# CryptoMarkets

6.85K

AngelEye

🏛️📉 #FedSignalsCarefulLiquidityTightening

A Federal Reserve official has hinted that the balance sheet should be reduced — but slowly and carefully.

This reinforces a controlled approach rather than aggressive liquidity tightening.

🔍 Why this matters:

Reducing the balance sheet means pulling excess liquidity out of the system.

That often leads to:

• More restrictive financial conditions

• Increased pressure on risk-on assets

• Greater market reaction to macro news

📊 What it means for Bitcoin & Crypto:

Periods of tightening liquidity usually bring higher volatility.

BTC and other risk asset

A Federal Reserve official has hinted that the balance sheet should be reduced — but slowly and carefully.

This reinforces a controlled approach rather than aggressive liquidity tightening.

🔍 Why this matters:

Reducing the balance sheet means pulling excess liquidity out of the system.

That often leads to:

• More restrictive financial conditions

• Increased pressure on risk-on assets

• Greater market reaction to macro news

📊 What it means for Bitcoin & Crypto:

Periods of tightening liquidity usually bring higher volatility.

BTC and other risk asset

BTC-2,02%

- Reward

- 4

- 6

- Repost

- Share

AylaShinex :

:

2026 GOGOGO 👊View More

One of $TON standout strengths is how it lowers both technical and psychological barriers for users.

Near-instant finality and minimal transaction costs allow participants to manage assets confidently, whether rebalancing portfolios, exploring new tokens, or interacting with DeFi protocols. This ease of access encourages repeated engagement, making DeFi feel approachable instead of complex.

STONfi leverages this environment as a reliable decentralized exchange layer on TON. By prioritizing execution consistency, it ensures swaps settle quickly and predictably, allowing users to act eff

Near-instant finality and minimal transaction costs allow participants to manage assets confidently, whether rebalancing portfolios, exploring new tokens, or interacting with DeFi protocols. This ease of access encourages repeated engagement, making DeFi feel approachable instead of complex.

STONfi leverages this environment as a reliable decentralized exchange layer on TON. By prioritizing execution consistency, it ensures swaps settle quickly and predictably, allowing users to act eff

TON0,82%

- Reward

- 1

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

Markets are once again at a critical decision point, forcing investors to choose between buying the dip or waiting for clearer confirmation. Recent price pullbacks across crypto and traditional markets have attracted opportunistic buyers who view these declines as healthy corrections within a broader long-term uptrend. Historically, disciplined dip-buying during periods of fear has rewarded patient investors, especially when supported by strong fundamentals, on-chain data, and improving macro conditions.

However, caution remains equally important. Volatility is still eleva

- Reward

- 4

- 7

- Repost

- Share

CryptoEye :

:

Buy To Earn 💎View More

#BuyTheDipOrWaitNow?

Markets are once again testing investor conviction. After a sharp pullback, emotions are running high—some see opportunity, others see risk. The key question isn’t just whether prices have fallen, but why they have fallen. If the dip is driven by short-term fear, leverage unwinding, or macro uncertainty without structural damage, it often presents selective buying opportunities for long-term investors. However, if liquidity is tightening, momentum is breaking, and higher time-frame trends are turning lower, patience can be a powerful strategy.

Buying the dip works best whe

Markets are once again testing investor conviction. After a sharp pullback, emotions are running high—some see opportunity, others see risk. The key question isn’t just whether prices have fallen, but why they have fallen. If the dip is driven by short-term fear, leverage unwinding, or macro uncertainty without structural damage, it often presents selective buying opportunities for long-term investors. However, if liquidity is tightening, momentum is breaking, and higher time-frame trends are turning lower, patience can be a powerful strategy.

Buying the dip works best whe

- Reward

- 1

- Comment

- Repost

- Share

#TopCoinsRisingAgainsttheTrend Even as broader crypto markets face pullbacks, tightening liquidity, and rising uncertainty, a select group of top coins continues to display strength and upward momentum. This divergence is a powerful signal of a maturing ecosystem — one where assets no longer move in perfect correlation and where capital is becoming more selective.

From a technical standpoint, these leading tokens are holding key support zones and forming higher lows despite overall weakness. Volume patterns, moving average alignment, and relative strength metrics indicate sustained accumulatio

From a technical standpoint, these leading tokens are holding key support zones and forming higher lows despite overall weakness. Volume patterns, moving average alignment, and relative strength metrics indicate sustained accumulatio

- Reward

- 4

- 2

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

#WhenWillBTCRebound? | Patience Before the Next Move

Bitcoin is once again testing investor conviction as price action remains volatile and range-bound. After a powerful rally earlier in the cycle, BTC has entered a consolidation phase that feels uncomfortable—but historically, these periods often lay the groundwork for the strongest rebounds. The key question now is not if Bitcoin will rebound, but what conditions will trigger it.

From a macro perspective, liquidity remains the primary driver. Bitcoin continues to respond closely to interest rate expectations, dollar strength, and broader fin

Bitcoin is once again testing investor conviction as price action remains volatile and range-bound. After a powerful rally earlier in the cycle, BTC has entered a consolidation phase that feels uncomfortable—but historically, these periods often lay the groundwork for the strongest rebounds. The key question now is not if Bitcoin will rebound, but what conditions will trigger it.

From a macro perspective, liquidity remains the primary driver. Bitcoin continues to respond closely to interest rate expectations, dollar strength, and broader fin

BTC-2,02%

- Reward

- like

- Comment

- Repost

- Share

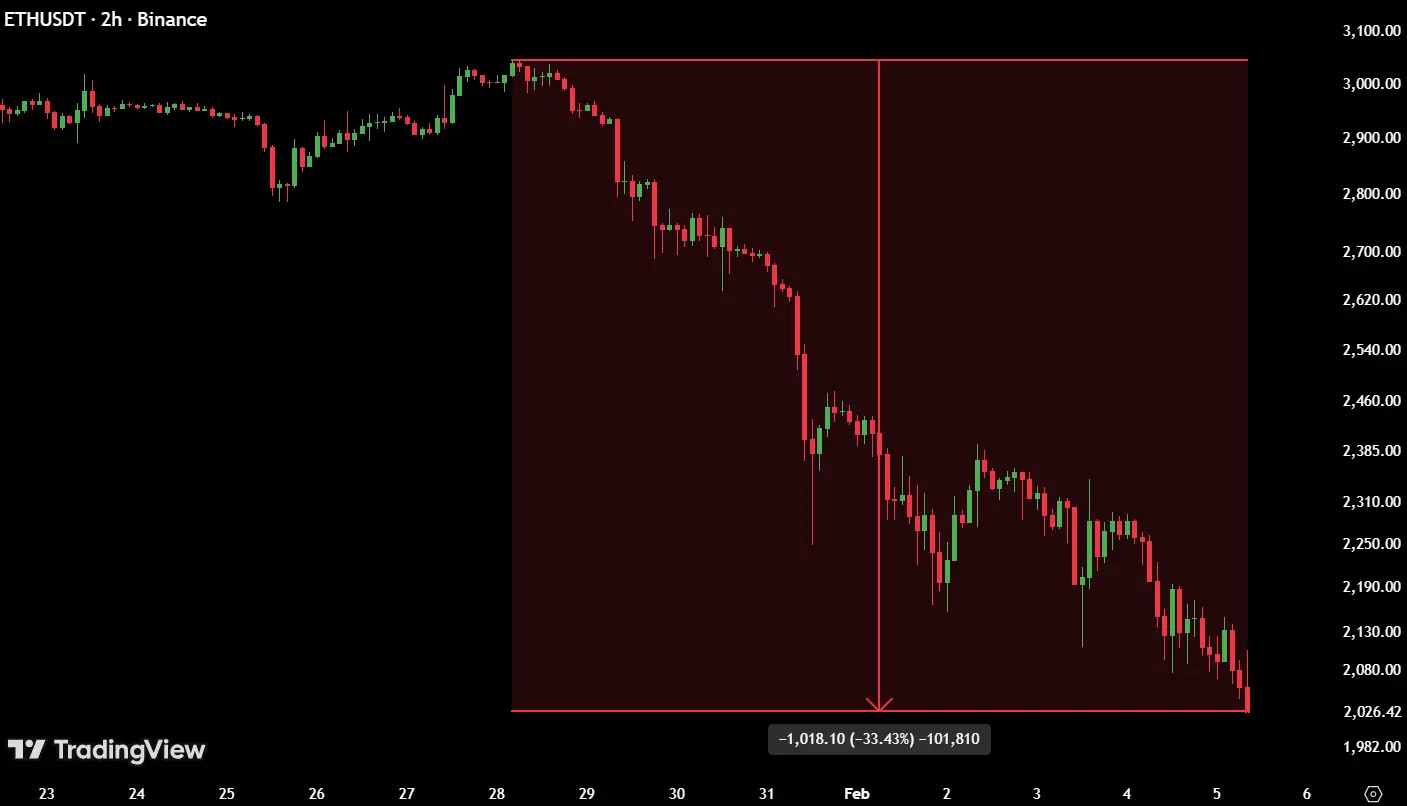

$ETH is down ~$1,000 in just 8 days.

At this pace, ETH hits zero in 16 days…

according to panic math, not reality.

Volatility shakes weak hands.

Markets reward patience.

#ETH #CryptoMarkets #Volatility #TradingPsychology

At this pace, ETH hits zero in 16 days…

according to panic math, not reality.

Volatility shakes weak hands.

Markets reward patience.

#ETH #CryptoMarkets #Volatility #TradingPsychology

ETH-3,12%

- Reward

- like

- Comment

- Repost

- Share

#InstitutionalHoldingsDebate #InstitutionalHoldingsDebate 🏦📊

Institutions aren’t just holding crypto — they’re shaping market psychology.

Key questions right now:

• Are big players stabilizing or destabilizing markets?

• Does their accumulation signal confidence or risk?

• How much influence do traditional funds have compared to retail traders?

📉 Short-term swings can fool sentiment

📈 Long-term trends are built by smart money

Your take:

▫️ Bullish — institutions = market backbone

▫️ Cautious — retail still moves emotion

▫️ Watching — waiting for clearer signals

Let’s discuss 👇

#CryptoMark

Institutions aren’t just holding crypto — they’re shaping market psychology.

Key questions right now:

• Are big players stabilizing or destabilizing markets?

• Does their accumulation signal confidence or risk?

• How much influence do traditional funds have compared to retail traders?

📉 Short-term swings can fool sentiment

📈 Long-term trends are built by smart money

Your take:

▫️ Bullish — institutions = market backbone

▫️ Cautious — retail still moves emotion

▫️ Watching — waiting for clearer signals

Let’s discuss 👇

#CryptoMark

- Reward

- 2

- 2

- Repost

- Share

BeautifulDay :

:

Happy New Year! 🤑View More

#TrumpWithdrawsEUTariffThreats Bitcoin Slides, Gold Soars Amid Macro Tensions

Global markets have reacted sharply to renewed tariff threats and geopolitical tensions emanating from the U.S., sending shockwaves through both traditional and digital assets. Bitcoin (BTC) dropped from above $95,000 to lows near $86,000–$90,000, while gold surged past $5,000, hitting record highs. This divergence highlights a classic risk-off rotation: investors are moving capital from high-beta assets into defensive stores of value. The move underscores how macro policy headlines can temporarily overshadow fundame

Global markets have reacted sharply to renewed tariff threats and geopolitical tensions emanating from the U.S., sending shockwaves through both traditional and digital assets. Bitcoin (BTC) dropped from above $95,000 to lows near $86,000–$90,000, while gold surged past $5,000, hitting record highs. This divergence highlights a classic risk-off rotation: investors are moving capital from high-beta assets into defensive stores of value. The move underscores how macro policy headlines can temporarily overshadow fundame

BTC-2,02%

- Reward

- 15

- 13

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

243.38K Popularity

54.45K Popularity

29.68K Popularity

22.88K Popularity

20.22K Popularity

123.36K Popularity

7.79K Popularity

13.43K Popularity

6.77K Popularity

5.87K Popularity

6.97K Popularity

17.73K Popularity

4.21K Popularity

23.53K Popularity

15.67K Popularity

News

View MoreMarket Report: Top 5 Cryptocurrency Declines on February 12, 2026, with the Largest Drop by MYX Finance

2 m

ENI CEO Arion Ho: DeFi decentralization, at its core, is about safeguarding rules and exit rights

3 m

TNSR (Tensor) 24-hour increase of 26.92%

4 m

Cardano Founder: Privacy-focused Midnight Blockchain to Launch in March

5 m

Analysis: Bitcoin is stuck in a "structural deadlock," with demand corridors absorbing selling pressure but massive trapped positions suppressing the rebound potential.

16 m

Pin