# CFTCOKsBankStablecoins

3.79K

CryptoChampion

#CFTCOKsBankStablecoins : A New Era for Digital Finance

In a significant development for the cryptocurrency and financial sectors, the U.S. Commodity Futures Trading Commission (CFTC) has recently indicated support for bank-issued stablecoins, signaling a potential shift in how digital currencies could integrate with traditional banking. Stablecoins, which are digital tokens pegged to assets like the U.S. dollar, have long been praised for their ability to provide stability in the highly volatile crypto market. The CFTC’s endorsement could accelerate their adoption, bringing both regulatory cl

In a significant development for the cryptocurrency and financial sectors, the U.S. Commodity Futures Trading Commission (CFTC) has recently indicated support for bank-issued stablecoins, signaling a potential shift in how digital currencies could integrate with traditional banking. Stablecoins, which are digital tokens pegged to assets like the U.S. dollar, have long been praised for their ability to provide stability in the highly volatile crypto market. The CFTC’s endorsement could accelerate their adoption, bringing both regulatory cl

DEFI-1,26%

- Reward

- 8

- 15

- Repost

- Share

ybaser :

:

DYOR 🤓View More

🚨 #CFTCOKsBankStablecoins — What Actually Changed & Why It Matters

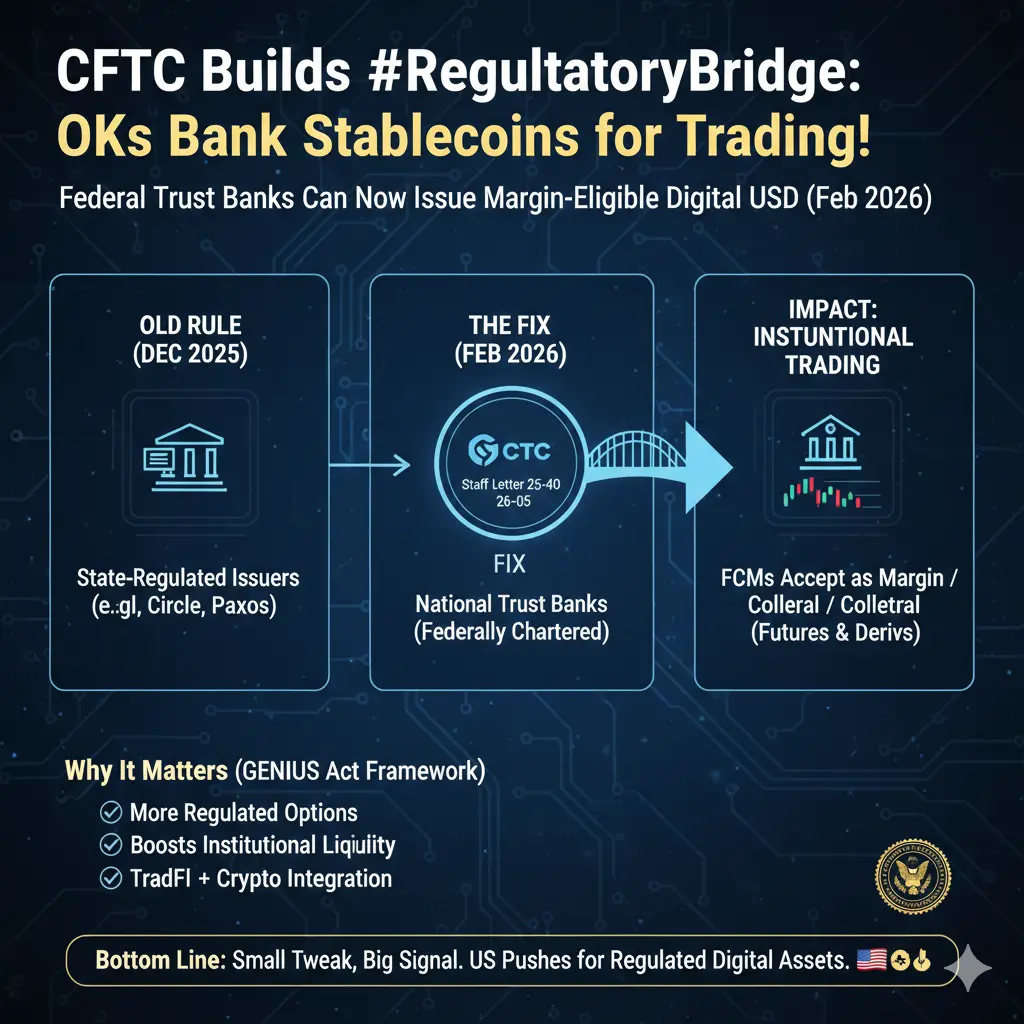

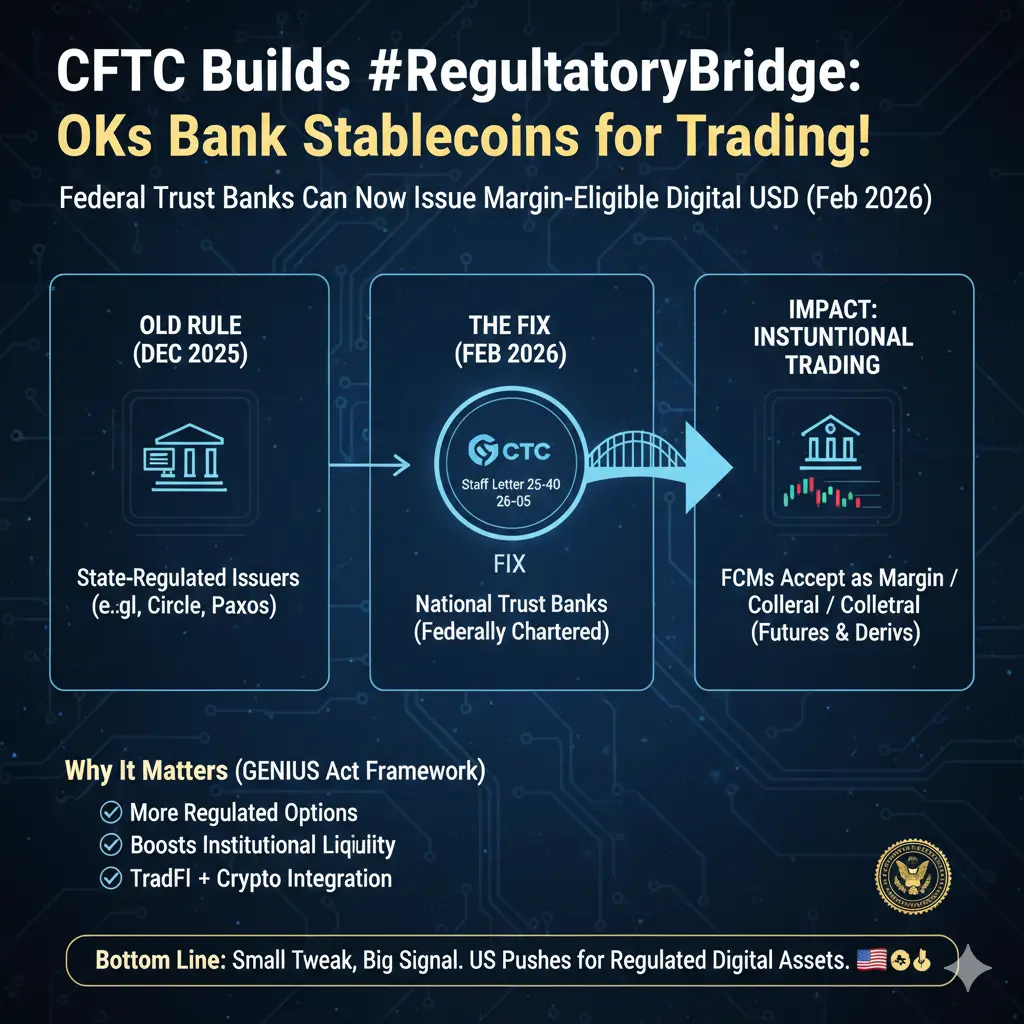

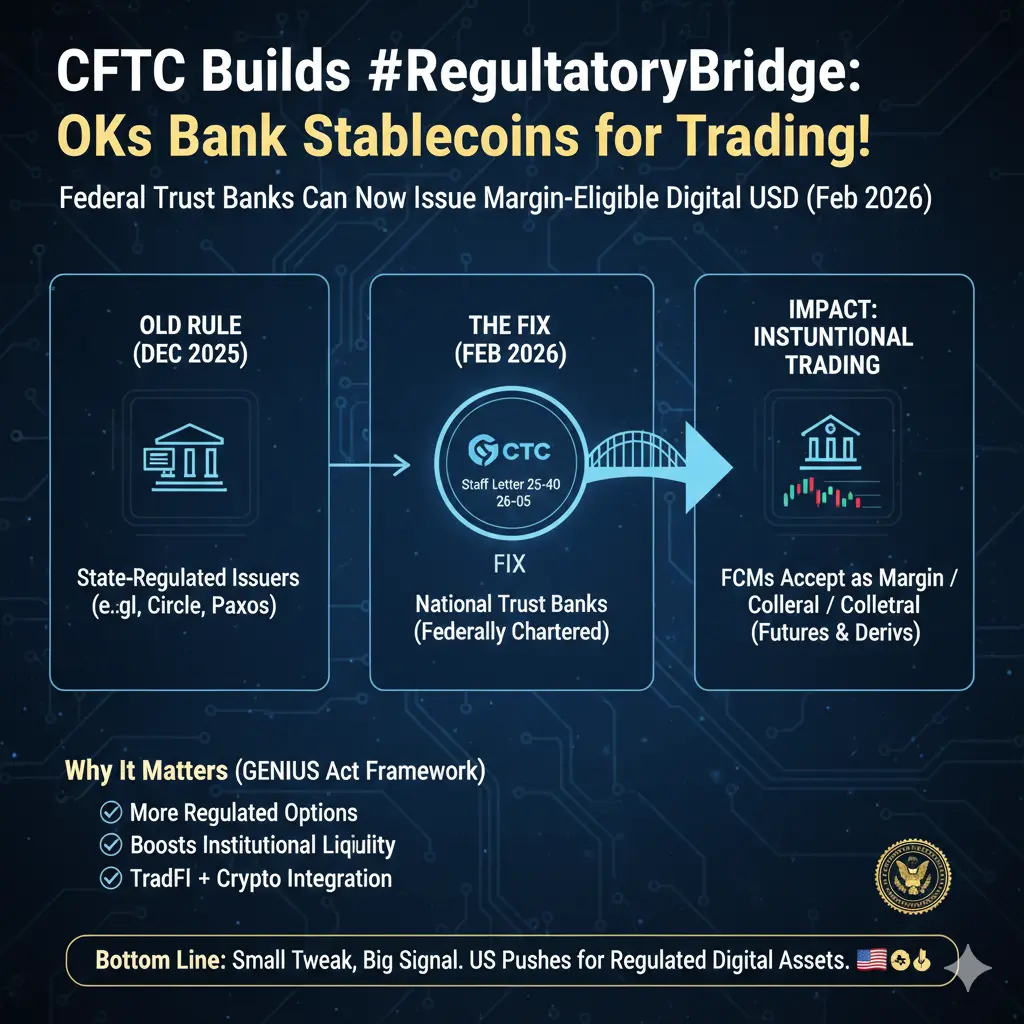

On February 6, 2026, the U.S. Commodity Futures Trading Commission (CFTC) reissued Staff Letter 25-40 (now under guidance 26-05) with a small but meaningful clarification for the crypto and derivatives markets.

The update confirms that national trust banks — federally chartered and OCC-supervised institutions — are now explicitly recognized as eligible issuers of “payment stablecoins” that Futures Commission Merchants (FCMs) can accept as margin or collateral in futures and derivatives trading.

This fixes an oversight from the

On February 6, 2026, the U.S. Commodity Futures Trading Commission (CFTC) reissued Staff Letter 25-40 (now under guidance 26-05) with a small but meaningful clarification for the crypto and derivatives markets.

The update confirms that national trust banks — federally chartered and OCC-supervised institutions — are now explicitly recognized as eligible issuers of “payment stablecoins” that Futures Commission Merchants (FCMs) can accept as margin or collateral in futures and derivatives trading.

This fixes an oversight from the

USDP0,07%

- Reward

- 6

- 9

- Repost

- Share

AnnaCryptoWriter :

:

Happy New Year! 🤑View More

#CFTCOKsBankStablecoins A Quiet but Important Win for Regulated Crypto

On February 6, 2026, the U.S. Commodity Futures Trading Commission (CFTC) reissued Staff Letter 25-40, originally released in December 2025, with a small but meaningful clarification. While the update may look minor on the surface, it carries important implications for the future of regulated stablecoins and institutional crypto markets.

The original letter gave a “no-action” position to Futures Commission Merchants (FCMs). This meant the CFTC would not take enforcement action if FCMs accepted certain payment stablecoins as

On February 6, 2026, the U.S. Commodity Futures Trading Commission (CFTC) reissued Staff Letter 25-40, originally released in December 2025, with a small but meaningful clarification. While the update may look minor on the surface, it carries important implications for the future of regulated stablecoins and institutional crypto markets.

The original letter gave a “no-action” position to Futures Commission Merchants (FCMs). This meant the CFTC would not take enforcement action if FCMs accepted certain payment stablecoins as

USDP0,07%

- Reward

- 8

- 20

- Repost

- Share

HanssiMazak :

:

1000x VIbes 🤑View More

#CFTCOKsBankStablecoins: A Milestone for Crypto Regulation and Market Stability

The Commodity Futures Trading Commission (CFTC) has recently given a green light to bank-issued stablecoins, a decision that could have significant implications for the crypto market, banking sector, and financial innovation.

This move, captured under the hashtag #CFTCOKsBankStablecoins, represents one of the most concrete steps toward bridging traditional finance and digital assets, signaling both regulatory clarity and potential growth opportunities.

Stablecoins, digital assets pegged to fiat currencies, have lo

The Commodity Futures Trading Commission (CFTC) has recently given a green light to bank-issued stablecoins, a decision that could have significant implications for the crypto market, banking sector, and financial innovation.

This move, captured under the hashtag #CFTCOKsBankStablecoins, represents one of the most concrete steps toward bridging traditional finance and digital assets, signaling both regulatory clarity and potential growth opportunities.

Stablecoins, digital assets pegged to fiat currencies, have lo

DEFI-1,26%

- Reward

- 6

- 12

- Repost

- Share

CryptoChampion :

:

Watching Closely 🔍️View More

#CFTCOKsBankStablecoins

What Actually Happened?

On February 6, 2026, the U.S. Commodity Futures Trading Commission (CFTC) reissued Staff Letter 25-40 (originally from December 8, 2025) with a small but important change.

The original letter (25-40) gave a "no-action" position — meaning the CFTC won't enforce certain strict rules against Futures Commission Merchants (FCMs) — if they:

Accept specific non-securities digital assets (like payment stablecoins) as margin/collateral for futures & derivatives trading.

Hold some proprietary payment stablecoins in segregated customer accounts.

The update

What Actually Happened?

On February 6, 2026, the U.S. Commodity Futures Trading Commission (CFTC) reissued Staff Letter 25-40 (originally from December 8, 2025) with a small but important change.

The original letter (25-40) gave a "no-action" position — meaning the CFTC won't enforce certain strict rules against Futures Commission Merchants (FCMs) — if they:

Accept specific non-securities digital assets (like payment stablecoins) as margin/collateral for futures & derivatives trading.

Hold some proprietary payment stablecoins in segregated customer accounts.

The update

USDP0,07%

- Reward

- 17

- 19

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊View More

#CFTCOKsBankStablecoins

The recent approval of bank-issued stablecoins by the U.S. Commodity Futures Trading Commission (CFTC) marks a significant milestone in the evolving regulatory and financial landscape. By formally recognizing bank-backed stablecoins, the CFTC is bridging the gap between traditional finance and digital assets, providing a framework that enhances market legitimacy, transparency, and investor confidence. This move not only accelerates the adoption of stablecoins in mainstream financial markets but also signals growing regulatory alignment with the realities of digital pay

The recent approval of bank-issued stablecoins by the U.S. Commodity Futures Trading Commission (CFTC) marks a significant milestone in the evolving regulatory and financial landscape. By formally recognizing bank-backed stablecoins, the CFTC is bridging the gap between traditional finance and digital assets, providing a framework that enhances market legitimacy, transparency, and investor confidence. This move not only accelerates the adoption of stablecoins in mainstream financial markets but also signals growing regulatory alignment with the realities of digital pay

- Reward

- 11

- 13

- Repost

- Share

HighAmbition :

:

1000x VIbes 🤑View More

#CFTCOKsBankStablecoins

The U.S. Commodity Futures Trading Commission (CFTC) has recently taken a major step in shaping the stablecoin landscape by approving banks to issue stablecoins directly. This move represents one of the most significant regulatory endorsements for the crypto industry in 2026, signaling that major regulators are increasingly willing to integrate digital assets into the traditional banking ecosystem. The decision aims to provide a clearer legal framework for stablecoins, enhance consumer protection, and strengthen financial stability while supporting innovation in paymen

The U.S. Commodity Futures Trading Commission (CFTC) has recently taken a major step in shaping the stablecoin landscape by approving banks to issue stablecoins directly. This move represents one of the most significant regulatory endorsements for the crypto industry in 2026, signaling that major regulators are increasingly willing to integrate digital assets into the traditional banking ecosystem. The decision aims to provide a clearer legal framework for stablecoins, enhance consumer protection, and strengthen financial stability while supporting innovation in paymen

DEFI-1,26%

- Reward

- 5

- 16

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

#CFTCOKsBankStablecoins

The CFTC’s recent approval of bank-issued stablecoins has sent ripples across the crypto and traditional finance ecosystems, highlighting the evolving relationship between regulation and innovation. Stablecoins, long criticized for regulatory ambiguity and risk, are now being embraced under clearer frameworks, marking a pivotal moment for mainstream adoption. This approval signals that regulators are recognizing the potential of stablecoins to bridge traditional finance and digital assets but it also raises questions about oversight, compliance, and systemic risk.

Fro

The CFTC’s recent approval of bank-issued stablecoins has sent ripples across the crypto and traditional finance ecosystems, highlighting the evolving relationship between regulation and innovation. Stablecoins, long criticized for regulatory ambiguity and risk, are now being embraced under clearer frameworks, marking a pivotal moment for mainstream adoption. This approval signals that regulators are recognizing the potential of stablecoins to bridge traditional finance and digital assets but it also raises questions about oversight, compliance, and systemic risk.

Fro

DEFI-1,26%

- Reward

- 6

- 11

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

# CFTCOKsBankStablecoins

The "Regulatory Clarity" (Analytical)

Caption: Regulatory clarity is the

fuel the market has been waiting for. ⚖️🔥

The news that #CFTCOKsBankStablecoins provides

a clear framework for banks is a huge win for the industry. It removes the

"uncertainty" premium that has scared away institutional capital for

years.

When banks feel safe entering the market, everyone

benefits. We move from the shadows into the light of regulated, transparent

financial markets. ☀️📈

This is a bullish long-term signal for the entire

space.

#CryptoMarket #Regulation

The "Regulatory Clarity" (Analytical)

Caption: Regulatory clarity is the

fuel the market has been waiting for. ⚖️🔥

The news that #CFTCOKsBankStablecoins provides

a clear framework for banks is a huge win for the industry. It removes the

"uncertainty" premium that has scared away institutional capital for

years.

When banks feel safe entering the market, everyone

benefits. We move from the shadows into the light of regulated, transparent

financial markets. ☀️📈

This is a bullish long-term signal for the entire

space.

#CryptoMarket #Regulation

- Reward

- like

- Comment

- Repost

- Share

#CFTCOKsBankStablecoins

What exactly happened?

On February 6, 2026, the U.S. Commodity Futures Trading Commission (CFTC) reissued Employee Letter 25-40, originally dated December 8, 2025, but with some minor yet important adjustments.

The original letter 25-40 provided a “no-action” stance—meaning the CFTC would not impose certain strict rules on futures commission merchants (FCMs)—if they:

Accept specific non-security digital assets such as payment stablecoins as collateral/margin for futures and derivatives trading.

Hold some proprietary payment stablecoins in segregated customer accounts.

What exactly happened?

On February 6, 2026, the U.S. Commodity Futures Trading Commission (CFTC) reissued Employee Letter 25-40, originally dated December 8, 2025, but with some minor yet important adjustments.

The original letter 25-40 provided a “no-action” stance—meaning the CFTC would not impose certain strict rules on futures commission merchants (FCMs)—if they:

Accept specific non-security digital assets such as payment stablecoins as collateral/margin for futures and derivatives trading.

Hold some proprietary payment stablecoins in segregated customer accounts.

USDP0,07%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

198.55K Popularity

1.25K Popularity

1.73K Popularity

5.88K Popularity

825 Popularity

34.15K Popularity

405 Popularity

795 Popularity

20.76K Popularity

277 Popularity

760 Popularity

10.1K Popularity

1.57K Popularity

17.51K Popularity

9.2K Popularity

News

View More21Shares has submitted an amendment for the issuance of the ONDO ETF to the US SEC

4 m

Data: 250 BTC transferred from an anonymous address, routed through intermediaries, and then flowed into Remitano

5 m

Jiang Zhuoer: U.S. stock market funds' perception of ETH is still in the 2014-2015 phase of the crypto circle. The ETH/BTC exchange rate may experience a second surge between 2026 and 2027.

6 m

"neoyokio.eth" added more after secretly accumulating ASTER, reaching a position of 11 million, becoming the largest on-chain ASTER long position.

10 m

Citi analyst: Wosh may adopt a gradual approach to reducing the Federal Reserve's balance sheet

22 m

Pin