inertia_A1

No content yet

inertia_A1

$38 trillion in debt… and yes, technically the U.S. government still accepts voluntary donations to help reduce it.

There’s something almost poetic about that — the world’s largest economy running trillion-dollar deficits while quietly keeping a public “donate” button open.

It won’t move the needle in any meaningful way, but it says a lot about the scale of the imbalance. When debt reaches this magnitude, repayment isn’t about donations — it’s about monetary policy, inflation management, growth, and global demand for Treasuries.

In reality, the system doesn’t collapse because of the headline n

There’s something almost poetic about that — the world’s largest economy running trillion-dollar deficits while quietly keeping a public “donate” button open.

It won’t move the needle in any meaningful way, but it says a lot about the scale of the imbalance. When debt reaches this magnitude, repayment isn’t about donations — it’s about monetary policy, inflation management, growth, and global demand for Treasuries.

In reality, the system doesn’t collapse because of the headline n

- Reward

- 1

- Comment

- Repost

- Share

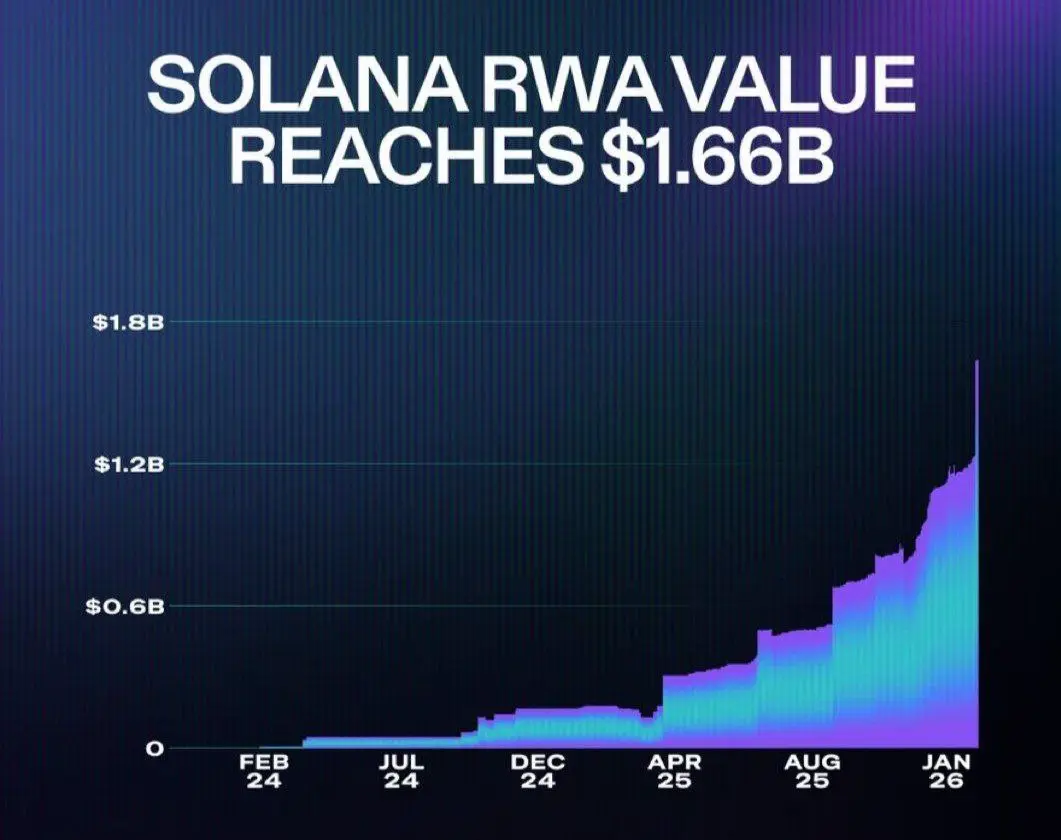

#RWA on #SOL is accelerating.

Solana’s real-world asset ecosystem just hit a new all-time high of $1.66B in tokenized value — up 42% in the last 30 days.

That’s not speculative TVL rotation. That’s capital flowing into on-chain representations of treasuries, credit, and yield-bearing instruments.

While most watch memecoin cycles, infrastructure quietly compounds.

RWA growth on Solana signals one thing: institutional-grade use cases are no longer theoretical — they’re scaling.

$SOL

Solana’s real-world asset ecosystem just hit a new all-time high of $1.66B in tokenized value — up 42% in the last 30 days.

That’s not speculative TVL rotation. That’s capital flowing into on-chain representations of treasuries, credit, and yield-bearing instruments.

While most watch memecoin cycles, infrastructure quietly compounds.

RWA growth on Solana signals one thing: institutional-grade use cases are no longer theoretical — they’re scaling.

$SOL

SOL-2,42%

- Reward

- 3

- Comment

- Repost

- Share

There might be some truth in what’s circulating, but markets don’t move on screenshots or recycled narratives.

Right now, the real issue isn’t a lack of catalysts — it’s a lack of trust. Liquidity feels thin, sentiment is fragile, and constant exchange-driven supply keeps capping momentum. In that environment, even bullish setups struggle to follow through.

And as always, past performance doesn’t guarantee anything. Different cycle, different structure, different players.

Conviction without context is just noise.

#USCoreCPIHitsFour-YearLow

Right now, the real issue isn’t a lack of catalysts — it’s a lack of trust. Liquidity feels thin, sentiment is fragile, and constant exchange-driven supply keeps capping momentum. In that environment, even bullish setups struggle to follow through.

And as always, past performance doesn’t guarantee anything. Different cycle, different structure, different players.

Conviction without context is just noise.

#USCoreCPIHitsFour-YearLow

- Reward

- 2

- Comment

- Repost

- Share

China’s share of US Treasury holdings has fallen to just 7.3% of total foreign holdings — the lowest level since 2001.

This isn’t noise.

It signals long-term portfolio rebalancing, reserve diversification, and a gradual shift in global capital flows.

Less concentration in Treasuries.

More multipolar reserve dynamics.

The structural trend matters more than the headline.

#china

This isn’t noise.

It signals long-term portfolio rebalancing, reserve diversification, and a gradual shift in global capital flows.

Less concentration in Treasuries.

More multipolar reserve dynamics.

The structural trend matters more than the headline.

#china

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕- Reward

- 2

- 1

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”$BTC .D is only down ~6% from its recent high.

That’s not a collapse in dominance — it’s a pause.

Despite noise around alt breakouts, capital is still largely anchored in Bitcoin. A true altseason usually needs a deeper dominance reset, not just a minor pullback.

Until BTC.D breaks structure decisively, this looks like rotation — not regime change.

Stay sharp.

#BTC

That’s not a collapse in dominance — it’s a pause.

Despite noise around alt breakouts, capital is still largely anchored in Bitcoin. A true altseason usually needs a deeper dominance reset, not just a minor pullback.

Until BTC.D breaks structure decisively, this looks like rotation — not regime change.

Stay sharp.

#BTC

BTC-2,31%

- Reward

- 3

- 2

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

Over $15M has already been wagered on a single Oscars category on Polymarket.

Prediction markets aren’t just pricing politics anymore — they’re pricing Hollywood.

When entertainment outcomes attract eight-figure liquidity, it signals something bigger: culture has become tradable. Attention is financialized. Narratives have order books.

The Oscars used to be speculation on Twitter.

Now it’s speculation on-chain.

#Polymarket

Prediction markets aren’t just pricing politics anymore — they’re pricing Hollywood.

When entertainment outcomes attract eight-figure liquidity, it signals something bigger: culture has become tradable. Attention is financialized. Narratives have order books.

The Oscars used to be speculation on Twitter.

Now it’s speculation on-chain.

#Polymarket

- Reward

- 4

- 2

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

$BNB Grinding Higher Into Range Top

BNB/USDT is trading around $627, up over 4% on the session. On the 4H timeframe, price is steadily climbing after defending the $592–$600 demand zone.

Structure shows a series of higher lows forming since the recent dip. Price has reclaimed the short-term moving averages, with MA5 above MA10 and both curling upward. The 30MA near $616 is now acting as dynamic support — a constructive sign for continuation. MACD is crossing higher, reflecting strengthening bullish momentum.

Key zones:

Immediate resistance: $628 (recent high)

Break above → opens $640–$647 ar

BNB/USDT is trading around $627, up over 4% on the session. On the 4H timeframe, price is steadily climbing after defending the $592–$600 demand zone.

Structure shows a series of higher lows forming since the recent dip. Price has reclaimed the short-term moving averages, with MA5 above MA10 and both curling upward. The 30MA near $616 is now acting as dynamic support — a constructive sign for continuation. MACD is crossing higher, reflecting strengthening bullish momentum.

Key zones:

Immediate resistance: $628 (recent high)

Break above → opens $640–$647 ar

BNB-3,4%

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

$SOL 4H – Expansion After Higher Low

SOL/USDT is trading around $86.10, up roughly 8% on the session. The 4H chart shows a clean reversal structure forming after holding the $76–$78 demand zone.

Price printed a higher low near $79, followed by strong bullish candles reclaiming the 10MA and now pushing into the 30MA around $82–$83. Short-term moving averages are aligned upward (MA5 > MA10), signaling momentum shift. MACD is expanding in positive territory, supporting continuation bias.

Structure shift:

Reclaim of $82 flipped short-term trend

Momentum building toward range high

Key levels:

Resi

SOL/USDT is trading around $86.10, up roughly 8% on the session. The 4H chart shows a clean reversal structure forming after holding the $76–$78 demand zone.

Price printed a higher low near $79, followed by strong bullish candles reclaiming the 10MA and now pushing into the 30MA around $82–$83. Short-term moving averages are aligned upward (MA5 > MA10), signaling momentum shift. MACD is expanding in positive territory, supporting continuation bias.

Structure shift:

Reclaim of $82 flipped short-term trend

Momentum building toward range high

Key levels:

Resi

SOL-2,42%

- Reward

- 5

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕$XRP 4H – Breakout Shift After Compression

XRP/USDT is trading around $1.444, up over 5% on the session. The 4H structure shows a clear transition from consolidation to expansion.

For several sessions, price moved sideways between roughly $1.36–$1.41, forming a tight compression range. That range has now broken to the upside with strong bullish candles. MA5 has crossed above MA10, and both are pushing above MA30 — a short-term bullish alignment.

MACD is turning positive with momentum building, suggesting buyers are regaining control.

Levels to track:

Immediate resistance: $1.46

Break above $1

XRP/USDT is trading around $1.444, up over 5% on the session. The 4H structure shows a clear transition from consolidation to expansion.

For several sessions, price moved sideways between roughly $1.36–$1.41, forming a tight compression range. That range has now broken to the upside with strong bullish candles. MA5 has crossed above MA10, and both are pushing above MA30 — a short-term bullish alignment.

MACD is turning positive with momentum building, suggesting buyers are regaining control.

Levels to track:

Immediate resistance: $1.46

Break above $1

XRP-1,88%

- Reward

- 5

- 2

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

$BTC 4H Structure – Reclaiming Strength Near $70K

BTC/USDT is trading around $69,750, up nearly 5% on the session. On the 4H chart, price has pushed back above the short-term moving averages (MA5 & MA10) and is now testing the mid-range resistance zone just below $70K.

After sweeping liquidity near the $65.5K area, BTC printed a higher low and followed with consecutive strong green candles. The 30MA around $68K is starting to flatten, suggesting momentum is shifting back to buyers. MACD is crossing upward, indicating bullish continuation if volume sustains.

Key levels to watch:

Resistance: $6

BTC/USDT is trading around $69,750, up nearly 5% on the session. On the 4H chart, price has pushed back above the short-term moving averages (MA5 & MA10) and is now testing the mid-range resistance zone just below $70K.

After sweeping liquidity near the $65.5K area, BTC printed a higher low and followed with consecutive strong green candles. The 30MA around $68K is starting to flatten, suggesting momentum is shifting back to buyers. MACD is crossing upward, indicating bullish continuation if volume sustains.

Key levels to watch:

Resistance: $6

BTC-2,31%

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

$ETH 4H Update – Momentum Building Near $2,100

ETH/USDT is trading around $2,080, up over 6% on the session. On the 4H chart, price has reclaimed short-term structure and is now holding above the 5MA and 10MA, with the 30MA acting as dynamic support near the $2,000–$2,020 zone.

After printing a higher low around $1,950, buyers stepped in with strong green candles and rising momentum. MACD is curling upward, suggesting continuation if volume expands.

Key levels:

Resistance: $2,093 (recent high) → $2,120 area next

Support: $2,035 → $2,000 psychological zone

If ETH sustains above $2,050, continu

ETH/USDT is trading around $2,080, up over 6% on the session. On the 4H chart, price has reclaimed short-term structure and is now holding above the 5MA and 10MA, with the 30MA acting as dynamic support near the $2,000–$2,020 zone.

After printing a higher low around $1,950, buyers stepped in with strong green candles and rising momentum. MACD is curling upward, suggesting continuation if volume expands.

Key levels:

Resistance: $2,093 (recent high) → $2,120 area next

Support: $2,035 → $2,000 psychological zone

If ETH sustains above $2,050, continu

ETH-7%

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

SWIFT just joined the Bank of England’s Synchronisation Lab to test cross-border FX and DvP settlement for tokenized securities.

This isn’t crypto hype — it’s infrastructure.

They’re exploring how to synchronise traditional payment rails with tokenized assets to enable atomic, cross-border settlement while reducing counterparty risk.

For RWA, this is a strong signal:

Institutions aren’t debating tokenization anymore they’re engineering it.

#rwa

This isn’t crypto hype — it’s infrastructure.

They’re exploring how to synchronise traditional payment rails with tokenized assets to enable atomic, cross-border settlement while reducing counterparty risk.

For RWA, this is a strong signal:

Institutions aren’t debating tokenization anymore they’re engineering it.

#rwa

RWA-1,26%

- Reward

- 1

- Comment

- Repost

- Share

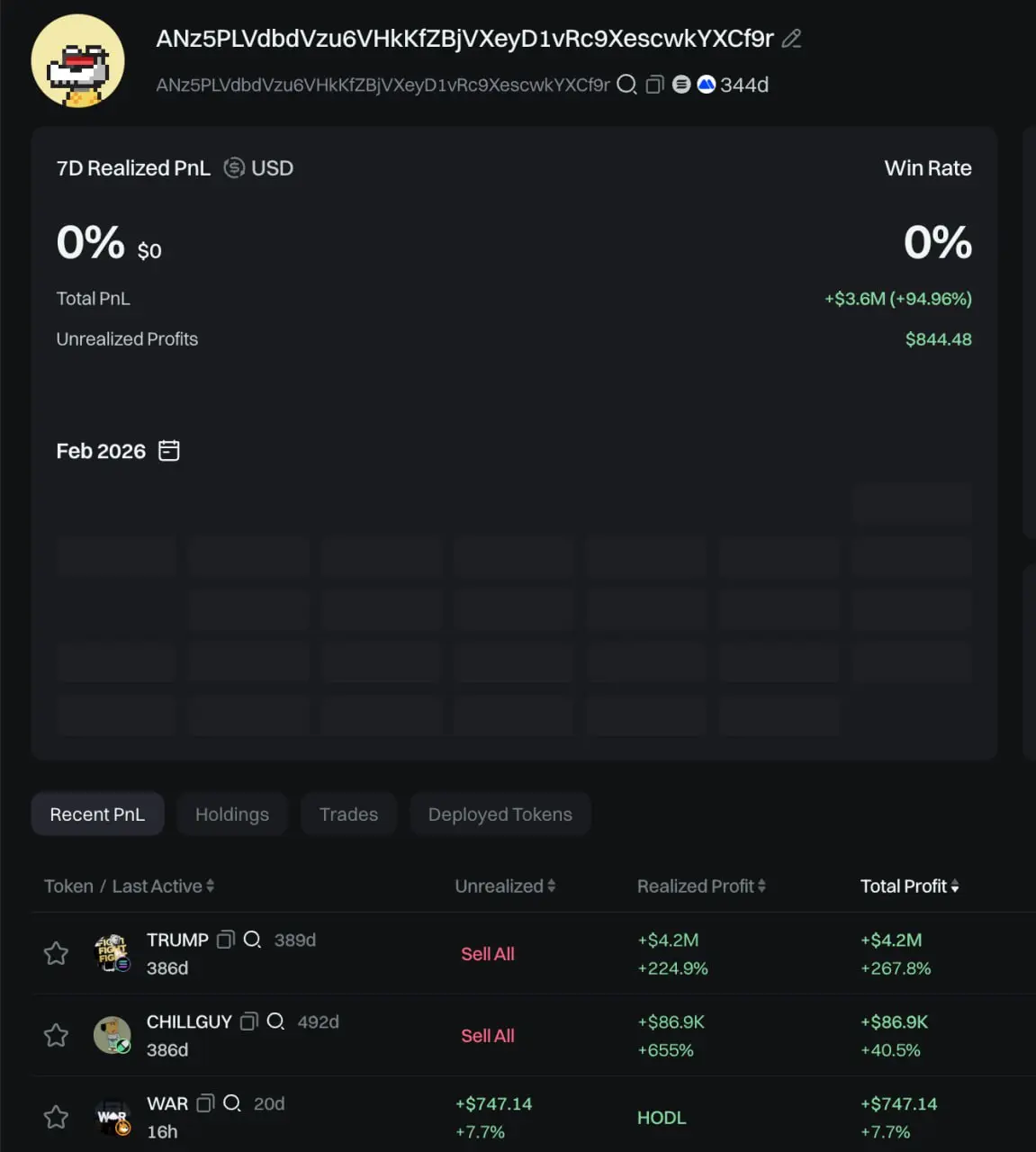

Smart money is waking up again.

Trader ANz5PL, who famously pulled $4.2M in profit on $TRUMP , just made his first move after 8 months of complete inactivity.

Today, he spent 112 $SOL (~$9.7K) to scoop up 307,159 $WAR.

Dormant wallets don’t move without conviction. When experienced traders re-enter the market, it’s rarely noise — it’s positioning.

Worth keeping $WAR on the radar.

#BuyTheDipOrWaitNow?

Trader ANz5PL, who famously pulled $4.2M in profit on $TRUMP , just made his first move after 8 months of complete inactivity.

Today, he spent 112 $SOL (~$9.7K) to scoop up 307,159 $WAR.

Dormant wallets don’t move without conviction. When experienced traders re-enter the market, it’s rarely noise — it’s positioning.

Worth keeping $WAR on the radar.

#BuyTheDipOrWaitNow?

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

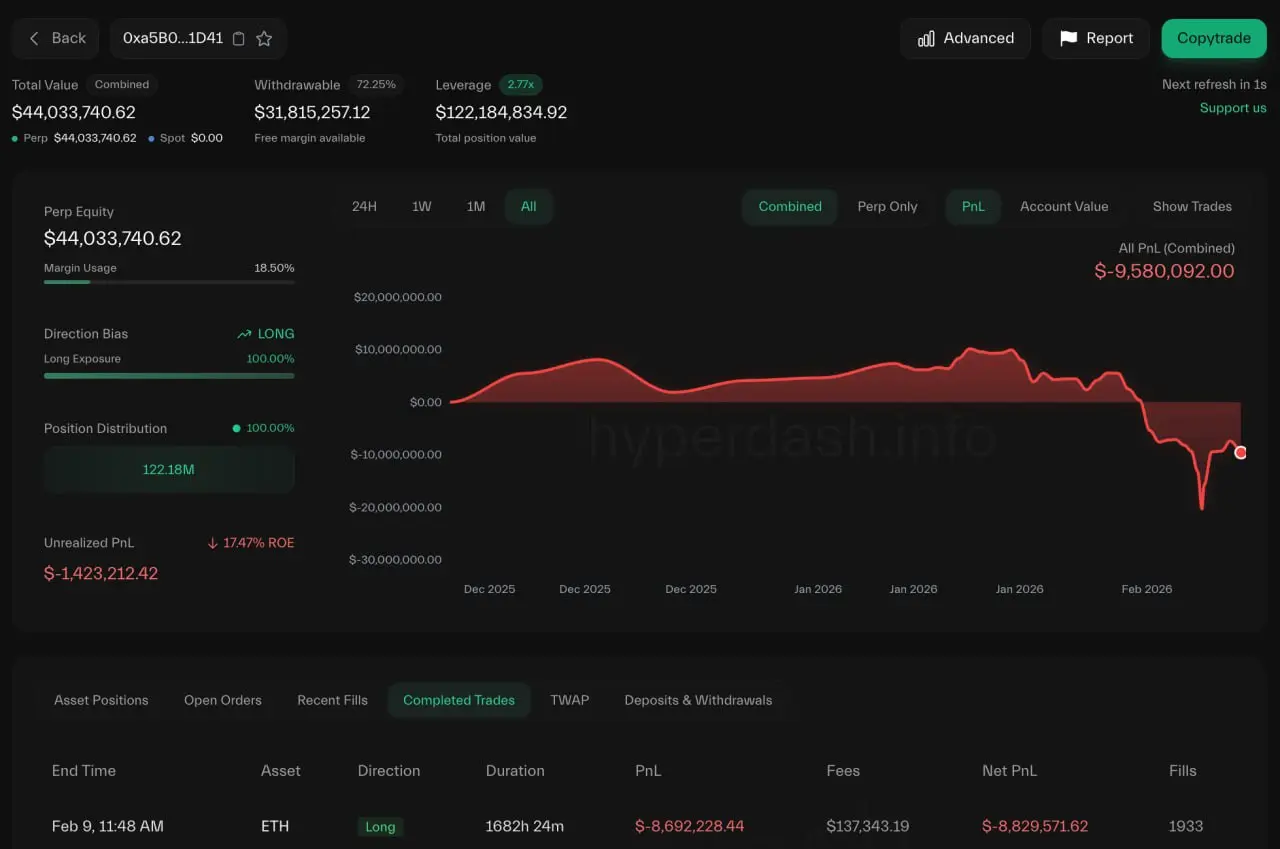

Conviction vs. Leverage a real-time lesson in $ETH trading

A known $ETH bull, 0xa5B0, just closed a 70+ day long at an $8.8M loss only to re-enter immediately with a 20× leveraged long on 60,000 ETH (~$122M).

Within hours, that position is already down another $1.4M.

This isn’t just a whale trade it’s a reminder:

Strong conviction doesn’t cancel timing risk

High leverage compresses patience

Even seasoned players get tested when markets chop

Markets don’t reward belief. They reward positioning.

A known $ETH bull, 0xa5B0, just closed a 70+ day long at an $8.8M loss only to re-enter immediately with a 20× leveraged long on 60,000 ETH (~$122M).

Within hours, that position is already down another $1.4M.

This isn’t just a whale trade it’s a reminder:

Strong conviction doesn’t cancel timing risk

High leverage compresses patience

Even seasoned players get tested when markets chop

Markets don’t reward belief. They reward positioning.

ETH-7%

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

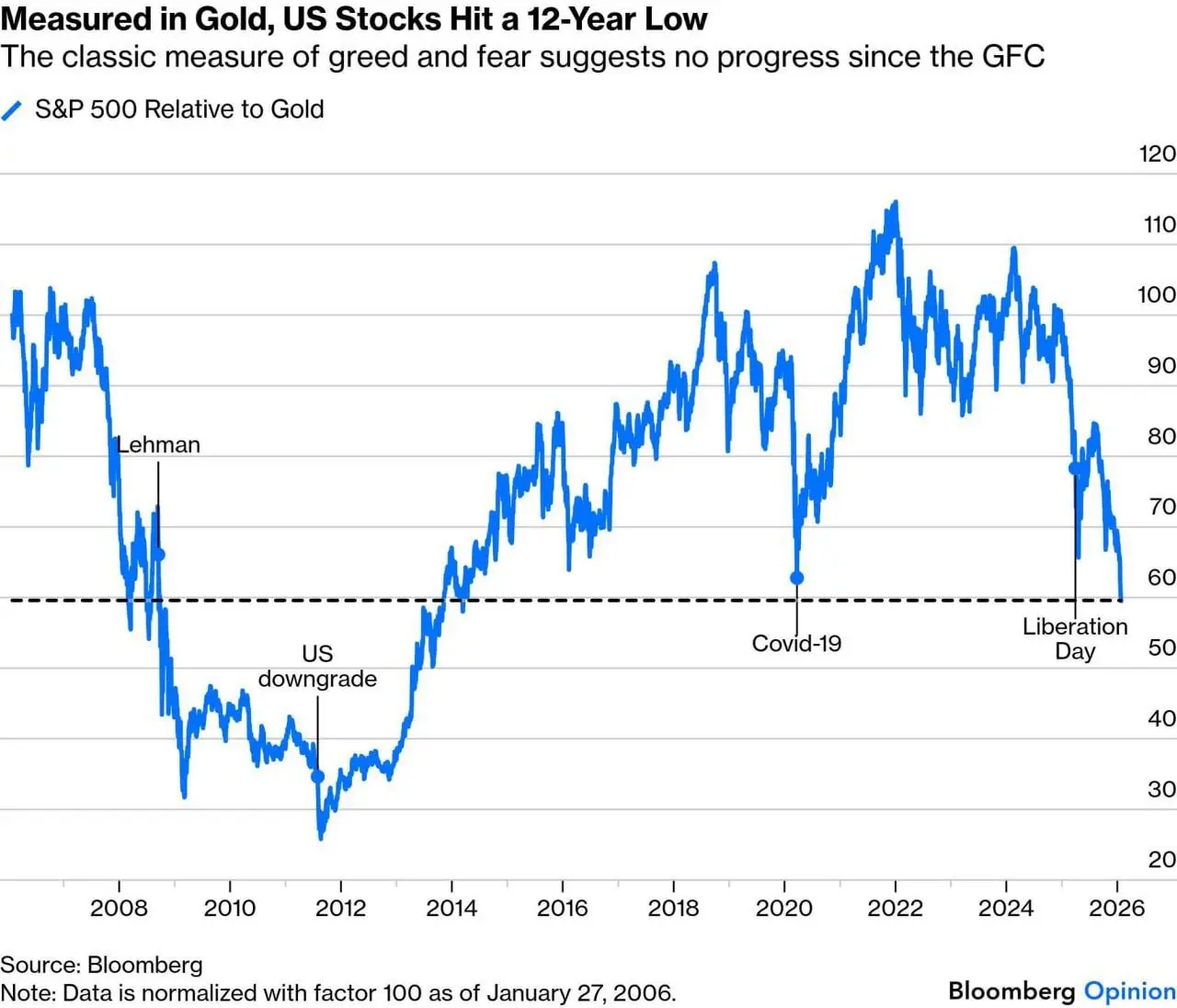

If you stop measuring the U.S. stock market in dollars and measure it in gold, the picture changes completely.

In gold terms, U.S. equities haven’t been compounding wealth — they’ve been losing purchasing power. The apparent “all-time highs” are largely a reflection of dollar debasement, not real value creation. Gold doesn’t care about rate cuts, earnings narratives, or CPI optics. It measures truth in scarcity.

This is why long-cycle investors track stocks priced in hard assets, not fiat. When stocks rise but gold rises faster, real wealth is quietly rotating — not growing.

Nominal gains can

In gold terms, U.S. equities haven’t been compounding wealth — they’ve been losing purchasing power. The apparent “all-time highs” are largely a reflection of dollar debasement, not real value creation. Gold doesn’t care about rate cuts, earnings narratives, or CPI optics. It measures truth in scarcity.

This is why long-cycle investors track stocks priced in hard assets, not fiat. When stocks rise but gold rises faster, real wealth is quietly rotating — not growing.

Nominal gains can

- Reward

- 3

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

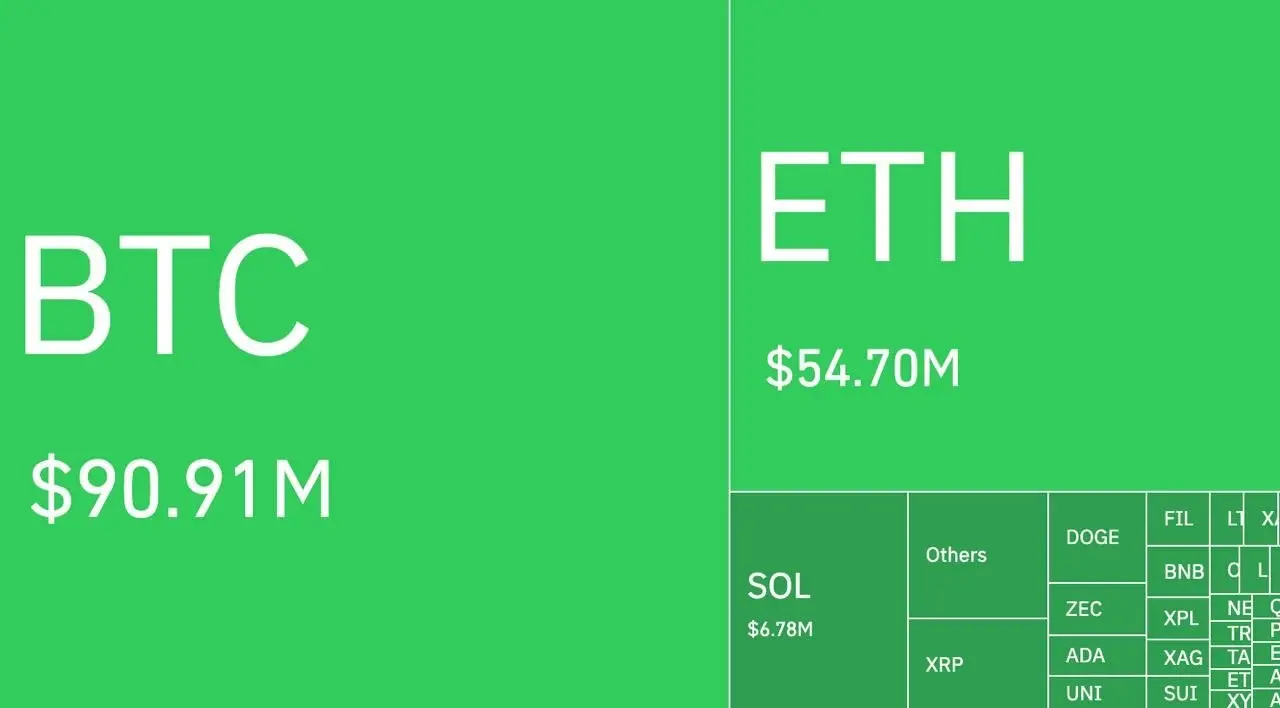

Leverage reset in real time.

Nearly $167M in long positions were liquidated across the crypto market in the past hour.

Overcrowded trades met volatility a sharp reminder that momentum cuts both ways.

Risk didn’t disappear; it repriced fast.

$BTC $ETH

#PreciousMetalsPullBack

Nearly $167M in long positions were liquidated across the crypto market in the past hour.

Overcrowded trades met volatility a sharp reminder that momentum cuts both ways.

Risk didn’t disappear; it repriced fast.

$BTC $ETH

#PreciousMetalsPullBack

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

DYOR 🤓View More

Policy risk back on the table.

Donald Trump says he will announce the new Federal Reserve Chair next week.

Markets are already recalibrating — rate expectations, dollar strength, and risk assets will all take cues from this decision.

#FedKeepsRatesUnchanged

$BTC $ETH

Donald Trump says he will announce the new Federal Reserve Chair next week.

Markets are already recalibrating — rate expectations, dollar strength, and risk assets will all take cues from this decision.

#FedKeepsRatesUnchanged

$BTC $ETH

- Reward

- 4

- 2

- Repost

- Share

dragon_fly2 :

:

Watching Closely 🔍️View More

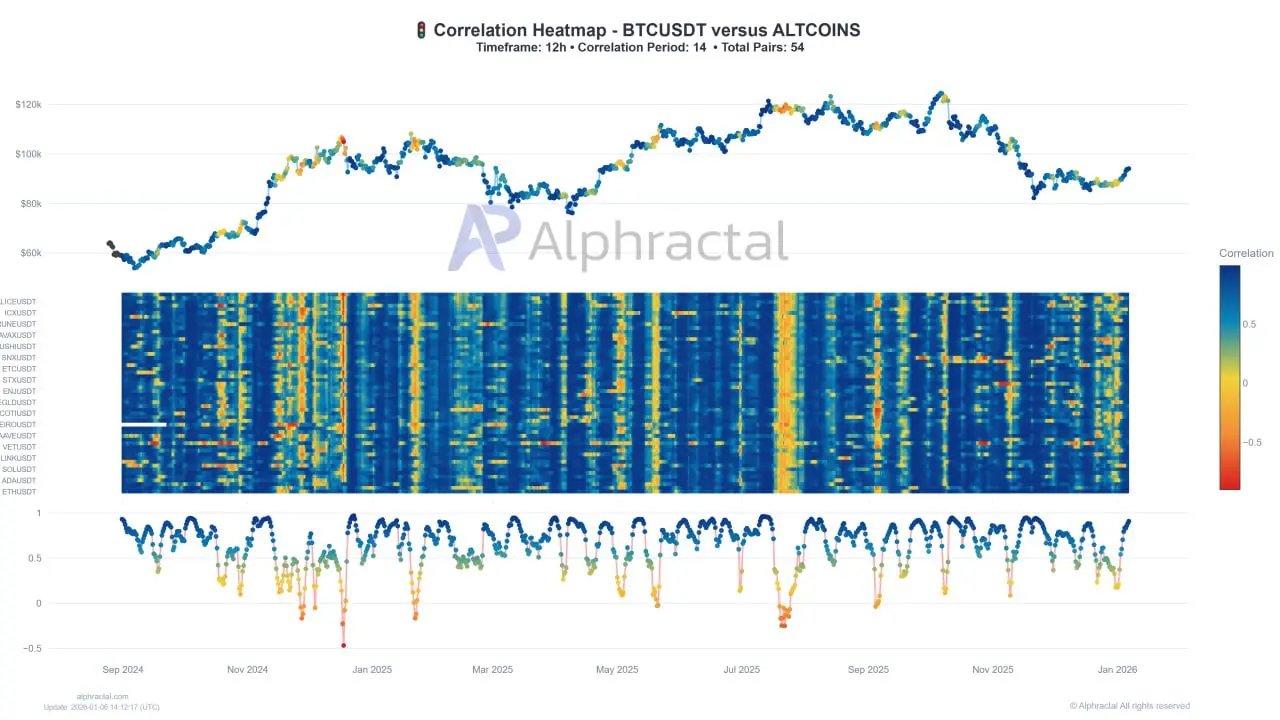

$BTC sets the tempo for the entire market.

The correlation between Bitcoin and altcoins remains high. When BTC moves, liquidity, sentiment, and risk appetite shift across the board—and altcoins usually follow the same direction, often with higher volatility.

This is why BTC isn’t just another asset. It’s the benchmark.

Track Bitcoin first, understand the move, then position on alts accordingly.

#BitcoinSix-DayRally

The correlation between Bitcoin and altcoins remains high. When BTC moves, liquidity, sentiment, and risk appetite shift across the board—and altcoins usually follow the same direction, often with higher volatility.

This is why BTC isn’t just another asset. It’s the benchmark.

Track Bitcoin first, understand the move, then position on alts accordingly.

#BitcoinSix-DayRally

BTC-2,31%

- Reward

- 4

- 8

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

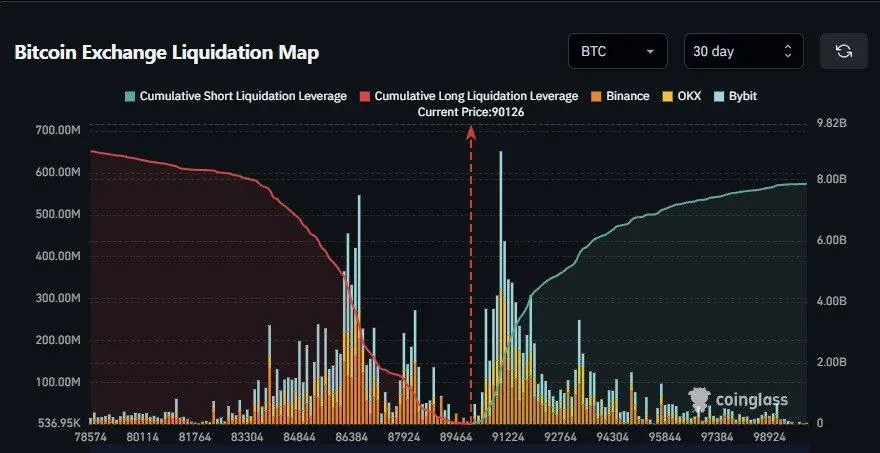

$BTC needs to drop $2,000 to wipe out $1.1B in longs, but it only needs to go up $770 to wipe out $1.1B in shorts.

#Bitcoin2026PriceOutlook

#Bitcoin2026PriceOutlook

BTC-2,31%

- Reward

- 5

- 8

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More