Search results for "CIRCLE"

Blockchains Prepare for Quantum Computing Threat by 2030

Circle Research says quantum attacks could break ECDSA and RSA by 2030, forcing blockchains to adopt post-quantum signatures.

Developers are testing post-quantum TLS, validator signatures, and larger keys as regulators push upgrades in the U.S. and EU.

Wallets, addresses, and ZK systems

CryptoFrontNews·1h ago

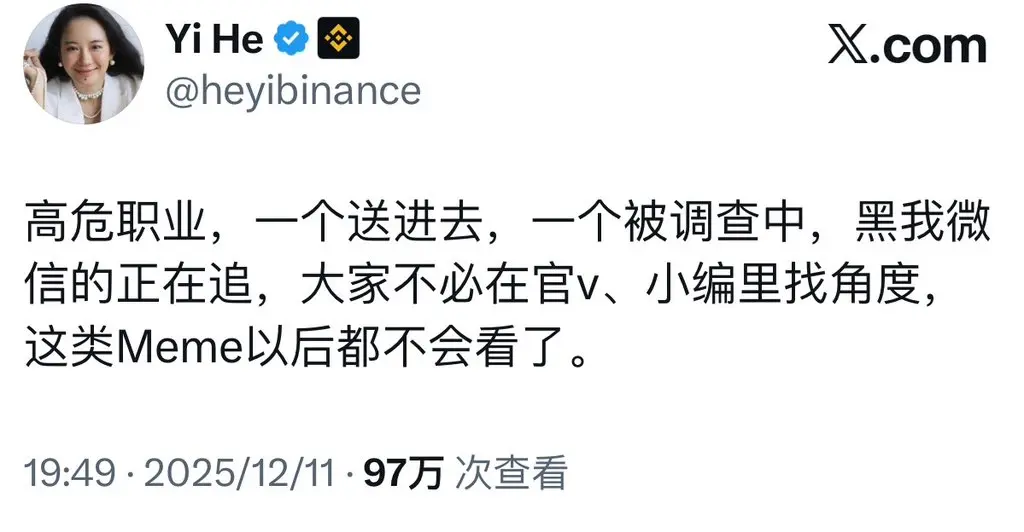

He Yiqi rides a horse, the community mints coins, Alpha is listed: the crypto world also has "Shandong School"

Writing: Curry, Deep Tide TechFlow

There is a rule at the Shandong drinking table: when serving fish, the fish head must face the main seat.

Who it faces, that person is the main character and must be the first to drink. This isn’t written explicitly anywhere, but all Shandong people know it. No one teaches it; they just learn it themselves.

Recently, someone made a diagram called "Crypto Circle Shandong Learning." A group of people sit around eating fish, with He Yi sitting in the main seat, while KOLs, coin listing groups, and editors sit on both sides.

Caption: When Binance lists a coin, which way should the fish head face? He Yi.

On January 1st, He Yi posted a New Year tweet. Riding a white horse, walking along the seaside, with four words:

I’ve come riding my horse.

A pretty good New Year’s blessing—"riding my horse," referring to the Year of the Horse, with a playful pun.

Today, Binance Alpha listed a new coin called "I’ve Come Riding My Horse." It was made by the community and has no direct relation to He Yi.

But look at this chain: the top influencer posts a tweet, the community issues a coin, and Alpha lists it.

PANews·8h ago

IPO illusion ends? Ripple remains private with a $40 billion valuation, aiming for dominance in financial infrastructure

Ripple President Monica Long confidently stated in a Bloomberg interview that the company currently plans to remain private and has no intention of initiating an IPO. This announcement comes shortly after a massive $500 million funding round completed in November 2025, valuing the company at $40 billion.

Ripple has chosen a different path from peers like Circle and BitGo, backed by a healthy balance sheet, a continuously growing $95 billion in payment processing volume, and the rapid rise of its stablecoin RLUSD, which surpassed $1 billion in market cap just seven months after launch. This marks a shift in the crypto industry’s leading players from pursuing the allure of public markets to leveraging private capital and strategic acquisitions to deepen their foothold in the next-generation global financial settlement layer.

XRP-2,18%

MarketWhisper·15h ago

Bloomberg: Discord has secretly filed for an IPO, teaming up with Goldman Sachs and Morgan Stanley to rush for a U.S. stock listing

Popular social app Discord has secretly submitted an S-1 to go public, collaborating with Goldman Sachs and JPMorgan Chase to accelerate the IPO.

(Background: Elon Musk's net worth approaches $750 billion, the first in history! Court restores sky-high compensation, SpaceX IPO sparks imagination)

(Additional background: Tether reiterates: We will return to the US market! Targeting institutional clients, but not following Circle's IPO)

Bloomberg citing sources reports that popular social software Discord has secretly filed an IPO application with the U.S. Securities and Exchange Commission (SEC), expected to list on the US stock market this year. People familiar with the matter told Bloomberg that Goldman Sachs (Goldman Sachs) and JPMorgan Chase

動區BlockTempo·01-07 02:25

SBF lashes out from prison at Western media double standards: Maduro's arrest is illegal, but Honduras JOH's arrest remains silent?

Still incarcerated FTX founder Sam Bankman-Fried (SBF) voiced his opinions on the X platform, titled "A tale of two presidents," sharply criticizing Western liberal media for double standards in the cases of Venezuelan President Maduro and former Honduran President JOH, sparking heated discussion in the international political circle.

(Previous context: Market complaints about CZ, people are beginning to miss SBF)

(Additional background: SBF reveals in prison: I privately donated millions of dollars to the Republican Party, and then I was arrested!)

Still incarcerated FTX founder Sam Bankman-Fried (SBF) posted a series of tweets today (6) through his proxy account @SBF_FTX on the X platform, forming a thread titled "A tale of two

動區BlockTempo·01-06 13:15

OKX's strongest public chain "Friend Circle": Analyzing the 2025 practical performance reports of 7 major chains including OP, Base, and Unichain

By 2025, public blockchains may no longer be the sexy track of grand narratives, because what users truly care about is no longer throughput, the size of funding rounds, or the豪华 backing behind them, but whether there are real users experiencing genuine growth. Are there on-chain transactions with real value? Are there developers who can stay long-term, and applications that can grow beyond the circle? During this year, some public chains have transitioned from "being discussed" to "being used," some have chosen to slow down and refine their underlying capabilities, and others have validated their long-term paths through market fluctuations.

"2025 OKX Public Chain Friends" is not a review of a grand narrative, but an invitation for frontline participants to clarify what has truly been achieved this year, which judgments have been proven correct, and where further adjustments are needed—because these are the core issues that communities and users care about most. By 2025, OKX's collaborations with multiple public chains will no longer be limited to single instances.

PANews·01-04 09:06

The biggest IPO wealth creation movement in history is about to begin: SpaceX, OpenAI, and Anthropic lead the way

SpaceX, OpenAI, and Anthropic are set to go public collectively in 2026, with a total valuation reaching up to 2.5 trillion USD, marking an unprecedented stress test for market funding.

(Background recap: Musk's net worth approaches 750 billion USD, the first in history! Court restores sky-high salaries, SpaceX IPO sparks imagination)

(Additional background: Tether reiterates: We will return to the US market! Targeting institutional clients, but not following Circle's IPO approach)

Table of Contents

Timeline and valuation of three super IPOs

SpaceX: Physical revenue as a backing

OpenAI, Anthropic: AGI valuation undergoes its first public scrutiny

Is the market capable of absorbing this?

2026 is just beginning, Financial Times reports that SpaceX, OpenA

動區BlockTempo·01-04 05:53

Circle Gain Conditional Approval for National Bank

Circle has received conditional approval to establish a federally regulated national trust bank for USDC custody, enhancing transparency and institutional trust. This follows Ripple's similar approval for XRP custody, indicating a growing federal regulatory framework for digital assets.

CryptoFrontNews·01-03 09:06

Circle Mints $1B USDC on Solana as $2B Stablecoin Liquidity Floods Crypto

Circle mints $1B USDC on Solana, boosting on-chain liquidity within hours.

Circle and Tether minted nearly $2B stablecoins.

Solana is the preferred stablecoin settlement network.

Circle mints $1B USDC on Solana during a short window of intensified stablecoin issuance. The move coincides wi

CryptoFrontNews·01-03 04:16

From Circle to Bullish: Crypto Wraps Up 'Bellwether Year' for IPOs

In brief

Circle and Bullish finally went public in 2025 after past failed SPAC attempts, with both seeing strong initial investor interest despite Circle's later momentum slowdown.

Trading platform eToro reached a $5.4 billion valuation at its May Nasdaq debut, while Kraken filed for IPO in

Decrypt·01-01 14:26

California Governor Launches Trump Ally Tracking Site! Names Top 10 Criminal Associates, Crypto Influencers Also Featured

California Governor Newsom recently launched a webpage publicly accusing Trump of pardons related to the cryptocurrency industry, including figures such as Zhao Changpeng, Ulbricht, and others in the crypto circle. This move has sparked concerns over the intertwining of political power and crypto interests, becoming a campaign issue in the upcoming election, highlighting Democratic Party's scrutiny of Trump and his family.

TRUMP-0,27%

CryptoCity·2025-12-31 05:11

Ark 2026 Stablecoin Outlook: Tether and Circle Maintain Market Share Advantage, Innovation Momentum Shifts to Emerging Markets

Ark Investment (ARK Invest) Digital Asset Research Director Lorenzo Valente stated in a recent video that stablecoins have entered a development stage vastly different from the past. From transaction volume scale and institutionalization to their linkage with the U.S. bond system, the positioning of stablecoins is no longer just an extension of annual performance but is beginning to be incorporated into the core discussions of the global financial architecture in 2026.

Transaction volume continues to expand steadily, and structural growth trends are taking shape

Valente indicated that by the end of 2025, the monthly transfer volume of stablecoins has stabilized at 2 – 2.5 trillion USD, with no significant decline since the beginning of the year. He pointed out that this continued expansion of monthly scale, despite a high baseline, demonstrates that stablecoins have entered a phase of structural growth rather than short-term cycles.

Against this backdrop, market focus has shifted from "whether it surpasses Visa" to stable

ChainNewsAbmedia·2025-12-31 03:14

2026 Financial Turning Point: Crypto Banks, Stablecoins, and AI Payments Going Mainstream

Although short-term cryptocurrency prices fluctuate frequently, the underlying logic of digital finance is undergoing significant structural changes. As the regulatory environment in the United States becomes more friendly, cryptocurrency companies have begun to penetrate the core of the traditional banking system from the periphery, seeking national licenses and direct integration with federal payment systems. The status of stablecoins as a medium of value exchange is becoming increasingly solidified, and at the same time, the rise of artificial intelligence (AI) agents is expected to change retail payment pathways. The integration of automated purchasing behavior with blockchain technology will become a key indicator to watch in 2026.

Regulatory Breakthrough: Crypto Startups Enter the National Banking Arena

After the Trump administration's regulatory policy towards cryptocurrencies shifted 180 degrees to a friendly stance, five cryptocurrency companies, including Circle and Ripple, have received preliminary approval for banking licenses. Silicon Valley investor Peter Thiel's supported startup bank Ereb

ChainNewsAbmedia·2025-12-31 01:24

From Circle to Bullish: Crypto Wraps Up 'Bellwether Year' for IPOs

In brief

Circle and Bullish finally went public in 2025 after past failed SPAC attempts, with both seeing strong initial investor interest despite Circle's later momentum slowdown.

Trading platform eToro reached a $5.4 billion valuation at its May Nasdaq debut, while Kraken filed for IPO in

Decrypt·2025-12-30 14:22

Gate Founder Dr. Han 2025 Year-End Open Letter: Web3 Is About to Change Everyone's Lifestyle

Gate founder Dr. Han stated in the 2025 year-end open letter that Web3 is moving from a niche tech circle to real-world applications. On Gate's 12th anniversary, with the second highest trading volume worldwide and a reserve of 11.676 billion USD, it is the platform with the most disclosed reserve currencies. Dr. Han believes that the integration of Web3 with AI, the surge in on-chain activities, and the normalization of crypto payments are trends marking the turning point for Web3's maturity.

ETH-0,91%

MarketWhisper·2025-12-30 07:11

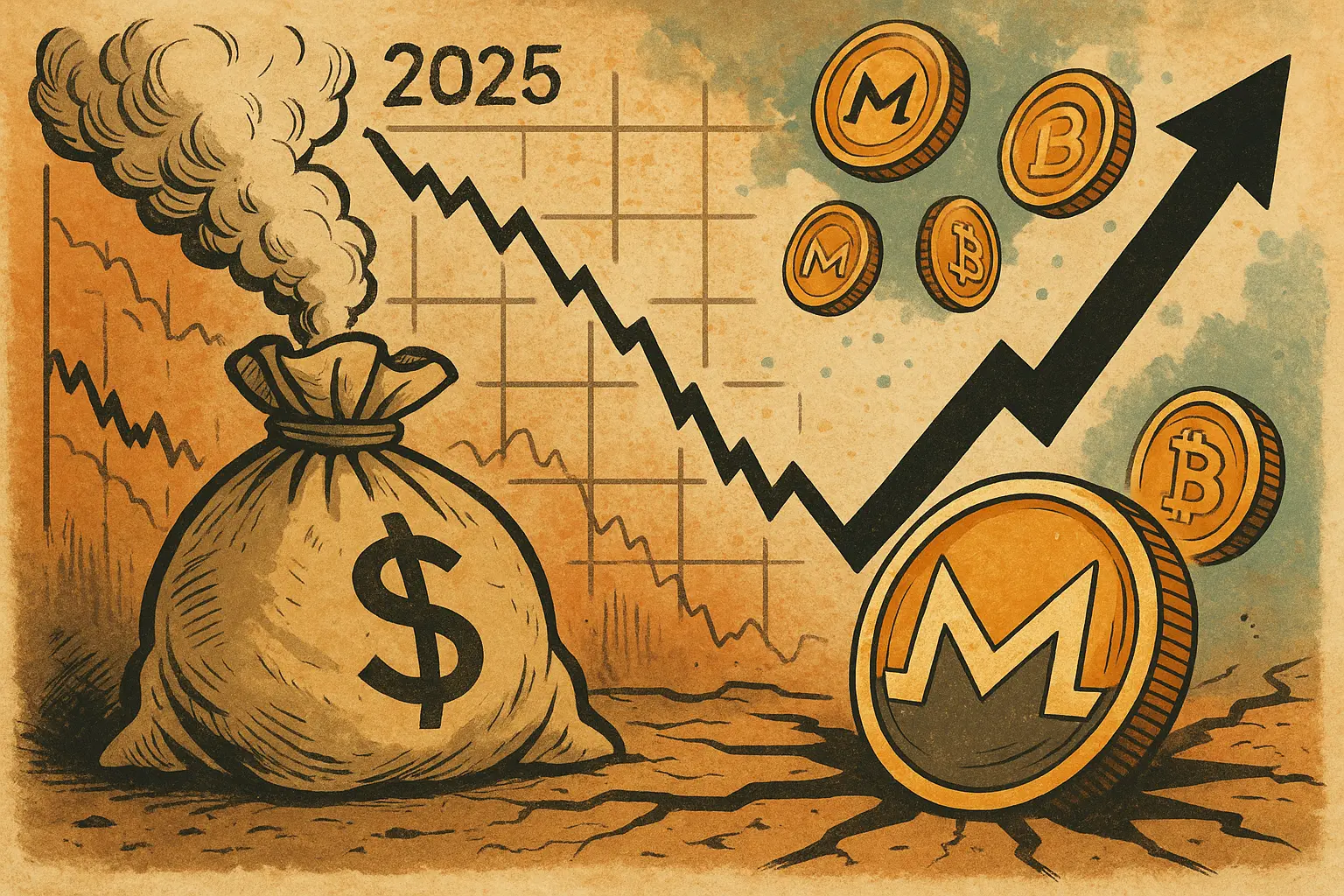

A Review of the 2025 Cryptocurrency Market: $290 Billion Market Cap Evaporated, Privacy Coins Soar 12 Times

The cryptocurrency market in 2025 shrank from 3.26 trillion to 2.97 trillion, evaporating 290 billion USD. The sector is highly polarized: privacy coins ZEC surged 1,200%, DASH increased 6 times; Bitcoin-related stocks MicroStrategy's stock price dropped 47%. On the policy front, the 《GENIUS Act》 was implemented, and Circle's IPO surged 9 times. October saw the largest liquidation in history with 19 billion USD in leveraged margin calls, and December entered a silent bear market.

MarketWhisper·2025-12-29 09:17

The Rise and Fall of FTX’s Ryan Salame: From Crypto Power Broker to Federal Inmate

Ryan Salame, once a powerful co-CEO of FTX’s Bahamian subsidiary, now serves a 90-month sentence at FCI Cumberland, marking a stunning personal and legal collapse. His journey from a traditional finance background at Circle to the pinnacle of Sam Bankman-Fried’s inner circle—and finally to federal prison—encapsulates the hubris, regulatory neglect, and illicit political maneuvering that doomed the FTX empire. Salame’s guilty plea to operating an unlicensed money-transmitting business and orchest

POWER-4,54%

MarketWhisper·2025-12-29 07:43

AI Circle Level 9 Earthquake! OpenAI Founder Karpathy Breaks Down Late at Night: I'm Falling Behind

Former OpenAI founder Andrej Karpathy posted on X: "As a programmer, I've never felt so behind." He admits that new technologies over the past year could boost capabilities by 10 times, but falling behind feels disappointing. The case of Claude Code founder Boris Cherny is even more shocking: 259 PRs completed in 30 days, 80,000 lines of code, all generated by AI.

MarketWhisper·2025-12-29 07:39

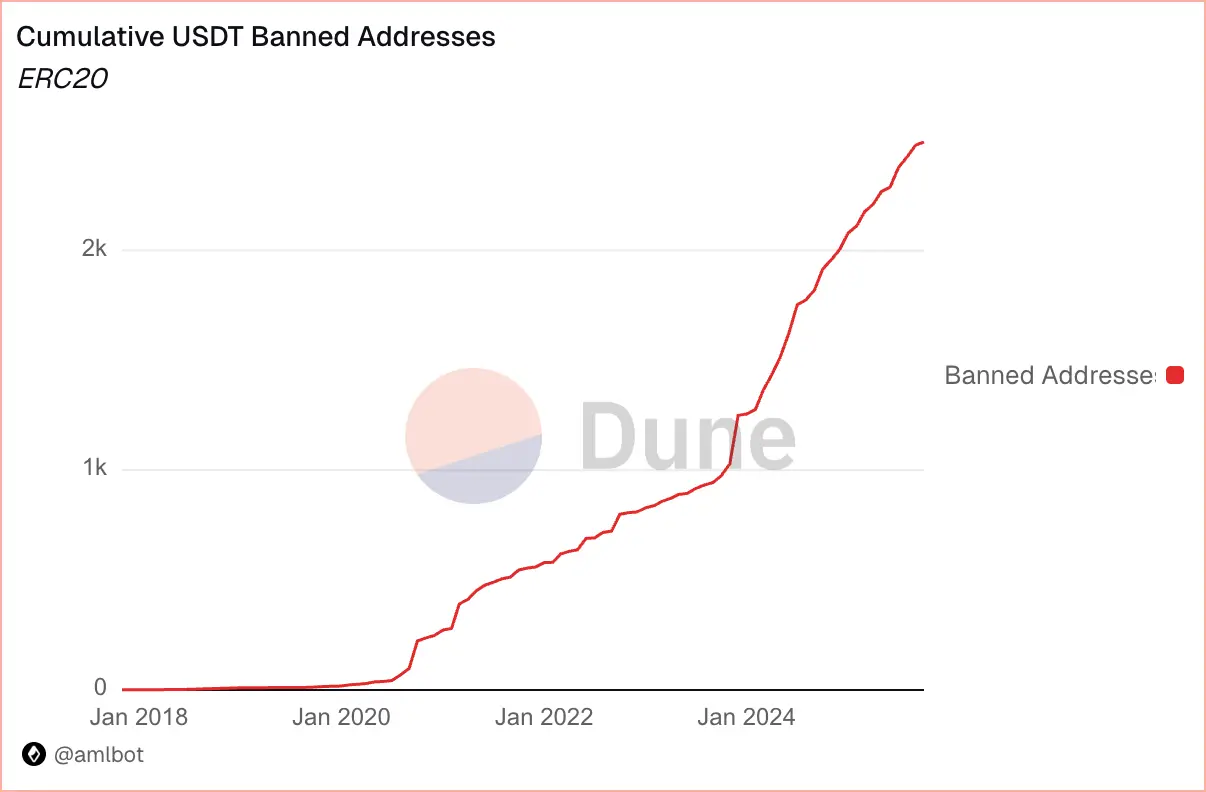

Tether freezes over 3.29 billion USDT, a contrasting approach to Circle

A recent AMLBot study reveals that from 2023 to 2025, Tether froze over $3.29 billion USDT across Ethereum and Tron, blacklisting 7,268 addresses, significantly outpacing Circle's USDC. This highlights contrasting enforcement philosophies shaping the stablecoin market.

TapChiBitcoin·2025-12-29 02:34

Binance Dominance Faces Scrutiny Amid Crypto Megadeals Surge

88% distrust Binance, yet its liquidity still drives altcoin price discovery, creating systemic market risks.

Coinbase, Kraken, and Ripple led 2025 megadeals, reshaping institutional crypto trading and hedging infrastructure.

Circle, Bullish, and Figure IPOs highlight Wall Street’s

CryptoFrontNews·2025-12-28 22:06

December 29 Work Commute Podcast — Adjusting in the political landscape... Focus on political circle buyouts and alternative token volatility

December 29, 2025, the cryptocurrency market experienced volatility, with Bitcoin slightly falling to $87,485 and Ethereum rising modestly to $2,930. The total market capitalization is $2.9638 trillion, with DeFi lock-up value decreasing. Meanwhile, the stablecoin market cap grew significantly. Liquidation data indicates market instability. Increased acceptance of digital assets by the political sector has raised concerns, and Hyperliquid is about to distribute tokens.

TechubNews·2025-12-28 21:25

From Circle to Bullish: Crypto Wraps Up 'Bellwether Year' for IPOs

In brief

Circle and Bullish finally went public in 2025 after past failed SPAC attempts, with both seeing strong initial investor interest despite Circle's later momentum slowdown.

Trading platform eToro reached a $5.4 billion valuation at its May Nasdaq debut, while Kraken filed for IPO in

Decrypt·2025-12-28 14:12

From Circle to Bullish: Crypto Wraps Up 'Bellwether Year' for IPOs

In brief

Circle and Bullish finally went public in 2025 after past failed SPAC attempts, with both seeing strong initial investor interest despite Circle's later momentum slowdown.

Trading platform eToro reached a $5.4 billion valuation at its May Nasdaq debut, while Kraken filed for IPO in

Decrypt·2025-12-27 14:06

Brooklyn man in New York impersonates Coinbase customer service staff and falls victim to social engineering phishing scam, losing 16 million and being charged

A typical social engineering phishing scam has occurred again in the cryptocurrency circle. The Brooklyn District Attorney's Office in New York recently announced that a 23-year-old man from Sheephead Bay, Brooklyn, Ronald Spektor, is suspected of stealing a total of up to $16 million worth of cryptocurrencies from approximately 100 Coinbase users through online phishing and impersonation of Coinbase customer service representatives. He has been charged and faces multiple serious criminal charges.

Suspect impersonates Coinbase customer service claiming accounts were hacked

Prosecutors stated that Spektor's online nickname is "lolimfeelingevil," believed to be the mastermind behind this scam. He impersonated Coinbase customer service via email, text messages, or messaging apps, falsely claiming that victims' accounts had been "hacked."

ChainNewsAbmedia·2025-12-27 09:48

Stablecoin News: Trump endorsement pushes USD1 into the top five, who will dominate the stablecoin arena in 2025?

2025 is a milestone year in the stablecoin industry. Driven by macroeconomic positive factors such as the passing of the GENIUS Act and Circle's successful IPO, the total global supply of USD stablecoins surged by over $100 billion, reaching $314 billion. However, market growth is not evenly distributed. According to the key metric of "circulation velocity," a fierce reshuffle is underway. USDT leads with an absolute advantage, boasting a circulation velocity of 166. Ripple's RLUSD has emerged as a dark horse in second place, while USD1, endorsed by the Trump family, entered the top five just months after its launch, demonstrating remarkable market penetration and topicality. This ranking not only reveals the activity levels of trading but also reflects the deeper trend of the stablecoin sector evolving towards compliance, differentiation, and politicization.

MarketWhisper·2025-12-26 05:33

Christmas Eve disguised as Circle official releases new products, media rushing to report instead fuels the spread of fake news

Fake Christmas Eve news impersonating Circle introduces CircleMetals and fictitious tokens, misleading users to connect wallets. Circle urgently clarifies and denies, criticizing media for rushing and amplifying scam risks.

Fake news released on Christmas Eve, disguising as official products to mislead the market

-------------------

During Christmas Eve, a press release claiming that stablecoin issuer Circle launched a new platform called "CircleMetals," offering tokenized gold and silver trading, circulated on social media and multiple crypto information channels.

The press release states that users can perform 24-hour exchanges between $USDC and the so-called "$GLDC" gold token and "$SILC" silver token on the CircleMetals platform, claiming liquidity is sourced from COMEX.

USDC0,02%

CryptoCity·2025-12-26 03:06

Top 15 Projects By Total Revenue in 2025: Tether and Circle Remain Forefront

LunarCrush's analysis for 2025 highlights Tether as the top revenue-generating crypto project with $5.2B, followed by Circle and Hyperliquid. Other notable projects include Pump Fun, Ethena, and Aave, with varying active addresses and total value locked (TVL).

HYPE-2,35%

BlockChainReporter·2025-12-26 01:03

Why Tether Froze 30x More Crypto Than Circle: AMLBot Report

_Tether froze $3.3B in crypto assets, 30x more than Circle’s $109M, using proactive methods like freeze, burn, and reissue._

A recent AMLBot report shows that Tether froze around $3.3 billion in crypto assets between 2023 and 2025. This is in stark contrast to Circle’s $109 million.

Tether’s a

LiveBTCNews·2025-12-25 13:35

About the 2025 Crypto Memory: Ups and Downs, Refinement, and Integration

Written by: Yangz, Techub News

Jingle bells, jingle bells, jingle all the way...

When this familiar holiday tune rings out on the streets and alleys, foreigners' New Year has arrived, and 2025 is entering the countdown. If I had to use one word to summarize the extraordinary year in the crypto world, the first that comes to mind is: "Ups and downs"; as for which narratives left a deep impression on me, the ones that come to mind are: the rollercoaster journey of DAT under Strategy's leadership from frenzy to silence, the wave of crypto company IPOs and stablecoin craze sparked by Circle going public, the market's enthusiasm and calmness after the approval of altcoin ETFs, and also

TechubNews·2025-12-25 11:39

Tether freezes 30x more value than Circle as stablecoin blacklists surge

Tether and Circle have starkly different policies on freezing stablecoin addresses, with Tether freezing $3.3 billion across 7,268 addresses, while Circle froze $109 million across 372 addresses. Tether's proactive model contrasts with Circle's more restrained legal approach.

Cryptonews·2025-12-25 10:12

Sei’s Market Grid Maps Onchain Capital Infrastructure

Wormhole's Market Infrastructure Grid is now live on the Sei Network, enabling on-chain capital infrastructure and liquidity. Major players like Tether, Circle, PayPal, and Revolut enhance stablecoin and payment foundations, while tokenization providers support cross-network access and asset utilization.

CryptoFrontNews·2025-12-25 09:01

December 25 Work Commute Podcast — Bitcoin Volatile Market... $120 million Liquidated, Short Positions Concentrated

December 25, 2025, the overall cryptocurrency market is weak, with Bitcoin down 0.23% and Ethereum slightly up 0.13%. Major altcoins generally declined, with a market capitalization of approximately $2.9544 trillion, while liquidated leveraged positions reached $122.2 million, with short positions dominating. Trend Research increased its holdings by 46,379 Ethereum, clarifying false rumors about Circle issuing gold/silver tokens.

BTC-0,03%

TechubNews·2025-12-24 23:08

Circle enters the "tokenized precious metals" market! CircleMetals launches USDC exchange for tokenized gold and silver services

USD Stablecoin USDC Issuer Circle Announces Expansion of Its Digital Currency Platform into the "Tokenized Precious Metals" Market: Circle, through its new platform CircleMetals.com, launches services for direct exchange of USDC for tokenized gold (GLDC) and tokenized silver (SILC).

(Background: US OCC Green Light! Ripple, BitGo, Circle, and five other Crypto giants receive "Conditional Approval" for trust bank licenses)

(Additional background: Circle partners with Aleo to launch privacy stablecoin "USDCx," with transaction records and wallet addresses fully hidden)

Table of Contents

GLDC and SILC Focus on Instant Exchange and Precious Metal Exposure

Liquidity Link

動區BlockTempo·2025-12-24 16:05

Is RWA moving towards the "Equity Era"? The behind-the-scenes of Securitize, Ondo, and Coinbase taking action simultaneously

Text: RWA Knowledge Circle

Editor: RWA Knowledge Circle

Introduction

Recently, a phenomenon has emerged in the RWA community that is worth pondering repeatedly. Securitize, the number one in RWA market share, third-place Ondo, and leading digital asset exchanges

PANews·2025-12-24 09:04

Circle Announces €300M Milestone for Euro Stablecoin EURC

_Circle reports stablecoin EURC reaching €300 million circulation, highlighting MiCA compliance, rising euro stablecoin demand, and expanding global digital finance use._

Circle has announced a major milestone for its euro-backed stablecoin, EURC. The company confirmed that circulation

LiveBTCNews·2025-12-24 07:50

Encryption Tycoons 2025 Wealth Fluctuation Record: Some people's fortunes doubled while others' assets declined by 50%.

The year 2025 is a dramatic collision of narrative and reality for the crypto assets industry, marking a significant divide in wealth. Despite Bitcoin's price retreating about 6% from its peak earlier in the year, the Bloomberg Billionaires Index shows a stark contrast in the fortunes of industry leaders: stablecoin giants have emerged as the biggest winners, with Circle founder Jeremy Allaire's wealth soaring by 149%, and Tether chairman Giancarlo Devasini's net worth rising 60% to $13.2 billion; meanwhile, the once-prominent "BitShares" pioneer Michael Saylor saw his fortune shrink by 37%, and the Winklevoss twins' wealth plummeted by 59%. Behind this wealth reshuffle lies a profound reflection of the industry's transformation from reckless growth to compliance and foundational services.

MarketWhisper·2025-12-24 01:35

Crypto Payment Funding Hits $6.2B in 2025 Led by Circle, Ripple

Funding for crypto payment companies surged sharply in 2025. Industry data shows firms in the payments sector raised a combined $6.2 billion during the year. This marks a jump of roughly 1,048% compared with $540 million raised in 2024. The data was compiled by a payments focused analyst using

Coinfomania·2025-12-23 08:31

Circle Mints Another $500 Million USDC on Solana

Circle's $500M USDC mint on December 23, 2025—pushing Solana totals to $18B since October—confirms surging demand for efficient, regulated stablecoins.

CryptopulseElite·2025-12-23 05:52

Coinbase Super App Bid, Saylor $1B Buy, and More — Week in Review

This week, Coinbase expanded its services, Saylor invested nearly $1 billion in Bitcoin as prices fell, Circle acquired Interop Labs raising concerns, and over 125 groups advocated for stablecoin rewards amid regulations. Additionally, Ripple's RLUSD surged in market cap.

Coinpedia·2025-12-21 21:19

Making money in the crypto world, and then what? Analysis of trader Vida's mindset after 00, aiming for the top twenty Chinese billionaires.

In the crypto assets market, stories of young trading prodigies becoming wealthy overnight only to quickly fall from grace are common. However, 25-year-old trader Vida deliberately distances himself from such narratives. He openly states that he has never considered himself a trading genius, nor does he stake his life on a lone hero-style high-leverage gamble.

People in the coin circle often do not regard money as money, and Vida always has a sense of awe towards money.

Vida positions himself as an entrepreneur and operator of a proprietary trading firm, rather than an independent trader working alone. He emphasizes that those who can truly survive in the market for the long term, and even reach the level of top players worth hundreds of millions of dollars, mostly rely on teamwork, information collaboration, and pack tactics, rather than individual heroism. He states bluntly: the market likes stories of striking it rich overnight, but reality often does not operate that way.

In his view, traders who can withstand severe fluctuations often reach a stage in life where they do not consider money as

ChainNewsAbmedia·2025-12-21 16:39

Acquisition of the Axelar team but selling the Token: Circle "wants people, not coins" sparks controversy.

Circle announced the acquisition of the development team Interop Labs from Axelar Network, aiming to strengthen its cross-chain infrastructure. This acquisition only involves the team and technology, excluding Axelar and its token AXL, which has sparked dissatisfaction and discussion among holders. Supporters believe this is the norm in the market, but critics accuse the token holders of being excluded. The core issue lies in the positioning of the token within the capital structure, which requires further exploration of its rights and value.

LINK-0,95%

区块客·2025-12-21 07:12

24 projects raised $335.1 million RedotPay raised $107 million

Organized by: Golden Finance

The largest round of financing this week

RedotPay raised $107 million in Series B funding, with investors including Goodwater Capital, Pantera Capital, Blockchain Capital, Circle Ventures, and Sequoia China (now HongShan).

RedotPay is a fintech company based in Hong Kong that specializes in stablecoin payments, dedicated to enabling cryptocurrency to fiat transactions globally through cards, wallets, and payment infrastructure. The company is founded by Michael Gao and Jonathan.

金色财经_·2025-12-21 06:56

S&P Global Confirms Strong Stability for USDC Stablecoin Issued by Circle

S&P Global Ratings has reaffirmed its strong assessment of USDC, one of the world’s largest U.S. dollar-pegged stablecoins, confirming its ability to maintain parity with the dollar despite ongoing regulatory and structural scrutiny in the global stablecoin market.

In its latest Stablecoin

USDC0,02%

CryptoDaily·2025-12-20 18:10

Acquiring the Axelar team but abandoning the tokens: Circle's "want people but not coins" sparks controversy

Original: Odaily Planet Daily

Author: Azuma

On the early morning of December 16, the stablecoin giant Circle officially announced that it has completed the agreement signing, acquiring the core talent and technology of the initial development team of cross-chain protocol Axelar Network, Interop Labs, to advance Circle's cross-chain infrastructure strategy and help Circle achieve seamless, scalable interoperability on its core products such as Arc and CCTP.

This is another typical case of industry giants acquiring high-quality teams, seemingly a win-win situation, but the key issue lies in—Circle explicitly mentioned in the acquisition announcement that this transaction only involves the Interop Labs team and its proprietary intellectual property, while Axelar Network

区块客·2025-12-20 07:10

Circle Drives USDC Expansion as Enterprise Platforms Shift From Trading to Real-World Usage

Circle Internet Financial is scaling USDC by embedding the dollar-backed stablecoin into real-world payments, treasury, and software platforms worldwide, accelerating enterprise adoption and positioning digital dollars as core financial infrastructure.

Circle Expands USDC Through Global

USDC0,02%

Coinpedia·2025-12-20 07:09

Citigroup remains optimistic about crypto stocks, Circle continues to be the top choice

Citigroup lowers price targets for many crypto stocks due to industry decline but remains optimistic in the long term. Circle's USDC is the top choice. Price targets for some stocks like BLSH and MSTR have also been lowered.

TapChiBitcoin·2025-12-20 04:57

S&P Global Confirms Strong Stability for USDC Stablecoin Issued by Circle

S&P Global Ratings has reaffirmed its strong assessment of USDC, one of the world’s largest U.S. dollar-pegged stablecoins, confirming its ability to maintain parity with the dollar despite ongoing regulatory and structural scrutiny in the global stablecoin market.

In its latest Stablecoin

CryptoDaily·2025-12-19 18:05

Intuit partners with Circle to bring USDC into TurboTax and QuickBooks

Intuit has partnered with Circle to integrate USDC stablecoin across its product ecosystem, enhancing financial services like tax payments. This collaboration aims to provide faster, cost-effective transactions but details about the blockchain implementation will be revealed in 2026.

USDC0,02%

TapChiBitcoin·2025-12-19 00:33

Intuit to Integrate USDC Stablecoin Across TurboTax, QuickBooks

Intuit has partnered with Circle for a multi-year agreement to integrate USDC into its products, enhancing tax refunds and payments. The blockchain for USDC settlement is not yet disclosed.

USDC0,02%

Decrypt·2025-12-18 19:03

"Female Stock Goddess" contrarian buying of crypto concept stocks! Ark invests $55 million in BitMine and Coinbase

Amid the decline in the Crypto market, Ark Invest once again demonstrates its buy-the-dip strategy, investing over $55 million to increase holdings in Crypto concept stocks such as BitMine, Coinbase, and Circle. Although the stocks purchased declined on the same day, Cathie Wood still believes that market volatility is a short-term phenomenon and the long-term trend remains unchanged.

ARK0,48%

区块客·2025-12-18 07:19

Load More