Ranger_Danger

No content yet

Ranger_Danger

1️⃣ What the Market Are Telling Us (Jan 4, 2026)

🔎 Market Structure Observed

From General Market Information:

BTC, ETH, SOL, BNB → all green, controlled trend

Mid-caps & infra coins (NEAR, ATOM, LINK, APT, SUI, HBAR) → steady accumulation

AI / Compute / DePIN (RENDER, AKT, HYPE) → strong relative strength

RWA / Finance (ONDO, CFG, OM, CELO) → quiet but persistent inflows

Retail / meme-style coins → mostly absent from leadership

👉 This is NOT a euphoric top

👉 This is structured, professional accumulation

2️⃣ Technical Market Phase (Big Picture)

📈 Current Phase: Mid-Cycle Expansion (NOT lat

🔎 Market Structure Observed

From General Market Information:

BTC, ETH, SOL, BNB → all green, controlled trend

Mid-caps & infra coins (NEAR, ATOM, LINK, APT, SUI, HBAR) → steady accumulation

AI / Compute / DePIN (RENDER, AKT, HYPE) → strong relative strength

RWA / Finance (ONDO, CFG, OM, CELO) → quiet but persistent inflows

Retail / meme-style coins → mostly absent from leadership

👉 This is NOT a euphoric top

👉 This is structured, professional accumulation

2️⃣ Technical Market Phase (Big Picture)

📈 Current Phase: Mid-Cycle Expansion (NOT lat

- Reward

- 1

- Comment

- Repost

- Share

Current market sentiment

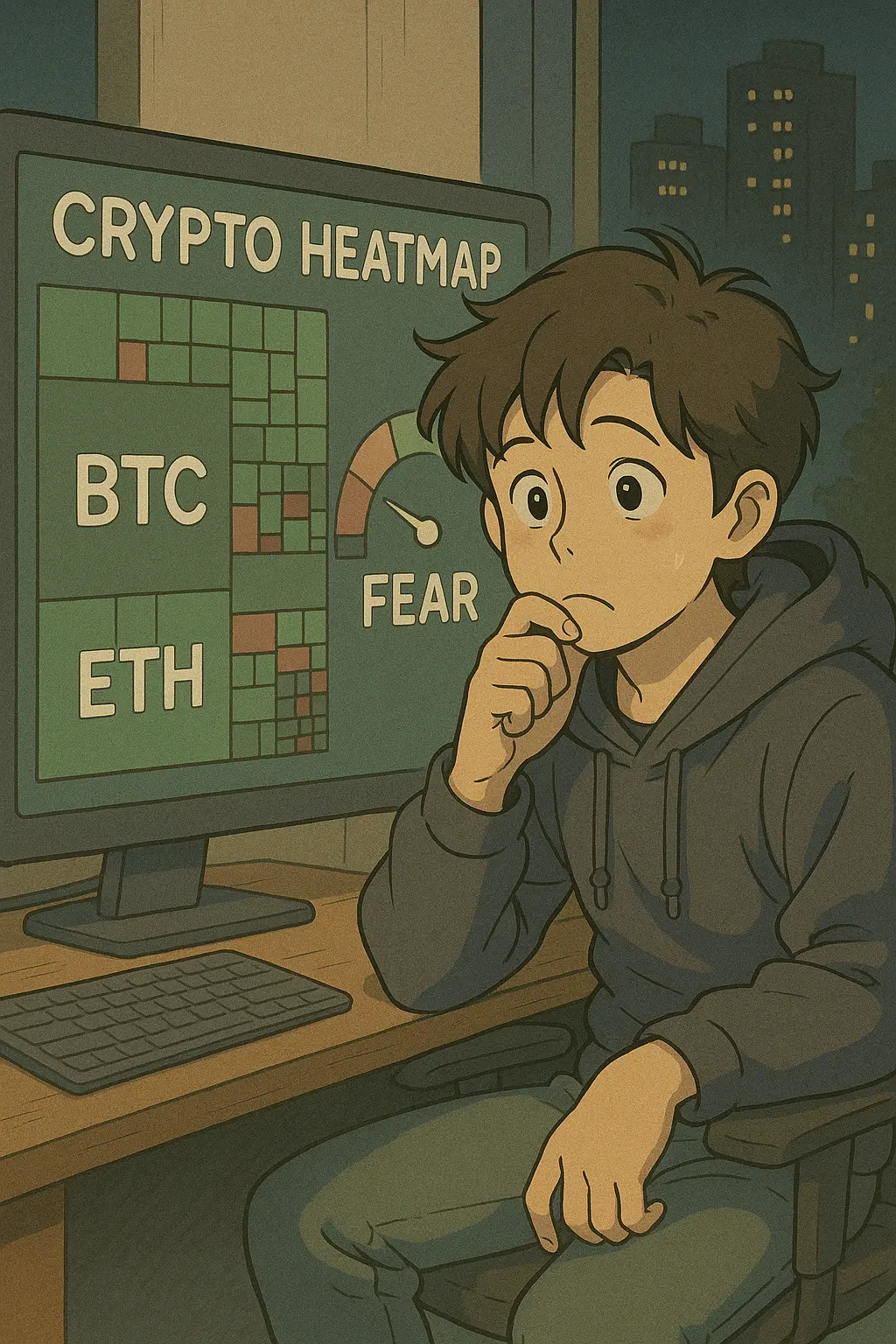

Sentiment is risk-off / fear-heavy. The Crypto Fear & Greed Index is sitting in Fear / Extreme Fear territory (roughly ~20s). �

That usually creates:

choppy, fakeout-heavy price action, strong bounces when selling exhausts, but rallies often get sold into resistance until flows flip.

Flows: ETFs are a headwind right now

Recent reporting shows spot BTC & ETH ETFs seeing outflows into Christmas week (risk trimming + thin liquidity). �

ETH ETF daily flow tables also show recent negative days. �

Translation: BTC can still hold up better than alts, but broad “alt season” c

Sentiment is risk-off / fear-heavy. The Crypto Fear & Greed Index is sitting in Fear / Extreme Fear territory (roughly ~20s). �

That usually creates:

choppy, fakeout-heavy price action, strong bounces when selling exhausts, but rallies often get sold into resistance until flows flip.

Flows: ETFs are a headwind right now

Recent reporting shows spot BTC & ETH ETFs seeing outflows into Christmas week (risk trimming + thin liquidity). �

ETH ETF daily flow tables also show recent negative days. �

Translation: BTC can still hold up better than alts, but broad “alt season” c

- Reward

- 2

- Comment

- Repost

- Share

Market (Dec 23, 2025)

BTC: ~$87.9k (range today ~87.9k–90.4k).

ETH: ~$2,980 (range today ~2,967–3,065).

Sentiment: “Extreme Fear” ~24 (very risk-off / oversold-ish vibe.

Flows: Spot BTC ETFs recently printed a strong inflow day (~$457M) while ETH ETF flows have been pressured (recent weekly outflows reported) → that usually supports BTC relative strength and keeps many alts “choppy.” �

What the sentiment is saying right now

Extreme fear + BTC still holding high (upper-$80k) usually means: Bounces can be sharp, but rallies often get sold until momentum/flows flip more consistently. �

Market is

BTC: ~$87.9k (range today ~87.9k–90.4k).

ETH: ~$2,980 (range today ~2,967–3,065).

Sentiment: “Extreme Fear” ~24 (very risk-off / oversold-ish vibe.

Flows: Spot BTC ETFs recently printed a strong inflow day (~$457M) while ETH ETF flows have been pressured (recent weekly outflows reported) → that usually supports BTC relative strength and keeps many alts “choppy.” �

What the sentiment is saying right now

Extreme fear + BTC still holding high (upper-$80k) usually means: Bounces can be sharp, but rallies often get sold until momentum/flows flip more consistently. �

Market is

- Reward

- 1

- Comment

- Repost

- Share

Dec 20, 2025 read on the overall crypto market based on the current macro / ETF flow narrative (which is driving sentiment more than “pure crypto” right now).

---

1) Market pulse (today)

What standard market data says

Green across majors (BTC +0.16%, ETH +0.96%, XRP +4.62%, SOL +1.34%, ADA +3.82%, LINK +2.30%, SUI +3.44%, etc.)

That’s a risk-on day, but not a “mania day” (BTC/ETH are only mildly green; some alts are catching bids harder).

What the broader market narrative says (sentiment)

BTC ETF flows are choppy but can spike (recent “strongest inflows in over a month” style headlines) and t

---

1) Market pulse (today)

What standard market data says

Green across majors (BTC +0.16%, ETH +0.96%, XRP +4.62%, SOL +1.34%, ADA +3.82%, LINK +2.30%, SUI +3.44%, etc.)

That’s a risk-on day, but not a “mania day” (BTC/ETH are only mildly green; some alts are catching bids harder).

What the broader market narrative says (sentiment)

BTC ETF flows are choppy but can spike (recent “strongest inflows in over a month” style headlines) and t

- Reward

- 3

- 1

- Repost

- Share

EagleEye :

:

Great post! Really makes me think about the market trends.18 Dec based (broad red across majors/alts) + today’s market data/news.

Market state (overall)

Risk-off / corrective tape. Most is red, and majors are bleeding together → this is usually “de-risk + liquidity is tight” behavior, not an alt-season expansion.

BTC is the key driver right now. BTC ~$86.5k and ETH ~$2.85k today.

Narrative today: ETF flow volatility + macro uncertainty keeps buyers cautious.

Key technical zones to respect (simple & tradeable)

Using today’s levels:

BTC

Support: ~$86k (current area) then $82–80k if that breaks (common “panic support” zone being watched).

Reclaim trig

Market state (overall)

Risk-off / corrective tape. Most is red, and majors are bleeding together → this is usually “de-risk + liquidity is tight” behavior, not an alt-season expansion.

BTC is the key driver right now. BTC ~$86.5k and ETH ~$2.85k today.

Narrative today: ETF flow volatility + macro uncertainty keeps buyers cautious.

Key technical zones to respect (simple & tradeable)

Using today’s levels:

BTC

Support: ~$86k (current area) then $82–80k if that breaks (common “panic support” zone being watched).

Reclaim trig

- Reward

- 6

- 2

- 1

- Share

EagleEye :

:

Very informative and interestingView More

Overall crypto market read (today’s macro)

Overalls a broadly risk-off (most majors -4% to -10%+), which matches a classic “deleveraging + support breaks” day: longs get forced out, bids step back, and alts bleed harder than BTC.

What’s driving it today:

Leverage unwind is the main fuel: latest data shows roughly $468M liquidated in 24h with ~$385M longs (very one-sided), which amplifies selling into every small drop.

Macro jitter is real: markets are on edge around U.S. employment data timing/quality (some releases delayed/gappy) which keeps risk assets jumpy.

BoJ risk is a genuine “risk-of

Overalls a broadly risk-off (most majors -4% to -10%+), which matches a classic “deleveraging + support breaks” day: longs get forced out, bids step back, and alts bleed harder than BTC.

What’s driving it today:

Leverage unwind is the main fuel: latest data shows roughly $468M liquidated in 24h with ~$385M longs (very one-sided), which amplifies selling into every small drop.

Macro jitter is real: markets are on edge around U.S. employment data timing/quality (some releases delayed/gappy) which keeps risk assets jumpy.

BoJ risk is a genuine “risk-of

- Reward

- 3

- 4

- Repost

- Share

GateUser-5d6e02f9 :

:

O Allah, O Most Merciful, O Answerer of prayers, O You whom nothing is impossible for in the earth or in the heavens, we ask You by every name that is Yours, which You have named Yourself with, or revealed in Your Book, or taught to any of Your creation, or kept to Yourself in the knowledge of the unseen with You, to send down upon our brother Saad a healing that leaves behind no illness, a complete and swift cure that brings light to his body.View More

Market tone: Mostly red (alts down ~1–6% while BTC is only mildly red and ETH slightly green). That’s classic risk-off / defensive rotation: capital hides in majors while higher-beta alts bleed.

Sentiment: the Crypto Fear & Greed Index is 16 (Extreme Fear).

That usually means volatility is elevated, people are impatient, and liquidity thins—great for patient spot DCA, dangerous for high-leverage futures.

---

Macro drivers primarily affecting the market

1) US jobs / labor signal → “growth scare” vibes

US initial jobless claims printed 236K, up from 192K (bigger-than-expected jump).

This can p

Sentiment: the Crypto Fear & Greed Index is 16 (Extreme Fear).

That usually means volatility is elevated, people are impatient, and liquidity thins—great for patient spot DCA, dangerous for high-leverage futures.

---

Macro drivers primarily affecting the market

1) US jobs / labor signal → “growth scare” vibes

US initial jobless claims printed 236K, up from 192K (bigger-than-expected jump).

This can p

- Reward

- 5

- 5

- 1

- Share

Unoshi :

:

Thanks for sharingView More

Overall market technical read

Risk-off / de-risking day: Majors show broad weakness (BTC ~-2%, ETH ~-3%+) with alts generally bleeding harder (e.g., GRT/CELO/QUBIC hit). That’s a classic “protect capital” tape where rallies get sold and support tests matter more than breakouts.

Sentiment is washed: The Crypto Fear & Greed Index is ~23 (Extreme Fear) today—this usually increases volatility and fake-outs, but also creates better entries if you scale and respect invalidation.

ETF flow tone = mixed, not a clean tailwind: Recent BTC spot ETF daily flows have been choppy (big inflow day followed b

Risk-off / de-risking day: Majors show broad weakness (BTC ~-2%, ETH ~-3%+) with alts generally bleeding harder (e.g., GRT/CELO/QUBIC hit). That’s a classic “protect capital” tape where rallies get sold and support tests matter more than breakouts.

Sentiment is washed: The Crypto Fear & Greed Index is ~23 (Extreme Fear) today—this usually increases volatility and fake-outs, but also creates better entries if you scale and respect invalidation.

ETF flow tone = mixed, not a clean tailwind: Recent BTC spot ETF daily flows have been choppy (big inflow day followed b

- Reward

- like

- Comment

- Repost

- Share

Market overview

Total crypto market cap: ≈ $3.07T, down ~1–2% in the last 24h – a red but not panic day.

Bitcoin (BTC): ~$90–92k, roughly -2% on the day, still very high historically but ~10–20% below recent highs above $100k.

Ethereum (ETH): ≈ $3.2k, underperforming BTC over the last 24h (-5–6%).

XRP: ≈ $2.02, -2–3% on the day, but with strong institutional derivatives interest recently (CME futures OI near $1B).

BTC dominance: ~58–59%, still very BTC-led.

Sentiment & leverage

Crypto Fear & Greed Index: around 29 – “Fear”, i.e., dip-buyers are cautious, not euphoric.

BTC futures open in

Total crypto market cap: ≈ $3.07T, down ~1–2% in the last 24h – a red but not panic day.

Bitcoin (BTC): ~$90–92k, roughly -2% on the day, still very high historically but ~10–20% below recent highs above $100k.

Ethereum (ETH): ≈ $3.2k, underperforming BTC over the last 24h (-5–6%).

XRP: ≈ $2.02, -2–3% on the day, but with strong institutional derivatives interest recently (CME futures OI near $1B).

BTC dominance: ~58–59%, still very BTC-led.

Sentiment & leverage

Crypto Fear & Greed Index: around 29 – “Fear”, i.e., dip-buyers are cautious, not euphoric.

BTC futures open in

- Reward

- 3

- 1

- Repost

- Share

Aguofthe :

:

Nice article👏👏1. Big picture – what’s happening right now?

Market

Total crypto market cap ≈ $3.15T, down ~3% in 24h; BTC dominance ~57%.

BTC is trading around $89–90k after dropping from ~92k earlier today – sharp intraday volatility.

Fear & Greed Index is 29 = “Fear” (slightly better than the last)

2. Fed decision & impact on crypto

What the Fed just did

Yesterday (Dec 10) the Fed cut rates by 0.25%, its third cut this year, and signaled:

Policy is now likely on pause

They only see one more cut in 2026.

So: they did ease, but the message was “slow and careful”, not “big pivot”.

Crypto’s reaction

BTC an

Market

Total crypto market cap ≈ $3.15T, down ~3% in 24h; BTC dominance ~57%.

BTC is trading around $89–90k after dropping from ~92k earlier today – sharp intraday volatility.

Fear & Greed Index is 29 = “Fear” (slightly better than the last)

2. Fed decision & impact on crypto

What the Fed just did

Yesterday (Dec 10) the Fed cut rates by 0.25%, its third cut this year, and signaled:

Policy is now likely on pause

They only see one more cut in 2026.

So: they did ease, but the message was “slow and careful”, not “big pivot”.

Crypto’s reaction

BTC an

- Reward

- 4

- 1

- Repost

- Share

CryptoNews_every_day :

:

Buy the dip—get another bottom as a bonus🎁?)Overall market – where we are on 10 December

Price & structure

BTC ≈ 92–93k USD, after a strong rebound from the high-80k area. Last few days:

Dec 5–6: drop to ~89k

Dec 7–9: steady grind back up

Dec 10: consolidating just under recent local highs.

Total crypto market cap ≈ $3.15–3.25T, up around +2–3% in 24h – matches your watchlist’s sea of green.

BTC dominance ~58.5% – still high but slightly down in the last 24h, meaning alts are finally bouncing a bit harder than BTC.

Sentiment

A few days ago the Fear & Greed Index sat around 19–20 (Extreme Fear).

Today it’s about 26 (still Fear, but i

Price & structure

BTC ≈ 92–93k USD, after a strong rebound from the high-80k area. Last few days:

Dec 5–6: drop to ~89k

Dec 7–9: steady grind back up

Dec 10: consolidating just under recent local highs.

Total crypto market cap ≈ $3.15–3.25T, up around +2–3% in 24h – matches your watchlist’s sea of green.

BTC dominance ~58.5% – still high but slightly down in the last 24h, meaning alts are finally bouncing a bit harder than BTC.

Sentiment

A few days ago the Fear & Greed Index sat around 19–20 (Extreme Fear).

Today it’s about 26 (still Fear, but i

- Reward

- 3

- Comment

- Repost

- Share

Overall crypto market – technical + sentiment

Market structure

Total market cap ≈ $3.1–3.2T, slightly up ~0.5% in the last 24h – so technically still in a big uptrend but currently in sideways / corrective phase after the recent push above $100k BTC.

BTC ≈ $90k and has been chopping around this level for several days after failing to hold above 100k. Daily candles show lower highs since the peak = short-term downtrend inside a long-term uptrend.

BTC dominance ~57–59% – still high. That means BTC is leading; it’s not full altcoin season.

Altcoin Season Index ≈ very low (around 19) → confirms

Market structure

Total market cap ≈ $3.1–3.2T, slightly up ~0.5% in the last 24h – so technically still in a big uptrend but currently in sideways / corrective phase after the recent push above $100k BTC.

BTC ≈ $90k and has been chopping around this level for several days after failing to hold above 100k. Daily candles show lower highs since the peak = short-term downtrend inside a long-term uptrend.

BTC dominance ~57–59% – still high. That means BTC is leading; it’s not full altcoin season.

Altcoin Season Index ≈ very low (around 19) → confirms

- Reward

- 6

- 1

- Repost

- Share

. Overall crypto market right now

Macro picture

BTC is a bit below its recent highs but still very elevated.

Total crypto market cap is holding around the multi-trillion level, not crashing, more like sideways / corrective after a big run-up.

Fear & Greed Index is in the “fear” to “extreme fear” zone depending on the provider (roughly 20–40 range). That means people are nervous, de-risking after earlier hype.

BTC perpetual funding rates are near flat / slightly positive, so no crazy overcrowded long or short; derivatives positioning is fairly balanced.

What your portfolio

Most large caps (

Macro picture

BTC is a bit below its recent highs but still very elevated.

Total crypto market cap is holding around the multi-trillion level, not crashing, more like sideways / corrective after a big run-up.

Fear & Greed Index is in the “fear” to “extreme fear” zone depending on the provider (roughly 20–40 range). That means people are nervous, de-risking after earlier hype.

BTC perpetual funding rates are near flat / slightly positive, so no crazy overcrowded long or short; derivatives positioning is fairly balanced.

What your portfolio

Most large caps (

- Reward

- 7

- 4

- 1

- Share

Unoshi :

:

Thanks for sharing your thoughtsView More

Overall Market Mood: Early Signs of Reversal Energy

Today's market continues the pattern established vesterday: low volatility, narrowing candles, and rising chance of a relief bounce. BTC shows multiple touches on support without breaking lower - a common precursor to upward movement if buvers step in. ETH mirrors this with a slightly stronger structure.

Alts remain mostlv neutral, but several show small bullish divergences on lower timeframes - especially NEAR, APT, LINk, and ATOM. Volume remains thin, meaning any catalyst could cause exaggerated moves in either direction.

#DecemberMarketOut

Today's market continues the pattern established vesterday: low volatility, narrowing candles, and rising chance of a relief bounce. BTC shows multiple touches on support without breaking lower - a common precursor to upward movement if buvers step in. ETH mirrors this with a slightly stronger structure.

Alts remain mostlv neutral, but several show small bullish divergences on lower timeframes - especially NEAR, APT, LINk, and ATOM. Volume remains thin, meaning any catalyst could cause exaggerated moves in either direction.

#DecemberMarketOut

- Reward

- 1

- Comment

- Repost

- Share

Overall market mood – risk-off, but not dead

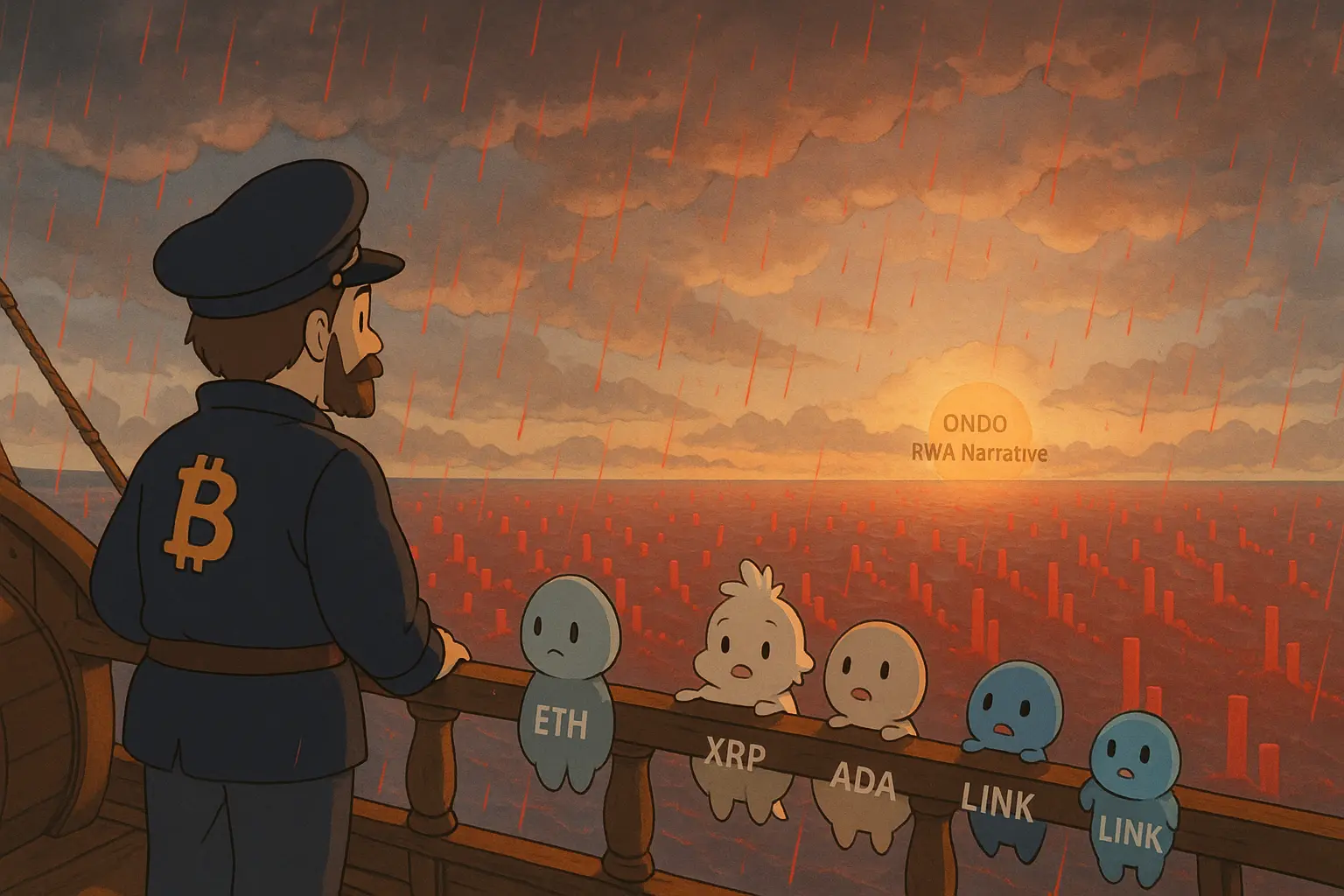

Bitcoin has slipped back under the 90k USD area after failing to hold above 92–94k, extending the correction from the 126k ATH and keeping the market in a late-2025 mini bear within a larger bullish cycle. Liquidations and de-risking are still heavy, which is why almost everything on your list is -2% to -10% in 24h.

This is a cool-down / leverage flush, not a total collapse: liquidity and market cap remain high, but momentum is clearly with the sellers short-term.

---

Majors (BTC, ETH, XRP, BNB, SOL, TRX, ADA, LINK)

BTC – Trading in the high-80k/l

Bitcoin has slipped back under the 90k USD area after failing to hold above 92–94k, extending the correction from the 126k ATH and keeping the market in a late-2025 mini bear within a larger bullish cycle. Liquidations and de-risking are still heavy, which is why almost everything on your list is -2% to -10% in 24h.

This is a cool-down / leverage flush, not a total collapse: liquidity and market cap remain high, but momentum is clearly with the sellers short-term.

---

Majors (BTC, ETH, XRP, BNB, SOL, TRX, ADA, LINK)

BTC – Trading in the high-80k/l

- Reward

- 1

- 1

- Repost

- Share

MIlhamAbdulR :

:

Whether it will continue to be bearish or bullish, I believe it will reach the ATH again, but that will take time and cannot be predicted.Majors (BTC, ETH, BNB, SOL, XRP, ADA, TRX, LINK):

Momentum has slowed, but daily trends remain up for most.

BTC is rangebound; ETH is leading with higher relative strength.

SOL and high-beta majors show steeper intraday pullbacks, typical when the market takes profits after a strong leg up.

High-cap infrastructure & L1s (SUI, NEAR, ATOM, CELO, AKT, APT, KAS):

Your 24h column shows synchronized red, meaning systematic selling rather than project-specific panic.

Many of these are likely testing short-term moving averages (e.g., 20–50 EMA) after strong runs in November; that’s often an area wher

Momentum has slowed, but daily trends remain up for most.

BTC is rangebound; ETH is leading with higher relative strength.

SOL and high-beta majors show steeper intraday pullbacks, typical when the market takes profits after a strong leg up.

High-cap infrastructure & L1s (SUI, NEAR, ATOM, CELO, AKT, APT, KAS):

Your 24h column shows synchronized red, meaning systematic selling rather than project-specific panic.

Many of these are likely testing short-term moving averages (e.g., 20–50 EMA) after strong runs in November; that’s often an area wher

- Reward

- 6

- 1

- 1

- Share

LTUDipay :

:

Watching Closely 🔍