Search results for "MYTH"

FXRP Data Shatters the Myth That XRP Holders Avoid DeFi

Flare Networks challenges the perception of XRP holders as passive investors. New data shows significant DeFi activity with 79.7% of FXRP's supply locked in Flare protocols, indicating long-term engagement despite market downturns. This trend suggests a shift toward utility-driven growth in the XRP community.

XRP5,74%

Coinfomania·2025-12-30 12:10

Tokenized stock market capitalization surpasses $1.2 billion, reaching a new high, replicating the "stablecoin myth" and entering the fast lane

According to industry data platform Token Terminal, the total market capitalization of tokenized stocks has surpassed $1.2 billion, reaching a record high, with particularly significant growth in September and December 2025. This rapid momentum has been compared by industry experts to "stablecoins in 2020" and the "boom of early DeFi," marking a shift where blockchain technology is moving beyond mere cryptocurrency trading toward a systematic reshaping of global core financial assets. This round of growth is driven by substantial entry from traditional financial giants like Nasdaq and BlackRock, as well as the regulatory clarity brought by the US GENIUS Act. Tokenized stocks are no longer a fringe concept; they are becoming the most representative frontier in the trend of bringing real-world assets onto the blockchain.

MarketWhisper·2025-12-30 01:58

Tokenized stocks explode! 1.2 billion market cap replicates the 300 billion stablecoin myth?

Tokenized stock market capitalization has soared to $1.2 billion, and Token Terminal compares it to the "stablecoin moment of 2020." This comparison is highly impactful: in 2020, stablecoin market cap was only a few hundred billion dollars, and now it has developed into a $3 trillion industry. If tokenized stocks replicate this growth trajectory, the future market potential will be beyond imagination. Nasdaq has submitted an application to the U.S. Securities and Exchange Commission to offer tokenized stocks on its platform.

MarketWhisper·2025-12-30 01:54

There Is No XRP Supply Shock, Top Analyst Says - U.Today

A market analyst debunks the "1.5 billion" XRP supply shock myth, asserting XRP's liquidity and the XRP Ledger's dynamic order books. Current data shows over 16 billion XRP available on exchanges, countering claims of dwindling supply.

XRP5,74%

UToday·2025-12-29 05:34

After the meme coin frenzy subsided, Pump.fun faces five major allegations including scam, fraud, and money laundering

This article is reprinted from Deep潮, original title: Pump.fun Litigation Year in Review: Mysterious Informants, Internal Records, and Unrevealed Answers

The core accusations are more than just "losing money."

In January 2025, the meme coin market was at the peak of frenzy. As U.S. President Trump announced the TRUMP coin, an unprecedented speculative frenzy swept through, and the wealth creation myth of "hundredfold coins" captured the market's attention.

At the same time, a lawsuit against the Pump.fun platform was quietly initiated.

Fast forward to recent days.

Alon Cohen, co-founder and COO of Pump.fun, has not spoken on social media for over a month. For someone who has always been active and constantly "surfing and watching" online, this silence is particularly noticeable. Data shows that Pump.fun's

ChainNewsAbmedia·2025-12-25 06:36

What happened to the crypto market? Among the 118 Virtual Money issued in 2025, 85% fell below the issue price.

Once regarded as a shortcut to instant wealth, the cryptocurrency "Token Generation Event" (TGE) officially saw its myth shattered in 2025. According to data from Memento Research analyst Ash, the vast majority of new tokens have performed extremely poorly after listing this year, making it a nearly endless slaughter for secondary market investors.

Shanzhai coins are no longer a path to wealth, data reveals that 4 out of 5 Tokens are losing money.

The research report tracked 118 major Token Generation Events (TGE) in 2025 and compared the fully diluted valuation (FDV) at launch with the current valuation, revealing shocking results:

High rate of breaking issue: Up to 84.7% the price of tokens (100/118) is currently below the valuation at the time of listing.

High probability of loss: This means that for every 5 new coins listed, about 4 will lead to investor losses.

ChainNewsAbmedia·2025-12-22 18:52

PIPPIN Wealth Creation Myth! Early trader accumulation reveals 20x returns

Even as the crypto market faces volatility and corrections, individual traders continue to profit from high-conviction bets. Lookonchain on-chain data shows that a Solana-based trader (wallet address BxNU5a) turned an initial investment of about $180,000 into approximately $3.6 million in less than two months, achieving a 20x return through early accumulation of AI agent tokens PIPPIN.

MarketWhisper·2025-12-18 05:04

XRP copying the 2017 script? Traders: After breaking through, replay the 1440% surge myth

XRP price has been hovering around $2 for several days, forming a critical technical stalemate. From the daily chart, the sharp decline over the past few months has created a descending wedge pattern, with the price narrowing around $2. Well-known trader Steph is Crypto pointed out that the current trend is remarkably similar to the accumulation phase in 2017, when XRP surged from $0.25 to $3.84, a gain of 1440%.

XRP5,74%

MarketWhisper·2025-12-16 00:54

After the Wealth Effect Disappears — The Myth or Lament of Decentralization

In God Protocol We Trust

Ethereum is shifting towards L1 scaling and privacy, with the US stock backend engine DTCC holding a trillion dollars and beginning to migrate on-chain. It seems a promising new wave of cryptocurrency is on the horizon.

But the profit logic for institutions and retail investors is completely different.

Institutions have extremely high tolerance in time and space, with ten-year investment cycles and leverage arbitrage with tiny spreads, which are far more reliable than retail investors' fantasies of a thousand-fold return in one year. In the upcoming cycle, it is very likely that on-chain prosperity, institutional influx, and retail pressure will occur simultaneously.

Please do not be surprised; the spot ETF and DAT for BTC, the four-year cycle of BTC, the disappearance of altcoin seasons, and the Korean trend of “abandoning coins for stocks” have already repeatedly validated this logic.

On 10·11

金色财经_·2025-12-13 04:56

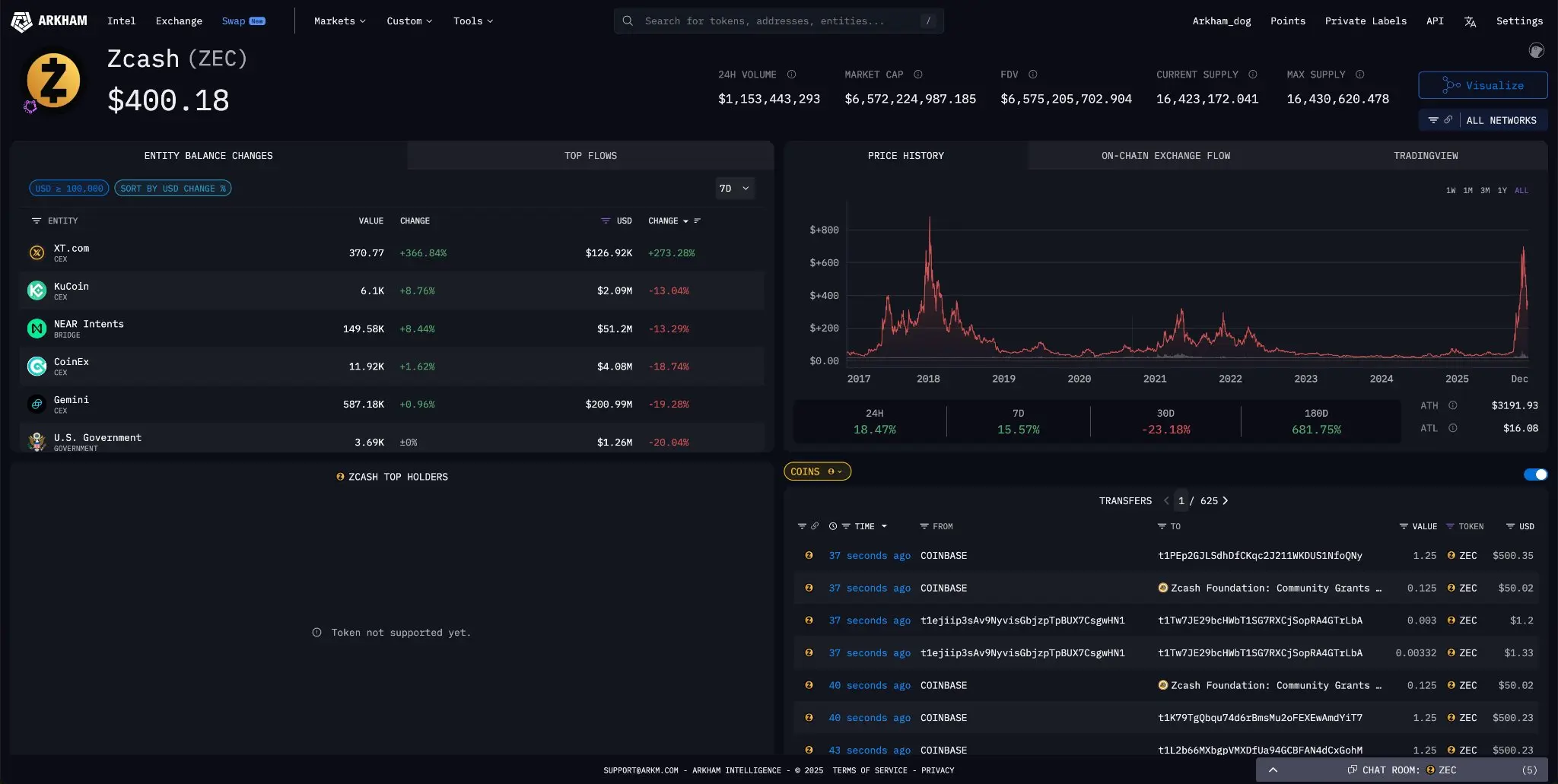

Zcash Privacy Myth Shattered: Arkham Identifies 53% of Transactions

Arkham identified 53% of all Zcash activity worth $420B, linking 37% of ZEC balance ($2.5B) to known entities without cracking encryption. Using behavioral patterns and exchange data, this challenges Zcash's privacy narrative as real-world interactions weaken anonymity.

MarketWhisper·2025-12-10 08:19

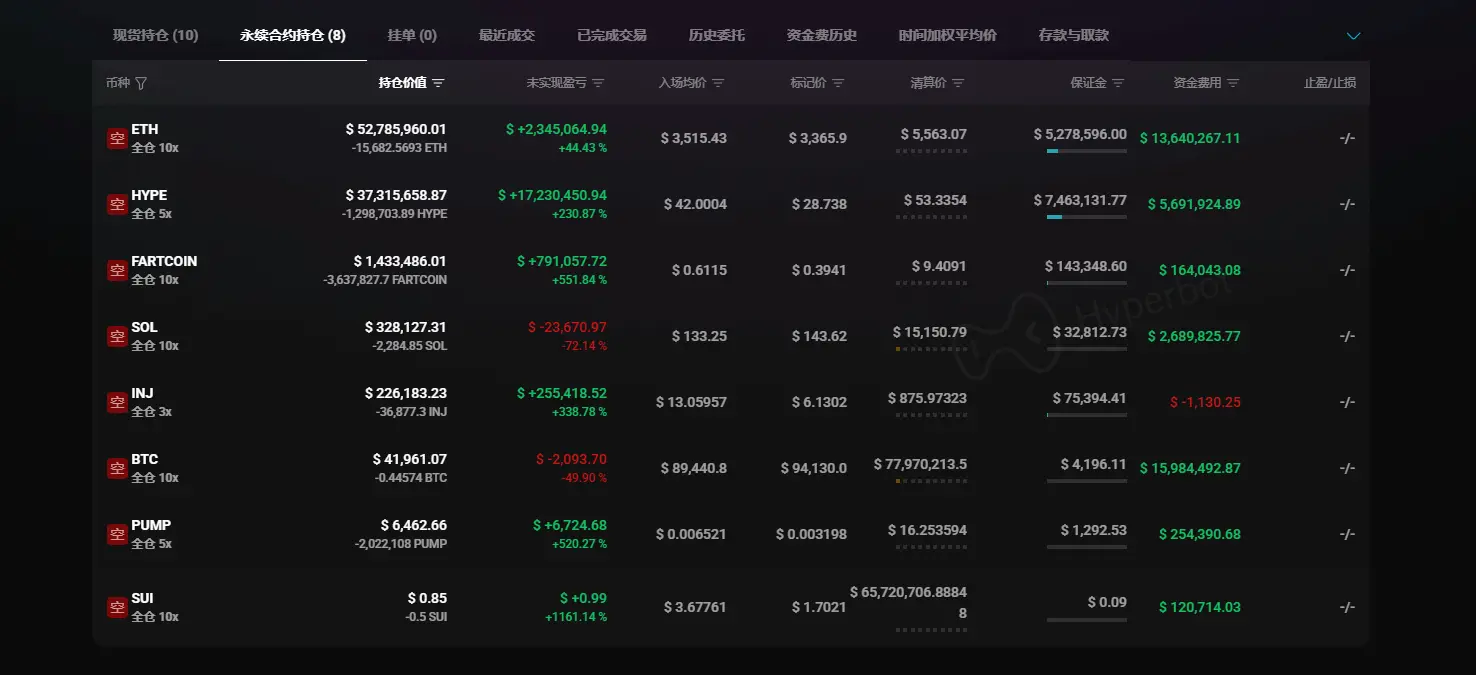

Hyperliquid Giant Whale Record: Someone turned over overnight, and someone died from obsession

Author: Frank, PANews

Whales on Hyperliquid became the focus of on-chain transactions. Here, the drama of getting rich and returning to zero is staged every day.

Digging deeper into the on-chain data, these giant whales show the style of thousands of people, some are "reverse indicators" who hold a lot of money but have been defeated repeatedly, some are "snipers" who have been lurking for half a year just to kill with one blow, and some are "cold-blooded machines" who use algorithms to harvest retail investors every second.

The data strips these big players of their mysterious coat. PANews selected the five most representative addresses on Hyperliquid: including the famous "Big Brother Maji", a mysterious person suspected of having inside information, a market maker with billions of capital, and the recent "turnaround myth" and "iron head army". Through their thousands of transaction records, we seem to be able to find our own picture in these portraits.

Brother Maggie: Win

PANews·2025-12-10 05:18

Arkham exposes Zcash’s “privacy nakedness”—why did Wall Street funds breathe a sigh of relief?

Arkham overturns the Zcash (ZEC) privacy myth: 53% of transactions have been tagged, yet no crash has occurred. The market is re-evaluating the compliance value of "partial transparency."

(Previous context: Arkham refutes Michael Saylor: has identified 87% of Strategy's Bitcoin addresses)

(Background: Arkham launches derivatives exchange! Early points may be airdropped as $ARK, driving a 17% surge in a single day)

The US federal government is cracking down on gray assets through on-chain data; Prince Group's Chen Zhi had 127,000 BTC confiscated, and Qian Zhimin was caught laundering 60,000 BTC, prompting funds to flow into Zcash (ZEC) for refuge. Prices surged to $750 in early December, and shielded transaction volume skyrocketed 6x in 24 hours. However, today (December 9), Ark...

動區BlockTempo·2025-12-09 09:13

Where will the money for the next bull market come from?

Author: Cathy

Bitcoin has dropped from $126,000 to the current $90,000, a plunge of 28.57%.

The market is in panic, liquidity has dried up, and the pressure of deleveraging is suffocating everyone. According to Coinglass data, there was a significant wave of forced liquidations in the fourth quarter, and market liquidity has been severely weakened.

But at the same time, some structural positives are gathering: the US SEC is about to introduce “innovation exemption” rules, expectations for the Fed entering an interest rate cutting cycle are growing stronger, and global institutional channels are rapidly maturing.

This is the biggest contradiction in the current market: things look grim in the short term, but the long-term outlook seems promising.

The question is, where will the money for the next bull market come from?

Retail investors’ money is no longer enough

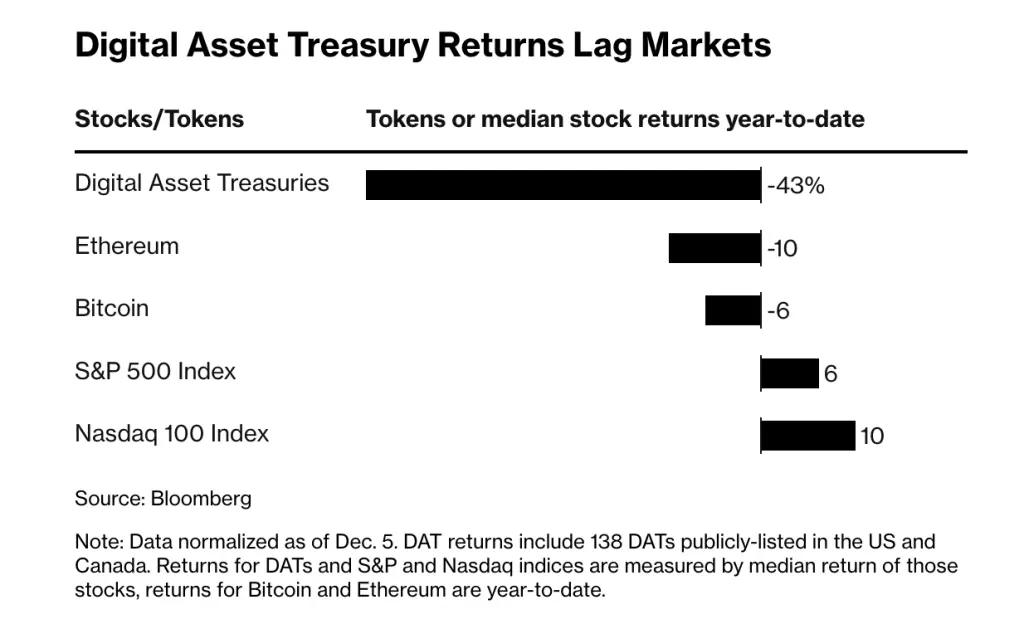

Let’s start with a myth that is being shattered: Digital Asset Treasury companies (DATs).

What are DATs? Simply put, they are public companies that issue stocks and debt

金色财经_·2025-12-09 06:12

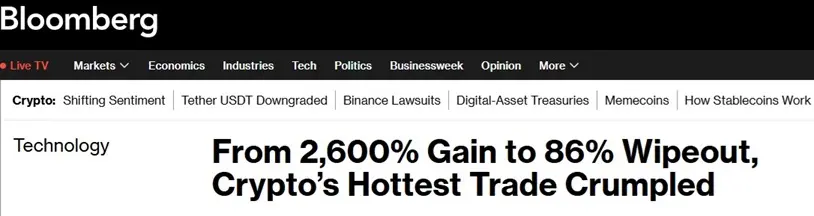

Myth shattered! The wave of public companies holding crypto assets collapses, stock prices plummet by 86%—what's behind it?

According to Bloomberg, the "digital asset treasury" craze that swept the capital markets in the first half of 2025 is collapsing at an astonishing rate. Data shows that among DATs companies in the US and Canada—which converted large amounts of corporate cash into Bitcoin and other cryptocurrencies and went public—the median stock price has plummeted 43% this year, far exceeding Bitcoin's roughly 6% decline over the same period. In a notable case, SharpLink Gaming's stock price once surged over 2,600% after announcing a full pivot to holding Ethereum, but subsequently crashed 86% from its peak, with the company's market capitalization now actually lower than the value of its token holdings.

At the core of this crash is the realization by investors that simply holding cryptocurrencies does not generate returns, while the huge debts companies incurred to acquire tokens—along with the burden of interest and dividend payments—have become unbearable.

MarketWhisper·2025-12-08 07:34

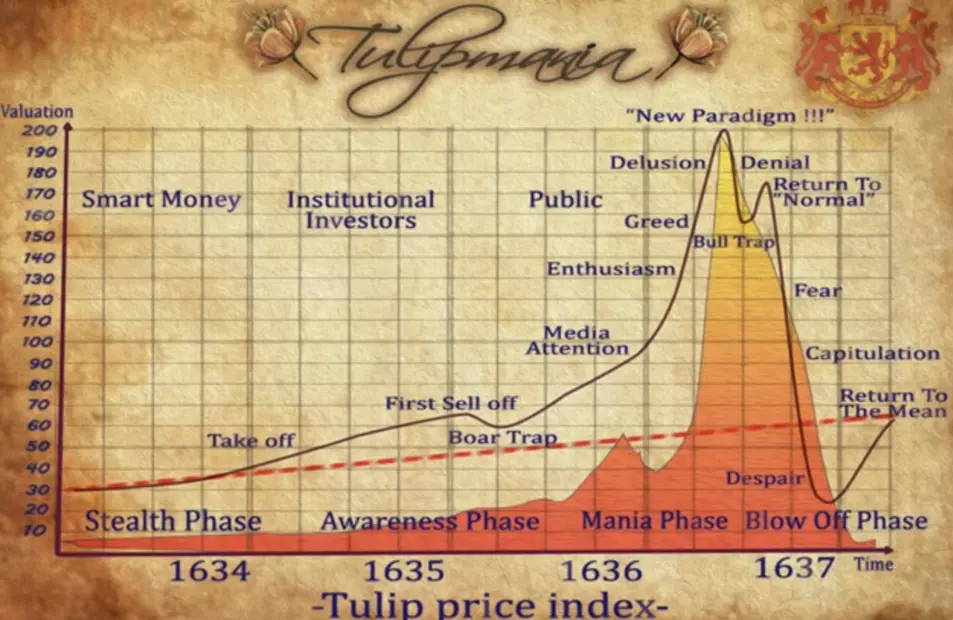

Bitcoin Shatters Tulip Mania Myth With 17-Year Track Record

Bitcoin has shown resilience over 17 years, surviving challenges that other speculative bubbles, like tulip mania, did not endure. Critics fail to recognize its durability and recovery, rendering the bubble narrative unfounded.

LiveBTCNews·2025-12-08 06:32

The hottest trading crash in the crypto world! Stock prices of 138 treasury companies halved, the MicroStrategy myth shattered

Bloomberg reported on December 7 that the crypto industry's craziest investment strategy of the year is undergoing an epic collapse. In the first half of 2025, more than 138 publicly listed companies in the US and Canada transformed into "digital asset treasuries," borrowing over $45 billion to purchase Bitcoin and other tokens. However, Bloomberg data shows that the median stock price of these listed companies emulating MicroStrategy has already dropped 43% this year, while Bitcoin has only fallen 6%.

MarketWhisper·2025-12-08 06:17

The MicroStrategy Myth Has Collapsed! US Stock Imitators See Their Share Prices Halved, But Saylor Still Hints at Further Accumulation

MicroStrategy founder and executive chairman Michael Saylor released Bitcoin Tracker information, hinting at another increase in holdings. However, digital asset management companies rushing to emulate MicroStrategy have suffered heavy stock price losses, with the median share price of these companies falling 43% year to date, while the broader market is rising. In the first half of this year, more than 100 publicly listed companies transformed into crypto holding vehicles, borrowing billions of dollars to purchase tokens, but their debt obligations have exposed structural weaknesses.

MarketWhisper·2025-12-08 02:08

After 17 years of persistent existence, Bitcoin officially debunks the 'tulip mania myth', according to an ETF expert.

Today, Bitcoin is no longer suited to outdated comparisons like the "tulip bubble." Its resilience and proven endurance over the years have rendered such comparisons obsolete, according to Eric Balchunas, a Bloomberg ETF expert.

“I would never put Bitcoin alongside the tu...

BTC0,7%

TapChiBitcoin·2025-12-08 00:32

Bitcoin Destroys Tulip Mania Myth After 17 Years | Balchunas

Bitcoin Outgrows Tulip Mania: Experts Highlight Resilience and Longevity

Bitcoin has established itself as a resilient digital asset that defies simplistic comparisons to historical bubbles like the Dutch tulip mania. Blockchain experts emphasize its durability, longevity, and capacity for

BTC0,7%

CryptoBreaking·2025-12-07 05:01

Bitcoin’s four year myth meets its real master: liquidity

Ran Neuner argues bitcoin's real market cycle is driven by global liquidity and PMI, not the four year halving myth traders still cling to.

Summary

YouTuber Ran Neuner says the four year bitcoin halving cycle was a comforting but misleading myth built on just three data points.

He shows past b

BTC0,7%

Cryptonews·2025-12-05 11:12

Is Bitcoin Whale Strategy in Danger? An In-depth Analysis of the Myth and Reality of "Too Big to Fail"

The world's largest publicly traded Bitcoin holding company, Strategy (formerly MicroStrategy), is facing a severe market test. Amid a decline in Bitcoin prices, a 30% plunge in the company's stock MSTR within a month, and founder Michael Saylor's first admission that Bitcoin might be sold, the market is starting to seriously question whether this giant—which holds 650,000 Bitcoins (3.1% of the total supply, worth about $60 billion)—might collapse. The debate over whether it is "too big to fail" is raging both inside and outside the industry. This debate concerns not only the fate of a single company but also touches on the core issue of the safety boundaries of Bitcoin as a corporate reserve asset.

MarketWhisper·2025-12-04 02:23

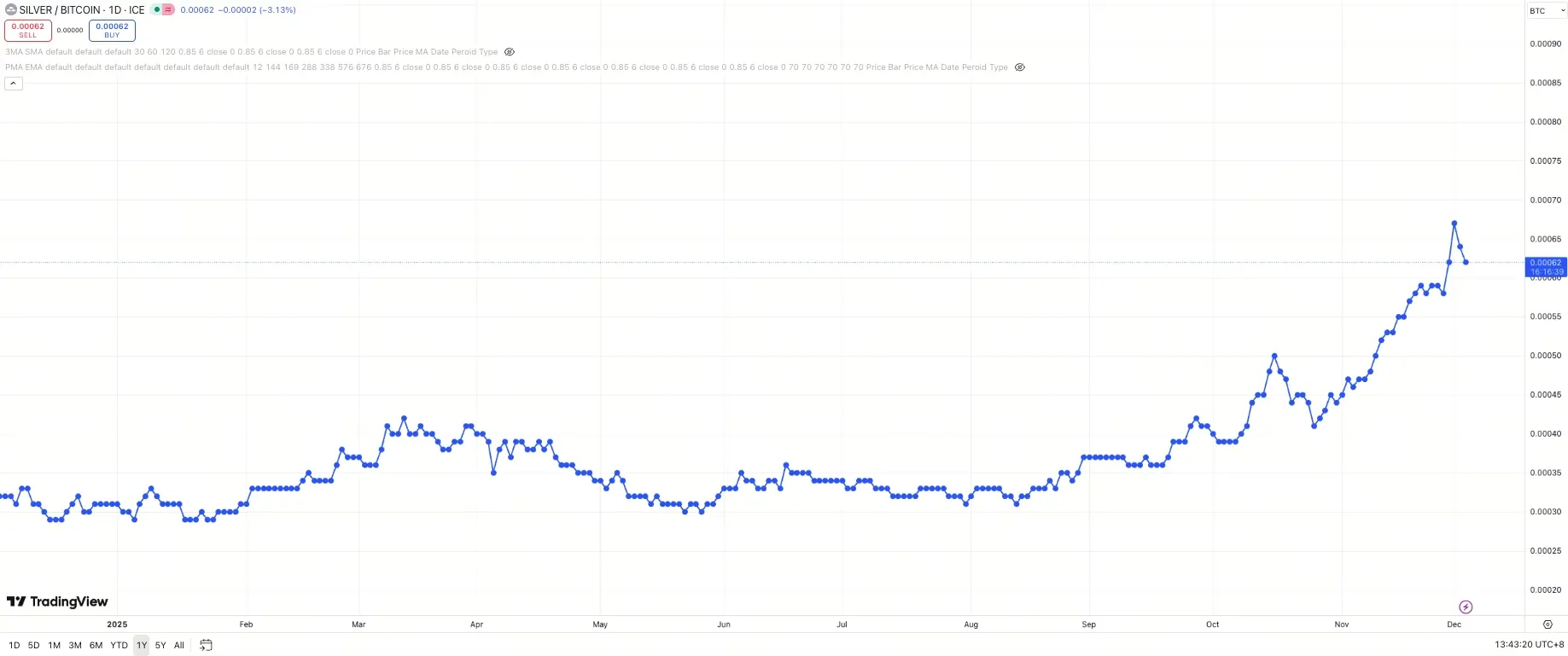

The digital gold myth is shattered! Bitcoin loses badly to silver, exchange rate drops to 1,458 ounces

In less than a year, the Bitcoin-to-silver ratio has dropped from about one Bitcoin being able to exchange for 3,500 ounces of silver to just 1,458 ounces today. During the same period, the price of Bitcoin fell by about 27%, while silver rose by more than 50%, resulting in this ratio plunging 58% since the beginning of the year. Many hardcore Bitcoin believers are used to using the US dollar to prove its "long-term invincibility," but once silver is used as the benchmark, the narrative is immediately reversed.

MarketWhisper·2025-12-03 05:45

Will MicroStrategy's empire collapse? The myth of never selling 650,000 BTC encounters the shattering of 700 million debt.

MicroStrategy (MSTR) has acknowledged for the first time that if its stock price remains below 1 times its book value for an extended period, the company may sell some Bitcoin. This company, which has made "never selling Bitcoin" a corporate belief over the past five years, holds approximately 650,000 Bitcoins, accounting for about 3% of the global Circulating Supply. The company is burdened with a mandatory annual preferred stock dividend of 750-800 million USD, which is not the type of expense that can be reduced during poor market conditions, but rather a rigid expenditure written into the contract.

BTC0,7%

MarketWhisper·2025-12-02 06:13

Perplexity global downloads big dump by 80%! Three major factors extinguished the "AI version of Google" rise myth.

The first giant about to fall in the AI competition? Renowned investor Sasha Kaletsky recently revealed the latest statistics on the X platform, indicating that Perplexity AI, dubbed the "Google of AI," has seen its global app downloads plummet by about 80% over the past six weeks. (Background: A heavy tech report from a16z: How AI is devouring the world?) (Additional context: Ray Dalio: It's still too early to sell AI stocks! Because the "long wick candle" that will burst the bubble hasn't come into play yet.) Renowned investor Sasha Kaletsky recently revealed the latest statistics on the X platform, indicating that Perplexity AI, dubbed the "Google of AI," has seen its global app downloads plummet by about 80% over the past six weeks. This statistical period is from October 2025.

BERA-0,43%

動區BlockTempo·2025-11-27 18:07

On-chain warming, the sniper artifact OCR creates another myth of hundredfold returns.

Recently, the $CHOG Token in the Monad ecosystem has attracted follow due to its team's release method, which uses images containing the contract Address to evade monitoring. However, snipers using OCR technology still managed to profit $410,000, demonstrating the narrowing gap in information acquisition and the complexity of on-chain investment. In the market environment, investors need to leverage efficient information processing capabilities to improve their success rate.

MarsBitNews·2025-11-27 09:45

The collapse of the 760-fold myth, how did the sports betting king Polymarket fall to this?

Original Title: "The Mystery of the Fall of Polymarket, the 'God of Sports Predictions', After Assets Drop to Zero with a Profit of 4 Million Dollars"

Original: Odaily Planet Daily

Author: Wenser

Polymarket's prediction games have always been a feast for the few and a gamble for the many. Similar to contract markets, it is also filled with "black swan reversals," especially in the case of unexpected outcomes in sports.

Today, we are going to talk about the fall of a trader once known as the "God of Sports Prediction"—Mayuravarma. This trader, with an Indian caste-style ID, violently ramped up his initial capital of $5,000 to $3.8 million in just a month, achieving a profit of up to 760 times and briefly ranking sixth on the sports profit list. However, what rises must fall; in just one week, his assets were nearly drop to zero.

Mayuravar

PANews·2025-11-27 09:06

Expert Says ‘Absolutely Nothing Happened’ to XRP as ISO 20022 Officially Goes Live

The recent launch of ISO 20022 has not impacted XRP Ledger activity, debunking the myth that it would compel banks to adopt XRP. ISO 20022 enhances payment messaging but does not inherently link to or boost XRP's use in settlements.

XRP5,74%

TheCryptoBasic·2025-11-24 14:45

Pi Network Moderators Reject GCV Myth as Map of Pi 2.0 Nears Launch

Pi Network moderators have publicly dismissed the long-circulated “Global Consensus Value” (GCV) myth. They are calling it harmful to the ecosystem and misleading for new community members. Their comments arrive as Map of Pi 2.0 prepares for launch. This brings built-in payments and escrow for

Coinfomania·2025-11-24 06:16

Synthetix Million Dollar Trading Competition Reveals the Harsh Truth: 90% of Top Experts are Losing Money! How Can Retail Investors Win?

The Synthetix million-dollar trading competition revealed the harshest truth in the crypto world at its conclusion: 100 top traders and KOLs participated, with 90% ultimately losing, proving that doing nothing and not trading can actually outperform 90% of the elite! This is not just a competition, but a wake-up call from the market to all retail investors. (Background: The 100% win rate whale myth ends; let's see how Hyperliquid's leveraged whale personally emptied their own pockets?) (Additional context: Synthetix's $27 million acquisition of Derive failed, facing community doubts: no promise to issue more tokens) The crypto assets derivatives protocol Synthetix launched its "trading competition" at the end of September, with a total prize pool of up to $1 million, originally intended to celebrate its perpetual futures decentralized exchange (Perps DEX) going live on the Ethereum Mainnet, but unexpectedly...

動區BlockTempo·2025-11-19 18:47

A Whale that once had unrealized gains of nearly a hundred million exposes: Why are they no longer trading on HyperLiquid?

Famous traders decided to leave HyperLiquid after the 10·10 incident, calling for the cryptocurrency industry to shift from protecting protocols to protecting users and establishing a true risk buffer mechanism. This article is based on @TheWhiteWhale's piece "V2 A Difficult Personal Decision," organized, compiled, and written by BlockBeats. (Background: The Future of Hyperliquid: HIP-3 and HyperStone) (Supplementary Background: ERC-8021 Proposal Interpretation: Will Ethereum Copy Hyperliquid to Create a Wealth Myth for Developers?) The author of this article is a well-known trader who has been deeply involved in cryptocurrency trading for a long time, with over seventy thousand followers on the X platform, aiming to achieve a trading performance of 100 million dollars. In August of this year, he was at H.

HYPE0,3%

動區BlockTempo·2025-11-18 07:34

Analyzing the value of the Uniswap unification proposal and the CCA auction protocol

Author | Shisi Jun

Preface

Recently, the industry's excitement has shifted due to the emergence of the X402 payment track, as well as the panic caused by Black Monday, Tuesday, Wednesday, Thursday, and Friday, along with the rotation of the privacy sector related to the bull market myth.

This world is truly wonderful, and also too noisy.

Right now, the bear market is fine, after all, a common mistake made by smart people is to strive to optimize something that shouldn't exist (from Musk). Now, calm down and review the brilliance of past successful products, observe which players in the competition are engaging in ineffective operations, and identify which are the pigs on the windfall. When the wind stops, we can truly see the long-term value of the future.

If asked, what are the representative track trends this year?

My first choice is Dex. It has been 4 years since the summer of DeFi, and there have been several typical products over the course of 25 years, which have gained significant attention from concept to market. The most fascinating aspect of this track is that,

WuSaidBlockchainW·2025-11-17 23:32

Coin Issuance Factory: Who is "sucking blood" on the assembly line?

Author: Liam, TechFlow

Reprinted: White55, Mars Finance

In 2025, the productivity revolution in the crypto market will not be AI, but the issuance of tokens.

Dune data shows that in March 2021, there were about 350,000 tokens across the network; this number increased to 4 million a year later; by the spring of 2025, this figure had surpassed 40 million.

In four years, inflation has increased a hundredfold, with almost tens of thousands of new coins being created, launched, and going to zero almost every day.

Although the myth that one can make money simply by issuing tokens has been shattered, it cannot withstand the determination of project teams eager to launch their tokens. This token issuance assembly line has also supported a large number of Agencies, exchanges, market makers, KOLs, media, and others that provide services. Perhaps it is becoming increasingly difficult for project teams to make profits, but every gear in the factory has found its own profit model.

So, this "Token Factory"

MarsBitNews·2025-11-17 11:37

Coin Issuing Factory: Who is "sucking blood" on the production line?

Author: Liam, Deep Tide TechFlow

In 2025, the productivity revolution in the crypto market will not be AI, but rather the issuance of tokens.

Dune data shows that in March 2021, there were about 350,000 tokens in the entire network; a year later, it rose to 4 million; by spring 2025, this number had surpassed 40 million.

In four years, it has expanded a hundredfold, with almost tens of thousands of new coins being created, launched, and going to zero almost every day.

Although the myth that issuing tokens can easily make money has been shattered, it cannot undermine the determination of project teams to launch tokens one after another. This token issuance assembly line has also supported a large number of service providers such as agencies, exchanges, market makers, KOLs, and media. Perhaps it is becoming increasingly difficult for project teams to make a profit, but every gear in the factory has found its own profit model.

So, how does this "token factory" actually operate? And who is involved in it?

PANews·2025-11-17 10:26

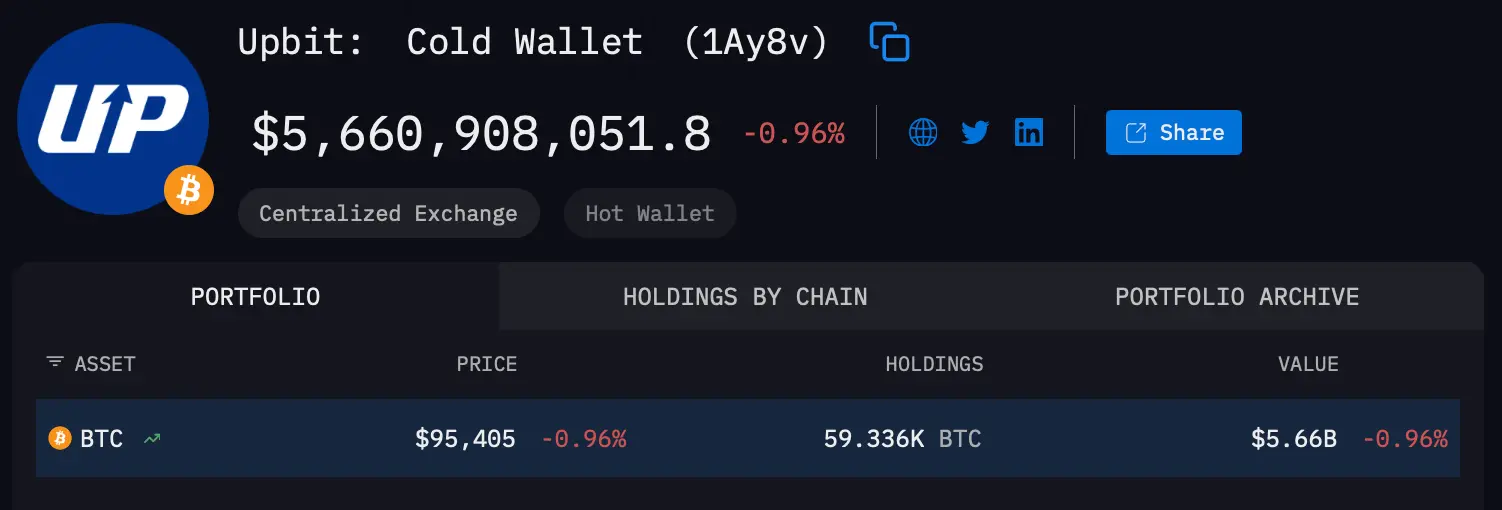

‘Mr. 100’ Mania Returns: Viral Whale Myth Falls Apart Under Scrutiny

On social media, the tall tale of a wallet dubbed ‘Mr. 100’ is making the rounds again, with claims that this mysterious figure is scooping up bitcoin while prices sit in the bargain bin. Yet the wallet has long been tied to the crypto exchange Upbit, and these posts seem more interested in

MYTH-1,6%

Coinpedia·2025-11-16 21:47

Fed Governor Resigns in Trading Scandal. This Is Why We Bitcoin.

This is the story that shatters the myth of the "impartial" central banker.

New ethics disclosures

BTC0,7%

BitcoinInsider·2025-11-15 22:02

When issuing coins becomes a production line

In 2025, the productivity revolution in the crypto market is not AI, but issue coin.

Dune data shows that in March 2021, there were about 350,000 tokens across the network; a year later it rose to 4 million; by the spring of 2025, this number had surpassed 40 million.

In four years, there has been a hundredfold expansion, with almost tens of thousands of new coins being created, launched, and going to zero almost every day.

Although the myth that issuing coins can make money has been shattered, it cannot stop the determination of project parties to issue coins one after another. This coin issuance assembly line factory has also supported a large number of agencies, exchanges, market makers, KOLs, media, and others that provide services. Perhaps it is becoming increasingly difficult for project parties to make money, but every gear in the factory has found its own profit model.

So, how does this "issue coin factory" operate? And who is really profiting from it?

issue coin in half a year

This cycle with

金色财经_·2025-11-14 10:22

When issuing coins becomes a production line

In 2025, the productivity revolution in the crypto market will not be AI, but issue coin.

Dune data shows that in March 2021, there were approximately 350,000 tokens across the network; a year later, it rose to 4 million; by the spring of 2025, this number had exceeded 40 million.

In four years, inflation has increased a hundredfold, with tens of thousands of new coins being created, launched, and going to zero almost every day.

Although the myth that issuing coins can make money has been shattered, it cannot withstand the determination of project teams to issue coins one after another. This coin issuance assembly line factory has also supported a large number of Agencies, exchanges, market makers, KOLs, media, etc., who provide services. Perhaps it is becoming increasingly difficult for project teams to make money, but every gear in the factory has found its own profit model.

So, how does this "issue coin factory" operate? And who is actually profiting from it?

Issue coin for half a year

This cycle is different from the previous one.

DeepFlowTech·2025-11-14 09:02

The Future of Hyperliquid: HIP-3 and HyperStone

Analyzing how Hyperliquid transitions from centralized exchange to decentralized ecological platform through HIP-3 and HyperStone Oracle Machine. (Background: ERC-8021 proposal interpretation: Will it create a wealth myth for Ethereum developers replicating Hyperliquid?) (Background supplement: The myth of 100% win-rate Whale comes to an end, let's see how Hyperliquid's leveraged Whale empties itself?) The future of Hyperliquid lies in HIP-3, and the foundation of HIP-3 is in HyperStone. 1⃣ Hyperliquid is building a complete ecosystem. Hyperliquid is not just creating an on-chain Futures Trading exchange, but is constructing an ecosystem, where the ceiling is high enough for this endeavor. Now

動區BlockTempo·2025-11-13 09:19

encryption "Veteran" Training Diary

Written by: tradinghoe

Compiled by: AididiapJP, Foresight News

In the crypto world, nothing is more important than survival. You must ensure that you can continue to participate in the game every day, preserve your capital, and keep learning.

Most people do not understand this principle when they first enter the market. They expect to achieve a leap in wealth within a few months, viewing cryptocurrency as a shortcut to overnight riches, and it is this misunderstanding that leads to the eventual failure of most people.

There is a myth circulating in the crypto community: as long as you wait long enough, you will definitely make money. People always think that after three to five years in this field, they will surely achieve financial freedom.

When seeing early players, many people will ask: "Why haven't you become a billionaire yet?"

But the truth is: cryptocurrency is not a get-rich-quick game, but rather a test of who can last the longest. "Success" does not come according to anyone's timetable; it only arrives when preparation, capital preservation, and opportunity align.

DeepFlowTech·2025-11-13 04:25

The US government is about to restart. Can Bitcoin replicate the 290% surge myth of 2019 again?

The U.S. Senate passed a funding bill on November 10th with a vote of 60 to 40, ending the government shutdown that lasted 40 days—the longest in history. Following this news, Bitcoin briefly surged past $106,000 but then retreated to around $105,333.

The market is closely watching whether the historical 290% increase in Bitcoin after the 2019 government reopening can be repeated. However, the current market scale in the trillions, the liquidity structure dominated by institutions, and macroeconomic differences make simple comparisons challenging. Analysts suggest that if the reopening effect is only half as strong as in 2019, Bitcoin could potentially surge to $260,000.

BTC0,7%

MarketWhisper·2025-11-11 10:08

Dispelling the Myth: Why 24-Word Seeds Can't Unlock Satoshi’s Bitcoin Fortune

The legend of Satoshi Nakamoto’s immense Bitcoin fortune—estimated to be over one million BTC—continues to captivate the crypto world. A common misconception circulating in the community is that this immense wealth, currently dormant in the original wallets, could be accessed if someone were to

BTC0,7%

Cryptoknowmics·2025-11-11 06:13

Interpretation of ERC-8021 proposal: Will it enable Ethereum to replicate Hyperliquid's developer wealth myth?

Application developers are earning millions of dollars through "Builder Codes" on platforms like Hyperliquid, and ERC-8021 proposes to natively integrate this system into Ethereum. This article is based on a piece by Jarrod Watts, organized, translated, and written by TechFlow. (Background: Ethereum AI Agent Economy Dual Engines: ERC-8004's Highway and Virtuals' Business Pipeline) (Additional context: Ethereum finalized the December 3rd Fusaka upgrade hard fork, introducing PeerDAS and increasing the Gas limit) The platform serves as a foundation, providing the possibility for thousands of applications to build and profit. Application developers are quietly leveraging Hyperliquid and Polymarket to...

動區BlockTempo·2025-11-10 08:58

Interpretation of ERC-8021 proposal: Will it enable Ethereum to replicate Hyperliquid's developer wealth creation myth?

Application developers implement revenue sharing on platforms like Hyperliquid and Polymarket through "Builder Codes," establishing on-chain ownership systems that attract the development of numerous high-quality applications. The ERC-8021 proposal integrates this model into Ethereum, driving the creation of new revenue streams for high-quality applications. This approach promotes a win-win situation for user experience and platform trading volume.

DeepFlowTech·2025-11-10 07:47

OpenAI as the guardian god of the nation? When investment myths collide with economic realities, will AI become the arms race of nations?

OpenAI's CFO seeking "government guarantees" has sparked market debate, revealing the reality pressures behind the AI investment frenzy. From CEO Sam Altman's denial statement to Trump AI czar David Sacks' firm response of "there will be no federal bailout," this controversy may signal a turning point for the AI industry from growth myth to national strategy.

Trigger: OpenAI's CFO raises concerns with a statement of "government guarantee"

OpenAI's CFO Sarah Friar mentioned yesterday at the Wall Street Journal (WSJ) event that she hopes the government will "play a backstop role" in AI investment, suggesting potential government support. This has been interpreted as OpenAI seeking government financial guarantees for its $1 trillion data center construction.

(OpenAI Financial

ChainNewsAbmedia·2025-11-07 05:33

The myth of the 100% win rate giant whale has come to an end. Let's see how Hyperliquid's leveraged whale is draining itself firsthand.

An anonymous whale, who previously achieved 14 consecutive wins with a 100% success rate on Hyperliquid, was forced to liquidate on November 5th. The account, which had peaked at over $25.34 million in profit, has now fallen to a net loss of $30.02 million, leaving only about $1.4 million in margin. This 21-day trading cycle began in October.

(Background context: The myth of the "100% success rate whale" has been shattered—after returning all profits from the last 12 trades, the account now shows an unrealized loss of $8 million.)

Previous highlights include: Bitcoin hitting $105,000, the myth of the 100% success whale being broken with an $18 million loss, and Amazon's partnership with OpenAI reaching new stock price highs.

HYPE0,3%

動區BlockTempo·2025-11-05 21:40

Soros predicts the AI bubble: We live in a self-fulfilling market.

Original Title: Busting the myth of efficient markets

Original author: Byron Gilliam

Source of the original text:

Reprint: Mars Finance

How does the financial market shape the reality it is supposed to measure?

There is a world of difference between the rational "knowing" and the experiential "understanding." It's like reading a physics textbook versus watching "MythBusters" blow up a water heater.

Textbooks will tell you: heating water in a closed system will generate hydraulic pressure due to the expansion of the water.

You understand the text and grasp the theory of phase transition physics.

But "MythBusters" showed how pressure can turn a water heater into a rocket, shooting it to an altitude of 500 feet.

You watched the video and truly understood what a catastrophic steam explosion is.

Showing is often more powerful than telling.

Last week, B

AGI4,51%

MarsBitNews·2025-11-05 12:09

The myth of a 100% win rate comes to an end, how the Whale empties itself.

An anonymous Whale experienced 14 consecutive wins on Hyperliquid, with profits reaching $25.34 million. However, due to market reverse adjustments and excessive increase of the position, they were ultimately forced to close all positions on November 5, with losses amounting to $30.02 million. This 21-day trading period ended in losses, reflecting the risks of Margin Trading and the challenges of human nature.

DeepFlowTech·2025-11-05 09:10

Web3 in 2025: Replaying the Millennium Internet Bubble

In 2000, China.com went public on NASDAQ with a portal website and the concept of "Chinese Internet," with a market capitalization soaring to $5 billion on its first day. They had no clear profit model, no core technological barriers, and even stable user growth was not to be mentioned. But this did not matter—investors were not buying a business, they were buying a ticket to "not miss out on the Chinese Internet."

In the same year, AOL acquired Time Warner for $164 billion, creating the myth of the "merger of the century." The market capitalization of a dial-up Internet service provider surprisingly surpassed that of a media empire with tangible assets like CNN and Warner Bros. The logic behind this deal was simple: the Internet represents the future, and traditional media must embrace change. As for how to make money? That is a matter for the future.

These two cases share a common script: first tell a sufficiently enticing story, secure massive financing, and then quickly go public to cash out. Zhonghua Net relies on the "China concept,"

TOKEN-6,17%

金色财经_·2025-10-26 04:34

Ethereum Mainnet speed breaks 200 milliseconds! FAST RPC defeats Solana speed myth

The Ethereum infrastructure platform Primev stated that using its "FAST RPC" solution, Ethereum Mainnet transfers can achieve block time in just 200 milliseconds. Its FAST RPC (Remote Procedure Call) allows for pre-confirmation of transactions within 200 milliseconds and inclusion in blocks, enabling transfers from Ethereum and interaction with smart contracts to mint NFTs at "extremely fast speeds."

ETH1,74%

MarketWhisper·2025-10-23 02:28

Load More