The Spring Festival Gala has turned into an AI parade battlefield. Why did China ultimately gain the advantage in the US-China computing power race?

The U.S. AI Data Centers Face a Severe Power Crisis, Electricity Prices Surge 36%, While China Has Built 45 Ultra-High Voltage Projects and Achieved Over 60% Renewable Energy Capacity, Forming an Uncopyable Strategic Advantage in Energy Infrastructure for the AI Era. This article is sourced from Foresight News, organized, compiled, and written by Dongqu Dongqu.

(Previous summary: Bloomberg: DeepSeek’s Rapid Rise, China Poses a “Huge Threat” to U.S. AI Dominance)

(Additional background: Bitcoin Mining and AI: Who Is Consuming Power More Quickly?)

In the spring of 2026, while the world is still marveling at OpenAI’s latest model parameters, China showcased another side of AI with a Spring Festival Gala — embodied intelligence in physical form.

Looking at the program list of the 2026 CCTV Spring Festival Gala, we see an unprecedented “AI Parade.” This is no longer the simple mechanical dance performances from a few years ago but a concentrated explosion of China’s robotics industry — multiple companies, multiple models, all-scenario deployment.

Magic Atom’s full-stack cluster turned robots into the best “atmosphere crew,” performing dance routines with Chen Xiaochun and Yi Yangqianxi in “Creating the Future,” with movements so coordinated that it’s hard to tell real from fake.

Unitree’s G1 and H2 robots demonstrated astonishing motion control in “Wu BOT” — not remote-controlled in real-time but autonomously balanced through edge computing. When H2, dressed in red, wields a sword, it proves that China’s robot cerebellums are already mature.

Songyan Dynamics’ “Grandma’s Favorite” skit had robots taking on comedic roles, handling punchlines and punchbags, crossing from “props” to “actors.”

Galaxy General’s Galbot G1 performed “twisting walnuts” in a micro-movie — behind this seemingly simple action is a pinnacle display of dexterous hands and tactile feedback technology.

This Spring Festival Gala sent a clear signal: China’s AI is no longer confined to servers; it has grown limbs and stepped into reality.

However, while we cheer for the robots, Wall Street across the ocean is falling into a silent panic. They’ve discovered that the “blood” powering these AIs — electricity — is running out. When shifting our gaze from the Gala stage to Silicon Valley data centers, we see a giant elephant in the room — power.

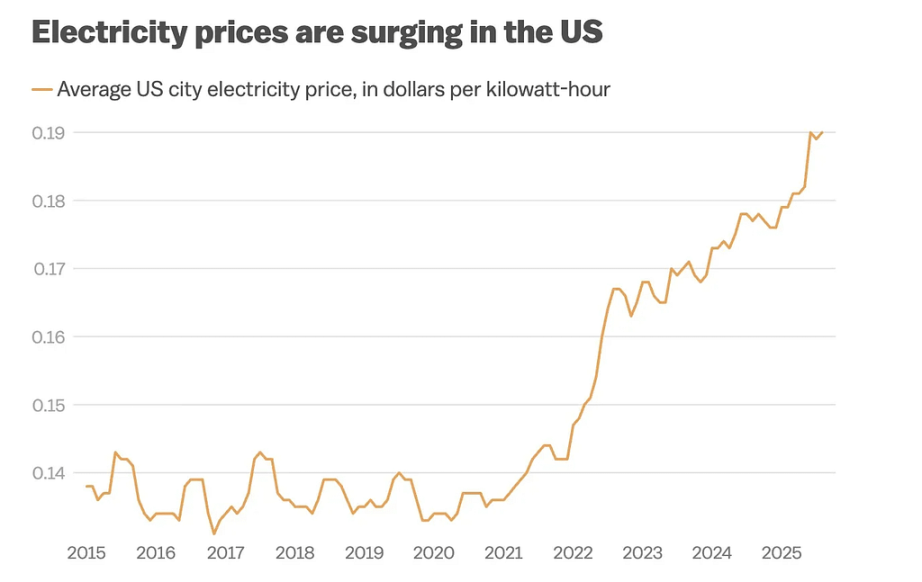

As of early 2026, electricity prices in the U.S. have surged 36%, reaching $0.18 per kWh. But this is only superficial; the core crisis lies in supply-side collapse. Training a GPT-4 level model consumes as much electricity as the total annual power of 100,000 households. It’s projected that by 2028, the annual electricity consumption of U.S. data centers will skyrocket to 600,000 GWh.

The U.S. power grid faces a double blow of “heart disease” and “vascular embolism”: 5% of electricity relies on aging fossil fuels and nuclear power, which are facing decommissioning waves. The grid is split into three isolated islands — East, West, and Texas — with poor interconnection. Approving a cross-state transmission line can take up to 15 years, preventing wind power from the Midwest from reaching data centers on the East Coast.

As Sam Altman said, “Energy is money.” Today’s Silicon Valley is no longer troubled by chip quotas but by — where is there enough power to run these chips?

If computing power is the engine of AI, then electricity is its fuel. In this energy game, China, with a decade of advanced planning, has built a strategic moat that the U.S. cannot easily replicate. If computing power is the engine, then electricity is the fuel. In this energy contest, China’s decade-long ahead layout has created an insurmountable strategic advantage for the U.S. in the short term.

By 2025, China has completed 45 ultra-high voltage projects, with the total length of UHV DC transmission lines exceeding 40,000 kilometers. This “power highway” can deliver abundant clean energy from the West to data centers in the East at millisecond speeds or directly support the “East Data West Computing” hub. China owns 35 of the world’s 37 largest high-voltage direct current cable systems, creating a technological gap that the U.S. cannot cross in the near future.

AI’s high energy consumption inherently requires clean energy. In 2025, China’s renewable energy capacity surpassed 60% for the first time — wind and solar added over 430 GW of new capacity. Nearly 40% of electricity in China’s society comes from green sources. Compared to the U.S., which is still struggling with delays in nuclear plant construction, China has achieved grid parity for solar and wind, providing cheap and green energy solutions for energy-intensive AI data centers.

China is the world’s largest transformer manufacturer, accounting for over 60% of global capacity. The biggest pain point in U.S. grid upgrades is transformer shortages, with delivery times up to 3–4 years. Whether through Mexico transshipment or direct procurement, the U.S. grid’s maintenance heavily depends on Chinese-made transformers. When U.S. data centers halt operations due to transformer shortages, Chinese power equipment companies are operating at full capacity, supporting rapid domestic infrastructure expansion.

The 2026 Spring Festival Gala is not just a robot extravaganza but also a snapshot of China’s industrial strength.

When we see the robotic dogs rolling and the Galaxy General robots working on screen, let’s not forget: behind every agile movement are not only advanced algorithms but also stable electricity transmitted over thousands of kilometers via ultra-high voltage lines and a robust power grid supporting it.

In this second half of the #AI revolution, the marginal cost of increasing computing power will no longer depend on chip nanometers but on the cost of joules. The U.S. has the top algorithms, but China has the most powerful energy conversion and transmission system.

For investors, the logic is clear: in this gold rush, if NVIDIA is selling shovels, then China’s infrastructure builders (UHV, power equipment, green energy) hold the real water source.

Related Articles

Bitcoin futures open interest plummets 55%, marking the largest decline in nearly three years

Bear market nearing the end! K33 Research: Bitcoin will enter a "long period of consolidation" with little chance of a major rally in the short term

Analysis: Bitcoin rebounds to $67,000, and Trump's tariff remarks reignite expectations of macro tightening

Federal Reserve Meeting Minutes: Progress Toward 2% Inflation Target May Be Slower

The United States will experience a historic tax refund wave! Bank of America: Expected to boost the stock market and cryptocurrency market

American Businessman Robert Kiyosaki Forecasts Giant Crash, Gets Called Out