Peacefulheart

No content yet

Peacefulheart

#CryptoMarketWatch 1️⃣ Very solid market overview. The balance between macro pressure, technical levels, and on-chain signals makes this analysis extremely valuable.

2️⃣ Great breakdown of BTC and ETH at decision zones. I like the clear separation between short-term relief and broader structural risk.

3️⃣ This is the kind of realistic crypto analysis traders need right now. No hype, just levels, liquidity, and disciplined scenarios.

4️⃣ Strong insight on leverage cleanup and its impact on market structure. The weekend dip context is explained very clearly.

5️⃣ Excellent comparison between Bitc

2️⃣ Great breakdown of BTC and ETH at decision zones. I like the clear separation between short-term relief and broader structural risk.

3️⃣ This is the kind of realistic crypto analysis traders need right now. No hype, just levels, liquidity, and disciplined scenarios.

4️⃣ Strong insight on leverage cleanup and its impact on market structure. The weekend dip context is explained very clearly.

5️⃣ Excellent comparison between Bitc

- Reward

- 12

- 16

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#USGovernmentShutdownRisk 1️⃣ Well-balanced analysis of how a potential U.S. government shutdown could impact crypto. Clear focus on volatility, liquidity, and risk management.

2️⃣ Great breakdown. I like how this highlights Bitcoin’s role as a hedge during fiscal uncertainty without overstating the impact.

3️⃣ Insightful take on shutdown risk. The distinction between short-term turbulence and long-term crypto resilience is very well explained.

4️⃣ Strong macro perspective. Watching BTC support levels alongside ETH and L2 strength is exactly the right approach in this environment.

5️⃣ This is

2️⃣ Great breakdown. I like how this highlights Bitcoin’s role as a hedge during fiscal uncertainty without overstating the impact.

3️⃣ Insightful take on shutdown risk. The distinction between short-term turbulence and long-term crypto resilience is very well explained.

4️⃣ Strong macro perspective. Watching BTC support levels alongside ETH and L2 strength is exactly the right approach in this environment.

5️⃣ This is

- Reward

- 7

- 14

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#TraditionalFinanceAcceleratesTokenization 1️⃣ Excellent breakdown of how traditional finance is embracing tokenization. Clear, insightful, and perfectly explains why this shift is structural, not just a trend.

2️⃣ This thread explains tokenization in a very mature way. Great clarity on liquidity, settlement efficiency, and why institutions are moving fast.

3️⃣ Well-articulated view on how blockchain is reshaping capital markets. Tokenization truly feels like the bridge between TradFi and DeFi.

4️⃣ Strong analysis. The focus on regulatory compliance + innovation shows why institutions are comf

2️⃣ This thread explains tokenization in a very mature way. Great clarity on liquidity, settlement efficiency, and why institutions are moving fast.

3️⃣ Well-articulated view on how blockchain is reshaping capital markets. Tokenization truly feels like the bridge between TradFi and DeFi.

4️⃣ Strong analysis. The focus on regulatory compliance + innovation shows why institutions are comf

DEFI1,51%

- Reward

- 7

- 11

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

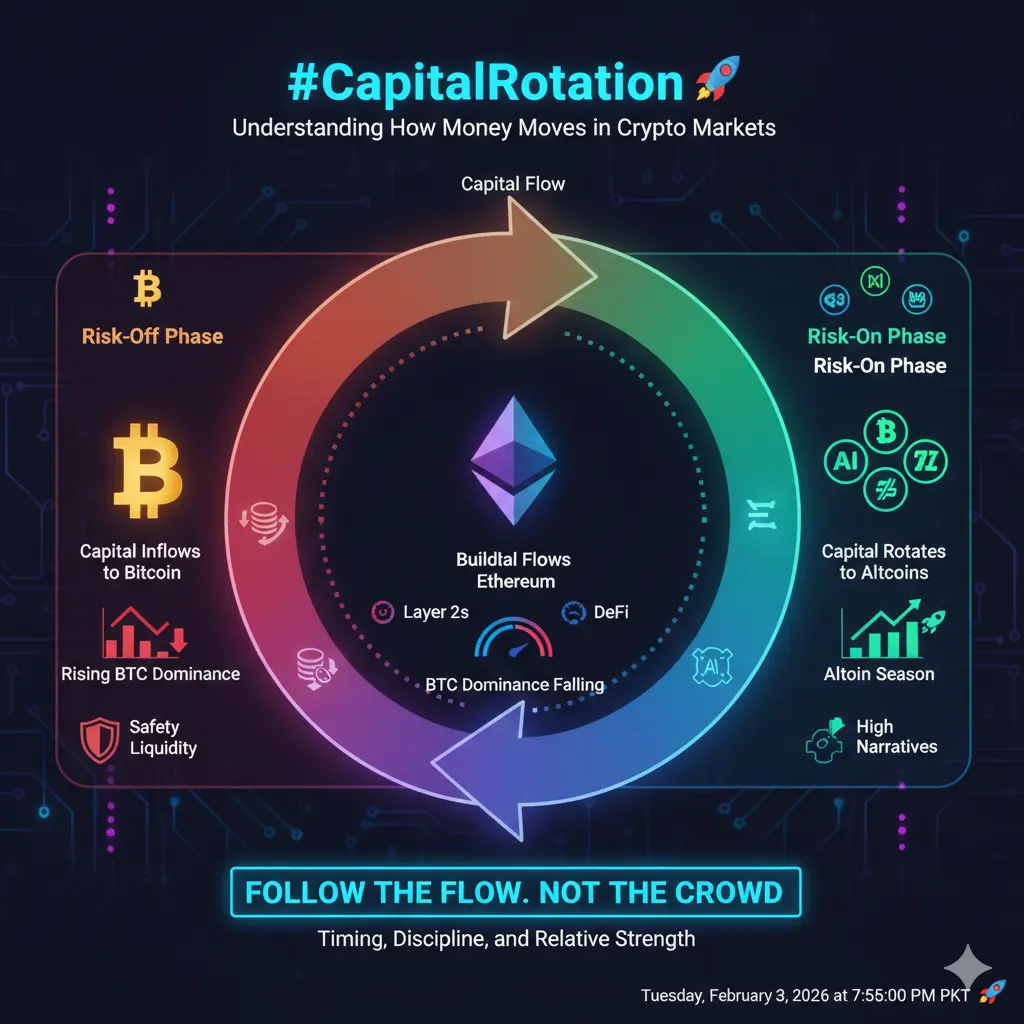

#CapitalRotation Understanding How Money Moves in Crypto Markets

In crypto markets, price movements rarely occur in isolation. Behind every rally, correction, or consolidation lies a powerful and often overlooked force: capital rotation. Understanding how money flows between assets is one of the most important skills for both active traders and long-term investors seeking consistent performance across market cycles.

Capital rotation refers to the movement of funds from one asset or sector to another as market conditions evolve. In crypto, this rotation often follows a recognizable sequence. Du

In crypto markets, price movements rarely occur in isolation. Behind every rally, correction, or consolidation lies a powerful and often overlooked force: capital rotation. Understanding how money flows between assets is one of the most important skills for both active traders and long-term investors seeking consistent performance across market cycles.

Capital rotation refers to the movement of funds from one asset or sector to another as market conditions evolve. In crypto, this rotation often follows a recognizable sequence. Du

- Reward

- 7

- 4

- Repost

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

#AltcoinDivergence Understanding a Structural Shift in Crypto Markets

Altcoin divergence is emerging as one of the clearest signals in the current crypto market structure. While Bitcoin continues to dominate headlines and maintain relative strength, altcoins are no longer moving as a unified group. Some are breaking down, others are consolidating, and a select few are quietly outperforming. This divergence is not random—it reflects changing liquidity flows, evolving risk appetite, and increasing capital selectivity across the market.

In earlier market cycles, altcoins largely moved together. B

Altcoin divergence is emerging as one of the clearest signals in the current crypto market structure. While Bitcoin continues to dominate headlines and maintain relative strength, altcoins are no longer moving as a unified group. Some are breaking down, others are consolidating, and a select few are quietly outperforming. This divergence is not random—it reflects changing liquidity flows, evolving risk appetite, and increasing capital selectivity across the market.

In earlier market cycles, altcoins largely moved together. B

- Reward

- 5

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#ETHUnderPressure Navigating Ethereum’s Critical Phase

Ethereum is currently undergoing a multi-dimensional pressure test, and the implications extend far beyond short-term price action. Traders, investors, and ecosystem participants are closely tracking not only ETH’s valuation but also network activity, on-chain behavior, and macroeconomic alignment. This convergence creates a high-stakes environment where Ethereum’s movements increasingly serve as a signal for broader trends across DeFi, NFTs, and the wider blockchain economy.

At the core of this pressure lies the interaction between liqui

Ethereum is currently undergoing a multi-dimensional pressure test, and the implications extend far beyond short-term price action. Traders, investors, and ecosystem participants are closely tracking not only ETH’s valuation but also network activity, on-chain behavior, and macroeconomic alignment. This convergence creates a high-stakes environment where Ethereum’s movements increasingly serve as a signal for broader trends across DeFi, NFTs, and the wider blockchain economy.

At the core of this pressure lies the interaction between liqui

- Reward

- 7

- 5

- Repost

- Share

Discovery :

:

Thank you for the information and sharing.View More

#BTCKeyLevelBreak Why Bitcoin’s Structural Shift Matters More Than Ever

Bitcoin has once again reached a decisive moment in its market structure. The recent BTC key level break is not merely a short-term price movement; it represents a potential shift in momentum, sentiment, and broader market psychology. In crypto markets, key levels function as decision zones where conviction is tested, liquidity is concentrated, and long-term trends often begin or end. When these levels break decisively, their impact typically extends far beyond a single trading session.

Understanding key levels is essentia

Bitcoin has once again reached a decisive moment in its market structure. The recent BTC key level break is not merely a short-term price movement; it represents a potential shift in momentum, sentiment, and broader market psychology. In crypto markets, key levels function as decision zones where conviction is tested, liquidity is concentrated, and long-term trends often begin or end. When these levels break decisively, their impact typically extends far beyond a single trading session.

Understanding key levels is essentia

BTC-7,27%

- Reward

- 6

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

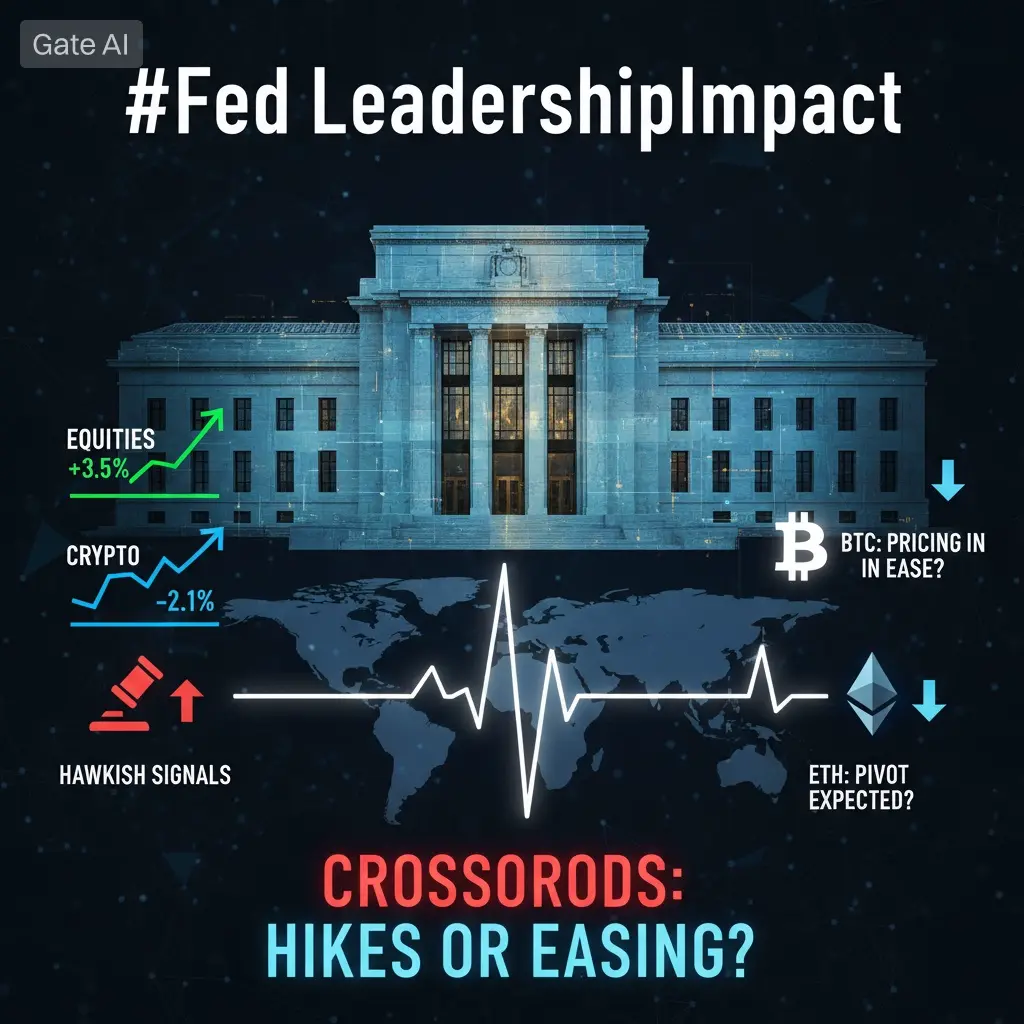

#FedLeadershipImpact How Monetary Policy Shapes Crypto Market Cycles

Macro expectations are once again dominating market attention, and the influence of Federal Reserve leadership has become especially critical for crypto markets at this stage. While the crypto sector has matured significantly over the past decade, it remains highly sensitive to macro liquidity conditions, interest rate expectations, and shifts in global risk appetite. Fed decisions around rates, balance sheet policy, and forward guidance directly affect capital allocation across risk assets, including Bitcoin, Ethereum, and m

Macro expectations are once again dominating market attention, and the influence of Federal Reserve leadership has become especially critical for crypto markets at this stage. While the crypto sector has matured significantly over the past decade, it remains highly sensitive to macro liquidity conditions, interest rate expectations, and shifts in global risk appetite. Fed decisions around rates, balance sheet policy, and forward guidance directly affect capital allocation across risk assets, including Bitcoin, Ethereum, and m

- Reward

- 4

- 3

- Repost

- Share

HanssiMazak :

:

Ape In 🚀View More

#Web3FebruaryFocus Key Trends Shaping the Next Phase of Decentralization

February has emerged as a defining checkpoint for Web3, offering early signals about how decentralized technologies are likely to evolve throughout the year. After cycles driven by speculation and rapid experimentation, the ecosystem is clearly shifting toward sustainability, real-world relevance, and long-term value creation. Builders, investors, and institutions are increasingly prioritizing fundamentals over narratives, marking a clear maturation phase for decentralized innovation.

A central theme defining Web3 this Fe

February has emerged as a defining checkpoint for Web3, offering early signals about how decentralized technologies are likely to evolve throughout the year. After cycles driven by speculation and rapid experimentation, the ecosystem is clearly shifting toward sustainability, real-world relevance, and long-term value creation. Builders, investors, and institutions are increasingly prioritizing fundamentals over narratives, marking a clear maturation phase for decentralized innovation.

A central theme defining Web3 this Fe

- Reward

- 3

- 10

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

#InstitutionalHoldingsDebate Conviction or Tactical Adaptation?

Bitcoin’s institutional landscape is at a critical crossroads. Recent volatility has exposed divergent strategies among institutional participants: some continue disciplined accumulation under long-term frameworks, while others face pressure from market drawdowns, unrealized losses, or capital constraints. This divergence raises a key question for the market — are institutions staying the course with conviction, or are they tactically adapting to short-term stress?

Understanding this distinction is essential for investors and trad

Bitcoin’s institutional landscape is at a critical crossroads. Recent volatility has exposed divergent strategies among institutional participants: some continue disciplined accumulation under long-term frameworks, while others face pressure from market drawdowns, unrealized losses, or capital constraints. This divergence raises a key question for the market — are institutions staying the course with conviction, or are they tactically adapting to short-term stress?

Understanding this distinction is essential for investors and trad

BTC-7,27%

- Reward

- 10

- 9

- Repost

- Share

HanssiMazak :

:

Watching Closely 🔍️View More

#HongKongIssueStablecoinLicenses A Deliberate Blueprint for the Next Phase of Digital Finance

Hong Kong is approaching a defining moment in digital asset regulation. In March 2026, the Hong Kong Monetary Authority (HKMA) is expected to issue its first stablecoin issuer licenses, marking the operational launch of the Stablecoins Ordinance framework. This will not be a broad or open rollout. Only a very limited number of licenses will be approved in the initial phase, signaling a strategy centered on control, credibility, and systemic stability rather than rapid expansion.

This approach reflects

Hong Kong is approaching a defining moment in digital asset regulation. In March 2026, the Hong Kong Monetary Authority (HKMA) is expected to issue its first stablecoin issuer licenses, marking the operational launch of the Stablecoins Ordinance framework. This will not be a broad or open rollout. Only a very limited number of licenses will be approved in the initial phase, signaling a strategy centered on control, credibility, and systemic stability rather than rapid expansion.

This approach reflects

DEFI1,51%

- Reward

- 8

- 7

- Repost

- Share

HanssiMazak :

:

1000x VIbes 🤑View More

#WhiteHouseCryptoSummit A Potential Turning Point for Digital Assets

Over the past decade, cryptocurrencies have evolved from a niche experiment into a multi-trillion-dollar global ecosystem. Yet despite this growth, the U.S. crypto sector has remained constrained by regulatory ambiguity, fragmented oversight, and recurring confidence shocks. A White House Crypto Summit could represent a critical inflection point — moving digital assets fully into the national policy spotlight and reshaping their future trajectory.

If handled correctly, such a summit would not just be symbolic. It could redef

Over the past decade, cryptocurrencies have evolved from a niche experiment into a multi-trillion-dollar global ecosystem. Yet despite this growth, the U.S. crypto sector has remained constrained by regulatory ambiguity, fragmented oversight, and recurring confidence shocks. A White House Crypto Summit could represent a critical inflection point — moving digital assets fully into the national policy spotlight and reshaping their future trajectory.

If handled correctly, such a summit would not just be symbolic. It could redef

- Reward

- 9

- 7

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

#StrategyBitcoinPositionTurnsRed A Defining Moment for Institutional Conviction

As of today, with Bitcoin slipping below the $76,000 level, Strategy — the world’s largest corporate Bitcoin holder — has officially entered unrealized loss territory on paper. For the first time in this cycle, the scale and visibility of this position make the development symbolically significant for the broader market.

Cost Threshold: Strategy in the Red

Following its most recent purchases, Strategy’s average acquisition cost stands near $76,052 per BTC. With spot prices trading in the $74,500–$75,500 range, the

As of today, with Bitcoin slipping below the $76,000 level, Strategy — the world’s largest corporate Bitcoin holder — has officially entered unrealized loss territory on paper. For the first time in this cycle, the scale and visibility of this position make the development symbolically significant for the broader market.

Cost Threshold: Strategy in the Red

Following its most recent purchases, Strategy’s average acquisition cost stands near $76,052 per BTC. With spot prices trading in the $74,500–$75,500 range, the

BTC-7,27%

- Reward

- 9

- 8

- Repost

- Share

Peacefulheart :

:

DYOR 🤓View More

#WhenWillBTCRebound? Key Signals I’m Watching for Confirmation

Bitcoin is currently trading in a high-sensitivity zone, holding key support while repeatedly failing to reclaim major resistance. We’ve seen multiple short-term bounces, but none have shown the strength or follow-through needed to confirm a genuine trend reversal. This price behavior reflects a market that remains under pressure, with buyers still lacking conviction.

So the real question isn’t whether Bitcoin will rebound — it’s when that rebound becomes confirmed rather than speculative.

Current Market Structure

At present, BTC r

Bitcoin is currently trading in a high-sensitivity zone, holding key support while repeatedly failing to reclaim major resistance. We’ve seen multiple short-term bounces, but none have shown the strength or follow-through needed to confirm a genuine trend reversal. This price behavior reflects a market that remains under pressure, with buyers still lacking conviction.

So the real question isn’t whether Bitcoin will rebound — it’s when that rebound becomes confirmed rather than speculative.

Current Market Structure

At present, BTC r

BTC-7,27%

- Reward

- 9

- 7

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

#CryptoMarketWatch February 2026 Market Snapshot

The crypto market is currently facing significant downward pressure and heightened volatility as we enter early February 2026. Overall sentiment is firmly bearish, with the Crypto Fear & Greed Index hovering in the “Extreme Fear” zone (14–26), reflecting widespread caution, liquidations, and diminished risk appetite among traders and institutions. Market participants are reacting to a combination of macro headwinds, leveraged position unwinds, ETF outflows, and geopolitical uncertainties, creating one of the most challenging trading environments

The crypto market is currently facing significant downward pressure and heightened volatility as we enter early February 2026. Overall sentiment is firmly bearish, with the Crypto Fear & Greed Index hovering in the “Extreme Fear” zone (14–26), reflecting widespread caution, liquidations, and diminished risk appetite among traders and institutions. Market participants are reacting to a combination of macro headwinds, leveraged position unwinds, ETF outflows, and geopolitical uncertainties, creating one of the most challenging trading environments

- Reward

- 11

- 10

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#USGovernmentShutdownRisk Crypto Markets Under Macro Pressure

A U.S. government shutdown occurs when Congress fails to pass—or the President does not sign—funding legislation such as appropriations bills or continuing resolutions before existing funding expires. This creates a funding gap, and under interpretations of the Antideficiency Act, non-essential federal operations must largely cease. The result is widespread furloughs of federal employees, closure of national parks, delayed public services, and broader economic ripple effects that extend into financial markets, including cryptocurren

A U.S. government shutdown occurs when Congress fails to pass—or the President does not sign—funding legislation such as appropriations bills or continuing resolutions before existing funding expires. This creates a funding gap, and under interpretations of the Antideficiency Act, non-essential federal operations must largely cease. The result is widespread furloughs of federal employees, closure of national parks, delayed public services, and broader economic ripple effects that extend into financial markets, including cryptocurren

- Reward

- 12

- 14

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#SEConTokenizedSecurities The Future of Finance: Tokenized Securities

The global financial system is entering a transformative phase where traditional assets converge with blockchain infrastructure. This evolution has given rise to Tokenized Securities, a regulated, transparent, and accessible way to own and trade real-world assets (RWAs) on-chain. Unlike speculative tokens or meme coins, tokenized securities represent legal ownership or economic rights in underlying assets, are backed by issuers, and comply with existing securities regulations. They provide holders with rights such as dividen

The global financial system is entering a transformative phase where traditional assets converge with blockchain infrastructure. This evolution has given rise to Tokenized Securities, a regulated, transparent, and accessible way to own and trade real-world assets (RWAs) on-chain. Unlike speculative tokens or meme coins, tokenized securities represent legal ownership or economic rights in underlying assets, are backed by issuers, and comply with existing securities regulations. They provide holders with rights such as dividen

- Reward

- 11

- 9

- Repost

- Share

MingDragonX :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate Geopolitical Stress Hits Crypto Markets

The rapid escalation of geopolitical tensions in the Middle East has significantly intensified stress across cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off event. As tensions involving the U.S. and Iran intensified, digital assets reacted immediately with accelerated price declines, thinning liquidity, and liquidation-driven volume spikes, highlighting how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies the Downside

The rapid escalation of geopolitical tensions in the Middle East has significantly intensified stress across cryptocurrency markets. What initially appeared to be a controlled pullback quickly transformed into a full-scale risk-off event. As tensions involving the U.S. and Iran intensified, digital assets reacted immediately with accelerated price declines, thinning liquidity, and liquidation-driven volume spikes, highlighting how sensitive crypto remains to global instability.

Price Impact — Escalation Multiplies the Downside

- Reward

- 10

- 9

- Repost

- Share

MingDragonX :

:

Buy To Earn 💎View More

#PreciousMetalsPullBack — A Healthy Market Consolidation

Markets are undergoing a sharp and synchronized correction across precious metals and cryptocurrencies after historic rallies in late 2025 and early January 2026. Gold briefly surged to around $5,595/oz, silver spiked near $121/oz, Bitcoin topped close to $90,000, and Ethereum traded above $3,000. As February begins, both asset classes have pulled back decisively. Importantly, this move reflects profit-taking, technical overextension, and macro repricing, rather than a breakdown of long-term bullish fundamentals.

Understanding the Pullba

Markets are undergoing a sharp and synchronized correction across precious metals and cryptocurrencies after historic rallies in late 2025 and early January 2026. Gold briefly surged to around $5,595/oz, silver spiked near $121/oz, Bitcoin topped close to $90,000, and Ethereum traded above $3,000. As February begins, both asset classes have pulled back decisively. Importantly, this move reflects profit-taking, technical overextension, and macro repricing, rather than a breakdown of long-term bullish fundamentals.

Understanding the Pullba

- Reward

- 10

- 9

- Repost

- Share

MingDragonX :

:

Buy To Earn 💎View More

#TraditionalFinanceAcceleratesTokenization The Shift Toward Digital Assets

Traditional financial institutions are increasingly embracing tokenization, signaling a major shift in how capital markets operate. From tokenized stocks and bonds to fractionalized real estate and commodities, this trend is bridging conventional finance with blockchain technology. February 2026 is seeing heightened activity as banks, asset managers, and hedge funds explore new ways to integrate digital assets, creating both structural opportunities and broader adoption for the crypto ecosystem.

Drivers of Tokenization

Traditional financial institutions are increasingly embracing tokenization, signaling a major shift in how capital markets operate. From tokenized stocks and bonds to fractionalized real estate and commodities, this trend is bridging conventional finance with blockchain technology. February 2026 is seeing heightened activity as banks, asset managers, and hedge funds explore new ways to integrate digital assets, creating both structural opportunities and broader adoption for the crypto ecosystem.

Drivers of Tokenization

- Reward

- 8

- 6

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More