and then quickly rebounded; this shakeout is si

View Original$XRP spot ETF saw a net inflow of $231 million last week, marking four consecutive weeks of net inflows. The total net asset value of the XRP spot ETF is $861 million. Currently, all mainstream coins available through ETFs include $LTC $HBAR $XRP $SOL &LINK $DOGE , among which XRP has the strongest capital inflow. Wall Street institutions are showing the most interest in the XRP (Ripple) ETF. From a technical perspective, XRP is also around the key support level of 2. In previous shakeouts, the price dropped below 2 and then quickly rebounded; this shakeout is si

- Reward

- 1

- Comment

- Repost

- Share

Boring market, so I play some pool 🎱 and patiently wait for the Fed to cut interest rates. I've been in crypto for 8 years now, started trading in college, and have basically never had a regular job—I've always lived off trading. While I haven't become insanely rich, A8.5 is basically financial freedom for me. A lot of people say I'm too young and unreliable, but the crypto industry is inherently a young industry. You can't really expect people in their 50s or 60s to understand blockchain and Bitcoin, right? So in crypto, being young is actually an advantage; you can accept new things more qu

BTC-1.55%

- Reward

- 1

- 1

- Repost

- Share

SailorSamba :

:

Short selling as a hedge sounds good, but the real risk is in execution.$BTC What is true value???

The True Value of Bitcoin

1. Nations undergo periodic declines, meaning that fiat currencies issued by countries periodically become worthless. Large countries like China and the United States may last longer, but many small countries in the world could go bankrupt and collapse at any time.

So, how can we create a man-made currency that surpasses national sovereignty and periodic cycles, and will never become worthless?

This is the first value that Bitcoin addresses.

2. Fiat currencies are subject to ongoing inflation; the ruling class cannot control their desire to

The True Value of Bitcoin

1. Nations undergo periodic declines, meaning that fiat currencies issued by countries periodically become worthless. Large countries like China and the United States may last longer, but many small countries in the world could go bankrupt and collapse at any time.

So, how can we create a man-made currency that surpasses national sovereignty and periodic cycles, and will never become worthless?

This is the first value that Bitcoin addresses.

2. Fiat currencies are subject to ongoing inflation; the ruling class cannot control their desire to

BTC-1.55%

- Reward

- 1

- Comment

- Repost

- Share

Actually, I'm not very optimistic about Apple. Its high market value is mostly just hype. Ever since Steve Jobs passed away, Apple has already fallen from its pedestal. It's really impressive that Tim Cook has managed to stretch things out for so many years.

View Original- Reward

- like

- Comment

- Repost

- Share

If you reach an older age and still haven't realized the existence of fate, it only shows that your perception is too poor.

From the moment each person starts modeling their life, everyone is playing their own role. From a local perspective, everyone is the protagonist. But from a broader perspective, there are only a handful of true protagonists; the vast majority of people are just NPCs in this life, assisting the main characters in driving the plot forward.

The biggest problem for ordinary people is that if their modeling is too poor and their starting point too low, the most golden decades

View OriginalFrom the moment each person starts modeling their life, everyone is playing their own role. From a local perspective, everyone is the protagonist. But from a broader perspective, there are only a handful of true protagonists; the vast majority of people are just NPCs in this life, assisting the main characters in driving the plot forward.

The biggest problem for ordinary people is that if their modeling is too poor and their starting point too low, the most golden decades

- Reward

- 1

- 1

- Repost

- Share

RagingBisonOpen :

:

快上车!🚗I think in the current market, altcoins have really dropped too much, it's a bit oversold, and most retail investors no longer dare to buy the dip. So there's no need for altcoins to keep falling further. The ideal scenario would be for $BTC to move sideways, altcoins to rebound for a while and then drop again, which also aligns with the interests of the market makers.

BTC-1.55%

- Reward

- like

- 1

- Repost

- Share

Sunnyleaf :

:

So that's how it is. I don't know now.