#InstitutionalHoldingsDebate

The role and impact of institutional investors in the cryptocurrency market remains one of the hottest and most divisive debates in crypto as of early 2026. With spot Bitcoin and Ethereum ETFs now managing hundreds of billions in AUM, corporate treasuries like MicroStrategy (now Strategy) holding massive BTC positions, and major players like BlackRock, Fidelity, and even sovereign funds piling in, institutions have fundamentally reshaped the space.

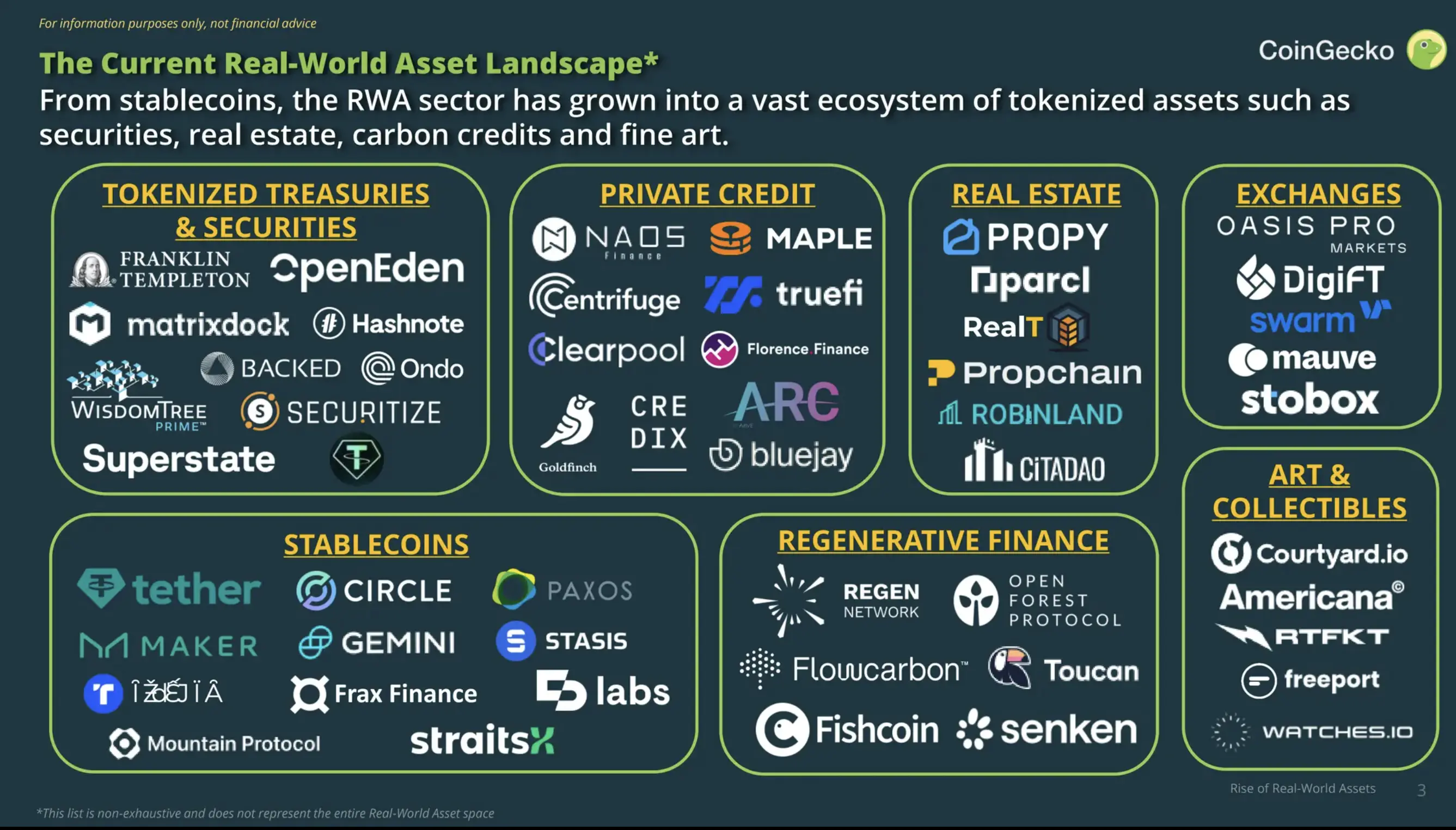

This isn't the wild, retail-driven market of 2017 or 2021 anymore. 2026 is widely called the "dawn of the institutional era" by firms like Grayscale, with structural shifts driven by regulatory clarity (e.g., GENIUS Act on stablecoins, expected bipartisan market structure laws), macro demand for alternative stores of value amid fiat concerns, and tokenized real-world assets bridging TradFi and blockchain.

Here's a fully extended, detailed breakdown of all major points in the ongoing debate — pros, cons, realities, and nuances — based on current data, surveys, and community discussions.

Positive Impacts (Pros): Why Many See Institutional Involvement as a Net Win

Massive Legitimacy and Mainstream Integration

Institutions like BlackRock (IBIT holding ~777k–805k BTC), Fidelity, and sovereign funds (e.g., Mubadala, Abu Dhabi) entering validates crypto as a serious asset class. Surveys show 86% of institutions have exposure or plan allocations in 2025–2026, with 68% eyeing BTC ETPs. Larry Fink now calls tokenization "the future of finance," and JPMorgan explores institutional crypto trading. This shifts perception from "speculative casino" to "portfolio staple," attracting advised wealth, pensions, and 401(k)s. Even skeptics like Jamie Dimon have softened, comparing BTC ownership to personal choice.

Improved Liquidity, Stability, and Reduced Extreme Volatility

Institutional capital brings deep, consistent flows. US spot Bitcoin ETFs alone have seen cumulative inflows topping $100–180B+ since 2024, with AUM near $135–191B in some reports. This creates mechanical buying pressure (ETFs bought more BTC than new supply in recent periods) and dampens retail-driven flash crashes. Volatility has normalized compared to prior cycles, thanks to longer holding horizons and better infrastructure (regulated custody, in-kind redemptions). Institutions act as "patient capital," absorbing shocks better than panic-selling retail.

Infrastructure Maturity and Innovation Acceleration

Demand has forced better tools: qualified custodians (e.g., Coinbase Custody, bank launches like BNY Mellon/State Street), compliant products (ETFs, tokenized Treasuries), and bridges to TradFi (e.g., JPMorgan's tokenized deposits, Citi's services). Tokenization of real-world assets (RWAs) is going mainstream, enabling efficient settlement and yield. Regulatory progress (e.g., clearer US/EU rules) reduces uncertainty, fostering sustainable growth over hype.

Enormous Capital Inflows and Price Support

Global institutional AUM is trillions; even 1–5% allocations could drive $90–450B+ inflows. ETFs and corporate treasuries hold ~5–11.5%+ of BTC supply (e.g., ~2.29M BTC combined in some 2025 estimates, now higher). This outpaces mining supply shocks, supporting resilience and potential for $150k–$200k BTC targets in bull scenarios. Institutions treat BTC as "digital gold" for diversification against inflation/debasement.

Broader Ecosystem Benefits

Institutions push for (and benefit from) clearer rules, protecting consumers while enabling growth. Retail gets easier, regulated access via ETFs/ETPs. Convergence of TradFi/DeFi creates crossover products, stablecoin infrastructure, and VC for institutional-grade tools.

Negative Impacts (Cons): Why Crypto Natives Often See It as a Threat

Centralization of Power and Loss of Decentralization Ethos

Crypto was built on "be your own bank" and resisting centralized control. Now, a few players (BlackRock ~3.9% of BTC supply, Fidelity, Grayscale) dominate via ETFs/custody. Critics argue this concentrates influence — coordinated selling or decisions could harm smaller holders. The "soul" of crypto (grassroots, anti-establishment) risks being lost as Wall Street invades.

Higher Risk of Manipulation and Controlled Markets

Deep-pocketed institutions enable large trades, basis trades, volatility selling, and lobbying. Some point to past examples (e.g., funds dumping on retail post-hype, insider advantages). ETFs create "paper BTC" suppressing natural discovery, while market makers control liquidity. Community voices warn of "institutional cycles" where accumulation is slow/sideways, frustrating retail until positions build — then potential violent unwinds if risk rules trigger forced sales.

Increased Correlation with Traditional Markets and Loss of Independence

As crypto integrates into portfolios, it tracks equities/risk sentiment more (correlation surged to 0.75+). No longer a true uncorrelated hedge — it amplifies losses in crashes. Institutions derisk into cash during downturns, not diamond-hand like early holders.

Retail Marginalization and "Frustrating" Price Action

This cycle feels "designed for institutions to take over" — suppressed prices, controlled pumps/dumps, sideways action while they accumulate. Retail often quits or loses, as gains accrue to big players. If wealth concentrates, public sentiment turns fragile; politicians could scapegoat crypto without broad voter support. Retail brings legitimacy/movements; institutions bring liquidity but not votes.

Potential for Future Downturns or Traps

Some forecasts see 2026 cooling (neutral/bearish sentiment post-2025 rally fade, macro tailwinds waning). Basis trade unwinds or custody concentrations (e.g., high reliance on few providers) create hidden risks. Institutions aren't permanent floors — they sell on rules, potentially causing bigger bears.

The Balanced Reality in Early 2026

Adoption is still early: Institutional allocations remain modest (e.g., <0.5–5% of advised wealth/portfolios), though growing fast. Retail still dominates some activity, but institutions drive marginal price action via ETFs.

Hybrid future: Most agree institutions are inevitable and bring maturity, but the debate is about preserving core principles (decentralization, open access) while scaling. Optimists see structural bull (institutional demand > supply, tokenization boom); skeptics fear "Wall Street takeover" diluting crypto's revolutionary edge.

Current trend: 2026 focuses on deeper integration (more ETPs, bank custody, 401(k) access, sovereign adoption), with volatility from macro/tactical flows but overall constructive infrastructure.

The role and impact of institutional investors in the cryptocurrency market remains one of the hottest and most divisive debates in crypto as of early 2026. With spot Bitcoin and Ethereum ETFs now managing hundreds of billions in AUM, corporate treasuries like MicroStrategy (now Strategy) holding massive BTC positions, and major players like BlackRock, Fidelity, and even sovereign funds piling in, institutions have fundamentally reshaped the space.

This isn't the wild, retail-driven market of 2017 or 2021 anymore. 2026 is widely called the "dawn of the institutional era" by firms like Grayscale, with structural shifts driven by regulatory clarity (e.g., GENIUS Act on stablecoins, expected bipartisan market structure laws), macro demand for alternative stores of value amid fiat concerns, and tokenized real-world assets bridging TradFi and blockchain.

Here's a fully extended, detailed breakdown of all major points in the ongoing debate — pros, cons, realities, and nuances — based on current data, surveys, and community discussions.

Positive Impacts (Pros): Why Many See Institutional Involvement as a Net Win

Massive Legitimacy and Mainstream Integration

Institutions like BlackRock (IBIT holding ~777k–805k BTC), Fidelity, and sovereign funds (e.g., Mubadala, Abu Dhabi) entering validates crypto as a serious asset class. Surveys show 86% of institutions have exposure or plan allocations in 2025–2026, with 68% eyeing BTC ETPs. Larry Fink now calls tokenization "the future of finance," and JPMorgan explores institutional crypto trading. This shifts perception from "speculative casino" to "portfolio staple," attracting advised wealth, pensions, and 401(k)s. Even skeptics like Jamie Dimon have softened, comparing BTC ownership to personal choice.

Improved Liquidity, Stability, and Reduced Extreme Volatility

Institutional capital brings deep, consistent flows. US spot Bitcoin ETFs alone have seen cumulative inflows topping $100–180B+ since 2024, with AUM near $135–191B in some reports. This creates mechanical buying pressure (ETFs bought more BTC than new supply in recent periods) and dampens retail-driven flash crashes. Volatility has normalized compared to prior cycles, thanks to longer holding horizons and better infrastructure (regulated custody, in-kind redemptions). Institutions act as "patient capital," absorbing shocks better than panic-selling retail.

Infrastructure Maturity and Innovation Acceleration

Demand has forced better tools: qualified custodians (e.g., Coinbase Custody, bank launches like BNY Mellon/State Street), compliant products (ETFs, tokenized Treasuries), and bridges to TradFi (e.g., JPMorgan's tokenized deposits, Citi's services). Tokenization of real-world assets (RWAs) is going mainstream, enabling efficient settlement and yield. Regulatory progress (e.g., clearer US/EU rules) reduces uncertainty, fostering sustainable growth over hype.

Enormous Capital Inflows and Price Support

Global institutional AUM is trillions; even 1–5% allocations could drive $90–450B+ inflows. ETFs and corporate treasuries hold ~5–11.5%+ of BTC supply (e.g., ~2.29M BTC combined in some 2025 estimates, now higher). This outpaces mining supply shocks, supporting resilience and potential for $150k–$200k BTC targets in bull scenarios. Institutions treat BTC as "digital gold" for diversification against inflation/debasement.

Broader Ecosystem Benefits

Institutions push for (and benefit from) clearer rules, protecting consumers while enabling growth. Retail gets easier, regulated access via ETFs/ETPs. Convergence of TradFi/DeFi creates crossover products, stablecoin infrastructure, and VC for institutional-grade tools.

Negative Impacts (Cons): Why Crypto Natives Often See It as a Threat

Centralization of Power and Loss of Decentralization Ethos

Crypto was built on "be your own bank" and resisting centralized control. Now, a few players (BlackRock ~3.9% of BTC supply, Fidelity, Grayscale) dominate via ETFs/custody. Critics argue this concentrates influence — coordinated selling or decisions could harm smaller holders. The "soul" of crypto (grassroots, anti-establishment) risks being lost as Wall Street invades.

Higher Risk of Manipulation and Controlled Markets

Deep-pocketed institutions enable large trades, basis trades, volatility selling, and lobbying. Some point to past examples (e.g., funds dumping on retail post-hype, insider advantages). ETFs create "paper BTC" suppressing natural discovery, while market makers control liquidity. Community voices warn of "institutional cycles" where accumulation is slow/sideways, frustrating retail until positions build — then potential violent unwinds if risk rules trigger forced sales.

Increased Correlation with Traditional Markets and Loss of Independence

As crypto integrates into portfolios, it tracks equities/risk sentiment more (correlation surged to 0.75+). No longer a true uncorrelated hedge — it amplifies losses in crashes. Institutions derisk into cash during downturns, not diamond-hand like early holders.

Retail Marginalization and "Frustrating" Price Action

This cycle feels "designed for institutions to take over" — suppressed prices, controlled pumps/dumps, sideways action while they accumulate. Retail often quits or loses, as gains accrue to big players. If wealth concentrates, public sentiment turns fragile; politicians could scapegoat crypto without broad voter support. Retail brings legitimacy/movements; institutions bring liquidity but not votes.

Potential for Future Downturns or Traps

Some forecasts see 2026 cooling (neutral/bearish sentiment post-2025 rally fade, macro tailwinds waning). Basis trade unwinds or custody concentrations (e.g., high reliance on few providers) create hidden risks. Institutions aren't permanent floors — they sell on rules, potentially causing bigger bears.

The Balanced Reality in Early 2026

Adoption is still early: Institutional allocations remain modest (e.g., <0.5–5% of advised wealth/portfolios), though growing fast. Retail still dominates some activity, but institutions drive marginal price action via ETFs.

Hybrid future: Most agree institutions are inevitable and bring maturity, but the debate is about preserving core principles (decentralization, open access) while scaling. Optimists see structural bull (institutional demand > supply, tokenization boom); skeptics fear "Wall Street takeover" diluting crypto's revolutionary edge.

Current trend: 2026 focuses on deeper integration (more ETPs, bank custody, 401(k) access, sovereign adoption), with volatility from macro/tactical flows but overall constructive infrastructure.