# ETHTrendWatch

147.93K

How do you view ETH’s recent price action? What’s your trading strategy? Share your thoughts in a post!

MrFlower_XingChen

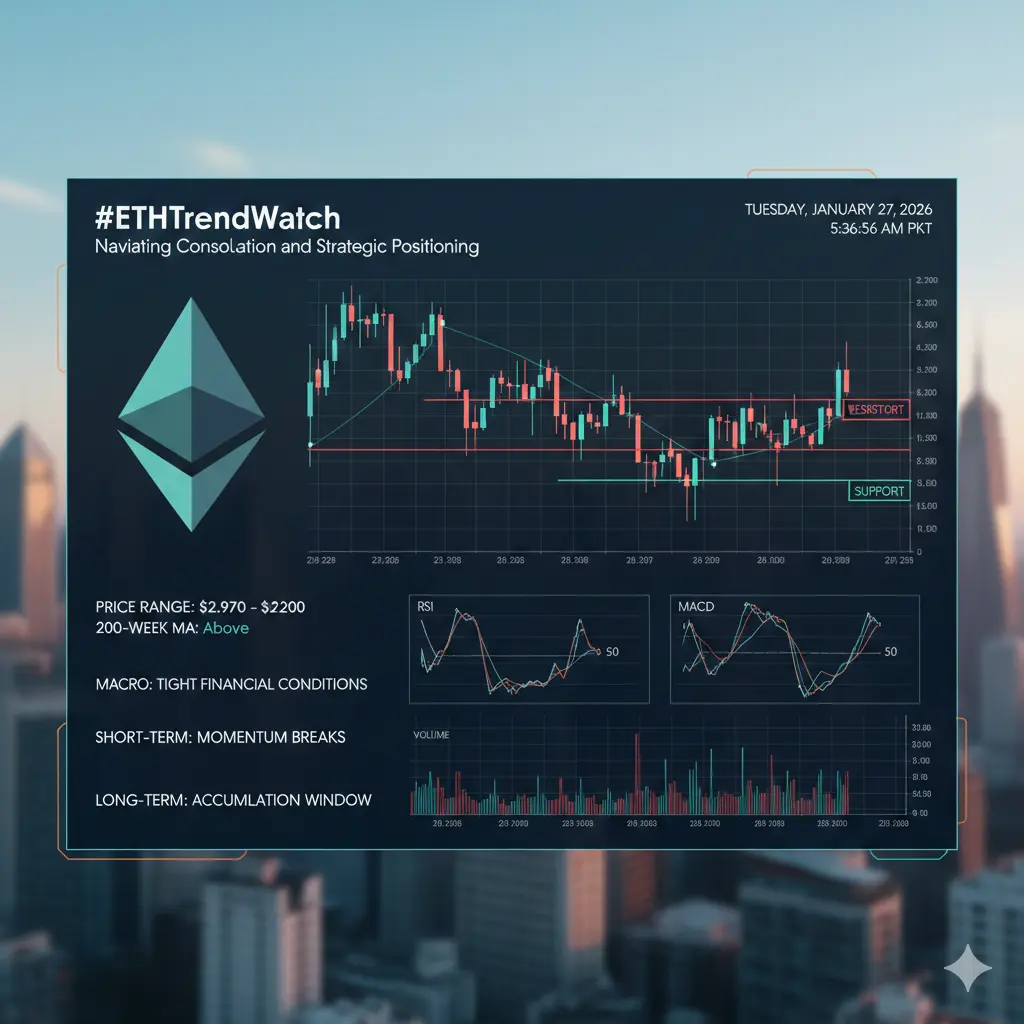

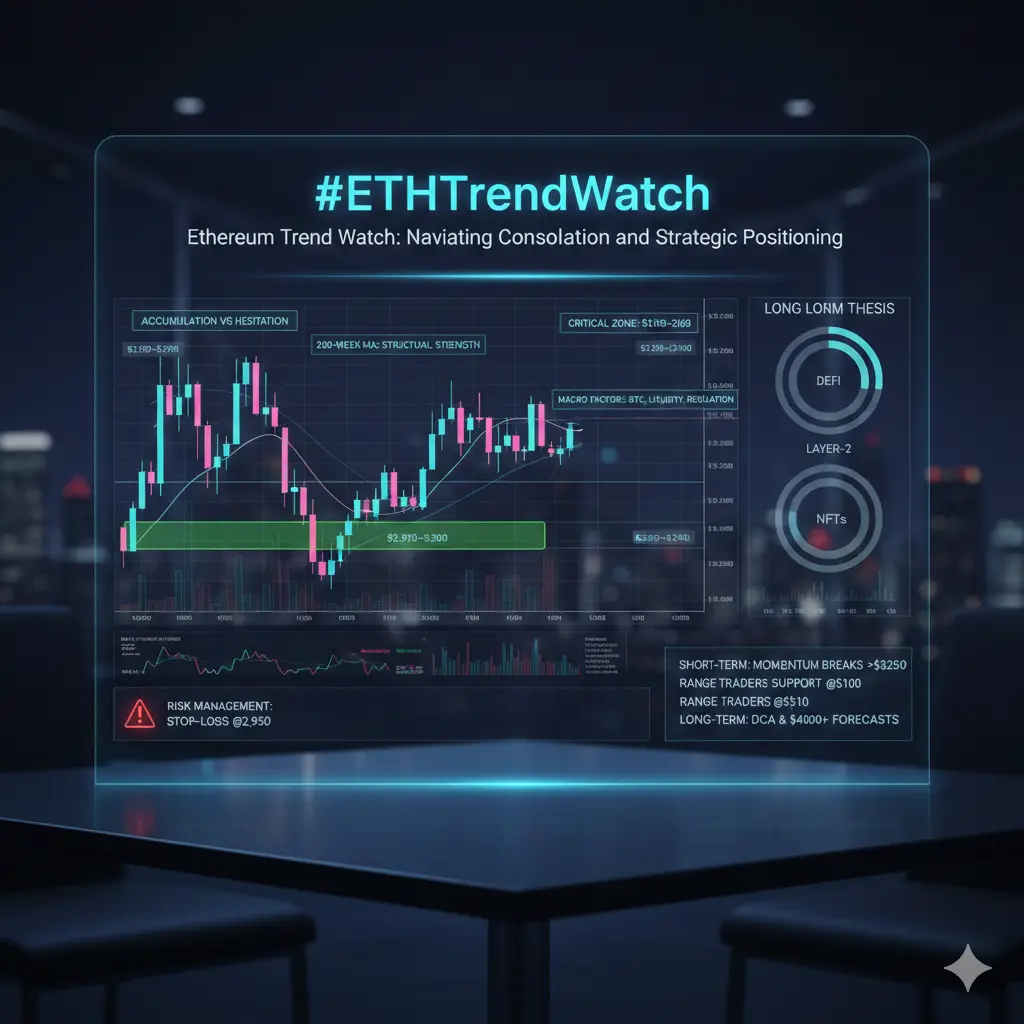

#ETHTrendWatch Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a consolidation phase marked by elevated volatility and cautious market participation. Price action remains confined within the $2,970–$3,200 zone, reflecting a market balancing accumulation interest with broader macro uncertainty. Traders and community participants are closely observing these ranges for actionable opportunities.

Demand consistently appears near the $3,100–$3,200 level, supported by short-term moving averages

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently navigating a consolidation phase marked by elevated volatility and cautious market participation. Price action remains confined within the $2,970–$3,200 zone, reflecting a market balancing accumulation interest with broader macro uncertainty. Traders and community participants are closely observing these ranges for actionable opportunities.

Demand consistently appears near the $3,100–$3,200 level, supported by short-term moving averages

- Reward

- 20

- 95

- Repost

- Share

GateUser-0647c8a9 :

:

Paying Close Attention🔍View More

#ETHTrendWatch

ETH price action is tightening, and compression like this often leads to a strong breakout.

I’m watching how ETH reacts to key support while tracking BTC dominance and altcoin rotation.

Volume behavior here matters more than small candles.

If momentum returns, ETH usually leads the next leg for alts.

Position size small, entries near structure, and patience for confirmation.

Are you accumulating ETH here or waiting for a clear breakout?

ETH price action is tightening, and compression like this often leads to a strong breakout.

I’m watching how ETH reacts to key support while tracking BTC dominance and altcoin rotation.

Volume behavior here matters more than small candles.

If momentum returns, ETH usually leads the next leg for alts.

Position size small, entries near structure, and patience for confirmation.

Are you accumulating ETH here or waiting for a clear breakout?

- Reward

- 21

- 32

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

#ETHTrendWatch The Current Setup: ETH at Critical Inflection Point

Ethereum is consolidating in a historically significant zone between $3,200 and $3,450. This isn't just another trading range—it's a macro decision point that will determine whether ETH:

1. Breaks out to retest all-time highs ahead of spot ETF trading

2. Breaks down into a deeper correction toward $2,800

3. Extends consolidation through summer (bullish for altcoins)

Current Technical State:

· Price: $3,315 (-2.4% 24h)

· Market Cap Rank: #2, but dominance slipping (15.8%)

· Against BTC: ETH/BTC ratio at critical 0.052 support (m

Ethereum is consolidating in a historically significant zone between $3,200 and $3,450. This isn't just another trading range—it's a macro decision point that will determine whether ETH:

1. Breaks out to retest all-time highs ahead of spot ETF trading

2. Breaks down into a deeper correction toward $2,800

3. Extends consolidation through summer (bullish for altcoins)

Current Technical State:

· Price: $3,315 (-2.4% 24h)

· Market Cap Rank: #2, but dominance slipping (15.8%)

· Against BTC: ETH/BTC ratio at critical 0.052 support (m

- Reward

- 9

- 12

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#ETHTrendWatch

As of 27 January 2026, the Ethereum market remains at a pivotal inflection point, with price action, sentiment and on‑chain dynamics all signaling a mixed but actively contested trend that traders and long‑term observers are watching closely. After a period of decline from cyclical highs seen in late 2025, ETH has struggled to find consistent upside, with recent data showing prices dipping below key support levels and extending a weekly decline of nearly 11 % as sellers have pushed the market lower and bearish momentum strengthened. On‑chain whale activity has been a double‑edg

As of 27 January 2026, the Ethereum market remains at a pivotal inflection point, with price action, sentiment and on‑chain dynamics all signaling a mixed but actively contested trend that traders and long‑term observers are watching closely. After a period of decline from cyclical highs seen in late 2025, ETH has struggled to find consistent upside, with recent data showing prices dipping below key support levels and extending a weekly decline of nearly 11 % as sellers have pushed the market lower and bearish momentum strengthened. On‑chain whale activity has been a double‑edg

- Reward

- 6

- 9

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

#ETHTrendWatch

ETH Market Update: A Deep Dive Into Recent Price Action, Key Levels, and How I’m Positioning Through the Noise

Ethereum has been on a noticeable rollercoaster over the past several weeks, and the recent price action is a textbook example of a market that is digesting prior gains while reassessing future expectations. Volatility has picked up, sentiment has flipped rapidly, and narratives have rotated almost daily. Despite all of this, ETH has continued to show a degree of resilience that’s easy to overlook if you’re focused only on short-term candles.

What we are seeing right n

ETH Market Update: A Deep Dive Into Recent Price Action, Key Levels, and How I’m Positioning Through the Noise

Ethereum has been on a noticeable rollercoaster over the past several weeks, and the recent price action is a textbook example of a market that is digesting prior gains while reassessing future expectations. Volatility has picked up, sentiment has flipped rapidly, and narratives have rotated almost daily. Despite all of this, ETH has continued to show a degree of resilience that’s easy to overlook if you’re focused only on short-term candles.

What we are seeing right n

- Reward

- 12

- 13

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#ETHTrendWatch

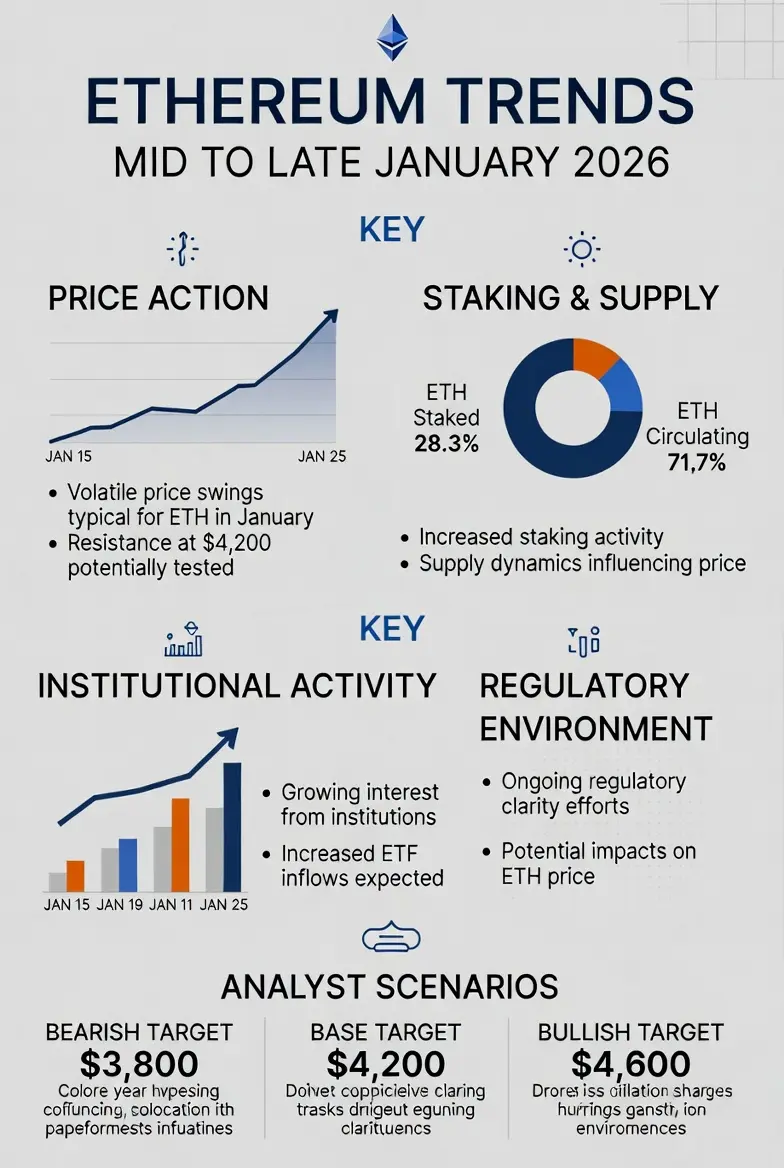

Here’s a snapshot of the key trends for mid-to-late January 2026:

· Current Price Action & Outlook: Recent price pressure; trading below a key resistance level, with some analysts concerned about further downside if it cannot hold support. Near-term focus on the $2,800-$2,920 zone.

· Narrative Pressure: The Ethereum Foundation is pushing back against narratives of a "midlife crisis" by highlighting institutional adoption, signaling a fight for market perception.

· Staking & Supply: A record ~30% of ETH supply is staked, tightening liquid supply and supporting network security.

Here’s a snapshot of the key trends for mid-to-late January 2026:

· Current Price Action & Outlook: Recent price pressure; trading below a key resistance level, with some analysts concerned about further downside if it cannot hold support. Near-term focus on the $2,800-$2,920 zone.

· Narrative Pressure: The Ethereum Foundation is pushing back against narratives of a "midlife crisis" by highlighting institutional adoption, signaling a fight for market perception.

· Staking & Supply: A record ~30% of ETH supply is staked, tightening liquid supply and supporting network security.

- Reward

- 15

- 15

- Repost

- Share

MoonGirl :

:

Happy New Year! 🤑View More

#ETHTrendWatch

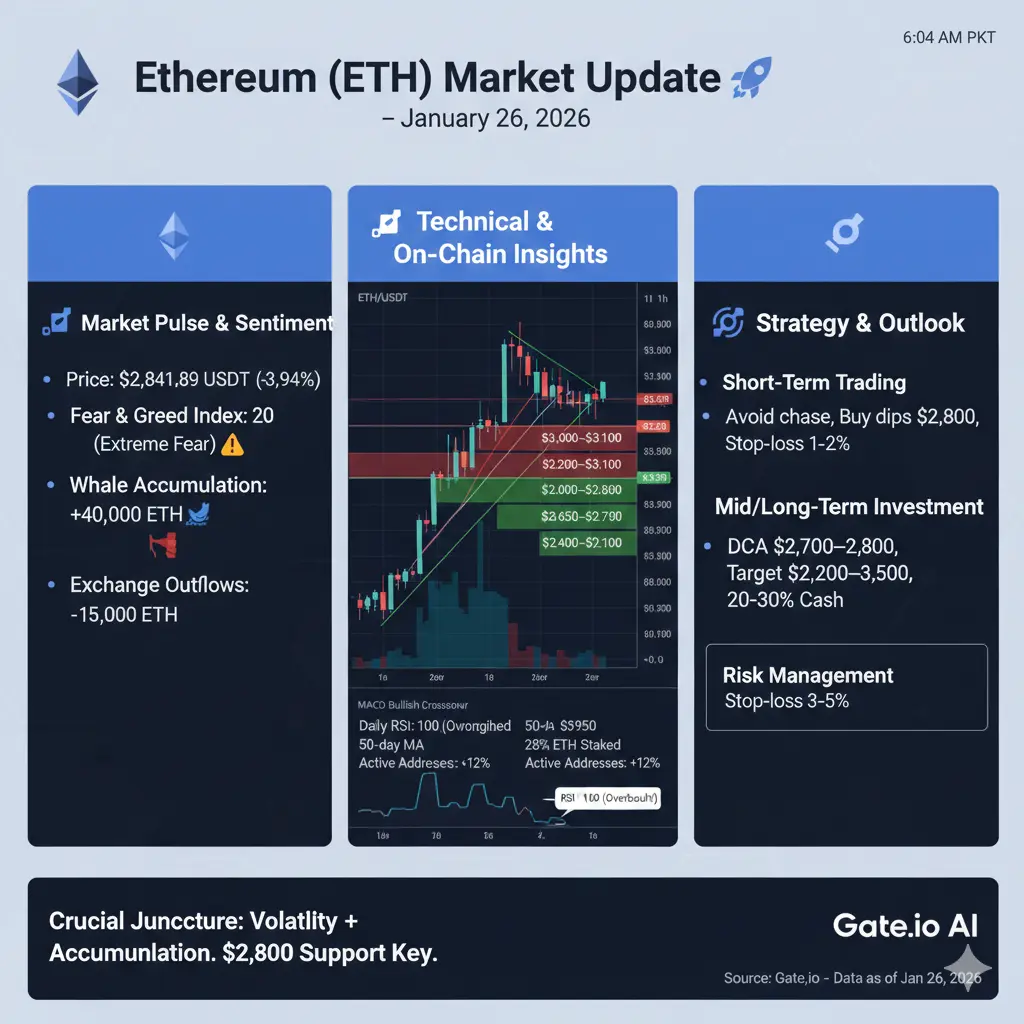

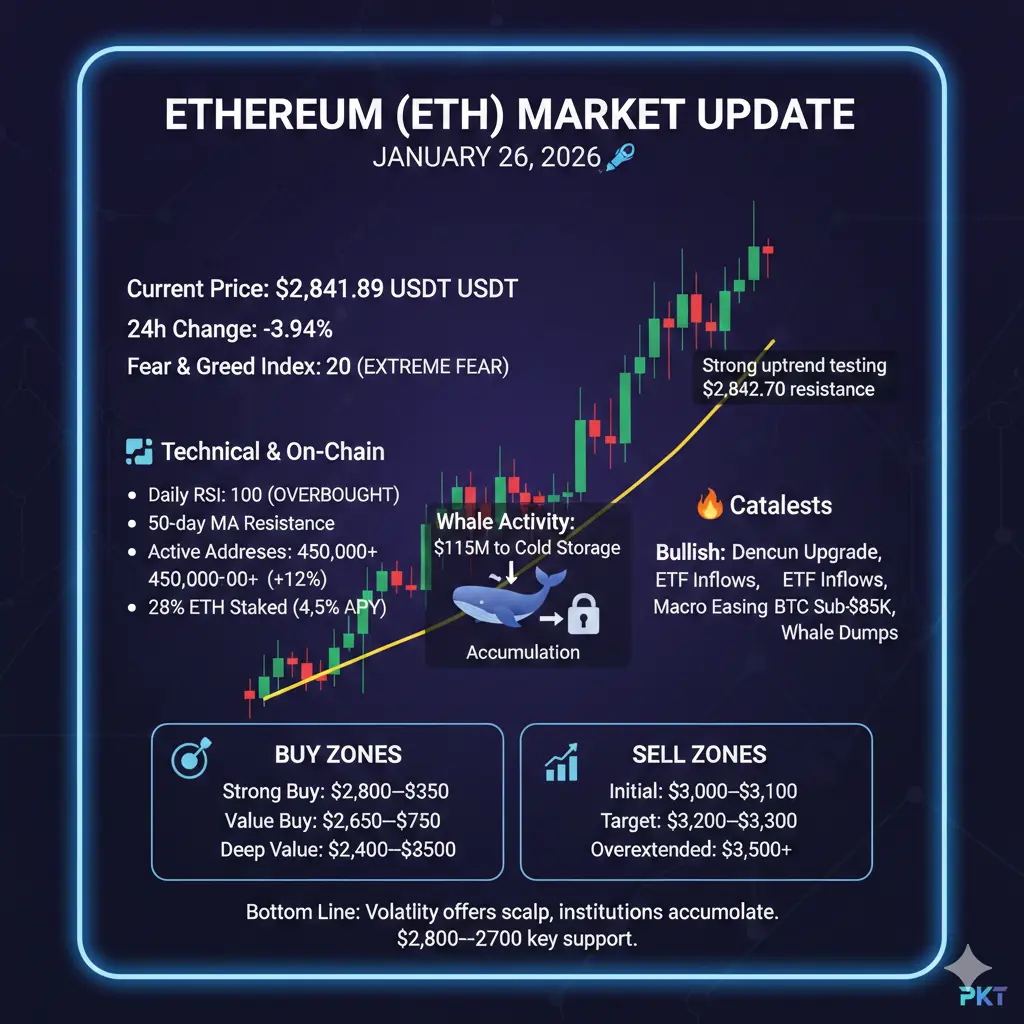

Ethereum (ETH) Market Update – January 26, 2026 🚀

Current Price: $2,841.89 USDT

24h Range: $2,787.25 – $2,960.46

24h Change: -3.94% (up 1.2% in last hour)

24h Volume: 197,278 ETH (~$568M)

📊 Market Pulse & Sentiment

Ethereum is navigating high volatility amid a broader crypto correction. Extreme fear dominates the market (Fear & Greed Index: 20), historically a potential bounce zone—but also a warning for short-term pullbacks. Short-term charts (15min–1h) show buying strength with volume surging 56%, signaling potential accumulation. Daily RSI hits 100—rare overbought levels t

Ethereum (ETH) Market Update – January 26, 2026 🚀

Current Price: $2,841.89 USDT

24h Range: $2,787.25 – $2,960.46

24h Change: -3.94% (up 1.2% in last hour)

24h Volume: 197,278 ETH (~$568M)

📊 Market Pulse & Sentiment

Ethereum is navigating high volatility amid a broader crypto correction. Extreme fear dominates the market (Fear & Greed Index: 20), historically a potential bounce zone—but also a warning for short-term pullbacks. Short-term charts (15min–1h) show buying strength with volume surging 56%, signaling potential accumulation. Daily RSI hits 100—rare overbought levels t

- Reward

- 32

- 26

- Repost

- Share

BTC1iqbal :

:

Watching Closely 🔍️View More

#ETHTrendWatch After Consolidation — Where Ethereum’s Next Direction May Form

As 2026 progresses, Ethereum’s extended consolidation is beginning to take on greater strategic meaning. What initially appeared as hesitation now increasingly resembles preparation — a phase where capital reorganizes rather than exits.

Sideways markets do not signal weakness by default.

They signal negotiation.

Ethereum continues to absorb supply within a clearly defined structure, suggesting that both buyers and sellers are waiting not for price confirmation alone, but for liquidity alignment across the broader mar

As 2026 progresses, Ethereum’s extended consolidation is beginning to take on greater strategic meaning. What initially appeared as hesitation now increasingly resembles preparation — a phase where capital reorganizes rather than exits.

Sideways markets do not signal weakness by default.

They signal negotiation.

Ethereum continues to absorb supply within a clearly defined structure, suggesting that both buyers and sellers are waiting not for price confirmation alone, but for liquidity alignment across the broader mar

- Reward

- 10

- 9

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#ETHTrendWatch Ethereum Trend Watch: Navigating Consolidation and Strategic Positioning

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently moving through a well-defined consolidation phase characterized by elevated volatility and cautious market participation. Price action remains largely contained within the $2,970–$3,200 range, reflecting a market balancing accumulation interest against hesitation driven by broader macro uncertainty.

Over the past several weeks, ETH has repeatedly oscillated between $2,950 and $3,260, reinforcing the idea that neither buyers nor sellers

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently moving through a well-defined consolidation phase characterized by elevated volatility and cautious market participation. Price action remains largely contained within the $2,970–$3,200 range, reflecting a market balancing accumulation interest against hesitation driven by broader macro uncertainty.

Over the past several weeks, ETH has repeatedly oscillated between $2,950 and $3,260, reinforcing the idea that neither buyers nor sellers

- Reward

- 8

- 9

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#ETHTrendWatch

Navigating Ethereum’s Consolidation and Market Dynamics

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently experiencing a phase of range-bound consolidation, reflecting a market that is balancing technical signals with macroeconomic considerations. As of January 25, 2026, ETH is trading in the $2,970–$3,200 range, following a period of choppy price action and retracements from recent highs. This consolidation phase signals that market participants are weighing accumulation against short-term profit-taking, and it highlights the importance of disciplined, s

Navigating Ethereum’s Consolidation and Market Dynamics

Ethereum (ETH), the world’s second-largest cryptocurrency, is currently experiencing a phase of range-bound consolidation, reflecting a market that is balancing technical signals with macroeconomic considerations. As of January 25, 2026, ETH is trading in the $2,970–$3,200 range, following a period of choppy price action and retracements from recent highs. This consolidation phase signals that market participants are weighing accumulation against short-term profit-taking, and it highlights the importance of disciplined, s

- Reward

- 17

- 18

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

52.12K Popularity

14.23K Popularity

10.75K Popularity

5.11K Popularity

4.41K Popularity

4.37K Popularity

3.71K Popularity

3.7K Popularity

69.7K Popularity

111.58K Popularity

78.73K Popularity

22.69K Popularity

45.42K Popularity

37.71K Popularity

176.03K Popularity

News

View MoreData: 511.57 BTC transferred from an anonymous address, and after routing, flowed into Cobo.com

10 m

Data: A total of 146,000 SOL transferred to anonymous addresses, worth approximately $182 million.

50 m

Data: If BTC breaks through $92,200, the total liquidation strength of mainstream CEX short positions will reach $1.523 billion.

1 h

Data: 24,646,700 TRX transferred from anonymous addresses, worth approximately $7,236,200.

1 h

Data: 36,400 SOL transferred from an anonymous address, worth approximately $4.5 million

1 h

Pin