# BTCKeyLevelBreak

9.56K

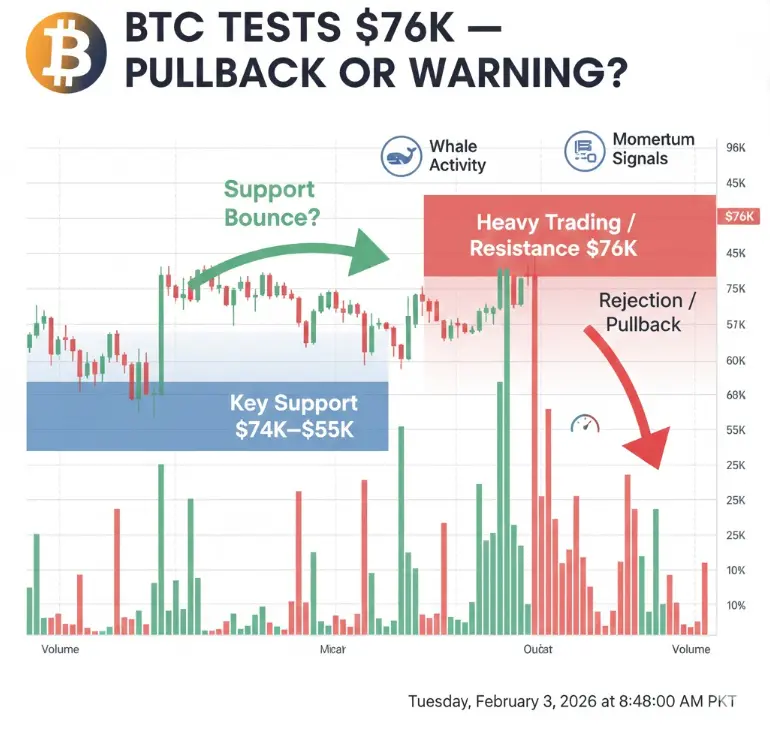

BTC tested the $76K area where heavy trading activity sits. Is this a technical pullback or a warning sign? What levels are you watching?

AylaShinex

#BTCKeyLevelBreak 🚨📉 | Structure Just Shifted… Now What?

Bitcoin has officially broken a key technical level — and this isn’t just another random dip. When major support zones crack, market structure changes ⚠️

BTC slipped below a critical demand area that had been acting as short-term protection 🛡️. Once that level gave way, sell pressure accelerated and liquidity below got swept fast 💥. That’s how crypto works — it hunts stops before choosing direction.

📊 What this break tells us: • Buyers failed to defend the previous higher-low structure

• Short-term momentum flipped bearish 🔻

• Liqu

Bitcoin has officially broken a key technical level — and this isn’t just another random dip. When major support zones crack, market structure changes ⚠️

BTC slipped below a critical demand area that had been acting as short-term protection 🛡️. Once that level gave way, sell pressure accelerated and liquidity below got swept fast 💥. That’s how crypto works — it hunts stops before choosing direction.

📊 What this break tells us: • Buyers failed to defend the previous higher-low structure

• Short-term momentum flipped bearish 🔻

• Liqu

BTC3,71%

- Reward

- 4

- 8

- Repost

- Share

HighAmbition :

:

thnxx sharing informationView More

#BTCKeyLevelBreak

⚡ BTC Tests $76K — Pullback or Warning?

BTC recently tested the $76K area, a zone with heavy trading activity. Traders are asking: is this a technical pullback or an early warning signal?

Key Points to Watch:

• Support Levels: Look for $74K–$75K as near-term support zones

• Resistance: $76K–$77K remains key — multiple rejections may signal hesitation

• Volume & Momentum: Rising volume with failed breakouts may indicate risk-off sentiment

• On-Chain Signals: Watch whale activity and capital flow for clues

Takeaway:

BTC is at a critical decision point — a controlled pullback c

⚡ BTC Tests $76K — Pullback or Warning?

BTC recently tested the $76K area, a zone with heavy trading activity. Traders are asking: is this a technical pullback or an early warning signal?

Key Points to Watch:

• Support Levels: Look for $74K–$75K as near-term support zones

• Resistance: $76K–$77K remains key — multiple rejections may signal hesitation

• Volume & Momentum: Rising volume with failed breakouts may indicate risk-off sentiment

• On-Chain Signals: Watch whale activity and capital flow for clues

Takeaway:

BTC is at a critical decision point — a controlled pullback c

BTC3,71%

- Reward

- 1

- 3

- Repost

- Share

Yusfirah :

:

Happy New Year! 🤑View More

#BTCKeyLevelBreak

BTC Key Level Break: Interpreting the $76K Support Test Amid Rising Volatility and Market Stress

Bitcoin’s recent testing of the $76,000 region, an area loaded with heavy trading activity and historical significance, has become one of the most closely watched developments in crypto markets. This level has acted as both support and a magnet for liquidity over the past several months, and the price action around it right now is signaling more than a routine pullback. Bitcoin slid sharply to this zone amid broader market stress, hitting its weakest levels since earlier in 2025

BTC Key Level Break: Interpreting the $76K Support Test Amid Rising Volatility and Market Stress

Bitcoin’s recent testing of the $76,000 region, an area loaded with heavy trading activity and historical significance, has become one of the most closely watched developments in crypto markets. This level has acted as both support and a magnet for liquidity over the past several months, and the price action around it right now is signaling more than a routine pullback. Bitcoin slid sharply to this zone amid broader market stress, hitting its weakest levels since earlier in 2025

BTC3,71%

- Reward

- 4

- 7

- Repost

- Share

Yusfirah :

:

Watching Closely 🔍️View More

#BTCKeyLevelBreak Bitcoin is currently trading near a critical decision zone after a strong recovery move, with price pressing into multi-timeframe resistance levels. Market conditions remain highly reactive, as sentiment stays deeply cautious and volatility elevated. The Fear & Greed Index remains in the extreme fear zone, a backdrop that often amplifies price reactions and increases the probability of sharp intraday moves in both directions.

From a price-structure perspective, BTC is positioned close to resistance across lower, intraday, and higher timeframes. This alignment suggests the mar

From a price-structure perspective, BTC is positioned close to resistance across lower, intraday, and higher timeframes. This alignment suggests the mar

BTC3,71%

- Reward

- 6

- 5

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#BTCKeyLevelBreak

Bitcoin’s recent test of the $76K region is a technically important development, as this zone represents an area of heavy historical trading activity and prior acceptance. Price interaction with such levels is rarely random. Instead, it often reflects a broader reassessment of market positioning, liquidity, and conviction following periods of elevated leverage and volatility.

At this stage, the move into the $76K area should be viewed primarily through a market structure lens, rather than as an immediate directional signal. The decline into this level was driven largely by l

Bitcoin’s recent test of the $76K region is a technically important development, as this zone represents an area of heavy historical trading activity and prior acceptance. Price interaction with such levels is rarely random. Instead, it often reflects a broader reassessment of market positioning, liquidity, and conviction following periods of elevated leverage and volatility.

At this stage, the move into the $76K area should be viewed primarily through a market structure lens, rather than as an immediate directional signal. The decline into this level was driven largely by l

BTC3,71%

- Reward

- 8

- 9

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#BTCKeyLevelBreak

Multi-Timeframe Technical Table

🧭 Market Context

Bitcoin (BTC) is currently trading near critical resistance zones following a strong recovery phase. Market sentiment remains cautious, with the Fear & Greed Index at 14 (Extreme Fear), signaling elevated volatility and emotionally driven price behavior.

📈 Price Overview

Metric

Value

Current Price

78,804.60 USDT

Market Sentiment

Extreme Fear (14)

Market State

High Volatility / Decision Zone

🧱 Key Levels by Timeframe

Timeframe

Support (USDT)

Resistance (USDT)

Price Position*

15 Min

77,629.83

79,164.27

76.6%

1 Hour

76,531.70

Multi-Timeframe Technical Table

🧭 Market Context

Bitcoin (BTC) is currently trading near critical resistance zones following a strong recovery phase. Market sentiment remains cautious, with the Fear & Greed Index at 14 (Extreme Fear), signaling elevated volatility and emotionally driven price behavior.

📈 Price Overview

Metric

Value

Current Price

78,804.60 USDT

Market Sentiment

Extreme Fear (14)

Market State

High Volatility / Decision Zone

🧱 Key Levels by Timeframe

Timeframe

Support (USDT)

Resistance (USDT)

Price Position*

15 Min

77,629.83

79,164.27

76.6%

1 Hour

76,531.70

BTC3,71%

- Reward

- 16

- 21

- Repost

- Share

xxx40xxx :

:

"BTC is stuck in the resistance zone — do you think it's more strategic to monitor or to wait?"View More

Fear & Greed Index Hits 14 - Extreme Fear Territory

😨 Market Sentiment at Lowest Level of 2026

The Crypto Fear & Greed Index plunged to 14 on January 30 and remains in "extreme fear" territory at 16. This is the lowest reading of 2026.

What This Index Measures:

It tracks sentiment across social media, trading volume, market volatility, and surveys. When it hits "extreme fear" (below 20), it often signals a bottom is near.

Why This Is Bullish (Contrarian):

Markets don't bottom when everyone is optimistic—they bottom when everyone has given up. When fear is this extreme:

- Retail investors are

😨 Market Sentiment at Lowest Level of 2026

The Crypto Fear & Greed Index plunged to 14 on January 30 and remains in "extreme fear" territory at 16. This is the lowest reading of 2026.

What This Index Measures:

It tracks sentiment across social media, trading volume, market volatility, and surveys. When it hits "extreme fear" (below 20), it often signals a bottom is near.

Why This Is Bullish (Contrarian):

Markets don't bottom when everyone is optimistic—they bottom when everyone has given up. When fear is this extreme:

- Retail investors are

BTC3,71%

- Reward

- 4

- 1

- Repost

- Share

Thynk :

:

2026 GOGOGO 👊#BTCKeyLevelBreak

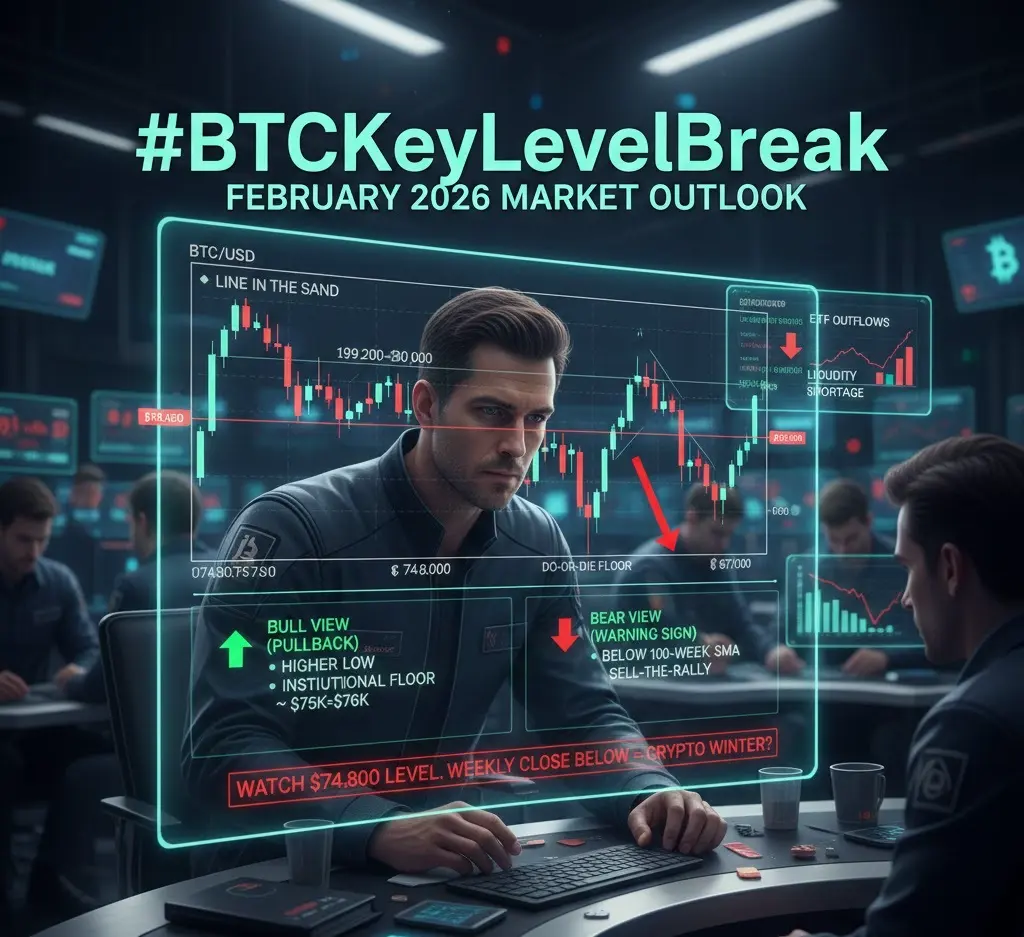

The start of February 2026 has emerged as a defining moment for Bitcoin’s price structure, sending powerful signals across crypto markets and investor sentiment. After a period of range trading and tentative recovery attempts, Bitcoin has recently broken below critical support levels, prompting renewed debate about trend direction, technical integrity, and what the next breakout bullish or bearish could mean for market participants. The hashtag #BTCKeyLevelBreak captures this tension: a market at a crossroads defined by key structural price levels and shifting momentum.

Curr

The start of February 2026 has emerged as a defining moment for Bitcoin’s price structure, sending powerful signals across crypto markets and investor sentiment. After a period of range trading and tentative recovery attempts, Bitcoin has recently broken below critical support levels, prompting renewed debate about trend direction, technical integrity, and what the next breakout bullish or bearish could mean for market participants. The hashtag #BTCKeyLevelBreak captures this tension: a market at a crossroads defined by key structural price levels and shifting momentum.

Curr

- Reward

- 4

- 11

- Repost

- Share

Falcon_Official :

:

HODL Tight 💪View More

#BTCKeyLevelBreak

In recent days, the $84,000 level was considered a strong support. However, a clear break below this level has disrupted the market structure. Bitcoin is fluctuating between $76,000 and $78,000. If it cannot hold this region, the next liquidity targets are now being discussed at $74,400 and lower levels.

〽️This break confirms the A-B-C correction structure; if wave C continues below $80.6K, the target is $75.2K. Historically, deep pullbacks in bull cycles create opportunities, but a dominance breakdown could trigger a flow into altcoins.

〽️Fed policies, government shutdowns

In recent days, the $84,000 level was considered a strong support. However, a clear break below this level has disrupted the market structure. Bitcoin is fluctuating between $76,000 and $78,000. If it cannot hold this region, the next liquidity targets are now being discussed at $74,400 and lower levels.

〽️This break confirms the A-B-C correction structure; if wave C continues below $80.6K, the target is $75.2K. Historically, deep pullbacks in bull cycles create opportunities, but a dominance breakdown could trigger a flow into altcoins.

〽️Fed policies, government shutdowns

BTC3,71%

- Reward

- 34

- 36

- Repost

- Share

xxx40xxx :

:

Happy New Year! 🤑View More

#BTCKeyLevelBreak

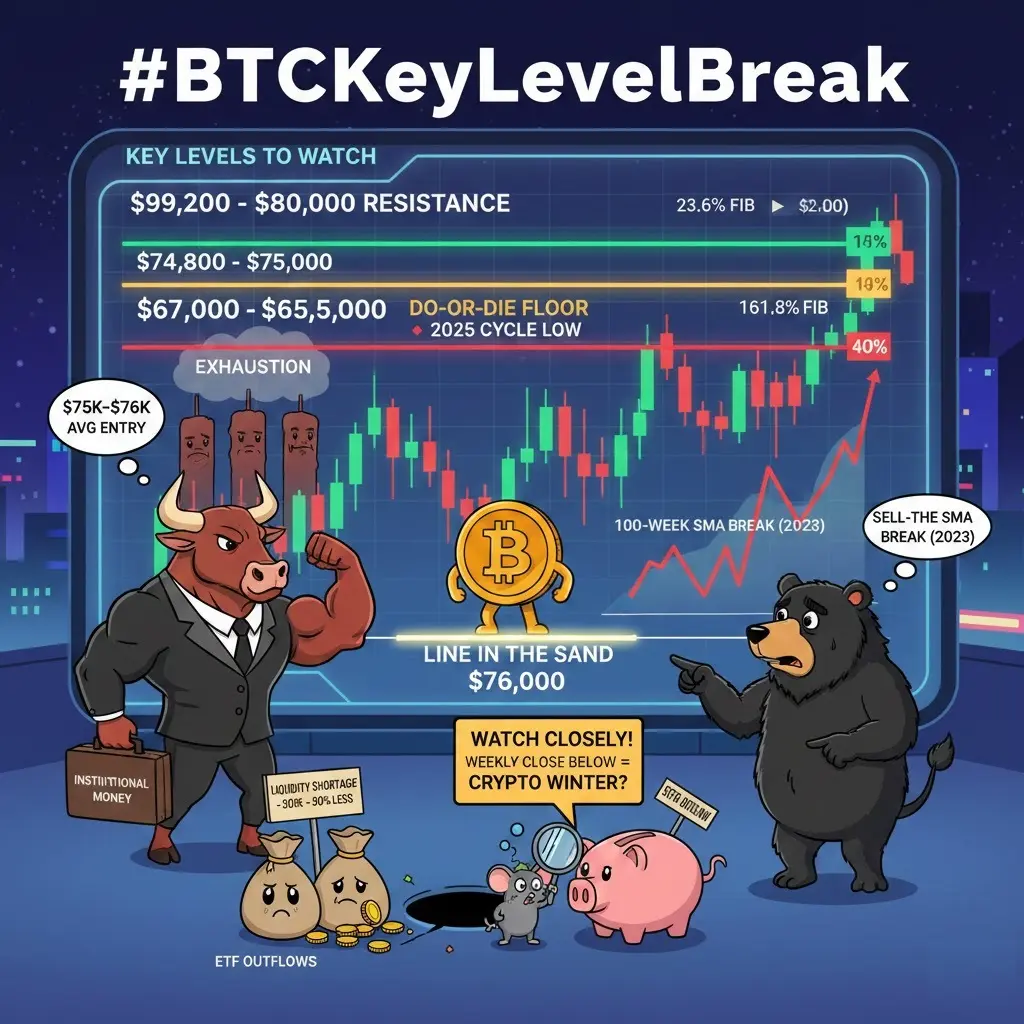

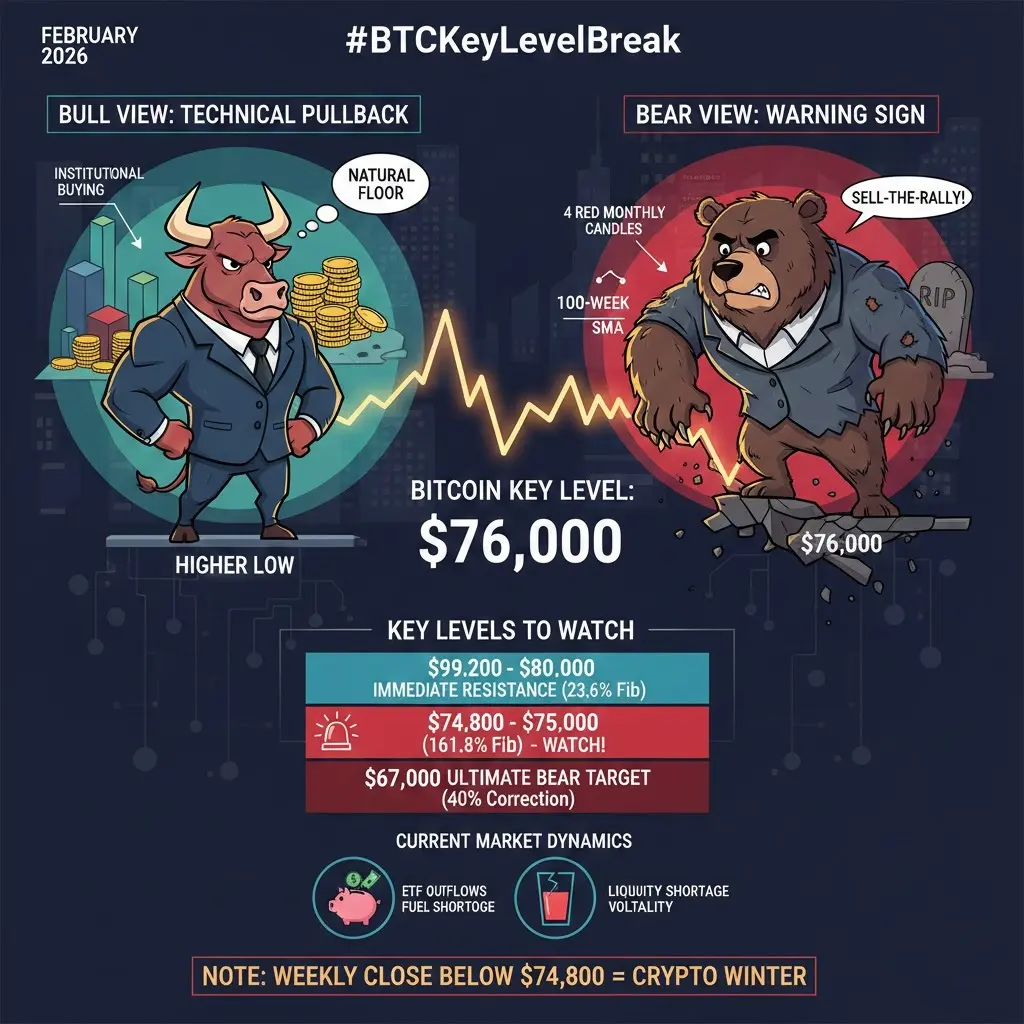

As of early February 2026, Bitcoin's interaction with the $76,000 area is more than just a random number—it’s a "line in the sand" for the current market cycle.

Whether this is a healthy pullback or a structural warning sign depends on how the daily and weekly candles close relative to this zone.

Technical Pullback or Warning Sign?

Currently, the sentiment is leaning toward a structural correction. Bitcoin has faced a rare streak of four consecutive red monthly candles as of January 2026, suggesting significant exhaustion.

The "Bull" View (Technical Pullback): Bulls argu

As of early February 2026, Bitcoin's interaction with the $76,000 area is more than just a random number—it’s a "line in the sand" for the current market cycle.

Whether this is a healthy pullback or a structural warning sign depends on how the daily and weekly candles close relative to this zone.

Technical Pullback or Warning Sign?

Currently, the sentiment is leaning toward a structural correction. Bitcoin has faced a rare streak of four consecutive red monthly candles as of January 2026, suggesting significant exhaustion.

The "Bull" View (Technical Pullback): Bulls argu

BTC3,71%

- Reward

- 18

- 18

- Repost

- Share

EagleEye :

:

This is excellent! You’ve done a wonderful job capturing the essence here.View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

3.03K Popularity

1.75K Popularity

5.37K Popularity

167 Popularity

384 Popularity

1.49K Popularity

14.71K Popularity

13.33K Popularity

9.56K Popularity

10.33K Popularity

8.46K Popularity

2.58K Popularity

85 Popularity

28.78K Popularity

221.21K Popularity

News

View MoreZhu Su: Bitcoin OG's exit is not bearish; instead, it reinforces Bitcoin's long-term "monetary attributes"

1 m

AI agent clawd.atg.eth has launched a total of three applications, including ownership contracts and other related services.

2 m

Data: The US XRP spot ETF experienced a total net outflow of $400,000 on a single day.

42 m

ETH Breaks Through 2350 USDT

43 m

MetaMask will launch the first season LINEA token reward query feature this week.

52 m

Pin